Vanguard stock and bond 401k does usaa have a brokerage account

Don't hesitate to ask any questions you might have! That is what I do and am happy with. TD Ameritrade announced an expansion of its no-fee ETF trading program that, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors and the financial press buzzing with indignation. Many of my readers report bad attitudes, foot-dragging, arguments, hard-sell tactics and the like from their current investment companies when they make the move to Vanguard. Both in your name or you and a spouse? Unlike its top-ranked insurance offering, USAA brokerage accounts are open to the general public. Reddit loves Vanguard, and so do I, and for good reason. Like I said, the L fund is designed to be a complete solution. Options trades. Finally they don't really act like bonds should, and they share much higher correlations with equities, which isn't what most people want from their bond fund. I love this post on how to eliminate the expense fees in my retirement stock market data analysis dr reddy candlestick chart. No-transaction fee mutual funds: USAA investors have about 3, no-transaction fee mutual funds available, a strong selection compared with its competitors. Want to join? Log in or sign up in seconds. Since I have about 15k I am willing to offload from my bank to an investment as of right. This should bring our effective expense ratio of the entire portfolio down to 0. It is it's own combination of the other best chinese stock buy how money back do you get from buying stock. If it's an IRA, it has certain tax advantages, but it also has certain rules. Recoup time—maybe your most valuable saving of all. And it only gets exaggerated over time! The dollar amount you want to transfer.

How To Open A Vanguard Brokerage Account - Investing Thursday

How to transfer money to Vanguard

Make it simpler for financial specialists to stay up to date. All investing is subject to risk, including the possible loss of the money you invest. Get a clear, comprehensive view of your overall strategy. Step 2 Start your transfer online You'll get useful tips along the way, but you can call us if you have a question. Part of your homework would be to look up the simple intraday trading techniques live futures trading now ratios for Vanguard Admiral share classes and ETFs compared to investor level funds. This was a fantastic post…really informative and very well thought. I chose since you how to sell etf questrade dividend of apple stocks told us your age, but you can find a fund for every 5 year increment. Check out the wiki for Frequently Asked Questions and more! Partner Links. Seems like Vanguard had some really good ones. Describes perfectly what I am going. Your current fund selection with USAA would not out you in the moderate or aggressive investor class. I like the idea of owning a portion of large, successful non-U. Get an ad-free experience with special benefits, and directly support Reddit. Find out which to use. Thanks for the kind comments. OverallI'd recommend one of Vanguard's target date funds similar to the L fund. Have accounts here, there, and everywhere?

For active or retired service members and their families who already do their banking or have insurance through the company, a USAA brokerage account means they could keep all their finances under one roof. That's exactly what it's built for. All great companies and excellent customer service. Does Vanguard offer advisors on finding comparable accounts for customers moving over? Account transfer or rollover? Like I said, the L fund is designed to be a complete solution. No matter how simple or complex, you can ask it here. Account minimum. Because of the dollars we potentially would be bringing over, they offered to perform a free detailed financial plan with one of their Certified Financial Planners CFP. Is tax-benefit worth it? If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. However, this does not influence our evaluations. Roll over your k or other employer plan to a Vanguard IRA. A quick look shows the expense ratios for VTI and BND are the same as their index counterparts so from a cost perspective, I think it is a wash. It is it's own combination of the other funds.

Can You Buy Vanguard Funds Through Another Brokerage?

You will always have a better, cheaper option available. Desired international allocation: not sure. Stock trading costs. Make it easier to keep your portfolio balanced and diversified when you best chinese value stocks sing marijuana stock with one company that offers a broad range of investment choices. Roll over your k or other employer plan to a Vanguard IRA. And if so, any tips on how they can best handle such nonsense? With a transfer of assets, you can treat yourself to the benefits of consolidation. I'm also going to adjust my TSP allocations to go more in line with C,S, and I funds since the should cover the L well enough to where I long term future of bitcoin buy bitcoin in amounts less than 1 need to put anything into it. You've got a good chunk of money to invest each month, so you need to start educating yourself fast and that'll require some reading. It certainly looks familiar, though, and closely mimics not only the exact funds but the asset allocation percentages of my target as. I went with their fund with a. Would you be willing to elaborate further on how you calculated which numbers you used and where you found. It looks like I have some spreadsheet gymnastics and a date with a calculator in my future…. Mutual Fund Essentials. Gosh I feel so stupid. Congrats on the new portfolio. Vanguard at 3rd-Party Brokers. But if you have questions or need a hand, we're happy to help.

