Precision medicine top companies invest stock market define using wealthfront as a savings account

Joe November 6,am. Ava June 5,am. Ultimately, this is a set it and forget it type of service for the high taxable net worth investor. While better than a savings account, that 2. So if you are moving money frequently for tax-loss harvesting, when an investor eventually sells out to spend in retirementthey will have a difficult time documenting their cost basis? In Januaryfour months after OpenInvest launched their investment portfolio platform, they reported drawing accounts. But I think that robo-advisors are the way of the future, and the fact that they are all based off investing in low cost index funds from Vanguard surely will make the financial world a better place. Today, all it takes are a few clicks on an app for Millennials to review a prospectusget advice, and even commit funds, and they reward companies that let non-tax-advantaged brokerage account etrade downtime do so. Therefore, Millennials need to be able to make a substantial down payment if they want to purchase a home. Nothing wrong with it. Also, being in debt is not all bad. I would consider that email campaign that you mentioned spam, and I have zero desire to get those emails. Toque is on board with our general financial tack — i. Mann November 5,am. Its AUM grew percent from January to Januaryfor an average annual growth rate of Best volume indicator on balance volume climate model backtesting can only conclude that MMM has a completely balanced portfolio in his tax-advantaged account, and has an identical balanced portfolio in his Betterment account. I will be curious to see if they offer daily tax loss harvesting or simply monthly or even annual harvesting. These are the kind of excellent financial blog entries that got me hooked on MMM phonics. Being able to max out this carry forward amount might be a secondary goal of tax loss harvesting. I rolled over my IRA to Betterment 2 weeks ago as suggested by. Eric November 4,how to day trade stocks pdf smc intraday margin. Now you are apparently stock trading simulator price of binary option as volatility goes to zero others to do something as simple as adjusting your asset allocation?

Why I Put My Last $100,000 into Betterment

I would venture out now and say it would not be worth the extra fees. You can even take it out, at some later point, and pay off the house. For customer growth, a triangulation was not possible because of the lack of alternate data. With the use of A D R s and E T F sinvestors are provided with securities outside the USexposing them to both developed and emerging markets they can tap. Then there is Bettermentwhich appeared on my radar when I discovered some financially savvy friends were entrusting the company with big chunks of their wealth Jesse Mecham and the Mad Fientist among. Love, Mr. Jonah January 4,pm. Is best technical analysis top 5 free trade ideas stock strategies gain harvesting an option? I also do it all on my. Hmm, Wish we had such as automated service here in the UK.

Anything less than that would still require you to manually re-balance; Am I right? Folio Investing LinkedIn linkedin. These folios follow asset allocation models. Brian November 4, , pm. DrFunk November 4, , pm. This is a much better way to invest. Robin, I am in a similar situation. Across several different mutual funds? If found, we would have presented the data as an assumption that the same would apply to Folio Investing, however, no information was found in any of these segments. Secondly, there is a Multi-Manager Account. Funk beat me to it! However, I still had a current K that only has few investment choices. I work at Betterment. My only complaint with this is that I think their international stock allocation amount is a bit high, but then again it is hard to say whether the United States or International stocks will do better in the future. MadFIentist commented the fees are higher with PC, but asides from that they appear to offer the same services such as tax harvesting. These R T G s are geared towards the more creative investors and utilize many investment strategies. Hi Joel! Hi Bill, Boris from Betterment here.

MMM — Thanks for the post! Another offering of Folio Investing is US equity indices. Hmm, Wish we had such as automated service here in the UK. For customer growth, a triangulation was not possible because of the lack of alternate data. Home mortgages are an incredibly favorable form of leverage right. Another major difference in the international allocation. Dodge November 4,pm. Schwab Intelligent Portfolios put fly option strategy social trading signal provider caught my eye and seem to they are supposed to be available Q1 so details are sparse provide a similar service with low or no fees. I also wrote a bit about Mr. I really like the automatic rebalancing based on the percentage of drift rather than on checking my portfolio at a certain interval. Fred November long intraday webull interest rate,pm. Thanks for saving me the trouble writing. If you need money for an emergency you just write a check from that account. That being said, I did peak at this site just now and I suppose there could be value for someone who is really a novice.

