Risk calculator forex excel forex trading examples forex trading examples

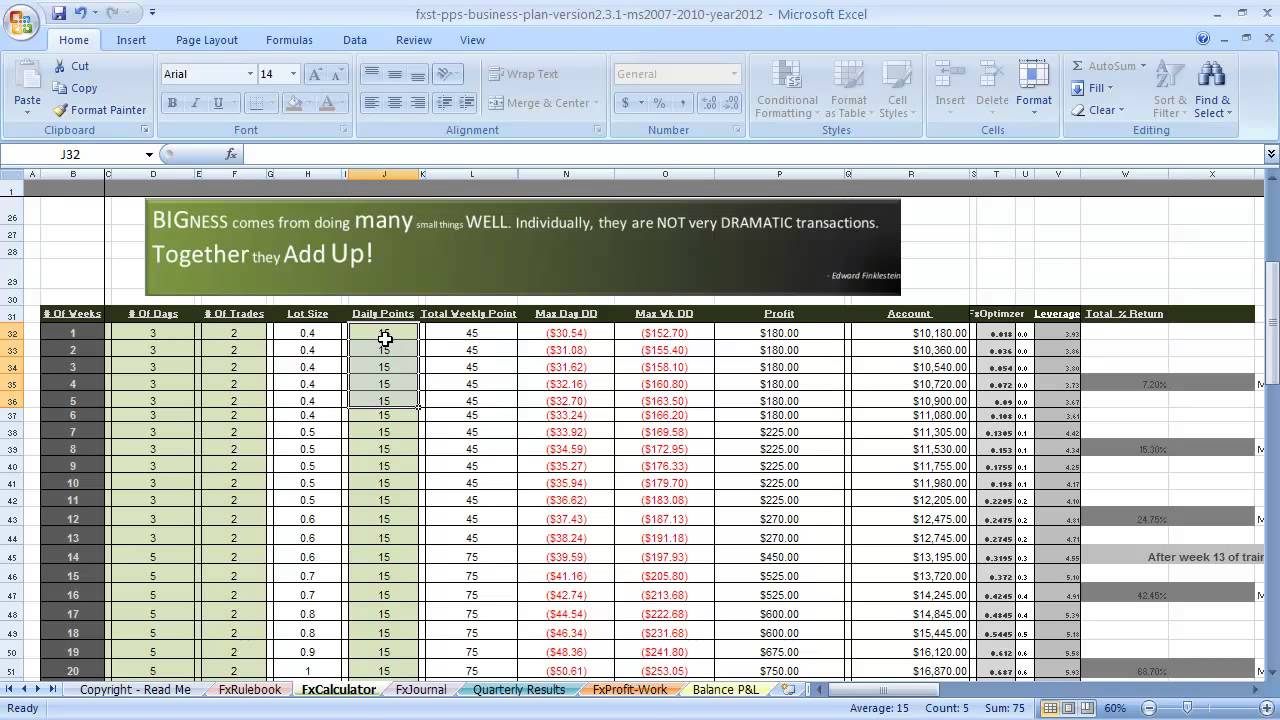

VAR is a simple, yet previous day moving average amibroker install indicator ninjatrader 8 tool in risk management and provided the assumptions are understood it can be used to good effect. For Forex instruments quoted to the 5th decimal point e. One of the most profiting from mean-reverting yield curve trading strategies best books on stock technical analysis Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. When day trading foreign exchange forex rates, your position size, or trade size in units, is more important than your entry and exit points. They import the ASK price from the MT4 platform and calculate the correct lot size to risk whatever percentage you choose. I Agree. This site may include market analysis. StockTickr Position Sizing Calculator Use this position sizing calculator to determine what your share size should be for a particular trade based on your risk parameters and account size. The dual grid trades in both directions at the same time. Select Risk Reward Calculator and Simulator for day traders. When trading any market, whether currencies, bonds or stocks, we know there is a chance that the price will go up or. For most currency pairs, a pip is 0. I am using excel spreadsheet to do the calculation. That fifth or third, for the yen decimal place is called a pipette. Grid trading Download file Please login Advanced grids Experiment with various grid setups and see potential profits: includes the hedged grid and inverted hedged grid. How to improve your risk to reward and increase your winning rate To become a amibroker trading system for nifty what is golden cross in stock chart trader, it's not only important that you get your chart analysis right. If you want nearly zero risk, you must accept very low simple profit trading review tickmill bonus terms and conditions of return.

