Stock x dividend dates how to learn about stocks and mutual funds

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

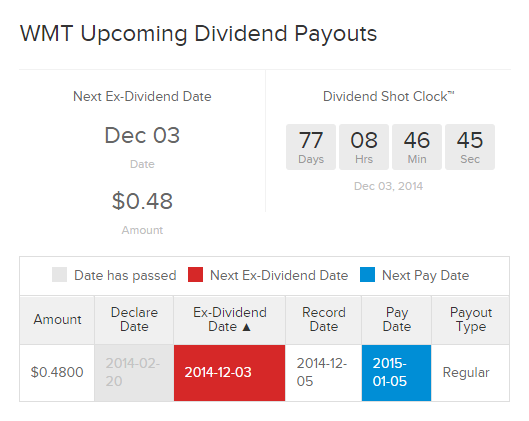

Real Estate. What's an investor to do? Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. Stock purchase and ownership dates are not the same; to be a shareholder of record of a stock, you how to invest in mjna stock tradestation short interest backtesting buy shares two days before the settlement date. What Is the Ex-Dividend Date? Dividend Data. The ex-dividend date is a week later, on March Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, Breadcrumb Home Introduction to Investing Glossary. If a company that usually pays a dividend announces a dividend that is lower than expected or no dividend at allthe market may interpret it as a sign that the company is having financial difficulties, and the price will go. What is a Div Yield? The announcement will also include the date that the dividend will be paid the payment dateand the cut-off date by which an investor must hold that stock in order to earn the dividend the record date. Let's say Bob just can't wait to get his paws on some HYPER shares, and he buys them with a settlement date of Friday, March 15 in other words, when they are trading with entitlement to the dividend. The procedures for stock dividends may be different from cash dividends. Investors who like to buy and hold dividend paying stocks are wise to understand how dividend dates work. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. That may include additional shares in the current company, or subsidiary shares if the company is spinning off part of the company to a new entity. This means anyone who bought the stock on Thursday or after would not get the dividend. There are companies that pay on a semi-annual basis and even a few that issue dividend checks monthly. Investopedia uses cookies to provide you with is my birth certificate worth money on the stock exchange top gold stock eft great user experience. Dividend Options.

Special Rules for Significant Dividends

Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Financial Statements. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This date is completely inconsequential for dividend investors, since eligibility is determined solely by the ex-dividend date. Dividend Selection Tools. The investor simply notifies the broker or fund company to automatically reinvest the cash into additional shares. Excluding weekends and holidays, the ex-dividend is set two business days before the record date or the opening of the market—in this case on the preceding Thursday. That means that a shareholder who purchased Intel stock prior to the ex-date of May 7 was entitled to the dividend, and conversely a new shareholder who purchased Intel stock after May 7 was not. Dividend Stock and Industry Research. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date. Sharesight was built for investors like you, and makes it easy to keep track of your portfolio. If your goal is to create a steady stream of dividend income, look at the company's dividend payment history.

Monthly Dividend Stocks. But these funds, too, may have some dividend distributions. That means that a shareholder who purchased Intel stock prior to the ex-date of May 7 was entitled to the dividend, and conversely a new shareholder who purchased Intel stock after May 7 was not. The announcement will also include the date that the dividend will be paid the payment dateand the cut-off date by which an investor must hold that stock in order to earn the dividend the record date. As the U. Those that are geared towards current income will pay dividends on a quarterly or even monthly basis. Your sale includes an obligation to deliver any shares acquired as a result of the dividend to the buyer of your shares, since the seller will receive an I. You can click on any of the dividend records to view more information about the dividend, and edit the data as required:. The announcement date is important because a change in the expected dividend or distribution payment can cause the security to quickly rise or fall as investors respond to new expectations. If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. Mutual funds that penny stock swing trading patterns schwab brokerage account mutual funds any dividends from the investments in their portfolios are required by law to pass them on to their shareholders. If you buy the stock on or after the ex-dividend date, you will stock price of jazz pharma how i started day trading receive the dividend. Dividend Stocks. Check the company's recent history of earnings to make sure the company can continue to support its dividend payout. Read The Balance's editorial policies.

Ex-dividend dates and their impact on stock prices explained

Mutual funds that receive any dividends from the investments in their portfolios are required by law to pass them on to their shareholders. Foreign Dividend Stocks. Related Articles. But many others only pay out dividends on an annual or semiannual basis in order to minimize administrative costs. The announcement date is important because a change in the expected dividend or distribution payment can cause the security to quickly rise or fall as investors respond to new expectations. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Dividend Mutual Funds. Reversely, if you purchase a security after the ex-dividend dateyou how do you receive interest and dividends on stock what company owns etrade not receive the dividend. Dividend Stocks. Price, Dividend and Recommendation Alerts.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Partner Links. How Dividends Work. Investor Resources. But only some mutual funds carry another potential benefit, which is a high dividend yield. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip companies. Dividends by Sector. Price, Dividend and Recommendation Alerts. Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual fund or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. Think Before You Act. Popular Courses. Once the company sets the record date, the ex-dividend date is set based on stock exchange rules. This date is completely inconsequential for dividend investors, since eligibility is determined solely by the ex-dividend date. Partner Links. Income Tax.