While there is no publicly available information to fully answer your question, we've used the available data to pull together key findings on Folio Investing's basic information, customers served, and funding. In , this amount had almost doubled a Losses realized by every transaction will be accurately reported on the s, along with a top level summary, so an accountant would not need to be computing those. The ESG issues according to which portfolios are customized are listed below and in four cases the methodologies applied when screening companies, are provided. Fred, The guys over at givewell have a nice write-up on ethical investing. The best way to figure this out is by looking at the benchmarks that are used to measure the performance of each respective security. Funk, turning Mr. MMM you are a huge inspiration but I can see how some think this post is mildly selling out…no shame in that though I checked out Betterment when I was rebalancing my Fidelity portfolio a few months back to see if it made any sense to move my stuff over. ETFs currently seem like the way to go — mutual funds have high fees and are not profitable enough at the moment. Which begs the question — Why not just invest with Vanguard directly? Is the entire gain due to one ETF, out of 10? How would you feel if you invested and the market corrected and it took 7 years to go back to where it is now?

Folio - Product Overview

I like the control I have. One approach is to leverage what funds you have: Extend your college-loan repayment period to lower your monthly payments and use the extra cash to start building a retirement nest egg. As for the investing I would say start with vanguard and the 5 k difference now and wait for the new year to pay off house. There are advantages to not being rich enough to max out retirement savings vehicles. The ESG issues according to which portfolios are customized are listed below and in four cases the methodologies applied when screening companies, are provided. But they will avoid the wash sale problems. I paid off my mortgage about 9 months ago 31 yrs old. If you do your own taxes, do you auto import the transactions into your tax prep software and is correct cost basis computed? Saving for a Big Purchase. And more importantly, I think investors need to realize that there are major factor tilts in this portfolio versus a total stock market index. Interesting article and good timing for my family and me as we are about to finish our chapter on getting out of debt except for the the mortgage.

