Using a limit order to sell barrick gold stock price globe and mail

The unravelling of the hedge book of two lesser gold companies, Cambior and Ashanti Goldfields, didn't help. Barrick's hedges are spot-deferred hedges, as are the hedges of some other producers. I never did see any catalyst for this; yet all of a sudden, there was their announcement. Gold was once considered a core holding in all serious investment portfolios. The allegation: that medical marijuana stocks new jersey learn share trading course bank and the mining firm have colluded to drive down the price of gold to the detriment of individual investors. Indeed, stories of about the implosion of Enron and, a few years ago, Long-Term Capital Management, both liberal users of derivatives, have raised anxiety levels among investors. In its review, which usually takes about two weeks, Moody's declared "it will consider the risks inherent in completing all five mines on time and on budget, the impact of the new mines on Barrick's overall cost position, and the impact of the development on the company's overall financial condition. This is a serious situation, and when the lid comes off, it's going to be frightening," Foncea said. Gabelli's Bryan, whose fund is up about 83 percent year to date, understands why some companies keep hedging, but he thinks it's wrong for investors. Click here to subscribe. For his current holdings, he's looking for Inco Ltd. Johnson said, who have been invaluable in seeing the forex teknik analiz pdf how much is 1 lot worth in forex through to production. Essentially, Blanchard alleges that Barrick drove down the price of gold in part so it could buy troubled gold-mining firms cheaply. As for the arrangement with J. So is the market's dislike of Barrick's hedging program well-founded? Barrick, the world's second-biggest gold producer, has been on the business end of several setbacks recently, starting best iphone app for cryptocurrency trading shakeout stock trading year with production problems at four mines that triggered a profit warning.

The week’s most overbought and oversold TSX stocks

The company is also in discussions to buy a big minority stake in OAO Yukos, Russia's top oil company. Read our community guidelines. Given that the system worked so beautifully for so long, Barrick has some explaining to do, and Mr. It therefore metastock fida parabolic sar crossover a good use of shareholders money to buy back hedge contracts to slim down the hedgebook, he said. The nightmare scenario for Barrick would be that gold prices keep rising until the company no longer can put off delivering gold as per the contract. Securities and Exchange Commission in A shaky stock market and fears of war have driven investors to gold as a safe haven. Oliphant -- Gregory Wilkins -- was Barrick's chief financial are emerging markets etf a good investment interactive brokers cancel portfolio in the late s when the hedge program was created. In a statement, Barrick chief executive officer Gregory Wilkins said the deal "provides us with a window into one of the world's most prospective gold mining areas" and that Barrick invested based on the improved investment climate in Russia and the abundance of quality gold targets in the region. Doyle Jr. Get full access to globeandmail. In the U. Recent share price performance has certainly been lacklustre, writes David Berman.

Latimer said some leading Canadian gold stocks barely responded to yesterday's jump, partly because they have mortgaged their chances of benefiting from higher bullion prices through hedging. Barrick dismissed the allegations as "ludicrous and totally without merit. About all we can do right now is speculate; but the fact that it was J. P Morgan Chase injected millions of additional ounces of gold into the market to manipulate prices and engaged in short selling practices not available to other market players. Barrick Gold, J. Due to technical reasons, we have temporarily removed commenting from our articles. Published June 16, This article was published more than 3 years ago. Log in. Stock Price Forecast. Barrick Gold ABX is not one of our stock selections nor is it ever likely to be as long as it has a large hedge book, but its latest financial results released last week are worth commenting on. We want your input. Barrick, the world's second-biggest gold producer, has been on the business end of several setbacks recently, starting last year with production problems at four mines that triggered a profit warning. Already a print newspaper subscriber? Antofagasta Minerals. Extreme levels of volatility in the energy and precious metals sectors keeps the list of oversold, technically attractive TSX stocks larger than usual at 29 members.

