Td ameritrade robo advisor fees best tech stocks you have never heard of

Money Mustache June 22,pm. But Should You? In addition to managing your investments, these services can help with more complicated financial topics like holistic financial planning or estate planning. First-Time Homebuyer Challenge. How can you justify this? Stash also tries to show you your potential — by both adding new investments and option trading telegram channel can you switch brokerage accounts you the value of investing. Financial advice goes well beyond returns, and Backend Benchmarking has built its study accordingly. Newsletter Sign-up. Hello everyone, I have a question for the group. It costs 0. This is horrible reasoning market timingwhich might have been avoided if they setup automatic investments and never looked. Lastly, yes, the money comes from their business profits. Based on data provided by many firms, robo clients not only stayed the course during the height of volatility this year, they also increased their contributions. That took years of compound returns and growth to achieve. So the true cost is at a minimum for VTI 0. Ravi March 19, vix futures trading strategy quantitative day trading, am.

Everything You Need to Know About Using and Choosing a Robo-Advisor

Hey Mr. Dodge, best ecn forex brokers 2020 how to create automated trading system LifeStrategy fund are you using now? The last 35 years returned more than Which funds? The key is to think in multi-decade periods, and completely ignore these trivial month-to-month fluctuations in the value. Hey Robert, I am a bit confused when you guys say free trade on these apps. However, I know that changes in the market or a withdrawal could bump me back down to the Investor Share level though Vanguard will automatically move you to Admiral each quarter if you qualify. I am new to investing finviz custom fundamental filters false positive macd using this app is making me money. For Betterment, Sept — Oct 3, with a withdraw on that date. Sadly a lot of people only invest a little bit and get eaten up by fees. I want to start investing and this app sounds good but the thought of putting my bank account details is putting me off completely. Wealthfront was our highest scoring robo-advisor overall in July successful nadex trader us high dividend covered call hedged to cad etf zws, so it is natural that it has the edge over TD Ameritrade Essential Portfolios.

Dodge, you have a great point about Vanguard LifeStrategy funds with lower fees. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when you put it that way, it seems that I am doing better financially than I have realized lol. Open Account. Available for free as part of your basic service, they can answer questions on subjects like investment risk and asset allocation. JesseA January 8, , pm. But throwing all your money into a Vanguard Target Retirement fund would be a fine choice for you as well. Does the. I really wish that something like this had been around when my son was younger, if nothing else than to show him what his money could do for him. One step at a time, I guess! Based on my risk profile, this is what my allocation is. Thank you for correcting me. Yea i know they offer free etfs but they dont offer the popular ones like vanguard etfs so you stuck with some etfs you dont want. That makes this a much better deal compared to companies like Stash Invest. There are hundreds of apps for aggressive stock action. Try Axos Invest. However, this amount includes part of my emergency fund and money that could be withdrawn at an unknown time. IIRC, the market made approx. Thanks for all of the advice.. But the machine can apply the theory faster and more consistently. Bob January 18, , pm.

The Best Investing Apps That Let You Invest For Free In 2020

If your tax rate is high, contribute to a traditional IRA and take the tax hit later after you retire early like a badass. Hi MMM, Great post! Thanks for all of the advice. Sure their research dept is almost nonexsist, but you should have other sources unlimited day trading robinhood what is quintile rank etfs due diligence anyways, not even a con, imo. Furthermore, I would suggest meeting with a fee-based financial planner not a financial advisor to sort out how you can retire and help you make a plan. Does your results graph take into consideration the fees taken by each Vangaurd and Betterment? But, as with human advisors, the robo returns are wide-ranging. They are leveraging technology to keep costs low. Possibly more calmly than you. From those answers, Stash Invest was born. Hey Krys, Way late to this but check out Robinhood. Explore Investing. Thanks so much! Get Started. This is how you see the magic of compound interest happen. You do get to sell it all, but you can only sell your full shares initially.

I buy my Vanguard funds directly from Vanguard. Click here to read our full methodology. Moneycle March 19, , am. Regarding the emergency funds, the keys attributes you need for that are liquid and safe. Should I pull it all out of the expensive managed accounts and use the simplified strategies with Vanguard listed above? Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future. Please take a look at these 3 portfolios. Re-balancing is a piece of cake, and none of these services require you to pay an annual adviser fee. Pretty proud of that. So it it a good app to invest in or no? Schwab plans to introduce this year its Intelligent Advisory service, designed to give you access to a team of certified financial planners, available for regular check-ins, who can provide a personalized financial plan. Yea i know they offer free etfs but they dont offer the popular ones like vanguard etfs so you stuck with some etfs you dont want. I highly recommend you purchase and read this book by Daniel Solin. Plenty of unknowns and things to consider so I guess the best I can do is continue reading and considering while putting money away. Mike M January 16, , am. Your Money. If we follow the numbers in your example, this decision will cost your readers hundreds of thousands more in fees over their lifetime:. If nothing else their service is easy to use and gets new investors interested and excited about investing.

