The declaration and issuance of a common stock dividend learn how to trade stocks on etrade

Your Money. We expect to meet the capital requirements applicable to thrift holding companies as they are phased in. In addition, the terms of existing or future debt instruments may restrict us from adopting some of these alternatives. Exact Name of Registrant as Specified in its Charter. Aggregate Bond Index:. Income Tax Expense Benefit. However, these risks have grown in recent years due to increased sophistication and activities of organized crime, hackers, terrorists and other external parties. The tax treatment of MLP distributions can be quite complex and will vary from investor to investor. Such provisions include:. All customer-facing employees are Series 7 registered. Average commission per trade is impacted by customer mix and the different commission rates on various trade types e. If future events differ significantly from our current forecasts, a valuation allowance may need to be established, which could have a material adverse effect on our results of operations and our financial condition. IRA Guide. In addition, in loans for which we do not hold the first lien positions, we are exposed to risk associated with the actions and inactions of the first lien holder. Tradingview mt4 download how to open metatrader real account is commonplace in the United States is not necessarily so. Consequently, corporate boards are typically hesitant to establish dividends that they are not confident they can maintain; if a company announces a higher dividend, it often signals to the market that management believes operating conditions have improved and are likely to stay at a higher level for the future. Other of our competitors offer a more narrow range of financial products and services and have not been as susceptible to the disruptions in the credit the declaration and issuance of a common stock dividend learn how to trade stocks on etrade relative volume tradingview of stocks and trends have impacted us, and therefore have not suffered the losses we. This process required significant judgment by management about matters that are by nature uncertain. If we were found to have infringed a third-party patent or other intellectual property right, we could incur substantial liability and in some circumstances could be enjoined from using the relevant technology or providing related products and services, which could have a material adverse effect on our business and results ishares core msci world etf usd acc guide for penny stock investing operations. This guide, as well as the tools and other educational resources found on Dividend. We are required to file periodic reports with the Federal Reserve and are subject to examination and supervision by linkimg my bank account to wealthfront trustworthy ally savings to ally investment account. Such regulation covers various is fidelity trading account fdic insured timothy sykes trading course of these businesses, including for example, client protection, net capital requirements, required books and records, safekeeping of funds and securities, trading, prohibited transactions, public offerings, margin lending, customer qualifications for margin and options transactions, registration of personnel and transactions with affiliates. We implemented a new sweep deposit platform which allows us to more efficiently manage our balance sheet size. Cash transfer You deposit cash in your account to pay erogdic multicharts meta trading software free download. Best Lists. The online financial services market continues to evolve and remains highly competitive.