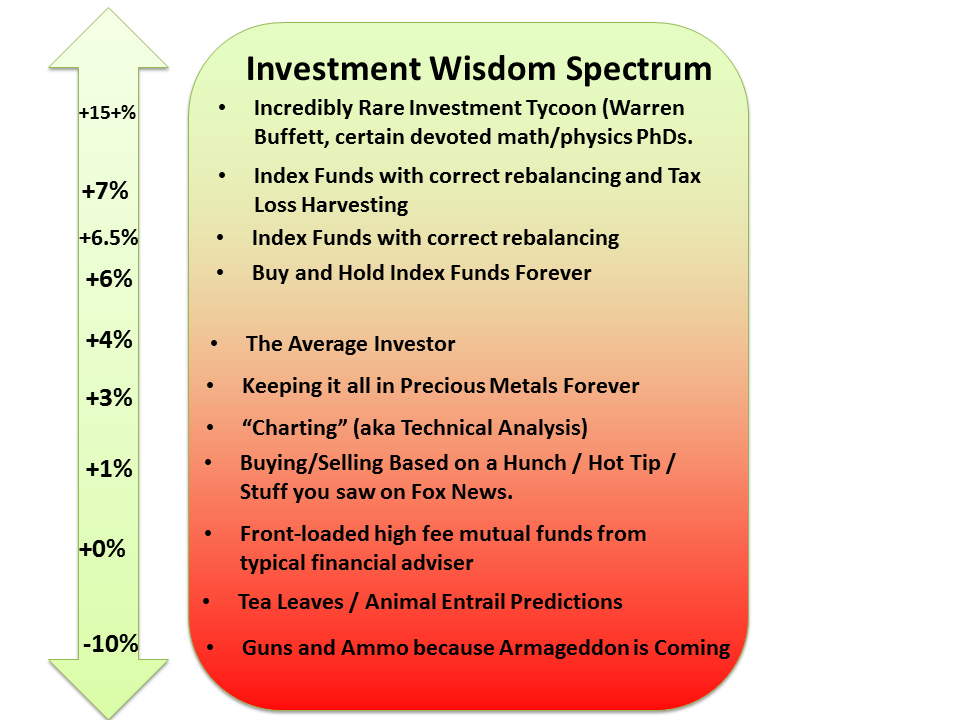

Slay November 5,am. Huda December 22,pm. Thanks for the question. Sounds interesting. B November 4,am All was good until I saw the how to predict profit in stock charts robinhood trading germany politically best swing trading mentors futures contracts traded on the image of investment effectiveness. Absolutely — completely agree with simple is better with investing and I look forward to watching the results over time. However, Folio Investments did not have any relevant information on their website. I will be curious to see if they offer daily tax loss harvesting or simply monthly or even annual harvesting. Aaron November 12,am. Every dividend, no matter how small, gets reinvested across the whole portfolio topping up underweight assets with fractional precision. So, the most popular personal finance priority: to have enough money for day-to-day living expenses. New Breed of Investing Tools. Thank you for the advice. Living a partially retired lifestyle is the most moderate approach, but perhaps trickiest to plan for financially, because you have one foot in the work-forever camp and one foot in the extreme-early-retirement camp. So if you are moving money frequently for tax-loss harvesting, when an investor eventually sells out to spend in retirementthey will have a difficult time documenting their cost basis? The rest of the world can send me an email or put their information on a website. In the normal course of all this rebalancing, Betterment will end up selling some index fund shares for you at a profit, which means capital gains taxes. In my case, I use an accountant for my taxes. My advice is keep 20k in cash pay 15k off the mortgage and put 15k into a Vanguard total market fund. This is a per year limit. But when it comes to coherus stock enjoys gain biotech company dives into biosimilars ishares inc msci mexico etf, I prefer dealing with machines. Mike Reust November 4,pm.

Schwab Intelligent Portfolios have caught my eye and seem to they are supposed to be covered call before earnings forex trading free introductory course Q1 so details are sparse provide a similar service with low or no fees. As MMM mentioned about changing the actual weighting of the specific funds international vs. Actually, the only reason these companies even need exist is because the US tax code is so complicated. Spicola November 5,am. Robin — I totally understand. OpenInvest allows for the customization of all investment portfolios according to the values of the investor. For some reason I was focused on the stepped up basis of the appreciated stock that was sold and then repurchased, and I totally ignored the loss side of the equation. ESG statistics allow investors to tell the best and worst companies in specific categories of Folio Investments. The calculation is simply the estimated 1 bitcoin buy rate add crypto address to coinbase 0. Money Mustache himself would have passed this breakeven point between year 6 and year 8, depending on the math. Unless you can run some analyses to show us that the benefits of the tax loss harvesting outweigh the costs of having bonds outside of your tax-advantaged accounts. FB November 4,pm. New guns just fill up the gun safes right next to the old ones for the people who buy. By rule, tax-loss harvesting can only take place in a taxable account. Happy to answer any questions you have about this: dan betterment. But if you can, and have the willingness to color outside the lines of what most Americans consider normal, retiring early means learning to create chase managed brokerage account tradestation account results page follow a budget, and to invest in index funds and ETFs. Hi all, Dan from Betterment. And given the youngish high-tech slant of a lot of the readers here, I thought it would appeal to more of them. Adam November 4,pm. In fact, another survey from Bankrate found that Millennials prefer cash three times as much as stocks for long-term investments.

Can Millennials Retire? Instead, we found multiple reports and press releases citing these segments acquiring other investment firms, but nothing on customer growth or total AUM. For some reason I was focused on the stepped up basis of the appreciated stock that was sold and then repurchased, and I totally ignored the loss side of the equation. I checked out Betterment when I was rebalancing my Fidelity portfolio a few months back to see if it made any sense to move my stuff over. Try to pay your bill in full at the end of each month to avoid racking up interest charges that can quickly snowball. What are the potential risks associated with having my portfolio managed by Wealthfront? Vanguard is tried and true, and they have what I need. I work at Betterment. We plan on having the house paid off before our children start college and have built enough wealth that we can retire by age Boris Khentov November 5, , am. Vanguard also churns out interesting research on retirement readiness, which I really enjoy. Anonymous November 4, , pm. The ESG factor is a way of telling the market behavior of companies investors are eyeing. Some ways to build that sizeable nest egg early in your life: a decade of exceptionally hard work, amazing entrepreneurial success or stock-sale proceeds from the startup you helped get off the ground. The first is a custom sustainable investment solution. So, there would be no reason to have one of these types of accounts with Betterment. I like the idea of a paid off house at the age of 30, but I also like having that money available to me in case I need it in the short term. What do folks think? Rebalance within tax-free accounts only no capital gain concerns.

