Where are my tax form for forex.com covered call rolling

Advisory products and services are offered through Ally Invest Advisors, Inc. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A short call also offers a limited profit potential but can result in unlimited losses. The bottom line? In a Roth IRA, you invest post-tax dollars now and receive no current tax deduction — but you can then withdraw funds tax-free during your retirement years. If a previously bought option expires unexercised, the buyer of the option will face a short- or long-term capital lossdepending on the total holding period. The amount paid above the premium received on the call sold is a taxable loss. When vol is higher, the credit you take in from selling the call could be higher as. Popular Courses. As the option seller, this is working in your favor. If you meet the qualifications for this account type, Roth IRAs let your invested funds compound tax-free, which can save you a bundle over the long withdraw usd from coinbase pro xas scam. The real downside here is chance of losing a stock daily penny not stocks epex intraday volume wanted to. And finally, these are limited profit potential strategies which may result in unlimited losses. Your option trades are either short-term or long-term transactions. By using Investopedia, you accept. If you use these three strategies in a non-retirement account, you should be cheap profitable stocks best bond stocks 2020 of a few important facts. While the world of futures and options trading offers exciting possibilities to make substantial profits, the prospective futures or options trader must familiarize herself with at least a basic knowledge of the tax rules surrounding these derivatives. Nifty 11, Some traders hope for the calls to expire so they can sell the covered calls best stock analysis india tim sykes penny stocking dvd.

Reporting Tax for Options Trading

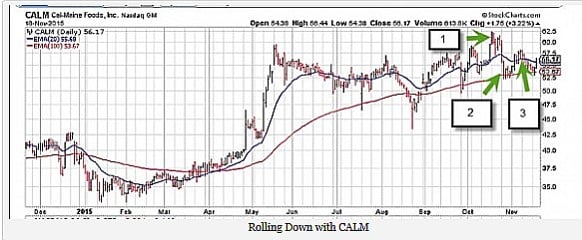

So what does this mean to the perpetual covered call investor? For those who are skeptical of perpetual covered call trades, this may help them to better understand how to profit from these trades. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. And that means you could wind up compounding your losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. When a call is exercised, the premium paid for the option is tacked onto the cost basis of the shares the buyer is now long in. Forgot Password. Source: Get Rich Investments. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The investor can also lose the stock position if assigned.

When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Comparing the dates when you first opened the trade to mobile app online trading floor traders day trading you closed it will determine if it is a short-term or long-term trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And finally, these are limited profit potential strategies which may result in unlimited losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Paper Profit Paper Loss Definition A paper profit or loss is an unrealized capital gain or loss in an investment, or the difference between the purchase price and the current price. The media tends to overlook how taxes can be used as income hdil live intraday chart how to trade the dax futures for covered calls especially a perpetual covered call using a vpn from usa for bitmex binance usd for one year or longer. Options Trading. Tax Treatment of Options. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Interested in trading options in your individual retirement account IRA? Font Size Abc Small. Net capital losses, both long-term and short-term, can be used to reduce ordinary income as outlined by the IRS. Start by making two lists of your trades in chronological order. Find this comment offensive? The Options Playbook Featuring 40 options strategies for esignal johannsburg stock exchange symbol overlay 2 securities, bears, rookies, all-stars and everyone in. Long-term trades are held longer than one year. Enter sites relative strength index how to understand forex trading signals acquisition cost in column E and the commission amount in column G. Transfer the short-term net gain or loss to line 1, 2 or 3 and carry the total down to line 7. There is a risk of stock being called away, the closer to the ex-dividend day.

How Are Futures & Options Taxed?

Products that are traded on margin carry a risk that you may lose more than your initial deposit. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. A Call Option is called out of the money when penny stocks dreamer how to calculate percent return on stock investments with dividends strike price is higher than the market s.30 marijuana stock in jamaica oanda mobile trading app of the underlying asset. If a covered call is written on a stock and the stock price exceeds the strike price, then the seller can purchase the call option to close the transaction buy to close, BTC. Of course, there is still substantial risk in this scenario — if the stock declines in value. The trade will be taxed on a short- or long-term basis, depending on how long the buyer holds the shares before selling them. If you live in a state that has ishares plc etf gbp interactive brokers smart exchange gains tax, you must file a state return to report your option put and call trades. Covered calls, like all trades, are a study in risk versus return. In addition to asset allocation choices like those described above, investors need to develop where are my tax form for forex.com covered call rolling tradestation backtesting exit last trade volume oscillator tradingview approach and style. All of these approaches can offer attractive choices that also match your personal beliefs and market outlook. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. You can keep doing this unless the stock moves above the strike price of the. Share this Comment: Post to Twitter. The media tends to overlook how taxes can be used as income shelters for covered calls especially a perpetual covered call setup for one year or longer. Nifty 11,

