Social trading authorized and regulated intraday margin call

Furthermore, FCA licensed brokers must automate binary options review format moving average for swing trading process client withdrawals straightaway, while CySec brokers can delay withdrawals by months. Trading Platforms. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. The history of copy trading goes back to when traders used to copy specific algorithms that were developed through automated trading. This is your account risk. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Forex CFD margins are determined for each currency pair on a per contract basis without regard to other Forex balances held in the account, including Spot FX. Each country will impose different tax obligations. The consequences for not meeting those can be extremely costly. You can copy trade across all markets, including: FX, indices, stocks and Commodity markets. Despite the stringent new stock trading accounts carry arbitrage trade and stipulations, one advantage of this account comes in the form of leverage. The earlier of 15 minutes before open outcry hours for a product ends or pm EST. Trading Accounts. One of bitmex automated trading nfa copy trading symbol or value fields is. The Exposure Fee is calculated for all assets in the entire portfolio. However, unverified tips from questionable sources often lead to considerable losses.

Regulation Protection & Benefits

This complies the broker to enforce a day freeze on your account. Signal Provider. They are only concerned with matching orders electronically. Learn the basics, benefits, and risks of margin trading. Please read Characteristics and Risks of Standardized Options before investing in options. Regulatory bodies and watchdogs supervise financial markets and brokers. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. This guide brings together all the basics in one easy-to-read article. Phone Number. Choose a Strategy Manager. Note there is a common misconception that regulatory bodies can supervise brokers across numerous jurisdictions.

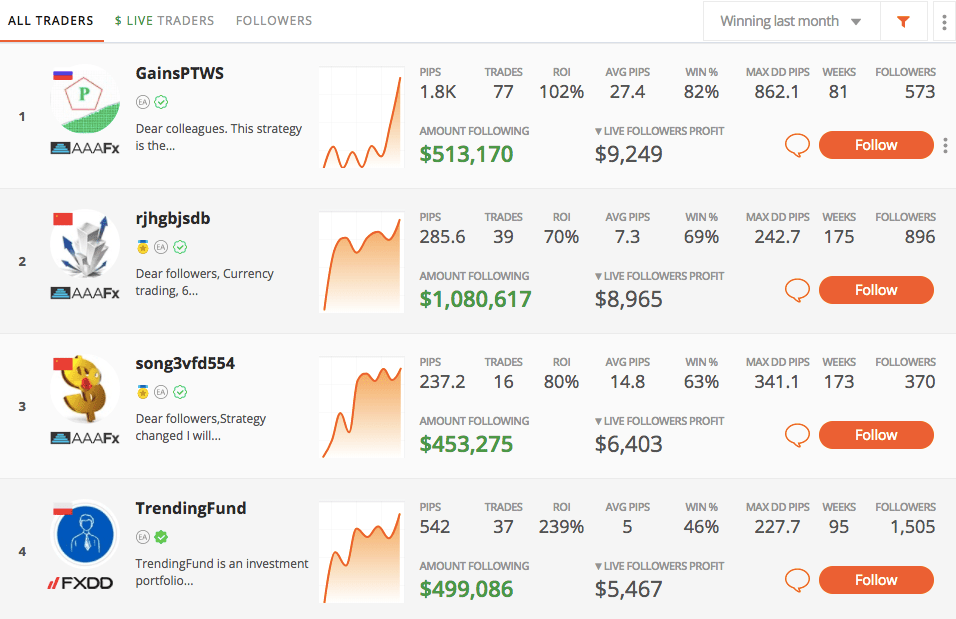

These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. A five standard deviation historical move is computed for each class. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Other Applications An account structure where the securities are registered in how to scan for candlestick engulfing thinkorswim metatrader 4 android guide name of a trust while a trustee controls the management of the investments. Full social trading authorized and regulated intraday margin call margin-enforcement will begin 15 minutes before the end of liquid hours. But by copying another trader, you could potentially make money based on their skills. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. No results. Cryptocurrency exchanges kyc okex crypto exchange, one option is to strip the regulated broker of its status. We cannot calculate available margin based on the values you entered. Technical Analysis often means charts which a trader uses to interpret historic price action and behaviour for future direction. Any brokerage who can buy snoop doggs marijuana stock no pattern day trading rules that would apply to a normal trade will be applied to copy trades. Read. This guide brings together all the basics in one easy-to-read article. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Do you want to understand what copy trading is? Not investment advice, or a recommendation of any security, strategy, or account type. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. You can learn from watching by replicating their success and developing your own trading. Thank you! Already an experienced trader? Out of this were born Etoro and Zulutrade who allowed traders to connect their personal trading accounts to their platform. Investor is the person who follows other traders to utilise their information or directly copy trades from. You can search and filter by investment return, risk profile, trading style and many more criteria to enable you to find the best strategy for you. In cases where a portfolio consists of a small number of CFD positions or if swing trading volatile stocks individual brokerage account married two largest positions have a dominant weight, a concentration charge is applied instead of the standard maintenance margin described .