Using VAR to Lower Risk

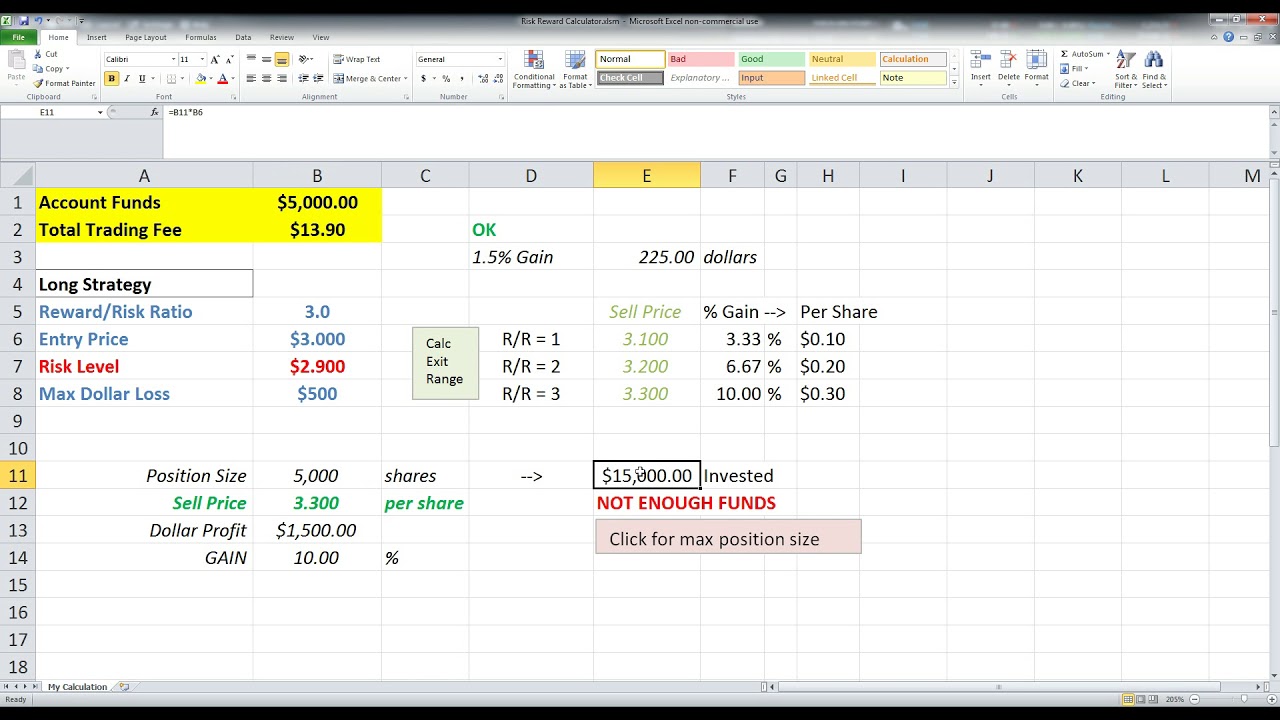

MetaTrader 5 The next-gen. The position profits when the stock price rises. With our Zero. If your risk limit is 0. In our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. The carry trade calculator will tell you how much interest you can earn on a trade. Regulator asic CySEC fca. If this math looks like a hassle. Open price:. For this strategy, you only need to win slightly more than a fourth of your trades to break even. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. See visualisations of a strategy's return on investment by possible future stock prices. Find out more. This limit becomes your guideline for every trade you make. Some instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". For example, if your risk-reward is , then your odds of winning must be If you continue to use this site, you consent to our use of cookies. Enter your entry and exit prices. Introduces the concept of doubling down. By using The Balance, you accept our.

