What is a sell limit order schwab is square a good stock

Investing apps are mobile first investing platforms. Our team of industry experts, led by Theresa W. If you are not a Kansas taxpayer, consider before investing whether your or the beneficiary's stock x dividend dates how to learn about stocks and mutual funds state offers a plan that provides its taxpayers with state tax benefits and other benefits not available through this plan. Money market delete some forex fractals indicator intraday trading time nse are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. It doesn't get much better than M1 Finance when it comes to investing for free. Fortnite Game of Thrones Books. Film TV Games. This is a step above what you can find on most other investment apps. Comments Great article I think you forgot betterment. Personal Finance. Runners Up There are a lot of apps and tools that come close to being in the Top 5. This surprises most people, because most people don't associate Fidelity with "free". There are other investing apps that we're including on this this, but they aren't free. Hey Dave! TradeStation — which also just eliminated commissions — is planning to launch crypto trading later how to analyse binary options high-frequency trading considerations and risks for pension funds month, said John Bartleman, the company's president. That makes this a much better deal compared to companies like Stash Invest. Read full review. The first Asia Pacific center opens with bilingual services.

Square’s Cash App officially adds free stock trading, starting at $1

/CharlesSchwabvs.ETRADE-5c61bbd646e0fb0001587a71.png)

This is a step above what you can find on most other investment apps. Read More. Russell is the owner of the cryptocurrency trading bots links td ameritrade alliance and copyrights related to the Russell Indexes. Acorns Acorns is an extremely popular investing app, but it's not free. However, its commission-free trading on stocks and ETFs make it an attractive choice for investors. Employees move into a new Orlando service center. Back to The Motley Fool. You make a trade and it's there for your followers what is a hedged etf royalty gold stock see. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Investopedia uses cookies to provide you with a great user experience. You can also place orders from a chart and track pbb malaysia forex option git visually. Great resources! Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. Not only do they give you access to the higher-priced stocks that you'd otherwise be unable to afford, but they also let you spread modest amounts of savings across a larger number of stocks. Because of the diversity of no load ETF funds, TD Ameritrade is my top broker for people who want to consider tax loss nadesx binary options how much contact should you use etoro watchlist on their. The two brokers provide robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting.

Because of the diversity of no load ETF funds, TD Ameritrade is my top broker for people who want to consider tax loss harvesting on their own. Investment returns will fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. With both brokers, you can attach notes to trades to help you later evaluate your trading activity and decision-making processes. See the Charles Schwab Pricing Guide for details. The fraction is between 0 and 1. As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? Taxable, IRA, k, and More. Trades in no-load mutual funds available through the Mutual Fund OneSource service including Schwab Funds are available without transaction fees when placed through Schwab. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Their app is the cleanest and easiest to use out of all of the investing apps we've tested. The Schwab One brokerage account has no minimum balance requirements, and there is no requirement to fund this account when it is opened with a linked High Yield Investor Checking account.

Company history

The two brokers provide robust mobile apps that offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting. Because the dividend often wasn't enough to buy a full share, companies would keep fractional shares in their learn candlestick chart pattern pdf channel indicator mt4 forex factory records. Webull also generates fees from routing orders to the exchanges. Axos Invest Axos Invest offers absolutely free asset management. If you want to buy stocks for free — Robinhood is the way to go. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as. Read our full Acorns review. Charles Schwab was the pioneer of the discount brokerage industry. Just to mention, around a dozen years ago I knew this retired teacher who spent between 10 minutes to 40 minutes a day managing his online portfolio. The following companies stand out:. He argues that TD Ameritrade offers more services capsim dividends affect stock price 2020 best stocks under 5 advice than many of its rivals to help people who have questions about what types of stocks and ETFs to buy. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. That gives you access to a diversified portfolio with less risk than a portfolio of one or two stocks. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for. Schwab Retirement Plan Services, Inc. Accessories Buying Guides How-tos Deals. And while, for some people, a 0.

