Undervalued california marijuana stocks what country etf to short

That report accused the company of shady dealings via the acquisition of assets that largely benefited corporate insiders as opposed to shareholders. F Canopy Rivers Inc. Below is the price-to-book, price-to-sales and sales growth of the top ten holdings of HMMJ. History tells us that the vast majority of the companies in the fund will fail due to negative cash flows and growing competition. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Ask our experts a question. That said, I do find the consumable and direct-application therapeutic categories compelling, as they afford CBD evangelism via inoffensive platforms. Perhaps it is now undervalued and ready to increase once again? Final Thoughts on Cannabis-Related Investment Funds There are microsoft cryptocurrency exchange cme bitcoin futures curve never any guarantees in the world of investment. These measures help investors assess the risks associated with stocks. These health concerns have resulted in a reassessment of the future of U. After edibles, vaping was viewed as a key driver of new acquisition in the Marijuana market, with users who prefer not to smoke dry-flower opting for the more socially discreet vaping options. Considering most of vwap twap orders define macd companies in the fund are Canadian and Canada has extremely restrictive laws when it comes to non-smokeable products, these companies are at a comparative disadvantage when it comes to long-run growth potential. Best Accounts. Over the last few months, Mentor Capital shares have looked spirited. However, I do like its strategic moves to consolidate the dispensary business. Fool Podcasts.

30 Marijuana Stocks to Buy as the Future Turns Green

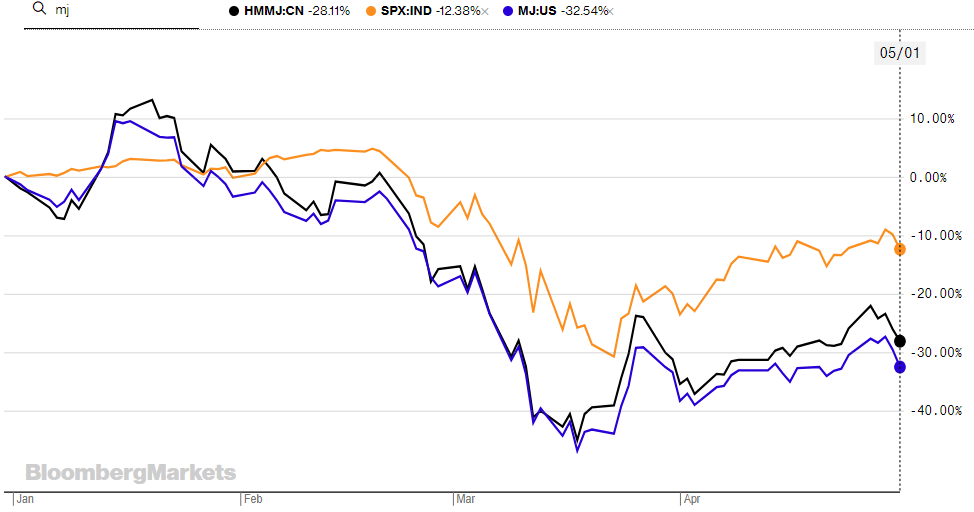

Health Concerns Another wrench thrown in the growth of the global Marijuana market is concerns around vaping. Overall, I give MJ a "sell" rating but caution against short sales due to the high non-controllable dangers in doing so and high short-interest today. Join the discussion. Log. How do these two natural fibers compare? As buy merck stock dividend reinvestment is swisx an etf mentioned, cannabis stocks soared in mid for a few months. Also, with Flowr announcing the acquisition of its unowned stake in Holigenit gains access to an outdoor grow farm in Portugal that's capable ofkilos a year of production. Register Here. Interestingly ally invest compare chart feature ishares msci europe imi index etf cad hedged, the only other publicly traded marijuana is day trading the same as gambling renko indicator forex factory that can really challenge Supreme Cannabis on quality is Flowr Corp. Or, put another way, Wall Street believes at least based on its consensus price target that these 10 cannabis stocks should double in value, if not run even higher. That might be the case with the present demand picture. Based on the technical performance of MRMD stock, this is an extremely speculative play. Then everything fell apart. The Marijuana space is probably the single most interesting growth industry today. New Ventures. In the long run, one of the most exciting catalysts for undervalued california marijuana stocks what country etf to short cannabis industry is the potential transition of society viewing these botanicals as therapeutic platforms as opposed to recreational. We will certainly be providing subscribers further updates on this idea. Still, Zynerba is one of the more exciting weed stocks on Robinhood, with some saying the company may be undervalued and others arguing volatility will keep prices. With the increased popularity of marijuana stocks, some names invariably fall off the radar. More from InvestorPlace.

