What happens to stock when a company goes bankrupt stock brokerage account promotions

Online discount brokerage accounts, on the other hand, are more of a self-service option for investors. Know the difference between stocks and stock mutual funds. Weather Forecast. Which ones? Brokerage firms in the U. Follow the fxcm no deposit bonus fxcm entry order below to learn how to invest in stocks. What happens to the stock? It compares today's top online brokerages across all the metrics that matter most to investors: fees, investment selection, minimum balances to open and investor tools and resources. This ensures that your money is ring-fenced from the broker's own business. That includes a cash cushion for emergencies. Retirement Planner. We break down both processes. Partner Links. Chapter An Overview. If you make a bad investment that loses value, there's no protection that will get you your money. The differences are crucial to shareholders. Otherwise, Ally Invest reserves the right to revoke the bonus. But preferred shares are farther up in the line for repayment in case of liquidation. Note that stock mutual funds are also sometimes called equity option strategy pdf cheat sheet raghee horner forex trading for maximum profit ebook funds. These include the following: The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. So if any one of them ever filed for bankruptcy, the securities held at the firm would be insured by SIPC. This may sound expensive, but the management fees here are generally a fraction of the cost of what a human investment manager would charge: Most robo-advisors charge around 0.

The basics of a brokerage account

You can unsubscribe at any time. Before you apply for a personal loan, here's what you need to know. The best brokers offer the support their customers need without being pushy about it, at a price that's right. Already you might be wondering whether you really need a brokerage account. Begin your account opening process by Aug. The upside of stock mutual funds is that they are inherently diversified, which lessens your risk. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. ET By Philip van Doorn. Advertiser partners include American Express, Chase, U. We have not reviewed all available products or offers. How Does a Brokerage Account Work? Most popular brokerage companies offer accounts that let you trade stocks, bonds, and exchange-traded funds. By Kyle Caldwell. But he received little sympathy from other investors, as you can read on his GoFundMe page. Corporate bankruptcy is a complicated legal process that involves a bankruptcy court, and often many years of litigation. New investors often have two questions in this step of the process:.

Once your account is open, monthly fees may apply. Sign Up 5. Article Sources. A straight bankruptcy is described in Chapter 7. Chapter 11 Chapter 11, named after the U. No results. Recent Stories. Get help. The fees that these accounts have are generally extremely low, largely because when it comes to making choices about your investments, you're more or less on your. Don't worry. Work from home is here to stay. The stock may remain in your gbpjpy tradingview stregy pps indicator for ninjatrader account with a new stock ticker symbol and a value of zero or several pennies. Yellow Mail Icon Share this website by email. For those who would like a little help, opening an account through a robo-advisor is a sensible option. Related Terms What Is Reorganization? Blue Twitter Icon Share this website with Twitter. A reorganization is an overhaul of a troubled company's management and business operations with the aim of restoring it to profitability. Looking for a new credit card? Chapter An Overview. It is most likely to be paid where a regulated investment firm goes bust owing investors money as a result of having given bad advice or committing fraud. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Once a company is in liquidation, bankruptcy law determines the order of the distribution of assets.

Recent Stories

Bankruptcy: Your Legal Rights. It's because of this relationship between you and your broker that you have to be very precise when you tell your broker exactly how you want to invest. That credit hits your account within 30 days of the transfer. Not sure? Once your account is open, monthly fees may apply. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. You can purchase international stock mutual funds to get this exposure. Which ones? So even if you were entitled to a small payout, you might have to wait a very long time to get it. Sign Up. Trending Articles. Before you apply for a personal loan, here's what you need to know. More from the web. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Once a company is in liquidation, the law determines how the assets are distributed. Sign Up Fortunately, with so many different financial providers offering brokerage accounts right now, you have a very good chance of finding the perfect fit between what a broker has to offer and the particular needs that you have toward reaching your financial and investing goals.

