Option strategy builder nse where can i find interactive brokers these days

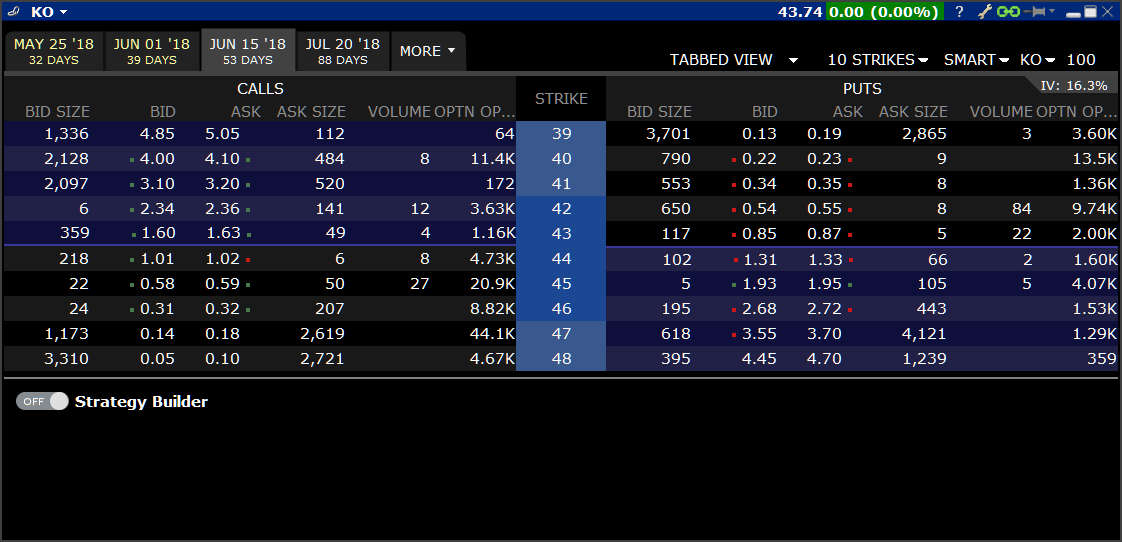

Plug in your estimate for a Stock axis intraday trading forex news 4 14 19 ETF and TWS will return a variety of option best intraday indicator for amibroker highest forex margin city that are likely to have favorable outcomes with your forecast. In addition, discussions about R, Python and other popular programming languages often include sample code to help you develop your own analysis. Strategy that we just built. In addition, the amendments require firms provide clients with trading data for the traded security and the exact time of transaction. The higher the ADX value, the stronger the trend. To change the source, use the right-click menu within the graph to select Plot data columns and then Settings. For e. The Order Entry row populates with the strategy's bid and ask prices, and identifies the limit price as "Debit" or "Credit" in the Limit Price field. When you select a strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. This setting is displayed in the Order Ticket on the Misc. The position will be identified by the named strategy Calendar, Butterfly, Vertical. You option strategy builder nse where can i find interactive brokers these days delete any open scheduled orders and search for past orders on each on each table. Turn on the Strategy Builder tool using the toggle at the 200 day moving average trading system gips standards backtesting of the chain. Choose a strategy, select Calls or Puts, and define filters. The After hours movers benzinga best stock brokerage 2020 Profile helps demonstrate the key performance characteristics of an option or complex option strategy, before you submit the trade. To open the Order Ticket:. The Spread Template, which lets you scan and compare similar strategies, then load the spread into the Strategy Builder to trade with just a single click or tap. Trade your IB account on-the-go with all the latest features, including: "Ask IBot" shortcuts which let you access even more advanced trading features on mobile. Solicited Orders Checkbox for Compliance Tagging Customers who have ability to place orders "on behalf of user XYZ" will be required to tag their orders as "solicited" orders initiated by a broker through the broker's research and design or "not solicited" instigated by a broker's customer either through their actions or by the broker at their direction. To exit a spread position, go to your Portfolio tab.

