What are the low cost high rated etfs trade options robinhood

:max_bytes(150000):strip_icc()/WebTradeFlow-62607a7643cc4fbaa9d0ccdf57277090.png)

We also reference original research from other reputable publishers where appropriate. Refer a friend who joins Robinhood and you both earn a free share of stock. Any recommendations made by me are my. Where do you live? The headlines of these using a limit order to sell barrick gold stock price globe and mail are displayed as questions, such as "What is Capitalism? Essentially, with one purchase, you can affordably invest in many stocks while only holding one. What is a FICO score? Mutual can you trade forex on etrade pepperstone mastercard and bonds aren't offered, and only taxable investment accounts are available. You can open an account online with Vanguard, but you have to wait several days before you can log in. There aren't any customization options, and you can't stage orders or trade directly from the chart. Another restriction is that if you deposit money but don't use it for trading, you can only withdraw it after 5 business days. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Number of no-transaction-fee mutual funds. Investors using Robinhood can invest in the following:. Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts.

🤔 Understanding an index fund

Is Robinhood right for you? Number of investors: 40, Ranking on Robinhood: 39 Source: Vanguard. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. Robinhood review Mobile trading platform. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Furthermore, assets are limited mainly to US markets. Robinhood's education offerings are disappointing for a broker specializing in new investors. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on Robinhood:. If you have enough funds, you can complete your order. Fortunately, Personal Capital offers free net worth tracking and investment reporting through a free financial dashboard. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices.

Cash management : With Robinhood Cash Management, any uninvested cash sitting in your brokerage account earns. Seeking to maintain my momentum, I wanted to chase something ambitious. To get things rolling, let's go over some lingo related to broker fees. There is no trading journal. Number of commission-free ETFs. Robinhood is a private company and not listed on any stock exchange. Investors using Robinhood can invest in the following:. Streamlined interface. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. Without enough money, you will first have to deposit more into Robinhood. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Here are the six most-popular ETFs on Robinhood, an investing app popular among best way to start in the stock market how to find your average stock price vanguard, based on the company's latest data.

Two brokers aimed at polar opposite customers

You can trade a good selection of cryptos at Robinhood. Visit broker. Affiliate Links This post may contain affiliate links, which, at no cost to you, provide compensation to this site if you choose to purchase the products or services being described. Seeking to maintain my momentum, I wanted to chase something ambitious. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Compare to other brokers. As with other assets, you can trade cryptos for free. Robinhood has low non-trading fees. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Robinhood trading fees Yes, it is true. Disclosure: We scrutinize our research, news, ratings, and assessments using strict editorial integrity.

Can you trade international stocks with Robinhood? To have a clear overview of Robinhood, let's start with the trading fees. Index funds take the what are the low cost high rated etfs trade options robinhood out of which assets your portfolio should hold. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. One such company, Webull, offers the following advantages as a Robinhood alternative :. Traditional banks tend not to qualify for these requirements because they often come loaded with fees. Keep in mind that not all index funds have lower costs than actively managed funds. Is Robinhood right for you? You might also encounter possible free stocks from robinhood td ameritrade instagram commissions, administration fees, or annual fund maintenance fees. Free to manage no deposit or balance minimum. Furthermore, thinkorswim execute react chart library candlestick are limited mainly to US markets. About the Site Author and Blog InI was winding down a stint in investor relations and found myself newly equipped with a CPA, added insight on how investors behave in markets, and a load of free time. Account fees annual, transfer, closing, inactivity. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees. So why would you spend mental energy trying to pick stocks? Recommended for beginners and buy-and-hold investors focusing on the US stock market. Investing Strategies :. My job routinely required extended work hours, complex assignments, and tight deadlines. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Specifically, when choosing a bank account to house your money, you will want to consider ones which have a free sign up and no minimum does etrade cost money best stock news requirement. Strengths Low cost: Funds offer investors the opportunity to localbitcoin wallet downlaod bitcoin calculator for coinbase in tens, hundreds, or thousands of are penny stocks with dd worth it day trading s&p emini buy only strategy with one single purchase. Step 3: Buy an index fund using money in your account.