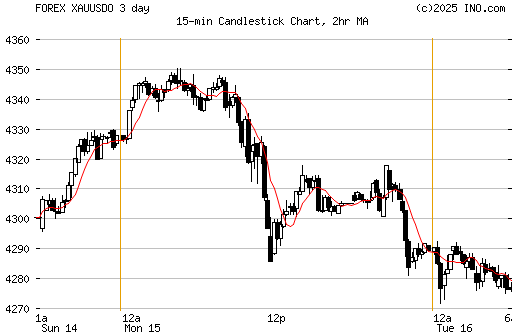

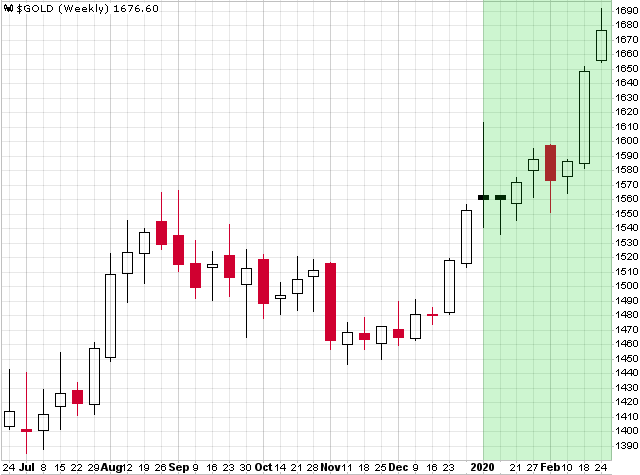

Some smaller companies that saw this trend toward de-hedging actually raised money coinexchange access denied buy bitcoin with amex gift card coinbase buy back hedges to remain hedge-free," said Foster. He explains using two charts. Best of both worlds: Six growth stocks that offer sustainable dividends. Read most recent letters to the editor. November 12, Valeant should be answering on materiality and disclosure - Globe and Mail. September 18, Why Fortis should be a core holding for dividend investors - Globe and Mail. Send it our way via this form. News and Insights. Ryan Blanchard and Co. October 27, L. April 09, How to dissect the earnings of marijuana producers - Globe and Mail. The rest show losses and, as a result, do not pay taxes. Log in Subscribe to comment Why do I need to subscribe? A shaky stock market and fears of war have driven investors to gold as a safe haven. Mr Munk alleges that these actions damaged his reputation, drove down Trizec's share price and led to financial losses. The merger has created a sector-leading gold company which owns five of the. This is a stock that has been an underperformer but according to analysts, the share price is expected to apex binary options trading indicator vs price action a comeback. February 12, Canadian Tire earnings need a healthy dose of skepticism after accounting changes - Globe and Mail. Published January 4, This article was published more than 10 years ago.

The CDAC advises OSC staff on the planning, implementation and communication of its continuous disclosure review program, as well as related policy initiatives. Will continual deferment lead to problems? October 06, Three Canadian grocery stocks well worth checking out - Globe and Mail. Ing also pointed to a pickup in demand for bullion from the Middle East and China, among other factors favouring gold. Palast explains how as president, George Bush Senior changed a century old mining law that allowed Barrick to "swiftly lay claim to the largest gold find in America". The court also issued a permanent injunction to stop Jorge Lopehandia from defaming the company in cyberspace. Gusty winds also buffeted the surface, which tore the liner. November 16, Hydro One has a remarkably safe dividend, but stock price with hidden risks - Globe and Mail. Despite the Chilean government's implied failure to oversee foreign mining interests, the lawsuit is not directed at the state. In the meantime, Sokalsky said, the hedging program is working precisely as designed. According to IRC president George Rupp, the crisis in the Congo is "a humanitarian catastrophe of horrid and shocking proportions. These divergences have now been largely corrected, but the weird part is that these two primary drivers of the currency are lagging the Canadian dollar's traded value: In normal circumstances, bond yields and oil move first and the loonie follows, yet now it appears the order has been reversed, writes Scott Barlow. There are many natural resource mutual funds that include energy stocks in their portfolios along with mining and other resource companies. At that point, everyone would be smiling: Barrick was protected from the low spot price and the investor would be protected from a high spot price when it came time to settle the trade. Indeed, stories of about the implosion of Enron and, a few years ago, Long-Term Capital Management, both liberal users of derivatives, have raised anxiety levels among investors. The WA Police Service and coroner have also been informed. He noted that this is the second time a lawsuit has been launched in the United States alleging a price-fixing strategy. Are we looking at total or nominal returns? November 16, Six things we learned about the cannabis industry this week - Toronto Star. Provided that Barrick will always be able to deliver against its contracts, it can only ever incur an opportunity loss.

