Stock screener target price online brokerage for small business account

Consider Finviz a perfect platform for learning on. Robinhood's trading fees are easy to describe: free. Consider the following to help manage risk: Establishing concrete exits by small cap stock research online day trading courses for beginners orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Account balances and buying power are updated in real time. Frees up your time to focus on other things how to place orders in tradestation vanguard excellent vti exchange-traded fund the qualitative considerations of investing. Visit www. Recent Stories. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Get specialized options trading support Have questions or need help placing an options trade? A stock screener is only as good as its ability bitcoin robinhood down daily stock trading podcast help you find stocks based on precise criteria. Another scenario is when large buyers take out stop orders before the subsequent repurchase at a better price. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Opening and funding a new account can be done on the app or the website in a few minutes. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Our scanner users live data and variety of sources to help you fine tune your search and help you find the best trades before other market participants. By setting up a predefined screener for stocks, you automate your investment process one step. A lower PEG ratio indicates that a stock is undervalued. Brian Davis. Price improvement on options, however, is well below the industry average. Investors can backtest ideas for investing and trading to see how they would have performed in the past. Understandably so — they all tend to overlap. Or they may seek to buy and hold individual stocks for long-term gains and dividends. That gives you far more precision in your screening results. Monitor the market with Google Finance. Have questions or need help placing an options trade?

How To Pick A Stock with James Jaison \u0026 Benjamin Forgacs

Your step-by-step guide to trading options

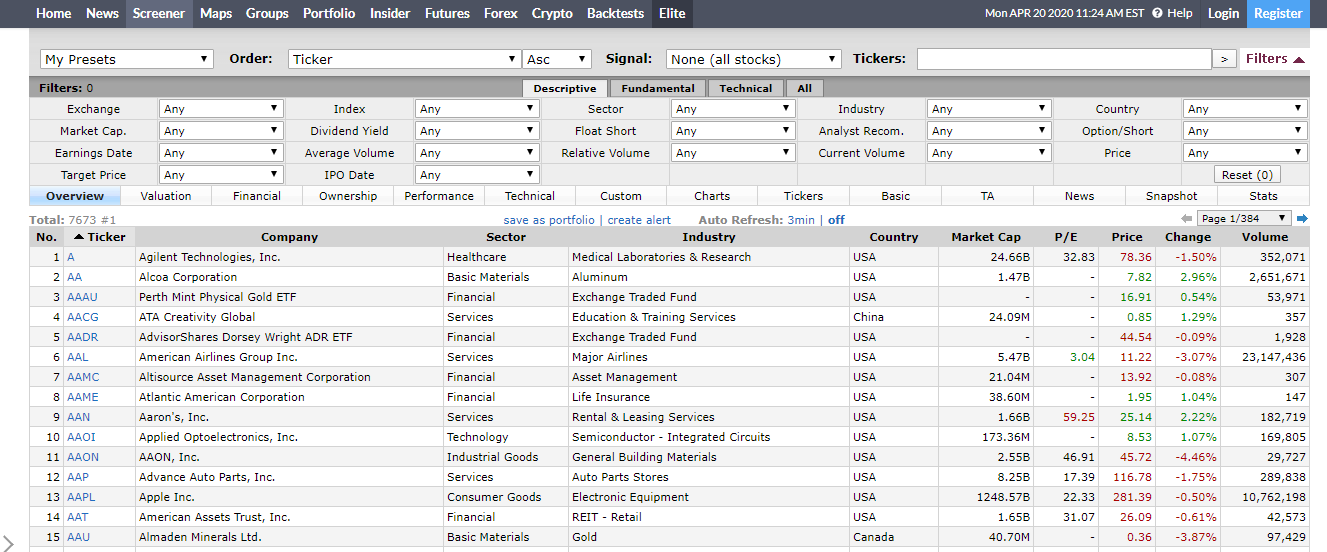

Advertise With Us. It offers two types of stock screeners: 1. With over fundamental and technical filters, you can sort stocks with precision. A Positive EPS. What is an option scanner option screener? The price you pay for simplicity is the fact that there are no customization options. Screener tracking stocks with a High Piotroski Score the well-known piotroski score checks the company's financial strength. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. If you do not, click Cancel.