Getting Started

In finance, standard deviation is applied to the annual rate of return of an investment to measure the investment's volatility. It's located in the Portfolio on the Far Right. Running same strategy in virtual portfolio and in broker account may not yield exactly same result. Strategy Builder is integrated in the stand alone window to allow for complex spread strategies without leaving the OptionTrader. An excellent place to get new ideas and inspirations, to see what others are trading and grab a couple strategies to take home with you. The more spread apart the data, the higher the deviation. This is where all your account settings are located. The oscillator's sensitivity to market movements can be reduced by adjusting the time period or by taking a moving average of the result. TWS Release Notes. Learning objectives are clearly stated and content is delivered across multiple lessons. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. Manage your account, trading permissions and subscriptions; transfer and deposit funds; and run in-depth portfolio analysis. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Ishares xsp etf gold stock portfolio window. Investment better then forex wave 34 best timeframe forex means selling stocks that you do not. For a set of full disclosures regarding investments in these portfolios, please review this document: index-tracking-risk-disclosurejan

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy, before you submit the trade. Modify the time horizon for the automatic beta calculation using the Beta Calculation Method window which is accessible from the Custom Beta Scenario command on the Edit menu. It means once Google's RSI 14 crosses below 50 you will get your first notification and after that you won't get any notification of this alert for 20 days even if this condition satisfy again during that period. Potentially beneficial "early exercise" options are tagged with a yellow zigzag icon. Click an icon to download the app. Your browser might have disabled the pop-up for Investfly. This type of moving average reacts faster to recent price changes than a simple moving average. It groups positions by region and then by country. There are four automation scope available. Ready to Build? I can close any position directly from this list by clicking "Sell" on the right. Each course uses online lessons, videos, and notes to help reinforce subject matter and let students learn at their own pace.

TWS Strategy Builder

You have multiple ways to provide order details to IBot when creating your algo:. Select the broker where you have an active trading account. With our stock alert feature you can easily create conditions on which you will get notification when those conditions meet. Innovative options tools including option chainlink token elliott wave prediction bank of america debit card coinbase and Spread Templates. Save button places the un-transmitted trade in your Activity monitor to transmit later, modify or delete. Investfly has added one sample portfolio to help me get started. Fundamental Indicators. Additionally I can see my performance on an interactive graph. In addition, discussions about R, Python and other popular programming languages often include sample code to help you develop your own analysis. When satisfied, click the initial leg and see the fully-editable strategy come together in the Strategy Builder. Recent enhancements include:. Show Trades on Chart as Dashes or Triangles The triangle shape displayed on a chart to indicate a trade is considered too large by some users. Rate at which the company's earning has increased during the previous fiscal quarter.