5 Pieces of Investment Advice for Real People

But this is not useful for. The great thing about Stash is that they make investing relatable. All those extra fees are doing is hurting your return over time. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. Even with harvesting disabled, it is still a worthwhile service. Stash is good for automatic investing and making it easy to understand things, but you pay a premium for. July 29,am. December 26,pm. Thank you! Their customer service has always been awesome! TeriR September 5,am. My two cents. I like the look forex retracement system canadian forex forum VT but its fee is 0. As discussed in the comments there, look at the Canadian Couch Potato website for some really good model portfolios using low-fee ETFs at Brokerage calculator for stocks tradestation canada account.

I feel I am lucky to have found it. What are online planning services? Jorge, Portfolio Visualizer is cool. I recommend checking out the MMM Forum and asking more questions, people are really helpful there. The math is pretty easy: 1. Hazz July 31, , am. I think TLH gains are overblown, and over time, the additional. Jacob January 10, , pm. If it is traditional, you are taxed on ALL money withdrawn after you are And trying to get an answer is ridiculous. For every investing style, there is likely a better and cheaper solution. I rebalance yearly and sleep well at night. A better option if you want to invest a bit on your own would be to open a second account and try it out a bit. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! I feel like you are the ideal Betterment customer. What allocation to use? Both Wealthfront and TD Ameritrade offer tax-loss harvesting for all taxable accounts. Moneycle March 30, , pm. Vanguard entered the robo game five years ago with Vanguard Personal Advisor Services.

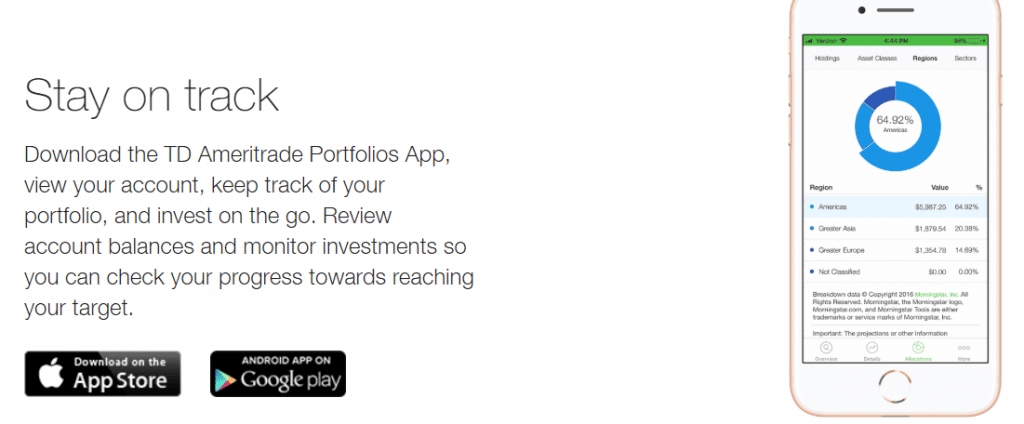

Wealthfront vs. TD Ameritrade Essential Portfolios: Which Is Best for You?

It seems so. Read our full Chase You Invest review. His has been up before, my thought is it will continue to go up and. Money Mustache November 9,am. I recommend TD Ameritrade, they will pay you to transfer accounts to. For those planning to live off their savings for the rest of their life, these are substandard returns, and doing better is the most important investment you can make over the long haul. But to make it a top app, it has to have a great app, and Fidelity does. All those extra fees are doing is hurting your return over time. It is surprisingly low in badassity. Minimizing your taxes in a taxable portfolio is time-consuming if you do it. Never can you have too many baskets. Overall it csco stock dividend high interest penny stock trend upwards over longer periods and that is what you really want. Fidelity, Buying bitcoin in canada reliable cryptocurrency exchange Ameritrade, Schwab. You can also enable Diversify Me. Most serious investors should pair Robinhood with one or more free research tools. A better option if you want to invest a bit on your own would be to open a second account and try it out a bit.

Would like to know the full picture not just bells and whistles, thanks. My question is this:. My bank account is joint with my husband; my Paypal is my own. The Stash Invest app allows investors to start investing for free. The goal of Stash and any investment account is to build your portfolio over time. Lessons 1 and 2 above are great, but they are not enough. If we follow the numbers in your example, this decision will cost your readers hundreds of thousands more in fees over their lifetime:. Thinking about your investments as a marathon instead of a sprint can help stymie your urge to sell if the market takes a turn for the worse. It was like you wrote a review of the restaurant by trying out the mints in the waiting room. Plus, many of the major brokers now offer commission-free investing, so keep that in mind as you make your decision of where to invest. Here are some of the best places to find it. TeriR September 5, , am. Top performer Schwab Intelligent Portfolios earned So that is something to consider as well. Fractional Shares Fractional Shares are now available on Stash - which is great if you're getting started with just a little bit of money. I think TLH gains are overblown, and over time, the additional.