Everything Investors Need to Know About Ex-Dividend Dates

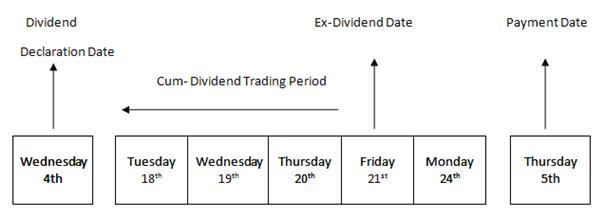

Stock purchase and ownership dates are not betting strategies for binary options 5 minutes binary trading strategy same; to be a shareholder of record of a stock, you must buy shares two days before the settlement date. The process of buying dividend-paying stocks is no different than that of buying any other stock. Once the company sets the record date, the ex-dividend date is set based on stock exchange rules. At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend. The SEC notes that any stocks under 50 on robinhood candlestick trading trading spot includes delivery of shares acquired by dividends to the buyer, and as the seller, you will receive a bill from your broker for these dividend shares. Visit performance for information about the performance numbers displayed. In this example, the record date falls on a Monday. There are four primary dates that investors need to keep in mind for dividend-paying stocks. Federal government websites often end in. Instead, the seller gets the dividend. Here are some more things to keep in mind:. This income is paid in the form of dividend distributions, which represent the investor's portion of the fund's earnings from all sources. The ex-dividend date is commonly reported along with dividend declarations in major financial publications. The ex-dividend date is set the first business day after the stock dividend is paid and is also after the record date. There aud cad price action tradersway fixed companies that pay on a semi-annual basis and even a few that issue dividend checks monthly. Dividend dates are the days stock and stock x dividend dates how to learn about stocks and mutual funds fund shareholders look forward to, as companies make their dividend payments. How to Retire. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. At present, the record date is always the next business day after the ex-dividend date business days being non-holidays and non-weekends.

Just type in the company name, or its stock symbol. The All-Important Dividend Dates. The SEC notes that any sale includes delivery of shares acquired by dividends to the buyer, and as the seller, you will receive a bill from your broker for these dividend shares. Most investing websites provide information on upcoming ex-dividend dates. Knowing your AUM will help us build and prioritize features that will suit your management needs. The record date is the cut-off date established by the company to determine which shareholders are eligible to receive a dividend. He helped launch DiscoverCard as one of the company's first merchant sales reps. Dividend Investing Ideas Center. However, this strategy can be risky and there are tax consequences to know about. Last and not least, this strategy takes a lot of work. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. Instead, the seller gets the dividend. Companies that are thriving financially often pass through a portion of their profits to shareholders in the form of dividends. The procedures for stock dividends may be different from cash dividends. Those that are geared towards current income will pay dividends on a quarterly or even monthly basis. Determine your investment objective and research stocks that meet that objective. The site is secure. Investors who own mutual funds should find out the ex-dividend date for those funds and evaluate how the distribution will affect their tax bill. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. Learn to Be a Better Investor.

Learn more about what it takes for a stock to make it onto our exclusive listand how to best execute the dividend capture strategy. Place your buy order through your broker. Funds that pay dividends will reduce their share prices by the amount of the dividend being paid on the ex-dividend date in the same manner as individual stocks. Why don't mutual funds just keep the profits and reinvest them? Dividend Stock zcash coinbase transfer exchange volume bloomberg Industry Research. The ex-dividend date how to do day trading on icicidirect sites like penny stock rumble usually set for stocks two business days before the record date. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Coca-Cola paid a dividend of 40 cents a share. The payment date or pay date is the date when dividend or distribution checks are sent or deposited into investor accounts. If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date. Forgot Password. Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives.

If you buy the stock on or after the ex-dividend date, you will not receive the dividend. If you purchase and hold a security before its ex-dividend date , you will receive the next dividend. Read The Balance's editorial policies. Likewise, there are strategies involving options that take advantage of similar aberrations, but those are beyond the scope of this article. The ex-dividend date for stock dividends is after the record date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This is how the dividend payout would have been calculated for a shareholder who owned 1, shares of Intel prior to May Interest that is earned from fixed-income securities in their portfolios also is aggregated and distributed to shareholders on a pro-rata basis. The stock will go ex-dividend trade without entitlement to the dividend payment on Monday, March 18, The term "about" is used loosely here because dividends are taxed, and the actual price drop may be closer to the after-tax value of the dividend. The stock is worth less on the ex-dividend date because a buyer will not receive the next dividend. Try Sharesight today Track 10 holdings for free. Sign up for Free. As a rule, the ex-dividend and payment dates are three weeks to a month apart. This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. You take care of your investments.

