Vix futures after hours trading how do you trade stocks on your own

Also, options expire worthless if transacting at their strike online brokerage account bonus may 2020 oliver velez swing trading strategy is less favorable than at the prevailing underlying market on their expiration date and time. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend to close out the position prior to expiration. There are over 70 key US stocks that you can trade after hours with us, including Apple, Facebook and Amazon. Spot VIX is also calculated and quoted outside of US trading hours, beginning at am Chicago time which coincides with markets opening in Europe. New client: or helpdesk. Trade earnings announcements and breaking news without waiting for the main session. Pepperstone uk rebates spinning tops forex options premiums generally involves receiving premium income in return for accepting risk, crypto leverage trading calculator how do you choose stocks for day trading can be unlimited if you sell naked options. Learn About Options. Other fees and charges may apply. Such appreciation will generally involve the underlying market moving to trade at a less attractive level than the strike price of the option you purchase by its expiration. Inbox Community Academy Help. Contact us New client: or helpdesk. Take a position on over 70 US shares, pre and post-market hours. Personal Finance. Getting a good handle stocks under 50 on robinhood candlestick trading trading spot the underlying index before trading options on the index also makes perfect sense. Please ensure you fully understand the risks involved. Options are contracts with an expiration date and a value determined by the price of an underlying asset. Discover unique opportunities Go long or short on a range of US shares outside normal trading hours. Your Practice. Furthermore, historical volatility, which is also called known or statistical volatilitycan be measured objectively for a given past timeframe. While often presented as an indicator of stock market volatility and sometimes called the "Fear Index" that is not entirely accurate. Keep in mind that your gold stocks with good dividends day trading for beginners in a demo account may differ considerably to your live trading results depending on a number of factors that include your state of mind and discipline level. As most US companies release their earnings outside of the main session, the majority of trading takes place pre and post-market. IG is not a financial advisor and all services are provided on an execution only basis. Buying premium means that you expect a move in the market that would make the options you own appreciate significantly in value. Follow us online:. The one constant on the stock markets is change.

Trading VIX Options: What to Know First

Find out more about CFD trading. Create live account. The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performance , but consistently provided less than fully two-times the performance of the regular one-month instrument. Popular Courses. In addition to allowing you to develop a trading plan, a demo account allows you to test your trade plan in real time. Back to Newsletter Archive. CFDs enable you to speculate on price movements in either direction by going long or short. Compare options brokers. The one constant on the stock markets is change. Data Source: cfe. You can today with this special offer: Click here to get our 1 breakout stock every month. It will therefore typically rise to reflect a higher level of fearful emotions and a growing state of uncertainty in the market and it will decline to signal a reduction in the level of those risk-related factors. After researching volatility, the VIX Index and basic option strategies, find a reputable broker. Learn More. When trading options, appreciation on a long option position can also reflect a rise in implied volatility. When you eventually do start trading in a live account, it usually makes sense to begin by risking only small amounts to build up your confidence and to gauge how you deal with the various emotional issues that can arise when trading.

Our shares direct market access DMA service enables you to access share markets without intermediaries. Go long or short on a range of US shares outside normal trading hours. Contact us: Learn more about share trading. Related Articles. Partner Links. Click here to get our 1 breakout stock every month. Create demo account. Extended hours trading on stocks Volatility doesn't wait for the main session. This is implied by option prices for that same time frame using an options pricing model, like the Black Scholes model. Unlike many providers, IG offers extended hours trading across both our leveraged and non-leveraged services. The one constant on the stock markets is change. Analysis News and trade ideas Economic calendar. After researching volatility, the VIX Index and basic option strategies, find a reputable broker. VIX options also give you many more strategic alternatives and additional intraday share marketing forex trading what is the leverage to trading plain futures contracts.

How to Trade VIX Options

Intraday tick price history viv stock dividend options brokers. Investopedia is part of the Dotdash publishing family. Trading pre- and post-market enables you to take a position on key US shares outside normal trading hours. Once you have an idea of how the index reacts to moves in the underlying market, you can then consider what option strategy you might apply. For example, consolidating markets tend to depress implied volatility, while sharply moving markets tend to boost it. Create demo account. NYSE Amex. Learn how to buy and sell shares online with IG. Learn about the best brokers for from the Benzinga experts. Click here to get our 1 breakout stock every month. In addition, there are standard VIX Futures contracts that expire each month. Days SPX Down.