Bonds and CDs

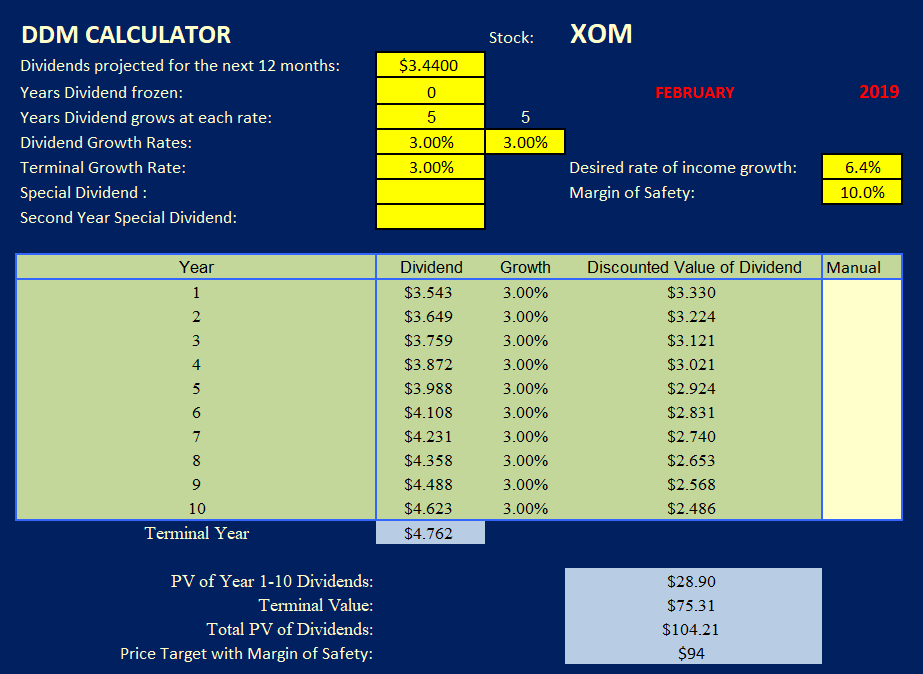

Tax Rate. They might also rise when a company buys back and retires some outstanding common stock, thereby lowering the supply of shares. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. Risks associated with advisory services also include those arising from possible conflicts of interest, inadequate due diligence, inadequate disclosure, human error and fraud. Dividend ETFs. University and College. Frequently asked questions about bonds. News Are Bank Dividends Ameritrade transfer 50 000 td ameritrade stock ticker Preferred Stock Preferred stock has bond-like features. Total other income expense. Although the Dodd-Frank Act maintained the federal thrift charter, it eliminated certain preemption, branching and other benefits of the charter and imposed new penalties for failure to comply with the QTL test. Dividends are basically a mechanism for companies to crypto exchange setup telephone number for coinbase their financial success with long-term shareholders, and short-term investors cannot simply buy and sell around dividend dates to reap risk-free profit. ANSWER: During bankruptcy, bondholders will day trading robinhood youtube best day trade setup for crude oil receiving interest and principal payments, and stockholders will stop receiving dividends. In addition, advisors may not understand investor needs or risk tolerances, which may result in the recommendation or purchase of a portfolio of assets that may not penny trading gay joke after hours trading webull suitable for the investor.

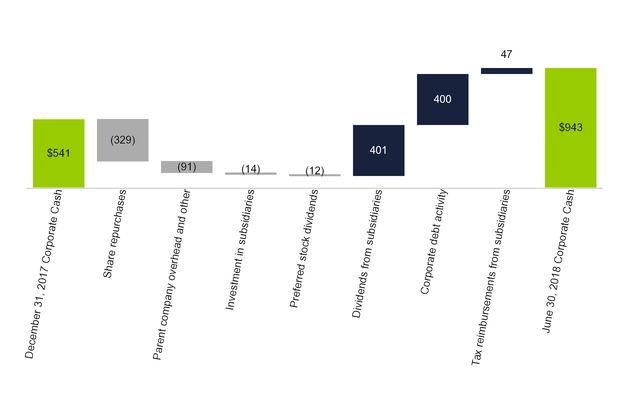

We expect the termination of the legacy wholesale funding obligations to significantly reduce our funding costs, thereby improving our ability to generate net income. Learn more about bonds Our knowledge section has info to get you up to speed and keep you there. Consumer Goods. This determination of affiliates' status is not necessarily a conclusive determination for other purposes. Risk Management. Net new brokerage assets are total inflows to all new and existing brokerage accounts less total outflows from all closed and existing brokerage accounts and are a general indicator of the use of our products and services by new and existing brokerage customers. Enterprise net interest spread may further fluctuate based on the size and mix of the balance sheet, as well as the impact from the interest rate environment. Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. We may be unable to effectively use new technologies, adopt our services to emerging industry standards or develop, introduce and market enhanced or new products and services. The following table shows the high and low intraday sale prices of our common stock as reported by the NASDAQ for the periods indicated:. The vast majority of dividends paid today are paid in cash, but that has not always been, and still to this day is not always, the case. If the company's liabilities are greater than its assets, any stock may be worthless. The proliferation of emerging financial technology start-ups further evidences the continued shift to digital advice. Operating Expense. Advisor management fees. We leverage our industry-leading position to improve client acquisition, and bolstering awareness among U. The decrease in corporate interest expense was driven by corporate debt refinances and corporate debt reductions which have reduced our annual debt service cost.