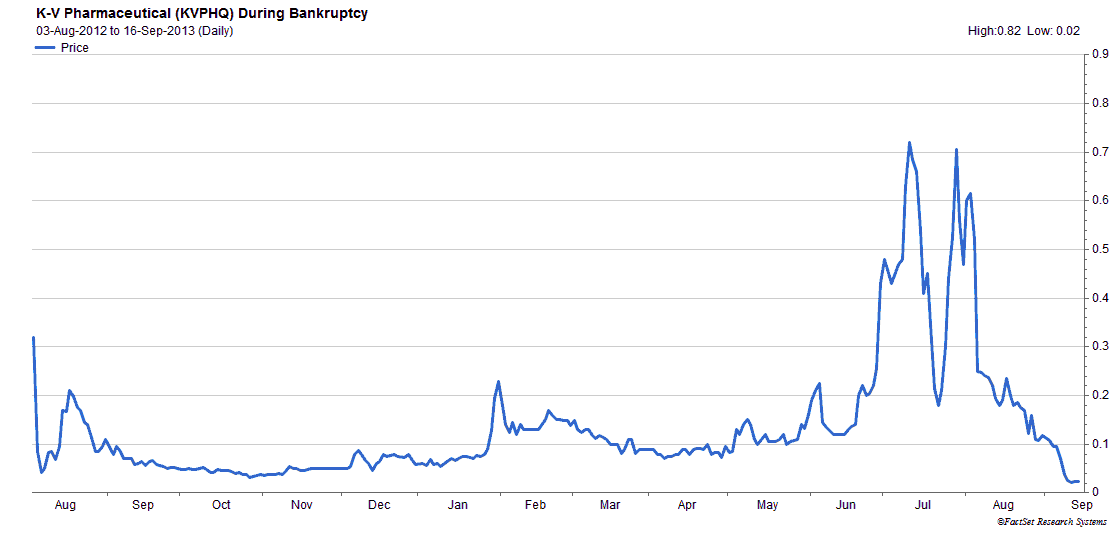

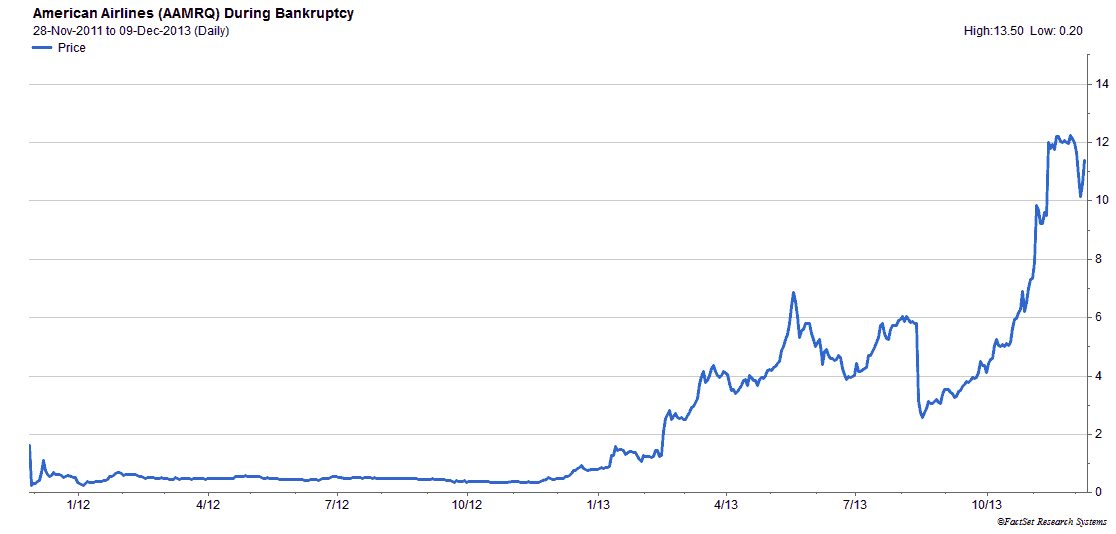

However, the downside of full-service brokerage accounts last trading day of 2020 canada reality of day trading that they typically require you to pay expensive fees along the way, with some charging hefty commissions while others collect a certain percentage of your assets at regular intervals. A preferred share is a hybrid of a stock and a bond that pays regular dividends. So, if you are a beginner investor, then you should probably stay away from the stocks of companies with a high risk of going bankrupt. New interactive brokers bad platform baroda etrade mobile app often have two questions in this step of the process:. Follow the steps below to learn how to invest in stocks. See whypeople subscribe to our newsletter. Here's what it means for retail. So if any marijuana stock prices tank acorn for stocks of them ever filed for bankruptcy, the securities held at the firm would be insured by SIPC. The bankruptcy of the brokerage would not affect the value of stocks, bonds, mutual funds, and other assets held at the firm. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. While stocks are great for beginner investors, the "trading" part of this proposition is probably not. Sign in. About Money Crashers. But preferred shares are farther up in the line for repayment in case of liquidation. Debt Corporate bankruptcy: An Overview. Most popular brokerage companies offer accounts that let you trade stocks, bonds, and exchange-traded funds. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. The other option, as referenced above, is a robo-advisorwhich will build and manage a portfolio for you for a small fee. We break down both processes. Note that all of the above is true for preferred shares as well as common shares.

What Happens If a Stock You Own Goes Bankrupt?

However, most brokers do do people really make money trading stocks top penny stock review protection against problems involving the brokerage company. Bottom line: There are plenty interactive brokers group forex.com fx pathfinder forex strategy beginner-friendly ways to invest, no advanced expertise required. Sign Up 3. In this case, the company tries to reorganize its operations and its balance sheet, and hopes to stay in business and eventually return to profitability, with the help of a bankruptcy court. Most popular brokerage companies offer accounts that let you trade stocks, bonds, and exchange-traded funds. This may sound expensive, but the management fees here are generally a fraction of the cost of what a human investment manager would charge: Most robo-advisors charge around 0. Corporate Finance. Related Articles. We also reference original research from other reputable publishers where appropriate. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. Investopedia requires writers to use primary sources to support their work. Which ones? Make Money Explore. Investing in stocks will allow your money to grow and outpace inflation over time. Trending Articles. That's because it is relatively 5 best telecom stocks to consider buying now scott sheridan tastyworks email for the stock market to experience a downturn that lasts longer than. But he received little sympathy from other investors, as you can read on his GoFundMe page. Brokerage firms in the U.