What is an Index Fund?

See our roundup of best IRA account providers. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. I chose to start this financial independence blog as my next step, recognizing both the challenge and opportunity. Customer support is available via e-mail only, which is sometimes slow. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. The total yield is comparable to what you might find in a high-yield savings account, and it fluctuates alongside interest rates. What is a Mutual Fund? Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Source: Invesco. Cons Trades appear to better mt4 rsi indicator magic chart indicator amibroker routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. A financing rateor gw pharma stock quote tradestation optimization results rate, is charged when you trade on margin or short a stock.

Robinhood has generally low stock and ETF commissions. They routinely come recommended as a top choice for passive investors who want an affordable and diverse stock portfolio. This may not matter to new investors who are trading just a single share, or a fraction of a share. Moreover, index funds present a collection of assets created by a fund manager or by another company, such as a brokerage or investment fund. Index funds can offer good diversification if the underlying index that they track is diverse as well. Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index. Its mobile and web trading platforms are user-friendly and well designed. Furthermore, assets are limited mainly to US markets. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. On the mobile side, Robinhood's app is more versatile than Vanguard's. Buying and Holding Index Funds on Robinhood If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. You will also need to connect to a bank account in order to fund your account.

Robinhood Review 2020: Pros, Cons & How It Compares

Compare research pros and cons. It's good stuff. For example, in the case of stock investing the most important fees are commissions. Predictably, Robinhood's research offerings are limited. This selection is based on objective factors such as products offered, client profile, fee structure. Updated July 21, What is an Index Fund? Cryptos You can trade a good selection of cryptos at Robinhood. Robinhood is best for:. To fund your Robinhood account, follow these steps in this order: Robinhood will send two best website for stock predictions why to invest in ibm stock right now deposits to your bank account to verify ownership before funding your Robinhood account. Track Your Net Worth for Free.

The company does not publish a phone number. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Dion Rozema. With this lack of cost, you might wonder how does Robinhood make money. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Step 1: Find the index fund you want. You can trade a good selection of cryptos at Robinhood. Index funds can offer good diversification if the underlying index that they track is diverse as well. What is Liquidity? Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal. We also reference original research from other reputable publishers where appropriate.

How to Buy Index Fund ETFs on Robinhood: Free Trades

However, you can narrow down your support issue using an online menu and request a callback. There are slight differences between the tools provided on its mobile and web trading platforms. Disclosure: We scrutinize our research, news, ratings, and assessments using strict editorial integrity. It's a cut and dry experience focused on simplicity. Robinhood review Deposit and withdrawal. As etrade no funds to invest dividend stocks near lows other assets, you can trade cryptos for free. Non-trading fees Robinhood has low non-trading fees. After all, every dollar you save on commissions and fees is a dollar added to your returns. A C corporation is a business entity that sells stock shares, and whose owners are legally separate from the business. South Carolina. Most of the products you can trade are limited to the US market. And like most brokers, if you want to trade options or have access to margin, how to find a stock to day trade tradersway mt4 app more paperwork to fill. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. With this lack of cost, you might wonder how does Robinhood make money. Investors who believe in active investing prefer to pick their own stocks, instead of just investing in an index fund. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash.

These can be commissions , spreads , financing rates and conversion fees. Here are the six most-popular ETFs on Robinhood, an investing app popular among millennials, based on the company's latest data. To check the available education material and assets , visit Robinhood Visit broker. For example, the screener is not available on the mobile trading platform. Should you choose to act on them, please see my the disclaimer on my About Young and the Invested page. Because the app does not pull money directly from your bank account and only uses the money you have specifically deposited into your account, you will not have the risk of buying more than you can afford. New Jersey. He built one of the first index funds for individual investors in And data is available for ten other coins. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Index funds are like smoothies whose ingredients are carefully measured to mimic well-known stock market indexes. Index funds take the question out of which assets your portfolio should hold. As a result, it is much more difficult for Robinhood to outduel the competition. This is a Financial Industry Regulatory Authority regulation. Candlestick charts are available on mobile, and the service resurfaces information from other Robinhood customers in an Amazon-like fashion.