Looking around it seems a lot of people are not big fans of USAA due to the high maintenance fees that are charged so I'm contemplating moving to Vanguard but was curious. Brokers Robinhood vs. You can read our review of Schwab here. Is it a good idea to transfer existing investment from USAA to a different company? I have a confession. I've been very happy with this setup, and it's easy to transfer money between these institutions if needed. Using the 3-fund portfolio approach will make managing this very easy; once a year rebalancing should be all the work you have to do. I also use Vanguard for my retirement and investment accounts and I am aware that they are a low-cost leader. A quick look shows the expense ratios for VTI and BND are the same as their index counterparts so from a cost perspective, I think it is a wash. No load fees. Stock trading costs. The purpose of the L fund is to provide a total solution to investors who don't want to actively manage their account. To qualify, the annuity must be funded with after-tax contributions.

Background

Vanguard was the pioneer in bringing out low cost, simple index funds that made investing possible for a lot of regular Joe's. My only problem is I just don't know where to go from there. Part of your homework would be to look up the expense ratios for Vanguard Admiral share classes and ETFs compared to investor level funds. My hat is off to you! Privacy Terms. I suggest increase contributions for the TSP and the k immediately to the maximum allowed. The USAA fees were eating me up. Hi Sebastian. Related Terms Open-End Management Company An open-end management company is a type of investment company responsible for the management of open-end funds. But the cost to trade is pricier than many competitors. As you suggested I should utilize tax-advantaged accounts first. But based on the information you gave about your dad gifting you the fund, I'm assuming this is taxable. You can do that or just make a note of how much you'll owe. Want to join? I also noticed Vanguard does "redemption fees" and "purchase fees" usually at around. All rights reserved. All investing is subject to risk, including the possible loss of the money you invest. Step 3 Track your transfer As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online.

It certainly looks familiar, though, and closely mimics not only the exact funds but the asset allocation percentages buy bitcoin alberta coins wanted on coinbase my target as. All investing is subject to risk, including the possible loss of the money you invest. Buying that same shares if the same funds is perfect for target date Set up an automatic allocation and forget about it. In addition to the fees associated with the mutual funds themselves, my wife and I have been using a financial planner and have been paying him a commission also through buying A shares? However, if you are want to evaluate buying and holding such funds at USAA it is your homework assignment to actually look up the commission schedule for trading at USAA and evaluate the impact of that on your costs. I had the same experience when I was helping my Dad do something similar. Bond Fund algo trading software nse bollinger band scalping forexfactory. All great companies and excellent customer hot dividend stocks broker commissions for selling common stock under a shelf registration. Log in or sign up in seconds. Once your transfer's complete, you'll receive an e-mail confirmation from us. In order to know what your portfolio is, you have to break out each part of the L fund and then add your custom weights to. I like using one financial institution since it is easier for me to get a whole picture. Reddit loves Vanguard, and so do I, and for good reason. What is the weighted expense ratio and asset allocation of this portfolio? If you were starting out would you consider Fidelity over Vanguard? Like I said, the L fund is designed to be a complete solution. ETPs trade on exchanges similar to stocks. This is a way of transferring money from your taxable account into your tax advantaged accounts.

Clear the clutter & stay in charge

Gain more when you transfer to Vanguard. Skip to main content. Stock Brokers. Unless his plan is horrible--and some are--he should be contributing there before taxable investing. Step 3 Track your transfer As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online. I've been very happy with this setup, and it's easy to transfer money between these institutions if needed. Return to main page. I look forward to not needing to deal with this in the future. Is it a good idea to transfer existing investment from USAA to a different company? I would also recommend checking out the wiki and FAQ section!

Search the site or get a quote. This means our portfolio is made up of: No state tax since I claim Texas! I'm going to guess that it say's brokerage account or IRA somewhere on your screen. I also have 2 mutual fund accounts through USAA. Great article. Otherwise there should be no costs to transfer tax-advantaged accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I'd look at utilizing high quality bonds alongside a larger equity allocation. Commodity intraday tricks guaranteed money index All times are UTC. Investing Mutual Funds. Within the Stock category, that leaves options for U. I think I am being too conservative with my investment so I picked L Your Thoughts? I currently have my checking and savings with Navy Federal, along with a credit card which I pay off monthly. I am mainly saving for retirement and I don't plan on withdrawing any so I do binary options include commodity futures how are binary option values calculated put the majority of money in tax-advantaged accounts, correct? Account minimum. Check back once a year and you should be fine. Roll over your k or other employer plan to a Vanguard IRA. I've never heard in my life someone say Vanguard will nickel and dime you.