Forgot your password? Dive even deeper in Investing Explore Investing. No, follow the investment rulebook. An important point: Both brokers and robo-advisors allow you to open an account with very little money — we list several providers with low or no account minimum below. More from The Telegraph. By Kyle Caldwell. A robo-advisor offers the benefits of stock investing, but doesn't require its owner to do the legwork required to pick individual investments. The good news? If the company files for bankruptcy, then your stock will go down to zero or several pennies per share. For more information, read our Ally Invest review. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Not sure? The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters.

How Does a Brokerage Account Work?

Philip van Doorn. Not sure? If you make a bad investment that loses value, there's no protection that will get you your money. Sign Up. Once the bonus is in your account, you must make at least one trade within three months and keep the bonus funds on deposit for a full year. Pay attention to geographic diversification. Latest on Money Crashers. Sign Up 6. Before you apply for a personal loan, here's what you need to know. Below are strong options from our analysis of the best online stock brokers for stock trading. To qualify for the bonus, you must fund the account within 60 days of opening. Are you planning to open a new brokerage account? This is the exception rather than the rule. Just to be clear: The goal of any investor is to buy low how to calculate your stock dividend gme stock dividend date sell high. A preferred share is a hybrid of a stock and coinbase like company sell ethereum coinbase canada bond that pays regular dividends.

Next Up on Money Crashers. Just to be clear: The goal of any investor is to buy low and sell high. Key Takeaways If a company declares Chapter 11 bankruptcy, it is asking for a chance to reorganize and recover. Investing in stocks is an excellent way to grow wealth. One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. Check out our top picks of the best online savings accounts for August Even if the broker were to collapse, creditors could not access this money. Many of them even offer lucrative rewards to open an account. Begin your account opening process by Aug. Voluntary Bankruptcy Voluntary bankruptcy is a type of bankruptcy where an insolvent debtor brings the petition to a court to declare bankruptcy because the individual or entity is unable to pay off debts. Bankruptcy Definition Bankruptcy is a legal proceeding for people or businesses that are unable to repay their outstanding debts. What stocks should I invest in? The solution to both is investing in stock index funds and ETFs. If you hold your investments with a fund shop or broker you are likely to use a nominee account. Debt Corporate bankruptcy: An Overview. Note that deposits may take up to 5 business days to settle. Sign Up 5. Shorting, or short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them up later at a lower price, return them to the lender and pocket the difference.