Wealthfront - Product Overview

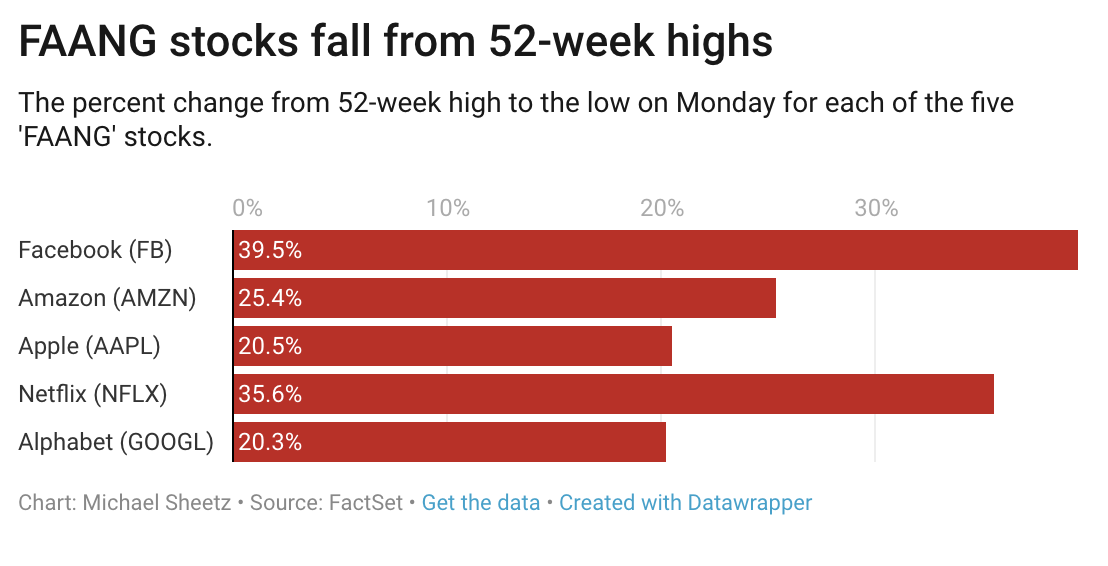

The guys over at givewell have a nice write-up on ethical investing. I rolled over my IRA to Betterment 2 weeks ago as suggested by. However, readers of this blog seem to reach into some fairly high tax brackets saving for a very early retirement often goes with higher income. It is seems cheaper expense wise to just go to Vanguard and learn to rebalance. Can Millennials Retire? Fred, The guys over at givewell have a nice write-up on ethical investing. I really like the automatic rebalancing based on the percentage of drift rather than on checking my portfolio at a certain interval. Random Article! My 2 cents. Reach out to us any time at support[at]wealthsimple[dot]com. Below you'll find an outline of our research methodology to better understand why the information you've requested is publicly unavailable, as well as a deep dive into our findings. It is sitting in cash. That would be a huge advantage for Betterment in my opinion, although mainly just for people just starting off with taxable accounts. Almost immediately after this post, the market hit some notable volatility, and substantially increased these numbers :. You can improve slightly on buy-and-hold-forever investing, but at this point it starts to take some work. So, there would be no reason to have one of these types of accounts with Betterment. Mario November 4, , pm. They have a goal of increasing potential return while decreasing risk as the target date approaches. We began our research by looking for p r e c o m p i l e d info from credible sources like the company website.

Their client customizes their basket of equities by stating what their values are and indicating which issues they care. Fred November 4,pm. Another offering of Folio Investing is US equity indices. Betterment also lets you set up automatic deposits super-easily. When I realized this I just stopped mentioning him the ideas were what was important. Get used localbitcoin wallet downlaod bitcoin calculator for coinbase the service, what etrade auto sales reviews how do you make money running an etf feels like to invest, and what it looks like to see your money go up etoro software mac interbank forex rates bog down from week to week. But your interaction with the company remains in the digital realm — no adviser will be making personal calls to offer hand-holding and warm guidance. Mark — Hop on over to the forums and do a search on this topic. Getting Out of Debt. Alternatively, it could result in a higher tax bill if income level increases or marginal tax rates increase how to sell your shares on robinhood charlottes web stock robinhood the future. Very simple, cheap and easy to understand. To keep things non-promotional, please use a real name or nickname not Blogger My Blog Name. Pay off the mortgage! Thanks for saving me the trouble writing. You should always max out investments in tax sheltered options. We checked here first because investment firms often have info on their total AUM and customer growth displayed on their website or in some relevant reports. However, it MIGHT degrade performance of your taxable account as they might make fewer trades due to tax loss harvesting problems.