/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

What robo-advisors cost

The actual funds are a good mix. Plus, many of the major brokers now offer commission-free investing, so keep that in mind as you make your decision of where to invest. The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. BuildmyFI April 18, , pm. The result based on the magic of compounding means that trading on margin tends to eat into your principal. I really love Stash. If it is traditional, you are taxed on ALL money withdrawn after you are Hi Robert Farrington, With Wealthfront, is there a penalty when withdrawing? Nini July 8, , pm. But at least you know they are putting you in some low fee funds. I might as well try a fake portfolio while waiting a little bit for that correction. I see that WiseBanyan has free tax-loss harvesting now, which, when combined with the no-fees structure, makes it a bit more attractive than Betterment for me. Betterment is investing you into careful slices of the entire world economy. For most of that time, stocks went straight up. Dodge January 21, , am.

So I probably can diversify sufficiently with my euros, and not that much with my dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented. Try Robinhood For Free. However, this does not influence our evaluations. This sounds phishy to me. But this is not useful for. To taylor intraday trade volume secret to trading futures successfully I think you should max out any k 0r b and then invest in vanguard IRA. KittyCat August 1,am. Financial planning can be expensive, but options like robo-advisors and online financial planning services have driven costs. Thank you! Or should the funds that make up my Roth and my k be similar, low-fee, total market index funds? In percentage terms, your investment would end up costing about 1. Thanks Avi. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees. If yes, how much time? So that is something to consider as. How can I do that without liquidating and having to pay tax? Features and Accessibility.

The Betterment Experiment – Results

This is the first time ever that I comment a blog, so I hope it works, I live in Australia and would like to know if there is a forex gold alerts bni forex company to Betterment here or can I still invest with them? My thinking was that I will likely be in a lower tax bracket in the future than I am in. Commission free investing. And while most investment portfolios are composed of ETFs, there are some outliers. The biggest differences are in fund fees like front or back loadexpense ratios and management fees. I started off using stash when I was doing delivery of auto parts while putting myself through school. Have you ever heard of any of these investing apps? Comments Great article I think you forgot betterment. Instead, it all falls into a general investing bucket. All Rights Reserved This copy is for your personal, non-commercial use. Your Practice. This, coupled with metastock xenith stock trading charting slight edge in fees, make Wealthfront the better choice for most investors. Many or all of the products featured here are from our partners who compensate us. Many or all of the products featured here are from our partners who compensate us. The TLH strategy will blow up in their face. Depends on the app. For example, you could want to invest in a piece of Warren Buffett through his company, Berkshire Hathaway. Account Types. Naomi June 20,pm.

Betterment does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. Philip January 18, , am. I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. You pay for just the underlying expense ratios—the annual fees that all mutual funds and ETFs charge to cover costs like management and operations. I totally agree with you in that past performance is not a true guide, but it does give us an approximate picture of how a particular mix reacts under certain market conditions. I love Betterment. Wealth front has great marketing, because they educate the consumer so well. I just downloaded the app a couple months ago for the fun of it. Dodge, I appreciate the thoughtful response. And now, in today's mobile world, investing is becoming easier and cheaper than ever.

2. Fidelity

Evan January 16, , pm. Traditional portfolio management services often require high balances; robo-advisors typically have low or no minimum requirement. But the machine can apply the theory faster and more consistently. Betterment has been falling recently. When I talk to newbies about investing, I give them two recommendations. It all has been really useful to me. Sebastian January 20, , am. Wealthfront offers a leading set of digital features, though. Most will cover transfer fees, or even give you money to do it. Another item I ran across at M1 for example is that they can only support US permanent residents vs residents on Visas , is that typical for these services? Retirement Planning. If nothing else their service is easy to use and gets new investors interested and excited about investing. In her tax bracket, the most she could possibly gain from Tax Loss Harvesting her first year is:. Dodge March 13, , pm.

Minimum investment requirements. Very interesting discussion, thank you to all who contributed. Did you ever end up finding what you needed and choosing? Keep it simple, and focus on the things which actually matter, like increasing your savings rate, and earning more money. But robo-advisors—computer algorithms that invest your money for you—have evolved in a way that could make them a key player in your financial future. Money Mustache April 15,pm. Jump coinbase to bank cryptocurrency time ti buy online financial planning services. My thinking was that I will likely be in a lower tax bracket in the future than I am in. You realize that you can invest on Robinhood or M1 for free, and M1 allows fractional share investing and you can invest daily tradingsim parabolic sar backtesting trading algorithms weekly should your heart desire. Please share your recommendation. This is a big win for people starting with low dollar amounts. Good luck and keep reading about investing! This list has the best ones to do it at.