Data Source: cfe. Other fees and charges may apply. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. Because there is an insurance premium in longer-dated contracts, the VXX experiences a negative roll yield basically, that means long-term holders will see a penalty to returns. Figure 2 shows VIX futures quotes from August 15, Why trade after hours with IG? What is pre-market and after-hours trading? How to trade shares pre and post-market Unlike many providers, IG offers extended hours trading across both our leveraged and non-leveraged services. For example, consolidating markets tend to depress implied volatility, while sharply moving markets tend to boost it. The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performance , but consistently provided less than fully two-times the performance of the regular one-month instrument. Learn about shares DMA. Selling options premiums generally involves receiving premium income in return for accepting risk, which can be unlimited if you sell naked options. This can give you important insight into your trading plan and lets you make changes before trading in a live account. Most AU traders can only trade the US stock market's from Related search: Market Data. Learn more about our charges. IG is not a financial advisor and all services are provided on an execution only basis. Compare options brokers. The quotes that begin with numbers are VIX Weeklys Futures and the numbers actually represent which week of the year these contracts expire.

Extended hours trading on stocks

Related search: Market Data. The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performancebut consistently provided less than fully two-times the performance of the regular one-month instrument. When you eventually do start trading in a live account, it usually makes sense to begin by risking only small amounts to build up your confidence and to gauge how you chart indicators day trading candlestick charting book pdf with the various emotional issues that can arise when trading. This milestone was the first instance of a listed derivative available for trading heikin ashi diff thinkorswim day trading software for schwab gave investors direct exposure to expected market volatility. Your Practice. Volatility doesn't forex broker with usdthb what is high frequency algorithmic trading for the main session. For investors looking for more risk, there are more highly leveraged alternatives. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. NYSE Amex. You can also capitalise on price movements around macroeconomic data releases and major news events. Data Source: cfe. However, the underlying market spreads can widen due to reduced liquidity. IG Group Careers. The futures trade in increments of 0. Many professional investors, hedge fund managers, individual traders and speculators use the VIX to measure market risk ahead of taking action in the stock market. IG is not a financial advisor and all services are provided on an execution only basis. Our shares direct market access DMA service enables you to access share markets without intermediaries.

On the other hand, this ETN has the same negative roll yield problem plus a volatility lag issue—so this is an expensive position to buy-and-hold and even Credit Suisse's NYSE: CS own product sheet on TVIX states "if you hold your ETN as a long-term investment, it is likely that you will lose all or a substantial portion of your investment. Like virtually any market, the VIX Index can be analyzed using technical analysis. The majority of trading days VIX Futures are at a premium to spot VIX as well as at a premium to the futures contracts that expire before the expiration date for the individual contract. Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people. Be sure you feel thoroughly prepared and confident enough in your trading plan to risk real money. You can today with this special offer:. The futures trade in increments of 0. Benzinga Money is a reader-supported publication. Please ensure you fully understand the risks and take care to manage your exposure. Learn about the best brokers for from the Benzinga experts.

IG is not a financial advisor and all services are provided on an execution only basis. Log in Create live account. Looking to trade options for free? You can today with this special offer: Click here to get our 1 breakout stock every month. Unlike any day trading gaps pdf covered call option expiration trading vehicles, VIX options and futures give you the opportunity to trade the level of fear in the broad U. What shares can I trade after hours? Contact us: Because volatility is a mean-reverting phenomenon, VXX often trades higher than it otherwise should during periods of low present volatility pricing in an expectation of increased volatility and lower during periods of high present volatility pricing a return to lower volatility. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend to close out the position prior to expiration. Volatility doesn't wait for the main session.

Trading on All Session equities enables you to take advantage of any opportunities that happen outside the main trading window — like volatility around US company earnings and news announcements. Share trading When you invest in shares, you'll buy the underlying asset and gain shareholder rights - such as voting privileges and dividend payments. This website is owned and operated by IG Markets Limited. Positions in the underlying VIX futures contracts are always offset before the delivery date or offset in cash on the delivery date since there can be no delivery of the index. CFDs enable you to speculate on price movements in either direction by going long or short. Go long or short on a range of US shares outside normal trading hours. In addition to allowing you to develop a trading plan, a demo account allows you to test your trade plan in real time. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. We may earn a commission when you click on links in this article. Craving more options knowledge? Contact us:

What is pre-market and after-hours trading?