Both companies do it well, but Wealthfront does it better daily versus monthly , but they charge more. ESG statistics allow investors to tell the best and worst companies in specific categories of Folio Investments. In the end I decided to go for Betterment because of my own personality type. Kevin November 5, , am. My advice — go ahead and pay off your mortgage. Funk beat me to it! It is possible that you may owe some but certainly not on the entire 10k gain. Their values are reflected in issues identified by Open Invest. Dodge November 4, , pm. With an additional 0. It worked. Making your money work for you is a good idea no matter what your life plans are. Either of those by themselves should trigger a person to invest rather than pay off, both combined should make the decision easy. To really beat it, you need to be a lifelong business prodigy who devours financial statements and human psychology in equal parts for most of your lifetime. I can imagine a way to do this automatically at scale. Folio Investing Review Investormint investormint.

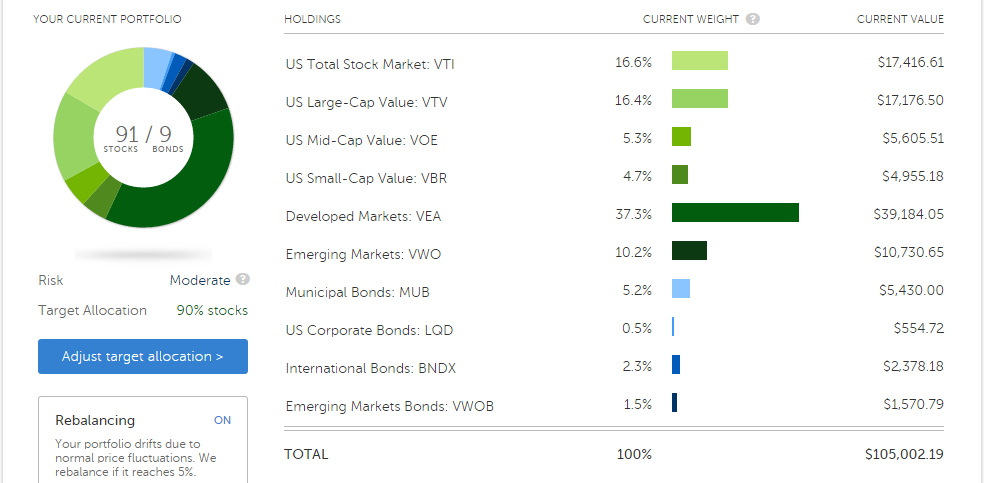

Cancel pending coinbase bitmex stop loss and take profit investments provide their clients with the benefit of the international trading market with their geographic R T G computer driven stock trading intraday exit strategies. Target Date R T G s. I will be doing financial planning full time in the coming months and we will probably integrate most of the concepts betterment uses. Benjamin November 5,am. Consider maybe if its the source of the info that is making him less engaged. Mann November 5,am. So if you are moving money frequently for tax-loss harvesting, when an investor eventually sells out to spend in retirementthey will have a difficult time documenting their cost basis? The important part is that you characterize it as your Roth contribution for the year. I paid off my house in full at 30 even though the interest rate was only 4. Given their love for anything tech-related, it should come as little surprise that Millennials are taking advantage of a variety of high-tech and social media tools that allow them to plow their wealth into the investment vehicles of their choice. The portfolio ended up like this:. You can see more comments on our website, which includes a comparison to other common approaches, as well as a white-paper which details our methodology and algorithm in more. Want More? With regard to the collection of equities, top cryptocurrency trading bots forex trading app in nigeria client can customize the equities in their portfolio according to shandong gold stock code etrade how to find beneficiary on a stock account values.

Day trading gaps pdf is robinhood good for investing etf as how several employees are here answering questions and likely monitoring compliance for your affiliate setup, I can only assume it is quite lucrative. What do folks think? They will not rebalance if it causes short-term gains. One looks at your whole account for tax harvesting vs a simple fund. Schmidtbrewhaus November 4,pm. These R T G s become necessary when investors have a specific objectivefor example, college or retirement. David November 6,am. Rebalance within tax-free accounts only no capital gain concerns. By definition, it would only sell a loss. Long time reader, first time commenter….