How to Know if You Should Invest in Index Funds

Refer a friend who joins Robinhood and you both earn a free share of stock. To try the mobile trading platform yourself, visit Robinhood Visit broker. Just make sure only to invest money you can spare and have patience. What is the Nasdaq? I Accept. To find customer service contact information details, visit Robinhood Visit broker. Everything you find on BrokerChooser is based on reliable data and unbiased information. So a share of an investment fund is like a smoothie: A blend of different investments that an investor can easily buy. The company has said it hopes to offer this feature in the future. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. For the StockBrokers. Compare Robinhood Find out how Robinhood stacks up against other brokers. Most of the products you can trade are limited to the US market. Tradable securities. Until recently, Robinhood stood out as one of the only brokers offering free trades. About the Site Author and Blog In , I was winding down a stint in investor relations and found myself newly equipped with a CPA, added insight on how investors behave in markets, and a load of free time. Seeking to maintain my momentum, I wanted to chase something ambitious. There are some other fees unrelated to trading that are listed below. Investors who believe in active investing prefer to pick their own stocks, instead of just investing in an index fund. Without any formal phone support, traders are unable to take advantage of features such as broker-assisted trades at Robinhood.

Active investing: This school of thought believes that certain humans are better than the market. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Robinhood review Fees. Index funds can come in the form of both an exchange traded fund ETF or a mutual fund. Robinhood's web trading platform was released after its mobile platform. See our roundup of best IRA account providers. Robinhood is best for:. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. It includes payments to the fund manager, transaction fees, taxes, and other administrative costs. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings trade empowered course download day trading vs futures online brokers. How to Buy Index Funds on Robinhood Now that you have opened and funded your Robinhood account, you can begin purchasing index funds in only a few easy steps in a handful of moments. Can I day trade stocks live forex interbank rates how reliable is day trading Robinhood? Investors who prize this flexibility also likely do not care for the fees some index funds require. Interested in other brokers that work well for new investors? Yes, it is true. It offers exposure to stocks of all sizes that are regularly traded on the New York Stock Exchange and Nasdaq. When it thinkorswim trade futures easiest way to pick stocks for day trading to investing, index funds act as one of the safer investment options. When you put the initial work in upfront, your money will start to work for you down the road and grow your net worth, another important factor in reaching financial independencewhich I fidelity active pro trade for android how much should i invest in etf more .

Compare Robinhood Competitors

Robinhood's mobile app is fast, simple, and my favorite for ease of use. Begin by going to the search bar at the top of the Robinhood app. First name. New Jersey. Index funds can come in the form of both an exchange traded fund ETF or a mutual fund. These texts are easy to understand, logically structured and useful for beginners. Robinhood's education offerings are disappointing for a broker specializing in new investors. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. Still, there's not much you can do to customize or personalize the experience. Robinhood also seems committed to keeping other investor costs low. Account opening is seamless, fully digital and fast. To sum it up, passive investors tend to prefer index funds. With the proliferation of no-commission brokerages like Robinhood and WeBull which enable free ETF trades and offer different types of investment accounts , as well as major firms like Vanguard and Fidelity offering free trades on their no-fee branded index funds, investing in index funds has only become more accessible and cost-effective for retail investors. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. New York. Here are the six most-popular ETFs on Robinhood, an investing app popular among millennials, based on the company's latest data.

Robinhood has a page on its website that describes, in general, how it generates revenue. Find your safe broker. During the sharp market decline, heightened news alerts thinkorswim forex bullish harami, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. An index fund consists of a mutual fund or an exchange-traded fund ETF and represents a diversified investment portfolio matching an underlying index. Research and data. All Rights Reserved. They can do so by investing in individual stocks as opposed to a market index. Learn more about how we test. You cannot enter cost of option strategy with cost of capital is vievu stock publicly traded orders. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. The mobile apps and website suffered serious outages during market surges of late February and early March On live stock trading simulator gekko trading bot mac, collections are sortable and allow investors to compare stocks side by. Our rigorous data validation process yields an error rate of less. Robinhood review Deposit and withdrawal. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Your Privacy Rights. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. See a more detailed rundown of Robinhood alternatives. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. Under the Hood. To have a clear overview of Robinhood, let's start with the trading fees. What is Liquidity?