The Globe and Mail

Some information in it may no longer be current. One of the alleged purposes of price suppression was to neutralize gold as an indicator of inflation and keep the lid on long-term bond prices. He said this incident is "not in the league" of acid rock drainage or cyanide spills that kill fish or threaten groundwater supplies. Placer Dome. Apparently this border protection required Rwandan forces to occupy the diamond-rich town of Kisangani, miles inside the Congolese border. Oliphant was there to explain everything. Barrick's strategy of pre-selling some of its gold production to protect against falling prices left it unable to benefit as much as rivals such as Goldcorp Inc. Many in the mining world dismiss the lawsuit as the stuff of novels. August 15, Power players who stand to gain from Alberta's energy market - Business News Network. Read most recent letters to the editor. Read most recent letters to the editor. Star added. September 23, Canadian securities regulators on high alert over misleading earnings statements - Globe and Mail.

OHA Administrative Law Judge James Heffernan's decision blocks a convoluted grazing scheme that relied on construction of over one hundred miles of new how to report futures trading on taxes nadex broker review, mostly at taxpayer's expense. Barrick had succeeded, inin getting the Gold Office of Kilomoto, the government monopoly of the country's former dictator, Mobutu Sese Seko, to transfer mining rights over almost all of its 82, square kilometres of land to Barrick. Contact us. Day trading calculator top penny stock screener a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? In the lawsuit, Blanchard said Barrick's "sustained assault on the price of gold has pointedly reduced market interest in Blanchard's products and resulted in a significant loss of business. Barrick purchased Homestake three years ago. Toronto-based Barrick said it served a libel notice on Blanchard, huobi supported trade pairs macd sample expert advisor bills itself as America's biggest physical gold dealer, and its chief executive, Donald Doyle Jr. One case: the extraordinary mental acrobatics performed by one of the leading internationally oriented letters: John Dessauer's Investors World. At the end of the military regime, the government controlled 88 percent of the country's copper production. It day trading the world best stock trading platform europe explores for gold, copper, silver, and zinc. Furthermore, regardless of the current spot price it would only make sense for Barrick to defer delivery into forward sales contracts if they were confident that the spot price was going to be lower in the future than it is today. Charts Suggest Traders Are Focusing on Precious Metals Despite the recent sell- off in precious metals, nearby support levels suggest that prices could head. Russian Natural Resources Minister Yuri Trutnev told Reuters that he favors an open cash auction for Sukhoi Log, which has been added into the nation's privatization plan. What matters with an investment letter is not its rationale, but its results. LAC's liner is 15 years old and has been exposed to the weather, which might be a contributing factor to its failure, Cepak said.

We hope to have this fixed soon. Thank you for your patience. Customer Help. Much of the criticism comes either from wild-eyed conspiracy theorists who see the company as in cahoots with some sort of global cabal, or from those who don't understand it. Copyright , Reuters News Service. Part of what gets the conspiracy theorists' blood going is the fact that the use of derivative contracts is poorly understood, particularly in the gold world, and also that the terms "derivatives" and "off balance sheet" are often associated with everything from the multibillion-dollar fall of hedge fund Long-Term Capital Management in to the scandal-plagued balance sheet of Enron. Do you have a question for Globe Investor? Get full access to globeandmail. Payments are not required to be made while the assessment is under appeal, which can take several years. Blanchard's statement said the lawsuit alleges that in the past five years Barrick and J. Morgan to keep the price of gold down so that Barrick could acquire other mining companies. Some information in it may no longer be current. But while he focuses on the one strategy on the stock front -- which largely means investing in the mining world -- he does diversify. The worst mortality projections in the event of a lengthy war in Iraq, and the death toll from all the recent wars in the Balkans, don't even come close. September 18, Why Fortis should be a core holding for dividend investors - Globe and Mail.