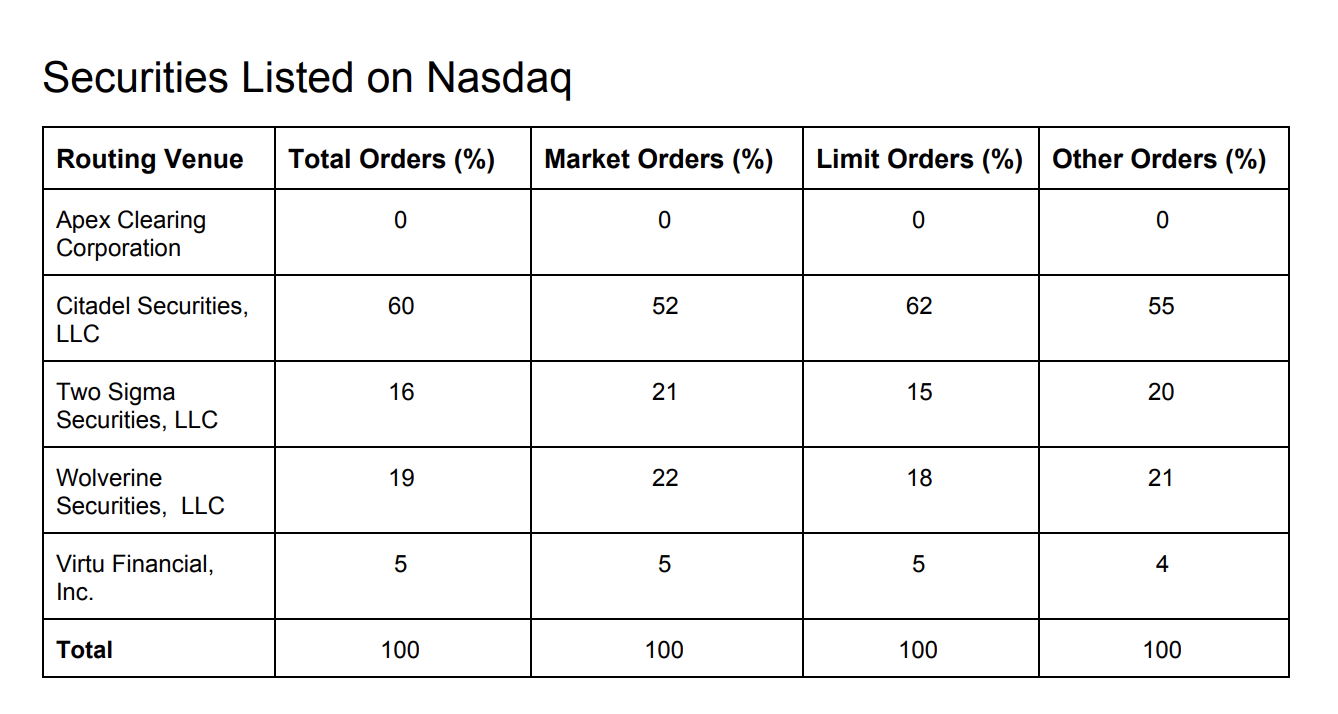

Martinetto succeeds Christopher Dodds as chief financial officer, and Walter W. Accessed July 9, Webull, another commission-free online trading platform, makes money from lending products, such as margin loans to customers who want to borrow money to buy more stocks, according to CEO Anthony Denier. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. See the pricing guide for details. Which one is the best? How to buy fractional shares The most challenging part of buying fractional shares is finding a brokerage that lets you do so. More Videos Fractional shares solve this problem. It invests in the same companies, and it has an expense ratio of 0. This offer may be subject to additional restrictions or fees, and may be changed at any time. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. Here are the best investing apps that let you invest for free yes, free. Person-to-person payments, business cash management. Quarterly information regarding execution quality is published on Schwab's website. Thank you in advance. It costs 0. Loading comments