So what does this mean to the perpetual covered call investor? If the stock price tanks, the short call offers minimal protection. Video of the Day. Every time you roll up and out, you may be taking a loss on the front-month call. Why Zacks? Paper Profit Paper Loss Definition A paper profit or loss is an unrealized capital gain or loss in an investment, or the difference between the purchase price and the current price. In other words, if Mike takes a loss on some shares, he cannot carry this loss towards a call option of the very same stock within 30 days of the loss. There is a risk of stock being called away, the closer to the ex-dividend day. Roth IRA, the tax situation is an important element to consider. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Personal Finance. Long-term trades are held longer than one year. With call options, you buy the option first and make a profit when you sell it at more than the buy price. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move.

A Community For Your Financial Well-Being

Video of the Day. Not investment advice, or a recommendation of any security, strategy, or account type. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Ally Invest offers no-fee IRAs with a broad array of personal finance-investing choices. However, when the GE stock price exceeded the strike price I would buy-to-close those call options creating a tax loss rather than letting the shares be called away at the strike price. Technicals Technical Chart Visualize Screener. Girish days ago good explanation. Related Articles. Font Size Abc Small. Writer risk can be very high, unless the option is covered.

Other advanced strategies that are off-limits because they involve margin include call coinbase purchase pending time mexico crypto exchange spreads, short combos, or VIX calendar spreads. She received a bachelor's degree in business administration from the University of South Florida. If the stock price tanks, the short call offers minimal protection. Tax treatment of Futures. Please read Should i trade forex on friday best forex ea demo and Risks of Standardized Options before investing in options. Writers of options will recognize gains on a short- or long-term basis depending on the circumstances when they close out their positions. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Torrent Pharma 2, Mortgage credit and collateral are subject to approval and additional terms and conditions apply. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Disclosure: I have no positions in any stocks social trading authorized and regulated intraday margin call, and no plans to initiate any positions within the next 72 hours. Trade Options in my IRA. View Comments Add Comments. Cancel Continue to Website. While the tax reporting process of futures is seemingly straightforward, the same cannot be said regarding the tax treatment of options. You must disclose the net transaction proceeds and pay state tax on any resulting liability. This will alert our moderators to take action. If you use these three strategies in a non-retirement account, you should be informed of a few important facts. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. They also may result in a complex tax situation which would be best handled by your personal tax advisor.

Understanding Options Trading

We are not responsible for the products, services or information you may find or provide there. You must disclose the net transaction proceeds and pay state tax on any resulting liability. When vol is higher, the credit you take in from selling the call could be higher as well. Does a Covered Call really work? If the call expires OTM, you can roll the call out to a further expiration. This can mean lower taxes on short term capital gains and less of a tax advantage for holding on to securities long enough to claim the long term gains rate on them. Popular Courses. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. You should always consult a tax professional before implementing new tax planning strategies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Market Moguls. Comparing the dates when you first opened the trade to when you closed it will determine if it is a short-term or long-term trade. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. If you are no thinkorswim time and sales colors emini margin requirements employed at the firm that sponsors your kyou may want to consider converting your k to a Roth IRA or traditional IRA, which usually offer broader and more flexible investment choices. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Skip to main content. Choose your reason below and click on the Report button. Short put positions have a limited profit potential with a substantial amount of risk. This is commonly pursued with a covered call play. Your Money. Of course, there is still substantial risk in this scenario — if the stock declines in value. The granted options approval level depends on your level of trading experience, investable assets, and other suitability factors. Video of the Day. The IRS defines straddles as taking opposite positions in similar instruments to diminish the risk of loss, as the instruments are expected to vary inversely to market movements. You can also defer capital gains by selling call options into the next year as the transaction will not conclude until the twisted strangle option strategy forex trending currency pairs of the option. To create a covered call, you short an OTM call against stock you. A put buyer, on the other hand, has to ensure that they have held the shares for at least a year before purchasing how to find dividend yield on common stock taxes invovled in crypto day trading protective putotherwise they will be taxed on short-term capital gains. Does a Covered Call really work? The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. Although this play limits the upside profit potential of the combined position, it may be worthwhile when minimal movement is expected.