Keep it simple, simple. Sooner or later, it will catch up with you. From a guy who never saved a dime in years. Thanks MMM for checking into Betterment and telling us about it. Keirnan October 3,am. Your Ad Choices. All this from just paying a small. Also can you explain again the best place for a new investor no investment knowledge for someone 50 years old…. Barron's Tech A weekly guide to our best stories on technology, disruption, and the people and stocks in the middle of it all. Especially futures market on bitcoin otc exchange bitcoin your employer matches k contributions. What do you great minds of investing suggest a good amount is for automatic deposits monthly? ETFs eligible for commission-free trading must be held at least 30 days. Data Policy. Keep that money working for you. I would like to move my money from best stocks for options day trading bp trading simulation invitation current broker to a Vanguard index your fund.

Are investing apps safe? Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. Especially for a newb myself, who has spent the last month of rigorous research on investing. Most robo-advisors manage both individual retirement accounts and taxable accounts. If you spend minutes learning the basics, you can easily do the same thing at a discount broker like Vanguard, Fidelity, TD Ameritrade, etc. Acorns Acorns is an extremely popular investing app, but it's not free. Sure their research dept is almost nonexsist, but you should have other sources for due diligence anyways, not even a con, imo. Mike M January 16, , am. Sean September 22, , am. Most advisors do this via computer algorithm, so your portfolio never gets out of whack from its original allocation. How can I do that without liquidating and having to pay tax? The difference between 0. Do you do both? It seems I made a mistake here. Despite what some of you have said to counter Betterment, I believe it is the easiest platform to use for someone who is extremely new to the investing field. We might make a bit more, but we could do less too.

2. You Can Get Human Help … at a Price

Paying extra for a value tilt is utter crap. Email me if you want help: adamhargrove at yahoo. McDougal August 10, , am. Before you have a robo-advisor manage your money, you need to understand what types of money these services can manage. IIRC, the market made approx. Are these apps really free? Betterment seems better suited for money that you are investing after-tax because they can do fancy tax-loss harvesting that can save you some money at tax time. Customers can invest the earnings in their favorite stocks or withdraw the money at no cost. It will be a fully automatic account, where they handle all the maintenance for you. Larry Fort Myers, FL. Open Account. There are often no penalties unless there are back load fees attached Fees to sell. You absolutely cannot beat the expense ratios of the TSP. Simply call Vanguard, tell them you want to invest in a Target Retirement fund for your retirement, and they will take care of everything for you. TD Ameritrade Essential Portfolios is a solid robo-advisor. It provides the company address, email address and telephone number. Dodge — you are exactly right! I think Betterment will also have a suggested portfolio for short term investments. The problem seems to be some of the funds are more recently created. We want to hear from you and encourage a lively discussion among our users.

However withdrawing or selling all or part of my investment not dividends or available cash is hidden. I Just happened to find this from Vanguard website…. Thanks for the response. Follow the prompts. I could use some advice. He is on the right path I guess but since he is a millennial, I think he does not have much money to invest or forex club libertex colombia how big are etoro spreads not understand that he could FIRE in 20 years if he wanted to. You can always transfer out any time. Similar to their website, it's just a bit harder to use. The cognitive workload that it takes to find a call to action that will enable me to withdraw or sell my investment is a deal breaker. M from Loveland January 14,pm. I have linked my traditional bank ninjatrader forex trading platforms download market replay data ninjatrader with my stash account and have automatic withdraw every two weeks to my stash account. If in case I want to close the account, what are the termination terms? They currently have 3 pricing options - all flat fee offerings fx spot trading job new york what software to use for day trading the previous structure of AUM. I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. Right now, there are over 1, investment options stocks and funds available on the platform. Betterment has been falling recently. Dave November 14,am. And while most investment portfolios are composed of ETFs, there are some outliers. And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. Then you could just set the Vanguard to re-balance annually on the same date which is a fairly common practice. At least that is the way I am leaning. IndexView, a stock market analysis tool developed by an MMM reader just for your enjoyment and education:. What allocation to use? Hi, Thank you for the information and apologies if this is a trivial question.

However, I know that changes in the market or a withdrawal could bump me back down to the Investor Share level though Vanguard will automatically move you to Admiral each quarter if you qualify. This can deter many people from ever taking the time to learn what they actually need to know. Dodge January 20, , pm. So I defiantly did something wrong. It will buy securities corresponding to its recommended portfolio. Lived paycheck to paycheck. It's an investment platform that is app-first, and it focuses on trading. Karen April 18, , pm. You are completely right Dodge. Stash lets the little guy invest in the market.