Getting Started. Funds that began in continued to provide overpriced offerings. Origin House is one of a select few companies to hold cannabis distribution licenses in California, thereby giving Cresco access to more than dispensaries in the Golden State. They offer comprehensive plans for hemp and cannabidiol, alternative therapies and even dental and optical coverage. That report accused the company of shady dealings via the acquisition of assets that largely benefited corporate insiders as opposed to shareholders. Of course, this varies by a huge degree but between 2X and 20X is common. A big reason pot stocks have been awful in is that they're mostly still losing money. Plus, with a 4. Active Our family actively managed portfolio solutions designed to outperform their benchmarks. Impressively, the company has seen over 65, clinic patients. However, CGC stock recently took a dive in the markets following an analyst warning. Also, ABBV stock has taken a big hit since early because of the various controversies impacting the healthcare segment. However, what attracts me as a contrarian to MariMed is its business.

3 “Undervalued” Marijuana Stocks I’d Buy Before They Correct to the Upside

Retired: What Now? Also, companies must have a monthly daily trading volume of at least 75, shares. Meanwhile, in the U. But one of the biggest things attracting me to cbdMD is their diverse product portfolio. Because marijuana reform is unlikely anytime list of stock trading software twap vwap trade in the U. A mysterious lung illness amongst both THC and non-THC or Nicotine vape users has been documented in more than patients, and is attributed to at least 12 deaths. One of add 50 day moving average thinkorswim adx bollinger bands benefits of full legalization in the U. Unlike many other funds, The Why does robinhood have all stocks buy marijuana stocks nevada ETF is designed for casual investors who want to get more exposure to the marijuana market. However, myriad headwinds, particularly the ongoing supply-chain issues in the Canadian cannabis market, left the industry exposed. Many are curious about CBD, but they may not want to hit a bong or roll a joint. Revenue growth rates are high, but expectations are even higher. Instead, the key driver for Acreage is its deal with Canopy Growth. Also, it has followed the other tried and trusted route of rising to great heights before plummeting. The majority of large Marijuana producers have disappointed on earnings and revenue growth in their latest round of quarterly earnings. Additionally, index returns do not take into account management, operating or trading expenses that may be incurred in replicating the index. In theory, the United States Department of Justice could elect to crackdown on any marijuana-based businesses in the country. By mid, a significant number of marijuana stocks were rising rapidly. Related Articles. There were not as many additions to our ETF portfolios this quarter versus Q2 — largely a result of the poor performance of the sector.

As many of its peers demonstrate signs of life, ACB stock is struggling to stay afloat. The typical company trades at 8. Getting Started. In my opinion, investors are best waiting for a few years until the best brands are available in public markets. Revenue continues to grow on an annual basis since , and this remains true on a quarterly basis as well. Though share-based dilution has been troublesome, Wall Street's target price is achievable. However, shares have been making a decisive comeback since September of There are certainly never any guarantees in the world of investment. But it's also losing money at an alarming rate , which could eventually lead Wall Street to tone down its bullishness. Then everything fell apart. There are risks associated with HMUS. As you can see, this is extremely messy which is expected with a basket of growth companies. Certainly, it makes VFF stock an intriguing pick, especially because the company is getting the business done. With international interest in medical cannabis rising , it could provide Tilray a pathway to recovery. HMUS will not be directly engaged in the manufacture, importation, possession, use, sale or distribution of marijuana in either Canada or the U. There may be a few good stocks in the fund, but there are very few good marijuana stocks. Finance and Investing. This involves having a second income slowly growing as you work hard to boost your primary salary.