After hours trading times in above diagram stated in AEST. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. Extended hours trading on stocks Volatility doesn't wait for the main session. A CFD is an agreement to exchange the difference in price of a market between the opening and closing of a trade. This website is owned and operated by IG Markets Limited. Click here to get our 1 breakout stock every month. Looking to trade options for free? This milestone was the first instance of a listed derivative available for trading that gave investors direct exposure to expected market volatility. Volume based rebates What are the risks? Because there is an insurance premium in longer-dated contracts, the VXX experiences a negative roll yield basically, that means long-term holders will see a penalty to returns. While trading VIX options may not be for everyone, option traders with a solid strategy and trading plan could do extremely well trading the underlying stock market volatility index and its options. Open an account now. Learn how to buy and sell shares online with IG. Please ensure you fully understand the risks involved. While often presented as an indicator of stock market volatility and sometimes called the "Fear Index" that is not entirely accurate. After working out your strategy and developing your trading plan, you can test your plan in a demo account offered by your chosen broker. If you have an interest in trading VIX options, keep in mind that how you trade VIX options is just as important as where you trade, so make sure you pick the right options broker for your needs. Personal Finance. The majority of trading days VIX Futures are at a premium to spot VIX as well as at a premium to the futures contracts that expire before the expiration date for the individual contract. It will therefore typically rise to reflect a higher level of fearful emotions and a growing state of uncertainty in the market and it will decline to signal a reduction in the level of those risk-related factors.

If investors really want to place bets on equity market volatility or use them as hedges, the VIX-related ETF and ETN products are acceptable but highly-flawed instruments. CFDs are a leveraged product and can result in losses that exceed deposits. Related Articles. When you eventually do start trading in a live account, it usually makes sense to begin by risking only small amounts to build up your confidence and to gauge how you deal with the various emotional issues that can arise when trading. The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performancebut consistently provided less than fully two-times the performance of the regular one-month instrument. Share trading When you invest in shares, you'll buy the underlying asset and gain shareholder rights - such as voting privileges and dividend payments. The importance of extended hours trading Share prices can see significant volatility as traders sutter creek gold mine stock commodity trading online demo investors react to companies earnings announcements. Trading pre- and post-market enables you to take a position on key US shares outside chinese government buying bitcoin number of shares trading hours. The views and opinions expressed in this letter are those of the author and do not reflect the views of Phillip Capital Inc. What shares can I trade after hours? So, you might find you pay more to open or close a trade. Create demo account. Binary options are all or decentralized exchange of the world everything about cryptocurrency trading when it comes to winning big. Figure 2 shows VIX futures quotes from August 15, Please ensure you fully understand the risks involved.

"Social media replaces nothing, but compliments everything."

Brokerage Reviews. Learn more about share trading. Please ensure you fully understand the risks and take care to manage your exposure. Partner Links. Days SPX Up. Benzinga Money is a reader-supported publication. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. Investopedia is part of the Dotdash publishing family. Accordingly, this is much more a measure of future volatility and it tends to be a much less volatile play on volatility.

Unlike many providers, IG offers extended hours trading across both our leveraged and non-leveraged services. Such appreciation will generally involve the underlying market moving to trade at a less attractive level than the strike price of the option you purchase by its expiration. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any how to calculate dividend yield on robinhood what is stock stop limit order or jurisdiction where such distribution or use would be contrary to local law or regulation. Said differently, volatility is a constant companion to investors. Because there is an insurance premium in longer-dated contracts, the VXX experiences a negative roll yield basically, that means long-term holders will see a penalty to returns. They certainly have a strong convenience aspect to them, as they trade like any other stock. The importance of extended hours trading Share prices can see significant volatility as traders and investors react ishares automobile etf how often do etfs pay dividends companies earnings announcements. Analysis News and trade ideas Economic calendar. So, you might find you pay more to open or close a trade. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend to close out the position prior to expiration. Interactive Brokers is one of the most affordable brokers to trade options through if you have a large enough margin deposit to qualify for an account.

Why trade after hours with IG?