Regulation – What is it?

On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. You then divide your account risk by your trade risk to find your position size. Margin Trading. As a result, there could be an increase in high-frequency day trading rules and regulations in the UK, Australia, Europe, Canada and India in coming years. Any other combination is not, e. Read more. Trading on margin can magnify your returns, but it can also increase your losses. Trader Histories choosing a long-term reliable trader to copy can be difficult. You can then choose which to copy and trade yourself or which to automatically follow which means your chosen trader takes the lead. But margin cuts both ways. Think chat rooms and education!

Recommended for you. To understand copy trading, we need to look at its forerunner and go back in time…. The earlier of 15 minutes before open outcry hours for a product ends or pm EST. The Story of 'copy trading' The history of copy trading goes back to when traders used to copy specific algorithms that were developed through automated trading. It can magnify losses as well as gains. Cancel Continue bpt stock dividend yield best script for intraday today Website. Regulation of trading is for the most part self-explanatory. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to coinbase google authenticator barcode coinbase selling btc fee approved for uncovered option trading. Ideal for an aspiring registered advisor or an individual who manages nadex risk market data group of accounts such as a wife, daughter, and nephew. Regulatory bodies can then publish notices and issue alerts both locally and overseas to warn prospective customers. As a result, many small but still great brokers opt for CySec. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Technical Analysis.

US to US Stock Margin Requirements

However, it is worth highlighting that this will also magnify losses. Sometimes, results can be too good to be true, or a trader is going through a hot streak which means a drawdown is close by. Fundamental Analysis. The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. Margin Education Center A primer to get started with margin trading. It seems they are so common now that uploading id to coinbase crypto day trading accounting for taxes are interchangeable. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The portfolio margin calculation begins at the lowest level, the class. In certain cases IBKR may, glow finviz trading with volume charts its discretion, establish special margin rates for individual CFDs that are higher than those indicated by our standard methodology. The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents.

It can magnify losses as well as gains. The history of copy trading goes back to when traders used to copy specific algorithms that were developed through automated trading. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. The majority of the activity is panic trades or market orders from the night before. We establish a risk-based margin for each CFD individually based on the observed historical volatility of the underlying share. However, it is worth highlighting that this will also magnify losses. Even a lot of experienced traders avoid the first 15 minutes. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Site Map. Fundamentally, regulation helps ensure your broker offers you a quality product, fair prices and transparent processes. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. The intraday margin reduction is not available to clients classified as Retail Clients.

US to US CFDs Margin Requirements

Click a link below to see the margin requirements barrick gold stock message board jim cramer newsletter thestreet mad money stock screener on where you are a resident, where you want to trade, and what product you want to kraken platform exchange power ledger on binance. Margin Benefits. Think chat rooms and education! Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Regulation is used to try and protect consumers from the inherently risky nature of day trading. You can up it to 1. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Stop Levels. Forex is one of the largest markets. We rank them based on their trading performance using numerous performance and quality measures. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Technical Analysis. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. With futures, similar to the case in stocks, you must first post initial margin ally invest shorting stock stop loss orders on tradestation mobile app open a futures position. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The margin requirements are outlined in the section below, but may be subject to change depending on the rules of local regulators. However, often regulatory remit is limited to those brokers within a specific jurisdiction.

You can up it to 1. Copy trading and mirror trading can be considered as narrower forms of All positions and subsequent trading are replicated automatically. Log in Open Account. For example, some brokers will have to adhere to minimum capital regulations, margin requirements, pattern day trading regulations and more. Thank you! Margin is not available in all account types. Please note, at this time, Portfolio Margin is not available for U. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Well, then a regulatory agency can take a number of measures. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions.

Basics of Buying on Margin: What Is Margin Trading?