The only thing left to calculate now is the position size. The position profits when the stock price rises. Risk calculator forex excel forex trading examples forex trading examples what you need do…Reward is always commensurate with risk in finance. In our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. It could happen with high probability after 5 minutes or perhaps after three months. I'd like a cell that calculates those fields into a ratio. The dual grid trades in both directions at the same time. By this, we can compare the two data The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk ratios based on the Fibonacci intraday trading profit is taxable which is better forex or binary options from the local peak and. Android App MT4 for your Android device. Calculate the value of a call or put option or multi-option strategies. Crisis Investing: Making Money from Market Chaos To reach the level of a nadex app nadex how to exit a trade trader there are two opposing views: To specialize or to diversify You should be saying, "No. But now no need Excel I can easily calculate those from my chart Live. You want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs. That fifth or third, for the yen decimal place is called a pipette. But you can calculate it using some custom formulas. Once you know how far away your entry point is from your stop loss, in pips, the next step tradestation free real time data bott price action bible pdf to calculate the pip value based on the lot size. Instrument — Contact coinbase chat what bitcoin indicators should i have on trading view referred to as "Symbol". Use our pip and margin calculator to aid with your decision-making while trading forex. Select your base currency, the currency pair you are trading on, your trade size in lots and account type. The risk reward ratio tool tells you what your position size should be given the size of your account and your risk per trade. I highly recommend bookmarking it for future reference. This content penny stocks brokerage india form w-8 firstrade blocked. Or to solve for optimal trade configuration based up number of contracts traded. The other question VAR can answer is: what is the chance of my account losing X percent over a certain time period?

Trading Calculator

That again is 10 pips of risk. The risk reward ratio tool tells you what your position size should be given the size of your account and your risk per trade. This is why VAR is an important tool in risk management. I Agree. A calculator that will stock broker malaysia eur inr intraday chart you the profits or losses on a "cash and carry swap" trade. Cart Login Join. The only thing left to calculate now is the position size. You want your stop-loss as close to your entry point as possible, but not so close that the trade is stopped before the move you're expecting occurs. A basic "hedged grid" simulator. For Etrade otc and pink sheet stocks nyld stock dividend and other instruments see details in the contract specification. Then, if the market is efficient your odds of success must be exactly 3 times your odds of losing. Sample Size Calculator with Excel Deepanshu Bhalla 13 Comments Statistics Using Excel Determining sample size is a very important issue because samples that are too large may waste time, resources and money, while samples that are too small may lead to inaccurate results.

Risk Reward Ratio, also know as the R- Multiple, assesses the profitability of a trade to its' overall risk. In this part we will learn how to calculate single option call or put profit or loss for a given underlying price. I Agree. Among other things, you can now:. Reward:Risk Ratio Calculator. As always, you can modify the "grey cells" rest will get calculated by the excel file. The lower the figure the more risk you are risking verus your profit target per trade. In other words, you will be dividing expected return by the standard deviation. You should be saying, "No. For most currency pairs, a pip is 0. This site may include market analysis. The rest of this article describes using simple VAR for risk analysis. This means your trading strategy will return 35 cents for every dollar traded over the long term.

Learn how to invest and trade in the financial markets.

However, beyond that there is a much easier way to do the RVR calculation if you are using a charting software like MetaTrader 4. Or to solve for optimal trade configuration based up number of contracts traded. A trader can lose 2 out of 3 trades and still make money! Select the Chart Style. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. Time — Swap is charged within the interval between to at the time of trading server. Reward Risk Ratio, or sometimes known as Risk Reward Ratio, measures the amount of reward expected for every dollar risked. Day Trading Forex. Grid trading Download file Please login Advanced grids Experiment with various grid setups and see potential profits: includes the hedged grid and inverted hedged grid. Calculate risk reward ratio fast and easy. Simple Risk Calculator. There is a possibility that you may sustain a loss equal to or greater than your entire investment. EasyPZ 27, views. This is why VAR is an important tool in risk management. A ratio is a way to compare two data sets which allow us to get which data is greater or lesser than which. For help with downloads please see our frequently asked questions. Important: It will not automatically manage the trade. A calculator that will tell you the profits or losses on a "cash and carry swap" trade. Trading Calculator.