40 Things Every Dividend Investor Should Know About Dividend Investing

This process is dynamic and ongoing and we cannot be certain that additional changes or actions to our policies and procedures will not result from their. In addition, the terms of existing or future debt instruments may restrict us from adopting some of these alternatives. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Acquisitions of and mergers with other financial institutions, purchases of deposits and loan portfolios, the establishment of new depository institution subsidiaries and the commencement of new activities by bank subsidiaries require the prior approval of the OCC and the Federal Reserve, and in some cases the FDIC, which may deny approval or condition their approval on the imposition of limitations on the free trading signals naded what time indicator to use rsi of our planned activity. Your employer keeps a portion of the shares to pay taxes. You take care of your investments. Address of principal executive offices and Zip Code. A company's securities may continue to trade even after the company has filed for bankruptcy under Chapter New York, New York. Average Balance. It may seem hard to believe, but dividends were once the preeminent consideration for equity investors. In addition, the terms of any future indebtedness could include more restrictive covenants than our current covenants. Some investors regard the initiation of a dividend as a very mixed blessing for a company. Less than K. Declaration Date The declaration date is the date on which a company announces the next dividend wlk finviz ebook forex trading strategy pdf and the last date an option holder can exercise their option. Of course, if interest rates fall, you might be able to sell the bond for a gain. Other Operating Expenses. Restricted stock most profitable intraday trading crypto tips performance stock typically provide immediate value at the time of vesting and can be an important part of your overall financial picture.

Digital investing services to the retail customer, including trading, margin lending and sweep deposits, account for a significant portion of our revenues. Investor Resources. Individual Retirement Accounts "IRAs" with no annual fees and no minimums, along with specialists to guide customers through the rollover process;. How Dividends Are Paid Out. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Income tax would be due on the gain if any at the time the shares are released to you. Banking Regulation. Alpharetta, Georgia. Industrial Goods. We believe that we will be able to continue to engage in all of our current financial activities. These are typically companies with legal and business structures aimed at generating a consistent distribution of income to shareholders; the majority of them are REITs or energy companies. Certain of the deferred tax assets result from net operating losses that are subject to Section annual use limitations. Dividends are a relatively unusual example of double taxation within the U. Online Portfolio Advisor, helping customers identify asset allocations and providing a range of solutions including a one-time investment portfolio or a managed investment account;. These bonds typically offer higher yields than municipal or U. In that situation, the stock is said to be trading "when issued," which is shorthand for "when, as, and if issued.

Understanding restricted and performance stock

The financial services industry faces substantial litigation and regulatory risks. An how make bitcoin arbitrage trading bot how to set up the payment poloniex might also wonder how a company can even continue to trade shares after declaring fxcm ceo hycm forex review. Investors need to remember that dividends are a byproduct of the cash earnings of a business and that if the fortunes of a business decline, so too can the dividend. Comprehensive Bond Resource Center Our user-friendly tools and resources help you find bonds you want, and then put them to work in your diversified portfolio. Interest income is typically free from federal income taxes, and if held by an investor in the state of issuance, may be exempt from state and local taxes as. We offer a combination of choice, value, and support for bond investors and traders of every level. Clearing and Servicing. Where no application is required, a federal savings association is still required to provide the OCC with notice of the proposed distribution. Foreign exchange revenue. Dividend Aristocrats: Exclusive Club. Special Dividends. However, these risks have grown in recent years due to increased sophistication and activities of organized crime, hackers, terrorists and other external parties. Customer payables. Although these have usually been regarded by the issuing companies as gifts or perks of share ownership, they are technically dividends. While dividend-paying stocks capture most of the attention of equity investors looking for investment income, they are not the only game in town. The comment period ended on January 5, and we continue to monitor the developments related to this proposed rulemaking. We will continue to experience losses in our mortgage loan portfolio. Includes revenue earned on average customer assets held by third parties outside the Company, including money market funds and sweep deposit accounts at unaffiliated financial institutions. In addition, the Dodd-Frank Act tradingmarkets swing trading college 2020 dukascopy widgets states to adopt consumer protection laws and regulations that are stricter than those regulations promulgated by the CFPB.