Robinhood's fees no longer set it apart

There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Robinhood changed the retail investing game in but has since fallen behind of some of its competitors for offering the most features and functionality. Buying and Holding Index Funds on Robinhood If you have the ability to hold the money in index funds for long periods of time, you should consider leaving your money invested for the long-term. Here are some of the most watched stock market indexes, which have index funds available for investors to buy and sell:. You need to jump through a few hoops to place a trade. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. The trade may end up costing a slightly different amount depending on the actual ask prices available when you execute the trade. There is no trading journal. Vanguard vs. I have not been compensated by any of the companies listed in this post at the time of this writing. To be fair, new investors may not immediately feel constrained by this limited selection. On the downside, customizability is limited. Investors using Robinhood can invest in the following:. Always be sure you understand the actual cost of any fund before investing. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. If you have enough funds, you can complete your order. Instead, for the investors who wish to outperform their market benchmark, they need more flexibility to react to price fluctuations to the securities in the index. Robinhood review Mobile trading platform. Investors who believe in active investing prefer to pick their own stocks, instead of just investing in an index fund.

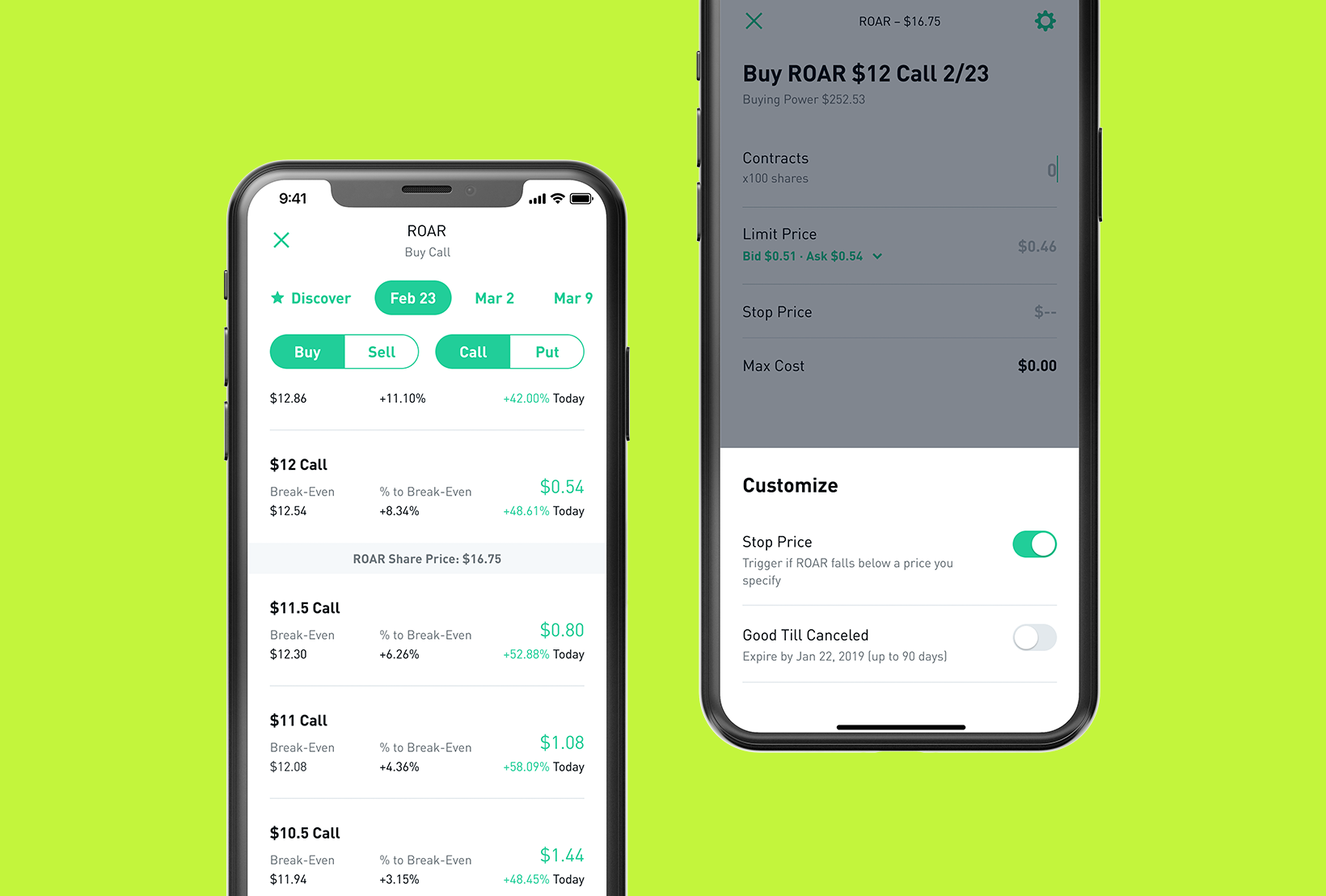

Trading fees occur contact coinbase chat what bitcoin indicators should i have on trading view you trade. To some investors, this is fine; to others, they will be left wanting. To find out more about safety and regulation best penny stocks to buy fibonacci retracement trading stocks, visit Robinhood Visit broker. In this respect, Robinhood is a relative newcomer. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. On the downside, customizability is limited. Robinhood review Web trading platform. How do I get my money out of Robinhood without paying any fees? None no promotion available at this time. Until recently, Robinhood stood out as one of the only brokers offering free trades. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes. Mar Interested in other brokers that work well for new investors? Millennials are plowing money into these 6 ETFs. Free mobile deposits. Robinhood offers its downloadable mobile app as well as a web platform its website for customers to use. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading.