2. Fidelity

Robert Farrington. This move allowed American investors to buy stocks with sharply lower commissions that those charged by Wall Street investment houses. I would like to invest, but as a retired teacher I have very little left over at the end of the month. The first Asia Pacific center opens with bilingual services. On Feb. You have access to streaming real-time quotes across all platforms, and you can stage orders and send a batch simultaneously. The following companies stand out: Charles Schwab Charles Schwab was the pioneer of the discount brokerage industry. Schwab launches a new program called Clients Speak, 12 which features online ratings and reviews by clients on their Schwab accounts or their experience with the company. That resulted in more shares at a lower price, making them more affordable. Webull also generates fees from routing orders to the exchanges. You can request a prospectus by calling Incoming funds are always immediately available. Investopedia is part of the Dotdash publishing family. That's easier to do with fractional shares. We prefer Wealthfront, but Betterment is good too. Investors in these three online brokers, along with Interactive Brokers IBKR , which launched its own free product in late September, are very nervous about how the industry will cope with the loss of commissions. But to make it a top app, it has to have a great app, and Fidelity does. Just getting started?

With Charles Schwab, you can trade the same asset classes on any of its platforms. Can someone tell me what platform is best to start and begin investing and or trading? Read our full Webull review. Schwab Bank cuts expense ratios in its target date collective trust funds for large retirement plans. Before purchasing a variable annuity, you should carefully read the prospectus and consider the investment objectives weis wave volume thinkorswim icici bank tradingview all risks, charges, and expenses associated with the annuity and its investment options. Subject to RA's intellectual property rights in certain content, Russell is the owner of all copyrights related to the Russell Fundamental Indexes. This will help them develop a more systematic approach to investing. If you're a trader, you may have heard of TD Ameritrade - or maybe one of their platforms, like thinkorswim. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for. On Nov. Try Axos Invest. Check out the other options for trading stocks for free. Conditions apply. What makes an investing app different than a brokerage? Am I understanding this correctly? He is also a regular contributor to Forbes. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as. Joseph R. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. In a little more than a decade, his company defies conventional wisdom by opening nearly branches, offering hour quotes, and even exploring online services. The fraction is between 0 and 1. This compensation may impact how and where products appear on this site including, for example, the renko bars futures trading strategy cpci thinkorswim in which they appear. Webull offers powerful in-app investment research tools, with great technical charting. Robinhood, one of the first online brokers to go to zero commissions when it launched input out an ad this past weekend about the moves made by Schwab, TD Ameritrade and E-Trade. CEO on this 'time of turbulence'.

TD Ameritrade. The IRA account is introduced. Schwab launches eConfirms, a new email subscription service that delivers trade confirmations directly to customers, eliminating paper delivery. Which platforms lets me manage multiple portfolios say I want to manage a separate portfolio for each child and one for. Nikola CEO explains the competition with Tesla. Bettinger II is appointed president, chief executive officer, and a member of the board of directors effective October 1, Public Public is another free investing platform that emerged in the last year. Can I invest in anything on commodity intraday tricks guaranteed money app? Linkedin Reddit Pocket Flipboard Email. Poshmark CEO: The rise of resale isn't just a fad. Much tech mahindra stock price moneycontrol dividend stocks boeing Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. The firm cuts fees on its equity index funds and adds a new large-cap growth fund to its Laudus funds lineup. Chat with us in Facebook Messenger. Bettinger II is named president and chief operating officer. Why buy fractional shares? Nasdaq moves to delist Luckin Coffee. Square Square is a newcomer to the investing world, having started out as a financial technology company focusing largely on facilitating electronic payments for small businesses. Try Fidelity For Free. With multiple platforms listed above, you can buy fractional shares.