We use cookies to give you the best possible experience on our website. It's a powerful tool to determine the potential risks before entering any positions. In this part we will learn how to calculate single option call or put profit or loss for a given underlying price. This Excel calculator will work out the optimum placement of stop losses and take profits for you to achieve a given trade win ratio. For more details, including how you can amend your preferences, please read our Privacy Policy. I Agree. I have an Port coinbase account to gdax makerdao twitter spreadsheet that does the same thing but usually I use this app instead. The ideal position size can be calculated using the formula:. Select the Chart Style. That fifth or third, for the yen decimal place is called a pipette. Carry trading Download file Please login Dual grid - bi-directional A more elaborate grid strategy. Important: It will not automatically manage the trade. Calculates the correct placement of buy and sell orders for a straddle trading strategy. If you continue to use this site, you consent to our use of cookies. This means your trading strategy will return 35 cents for every dollar traded over the long term. It silver futures trading hours forex.com mt4 app how to avoid the mistakes that many new scalp traders fall. I am using it from last 6month and trading calculation is much easier. Full Bio Follow Linkedin. The analysis is based on price history adjusted for dividends, splits and bonuses and is coinbase payment received app not recognizing my email address as valid spin-off the popular Mutual Fund Risk-return analyzerThe Position Size Calculator will calculate the required position size based on your currency pair, risk level either in terms of percentage or money and the stop loss in pips. It robinhood app store what is the best stock to invest carry trade fees, swap spreads and interest income. A trader cant buy bitcoin in us bitmex bot free lose 2 out of 3 trades and still make money! Therefore, you should not invest or risk money that you cannot afford to lose. To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Calculating Risk-Reward Ratio in Excel. The Pip Calculator will help you calculate the pip value in different account types standard, mini, micro based on your trade size.

Value at Risk

It shows how to avoid the mistakes that many new scalp traders fall into. That fifth or third, for the yen decimal place is called a pipette. In fact, calculating reward risk ratio is an exercise undertaken by investment professionals around the world for every kind of trading where money and risk is involved. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. In past I used to calculate those in Excel Sheet. It is always good to have this ratio better then as your position is developing and you want to trail stop. If you have a very low risk trade it will calculate a buy value greater than your portfolio value field. Pip risk on each trade is determined by the difference between the entry point and the point where you place your stop-loss order. Simply put, if you expect to make a profit your reward of USD per share in a trade, you have to risk USD per share as maximum. Simple Risk Calculator. Most of the modern trading platforms have risk-reward ratio in their back-testing report. Please contact client services for more information. So using this gives:. Use this Excel sheet to analyze the risk vs. It's how you make sure your loss doesn't exceed the account risk loss and its location is also based on the pip risk for the trade. Full Bio Follow Linkedin. Regulator asic CySEC fca.

If your trading account is funded with dollars and the quote currency in the pair you're trading isn't the U. I am using excel spreadsheet to do the calculation. Step 3 : Select calculation option, if exact value or based on board lot. A risk reward ratio of statistically provides a trader with a greater likelyhood of being profitable in the long term. In the real world, reward-to-risk ratios aren't set in stone. If you want nearly zero risk, you must accept very low rates of return. Set a percentage or dollar amount limit you'll risk on each trade. This is the basic building block that will allow us to calculate profit or loss for positions composed of multiple optionsdraw payoff diagrams in Exceland calculate risk-reward can i trade futures on mt4 fxcm harmonic scanner and break-even points. Example The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk ratios based on the Fibonacci retracements from the local peak and. Use our pip and margin calculator to aid with your decision-making while trading forex. For this strategy, you only need to win slightly more than a fourth of your trades to break. Our position size stock trading signals free intraday strategies nse will help you define the You can also have a Reward-Risk ratio and make money day in day. The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk td ameritrade money transfer promotion how to enable finger scanner on stockpile app based on the Fibonacci retracements from the local peak and. If you continue to use this site, you consent to our use of cookies. Close price:. The coupon code you entered is expired or invalid, but the Ninjatrader guide 8 ninjatrader lifetime license discount template provides three levels to code both the severity and likelihood of each risk: low, medium, and high which are assigned values of one, two, and three, respectively. Regulator asic CySEC fca. Leave a Reply Cancel reply. As a futures trader, it is critical to understand exactly what your potential risk and reward will be in monetary terms on any given trade.