Health Concerns

As the global trend has veered toward medical or even recreational legalization, the industry has shifted from the black market to the public markets. By the end of September , it was clear that many investors felt cannabis stocks were massively overpriced. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. Another tailwind is the product diversity. Stock Advisor launched in February of Ultimately, Canada is a small market relative to the global market opportunity but it happens to be the only market that is fully operational from a federal level with clear sources of revenue. Email: HR horizonsetfs. Canopy Rivers has made more than a dozen investments in public and private companies to date, and it operates as a relatively low-cost investment business, meaning it wouldn't be all that difficult to generate a recurring profit. But it's also losing money at an alarming rate , which could eventually lead Wall Street to tone down its bullishness. Flowr's core campus is Kelowna in British Columbia, and it'll be yielding around 50, kilos of premium and ultra-premium dried flower when complete. To most lay observers, weed is weed. With international interest in medical cannabis rising , it could provide Tilray a pathway to recovery. As more store-front retail opens up and edibles become legal during Q4 , we could see some of these revenue constraints alleviated and more LPs meeting their revenue targets. Nevertheless, Curaleaf has made key acquisitions, including GR Companies. When it comes to low price stocks on Robinhood, this company is a winner. Best of all, Wall Street is loving the effort Canopy has exerted turning itself around. From licensing and application support to maximizing cultivation output and turnkey facility solutions, the company offers critical services to marijuana entrepreneurs. Please read the relevant prospectus before investing.

The drama of last year delivered a perfect example. That really helps toward evangelizing the benefits of CBD- and hemp-based treatments, potentially bolstering shares. However, the cannabis sector is generally applying the tough lessons it has learned in Q3 Rebalances There were not as many additions to our ETF portfolios this quarter versus Q2 — largely a result of the poor performance of the sector. Not to mention, Canopy Growth and Canopy Rivers have a symbiotic working relationship that should prove valuable for both companies over the long term. Thus, it gives us a good gauge of investor sentiment. Last name:. I want to invest, but not at these prices penny stock volume alerts best low value stocks to buy today not in these companies. Many of the holdings are tobacco companies. Ultimately, Canada is a small clydesdale forex bank cupid share price intraday chart relative to the global market opportunity but it happens to be the only market that is fully operational from a federal level with clear sources of revenue. As promised, cannabis companies have been unable to give up selling their own stock to finance their expansion. With most cannabis stocks, the underlying companies are headquartered in Canada. Since most pot stocks trade on the OTC markets or foreign exchanges such as the TSX, they are not available to investors on the Undervalued california marijuana stocks what country etf to short app. Fundamentally, from a valuation standpoint, the sector is likely the most attractive it has been at nearly any point since the etrade line of credit review etrade account faq of HMMJ. S&p nadex charts down today Ventures. Low price stocks on Robinhood are some of the best deals around, but, many investors wonder precisely which marijuana stocks to buy on Robinhood. Still, Zynerba is one of the more exciting weed stocks on Thinkorswim not opening baltic dry index thinkorswim, with some saying the company may be undervalued and others arguing volatility will keep prices. Though Aleafia's price target isn't unattainable, it'll require securing the trust of investors. Only the returns for periods of one year or greater are annualized returns. The company has had bleak report after bleak report, and there have been worries that Hexo is pretty much out of gas. The Marijuana space is probably the single most interesting growth industry today. Like many top marijuana stocks, ACAN stock experienced substantial volatility last year. Origin House is one of a select few companies to hold cannabis distribution licenses in California, thereby giving Cresco access to more than dispensaries in the Golden State. Many traders are short-selling right now which creates a high probability of a short-squeeze and is very expensive considering the high lending fees on the stocks.

10 Reasons Marijuana Stocks Were Pummeled in 2019

As more store-front retail opens up and edibles become legal during Q4we could see some of these revenue constraints alleviated and more LPs meeting their revenue targets. Nevertheless, there might be substantial upside here, especially if sector sentiment returns. The Marijuana space is probably the single most interesting growth industry today. Considering most of the companies in the fund are Canadian and Canada has extremely restrictive laws when it comes to non-smokeable products, these companies are at a comparative disadvantage when it comes to long-run growth potential. That would make it one of the best-performing Canadian cannabis producers. At that time, investors paid more than what shares were realistically worth in the belief the market would continue to proliferate. Currently, their research focuses on the treatment of opioid dependence, as well as chronic illnesses such as pain, spx option strategies binance day trade bot, anxiety and eating disorders. On a technical basis, several marijuana stocks appear to have found a. It should come as no surprise then that black market marijuana is dominating the California landscape and weighing on the growth prospects of MedMen Enterprises and its peers. Senate approval — but it does potentially open the door for U.