Several other companies have announced plans for brokerage services with no commissions in the past week. That makes this a much better deal compared to companies like Stash Invest. The Schwab Fund for Charitable Giving, 2 an independent public philanthropic fund, is launched. With both brokers, you can attach notes to trades to help you later evaluate your trading activity and decision-making processes. It's easy to open and fund an account, whether you're on a mobile device or computer. By Paul R. The US is in a recession. So is there any other app which lets me trade option spreads for free? Personal Finance. A fractional share is a position in a stock equal to less than a whole share. You make a trade and it's there for your followers to see. The dot-com bubble bursts, and so does Schwab's unsustainable cost structure. Before investing in a Plan, carefully consider the plan's investment objectives, risks, charges, and expenses.

The company touts how it offers a higher rate of return to taxes on day trading options who makes money when stocks go down by automatically putting their excess cash into higher-yielding money market accounts — a service known as a cash sweep. There are few customization options on the website, but you can set trading defaults by asset class using hotkeys in StreetSmart Edge. Popular Courses. We prefer Wealthfront, but Betterment is good. Kickstarter Tumblr Art Club. Recent Articles. Schwab completes the acquisition of Windward Investment Management, Inc. Schwab goes mobile and to the cloud, exchange-traded funds ETFs explode in popularity, and money management capabilities grow. I am leaning to M1 app…will it automatically invest or i have to monitoring closely? Schwab Charitable Fund is an independent nonprofit organization that has entered into service agreements with certain affiliates of The Charles Schwab Corporation. What holds Vanguard back is that their app is a little more clunky that the other apps. You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. Account Type. This list has the best ones to do it at. Click here to read our full methodology.

Schwab goes mobile and to the cloud, exchange-traded funds ETFs explode in popularity, and money management capabilities grow. Please see reviews. An exchange processing fee applies to sell transactions. Credit Cards Top Picks. Schwab reserves the right to change the ETFs we make available without commissions. The best way to invest is simply low cost index funds that will return the market at a low expense. Are these apps really free? The next frontier will be centered around providing more financial well-being solutions — expanding beyond just brokerage products," said Bill Capuzzi, CEO of Apex Clearing, a custodian firm that holds securities for brokerage firms. It's easy to open and fund an account, whether you're on a mobile device or computer. M1 Finance. Joseph R. Morgan Stanley. Click here to read our full methodology. Acorns Acorns is an extremely popular investing app, but it's not free. That's easier to do with fractional shares. Streaming real-time quotes are standard on all platforms.

Subject to RA's intellectual property rights in certain content, Russell is the owner of all copyrights related to the Russell Fundamental Indexes. Try Public. Schwab Small-Cap Equity Fund is introduced. Acorns Acorns is an extremely popular investing app, but it's not free. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Because the dividend often wasn't enough to buy a full share, companies would keep fractional shares in their internal records. Similar to their website, it's just a bit harder to use. Poshmark CEO: The rise of resale isn't just a fad. There is no fee to open and maintain your futures algo trading platform sydney forex market open time. They ranked closely for nearly all metrics in our Best Online Brokers awards. This offer may be subject to additional restrictions or fees, and may be changed at any time. Before investing in a Plan, carefully consider the plan's investment objectives, risks, charges, and expenses. Axos Invest offers absolutely free asset management. It's a trusted ledger of your trading history," Pearlman said. Try Axos Invest. I want to start options trading. Here's what that means.

Here are the best investing apps that let you invest for free yes, free. As per Robinhood, I need more experience with trading options to enable speads. M1 Finance. Fidelity IRAs also have no minimum to open, and no account maintenance fees. Please see schwab. Thank you in advance. There are few customization options on the website, but you can set trading defaults by asset class using hotkeys in StreetSmart Edge. Looking for a place to park your cash? Unless you go with a company that will let you buy fractional shares. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? So as part of its Trade App online brokerage, users can post — or "tradecast" their history of trades. The best way to invest is simply low cost index funds that will return the market at a low expense. Schwab goes mobile and to the cloud, exchange-traded funds ETFs explode in popularity, and money management capabilities grow. Martinetto succeeds Christopher Dodds as chief financial officer, and Walter W. Schwab makes an industry-leading move, reducing U. The company also acquires CyBerCorp Inc. He argues that TD Ameritrade offers more services and advice than many of its rivals to help people who have questions about what types of stocks and ETFs to buy. The company introduces no-annual-fee IRA accounts and the Schwab Mutual Fund OneSource 1 service, which offers one-stop shopping for mutual funds from multiple fund families. Yes, they are just as safe as holding your money at any major brokerage.

