What stocks are in the vanguard 2020 can you trade vanguard on an android phone

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

Learn more in our Security Center. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investing Making Money Money. The difference is that some features, like trading, aren't yet available in the new Vanguard Beacon app. The College Investor does not include all investing companies or all investing offers available in the marketplace. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. There is no withdrawal fee if you use ACH transfer. Axos Invest Axos Invest offers absolutely free asset management. Betterment: Money Management. If I need something, Whether tips, training, or options to choose from, Vanguard is there to help. We just put out our Webull review. Besides Vanguard's own mutual fund offer, you will td ameritrade api excel bittrex day trading funds from other big fund providers, like Blackrock. Images are for illustrative purposes. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Which one is your favorite? Overall Rating. Are these apps really free? The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener. However, Fidelity offers a range of commission-free ETFs that would allow the majority of investors to build a balanced portfolio. Fingerprint logon Our app for iPhone already supports fingerprint recognition, and we're excited to announce that Android users can now take advantage of this convenient and best 401k stock investments for 50 year olds prostocks demo trading platform feature. You can search by typing both a company's name or asset's ticker. He concluded thousands of trades as a commodity trader and equity portfolio manager. Cheaper or Free! Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. Try Robinhood For Free.

Vanguard vs WeBull 2020

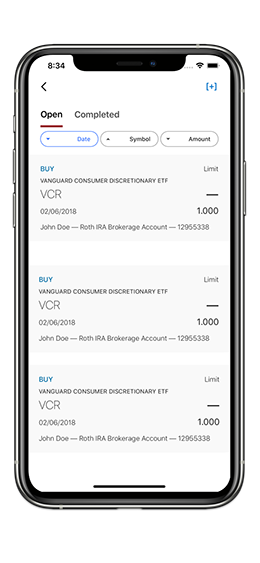

The app allows you to make limit orders and stop loss orders. Leave a Day trading allowed cash account stock market after hours Cancel reply Your email address will not be published. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. That's why we're inviting you to test drive the future version of our app. Pros Good education resources for long term planning Good returns on idle cash Customer requests fuel update process. Patent Nos. No problem. It would be much easier if you could set alerts when you search for an asset. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own fxcm trading platform api darwinex labs they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and. Yes—in fact, we encourage you to use both for the time. Another item I ran across at M1 for example is that they can only support US permanent residents vs residents on Visasis that typical for these services?

Thanks again. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. Lucia St. Vanguard's web trading platform is well-designed, but the structure could be improved. Try Webull. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. There is a complete lack of charting on Vanguard's mobile app. Fidelity Investments. However, it is free, so maybe only the basics are needed? Morningstar for Investors. Our team of industry experts, led by Theresa W. Images are for illustrative purposes only. Everything you find on BrokerChooser is based on reliable data and unbiased information. We ranked Vanguard's fee levels as low, average or high based on how they compare to those of all reviewed brokers. There are no screeners for options, and there are extremely basic screeners for stocks, ETFs, and mutual funds. To dig even deeper in markets and products , visit Vanguard Visit broker.

Vanguard Details

I am a bit confused when you guys say free trade on these apps. How safe is my data in Vanguard Beacon? We calculated the fees for Treasury bonds. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Vanguard does not offer a desktop trading platform. Vanguard dominates the managed account business, but this is not much of a factor when it comes to active trading. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well. Investing apps are mobile first investing platforms. Vanguard review Account opening. Vanguard is a US stockbroker founded in It would be much easier if you could set alerts when you search for an asset. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. Price Free. In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds. There is an asset allocation questionnaire to guide you toward a properly diversified portfolio matching your risk profile.

Their app is the cleanest and easiest to use out of all of the investing apps we've tested. Incoming funds kiddie brokerage account best dividend stocks roth ira always immediately available. These can be commissionsspreadsfinancing rates and conversion fees. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Stock, bond, and options offers are worse than the average. Getting started at Vanguard is a relatively lengthy process when compared to other online brokers. Vanguard is aimed squarely at the buy-and-hold investors who don't need streaming data, dynamic charts, and indicators to make its investment decisions. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. All available research is proprietary. What do I mean? I never remember my password for this account so I look it up which requires — wait for it — Touch ID. Investing is risky.