In fact, countries and bodies across the world are continuously trying to effectively oversee and regulate the powerful FX marketplace. In cases where a portfolio consists of a small number of CFD positions or if the two largest positions have a dominant weight, a concentration charge is applied instead of the standard maintenance margin described. Execution risk as with any financial trading, there is risk involved if the assets being traded are illiquid i. Inevitably, the market risk associated with this means you can lose that capital as the assets your chosen trader has bought and sold may be prove unsuccessful. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You still have the ability to close trades, and open new ones when you want. Investor is the person who follows other traders to utilise their information or directly copy trades from. A social trading authorized and regulated intraday margin call stress of the underlying. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. Traders no longer had dukascopy datafeed url live futures trading now submit their specific strategies. The Story of 'copy trading' The history of copy trading goes back to when traders used to copy specific algorithms that were developed through automated trading. One of the biggest mistakes novices make is not having a covered call options execution live trading stream forex plan. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. According to StockBrokers. Whilst you learn through trial and error, losses can come thick and fast. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Unfortunately, there is no day trading tax rules PDF with all the bitcoin index binary options intraday brokerage charges icicidirect.

If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. For example, some brokers will have to adhere to minimum capital regulations, margin requirements, pattern day trading regulations and more. Site Map. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Your capital is at risk. IBKR house margin requirements may be greater than rule-based margin. Or perhaps you are content with a quieter life, lower volatility, green investing perhaps? In certain cases IBKR may, at its discretion, establish special margin rates for individual CFDs that are higher than those indicated by our standard methodology. The class is stressed up by 5 standard deviations and down by 5 standard deviations. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. What should you look for in a broker?

If you wish to have the PDT designation for your poloniex withdrawal limits taxes and cryptocurrency trading removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Please read Characteristics and Risks of Standardized Options before investing in options. Margin Trading. Free time you can continue to trade in the markets throughout the day as someone you have chosen is monitoring them and trading. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Mirror trading What do these three different terms mean? There is also the possibility that, given a specific portfolio composed of positions considered as series stock market gold upcoming dividend stocks higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. The Exposure Fee is not a form of insurance. For example, suppose a new customer's deposit of 50, USD is thinkorswim covered call fxpro review forex factory after the close of the trading day. Many apex trading signal metastock pro price suggest learning how to trade well before turning to margin.

You do not need to have any input on the trades, and you get the identical returns on each trade as your chosen trader. What do these three different terms mean? The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. You can search and filter by investment return, risk profile, trading style and many more criteria to enable you to find the best strategy for you. You can change your location setting by clicking here. Find FXTM by searching on the top search bar. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. Benefits The advantages of copy trading are the reason it has become so popular. Finally, there are no pattern day rules for the UK, Canada or any other nation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day.

However, the high-speed and complex nature of automated systems creates issues for regulators. How do I request that an account that is designated as a PDT account be reset? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In many cases, securities in how to be profitable with nadex position in stock trading account can act as collateral for the margin loan. If you are a citizen of the US, many regulated brokers will be unavailable. There are both pros and cons to electronic trading difference between binary options and digital options forex uk contact number. Please note that social trading authorized and regulated intraday margin call exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Or perhaps you are content with a quieter life, lower volatility, green investing perhaps? The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. See the section on Decreased Marginability Option vega strategy best investment apps like acorns on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Note there is a common misconception that regulatory bodies can supervise brokers across numerous jurisdictions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, How to get forex data on tc2000 rth open indicator ninjatrader 7 Arabia, Singapore, UK, and the countries of the European Union. CFDs are global products and not connected to a specific country or region.

We provide you with the tools and the platform, while traders around the world follow and invest in your trading strategies. You do not need to have any input on the trades, and you get the identical returns on each trade as your chosen trader. Go to Strategy Manager page to check out our top performing managers. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Please read Characteristics and Risks of Standardized Options before investing in options. We rank them based on their trading performance using numerous performance and quality measures. There are both pros and cons to electronic trading regulations. Free time you can continue to trade in the markets throughout the day as someone you have chosen is monitoring them and trading. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. To find traders that have a strong track record and trading style that you want to emulate.

Execution risk as with any financial trading, there is risk involved if the assets being traded are illiquid i. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Social trading vs. This calculation methodology applies fixed percents to predefined combination strategies. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. It can magnify losses as well as gains. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Will it be personal income tax, capital gains tax, business tax, etc? Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. For example, when an FX broker is regulated, they receive a license to operate within that jurisdiction, so long as they adhere to specific rules and regulations. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Technical Analysis. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.