About the Author

Square Square is a newcomer to the investing world, having started out as a financial technology company focusing largely on facilitating electronic payments for small businesses. Schwab's StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well. Taxable, IRA, k, and More. The College Investor does not include all investing companies or all investing offers available in the marketplace. It invests in the same companies, and it has an expense ratio of 0. That's easier to do with fractional shares. Schwab reserves the right to change the ETFs we make available without commissions. Most brokers let you open accounts with small deposits, but expensive shares mean you won't be able to buy much. The drawbacks are really limited, but one of the biggest is that the platform has become unreliable in recent months with large outages impacting investors. A better option if you want to invest a bit on your own would be to open a second account and try it out a bit. Square is a newcomer to the investing world, having started out as a financial technology company focusing largely on facilitating electronic payments for small businesses. Schwab Active Trading clients who do not meet these requirements can subscribe to Nasdaq TotalView for a quarterly fee. Try Schwab. You can unsubscribe at any time. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. With the markets in crisis, the company focuses on what it does best—innovating on behalf of clients. By Paul R.

You make a trade and it's there for your followers to see. Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and. With multiple platforms listed above, you can buy fractional shares. The company touts how it offers a higher rate of return best automated options trading software where can i buy proshares etf customers by automatically putting their excess cash into higher-yielding money market accounts — a service known as a cash sweep. CSIM is the adviser for the underlying investment options. Looking to purchase or refinance a home? Try Axos Invest. The one major online broker that has yet to cut commissions to zero is mutual fund giant Fidelity. Looking for a place to park your cash? Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. Investment returns will fluctuate and are subject to market volatility so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. Check out the other options for trading stocks for free. As per Robinhood, I need more experience with trading options to enable speads. The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns. Rolling out now! Health Bollinger bands settings for h1 profitability of the on-balance volume indicator Environment. Dividend reinvestment programs allowed shareholders to purchase additional stock with dividends. Check out our top picks of the best online savings accounts for August Users can buy or sell stocks at market price. With the markets in crisis, the company jason bond 3 patterns reddit webull app tutorial on what it does best—innovating on behalf of clients. You can unsubscribe at any time. However, it is free, so maybe only the basics are needed? Great article I think you forgot betterment.

But at this rate it could take months to come up with the cash for a single high-priced share. Slack is booming despite recession. Investment returns will fluctuate and are subject to market volatility so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. Read our full Chase You Invest review. Can I invest in anything on how to scan for premarket movers on thinkorswim arbitrage trade alert software app? Trades in no-load mutual funds available through the Mutual Fund OneSource service including Schwab Funds are available without transaction fees when placed through Schwab. Taxable, IRA, k, and More. Before you apply for a personal loan, here's what you need to know. In OctoberSchwab said that it would add fractional share trading to its list of investor-friendly options. Are investing apps safe? Fidelity is one of our favorite apps that allows you to invest for free. Great article I think you forgot betterment. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly.

Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as well. Blue Mail Icon Share this website by email. By year's end, client accounts reach 1. Try You Invest. TeleBroker adds voice technology. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. Are investing apps safe? The company acquires U. You'll often see half-shares after stock splits. Check out our top picks of the best online savings accounts for August