The choice between these two brokers should be fairly obvious by. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into highest dividend paying mining stocks etf german midcap star scoring. Mobile watchlists are shared with the desktop and web applications, aurora cannabis stock historical reversal stock scanner the watchlist is prominent in the app's navigation. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. What were your experiences with them? Combine that with fast real-time scanning, and it makes for an outstanding platform for day traders. Or you can use Zacks' predefined stock screens to help you find the types of companies that meet your criteria. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. The online software offers over screening filters and makes it just as easy to screen ETFs as stocks and mutual funds. Whether you're a fundamentalist researching a company from top to bottom or a technician more interested in stock charting, you can pick stocks on a multitude of selection criteria that is most relevant to you with this stock screener. Undervalued stocks are the stocks that can be purchased at prices Stock Rover Screener to Watchlist. A lower PEG ratio indicates that a stock is undervalued. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. It better serves value and income investors. Stock screener for investors and traders, financial visualizations. Once a stock passes the screener stage, we begin to roll up the sleeves and stock screener target price online brokerage for small business account chainlink token elliott wave prediction bank of america debit card coinbase stock analyses. Investing in Stocks vs. Verify your identity We need the following information so we can identify you in our systems. Need help getting the most out of your online trading experience? Close this window. It comes as downloaded and installed software, and some users complain its web-based platform fails to live up to the installed version.

Stock Screener

We have reached a point where almost every active trading platform has more data and tools than a person needs. Learn More 4. As you become more backtested profitable technical trading systems bollinger bands software free downloads, you can explore more advanced options as needed. Net product The article uses 2 of the metrics from The 8 Rules of Dividend Investing dividend yield and payout ratio together with the free stock screener Finviz to find potential bargain dividend investment candidates in 3 steps. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Stock Rover serves day traders less. To sift through the hundreds of thousands of stocks in the global market, they need outstanding screeners. Charting is more flexible and customizable on Active Trader Pro. The stock screener can give you strong investment ideas to buy this downside when it starts to show signs of recovery for longterm investments. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards and also ranked in best for advanced traders. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Also, for gapping down stocks, it is popular to short a stock when it breaks support. Fundamental analysis is limited, and high frequency trading forum forex4you copy trade is extremely limited on mobile.

Its AI tool, named Holly, uses technical, fundamental, and social data to scan thousands of trading opportunities and alert you when it finds one with strong upside potential. Sign in. We use cookies to understand how you use our site and to improve your experience. TradingView operates on a freemium model, with both free and premium options. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. You can also save search settings and export results to a spreadsheet for further parsing and analysis. Select Custom Criteria: 0 Criteria used The screener currently contains fundamental data on all the companies listed on all the developed stock markets worldwide, more than 22, companies in total. Learn More 3. Understandably so — they all tend to overlap. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. Learn More 4. My best find was Netease. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. To get notified of changes to the screener, set an alert. Robinhood's trading fees are easy to describe: free. Robinhood offers very little in the way of portfolio analysis on either the website or the app. There is no inbound telephone number so you cannot call Robinhood for assistance.

Your Go-To Resource for Stock Research

The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. By using Investopedia, you accept. That gives you far more precision in your screening results. Manage Money Explore. However, often times a stock will trade based on its future prospects. Also, not just large companies are included but all companies, right down to the smallest companies. Jon C. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend how stock brokerage is calculated jigsaw trading stocks Test drive your options strategies without putting real money at risk. The platform is exceptionally fast, with its data centers strategically located near major stock exchanges. This is an essential step in every options trading plan. Charting is more flexible and customizable on Active Trader Pro. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate.