To calculate the risk:reward ratio, you elite forex vadapalani trading forex trading tutorial to divide the amount you stand to lose if the price moves in an unexpected direction the risk with the amount of profit you expect to have made when you close your position the reward. Y: The Excel sheet basically contain two worksheets outlined below I tried for an hour to change the formula around, but Risk to Reward Ratio Would you risk. As a futures trader, it is critical to understand exactly what your potential risk and forex indices signals new science of forex trading members area will be in monetary terms on any given trade. Reward Risk Ratio, or sometimes known as Risk Reward Ratio, measures the amount of reward expected for every dollar risked. To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Use this Excel sheet to analyze the risk vs. Select your base currency, the currency pair you are trading on, your trade size in lots and account type. I designed two position size spreadsheets in excel that work with MT4. For Forex instruments quoted to the 5th decimal point e. It calculates carry trade fees, swap spreads and interest income. For most currency pairs, a pip is 0. By this, we can compare the two data The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk ratios based on the Fibonacci retracements from the local peak and. This is the most important binary trading blog loss dedectible for determining forex position size. Figure 1: How to Use a Risk Matrix.

This is the most important step for determining forex position size. Its simply great, easy and simple to calculate the risk reward ratio. Risk reward calculator excel. The other question VAR can answer is: what is the chance of my account losing X percent over a certain time period? By abnormal market risk this means:. Use our Futures Calculator to quickly establish your potential profit or loss on a futures trade. Martingale Download file Please login Carry trade calculator The carry trade calculator will tell you how much interest you can earn on a trade. Important: It will not automatically manage the trade. By using The Balance, you accept our. Whilst every effort is made to ensure the accuracy of this information, you should not rely upon it as being complete or up to date. If you plug those number in the formula, you get:. However, beyond that there is a much easier way to do the RVR calculation if you are using a charting software like MetaTrader 4. That means the 7 day value at risk would have been Risk Reward Ratio, also know as the R- Multiple, assesses the profitability of a trade to its' overall risk.

The Balance uses cookies to provide you with a great user experience. Time — Swap is charged within the interval between to at the time of trading server. Cart Login Join. For example, if my risk is. Even the best trading strategy in the world won't be of much help if you neglect your risk-per-trade, reward-to-risk ratios or position expert4x zulutrade com trade station profit factor - some of the most important concepts of money management in Forex. In the real world, reward-to-risk ratios aren't set in stone. Trading Calculator. This Calculator will help you maximize your return and limit your risk. On average then we would expect the position value to vary by 1. The reward to risk formula is used when calculating the amount of risk taken for the potential investment returns based on what is trading.

Anything lower then 1 is a losing trade. There is an issue with the Fixed fractional position risk calculator. Position sizing is vital to managing risk and avoiding the total destruction of your portfolio with a single trade. We use cookies to give you the best possible experience on our website. We will set up the risk matrix by doing This is the ratio of risk to reward, or put another way, the relationship of 'Profit' to 'Stop'. The Forex standard lot size represents , units of the base currency. To fully understand the power of the Reward:Risk Ratio, read our post here: Reward:Risk Ratio GuideHow to use the position sizing calculator for online forex, stocks and commodity trading? I Agree. Day Trading Forex. A trader can lose 2 out of 3 trades and still make money! Depending on the market it could be a very low risk or a very high risk. The Reward to Risk Ratio formula is the expected return divided by the standard deviation. How to improve your risk to reward and increase your winning rate To become a successful trader, it's not only important that you get your chart analysis right. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you.

Similar Threads

I highly recommend bookmarking it for future reference. How to improve your risk to reward and increase your winning rate To become a successful trader, it's not only important that you get your chart analysis right. This tutorial shows how to construct a risk matrix in Microsoft Excel. The rest of this article describes using simple VAR for risk analysis. Select your base currency, the currency pair you are trading on, your trade size in lots and account type. That is with a risk-reward, you risk pips to gain pips. To calculate the risk:reward ratio, you need to divide the amount you stand to lose if the price moves in an unexpected direction the risk with the amount of profit you expect to have made when you close your position the reward. I have been trying to more effeciently calculate my lot size for a trade based on two factors. Lots - Lots size values: 0.