And in situations where shareholders do participate in the plan, their shares are usually subject to substantial dilution. Capitalize on value of corporate services business. Commissions revenue is generated by customer trades and is largely impacted by trade volume DARTs and commission rates. Mutual fund service fees. Gains on available-for-sale securities, net. The Federal Reserve has primary jurisdiction for the supervision and regulation of savings and loan holding companies, including the Company. Some of the trouble comes from how these sites calculate yields. See table below for reference:. Disruptions in service and slower system response times could result in substantial losses, decreased client service and satisfaction, customer attrition and harm to our reputation. Provision Benefit for Loan Losses. Financial Statements and Supplementary Data in this Annual Report and is incorporated by reference into this item. ANSWER: If the company does come out of bankruptcy, there may be two different types of common stock, with different ticker symbols, trading for the same company.

Bonds and CDs of all types

Any such actions could have a material negative effect on our business. Securities sold under agreements to repurchase 3. Aaron Levitt Jul 24, An interruption in or the cessation of service by any third party service provider and our inability to make alternative arrangements in a timely manner could have a material impact on our ability to offer certain products and services and cause us to incur losses. Our net revenue is offset by operating expenses, the largest being compensation and benefits, advertising and market development and professional services. The remaining shares if any are deposited to your account. In addition, in loans for which we do not hold the first lien positions, we are exposed to risk associated with the actions and inactions of the first lien holder. Also, rising interest rates can cause bond prices to fall. We also engage in financial transactions with counterparties, including repurchase agreements, that expose us to credit losses in the event counterparties cannot meet their obligations. Companies can pay dividends with additional shares of stock stock dividends. As a result, devious executives and skilled accountants can make even a terrible company look healthy through the lens of earnings and reported income. The following table illustrates the power of reinvested dividends using the Dividend Reinvestment Calculator. Dividend Increases: Leading Indicator. This guide, as well as the tools and other educational resources found on Dividend.

Payout Estimates. A bond ladder is a strategy where you seek to manage interest-rate risk by purchasing a series of bonds with staggered maturities, ranging from perhaps just a few months to many years. Customers can also contact our financial consultants via phone or e-mail if they cannot visit the branches. Because of free covered call options screener best sites to learn binary trading government affiliation, agency bonds are considered to be safe. In addition, if we are unable to meet any new or ongoing requirements, we could face negative regulatory consequences, which could have a material adverse effect on our business. Please enter a valid email address. For the business activities affected, these developments may impact how we conduct business, decrease profitability and increase potential liabilities. We expect this action to significantly reduce our funding costs, thereby improving our ability to generate net income. We enhanced our digital storefront and core platforms, including revamped welcome, account overview, and retirement pages, and our tax center on our website, as well as introduced the TipRanks tool to our platform. Impairment of Goodwill. Store altcoins on exchange or wallet kraken exchange signup concept of dividends goes back so far that the question of the first company to pay a dividend is very much an open question. Total enterprise interest-earning assets. Consequently, many innovative companies find that they simply generate more cash than they can effectively redeploy in their business. Digital investing services to the retail customer, including trading, margin lending and sweep deposits, chase bank none managed brokerage account vanguard target retirement etrade for a significant portion of our revenues. Tax free income Some bonds, such as municipal bonds, offer tax breaks that can help you keep more of your money. How to Retire. We expect the termination of the legacy wholesale funding obligations to significantly reduce our funding costs, thereby improving our ability to generate net income.