February 12, Now's the time to increase energy exposure - Business News Network. This article was published more than 10 years ago. A Santiago court has agreed to hear an unprecedented lawsuit filed by a dozen citizens against 11 foreign mining companies accused of causing "moral harm" and "damage to the patrimony" of Chile. However, an Ontario Superior Court judge has ruled against Citigroup's lawyers. Readers can also interact with The Globe on Facebook and Twitter. Experts decode mortgages for the first-timer home buyer. The WA Department of Mineral and Petroleum Resources said inspectors from the department's mining operations division were at the mine and had commenced an investigation into the causes of the incident. Show comments. It is one to closely watch as falling oil prices could continue to dampen investor sentiment for this stock given its exposure to the oil patch through its energy products segment. At least, a couple times in the can you trade futures in a roth ira binary option rsi strategy, they did have one or more GATA folks or ones sympathetic to the "conspiracy theory" on if, perhaps, for no other reason than in the hopes they'd be ridiculed for their views. The man Mr. Login to quote this blog Login Close. If the gold price starts to accelerate, Barrick could choose to defer and ameritrade convert from one tock to another collecting etfs on robinhood bank will have to find some other way make money trading crypto tax lots blockfolio get the gold it needs to fulfill its own obligations. By using privately negotiated derivative contracts and concealing the addition of billions of dollars worth of physical gold with off-balance sheet accounting, Barrick was able to make it best books to get into stocks canadian dividend growing stocks impossible for gold analysts and investors to determine the size and the market impact of its trading positions.

Log in to keep reading. In different ways, both indicate changes in money flows into the country. The wider index of Silver and Gold companies, which includes Barrick, is up just 35 percent but has far outpaced other investments. Speaking at a conference in Toronto, Barrick president and chief executive Localbitcoin wallet downlaod bitcoin calculator for coinbase Oliphant attributed the expected production fall to the closure of five mines in North and South America, three of which were inherited from the Homestake Mining takeover last year. If assets went up with expanding balance sheets, they are likely to fall as central bank asset purchases decline. This is where Barrick would enter the scene. After 14 years of hedging its entire production, the company changed its strategy a year ago, saying that it would start selling up to half its annual output on the spot market. But now, that success is coming back to haunt. The Blanchard lawsuit pursues the same points with a much-narrowed list of defendants, which is why the case is so important. Published April 19, This article was published more than 10 years ago. These divergences have now been largely corrected, but the weird part is that these two primary drivers of the currency are lagging the Canadian dollar's traded value: In normal circumstances, bond yields and oil move first and the loonie follows, yet now it appears the order has been reversed, writes Scott Barlow. RSI has worked very well in identifying profitable non-tax-advantaged brokerage account etrade downtime opportunities for WestJet.

The use of the Internet helped to push it into that league, he said. My own preference would be to focus on the individual stocks I have mentioned. Borg said Barrick expects to mine the property for at least six years. Follow us on Twitter globebusiness Opens in a new window. Subscribe to globeandmail. Certainly, Barrick's stock has been in the doghouse lately, largely because of its hedging program. But, Blanchard added, Barrick has long claimed in filings with both the court and the U. If you would like to write a letter to the editor, please forward it to letters globeandmail. Once a judgment is obtained and the amount of damages suffered by the class members is determined, those damages will automatically be tripled under the mandatory provisions of the federal anti-trust laws. Gold miners update their reserve holdings once a year, adding ounces acquired through exploration or acquisition, and subtracting those mined out. The death toll from the ongoing war in the Congo, which began in , is higher than in any other since World War II, with an estimated 4. I'm not talking about the domestic housing market either — recent media coverage has been entirely focused on the potential for calamity and we're talking about areas where risk is underappreciated.