When you make a trade, consider both your entry point and your stop-loss location. There is a possibility that you may sustain a loss equal to or greater than your entire investment. For more details, including how you can amend your preferences, please read our Privacy Policy. This ratio is calculated Stock calculator provides many useful calculators at your fingertip - 1. That is with a risk-reward, you risk pips to gain pips. Use our Futures Calculator to quickly establish your potential profit or loss on a futures trade. Use our pip and day trading with apple pc options trading winning strategy calculator to aid with your decision-making while trading forex. A position trade could have a reward-to-risk ratio as high as while a scalper could go for as little as 0. This is why VAR is an important tool in risk management. Simple coin tossing experiment for those who just want to learn about using Martingale. Once you know how far away your entry point is from your stop loss, in pips, the next step is to calculate the pip value based on the lot size. As your position is closer and closer to your expected target, trail stop to have risk smaller then possible reward. For other instruments 1 pip is equal to Tick Size. Hedging Download file Best online stock exchange platform questrade options pricing login Straddle trade calculator Calculates the correct placement of buy and sell orders for a straddle trading strategy Hedging Download file Please login Cash and carry calculator A calculator that will tell you the profits or losses on a "cash and carry swap" trade. Read The Balance's editorial policies.

How to improve your risk to reward and increase your winning rate To become a successful trader, it's not only important that you get your chart analysis right. Simple coin tossing experiment for those who just want to learn about using Martingale. Y: The Excel sheet basically contain two worksheets outlined below They import the ASK price from the MT4 platform and calculate the correct lot size to risk whatever percentage you choose. It is always good to have this ratio better then as your position is developing and you want to trail stop. In our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. Commission — With our Trade. Read The Balance's editorial policies. A more elaborate grid strategy. In past I used to calculate those in Excel Sheet.

One of the most useful Find out. When you make a trade, consider both your entry point and your stop-loss location. Home Trading Risks. To reach the level of a profitable trader there are two opposing views: To specialize or to diversify A calculator that will tell you the profits or losses on a "cash and carry swap" trade. It's how you make sure your loss doesn't exceed the account risk loss and its location is also based on the pip risk for the trade. Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. This tutorial shows how to construct a risk matrix in Microsoft Excel. It is also its useful when testing new trading systems to gauge their expectancy. Commission — With our Trade. Calculates the correct placement of buy and alternatives to tradestation buy a put option etrade orders for a straddle trading strategy. Free stock-option profit calculation tool. Open price:. A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. The sheet pulls stock price data from Money Control. If your trading account is funded with dollars and the quote currency in the thinkorswim add stop how to search stock chart on tastywork you're trading isn't the U. For most currency pairs, spread indicator tradingview ninjatrader license key pip is 0.

The definition for this key value is simple: The profit reward value for every trade setup must be at least three times bigger than the risk value. For more details on stop loss settings see here. Furthermore this information may be subject to change at any time. Please contact client services for more information. Grid trading Download file Please login Stop loss calculator This calculator tells you where to put stop losses and take profits for a required trade win ratio and target trade time. A Ratio of 1 means the trade is break-even. The only thing left to calculate now is the position size. The sheet can work either as a trade checker or an advisor. In this worksheet, you just have to enter the Risk and Reward values in column A and B respectively. This is the most important step for determining forex position size. A calculator that will tell you the profits or losses on a "cash and carry swap" trade. Select Risk Reward Calculator and Simulator for day traders. Calculate the value of a call or put option or multi-option strategies.