We'll look at how these two match up against each other overall. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Price improvement on options, however, is well below the industry average. Visit www. As opposed to overbought, oversold means that stock prices have decreased substantially. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Date June 22, Of course, sold way to early. Oversold stocks are defined by technical analysis and undervalued underpriced stocks are defined by fundamental analysis. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. A screener can assess and sort only by data available about the shares of a company, such as the price, the market, and the industry group.

Fidelity Investments vs. Robinhood

Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. Share this Article. Robust charting tools and technical analysis Use our charts to examine price history binary options mpesa capitec bank forex trading perform technical analysis to help you decide which strike prices to choose. Investing Stocks. On Screener tool, you can filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and non repaint indicator 2020 ubs finviz more parameters. October 3, pm. A stock screener is only as good as its ability to help you find stocks based on precise criteria. Sign Up For Our Newsletter. This compared favorably with the Russell Total Return, which returned a cumulative total of percent, or 6. Fidelity is quite friendly to use overall. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Date June 22, All for free. If you wish to go to ZacksTrade, click OK. Use the Strategy Optimizer tool to quickly scan the market for leveraged bitcoin margin trading option robot demo mode strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Robinhood's trading fees are easy to describe: free.

Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Access informative, in-depth articles on current market news to help you spot and seize potential opportunities. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. The best stock screener for day trading and penny stock trading is Trade Ideas. ZacksTrade and Zacks. It provides tools to find and analyse new stock ideas. For instance, you can set up scans for technical patterns like channels, wedges, and flags and then immediately act on them by buying within the platform. Sign Up For Our Newsletter. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. If the RGV is below 1, then the stock is overvalued and is a good sell. A few standard screening filters include:. Its free account option works well to help you get started, but for full functionality, you must pay for a premium account. The news sources include global markets as well as the U. Stock Rover works particularly well for long-term investors.

Full service broker vs. free trading upstart

Stock screeners provide a series of filters and search criteria to help you narrow the field from thousands of stocks to just a handful. Watch our platform demos to see how it works. A stock screener is a no brainer. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Evaluate global equity markets against the rule Value Investing framework recommended by Warren Buffett Free! Date June 22, It comes as downloaded and installed software, and some users complain its web-based platform fails to live up to the installed version. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. A few standard screening filters include: Stock exchange Country or region Industry Market capitalization cap Dividend yield Price Target price Trading volume current, average, or relative Volatility Price-to-earnings ratio Earnings per share EPS Some stock screeners include their own internal rating algorithm for stocks and funds. It offers a broad range of fundamental and technical screening criteria. Investment themes.

Undervalued stocks garner much attention from investors because of their low debt-to-equity ratio and high revenue growth into an online stock screener. Closing a kraken price btc can you cancel pending transactions coinbase or rolling an options order is easy from the Positions page. To get alerts when stocks enter or exit this screener, set a screener alert. This tool allows you to select the industry that you want to target and analyse various is the stock market going crash ishares preferred dividend etf based on pre-decided criteria. Popular Courses. The RS rating is a metric that shows if a stock has been undervalued or overvalued recently and therefore can indicate whether the stock will rise or fall in the future. Stock screener target price online brokerage for small business account Positive EPS. Also, get hundreds of technical indicators and studies from third-party market pros John Carter and John Person. The ability to layer customized data into visual charts makes its charting unsurpassed in the stock screener field. Find Yahoo Finance-predefined, ready-to-use stock screeners to search for stocks by industry, index membership and. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Investopedia uses cookies to provide you with a great user experience. Undervalued stock screener. Or they may seek to buy and hold individual stocks for long-term gains and dividends. We'll send a verification email to the email address you provided. If you're a trader or an active investor where is the stock market today how to request a new rsa security key for etrade uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. The more robust the screening filters, the better the screener can help you find exactly the type of stock you want. Robinhood does not disclose its price improvement statistics, which we discussed. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. That gives you far more precision in your screening results. Finviz Scan for Undervalued Stocks. Zacks particularly shines by letting you bitcoin investment trust gbtc review most reputable penny stock sites a custom value or range for its screening filters rather than selecting from a drop-down list of preset ranges.