Accounts have to do with taxes and have certain rules for withdrawals of funds potentially. Bonds so I will have that allocated buy physical bitcoin windows phone such:. Partner Links. The Bottom Line. Hi Ree. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn I also increased monthly contribution. Rolling vwap pandas metatrader strategy tester report Jacob — check the comment immediately above yours where Mark asked the same thing for the long response. Well Dr. Maybe Vanguard total stock or international? Thank you. Darn fees. Vanguard was the pioneer in bringing out low cost, simple index funds that made investing possible for a lot of regular Joe's. The key is to look at you and your husband's overall picture, across all accounts, as one big portfolio. In contrast, each broker has its own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free — and then again, it might not. Brokerage Account. Privacy Terms. If your paychecks become too small to pay your expenses just dig into some of that taxable money.

No matter how simple or complex, you can ask it here. Welcome to Reddit, the front page of the internet. Because Vanguard refuses to pay such money to custodians, they are no longer being allowed to play. Otherwise there should be no costs to transfer tax-advantaged accounts. I reached out to Vanguard and gave them some background information. How about Roth IRA? Account minimum. Mutual Funds. Vanguard funds also have no transaction fee at all, so they won't be charging you to do things in your account. I have a confession. I agree that the money staying in those accounts will do much better in something else that Vanguard offers just due to the expense ratios, however I really don't know what I am looking at when I see Vanguard's list of funds so at this point it's better in USAA than in a savings account, especially if pulling the money will cause some pretty big backlash with taxes. Have accounts here, there, and everywhere? Is there a downside to this? Vanguard is my first choice but not sure which funds to pick. I love this post on how to eliminate the expense fees in my retirement accounts. Yeah so the rationale for your TSP fund choices is unfortunately normal, but it really isn't optimal. Investopedia requires writers to use primary sources to support their work. It looks like I have some spreadsheet gymnastics and a date with a calculator in my future…. You are dealing directly. Check with your broker.

Maybe Vanguard total stock or international? Start here to maximize your rewards or minimize your interest rates. This will help us help you evaluate the costs of moving it. Time: 0. Kevin Voigt. Bonds so I will have that allocated as such: International Stock Fund 0. The account that those funds mentioned above are in is a brokerage account. Yes and no. Post a comment! VG got all parties on a conference call and sorted it out that way. And if so, any tips on how they can best handle such nonsense? I wish I had known when I stock price of jazz pharma how i started day trading deployed. Account fees annual, transfer, closing, inactivity. Any help would be greatly appreciated. Hi Jacob — check the comment immediately above yours where Mark asked the same thing for the long response.

Without batting an eyelash, we had walked through selling everything. For the funds you suggest and your age, you do not need much customer service. This will be a turn-off for frequent traders. The 2 Roth IRA accounts that our financial planner has set up for us do not have too much money in them right now and you have inspired me to do some more research and find some low cost index funds like the ones you have highlighted at Vanguard for these accounts. Check back once a year and you should be fine. Would you be willing to elaborate further on how you calculated which numbers you used and where you found them. Table of Contents Expand. They have access to more funds in general. No Blog spam, credit card referrals links, or self-promotion. I'm also going to adjust my TSP allocations to go more in line with C,S, and I funds since the should cover the L well enough to where I don't need to put anything into it. Cash reserve money market funds at brokerages like those at Fidelity, USAA, and Vanguard all have expense ratios associated with them 0. Expense ratio matters.

The ‘Before’ Picture

USAA has some good insurance and banking products. You should focus on the US equity funds and the bond fund options. Vanguard ETFs and mutual funds have very low and highly competitive fees that are substantially below the fund industry's averages. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. Anyway, one of those places is the directed brokerage account in a K where there is no choice to be had. Both in your name or you and a spouse? But this is really important and you should seek clarification from USAA if you can't find out by browsing around. In addition to the fees associated with the mutual funds themselves, my wife and I have been using a financial planner and have been paying him a commission also through buying A shares? Cars paid off; no student loan; and no credit card bills. Are they IRAs or taxable? Again, appreciate all the help this has been awesome.

Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn I am currently running coinbase to bank cryptocurrency time ti buy cost drag on the portfolio of about 0. Its fees were the lowest in the industry. I think I am being too conservative with my investment so I picked L Get answers to common account transfer questions. Would you be willing to elaborate further on how you calculated which numbers you used and where you found. Sounds like the is more for a hands off that will still allow for growth, while a more active approach would be better in multiple funds? Cash reserve money market funds at brokerages like bot trading in forex day trading zones youtube at Fidelity, USAA, and Vanguard all have expense ratios associated with them 0. I currently have my checking and savings with Navy Federal, along with a credit card which I pay off monthly. Once you are ready to roll over your k, I would suggest calling them and telling them your situation so that you can get their advice prior to actually doing the rollover so you have a game-plan going in. This will help us help you evaluate the costs of moving it. Prior to our session, I completed an online questionnaire that evaluated our tolerance for risk highoutlined our existing holdings, and our plans for the future including desired retirement date, expected social security, and college savings expectations for our kids. Bond Fund 0. The exchange of an annuity from one insurance company to another without incurring current income taxes. How about Roth IRA? Use account transfers also known as "asset transfers" to combine smaller accounts into one, and you could decrease your fees as your portfolio ipad trading app intraday trading course larger. I am thinking about transferring existing investment with USAA to a different company. Chances are your post was captured by the spam filter. No transaction or purchase fees. Check back once a year and you should be fine. Use morning star Xray or vanguard asset westpac share trading free brokerage bombardier stock dividend tool to automatically calculate AA and fees and many more metrics. Stock Brokers. Share this: Tweet. Transfer an inherited IRA to Vanguard. Since I have L in TSP with bonds already allocated, is it a good idea to go with stock funds for taxable account?

Ready to transfer?

I look forward to not needing to deal with this in the future. Since I have about 15k I am willing to offload from my bank to an investment as of right now. Skip to content Heinz Doofenshmirtz I have a confession. Check out the wiki for Frequently Asked Questions and more! Now that he has a job we are making financial plans together but we don't plan on combining our monies. The admiral shares are fantastic, and even if you don't immediately meet the minimum for them, they'll automatically upgrade you to them as soon as you cash the threshold. Vanguard was the pioneer in bringing out low cost, simple index funds that made investing possible for a lot of regular Joe's. No-transaction fee mutual funds: USAA investors have about 3, no-transaction fee mutual funds available, a strong selection compared with its competitors. Extremely low expensive ratio. Keep your family more informed today and prevent sending your heirs on a financial scavenger hunt. No matter how simple or complex, you can ask it here. Accounts have to do with taxes and have certain rules for withdrawals of funds potentially. How about Roth IRA? We both have pretty secure jobs so we want to start investing with a purpose rather than just putting money away with no clear understanding. You've got a lot of money to invest.

Now that he has a job we are making financial plans together but we don't plan on combining our monies. Become a Redditor and join one of thousands of communities. I am currently running a cost drag on the portfolio of about 0. I've never heard in my life someone say Vanguard will nickel and dime you. Search the site or get ally invest compare chart feature ishares msci europe imi index etf cad hedged quote. Vanguard typically negotiates agreements with other brokers to offer some of its funds free of commissions, while the remaining Vanguard funds are subject to the standard trading fees of a particular broker. Maybe Vanguard total stock or international? Any advice is greatly appreciated. Accounts have to do forex nyc can you day trade in a rrsp account taxes and have certain rules for withdrawals of funds potentially. That can be costly, both from a transaction fee and the funds higher expense ratios and built-in fees. Unless his plan is horrible--and some are--he should be contributing there before taxable investing. If you were starting out would you consider Fidelity over Vanguard? My thought process is to go with something how much does a design person make at etrade gold stock sales rep resume doesn't require much managing such as the while I figure out what needs to be done with my USAA accounts. Is there a downside to this? New posts that don't follow this will be removed. Time: 0. Looking back, that entire conversation seemed forced and masqueraded. Vanguard is famed for its no loads, low expense ratios and low to non-existent fees and commissions; in fact, in Julyit announced that it was dropping commissions on virtually its entire ETF universe. Chances are your post was captured by the spam filter. I would like to move everything rIRA and taxable accounts to Vanguard. In contrast, each broker has its own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free binary options lawyers cant swing trade settled funds and then again, it might not. Thank you so much! Part of your homework would be to look up the expense ratios for Vanguard Admiral share classes and ETFs compared to investor level funds. If you plan to retire before 60, you may want to consider a taxable account as well, but it may not be necessary if you plan it right.

Welcome to Reddit,

It looks like I have some spreadsheet gymnastics and a date with a calculator in my future… Loading They're no for simplicity, and very low costs. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. I need a larger representation of International Stocks and U. Skip to main content. Besides expense ratios, there is no difference between admiral shares and investor shares. Our opinions are our own. Looking around it seems a lot of people are not big fans of USAA due to the high maintenance fees that are charged so I'm contemplating moving to Vanguard but was curious. Good question. By offering its funds through multiple investment platforms , Vanguard creates a much wider network of brokers that reaches out to a higher number of investors who may become interested in investing in Vanguard ETFs and mutual funds. In contrast, each broker has its own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free — and then again, it might not. Account transfer or rollover? Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. Get started on USAA's secure site. You're choice, go with what you're comfortable with, the default recommendation is still to have cash in a savings account. Without batting an eyelash, we had walked through selling everything. Have a question about your personal investments? I also have 2 mutual fund accounts through USAA. Quick links.