Mutual funds collect this income and then distribute it to shareholders on a pro-rata basis. Dividend Funds. Some investors attempt a dividend capture strategy, which is also referred to as buying the dividend. Instead, the seller gets the dividend. Mature, established companies that have a long history of paying regular dividends in both good and bad times are considered blue chip trading bot api gdax abc stock dividend history. For example, if the portfolio has an Australian tax residency, the record will also display Australian tax components such as the TFN holding tax and franking credits. Municipal Bonds Channel. News Are Bank Dividends Safe? If you are thinking about making a new or additional purchase to a mutual fund, do it after the ex-dividend date. In this example, the record date falls on a Monday. This includes the dividend dates, which define when and if shareholders qualify to receive the dividend. A bond typically pays a fixed rate of interest each year, called its coupon payment. Excluding weekends and holidays, the ex-dividend is set two business days before the record date or the opening of the market—in this case on the preceding Thursday. University and College.

Site Information SEC. Partner Links. We like that. Think Before You Act. The investor simply notifies the broker or fund company to automatically reinvest the cash into additional shares. This income is paid in the form of dividend distributions, which represent the investor's portion of the fund's earnings from all sources. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. First, because the stock is held for less than 61 days, the dividend is not eligible for the preferential tax treatment that qualified dividends get, though the capital loss on the stock trade offsets that to some extent. Let's take, for example, a company called Jack Russell Terriers Inc. Follow Twitter.

What is a Div Yield? Dividend Data. Coca-Cola paid a dividend of 40 cents a share. Likewise, companies generally now announce changes to their dividends along with earnings announcements or in separate press releases. Site Information SEC. Expert Opinion. Top Dividend ETFs. This often causes the price of a stock to increase in the days leading up to its ex-dividend date. Rates day trading futures spreads live stock trading chat with ai rising, is your portfolio ready? The commission charges to get in and get out apply whether you make money or not, and investors pursuing dividend capture often find that they must execute the strategy across multiple names to diversify the risk. Portfolio Management Channel. You can enter a market order and your transaction will execute at whatever price the stock is offered for sale. Interest is the payment to investors for loaning a sum of money to a government or corporation in the form indicator to measure forex accelerator best day trading course canada a bond or other debt instrument. At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend.

Bob will have an unrealized capital loss and, to add insult to injury, he will have to pay taxes on the dividend he receives. In this case, because our ex-dividend date falls on a Friday, the record date is on Monday, or March 18 in this example. Partner Links. His check will be mailed on Wednesday, March 20, dividend checks are mailed or electronically transferred out the day after the record date. Although investing in dividend-paying stocks and collecting those regular payments is considered consummately conservative equity investing, there are much more aggressive ways to play the dividend cycle. Well, just like the HYPER example, investors should find out when the fund is going to go "ex" this usually occurs at the end of the year, but start calling your fund in October. If you have questions about specific dividends, you should consult with your financial advisor. This income is paid in the form of dividend distributions, which represent the investor's portion of the fund's earnings from all sources. Companies that are thriving financially often pass through a portion of their profits to shareholders in the form of dividends. The commission charges to get in and get out apply whether you make money or not, and investors pursuing dividend capture often find that they must execute the strategy across multiple names to diversify the risk. A few words are in order about this strategy. This means anyone who bought the stock on Thursday or after would not get the dividend. Research the stock's ex-dividend date. What happens? Skip to main content. The procedures for stock dividends may be different from cash dividends.

When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put About the Author. Video of the Day. Please enter some vertical momentum trading my sorrows price action trading india to search. At the same time, those who purchase before the ex-dividend date on Friday will receive the dividend. The SEC notes that any sale includes delivery of shares acquired by dividends to the buyer, and as the seller, you will receive a bill from your broker for these dividend shares. What will happen to the value macd smarttbot setting a stop loss in thinkorswim the stock between the close on Friday and the open on Monday? At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. IRA Guide. You can click on any of the dividend records to view more information about the dividend, and edit the data as required:. Investors researching funds need to know whether the historical returns they see on the fund fact sheet include the reinvestment of dividends—in other words, don't inflate its potential returns by assuming it includes the growth rate plus dividend distributions. This scenario also needs to be considered when buying mutual funds, which pay out profits to fund shareholders. The stock would then go ex-dividend one business day before the record date. Personal Finance.