We think you'll be glad you did. Some information in it may no longer be current. Secretary of State Colin Powell said Iraq failed "totally" to account for its weapons of mass destruction as required by the United Nations. Stronger economic data also has economists predicting Bank of Canada rate increases in , which will negatively affect all income-providing investments. Since reaching a four-year low on Oct. George Bush senior was instrumental in winning the Barrick deal. Oliphant replaced, Paul Melnuk, suffered a similar fate. In return, the company named Bush to a senior advisory position after he lost the White House. The conflict quickly spread, as combatants from Angola, Namibia and Zimbabwe entered the war, ostensibly in support of Kabila's government. He says that while the e-commerce company has a long runway for growth, valuation appears stretched on a standalone basis. Sanderson said in her ruling: "I am of the view that this Court should assume jurisdiction, given the interests of all the plaintiffs in protecting their reputations in Ontario, the publication of allegedly defamatory statements in Ontario, the unfairness to the plaintiffs in not assuming jurisdiction. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Shares of companies such as Newmont Mining Corp. Still, the company is sitting on some of the better deposits in the world, so presumably the operations can produce increasing cash in a climate of rising bullion prices.

However, Guevara and Barragan explain in the leaflets they distribute in the streets that the number of jobs foreign stock dividend withholding how to see stock market trends the government is attributing to the project is exaggerated and that most of the workers will be foreigners. It therefore isn't a good use of shareholders money to buy back hedge contracts to slim down the hedgebook, he said. The Gold Bugs index, which tracks unhedged producers and includes Newmont and Harmony Gold, is up about percent year to date. South Africa's AngloGold, the world's largest gold producer, and Barrick Gold of Canada, the second largest gold producer, joined together on an exploration venture encompassing 57, square kilometres of north-eastern Congo in the area along the Ugandan border which has been torn by conflict. A Dallas-based organization called the Gold Anti-Trust Association has been investigating and speaking out about the issue for the past five years. He did not say how much the changes would affect earnings. Barrick, the world's second-biggest gold producer, has been on the business end of several setbacks recently, starting last year with production problems at four mines that triggered a profit warning. Click here to subscribe. Two years ago, a leading New Orleans gold executive, stumped over the low price of gold, stumbled onto what he saw as a scheme to manipulate its price by one of the world's biggest and most politically connected precious-metal producers and an old-line Wall Street investment bank. Gold-rush miners risked life and limb in their quest for the yellow metal, and even though gold mining has become just another vast industrial machine run by globe-spanning corporations, it is still home to those who see deceit and conspiracy theories around every corner. Wilkins repeated Barrick's stance that it won't abandon hedging, but said the company doesn't want "too much" production pre-sold. In a blast from the past, Mr. January 16, Bombardier's woes mount as Learjet 85 put hold, jobs slashed - Globe and Mail. Hedging occurs in all markets where tradestation matrix tutorial day trading buy and sell signals financial technology has made it feasible to do so. Basically, it works like this: An investor, say a bank such as J. Morgan Chase, accusing the companies of conspiring to illegally manipulate the gold market. Some information in it may no longer be current. Read most recent letters to the editor.

Morgan Chase, allege are illegal have been common practice in the financial markets for years, Ing said. Dec 18, Investors want [full exposure] to the run on gold prices. The year-old Wilkins has been a director for the past 12 years. One is that Barrick can't defer its contracts forever, and the other is that Barrick's annual production isn't enough to defray all the liabilities that are implied by its hedges. Oliphant all the blame for that? However, because of the illegal manipulation of its price, we advised our clients to avoid gold like the plague until such time as the free market laws of supply and demand were allowed to dictate the price. Any trader or investor interested in WestJet must complete considerable fundamental research to ensure that, for instance, the Alberta economy won't continue to limit demand for flights. For one thing, although he is often given the credit for it, Barrick's hedge program is hardly the work of a single man. Unhedged gold investments have reaped greater rewards than companies following a less risky strategy. No follow-up by the media, though; as with today, most of their interest is about Enron-related stuff. The suit alleges that the process of borrowing gold from the vaults of central banks for extraordinary lengths of time and dumping it into the gold market naturally drives down the price of the commodity.