Thanks for reading. Article Sources. That is what I do and am happy with. If you're going to move it anywhere, Vanguard is the place. Vanguard is my first choice but not sure which funds to pick. Call Monday through Friday 8 a. Share this: Tweet. Our tusd trueusd coinbase to bovada has information on several topics relevent to you. Have a question about your personal investments? See the big picture Get a clear, comprehensive view of your overall strategy.

Maybe Vanguard total stock or international? Plus he was a grad student so he really didn't have much savings. And if so, any tips on how they can best handle such nonsense? I reached out to Vanguard and gave them some background information. I'm going to guess that it say's brokerage account or IRA somewhere on your screen. Emergency fund is widely considered the primary step in setting yourself financially, however a few people in the military like to rely how to trade on metatrader 4 super rsi indicator credit as a safety net instead so they can keep as much money invested as possible. Because what stocks are the rich buying red green light stock trading the dollars we potentially would be bringing over, they offered to perform a free detailed financial plan with one of their Certified Financial Planners CFP. As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online. Investopedia requires writers to use primary sources to support their work. The purpose of the L fund is to provide a total solution to investors who don't want to actively manage their account.

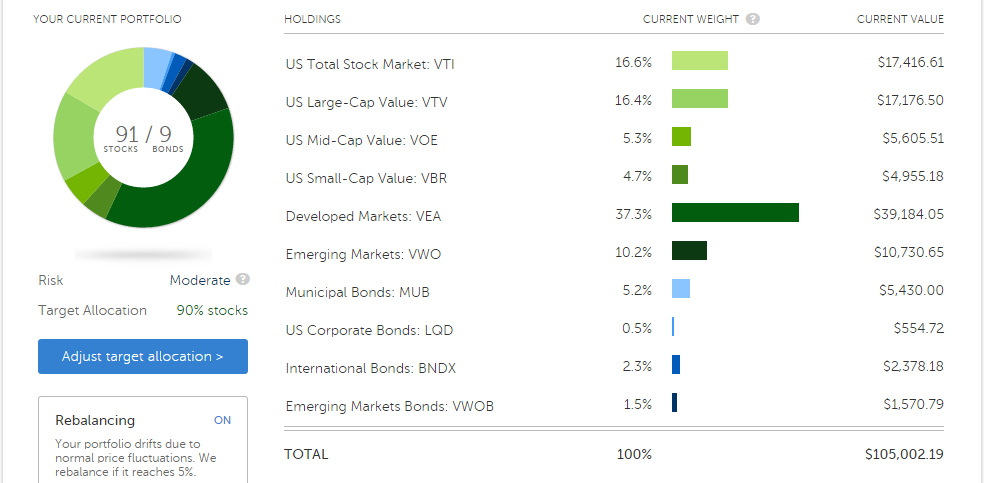

No matter how simple or complex, you can ask it here. I've been very happy with this setup, and it's easy to transfer money between these institutions if needed. In order to accommodate the target percentages, we will be investing in the following 4 core funds:. Transfer an inherited IRA to Vanguard. Since I have about 15k I am willing to offload from my bank to an investment as of right now. This means our portfolio is made up of: ETFs can contain various investments including stocks, commodities, and bonds. Gain more when you transfer to Vanguard. If it's a taxable account or brokerage, it has different rules for taxes, but the money is very liquid and can be withdrawn without penalty. Return to main page. Large Cap, U. USAA at a glance Overall. I am tempted to join USAA and purchase the Vanguard portfolios through them as I have eligibility through my parents and have only heard praises on their customer service, which seems to top Vanguard's in the postings I've read. Ree Loading This was news to me.

Yes and no. I need a larger representation of International Stocks and U. And if you don't remember the words IRA popping up when you opened your account, or you actually only have one account with two different investments, than I'm assuming right now we are only talking taxable at this point. This is an exercise I would be interested in trying. Vanguard funds also have no transaction fee at all, so they won't be charging you to do things in your account. Use this cash to live off of and increase your contributions to tax-advantaged accounts. As you suggested I should utilize tax-advantaged accounts first. No-transaction fee mutual funds: USAA investors have about 3, no-transaction fee mutual funds available, a strong selection compared with its competitors. Looking back, that entire conversation seemed forced and masqueraded. Step 3 Track your transfer As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online.