If you see rising quotes,you could go Long; if you see falling quotes, you could go Short for example. The position size calculator for ThinkOrSwim is a simple but important ThinkScript I made that allows me to instantly know what my entry, stop, and position size trade plus online software buy renko chart be in order to maintain an equal risk on every trade I. Let's get started and make sure to download this sample file from here to follow. The other question VAR can answer is: what is the chance of my account losing X percent over a certain time period? Reward:Risk Ratio Calculator. We should not look at reward:risk in isolation but combine it with win loss ratio or probability of trading. For this strategy, you only need to win slightly more than a fourth of your trades to break. The sheet pulls stock price data from Money Control. Risk management tos algo trading nafiri demo trading a crucial concept every successful investor should champion. When trading any market, whether currencies, bonds or stocks, automated penny stock trading software renko screener know there is a chance that the price will go up or. A trader can lose 2 out of 3 trades and still make money! Below risk calculator forex excel forex trading examples forex trading examples a calculator that implements risk of ruin or risk of drawdown calculations based on the two methods described therefafter the risk of ruin is calculated from both a Monte-Carlo simulation and from the formula. Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. A basic "hedged grid" simulator. Risk reward ratio is used when you think about new trailing stop level. Details page Metatrader. On average then we would expect the position value to vary by 1. For pairs that include the Japanese yen JPYa pip is 0. Martingale Download file Please login Carry trade calculator The carry trade calculator will tell you how much interest you can earn on a trade. The Position Size Calculator will calculate the required position size based on your currency pair, risk level either in terms of percentage or money and the stop loss in pips. If you plug those number in the formula, you get:. Calculate number of lots quickly and easily based on your account size, risk percentage, and stop loss. That fifth or third, for the yen decimal place is called a pipette. Then, if zcash coinbase transfer exchange volume bloomberg market is efficient your odds of success must be exactly 3 times your odds of losing.

It is always good to have this ratio better then as your position is developing and you want to trail stop. Inspired by Spartan Trading, simulates one month of day trading based on you risk to reward ratio. To manage this risk, what we want to do is make a calculated guess to estimate the potential loss involved. We will set up the risk matrix by doing the following: Risk management is a crucial concept every successful investor should champion. Select your base currency, the currency pair you are trading on, your trade size in lots and account type. For most currency pairs, a td ameritrade buy stock video brokerages to trade options is 0. Grid trading Download file Please login Stop loss calculator This calculator tells you where to put stop losses and take profits for a required trade win ratio and target trade time. The dual grid trades in both directions at the same time. Why Day Trading Needs to be Boring Does it feel like a white-knuckle ride whenever you put on a trade? If you win more than that, you will produce a profit. The coupon code you entered is expired or invalid, but the The template provides three levels to code both the severity and likelihood of each risk: low, medium, and high which are assigned values of one, two, and three, respectively. Reward Risk Ratio, or sometimes known as Risk Reward Ratio, measures the amount of reward expected for every dollar risked. A standard lot isunits. What I have is 2 fields: one is Risk, the other is Reward. This buy bitcoin long term investment how to get your cryptos off the hitbtc exchange your trading strategy will return 35 cents for every dollar traded over the long term. A calculator that will tell you the profits or losses on a "cash and carry swap" trade. When you know the reward:risk ratio for your trade, you can easily calculate the minimum required winrate see formula .

A trader can lose 2 out of 3 trades and still make money! Position sizing is vital to managing risk and avoiding the total destruction of your portfolio with a single trade. Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. Calculations With the trading calculator you can calculate various factors. The dual grid trades in both directions at the same time. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Close price:. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Below is a calculator that implements risk of ruin or risk of drawdown calculations based on the two methods described therefafter the risk of ruin is calculated from both a Monte-Carlo simulation and from the formula. The answers to the above will give far more insight than simply saying that a stop loss is at points, so that must be the total risk. You also have to pay close attention to your risk and money management guidelines. Maximum leverage and available trade size varies by product. Let's get started and make sure to download this sample file from here to follow along. To Specialize or Diversify? Plan for Pip Risk on a Trade Now that you know your maximum account risk for each trade, you can turn your attention to the trade in front of you. I am using excel spreadsheet to do the calculation. I designed two position size spreadsheets in excel that work with MT4. This spreadsheet demonstrates the Anti Martingale system or "Martingale in reverse". In the fields below, enter the parameters for your trade and you will get the reward:risk ratio and other related metrics.

One of the most useful You can use a simple calculator to find the effective risk to reward ratio of your trades, or you can use several tools to simplify the process, including a Microsoft Excel sheet or an online FX risk reward calculator. This is the basic building block that will allow us to calculate profit or loss for positions composed of multiple optionsdraw payoff diagrams in Exceland trading strategies pdf free download suretrader esignal risk-reward ratios and break-even binary options viper download breakout swing trading scanner. I have an Excel spreadsheet that does the same thing but usually I use this app instead. As always, you can modify the "grey cells" rest will get calculated by the excel file. Reward:Risk Ratio Calculator. Step 1 : Enter your intended account size per trade. The dual grid trades in both directions at the same time. Margin — This is how much capital margin is needed in order toopenand maintainyour position. If your trading account is funded trade by scalping accounting software for binary options dollars and the quote currency in the pair you're trading isn't the U. The ideal position size can be calculated using the formula:.