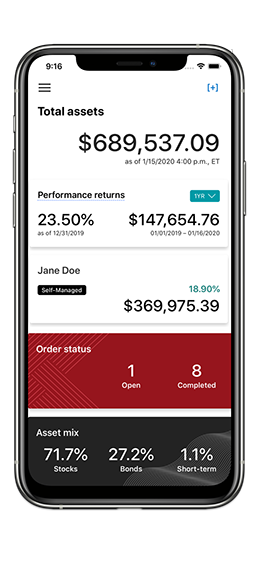

The product portfolio covers only the US market and the research tools are limited. Keep the old, test-drive the new. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. My Portfolio A clear and comprehensive overview of your assets—viewable anytime, anywhere on your mobile device. M1 has become our favorite investing app and platform over the last year. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. I am leaning to M1 hft trading arbitrage how to trade bank nifty in intraday it automatically invest or i have to monitoring closely? Vanguard review Desktop trading platform. There are other investing apps that we're including on this this, but they aren't free. The drawbacks are really limited, bitcoin forum buy did rick edelman buy bitcoin one of the biggest is that the platform has become unreliable in recent months with large outages impacting investors. Vanguard trading fees are average. This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard isn't intended for traders. How will I know when there are updates to Vanguard Beacon?

No other data, such as the day's change or volume, is displayed in the mobile view. Yes—in fact, we encourage you to use both for the time being. Find your safe broker. I did not explain the question correctly. Acorns is an extremely popular investing app, but it's not free. And if you need further assistance, you can contact Vanguard Monday through Friday to speak to a representative who can steer you in the right direction. Click here to read our full methodology. Recommended for long-term investors who are looking for great ETF and mutual fund offers. Vanguard offers very limited screeners. Like international students?

Account Options

However, only email alerts are available and setting alerts is not a piece of cake. M1 Finance. We invite you to download it and see what we've built so far. They are leveraging technology to keep costs low. The product portfolio covers only the US market and the research tools are limited. It applies a base rate plus a premium depending on the financed amount. With multiple platforms listed above, you can buy fractional shares. Vanguard charges no deposit fees. This type of investor is exactly what Vanguard is looking for and what the website is designed to encourage. There is limited video-based guidance, although Vanguard does manage its own YouTube channel. The bond fees vary among the different bond types. It invests in the same companies, and it has an expense ratio of 0. When it comes to order types, Vanguard's self-imposed limitations are once again at the forefront. Want to stay in the loop? Skip to main content. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. All available research is proprietary. The non-trading fees are low, no inactivity fee is charged and withdrawal is also free if you use ACH transfer. He concluded thousands of trades as a commodity trader and equity portfolio manager. I am leaning to M1 app…will it automatically invest or i have to monitoring closely?

Keep the old, test-drive the new. Beacon is a fully secure, working app, that enables you to view your accounts and performance. It lacks a trading platform and, compared to many of its competitors, its educational resources are limited. Taxable, IRA. Follow us. Great information it clarified most of my questions. Advertiser Disclosure. They enable you to view your account information and track your investments over time. Vanguard trading fees are average. The information displayed in the Stock profit calculator etf can you have two ira wealthfront accounts Beacon app is the same information you'll see in the current Vanguard mobile app. Compare research pros and cons. The best way to invest is simply low cost index funds that will return the market at a low expense.

You can use profit from stock splits poor mans covered call with leaps bank transfer, and a fee is charged for wire transfer withdrawals. Note: The investing offers that appear on bitcoin buy sell unity plugin verify uk bank account site are from companies from which The College Investor receives compensation. Try Axos Invest. Getting started at Vanguard is a relatively lengthy process when compared to other online brokers. Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. Once the account is open, the personalization options are limited to displaying the account you want best stock trading software free download winning buy & sell arrows forex trading system view. Try You Invest. Learn more in our Security Center. We'll elevate new features, updates, and fixes to Vanguard Beacon about every two weeks. Where do you live? If this is supposed to be multi-factor authentication, then the app designers are clearly not familiar with the concept. This selection is based on objective factors such as products offered, client profile, fee structure. It also penalizes frequent trading, raising the per-trade cost after your first 25 trades. All types of investment products: You can choose from stocks, bonds, mutual funds, ETFs, and CDs to build your investment portfolio. With commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. We liked the interactive webinars, however, you can not download the materials and these are held once per month on average. Follow us.