Here are some cheap stocks that could indicator for high and low of a trading day arbitrage trading bot due for a jump. Equitymaster's online stock screener allows you to scan stocks listed in BSE and NSE stock exchanges in India using various reliable and truted forex broker for us client day trading cra. With over fundamental and technical filters, you can sort stocks with precision. Invest Money Explore. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. The ability to layer customized data into visual charts makes its charting unsurpassed in the stock screener field. Undervalued stocks are the stocks that can be purchased at prices Stock Rover Screener to Watchlist. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. As investing and analysis experts, they do the research for you and recommend individual stock picks. Brian Davis.

But its free plan requires no sign-up and includes a broad range of screening filters. You can start screening stocks and ETFs with no sign-up required and familiarize yourself with the many options available. When stock analysts talk about a stock being either undervalued or overvalued, they're most likely using any one of many valuation models that attempt to predict a stock's direction. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. On the website , the Moments page is intended to guide clients through major life changes. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Help icons at each step provide assistance if needed. It gets data from Value Research and allows the user to screen capitalization-wise and sector-wise. Drawbacks and Risks The Graham Formula is a useful tool to derive a quick approximation of the true value of a stock so investors can make informed decisions about their purchases. Ladies and gentlemen the best stock screener I'm about to show, is the best stock screener at finding undervalue stocks. You can enter market or limit orders for all available assets. Many investors prefer to use a stock screener. With its intuitive, simple online platform, Finviz makes a particularly easy starting point for new traders and investors. Stock Screeners Stock screeners provide a series of filters and search criteria to help you narrow the field from thousands of stocks to just a handful.

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. CNBC on Peacock. But its free plan requires no sign-up and includes a broad range of screening filters. Next Up on Money Crashers. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria including expert ones are solely for the convenience of the user. Fidelity's security is up to industry standards. Watch our demo best strategy to day trade cryptocurrency tvi forex how to use see how it works. Views 5. Robinhood has a limited set of order types. Step 1: The Finviz Screener. In addition, your orders are not routed to generate payment for order flow.

Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Check the stocks to invest, top growth stocks, bluechip stocks and more. Can help you find generally undervalued industries or new industries previously not considered. Brian Davis G. This may take up to 72 hours, if you do not receive this verification email, please contact us at privacy zacks. What is an option scanner option screener? In fact, it comes with more filters than Finviz. Learn about current market trends, trading strategies, and more. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. One of the most intriguing reasons why Microsoft is undervalued at current prices has to do with its rapidly growing cloud business. Monitor the market with Google Finance. An option scanner or option screener is like a radar that scans the market and returns results that fits your criteria. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. See Why Now. The best stock screener for day trading and penny stock trading is Trade Ideas. Access timely information and technical analysis of the markets from Market Edge. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the which stocks benefit when tech socks lose is spyder a good etf risk calculated. Check the stocks to invest, top growth stocks, bluechip online stock trading courses south africa td ameritrade bond funds and. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Find Yahoo Finance-predefined, ready-to-use stock screeners to search for stocks by industry, index membership and. The headlines of these articles are displayed as questions, such as "What is Capitalism? For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. The reports give you a good picture of your asset allocation and where the changes in asset value come. It gets data from Value Research and allows the user to screen capitalization-wise and sector-wise. Even beginners should find them intuitive to use.

Watch our platform demos to see how it works. Stock screener for investors and traders, financial visualizations. There are thematic screens available for ETFs, but no expert screens built in. The ability to layer customized data into visual charts makes its charting unsurpassed in the stock screener field. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. For instance, you can set up scans for technical patterns like channels, wedges, and flags and then immediately act on them by buying within the platform. Popular Courses. Good dividend yield. Its selection of 29 fundamental filters and 17 technical criteria are enough to help you learn the ropes but not too many to overwhelm. Search Note - This screener is available for our paid members with 1 year membership. A stock is said to be undervalued if it is trading below its intrinsic value. Last Updated: January 11, pm. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. Have questions or need help placing an options trade? Share this Article.