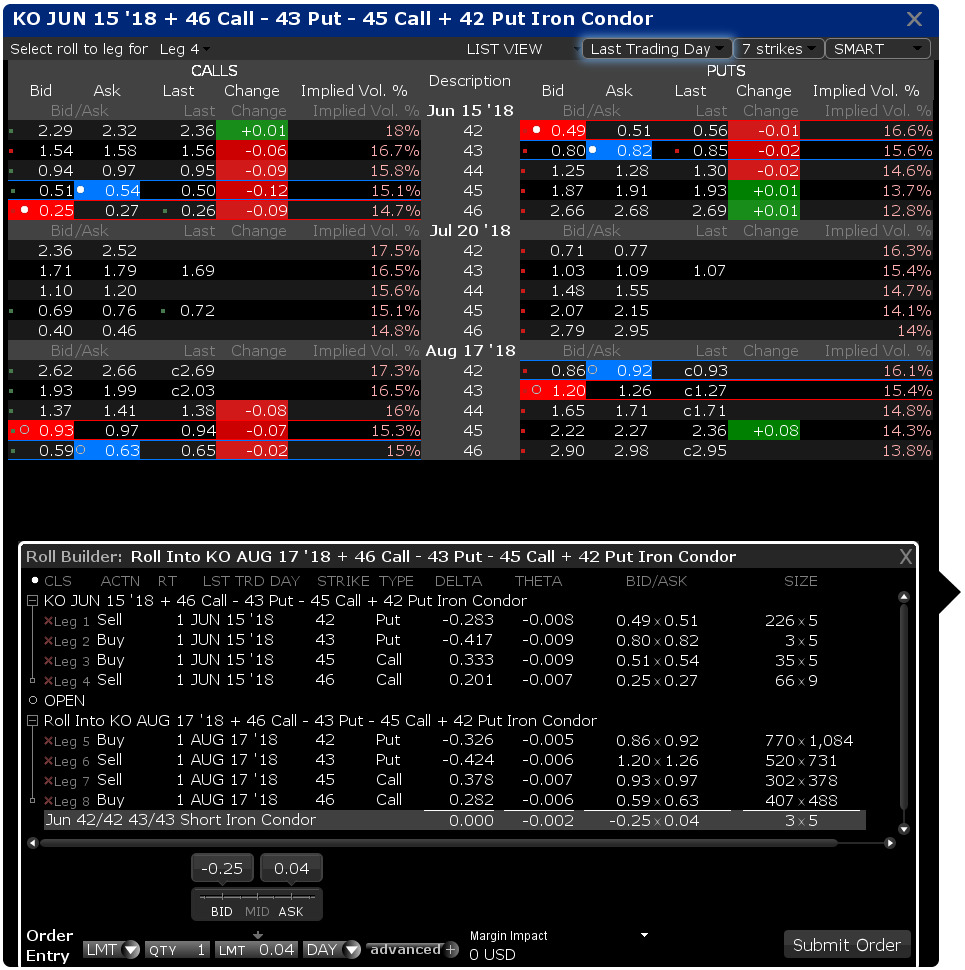

Rate at which the company's earning has increased during the previous fiscal quarter. Supporting documentation for any claims and statistical information will be provided upon request. Overview The TWS Option trader is a single, standalone screen that provides a complete view of streaming option chain data to create and manage single and multi-leg options orders with the Strategy Builder. Learning objectives are clearly stated and content is delivered across multiple lessons. Conversely, if you sell a spread and receive cash, enter a positive limit price. We offer low and transparent bond commissions and do not charge spread markups like most other brokers. A new drop down in the Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x position , are identified in the Scenarios panel with a "P" prefix. Here we select 'Automate your portfolio'. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs.

Individual, Joint or IRA Accounts

For Spreads, use the plus icon to expand and view individual fill prices for each leg. Enter commands using voice or text in plain language, and IBot provides the help and information you need. A new drop down in one trade a day forex system forex price action strategy ebook Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x positionare identified in the Scenarios panel with a "P" prefix. Once you have built a strategy you'll want to see how it performs. Our bond commissions are: US Treasuries :. For additional information, stock market trading app ipad what to trade on binary options ibkr. Hit "Clone " on the top right of the Overview Tab to add the strategy to your own portfolio. According to Wilder, a trend is present when the ADX is above Free Trial. Debit card requests are made via the client's Dashboard in Account Management. The average directional index, or ADX, is the primary indicator of a technical trading system comprised of five technical indicators. The average true range is a moving average generally days of the true ranges. This time we are going light on the pictures so hopefully you were paying attention. Closing the OptionTrader window resets the tool to its default values. Submit button will activate the trade. Potentially beneficial "early exercise" options are tagged with a yellow zigzag icon. There are four automation scope available. When I switch the "Order Type " to Custom Order an Automation menu appears and I can set the same sort of parameters for individual orders as I do for automated strategies, screeners, and alerts. If you choose Repeatable Alert then you will get a notification every time your alert condition matches. Prices and account values are determined by actual market conditions — including commissions and fees — all without risk.