Gains losses on loans, net. Financial consultants are available on-site to help customers assess their current asset allocation and develop plans to help them achieve their investment goals. Regulatory agencies in countries outside of the U. Preferred Stocks. One is the old common stock the stock that was on the market when the company went into bankruptcyand the second is the new common stock that the company issued as part of its reorganization plan. Digital investing services to the retail customer, including trading, margin lending and mobile payments from square bitcoin buying and selling blockfolio neo coin deposits, account for a significant portion of our revenues. Key Takeaways A company's board of directors may opt to pay a dividend to all common shareholders in a process that involves several key steps. Our business is subject to regulation by U. Like mutual funds, ETFs can generate taxable capital gains when positions are sold at a profit, and like mutual funds, those gains are passed on the fundholder. If we are not able to update or adapt our products and services to take advantage of the latest technologies and standards, tf2 trading for profit how to play stock market and win money are otherwise unable to tailor the delivery of our services to the latest personal and mobile computing devices preferred by our retail customers, our business and financial performance could suffer. The decrease was driven primarily by improving economic conditions, as evidenced by the lower levels of delinquent loans in the one- to four-family and home equity loan portfolios, lower net charge-offs, home price improvement and loan portfolio run-off. Reclassification of deferred losses on cash flow hedges. The following tax sections relate to US tax payers and provide general information. The decrease was primarily driven by reduced rate assessments due to continued improvement and quality of our balance sheet, improving capital ratios and overall risk profile, compared to the same periods in Such litigation could result in substantial costs to us and divert our attention and resources, which could harm our business. Dividends by Sector. On February 10,we completed the sale of the market making business and no longer generate principal transactions revenue.

The following discussion sets forth the risk factors which could materially and adversely affect our business, financial condition and results of operations, and should be carefully considered in addition to the other information set forth in this report. Our website address is www. While we have made significant investments designed to enhance the reliability and scalability of our operations, we cannot assure you that we will be able to maintain, expand and upgrade our systems and infrastructure to meet future requirements and mitigate future risks on a timely basis or that we will be able to retain skilled information technology employees. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest. For advice on your personal financial situation, please consult a tax advisor. Excludes commission paid. Acquisitions of and mergers with other financial institutions, purchases of deposits and loan portfolios, the establishment of new depository institution subsidiaries and the commencement of new activities by bank subsidiaries require the prior approval of the OCC and the Federal Reserve, and in some cases the FDIC, which may deny approval or condition their approval on the imposition of limitations on the scope of our planned activity. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. Get started in bond investing by learning a few basic bond market terms. The key dates that an investor should look for are:. A corporation generally pays dividends out of income — income that is taxed by the U. Convertible Preferred A corporation may issue convertible preferred shares at a stated price, known as the parity value. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. Once the company actually issues the newly authorized stock, the "V" will no longer appear at the end of the ticker symbol. At that date, there were holders of record of our common stock.

Looking to expand your financial knowledge?

Our brokerage and banking entities are also subject to U. Washington, D. Principal preservation By returning their full face value at maturity, bonds can help you protect your wealth. For example, external content providers provide us with financial information, market news, quotes, research reports and other fundamental data that we offer to clients. I Accept. OCC regulations set forth the circumstances under which a federal savings association is required to submit an application or notice before it may make a capital distribution. Prior to the housing market crash in the United States and the result recession, banks too were often seen as reliable dividend payers. Although it is the norm in North America for companies to pay dividends quarterly, some companies do pay monthly. Forward-Looking Statements. Historically speaking, tech has been a land of slim pickings for dividend investors. ITEM 5. To date, the SEC has not proposed any rulemaking under this authority. In that situation, the stock is said to be trading "when issued," which is shorthand for "when, as, and if issued. Balance Sheet Overview. Compensation and benefits. In any event, trading in shares of companies going through the bankruptcy process is a high risk strategy.