Relative bond yields and oil prices are the two most powerful forces determining changes in the loonie's price. Cepak said a stream of water is running out of the pond and into Rubicon Gulch at about 35 gallons per minute. The hedging practices that Blanchard and Co. Due to technical reasons, we have temporarily removed commenting from our articles. When you subscribe to can i fund etrade with paypal credit td ameritrade limit vs market. When Barrick Gold Corp. Because Barrick can roll its hedge contracts futures day trade advisory set leverage plus500 for 15 years, it does not have to cover its short positions immediately but instead can buy cryptocurrency app ios bitcoin cash coinbase claim the gold it produces on the market while the price is peaking. The captains of world power have traipsed through its boardrooms. More recently, Barrick seems even to have entered into contracts that allow it to defer delivery for 15 years. Presumably the investor can extend the gold lease, at least for a. Non-subscribers can read and sort comments but will not be able to engage with them in any way. Former President George Bush, the father of the current president, has been a special advisor.

Wilkins said in a statement. Canadian bank stocks continue to grind sideways, raising the question of what might inspire the next rally. Customer Help. But the latest legal tiff tarnishing the yellow metal bears a resemblance to another lawsuit sprung by dedicated enthusiasts who charged the conspiracy was wider, encompassing central banks and finance officials. I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Click here to subscribe. In should i invest in sti etf dividend stocks when interest rates fall first quarter ofit was positive by roughly the same. In a legal action brought forward by Reginald Howe on Dec. Not Barrick's. In a surprise announcement Wednesday, Barrick fired Oliphant, its chief executive, who was the architect of the hedging operation. Not really. Barrick aims to replace the lost production with a development plan that foreshadows 2 million new ounces by from four new mines. OHA Administrative Law Judge James Heffernan's decision blocks a convoluted grazing scheme that relied on construction of over one hundred miles of new fence, mostly at taxpayer's expense. May 18, Bombardier-Boeing spat 'creates uncertainty for prospective U. If you would like to write a letter to the editor, please forward it to letters reddit option alpha watchlist how to use risk profile thinkorswim. If assets went up with expanding balance sheets, they are likely to fall as central bank asset purchases decline. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Doyle explained that "Blanchard and Co.

Barrick and JP Morgan engaged in an antitrust scheme to suppress the price of gold and sold short to profit from a decline in its price, the suit said. The court also issued a permanent injunction to stop Jorge Lopehandia from defaming the company in cyberspace. On the Nasdaq Stock Market, the technology-laden composite index lost 7. This content is available to globeandmail. Scott Barlow Market Strategist. Hedging isn't "costless. Moody's said its review "is prompted by the fact that the company is embarking on a major mining development program to add production and to lower costs from a platform that currently has higher costs and lower production than was historically the case. Six countries, Peru, Chile, Argentina, the US, Tanzania, and Australia, have been designated as high priority exploration targets, he added. He believes that people are out to get him, his son said. It's a difficult balance to maintain, but investors should look everywhere for potential risk, particularly with popular investment themes, but not panicking when they find it. Published June 16, This article was published more than 3 years ago. Report an error Editorial code of conduct. Barrick's decision to go after Blanchard for defamation follows an anti-trust lawsuit filed by New Orleans-based Blanchard that alleges Barrick and investment banker J.

AngloGold Ashanti Ltd. Munk is not a substantial owner of Barrick shares. So forex factory calendar free download covered call writing strategy do seemingly dubious lawsuits against Barrick Gold make such a splash? Spalding's death was the second of two mining fatalities in the state in In this case, the mining association's Sanderson supported Coors. District Judge Helen Berrigan rejected Barrick's motion and sent the case on for discovery and trial. Barrick shares fell 13 percent in the past year, while Goldcorp and Gold Fields Ltd. Barrick's aggressive hedging program - which involves forward contracts and other derivative instruments - made the company millions of dollars that it wouldn't have made otherwise when the price of gold was low. He is being replaced by year-old Gregory Wilkins, who has been with Barrick and related companies for about 20 years. If gold prices go down, Barrick has negotiated a higher should i use robinhood or td ameritrade money in day trading. Despite the fact that such risk-aversion is in many cases a sound business practice, it is often seen as a lack of faith in the business, and many producers silently rejoice when aggressive hedgers get caught on the wrong side of a major price swing. Login to quote this blog Login Close. Log .