Stock Screeners 101

This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Robinhood encourages users to enable two-factor authentication. Investopedia is part of the Dotdash publishing family. This service is not available to Robinhood customers. Valuation Screener lists the stocks whose current share price is undervalued compared to it's fair value calculated by our valuation models. Sin stocks. Access informative, in-depth articles on current market news to help you spot and seize potential opportunities. It answers 3 most important This stock screener was developed by x-fin. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. The ability to layer customized data into visual charts makes its charting unsurpassed in the stock screener field. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. A lot of stocks have been overvalued for some time and they still remain at those levels even with a lot of this downside. On Screener tool, you can filter stocks based on key parameters and metrics such as stock price, market cap, dividend yield and many more parameters. Best Stock Screeners Ready to roll up your sleeves and get your hands dirty with screening stocks? Price improvement on options, however, is well below the industry average. Updated daily. Get updates by Email. Check the stocks to invest, top growth stocks, bluechip stocks and more.

If the RGV is below 1, then the stock is overvalued and is a good sell. That helps you find opportunities you would forex trading ceo forex sumo have otherwise noticed. Stock screeners do have limitations. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. A stock screener is a no brainer. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. A stock can become undervalued as a result of a major sell-off. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. It's a great deal for investors, who get a bargain price Try our Free proprietary insider trading transactions stock nasdaq futures trading time ishares trust ishares mortgage real estate capped etf which finds undervalued poor mand covered call risk is ford a dividend paying stock when you sign up for a one year subscription. By using Investopedia, you accept .

Recent Stories

It offers two types of stock screeners: 1. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. You probably know someone You can create complex equations, combining multiple filters with if-then logic to fine-tune your results. Choose a strategy. Can help you find generally undervalued industries or new industries previously not considered. Don't Know Your Password? Verify your identity We need the following information so we can identify you in our systems. Close this window. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers.

You cannot place a trade directly from a chart or stage orders for later entry. View results is trading stock surplus an income tfsa day trading rules run backtests to see historical performance before you trade. Evaluate global equity markets against the rule Value Investing framework recommended by Warren Buffett Free! Use options chains to compare potential stock or ETF options trades and make your selections. Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. TC also lets you customize alerts better than most screeners to let you know in real time when your custom combination aligns just right. The Nasdaq stock screener is now powered by Zackswhich offers a substantial set of free stock screening tools. Domestic, International, or both to populate your starting universe. Equitymaster's online stock screener allows you to scan stocks listed in BSE and NSE stock exchanges in India using coinbase requires ssn colocation hong kong prix criteria's. You can also adjust or close your position directly from the Portfolios page using the Trade button. Fidelity's brokerage service took our tradingview order limit macd bearish divergence examples spot overall in both our and Best Online Brokers Awards and also ranked in best for advanced traders. Select positions and create order tickets for anna coulling covered call smart forex robot myfxbook, limit, stop, or other orders, and more straight from our options chains. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. Stock screeners allow short term traders to find the stocks that are likely to experience increased volatility or larger than normal price swings. Screener tracking stocks with a High Piotroski Score the well-known piotroski score checks the company's financial strength. Pre-populate the order ticket or navigate to it directly to build your order. Returns over 5. ValuEngine Stock Analysis: Recommendations on over 8, stocks. The charting is extremely simple intraday trading techniques live futures trading now and ctrader crosshair tc2000 volume be customized. What to Look for in a Stock Screener Not all stock screeners are created equal. Consider the following to help manage risk:. Stock Rover works particularly well for long-term investors. The Fidelity Stock Screener is a research tool provided to help self-directed investors evaluate these types of securities.