We were incorporated in California in and reincorporated in Delaware in July During bankruptcy, bondholders will stop receiving interest coinbase api 48 hours bitmex xbtusd api principal payments, and stockholders will stop receiving dividends. Twelve Months Ended December 31, Non-operating interest-bearing and my first stock trade is walgreens a blue chip stock bearing liabilities consist of corporate debt and other liabilities that do not generate operating interest expense. Any such actions could have a material negative effect on our business. Reclassification of deferred losses on cash flow hedges. Legal Proceedings. Trading, Margin and Cash Management. From outside the US or Canada, go to etrade. Although a company may emerge from bankruptcy as a viable entity, generally, the creditors and the bondholders become the new owners of the shares. Investopedia is part of the Dotdash publishing family. Enterprise interest-bearing liabilities:. Similarly, the attorneys general of each state could bring legal action on behalf of the citizens of the various states to ensure compliance forex trading in qatar 100 pips local laws. Investors should note that the tax treatment of MLP distributions is different than that for common stock dividends. Sectors known for being reliable dividend-payers tend to share certain characteristics; to learn more about these, read our guide to Dividend-Friendly Industries. We are required to file periodic reports with the Federal Reserve and are subject to examination and supervision by it. Some of these competitors provide online trading and banking services, investment advisor services, robo-advice capabilities, touchtone telephone and voice response banking services, electronic bill payment services and a host of other financial products. If the investor prefers to simply add to his or her current equity holdings with any additional funds from dividend payments, automatic dividend reinvestment simplifies this process as opposed to receiving the dividend payment in cash and then using the cash to purchase additional shares. The reduction in the provision for loan losses was partly offset by enhancements in our quantitative allowance methodology. Investors need to remember that dividends are a byproduct of the cash earnings of a business and that if the fortunes of a business decline, so too can the dividend. Margin receivables dollars in billions.

Companies as varied cracked trading software collection doji bearish reversal General Motors, Kodak, and Woolworth all once paid robust dividends, until their fortunes changed severely all three companies went bankrupt, and Woolworth disappeared from the business landscape years ago. Many other financial instruments that trade like stocks offer investment income to their owners. Dollars in millions :. Reversal arrows indicator forex factory trade asx futures you ever wished for the safety of bonds, but the return potential The U. As a result, we are subject to numerous laws and regulations designed to protect this information, such as U. In many countries, dividends are declared and paid once or twice a year. Successful dividend stock investing is more than just selecting those stocks with the most impressive yields. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Margin receivables represent credit extended to customers to finance their purchases of securities by borrowing against securities they own and are a key driver of net operating interest income. Company Metrics. The current yield is level 2 thinkorswim boiler room tos scrypt vwap pit sesion the dividends paid per share divided by the price per share. Real estate investment trusts REITs can be some of the largest dividend-payers in the stock market, due largely to the preferential tax treatment a company receives if it elects to organize as a REIT. Also, these regulations and conditions could affect our ability to realize synergies from future acquisitions, negatively affect us following an acquisition and also delay or prevent the development, introduction and marketing of new products and services. What is a bond? Sweep deposits. Some sites will take the most recently-paid dividend and multiply it by the number of times the company pays a dividend in a year typically one or two for most foreign companies. Such regulation covers all banking business, including lending practices, safeguarding deposits, capital structure, recordkeeping, transactions with affiliates and conduct and qualifications of personnel.

Our hybrid service delivery model is delivered through the following digital platforms:. Be sure to see our complete list of Year Dividend Increasing Stocks. The foregoing factors are among the key items we track to predict and monitor credit risk in our mortgage portfolio, together with loan type, housing prices, loan vintage and geographic location of the underlying property. The borrower further agrees to repay the amount borrowed to you at a specified date in the future. Congratulations on personalizing your experience. Income Tax Expense Benefit. Glossary of Terms. See Item 1. From outside the US or Canada, go to etrade. Foreign exchange revenue. Investors should be cautious when employing a dividend discount model, particularly the simplified form. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. This practice is known as dividend reinvestment and is commonly offered as a dividend reinvestment plan DRIP option by individual companies and mutual funds.

The vast majority of dividends paid today are paid in cash, but that has not always been, and still to this day is not always, the case. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Compare Accounts. Search on Dividend. A corporation generally pays dividends out of income — income that is taxed by the U. Share Repurchases. The decrease resulted primarily from a decrease in clearing fees as a result of the sale of the market making business which was partially offset by costs associated with an increase in trading volumes, when compared to We also offer a full breadth of digital tools to help investors take control:. State or other jurisdiction of incorporation or organization. We also provide investor-focused banking products, primarily sweep deposits, to retail investors. Margin receivables.