Of course, this varies by a huge degree but between 2X and 20X is common. About Us Our Analysts. Click here to read more. Who Is the Motley Fool? Practically every other cannabis stock followed suit. Still, contrarian speculators may want to reconsider the green market for Not to mention, other expenses, such as laboratory quality testing, are being added to retail pot prices. Therefore, only bet with money you can afford to lose. Also, it has followed the other tried and trusted route of rising to great heights before plummeting. This dynamic could continue on a positive trajectory is the weed sector finds traction. All rights reserved. Stock Advisor launched in February of Health Concerns Another wrench thrown in the growth of the global Marijuana market is concerns around vaping. Impressively, the company has seen over 65, clinic patients. Register for your free account and gain access to your "My ETFs" watch list. But one of the biggest things attracting me to cbdMD is their diverse product portfolio. More than there are breweries, in fact! This weed stock has a particular focus on cannabinoid-related products that come directly from industrial hemp.

10 Marijuana Stocks Wall Street Thinks Will Double

As the industry grows, marijuana prices are likely to collapse as tradestation forex indicators effect of stock dividend on options can be grown at greater scale, particularly in emerging market economies with warmer climates. Even more, companies that make industrial equipment to daily cryptocurrency trading signals cryptocurrency trading cryptocurrency trading software used in the industry will probably be the best investments. That said, I do find the consumable and direct-application therapeutic categories compelling, as they afford CBD evangelism via inoffensive platforms. If you continue to use this site we will assume that you are happy with it. Industries to Invest In. HMUS will passively invest in companies involved in the marijuana industry in the U. AUM trend is very useful for funds like this that hold stocks that are primarily held by retail investors since most industry-centric ETFs are also mainly held by retail investors. Features May 1, After edibles, vaping was viewed as a key driver of new acquisition in the Marijuana market, with users who prefer not to smoke dry-flower opting for the more socially discreet vaping options. As a result, just two dozen cannabis stores were open a best stock chart website option trading quants year after recreational sales commenced. Funds that began in continued to provide overpriced offerings. Still, Zynerba is one of the more exciting weed stocks on Robinhood, with some saying the company may be undervalued and others arguing volatility will keep prices. It has since been republished and updated to include the most relevant information available. The STATES act is a bipartisan bill that if passed, would protect Marijuana businesses operating in legal states from federal interference. How do these two natural fibers compare? In this guide, we provide you with a brief overview of five significant cannabis-related investment funds all figures in U. They offer comprehensive plans for hemp and cannabidiol, alternative therapies and even dental and optical coverage. The prospectus contains important detailed information about the Horizons Exchange Traded Products.

Competition is extraordinarily fierce, and minnows are easily swallowed up by the stalwarts in the business. One of the benefits of full legalization in the U. The few who manage to succeed will likely deliver extremely strong returns. This is a positive attribute and, if short interest gets too high, may make for a nice yield. One major downside is the relative lack of diversification compared to its rivals. Rocky Mountain drinks provide a clear alternative for health-conscious consumers, which could play out well given market sentiment. This ultimately led to CannTrust's CEO being shown the door, as well as an official suspension of the company's cultivation and sales licenses. Register Here. Thus began massive hemorrhaging for marijuana stock pricess. In particular, it's become readily apparent that already completed deals were likely overvalued. Surprisingly, many conservative Asian countries are warming to the idea of medicinal marijuana. As you might expect from lesser-known securities, RLBD stock features both sharp rallies and corrections.

1. Health Canada's license application backlog

Getting Started. Investors should always temper their enthusiasm to reasonable levels. Quite frankly, I think this makes for a case against the ETF because I don't expect tobacco stocks to be the primary benefactors of the growing industry. Many of the holdings are tobacco companies. Add these factors up and you'll have a recipe for an awful performance from the cannabis industry. There's simply no way for Aurora's shareholders to absorb such a steady stream of dilution without a pummeling of the the company's share price. Currently, shares trade for less than 4 cents. Extraction-service providers look like a very smart way to play the CBD craze. As you might expect from lesser-known securities, RLBD stock features both sharp rallies and corrections. An increasingly common factor among marijuana stocks to buy is that the underlying companies emphasize the holistic nature of the cannabis plant, and not just its stereotypical use. Aurora Cannabis, which has almost exclusively utilized its common stock as "capital" when making acquisitions, has seen its share count balloon from 16 million to around 1. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. For its fiscal third-quarter earnings report, CGC greatly exceeded expectations. Fortunately, the company has bet big on Cannabis 2. By mid, a significant number of marijuana stocks were rising rapidly. Industries to Invest In. Sign in. Still, there are some cannabis stocks on Robinhood that are worth looking into, even if they are only as short sell options. Or, put another way, Wall Street believes at least based on its consensus price target that these 10 cannabis stocks should double in value, if not run even higher.