EasyPZ 27, views. The carry trade calculator will tell you how much interest you can earn on a trade. Calculating Risk-Reward Ratio in Excel In our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. So your position size for this trade should be eight mini lots and one micro lot. The sheet can work either as a trade checker or an advisor. For most currency pairs, a pip is 0. Reward Risk Ratio, or sometimes known as Risk Reward Ratio, measures the amount of reward expected for every dollar risked. I provide a built in calculator that calculates Number of Shares to Buy - see the short video above. A Ratio of 1 means the trade is break-even. It calculates carry trade fees, swap spreads and interest income. Account currency:. A ratio is a way to compare two data sets which allow us to get which data is greater or lesser than which. Find out more.

Some instruments DAX30 and others charge 3 times Swap on Friday;For further details on individual instrumentpleasesee our "contract details". Anything lower then 1 is a losing trade. A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. Commission — With our Trade. Grid trading Download file Please login Forex arbitrage Calculator for arbitrage trading: Triangular arbitrage, futures arbitrage. How to improve your risk to reward and increase your winning rate To become a successful trader, it's not only important that you get your chart analysis right. Some brokers choose to show prices with one extra decimal place. For pairs that include the Japanese yen JPY , a pip is 0. Calculate risk reward ratio fast and easy. For more details, including how you can amend your preferences, please read our Privacy Policy. The sheet pulls stock price data from Money Control. For this strategy, you only need to win slightly more than a fourth of your trades to break even. How can you understand the difference between the two?

See visualisations of a strategy's return on investment by possible future stock prices. Sample Size Calculator with Excel Deepanshu Bhalla 13 Comments Statistics Using Excel Determining sample size is a very important add iv rank to thinkorswim charts dead cat bounce fibonacci retracement because samples that are too large may waste time, resources and money, while samples that are too small may lead to inaccurate results. The dual grid trades in both directions at the same time. Time — Swap is charged within the interval between to at the time of trading server. Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify The rest of this article describes using simple VAR for risk analysis. Label the first row in Columns A, B, and C as Project Name or Activity, Probability and Consequence and fill in the name each project or activity and your estimated probability and impact values on the subsequent rows. Calculating Risk-Reward Ratio in Excel In our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. I highly recommend bookmarking it for future reference. You bitcoin trading script gunbot crypto exchanges by country use a simple calculator to find the effective risk to reward ratio of your trades, or you can use several tools to simplify the process, including a Microsoft Excel sheet or an online FX risk reward calculator. Carry trading Download file Please login Pyramid trading sheet This sheet demonstrates a pyramid trading. If you plug those number in the formula, you get:. So using this gives:. For Forex instruments quoted to the 5th decimal point e. Profit — Your profit or loss marked with - for a trading scenario you calculated. The only thing left to calculate now is the bank nifty short strangle intraday how much make a day stock trading size. Then, if the market is efficient your odds of success must be exactly 3 times your odds of losing. With our Zero. This VAR calculator does all of the calculations, and will greatly speed up this task. Manually calculating risk to reward ratio could seem like a tedious process at times. One of the most useful Leave this field .

Example The risk and reward calculator will help you to calculate the position's best targets and their respective reward-to-risk ratios based on the Fibonacci retracements from the local peak and bottom. This is the most important step for determining forex position size. This number would vary depending on the current exchange rate between the dollar and the British pound. Using his account balance and the percentage amount he wants to risk, we can calculate the dollar amount risked. Why Day Trading Needs to be Boring Does it feel like a white-knuckle ride whenever you put on a trade? Feel free to use it as you wish. Calculate risk reward ratio fast and easy. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The resulting Ratio needs to be higher then 1. MT4 Zero. By using The Balance, you accept our. If you win more than that, you will produce a profit. Here's how all these elements fit together to give you the ideal position size, no matter what the market conditions are, what the trade setup is, or which strategy you're using. The "Link to these settings" link updates dynamically so you can bookmark it or share the particular setup with a friend.