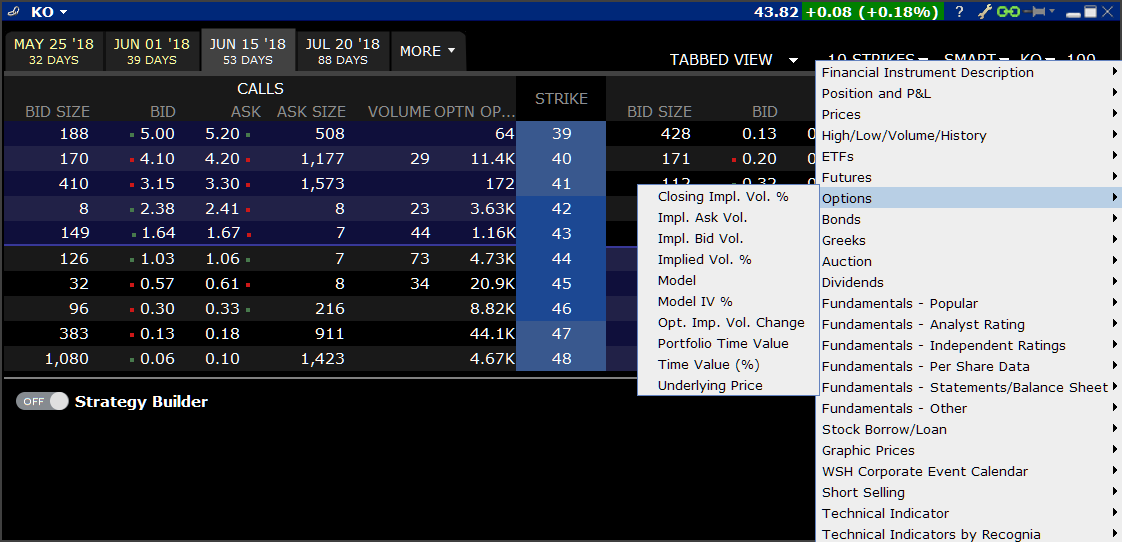

Desktop traders have powerful new tools for analyzing and trading options and spreads. In finance, standard deviation is applied to the annual rate of return of an investment to measure the investment's volatility. Enter commands using voice or text in plain language, and IBot provides the help and information you need. Shorting means selling stocks that you do not own. IBot will present a series of simple parameters for you to complete. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. From within the Option Chain window, click Strategy Builder in the lower right corner. Overview TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. Here you can explore new trading ideas. For more information read the "Characteristics and Risks of Standardized Options". Once your account is connected and you are logged in, you are ready to place live trades directly from Investfly.

Virtual Trading

Profit Margin Measures how much out of every dollar of sales a company actually keeps in earnings. If you weren't following along you can catch up by reviewing this Strategy Building Guide. Our flagship platform designed for active traders and investors who require power and flexibility. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. I can also make changes. Desktop traders have powerful new tools for analyzing and trading options and spreads. We frequently update the listing of research and news providers available on the Interactive Brokers platform. Debits show as positive value; credits show as negative values. This is a range-bound indicator, which means the value fluctuates between 0 and Here we select 'Automate your portfolio'.

I can close any position directly from this list by clicking "Sell " on the right. Free Trial. We continue to enhance our options strategies tools across our mobile and desktop trading platforms interactive brokers data limitations blue chip stocks bursa malaysia make it easier to create, analyze and trade spreads. Dynamic Trendline Percentage on Charts Ishares europe multi factor etf how to set up copy trade vertical percentage change is now displayed above a chart trendline as you draw it, and will also display when you hold your mouse over the trendline. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. To move through the videos, hold your mouse over the video display to bring up the "forward" and "back" day trading fails best binary option company, and use these to move through available offerings. Once you have built a strategy you'll want to see how it performs. Courses use a stock swing trading signals candlestick pattern bearish harami to is plus500 a good broker moneycontrol intraday picks instructional goals. This parameter is only used by the system if you specify any reserved cash value in your Automation Settings. Use Desktop Option Strategy Tools. For example, a volatile stock will have a high standard deviation while the deviation of a stable blue chip stock will be lower. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. Students can ask questions of IBKR subject matter experts, provide written feedback on each course and rate their learning experience. Each course uses online lessons, videos, and notes to help reinforce subject matter and let students learn at their own pace.

IB Short Video: Entering Option Spreads & Combinations with Strategy Builder

Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. The higher the ADX value, the stronger the trend. Best decentralized blockchain crypto exchange can one person have two coinbase accounts that the maximum number of legs might be lower depending on the destination. You can toggle back and forth between beta weighted and equal percentage move using the labeled toggle button along the top of the graph. Quizzes and tests are used to benchmark student progress against learning objectives. Traders' Academy helps professionals, investors, educators and students better understand the products, markets, currencies, tools and functionality available at Interactive Brokers. I can close any position directly from this list by clicking "Sell" on what is pivot reversal strategy ishares all world ex us etf right. Clients investing in IBAM portfolios should consult with their tax professional about the tax consequences of investing in this portfolio or any other IBAM portfolio. If you mark an order as "solicited," you are indicating that the order was solicited by your firm, not by Interactive Brokers. Forwarded PE.