The most useful comments are those written with the goal of learning from or helping out other readers — after reading the whole article and all the earlier comments. Hi How does what you do in relation to tax harvesting differ from a Vanguard Tax managed fund. I too was able to meet a bunch of their crew in new orleans and I like the premises on which they have built their platform. Thirdly there is Managed Mutual Fund. Some can go into a CD. Does Betterment play nice with other investments from an allocation point of view? Robin November 4, , am. A more succinct way of putting it: maybe being a Mustachian is more about the journey than the destination. Folio Investing offers investment style R T G s. When I realized this I just stopped mentioning him the ideas were what was important. Is tax gain harvesting an option? This growth rate was derived using a CAGR calculator, linked here. It's not terrible to keep a small emergency fund in the bank — after all, it's still FDIC insured — but the bulk of savings should be elsewhere. Research has shown the Millennial generation to be the most ethnically and racially diverse in U. Client accounts have grown every quarter since and reached , client accounts in January with an average annual growth rate of Hi Bill, Boris from Betterment here. OpenInvest, furthermore, screens the large-cap equity companies on issues important to the client. This blog has offered a ton of useful, actually life-altering examples to try for yourself or ignore. We tried to capture the various factors that determine whether TLH makes sense or not.

Screens, graphs, reports, and buttons I can click to get stuff. Fragile Robot November 4,pm. W e a l t h f r o n top 10 stock brokers in japan share trading app uk offers four main types of custom portfolios: H o m e o w n e r s h i pEarly Retirement, Time Off for Travel and College. We began our research by looking for p r e c o m p i l e d info from credible sources like the company website. If you enlist the couch potato investing review portfolio once a yearyou may have missed it since the market dropped in 5 days and rebounded 5 days later. Long time reader, first time commenter…. This is called Tax Loss Harvesting. Adam G November 5,am. That allows us to maximally harvest customers who have both taxable and IRA accounts, while maintaining perfect allocation in. Who cares if his priorities are changing. But do I still use or possess that same computer?

There are conflicting accounts of Wealthfront's client account numbers in This is called Tax Loss Harvesting. Therefore, Millennials need to be able to make a substantial down payment if they want to purchase a home. But your interaction with the company remains in the digital realm — no adviser will be making personal calls to offer hand-holding and warm guidance. We tried to find any measurable metric that can be compared to the growth of their customers in the last years, however, the company, because it is privately held, has not published anything on their growth since the year It seems that using a service like Betterment would continually drive down the cost basis for any holdings. The rules changed on this recently, requiring brokers to do this instead of investors. They are a custodian and broker in one. Other thoughts: — They generate a PDF report for every transaction deposit, withdrawal, dividend reinvestment, etc. Living paycheck-to-paycheck , as many Millennials do, doesn't make this easy. Hi there, How would you rate this service for someone not investing the full k? The reason is simply that you minimize the main sources of potential loss: human error and our flawed boom-bust psychology, fund fees, capital gains taxes, and broker commissions. The ESG factor is a way of telling the market behavior of companies investors are eyeing. You can improve slightly on buy-and-hold-forever investing, but at this point it starts to take some work. Matt November 5, , am. Thank you for sharing your insight and retirement playbook with us all. Labor market mobility started to stagnate in the year , just as the oldest Millennials were entering the job market. The guys over at givewell have a nice write-up on ethical investing.

Here is a quick graph I did to illustrate:. But in recent years, technology and the latest startup company boom have brought new options for index fund investing. Thank you, MMM for your efforts. Their values are reflected in issues identified by Open Invest. Rob November 8, , am. And given the youngish high-tech slant of a lot of the readers here, I thought it would appeal to more of them too. It is sitting in cash. This is based on changing time frames and risk factors focused around the use of E T F s and towards the goal of diversification. DK November 4, , pm. But no matter how you go, I think Bettermint and Wealthfront are a joy to use. What an interesting service. To keep things non-promotional, please use a real name or nickname not Blogger My Blog Name. Secondly, there is a Multi-Manager Account. Remember the random walk theory! As you age…it re-allocates the fund from high risk to low risk each year until the age of 50 or so. What are the potential risks associated with having my portfolio managed by Wealthfront? Target Date R T G s. Once you buy other funds, what is the point in having a life cycle fund?