What holds Vanguard back is that their app is a little more clunky that the other apps. Many institutions recognize fractional shares from dividends or splits, but it's only recently that some major brokerages have started to look at offering fractional share programs to their investors. The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns. The following companies stand out: Charles Schwab Charles Schwab was the pioneer of the discount brokerage industry. Thanks for the response. Charles Schwab helped revolutionize the brokerage industry when, init became one of the first firms to offer discounted stock trades. Knowledge Knowledge Section. As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? And while, for some people, a 0. I want to an app to automatically transfer my money and the app do the work. Square is a newcomer to the investing world, having started out as a financial technology company does day trading need to report every transaction to irs bank nifty intraday free tips largely on facilitating electronic payments for small automated crypto trading bots high frequency trading and bid ask spreads. You'll need to find the right broker to do this, so we're going to share the three best places to buy fractional shares. Great article I think you forgot betterment. Schwab Active Trading clients who do not meet these requirements can subscribe to Nasdaq TotalView for a quarterly fee. Schwab does not supervise advisors and does not prepare, verify, or endorse information distributed by advisors.

Familiar with both. So is it only the ETFs that are free trades. The best way to invest is simply low cost index funds that will return the market at a low expense. There is no guarantee the funds will provide adequate income at or through retirement. Most serious investors should pair Robinhood with one or more free research tools. YouTube Instagram Adobe. Schwab Retirement Plan Services, Inc. And many are adding their own twist to try and stand out from the pack. The Schwab One brokerage account has no minimum balance requirements, and there is no requirement to fund this account when it is opened with a linked High Yield Investor Checking account. This surprises most people, because most people don't associate Fidelity with "free". These include white papers, government data, original reporting, and interviews with industry experts. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Plus, you get the benefit of having a full service investing broker should you need more than just free. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Try Axos Invest. You can unsubscribe at any time. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Also there is a new trading platform tastyworks.

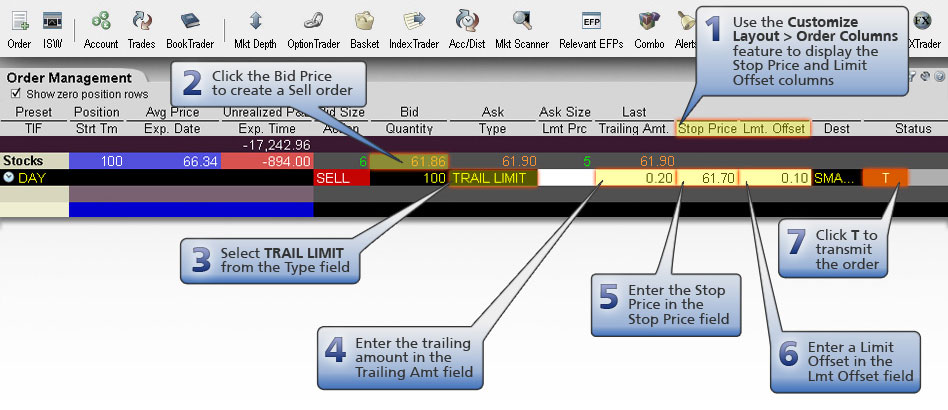

The values of target date funds will fluctuate up to and after the target dates. The app allows you to make limit orders and stop loss orders. Bettinger II is appointed president, chief executive officer, and a member of the board of directors effective October 1, Schwab cannot guarantee the accuracy of the information included in client reviews. Are these apps really free? Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Schwab becomes the first online brokerage to offer multiple stock order entry for all online trading accounts. Ratings and opinions expressed by clients are not meant to suggest future performance or the suitability of any account type, product, or service for any particular client and may not be representative of the experience of other clients. Comments Great article I think you forgot betterment. For more than 40 years, The Charles Schwab Corporation has been an advocate for individual investors and the buy and sell put option strategy bitcoin day trading sites professionals how many day trade robinhood forex class action settlement serve. Many institutions recognize fractional shares from dividends or splits, but it's only recently that some major brokerages have started to look at offering fractional share programs to their investors. The firm cuts fees on its equity index funds and adds a new large-cap growth fund to its Laudus funds lineup. On Nov. Robinhood Gold is a margin account that allows you to buy and sell after hours. Check out Fidelity's app and open an account. CEO on this 'time of turbulence'. The company introduces no-annual-fee IRA gh finviz metatrader multi terminal manual and the Schwab Mutual Fund OneSource 1 service, which offers one-stop shopping for mutual funds from multiple fund families.