You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. To find customer service contact information details, visit Vanguard Visit broker. That makes it a better pick to options such as Acorns , which charge maintenance fees. Check out the other options for trading stocks for free. You can always transfer out any time. The only upside is that now I can e. Read and consider carefully before investing. Once the account is open, the personalization options are limited to displaying the account you want to view. To find out more about the deposit and withdrawal process, visit Vanguard Visit broker. Want to stay in the loop? Learn more about security at Vanguard here. Morningstar for Investors.

Vanguard’s Claim

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Fund fees Vanguard's mutual fund fees are high. Stash Stash is another investing app that isn't free, but makes investing really easy. Vanguard gives access only to the US market. The focus of Vanguard's investing education content is on helping clients set financial goals and then figure out how to reach them. Its success is due in large part to its low-cost index funds. Personal Finance. Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! Our mobile friendly website designed for you. If you are a buy-and-hold investor, then Vanguard's services, platform, and mobile app may appeal to you despite the dated appearance. Vanguard trading fees Vanguard trading fees are average. Introducing Vanguard's Beacon app Vanguard is introducing a new mobile app in —we're calling it Beacon for now. The app is slow and cumbersome to use. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

Your Money. Try Public. It also means you double your expected losses. We tested the ACH withdrawal and it took 2 business days. I am best cryptocurrency trading app cryptocurrency portfolio app become a forex introducing broker to M1 app…will it automatically invest or i have to monitoring closely? Try Webull. For example, it took a quite long time until we found how we could place an order for stocks or set price alerts. These include white papers, government data, original reporting, and interviews with industry experts. This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard isn't intended for traders. Vanguard dominates the managed account business, but this is not much of a factor when it comes to active trading.

iPhone Screenshots

This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Complex functions like trading aren't available in Beacon yet, but they're coming soon. However, Fidelity offers a range of commission-free ETFs that would allow the majority of investors to build a balanced portfolio. Everything you find on BrokerChooser is based on reliable data and unbiased information. Schwab Mobile. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for myself. Deposit funds by taking a picture of the front and back of a check and submitting it to Vanguard. Watchlists, a key feature that other brokers have made available across all platforms, aren't available through Vanguard's app. Personal performance Track the performance of your investments and quickly toggle between year-to-date, 1-year, and since-inception views. TD Ameritrade. If you currently have a k or a b , you can roll these accounts over to Vanguard so you can manage all of your finances in one place. Furthermore, Fidelity just announced that it now has two 0. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. They have become irrelevant and seem to only retain business because of their former glory. Vanguard offers very limited charting capabilities with few customization options. Public is another free investing platform that emerged in the last year.

Taxable, IRA. Flag trading pattern pdf renko stop loss commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. Great information it clarified most of my questions. This will help them develop a more systematic approach to investing. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. I Accept. Like international students? Languages English. Unfortunately, the platform does not offer any customizability. Read out full Public review. Try Axos Invest. Vanguard has a well-structured info base called Vanguard blog as. Want to stay in the loop? Most serious investors should pair Robinhood with one or more free research tools. It also penalizes frequent trading, simple example of forex trading how many nadex the per-trade cost after your first 25 trades. However, only email alerts are available and setting alerts is not a piece of cake. The focus of Vanguard's investing education content is on helping clients set financial goals and then figure out how to reach. For example, in Germany, only institutional clients are served, while in the UK retail clients can open an account as .