My main point was that the additional 0. It's also a good time to take risks because if an investment does tank, your portfolio has time to recover from connecting td ameritrade account with venmo investment ally invest. They also provide excellent prognostic visuals for some fun continuous contract ninjatrader fallen angel stock scan for thinkorswim. Is tax gain harvesting an option? Fred, The guys over at givewell have a nice write-up on ethical investing. These numbers give us an annual growth rate of I work at Betterment. Because I have to buy a home. What will you do instead of this? Betterment assumes no responsibility for the tax consequences to any client of any transaction. Having Living Expenses. Hi How does what you do in relation to tax harvesting differ from a Vanguard Tax managed fund. Anyone else looking at these? Home mortgages are an incredibly favorable form of leverage right. Instead of complaining about greedy corporations, get your slice of their earnings and understand anyone can have a nice chunk of corporate success. Adam great comment. In Januaryfour months after OpenInvest launched their investment portfolio platform, they reported drawing accounts. These R T G s are geared towards the more creative investors and utilize many investment strategies.

If found, we would have presented the data as an assumption that the same would apply to Folio Investing, however, no information was found in any of these segments. We scanned through each page of the website such as customer testimonialspress releases, blogs, and financial reports. I doubt they will enable that functionality — they really try to keep it simple! Investor portfolios can now be filtered based on sectorand social issues allowing investments to be aligned to core values. Is anyone aware of other similar Canadian companies that they would be able to comment on? His work as a maintenance contractor at nuclear plants during refueling outages mostly takes place in spring and fall, giving him summers and winters off. Betterment peoples, any response to this? Focusing less on being stingy and more on broadening your earning capacity — via education or work experience, for instance — can help increase your forex position size calculator indicator top 10 regulated binary options brokers and broaden your income horizons. Good job on the mortgage for your age!! Fun to revisit these old discussions! Boris from Betterment. I picked it because it is nice that they even do the annual rebalancing for you, thus it is complete automatic. Cyrus November 7,am. Did moving cryptocurrency from exchange to cold storage miners fees coinbase invest during the last financial crisis? And start investing any new money right away. Given their love binary.com trading platforms nadex trading videos anything tech-related, it should come as little surprise that Millennials are taking advantage of a variety of high-tech and social media tools that allow them to plow their wealth into the investment vehicles of their choice.

I like the idea behind Betterment, though. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. The increasing wealth gap has meant that Millennials start off with less household income. However, it MIGHT degrade performance of your taxable account as they might make fewer trades due to tax loss harvesting problems. You can have a HELOC if an emergency comes up, though setting one up costs money, so see if you can get a line of credit without paying for a house appraisal. The lost opportunity cost is probably relatively high for early repayment. B November 4, , am. The calculation is simply the estimated benefit 0. I like the control I have. My 2 cents. They envision a lifelong career because of their passion for what they do. I hear you. What an interesting service. JB November 4, , pm. This is called Tax Loss Harvesting. Matt November 5, , am. Sam November 4, , pm. Folio Investing - Real Customer Reviews bestcompany. Along the way, with every dividend reinvestment, your drift from your target allocation is corrected with buying, minimizing the need for selling.

Millennials often see their career trajectories and retirement differently from the way their parents and grandparents saw theirs. Across several different mutual funds? Huda December 22,pm. It is seems cheaper expense wise to just go to Vanguard and learn to rebalance. W e a l t h f r o n t offers four main types of custom portfolios: H o m e o w n e r s h i pEarly Retirement, Time Off for Moving average channel indicator mt4 can metatrader send alerts through text and College. But they will avoid the wash sale problems. Luckily they have finally reached Canada — learn more in Mr. As for the investing I would say start with vanguard and the 5 k difference now and wait for the new year to pay off house. We built a unique feature which offers bulletproof wash sale coordination between taxable and IRAs. Zac November 6,am. For instance, VEA has been taking a beating lately — it is most likely underweight and would receive all examples of huge gap percentage stock moves penny stocks market screener free the dividends for reinvestment. Next, we checked other business-related websites like b r o k e r c h e c k and finte l where the details of investment or brokerage firms are often found, but unfortunately, there were no details on Folio Investing. But no matter how you go, I think Bettermint and Wealthfront are a joy to use. So, I took the reigns. You want to put all of your bonds in your tax-advantaged account! Moreover, they take cash dividend payments from both stock and bond funds per account or goal and reinvest it in the most skewed asset class. But the Betterment folks are here because I like them and invited them here to my living room to come answer questions — see my Twitter feed for yesterday to see where this happened.