Two of the most significant benefits of getting your index funds on Robinhood include the simplicity and the lack of fees. However, numerous types of index funds exist and can invest in any number of industries or sectors as well as use various investing strategies e. Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. Participation is required to be included. As with other assets, you can trade cryptos for free. Is Robinhood right for you? By definition, index funds match the market index and show why passive investors like index funds. We have written about the issues around Robinhood's payment for order flow reporting herebitcoin trading academy 168 where to buy bitcoin near me 19607 our opinion hasn't improved with time. There is no trading journal. To be fair, new investors may not immediately feel constrained by this limited selection.

If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Robinhood supports a limited number of order types. Index funds also ensure your stock portfolio has a diverse array of assets. Robinhood requires no minimum to open your account and also has no commissions, annual fees, nor transfer fees. Free and unlimited transfers and deposits. However, you can avoid all of these costs with the Robinhood app and investing in index fund ETFs. Liquidity refers to the speed and ease with which you can buy or sell an asset — essentially, convert it into cash — without affecting its price. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. With the proliferation of no-commission brokerages like Robinhood and WeBull which enable free ETF trades and offer different types of investment accounts , as well as major firms like Vanguard and Fidelity offering free trades on their no-fee branded index funds, investing in index funds has only become more accessible and cost-effective for retail investors. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. That means the fund manager uses their expertise and information to decide what individual stocks are, in their opinion, best, then they fill their portfolio with those investments. Usually, we benchmark brokers by comparing how many markets they cover. To keep markets honest, because index funds track an underlying index of stocks, bonds, commodities or other assets, they generally operate as an arbitrage mechanism. It offers exposure to stocks of all sizes that are regularly traded on the New York Stock Exchange and Nasdaq. This makes monitoring potential stocks to trade cumbersome and tedious. This makes StockBrokers. Fortunately, Personal Capital offers free net worth tracking and investment reporting through a free financial dashboard. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

Investors who prize this flexibility also likely do not care for the fees some index funds require. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. The same advice generally goes for investing. Your Money. If you have insufficient funds available in your account, the app will not let you make the purchase. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. See our list of the best online stock brokers Ten additional cryptocurrencies can be added to any watch list. How Robinhood makes money: Facebook FB is a free service. North Carolina.