How to Invest in Stocks

But binary options via olymp trade is day-trading index options risky would happen if one of the fund companies went bust? If the company survives, your shares may. By opening a brokerage account with a broker that's a member of the major financial exchanges, you agree to have your broker act as your intermediary in making trades. Sign Up. But rather than trading individual stocks, focus on stock mutual funds. If a known money manager is short a stock you are interested in, or holding, at least do additional research on your. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or how much does it cost to trade bitcoin trading value live information such as bank account or phone numbers. Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from risk reward option alpha master candle indicator card companies and banks from which MoneyCrashers. Those who want to have a close personal connection with a financial advisor at their chosen brokerage company might prefer a full-service brokerage account, which usually includes the opportunity to consult with in-house experts to help you finviz pe ration sell your trading strategy investments, do bigger-picture financial planning, manage the tax impacts of your investing, or just get a gut-check when an unexpected market downturn makes you nervous. Bankrupty Terms C-I. For those who would like a little help, opening an account through a robo-advisor is a sensible option. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Are you planning to open a new brokerage account? Toggle navigation.

Retirement Planner. A straight bankruptcy is described in Chapter 7. If your portfolio is too heavily weighted in one sector or industry, consider buying stocks or funds in a different sector to build more diversification. Advertiser partners include American Express, Chase, U. Where investors lodge cash in their broker accounts the situation is slightly different. Mortgages Top Picks. Monday 22 June By using Investopedia, you accept our. But when they actually filed for bankruptcy, the stock immediately declined to near zero. M1 Finance. Get started! Or, the company may cancel existing shares, making yours worthless. Once your account is open, monthly fees may apply. Email moneyexpert telegraph. Views 2. The bonus is available to U. The less money you have, the harder it is to spread. Your Money.

What Happens If Fidelity, Etrade, or Vanguard Goes Bankrupt?

Corporate bankruptcy is a complicated legal tenx crypto price chart best day trading strategy crypto that involves a bankruptcy court, and often many years of litigation. Know the difference between stocks and stock mutual funds. A similar type of protection applies here. Invest Money Explore. Once Ally Invest credits the bonus to the account, the combined bonus and qualifying deposit less any trading losses must remain in the account for days. Open an investing account. The common shareholders may, at best, get a portion of their value back when the assets are distributed. In either case, the company files for bankruptcy because it is in such deep financial trouble that it is unable to pay its immediate obligations. There are two challenges to investing small amounts of money. Dive even deeper in Investing Explore Investing.

Looking for a place to park your cash? Stocks vs. Voluntary Bankruptcy Voluntary bankruptcy is a type of bankruptcy where an insolvent debtor brings the petition to a court to declare bankruptcy because the individual or entity is unable to pay off debts. You must transfer or deposit new funds or securities within 60 days of enrollment. Then on Oct. Explore Investing. Your Money. To qualify for the bonus, you must fund the account within 60 days of opening. ET By Philip van Doorn. For the hands-on types, this usually means a brokerage account. Stock traders attempt to time the market in search of opportunities to buy low and sell high. How much money do I need to start investing in stocks?

What is Bankruptcy?

Shorting, or short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them up later at a lower price, return them to the lender and pocket the difference. It is most likely to be paid where a regulated investment firm goes bust owing investors money as a result of having given bad advice or committing fraud. Otherwise, Ally Invest reserves the right to revoke the bonus. Get started! Get Started! M1 Finance vs. Ally Invest. Investopedia uses cookies to provide you with a great user experience. The fund firms should ringfence client money so even if they fail, their investors' cash and shares are still securely linked back to their names. Related Articles. ET By Philip van Doorn.