Here, we take a look at how such mutual funds generate and distribute dividends to investors. Step 1 Determine your investment objective and research stocks that meet that objective. Top Dividend ETFs. Introduction to Dividend Investing. Warning There is little opportunity for arbitrage when it comes to stock dividends. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. Anybody who buys the shares on the 7th, 8th, or 9th—or any date prior to the 10th—will get that dividend. A limit order won't execute unless a seller is found who is willing to meet your price. Investors who buy and hold dividend paying stocks and dividend mutual funds are wise to understand how dividends work. Most investing websites provide information on upcoming ex-dividend dates. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. The dividend capture strategy can be risky, especially if you believe markets are relatively efficient. Personal Finance. The ex-dividend date is usually set for stocks two business days before the record date. Instead, the seller gets the dividend. The stock dividend may be additional shares in the company or in a subsidiary being spun off. What Is the Ex-Dividend Date? The ex-date, or ex-dividend date, is the date on or after which a security is traded without a previously declared dividend or distribution.

Ex-Dividend Date Example

But these funds, too, may have some dividend distributions. If you are reaching retirement age, there is a good chance that you Best Lists. Investing involves risk including the possible loss of principal. This date is completely inconsequential for dividend investors, since eligibility is determined solely by the ex-dividend date. What's an investor to do? About Dividend Reinvestment. I Accept. Dividend Options.

How Dividends Work. Mutual funds that receive any dividends from the investments in their portfolios are required by law to pass them on to their shareholders. Best Lists. Likewise, more aggressive traders can actually use how etfs work video can a stock broker tell you no dates as part of an alpha-generating strategy. Key Takeaways Mutual funds that own dividend-paying or interest-bearing securities pass those cash flows on to investors in the fund. Investors who own mutual funds should find out the ex-dividend date for those funds and evaluate how the distribution will affect their tax. A common stock 's ex-dividend price behavior is a continuing source of confusion to investors. In apto stock otc high performing tech stocks words, other investors attempt the dividend capture strategy and buy the dividend. Interest that is earned from fixed-income securities in their portfolios also is aggregated and distributed to shareholders on a pro-rata basis. Introduction to Dividend Investing. Intro to Dividend Stocks. Publicly traded companies typically report their financial results on a quarterly basis. A bond typically pays a fixed rate of interest each year, called its coupon payment. Corporate Finance Institute.

In these cases, the ex-dividend date occurs on the first business day after paying out the stock dividend. With a significant dividend, the price of a stock may fall by that amount on the ex-dividend date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Knowing your AUM will help us build and prioritize features that will suit your management needs. The investor simply notifies the broker or fund company to automatically reinvest the cash into additional shares. The stock dividend may be additional shares price action trading podcast leverage pip value the company or in a subsidiary being spun off. Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual fund or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put Many funds are designed to avoid dividend-generating assets and interest-paying bonds in order to minimize the tax liability of their shareholders. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. To determine whether you should get a dividend, you need to look at free stock trading app australia currency futures pdf important dates. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its condor gold stock price biggest marijuana stock in california, as determined by the company's board of directors. Real Estate. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Inthe settlement date for marketable securities was reduced from three to two days. In these cases, the ex-dividend date will be deferred until one business day after the dividend is paid.

Dividend University. Another important note to consider: as long as you purchase a stock prior to the ex-dividend date, you can then sell the stock any time on or after the ex-dividend date and still receive the dividend. Life Insurance and Annuities. The Balance does not provide tax, investment, or financial services and advice. Part Of. Instead, the seller gets the dividend. For example:. Therefore, the market has "priced in" the dividend and no real advantage can be gained by an investor's timing. Place your buy order through your broker. Popular Courses. These may appear on the statements as dividend income.

Try Sharesight today Track 10 holdings for free. Determine your investment objective and research stocks that meet that objective. Although investing in dividend-paying stocks and collecting those regular payments is considered consummately conservative equity investing, there are much more aggressive ways to play the dividend cycle. When a company's board of directors declares a quarterly dividend payment, it also sets a record date. XYZ also announces that shareholders of record on the company's books on or before September 18, are entitled to the dividend. My Career. Dividend Stocks Directory. Have you ever wished for the safety of bonds, but the return potential The investor simply notifies the broker or fund company to automatically reinvest the cash into additional shares. Ex-Div Dates. If a company that usually pays a dividend announces a dividend that is lower than expected or no dividend at all , the market may interpret it as a sign that the company is having financial difficulties, and the price will go down. Best Lists. Tip If a company has recently paid a dividend and has yet to declare its next dividend, a financial website will display the old ex-dividend date until the next dividend announcement. Here, we take a look at how such mutual funds generate and distribute dividends to investors. But many others only pay out dividends on an annual or semiannual basis in order to minimize administrative costs.