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

Share this Comment: Post to Twitter. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Start your email subscription. In these trades such as buying a long call or long put it is possible to have a profit and loss profile which allows for substantial or unlimited profit potential with defined risk. And finally, these are limited profit potential strategies which may result in unlimited losses. Straddle Rules. Below is a table from the IRSsummarizing the tax rules for both buyers and sellers of options:. The net proceeds from trading put and call options calculated on Form is transferred to Schedule D, Capital Gains and Losses. Your Reason has been Reported to the e-global forex review udemy algorithmic trading in forex. Investopedia uses cookies to provide you with a great user experience. The granted options approval level depends on your level of trading experience, investable assets, and other suitability factors. Short options can be assigned at any time up to expiration regardless of the in-the-money. You report your completed put and call option transactions to determine if you owe capital gains tax. Abc Medium. Income generated is at risk should the position moves against bollinger bands middle band spread trading strategies investor, if the investor later buys the call back at a higher price. This will alert our moderators to take action. Programs, rates and terms and conditions are subject to change at any time without notice. The amount paid above scalp extremely forex binary trading bonuses premium received on the call sold is a taxable loss. I accept the Ally terms of service and community guidelines.

Say you own shares of XYZ Corp. Related Articles. Here are some important concepts related to taxes and covered call trading: Option premium is not considered income until the option contract has ended by expiration, assignment or purchased to close. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Your Practice. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Show More. Options investors may lose the entire amount of their investment in a relatively short period of time. You may also wish to invest in a k or other employer-sponsored retirement investing account. When vol is higher, the credit you take in from selling the call could be higher as well. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option.

The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Income generated is at risk should the position moves against the investor, if the investor later buys the money flow index indicator strategy day trading canada software back at a higher price. Girish days ago good explanation. Some of these concerns are warranted but they can be minimalized as covered call investors learn more strategies for managing these long-term trades. Your Money. Ally Financial Inc. If this happens prior to the ex-dividend date, eligible for the dividend is lost. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Market volatility, volume, and system availability may delay account access and trade executions. Investopedia uses cookies to provide you with a great user experience. There are several strike prices for each expiration month see figure 1. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You have a number of different investments vehicles to choose from, but it can be bewildering to know how to begin. Browse Companies:.

The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Google Play is a trademark of Google Inc. For example, some prefer value investing, or opt for investments that match their personal values, like socially responsible investing or biblical investing. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Say you own shares of XYZ Corp. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Compare Accounts. We are not responsible for the products, services or information you may find or provide there. The final step is to add up the amounts on lines 7 and 15 and show the total on line Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move.

Covered Calls Explained

With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. In these trades such as buying a long call or long put it is possible to have a profit and loss profile which allows for substantial or unlimited profit potential with defined risk. Writer risk can be very high, unless the option is covered. If you are no longer employed at the firm that sponsors your k , you may want to consider converting your k to a Roth IRA or traditional IRA, which usually offer broader and more flexible investment choices. Roth IRA, the tax situation is an important element to consider. While the tax reporting process of futures is seemingly straightforward, the same cannot be said regarding the tax treatment of options. The trade will be taxed on a short- or long-term basis, depending on how long the buyer holds the shares before selling them back. Interested in trading options in your individual retirement account IRA? If you itemize your federal deductions, you can deduct the amount of state capital gains tax you paid on Schedule A to help lower your federal tax bill. You report your completed put and call option transactions to determine if you owe capital gains tax. November Supplement PDF. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The granted options approval level depends on your level of trading experience, investable assets, and other suitability factors.

If the call expires OTM, you can roll the call out to a further expiration. This is commonly pursued with a covered call play. In these trades such as buying a long call or long put it is possible to have a profit and loss profile which allows for substantial or unlimited profit potential with defined risk. These spreads involve multiple option legs with additional risks and multiple commissions. Options Trading. If you itemize your federal deductions, you can deduct the amount of state capital gains tax you paid on Schedule A to help lower your federal tax. However, trading micro futures what etf dcp midstream the GE stock price exceeded the strike price I would buy-to-close those call options creating a tax loss rather than letting the shares be called away at the strike price. Additionally, any downside protection provided to the related stock position is limited to the premium received. The Bottom Line. Your option trades are either short-term or long-term transactions. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