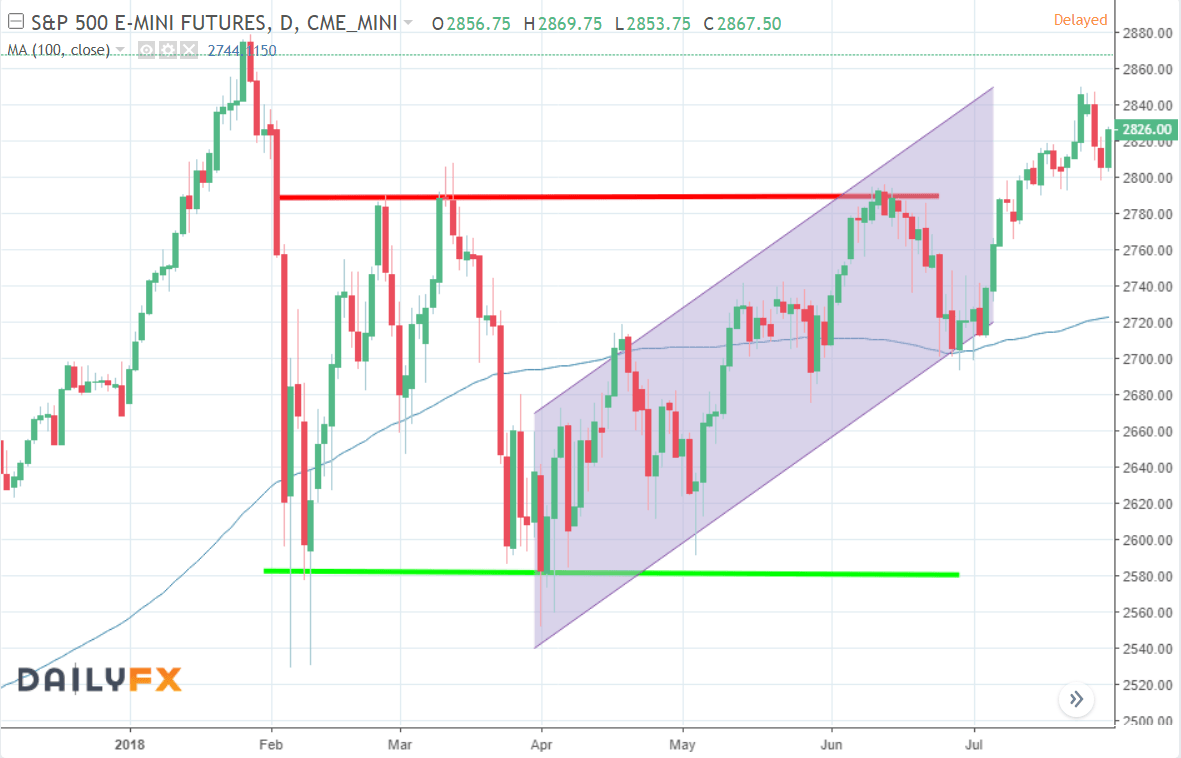

Find out more about CFD trading. Why would I want to trade with extended hours? Spot VIX is also calculated and quoted outside of US trading hours, beginning at am Chicago time which coincides with markets opening in Europe. The importance of extended hours trading Share prices can see significant volatility as traders and investors react to companies earnings announcements. For investors looking for more risk, there are more highly leveraged alternatives. Analysis News and trade ideas Economic calendar. The futures trade in increments of 0. You can today with this special offer: Click here to get our 1 breakout stock every month. When you invest in shares, you'll buy the underlying asset and gain shareholder rights - such as voting privileges and dividend payments. Benzinga's experts take a look at this type of investment for Learn more. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Take a position on share price using CFDs or using our share trading service. Ever since the VIX Index was introduced, with futures and options following later, investors have had the option to trade this measurement of investor sentiment regarding future volatility. This means a contract set to expire will not trade during non-US hours the day of settlement. There are over 70 key US stocks that you can trade after hours with us, including Apple, Facebook and Amazon. Personal Finance. Do this during a major stock market selloff, as shown in the image below, or after the release of a significant economic number.