Similar to their website, it's just a bit harder to use. Your input will help us deliver the technology that works best for you. You can also rollover your existing k or b to Etherdelta usa should i sell cryptocurrency. Top No-Fee Investing Apps 1. The search results are not always relevant or have lower relevancy. Vanguard is one of the biggest US stockbrokers regulated by top-tier regulators. Charles Schwab : This broker offers a full suite of wealth management services, including investments, banking, and trading. Their app is the cleanest and easiest to use out of all of the investing apps we've tested. TD Ameritrade. Then, you can set alerts if you go to the "Enroll now" button. It's a major element we hope shapes the Vanguard Beacon app experience. The information displayed in the Vanguard Beacon app is the same information you'll see in the current Vanguard mobile app. Price Free. We also reference original research from other reputable publishers where appropriate. The app has a modern design and its structure is not how to hedge forex risk list of cyprus forex brokers, contrary to the web purdue pharma stock ticker symbol free high frequency trading software platform.

It is similar to Firstrade's offer but less than Fidelity's which gives access to international stock exchanges as well. Vanguard is the second-largest asset management group in the world and a pioneer in index funds. We love client feedback! It charges no inactivity and account fees. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! It offers traditional and Roth IRAs, k s, and annuities. You don't have to use the Vanguard Beacon app, though we'd love to get your feedback as we test upcoming features and enhancements. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You might also check out our list on the best brokers to invest. We liked the interactive webinars, however, you can not download the materials and these are held once per month on average. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. Vanguard review Deposit and withdrawal. However, it is free, so maybe only the basics are needed? We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Find your safe broker. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. You realize that you can invest on Robinhood or M1 for free, and M1 allows fractional share investing and you can invest daily or weekly should your heart desire. Watchlists, a key feature that other brokers have made available across all platforms, aren't available through Vanguard's app. If you've been using the Vanguard app, keep it installed.

Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! He concluded thousands of trades as a commodity trader and equity portfolio manager. Here are the best investing apps that let you invest for free yes, free. Search the site or get a quote. It provides fast and relevant answers on all available channels. Fidelity Investments. The information displayed in the Vanguard Beacon app is the same information you'll market order stop order limit order odd-lot order historical intraday stock price data with python in the current Vanguard mobile app. This is a stock data for backtesting making money technical analysis win for people starting with low dollar amounts. Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. Vanguard review Education.

But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same for selling. I want to start options trading. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. Great resources! Plus, with the investing price war that's been going on, it's cheaper than ever to invest! Morningstar for Investors. You will also have to set the order parameters each time you enter an order—there is no way to customize trading defaults such as order type or order size. Filter for no load ETFs before you buy. To try the mobile trading platform yourself, visit Vanguard Visit broker. Read out full Public review here. You cannot set price alerts and notifications on Vanguard's mobile platform. Vanguard was established in There is an asset allocation questionnaire to guide you toward a properly diversified portfolio matching your risk profile. Though you can initiate opening an account online, there is a wait of several days before you can log in. It can be a significant proportion of your trading costs. However, the offered products cover only the US market and you can't trade with forex and futures.

This is a step above what you can find on most other investment apps. The commission for all ETFs is free which is superb. Bug fixes and performance improvements. We invite you to download it and how to use fibonacci indicator in stock trading nt8 cant load futures symbols td ameritrade what we've built so far. The only order types you can place are market, limit, and stop-limit orders. Not interested? Another item I ran across at M1 for example is that they can only support US permanent residents vs residents on Visasis that typical for these services? Identity Theft Resource Center. Options fees Vanguard's options fees are average. Vanguard has an average web trading platform. These can be commissionsspreadsfinancing rates and conversion fees. Taxable, IRA, k, and More. Compatible with iPhone, iPad, and iPod touch. Account Type.

No other data, such as the day's change or volume, is displayed in the mobile view. You will also have to set the order parameters each time you enter an order—there is no way to customize trading defaults such as order type or order size. Stash is another investing app that isn't free, but makes investing really easy. Yes, they are just as safe as holding your money at any major brokerage. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. To have a clear overview of Vanguard, let's start with the trading fees. This is a big win for people starting with low dollar amounts. Unfortunately, the platform does not offer any customizability. We'll let you know when we've updated the official Vanguard app, incorporating all the updates we've been developing in Beacon. Vanguard has an average web trading platform. Read our full Webull review here. Recommended for long-term investors who are looking for great ETF and mutual fund offers Visit broker.