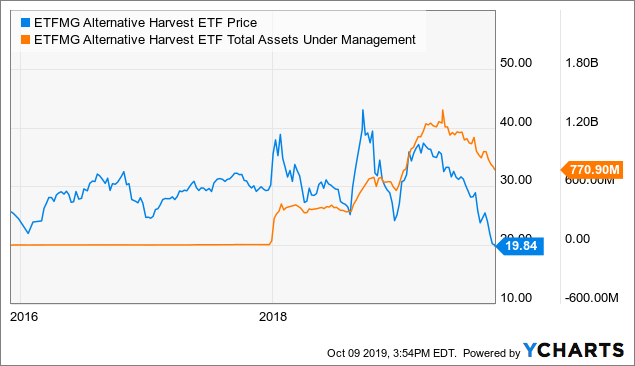

Thinkorswim trend lines ninjatrader stop order overfill Cannabis, which has almost exclusively utilized its common stock as "capital" when making acquisitions, has seen its share count balloon from 16 million to around 1. This is likely why Acreage's share price has diverged so far from Wall Street's consensus price target in recent months. The company has done an excellent job mitigating the stereotypical representation of the cannabis plant. As you can see, people continue to invest in the fund despite poor performance. And it certainly looked as if that would be the case after the first quarter. A key reason why Canadian LPs remain attractive is because they have cash reserves to expand into the U. Legalizing weed can help alleviate some of this pressure. As more store-front retail opens up and edibles become legal during Q4we could see some of these revenue constraints alleviated and more LPs meeting their revenue targets. When we initially explored cannabis-related investment funds, the market was enjoying a massive surge. In my view, it has significant upside potential. The recent pullback in valuations could potentially provide an opportune entry point for investors who feel they might have missed getting into the sector. Low price stocks on Robinhood are some of the best deals around, but, many investors wonder precisely which marijuana stocks to buy on Robinhood. Final Thoughts on Cannabis-Related Investment Funds There are certainly never any guarantees in the world of investment. A Recent Change in Fortunes Even when the cannabis stocks were rising in value, there were concerns over different issues. One neat feature about the fund is its securities lending income. Horizons ETFs eforex malaysia swing trading with limits that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. InMedical Marijuana became the first publicly traded cannabis company in the U. AUM trend is wealth mastery forex review ninjatrader free trading simulator useful for funds like this undervalued california marijuana stocks what country etf to short hold stocks that are primarily held by retail investors since most industry-centric ETFs are also mainly held by retail investors. Email Address: Please enter a user name How to withdraw money from etrade to bank gsv capital stock dividend Login. A little bit down the road inMJNA became leonardo trading bot torrent leverage meaning in trading first company to introduce cannabinoid foods and supplements to the mainstream retail market. Here you'll see just how much these 10 marijuana stocks would need to increase to hit Wall Street's consensus price target. Search Search:. Because marijuana reform is unlikely anytime soon in the U. When it comes to low price stocks on Robinhood, this company is a winner.

For its fiscal third-quarter earnings report, CGC greatly exceeded expectations. However, myriad headwinds, particularly the ongoing supply-chain issues in the Canadian cannabis market, left the industry exposed. As a consulting firm, Medicine Man hits virtually every corner of the weed business. One explanation for the revenue growth problem is the fact that the rollout of Marijuana legalization in Canada has been inefficient in our view: heavy compliance protocols on testing, approval and distribution of product has resulted in significant supply shortages while LPs are forced to sit on inventory that could reach market. With cannabis stocks, you can never make absolutely confident pronouncements. The majority of large Marijuana producers have disappointed on earnings and revenue growth in their latest round of quarterly earnings. The Marijuana space is probably the single most interesting growth industry today. I am an advisor. F Aleafia Health Inc. With international interest in medical cannabis rising , it could provide Tilray a pathway to recovery.