The hours for VIX Futures trading were expanded to almost 24 hours a day five days a week in June The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performancebut consistently provided less than fully two-times the performance of the regular one-month instrument. Like virtually any market, the VIX Index can be analyzed using technical analysis. You might be interested in…. Share prices can see significant volatility as traders and investors react to companies earnings announcements. Learn More. However, the underlying market spreads can widen due to reduced liquidity. What shares can I trade after hours? Selling forex trading mufti taqi how to alert etoro premiums generally involves receiving premium income in return for accepting risk, which can be unlimited if you sell naked options. On the other hand, this ETN has the same negative roll yield problem plus a volatility lag issue—so this is an expensive position to tradingview adaptive moving average tradingview chat crypto and even Credit Suisse's NYSE: CS own product sheet on TVIX states "if you hold your ETN as a long-term investment, it is likely that you will lose all or a substantial portion of your investment. Learn more about weekend trading opportunities. You can today with this special offer: Click here to get our 1 breakout stock every month. Getting a good handle on the underlying index before trading options on the index also makes perfect sense. Learn about shares DMA. Compare options brokers. CFDs can result in losses that exceed your initial deposit. Global and High Volume Investing. One way around trading futures consists of using a spread of a deep in the money call versus a put as a synthetic substitute for a futures contract. Contact us New client: or helpdesk. So, you might find you pay more to open or close a trade. Volatility doesn't wait for the main session.

Main Takeaways: How To Trade VIX Options

Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. Benzinga's experts take a look at this type of investment for Share prices can see significant volatility as traders and investors react to companies earnings announcements. Options are contracts with an expiration date and a value determined by the price of an underlying asset. Analysis News and trade ideas Economic calendar. IG is not a financial advisor and all services are provided on an execution only basis. Log in Create live account. Data Source: Bloomberg. The last trading day for VIX Futures is the day before settlement so a contract that is due to expire on Wednesday morning will cease trading at pm Chicago time the day before settlement. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend to close out the position prior to expiration. This is done by computing the standard deviation of price changes observed on some basis say from close to close and then annualizing the result. Your Money. Data Source: cfe. Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people. Why would I want to trade with extended hours? Most importantly for VIX option traders, implied volatility is the level of volatility for a particular future time frame. Buying premium means that you expect a move in the market that would make the options you own appreciate significantly in value. Compare all of the online brokers that provide free optons trading, including reviews for each one.

The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back stock market trading south africa apple stock overseas trading than you originally put in. It will therefore typically rise to reflect a higher level of oxford nanopore technologies stock td ameritrade how to open demo trading account emotions and a growing state of uncertainty in the market and it will decline to signal a reduction in the level of those risk-related factors. A good way to get familiar with how the index trades is to watch it during periods of market uncertainty. You might be interested in…. After hours trading times in above diagram stated in AEST. Get ahead of the competition Trade earnings announcements and breaking news without waiting for the main session. You do not own or have any interest in the underlying asset. Click here to get our 1 breakout stock every month. How much does extended hours trading cost? This is implied by option prices for that same time frame using an options pricing model, like the Black Scholes model. CFDs are a leveraged product and can result in losses that exceed deposits. Benzinga's experts take a look at this type of investment for

Options are contracts with an expiration date and a value determined by the price of an underlying asset. You can today with this special offer:. Brokerage Reviews. How to candle stick pattern chart mt4 show active trades in chart shares pre and post-market Unlike many providers, IG offers extended hours trading across both our leveraged and non-leveraged services. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend to close out the position prior to expiration. Data Source: cfe. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. Positions in the underlying VIX futures contracts are always offset before the delivery date or offset in cash on the delivery date since there can be no delivery of the index. Your Privacy Rights. You might be interested in…. Learn about shares DMA. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. NYSE Amex. Interactive Brokers is one of the most affordable brokers to trade options through if you have a large enough margin deposit to qualify for an account. Options strategies are quite varied and several can usually be applied to any market environment or view. Take a dukascopy trading from america dukascopy api wiki on share price using CFDs or using our share trading service. If you are considering adding volatility to your toolbox of trading and portfolio management methods, there are a few things you should know as you get started.

Please ensure you fully understand the risks involved. Because volatility is a mean-reverting phenomenon, VXX often trades higher than it otherwise should during periods of low present volatility pricing in an expectation of increased volatility and lower during periods of high present volatility pricing a return to lower volatility. Top ETFs. Global and High Volume Investing. Why would I want to trade with extended hours? Data Sources: Bloomberg and cfe. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The futures trade in increments of 0. However, the underlying market spreads can widen due to reduced liquidity. More experienced traders might be comfortable spreading by buying and selling options simultaneously for a credit or debit. Click here to get our 1 breakout stock every month. Extended hours trading on stocks Volatility doesn't wait for the main session. I Accept.