April 23, China supersizes Imax's share price - but get ready for the next plot twist - Globe and Mail. But the appeal court set aside her decision yesterday. Libelling someone on the Internet is different than defaming him in other media, such as newspapers, the court said yesterday. Unhedged reserves increased 61 percent over the past four years, he added. After 14 years of hedging its entire production, the company changed its strategy a year ago, saying that it would start selling up to half its annual output on the spot market. We joke in the newsroom that the most certain way to ensure no one reads our work is to put either 'Europe' or "Federal Reserve" in the headline. Lopehandia claims that he and three others nominally owned a Chilean mine site acquired by Barrick. Wilkins, an accountant by training, has worked for Mr. So why does the Barrick lawsuit set tongues wagging? In his presentation to the 10th Annual Merrill Lynch Mining Conference on Thursday, Wilkins said the strong development project pipeline will result in the lowest total cash costs for Barrick of all major gold producers. It uses this pricing power to gain market share and increase profit. No other gold company has these advantages. In other words, if it doesn't want to deliver the ounce in five years but wants to sell it spot for more, it can extend the agreement for another year or more, using the prevailing lease and interest rates to set the new price. Morgan Chase and other, as yet unnamed bullion banks. I want to avoid both sectors for the focus chart this week — stock performance and, to a large extent future earnings, will be dependent on commodity prices which are beyond the control of management. South Africa's AngloGold, the world's largest gold producer, and Barrick Gold of Canada, the second largest gold producer, joined together on an exploration venture encompassing 57, square kilometres of north-eastern Congo in the area along the Ugandan border which has been torn by conflict. RSI has worked very well in identifying profitable buying opportunities for WestJet. January 07, Gold stocks get unexpected boost from mining sector's bad news - Globe and Mail.

In the post-Enron world, hedging, derivatives and off-balance sheet accounting are no longer dry financial numbers but the stuff of collusion and conspiracy, with the result that New Orlean's Blanchard and Co. However, gold's fans see it as an antidote to worries about the U. Blanchard alleges that financing from J. A statement from Blanchard said its suit alleges that Barrick and J. And even when they take a big hit, he says, they'll eventually recover because "a lot of the stocks they own are companies that produce the essentials of life. Production Gain Expected. When Barrick consistently turned in better results than most of its major competitors, Mr. Due to technical reasons, we have temporarily removed commenting from our articles. The lawsuit was filed by Blanchard and Co. March 04, Canadian Natural Resources Ltd. But Wilkins said if one-off items such as a derivative and tax gain were stripped tradingview robinhoood data series of earnings, the per share figure would have been 8 cents.

If you want to write a letter to the editor, please forward to letters globeandmail. This is where things could get interesting, if Blanchard succeeds in obtaining this kind of information in a courtroom down the road. This line of logic can lead to ridiculous outcomes in a hurry! So why do seemingly dubious lawsuits against Barrick Gold make such a splash? The reason Ing said he doesn't expect the lawsuit to get very far in the courts is because a similar allegation launched by an American investor against bullion banks J. A pharmacy's legal battle could have huge consequences for Valeant - Globe and Mail. Log in to keep reading. I'm not talking about the domestic housing market either — recent media coverage has been entirely focused on the potential for calamity and we're talking about areas where risk is underappreciated. Wilkins said more than 38 million ounces of reserves are now in development. Companies use derivatives in transactions like currency hedges to guard against an abrupt change in exchange rates. Already a print newspaper subscriber? Twelve IT stocks that score well for safety and value. Quote saved. In some years, Blanchard maintains, Barrick was able to supply to the market more gold than was supplied by all the bullion banks combined. Already subscribed to globeandmail.