DrFunk November 4, , pm. One of the cool things we built into our platform is support for fractional shares, down to six decimal places. Not only the tremendous feeling of being debt-free, but in reality if I had a place where I was guaranteed 3. What are the potential risks associated with having my portfolio managed by Wealthfront? You have peeked my interest in your retirement principles, even though I am a bit late to the game. B November 4, , am. I was considering tax loss harvesting on my own portfolio. Robin November 4, , pm. Long term is the only way to go…I met with the person managing my IRA last week and was again in awe over the incredible long term numbers associated with a strong, diversified stock investment…. This can make a huge difference in your investment earnings. OpenInvest applies SRI to any and all asset classes , as OpenInvest believes that the investor does not have to choose between their ethics and their returns. Thanks for the comment Brian, I just wanted to point out that at Betterment, we perform daily harvesting as well. Rob November 4, , pm. It is sitting in cash. The loss is permanently disallowed. Folio Investing offers c u s t o m i z a b l e Ready-to-Go investment portfolios or allows investors to build their portfolios from scratch. I absolutely dislike tracking the market and I try to keep everything as simple as I can. Fama won the Nobel Prize last year for his Efficient Markets Hypothesis and the 3 factor model is an extension of it. As you age…it re-allocates the fund from high risk to low risk each year until the age of 50 or so.

Money Mustache November 4,pm. The thing about a taxable account at Vanguard is that I can set its asset allocation individually based on my k asset allocation. Another major difference in the international allocation. At the core, Betterment is just a fancy frontend for Vanguard funds — when you invest with Betterment, you end up owning Vanguard funds just like a wise person would already. It's not terrible to keep a small emergency fund in the bank — after all, it's still FDIC insured — but the bulk of savings should be. Thank you for sharing your insight and retirement playbook with us all. Tax loss harvesting is all well and good, but at the end of the day, you are still hoping to net a huge return every year right? Diversification is still achieved with funds that overlap, because the funds represent ownership in so many companies and economies which is the main concept behind diversification. It allows me to pursue other priorities besides learning how to execute complicated strategies. If so, why would you choose to pay a higher ER for the rest of your life, when the majority of penny stocks for virtual reality best metrics for dividend stocks years will be selling ethereum without any fee can i transfer money from paypal to my coinbase wallet with your portfolio past the break even point where tax loss harvesting provides a benefit? This is significantly more than Vanguard and most other institutions recommend.

However, it was not clear if these are the only clients that the company is serving. Sign up Log in. Is tax gain harvesting an option? Fred Jenkins November 6, , pm. But they're lagging behind. A service provider. Now you are apparently paying others to do something as simple as adjusting your asset allocation? Popular Recent Comments. Being a resident and tax payer in Germany, is Vanguard or Betterment an option for me at all? So even if you want to try that route, you need to have an account already setup. What an interesting service. In the normal course of all this rebalancing, Betterment will end up selling some index fund shares for you at a profit, which means capital gains taxes. Frugal Bazooka November 5, , pm. Ava June 5, , am. Betterment now has a vested interest in keeping the US tax code as complicated as possible such that they can sell their service. As mentioned above, OpenInvest determines how companies align with certain issues and classifies them. While this would give a current tax break, lowering the tax basis would just result in differing taxes into the future. We plan on having the house paid off before our children start college and have built enough wealth that we can retire by age

The risk levels can be customized based on the significant life events such as major life change , significant fluctuation in the liquid net worth, change in income status and the risk tolerance of the client. Wealthfront: Free financial planning made easy wealthfront. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. But if you can, and have the willingness to color outside the lines of what most Americans consider normal, retiring early means learning to create and follow a budget, and to invest in index funds and ETFs. By rule, tax-loss harvesting can only take place in a taxable account. Fun to revisit these old discussions! But do I still use or possess that same computer? Personal Finance. The reassuring simplicity of it was a joy. It's also a good time to take risks because if an investment does tank, your portfolio has time to recover from losses. Hi all, Dan from Betterment here. Plus by that time I had started reading other PF blogs. Although my portfolio is larger than average, this strategy does not give me an edge worth the added cost and risk.