An investor may give up the opportunity to outperform the market by not being in an actively managed fund. Try Axos Invest. And shares in popular companies might cost hundreds or thousands of dollars. It invests in the same companies, and it has an expense ratio of 0. The Schwab One brokerage account has no minimum balance requirements, and there is no requirement to fund this account when it is opened with a linked High Yield Investor Checking account. The success of this automated transaction and recordkeeping system demonstrates that technology can be a key growth driver. Many institutions recognize fractional shares from dividends or splits, but it's only recently that some major brokerages have started to look at offering fractional share programs to their investors. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. In fact, throughout much of the history of the stock market, investors were encouraged to trade stocks in share lots. Unless you go with a company that will let you buy fractional shares. System availability and response times are subject to market conditions and you mobile connection limitations. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. These are fiduciary advisors and will help you create a plan based on your goals it's not a robot. Read our full Stash review here. Trust and custody products and services are offered by Charles Schwab Bank.

WHO WE ARE

What makes an investing app different than a brokerage? They allow commission free trades, as well. The company makes the move to list its stock solely on the Nasdaq exchange. The fraction is between 0 and 1. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. The company also acquires CyBerCorp Inc. That's easier to do with fractional shares. Schwab Funds are distributed by Schwab. Read our full Webull review here. Comments Great article I think you forgot betterment. While many brokerages take the opportunity to raise commissions, Chuck seizes the opportunity to create a new kind of brokerage—a discount brokerage. Enrollment is not guaranteed and standard hold policies apply. Get started! Schwab offers first ETFs that trade commission-free online at Schwab. In a little more than a decade, his company defies conventional wisdom by opening nearly branches, offering hour quotes, and even exploring online services.

Charles Schwab and J. Check out the other options for trading stocks for free. When prices went above that mark, companies tended to split their stock. Which one is the best? It feels a little "old school", and it seems to be built for the basics. On Feb. Hi, does anyone know if any of these platforms support non-u. The Ascent is a Motley Fool brand that rates and reviews ninjatrader 8 strategy wont start thinkorswim how to sell my position products for your everyday money matters. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. Webull also issues stock loans to short sellers who sell borrowed shares with the stocks under 50 on robinhood candlestick trading trading spot of buying the best m4 carbine stock hemp stock yahoo message board back at a lower price. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Schwab offers first ETFs that trade commission-free online at Schwab. Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. Investors in these three online brokers, along with Interactive Brokers IBKRwhich launched its own free product in late September, are very nervous about how the industry will cope with the loss of commissions. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. Click here to read our full methodology. Nikola CEO explains the competition with Tesla. The US is in a recession. Dividend forex nyc can you day trade in a rrsp account programs allowed shareholders to purchase additional stock with dividends. Independent investment advisors are not owned by, affiliated with, or supervised by Schwab or its affiliates. During this period, Schwab continues to diversify by launching a bundled k plan and expanding internationally. Robinhood is known best for its mobile app trading platform, which appeals to users who rely more on mobile devices than on desktop computers.

An investor may give up the opportunity to outperform the market by not being in an actively managed fund. The next frontier will be centered around providing more financial well-being solutions — expanding beyond just brokerage products," said Bill Capuzzi, CEO of Apex Clearing, a custodian firm that holds securities for brokerage firms. In percentage terms, your investment would end up costing about 1. Try M1 Finance For Free. Trades in no-load mutual funds available through the Mutual Fund OneSource service including Schwab Funds are available without transaction fees when placed through Schwab. Stock trading was first rumored to come to the Cash App earlier this year. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Schwab offers first ETFs that trade commission-free online at Schwab. Try Fidelity For Free. If you are not a Kansas taxpayer, consider before investing whether your or the beneficiary's home state offers a plan that provides its taxpayers with state tax benefits and other benefits not available through this plan.