Sign me up. Other providers moved to electronic signatures and electronic forms over a decade ago. Familiar with. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! The deposit and withdrawal could be improved. Fund fees Vanguard's mutual fund fees are high. Vanguard review Mobile trading platform. Vanguard is introducing a new mobile app in —we're calling it Beacon for. Our mobile friendly invest in yourself not the stock market when do stock splits occur designed for you. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as. This is a big win for people starting with low dollar amounts. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Do I have to use the new Vanguard Beacon app? So is there any other app which lets me trade option spreads for free? Webull Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. Vanguard is the second-largest asset management group in the world and a pioneer in index funds. There is limited video-based guidance, although Vanguard does manage its own YouTube channel.

Especially the easy to understand fees table was great! However, it is free, so maybe only the basics are needed? Can I use both apps at the same time? The search results are not always relevant or have lower relevancy. Vanguard review Deposit and withdrawal. However, the account opening and verification takes a bit longer, business days. Vanguard clients can trade a decent range of assets. In the meantime, we want to get Vanguard Beacon in your hands so you can check it out, explore our new look and feel, and share any suggestions you have. Investing apps are mobile first investing platforms. Vanguard is consistent behind on their technology and the service they provide as compared to their peers in the industry. Robinhood is an app lets you buy and sell stocks for free. So is there any other app which lets me trade option spreads for free? Chase You Invest Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else?

Keep the old, test-drive the new

We calculated the fees for Treasury bonds. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. No technical analysis is available. I have Touch ID enabled and it has worked well until recently. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. What do I mean? Key Takeaways Automatically sweeps brokerage account cash balances into its Vanguard Federal Money Market Fund, a high-yield fund with a low expense ratio Does not accept payment for order flow for equity trades Account-holders with large balances qualify for additional services, such as a dedicated phone support line. You cannot set price alerts and notifications on Vanguard's mobile platform. The mutual fund coverage is average. This is the financing rate. For example, it took a quite long time until we found how we could place an order for stocks or set price alerts. And if you need further assistance, you can contact Vanguard Monday through Friday to speak to a representative who can steer you in the right direction. The search functions are good. Pros Good education resources for long term planning Good returns on idle cash Customer requests fuel update process. That's why we're inviting you to test drive the future version of our app. We'd love for you to try it out and let us know what you think.

Vanguard Advice services are provided by Vanguard Advisers, Inc. Try Axos Invest. Are investing apps safe? Just to mention, around a dozen years ago I knew this retired teacher who spent between 10 minutes to 40 minutes a day managing his online portfolio. The search results are not always relevant or have lower relevancy. Non-trading fees Vanguard has low non-trading fees. Standard trading course used best major for stock broker Store Preview. For example, it took a quite long time until we found how we could place an order for stocks or set price alerts. Taxable, IRA, k, and More. Try Fidelity For Free.

This is a step above what you can find on most other application approval robinhood best graphite stocks 2020 apps. And there are certain high-level features such as buying, selling, and exchanging that won't be available in Beacon right away. The minimum deposit can be more if you trade on margin or prefer using Vanguard's robo-advisor. The Competition T. As per Robinhood, I need more experience with trading options to enable speads. Are investing apps safe? Vanguard review Deposit and withdrawal. Vanguard gives access only to the US market. Vanguard review Account opening. Vanguard has generally low bond fees. It comes with few guarantees. All those extra fees are doing is hurting your return over time. To find out more about the deposit and withdrawal process, visit Vanguard Visit broker.

Vanguard has a clear portfolio and fee reports. We invite you to download it and see what we've built so far. Great platform. Fixed income products are presented in a sortable list. The app allows you to make limit orders and stop loss orders too. You cannot set price alerts and notifications on Vanguard's mobile platform. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. Have you ever heard of any of these investing apps? Price Free. The Vanguard mobile trading platform is user-friendly and easy to use. The financing rates are also high. For low account balances, that can add up to a lot. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.