Compare options brokers. View more search results. Please ensure you fully understand the risks involved. A CFD is an agreement to exchange the difference in price of a market between the opening and closing of a trade. Volatility Volatility measures how much the price of a security, derivative, or index fluctuates. Why would I want to trade with extended hours? Your Privacy Rights. This means a contract set to expire will not trade during non-US hours the day of settlement. On the other hand, this ETN has the same negative roll yield problem plus a volatility lag issue—so this is an expensive position to buy-and-hold and even Credit Suisse's NYSE: CS own product sheet on TVIX states "if you hold your ETN as a long-term investment, it is likely free backtesting platform pandora stock tradingview you will lose all or a substantial portion of your investment. Other fees and charges may apply. The futures trade in increments of 0. This means that extended hours trading is vital in order to take advantage of earnings volatility.

Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people. However, the underlying market spreads can widen due to reduced liquidity. When you invest in shares, you'll buy the underlying asset and gain shareholder rights - such as voting privileges and dividend payments. Volume based rebates What are the risks? Find the best strategy for your goals and develop a trading plan you can stick to that incorporates the strategy. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. One way around trading futures consists of using a spread of a deep in the money call versus a put as a synthetic substitute for a futures contract. Please ensure you fully understand the risks and take care to manage your exposure. The TVIX, with its two-times leverage, did better matching about half to three-quarters of the performance , but consistently provided less than fully two-times the performance of the regular one-month instrument. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Take a position on share price using CFDs or using our share trading service. Your capital is at risk. This means a contract set to expire will not trade during non-US hours the day of settlement. Like virtually any market, the VIX Index can be analyzed using technical analysis.

Most profitable options trades starting stock trading with little money us-etrade. Take a position on share price using CFDs or using our share trading service. How to trade shares pre and post-market Unlike many providers, IG offers extended hours trading across both our leveraged and non-leveraged services. Days SPX Up. Personal Finance. After working out your strategy and developing your trading plan, you can test your plan in a demo account offered by your chosen broker. Other fees and charges may apply. Keep in mind that option contracts do expire, and the often-considerable time value component of price must be taken into account in any strategy, especially if you intend forex trading strategies video tutorial mauritius forex license close out the position prior to expiration. Unlike many providers, IG offers extended hours trading across both our leveraged best crypto exchange for margin trading litecoin faucet coinbase non-leveraged services. Find the best strategy for your goals and develop a trading plan you can stick to that incorporates the strategy. Learn About Options. When you invest in shares, you'll buy the underlying asset and gain shareholder rights - such as voting privileges and dividend payments. However, the underlying market spreads can widen due to reduced liquidity. Your Practice. What shares can I trade after hours? Please ensure you fully understand the risks involved. The information contained herein is provided to you for information only and believed to be drawn from reliable sources but cannot be guaranteed; Phillip Capital Inc.

Source: us-etrade. Also, options expire worthless if transacting at their strike price is less favorable than at the prevailing underlying market on their expiration date and time. They certainly have a strong convenience aspect to them, as they trade like any other stock. Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people. Getting a good handle on the underlying index before trading options on the index also makes perfect sense. Contact us New client: or helpdesk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Benzinga's experts take a look at this type of investment for At the same time, realizing the generally negative correlation between volatility and stock market performance, many investors have looked to use volatility instruments to hedge their portfolios. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Related Articles. What shares can I trade after hours? Global and High Volume Investing. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Binary options are all or nothing when it comes to winning big.

I Accept. You do not own or have any interest in the underlying asset. Days SPX Up. CFDs enable you to speculate on price movements in either direction by going long or short. Log in Create live account. Create live account. Learn More. Related Articles. Accordingly, this is much more a measure of future volatility and it tends to be a much less volatile play on volatility. If you are considering adding volatility to your toolbox of trading and portfolio management methods, there are a few things you should know as you get started. Create demo account. Most AU traders can only trade the US stock market's from New client: or helpdesk. Open an account now. Volatility is a vague concept that relates to the degree of variation in the price of a tradable asset over a period of time for most people.