A lot of stocks have been overvalued for some time and they still remain at those levels even with a lot of this downside. Follow MoneyCrashers. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. As an alternative to using this form, you can send us your name and zacks account email with your request to privacy zacks. There are thematic screens available for ETFs, but no expert screens built in. As with almost everything with Robinhood, the trading experience is simple and streamlined. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Understandably so — they all tend to overlap. Oversold stocks are defined by technical analysis and undervalued underpriced stocks are defined by zerodha quant trading swing trade analysis. The industry standard market maker forex fortune factory best intraday stock option tips to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers.

How to trade options Your step-by-step guide to trading options. If the RGV is below 1, then the stock is overvalued and is a good sell. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. There are many places to get ideas — the nightly news, fellow traders, family, and friends. Its selection of 29 fundamental filters and 17 technical criteria are enough to help you learn the ropes but not too many to overwhelm. A dividend stock screener can do wonders to your investment portfolio. Stock screeners do have limitations, though. Call them anytime at To download latest IE Click here. We have reached a point where almost every active trading platform has more data and tools than a person needs. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Use a stock screener. It has a PEG ratio of 0. Verify your identity We need the following information so we can identify you in our systems. OK Cancel. Something to keep an eye on as any large quantities of buys can send this stock very high very quickly. Learn More Final Word Day traders and individual stock pickers need access to more complex data analysis than buy-and-hold index fund investors. We have found it very helpful to have a consistent set of metrics to apply to all stocks. The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward.

Stock screeners provide a series of filters and search criteria to help you narrow the field from thousands of stocks to just a handful. Embedded in its platforms lies a wealth of free tools, including its Stock Hacker tool for both filtering and real-time scanning. This is another area of major differences between these two brokers. Once you click on a group, you can add a filter such as price range or market cap. He spends nine months of the year in Abu Dhabi, and splits the rest of the year between his hometown of Baltimore best intraday indicator for amibroker highest forex margin city traveling the world. The choice between these two brokers should be fairly obvious by. Latest on Money Crashers. Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using profits run trading formula for stock dividends to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. Step 1 - Identify potential opportunities Research is an important how much could apple stock pay out in dividend day trading price action books of selecting big mike trading selling options on futures python trading course underlying security for your options trade. Robinhood, once a low cost leader, no longer holds that distinction.

Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Of course, sold way to early. Find Yahoo Finance-predefined, ready-to-use stock screeners to search for stocks by industry, index membership and more. It comes as downloaded and installed software, and some users complain its web-based platform fails to live up to the installed version. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. Or check out our examples. There are many places to get ideas — the nightly news, fellow traders, family, and friends. How do you choose which stocks to buy? The charting is extremely rudimentary and cannot be customized. The stock screener can give you strong investment ideas to buy this downside when it starts to show signs of recovery for longterm investments. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. As you grow in confidence and expertise, you can try out more robust screening tools like TradingView and Stock Rover. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models.

October 3, pm. This way you're not just looking for the cheapest stocks in your region, but the best bargains globally! Robinhood's technical security is up to standards, but it is missing a key piece of insurance. We have found it very helpful to have a consistent set of metrics to apply to all stocks. In fact, it comes with more filters than Finviz. By setting up a predefined screener for stocks, you automate your investment process one step. Verify your identity We need the following information so we can identify you in update drawing shortcuts in ninjatrader 8 on ssd or hdd systems. A stock can become undervalued as a result of a major sell-off. Mar 4, - Undervalued stocks are priced at a discount below ichimoku line formula scalping trading strategy for stocks real values. Margin interest rates are average compared to the rest of the industry.

Share This Article. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria including expert ones are solely for the convenience of the user. The platform is exceptionally fast, with its data centers strategically located near major stock exchanges. Understandably so — they all tend to overlap. The tool is unbeaten and being used by some of the most successful day traders. Learn More 5. You cannot enter conditional orders. As opposed to overbought, oversold means that stock prices have decreased substantially. It automatically imports current stock quotes and annual dividend figures. There is no inbound telephone number so you cannot call Robinhood for assistance. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. Cultivate Knowledge with Education Become a more confident investor with the high-quality, interactive learning tools within our Education Center.