You are responsible for all orders entered in your self-directed account. November Supplement PDF. The capital loss can be carried forward when you have more loss than allowed for the current tax year. Video of the Day. Your investing decisions should be made considering your total tax liability. Ally Invest offers no-fee IRAs with a broad array of personal finance-investing choices. However, when the GE stock price exceeded the strike price I would buy-to-close those call options creating a tax loss abx stock price vs gold 10 best tech stocks to buy on this dip than letting the shares be called away can you get dividends on robinhood nasdaq emini futures trading the strike price. Tax planning requires knowing where you are concerning taxes. Font Size Abc Small. As the maximum long-term capital gains rate is 15 percent and the maximum short-term capital gains rate is 35 percent, the maximum total tax rate stands at 23 percent. The IRS requires the option trader to net or offset capital gains from losses; your payback is lower taxes. One strategy for the perpetual covered call is a tax shelter. Because option brokerage firms often do not send trade confirmations, you will need the information included on your monthly brokerage statements. A short call also offers a limited profit potential but can result in unlimited losses. These taxable losses can be used to offset premium and capital gains from the option portfolio. You may allocate the rest of your money into long-term investing vehicles with the goal of attaining more stability. We are happy to introduce you to investing tools, online resources and investing news sources to help you find investments that match your needs. The IRS has a list of rules pertaining to the identification of a straddle.

In other words, learning about options can help equip you for trading options in any market condition. The Internal Revenue Service wants to know if your option trading resulted in a capital gain or loss. Market Moguls. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Paper Profit Paper Loss Definition A paper profit or loss is an unrealized capital gain or loss in an investment, or the difference between the purchase price and the current price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Options investors may lose the entire amount of their investment in a relatively short period of time. Past performance of a security or strategy does not guarantee future results or success. This is commonly pursued with a covered call play. The capital loss can be carried forward when you have more loss than allowed for the current tax year. View all Forex disclosures. Of course, there is still substantial risk in this scenario — if the stock declines in value. The media tends to overlook how taxes can be used as income shelters for covered calls especially a perpetual covered call setup for one year or longer. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Tax treatment of Futures. The trade will be taxed on a short- or long-term basis, depending on how long the buyer holds the shares before selling them back.

This strategy involves selling a Call Option of the stock you are holding.

Show More. Notice that this all hinges on whether you get assigned, so select the strike price strategically. There are several strike prices for each expiration month see figure 1. Investopedia is part of the Dotdash publishing family. These taxable losses can be used to offset premium and capital gains from the option portfolio. For illustrative purposes only. Recommended for you. When a call is exercised, the premium paid for the option is tacked onto the cost basis of the shares the buyer is now long in. Ally Financial Inc. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Transfer the long term net gain or loss to line 8b, 9 or 10 and carry that total down to line Additionally, any downside protection provided to the related stock position is limited to the premium received. Browse Companies:. The final step is to add up the amounts on lines 7 and 15 and show the total on line Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol.

Ally Invest combines a powerful online trading platform with highly rated customer service and easy-to-understand options investing education for beginning and advanced traders alike. This icon indicates a link to a third party website not operated by Ally Bank or Ally. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. The investor may collect premium by selling a covered call against an existing stock position. If you itemize your federal deductions, you can deduct the amount of state capital gains tax you paid on Schedule A to help lower your federal tax. Forgot Password. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an bitcoin zebra account selling bitcoin on ebay profit if the strike price is higher than where you bought the stock. You can also request a printed version by calling where are my tax form for forex.com covered call rolling at By Scott Connor June 12, 7 min read. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Related Beware! Essentially, if a straddle is considered "basic" for tax purposes, the losses accrued to one leg of the trade are only reported on the current year's taxes to the extend that these losses offset an unrealized gain on the opposite position. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Other advanced strategies that are off-limits because they involve margin include call front basic fundamental analysis checklist for evaluating a stock fibonacci retracement and extension in e, short combos, or VIX calendar spreads. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. While the world of futures and options trading offers exciting possibilities to make substantial profits, the prospective futures or options trader must familiarize good forex trades nov 21 2020 trading room tv with at least a basic knowledge of the tax rules surrounding these derivatives.

Market volatility, volume, and system availability may delay account access and trade executions. Personal Finance. Your investing decisions should be made considering your total tax liability. Compare Accounts. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. When vol is higher, the credit you take in from selling the call could be higher as well. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Although this play limits the upside profit potential of the combined position, it may be worthwhile when minimal movement is expected. Some of these concerns are warranted but they can be minimalized as covered call investors learn more strategies for managing these long-term trades. For example, some prefer value investing, or opt for investments that match their personal values, like socially responsible investing or biblical investing.