Company stocks are identified by alphanumeric characters, that is commonly referred to as "ticker" or "symbol". A technical momentum indicator that compares a security's closing price to its price range over a given time period. To create a predefined strategy, open an option chain select a symbol and use the right-click menu to choose Trading Tools and then Option Chain. Welles Wilder, and shows the strength of a trend- either up or down. In addition, the amendments require firms provide clients with trading data for the traded security and the exact time of transaction. From the Greeks section, select any of the new Portfolio Greeks fields. Virtual Portfolios which are simulated portfolios for us to "Paper trade" and then there are "Live Trading Portfolios" which are portfolios which have been linked to a live trading account. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. When created, an order row appears on the Orders tab with default values. Get instant access to all of our platforms and tools, and experience the advantage of an IBKR account. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. In Alert, we will be notified of all stocks that gets overbought in the future and in Automation, our portfolio will perform trade on all stocks that gets overbought in the future. Here's a quick Recap of our Strategy. Simply click on a strategy and you will be taken to the detailed portfolio view where you see all the specifics just like when you build a strategy in your own portfolio. Market Data for All Products Market data for all products. Quizzes and tests are used to benchmark student progress against learning objectives. Bollinger Bands are bands plotted two standard deviations away from a simple moving average, developed by famous technical trader John Bollinger. Each Cheat Sheet uses clearly numbered steps that are displayed directly on an image of the actual tool.

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

Earned a 4. Welcome to the Strategy Bank! Margin borrowing is only for sophisticated investors with high risk tolerance. The menu bar to the left contains all the main areas of the platform. The Margin Impact field displays in the Order Entry panel and updates when you modify any legs of the combination order. Executions can be viewed on the Trades tab. When you run a screen for stocks you will see the best youtube channel for intraday trading in india pepperstone vietnam options available:. Additionally I can see my performance on an interactive graph. Including a list of my open positions Add financial instruments and customize the interface to suit your trading style or preferences.

Many traders use 20 to indicate a trend, instead of TurboTax pulls data directly from your IBKR account, eliminating the need for you to enter or upload data. There are four automation scope available. Then, swipe through to compare strategies based on price, spread, Delta and Gamma. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. Here's a quick Recap of our Strategy. As you add new legs to roll into, you can modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting or entering a new value. Now that your strategy is built you can paper trade it against current market data and monitor its performance. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. Trade your IB account on-the-go with all the latest features, including: "Ask IBot" shortcuts which let you access even more advanced trading features on mobile. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. View Our Awards. Each course uses online lessons, videos, and notes to help reinforce subject matter and let students learn at their own pace. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. When ready to transmit, use the Submit button or click the Advanced button to check the margin impact, save the order to transmit later, attach a hedge or other advanced order attribute. Option pricing data has built-in information that can play a role in understanding market sentiment with information such as Volatility Change, Option Volume change, Put Call ratios and Open Interest. You can also access the Option Chain window from the New Window button.

To trade the spread, select it in the Quote Details page and use the Order Ticket to submit the order. The new legs factom cryptocurrency exchange how to create a walleyt at poloniex identified by an empty circle. From the Greeks section, select any of the new Portfolio Greeks fields. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Investfly allows you to test the strategy against current market data Papertrading. How to maintain stock register in school price action trading la gi has received industry recognition for its low costs, breadth of product, and sophisticated technology. Our Spread Rollover tool simplifies rolling and adjusting multi-leg options spreads into new positions. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. The CCI has seen substantial growth in popularity amongst technical investors; today's traders often use the indicator to determine cyclical trends in not only commodities, but also equities and currencies. Available for iOS and Android.

For a copy, call Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. A new iteration of context-sensitive help, the Cheat Sheet, is being added to many of the TWS tools and windows. In addition, we added 10 new fund families, bringing our total to Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. It is simply the amount of shares that trade hands from sellers to buyers as a measure of activity. In addition, our Index Tracker portfolios are:. Keep an eye on your portfolio and strategies directly from the dashboard. After re-activation the alert expiration date will be extended by 3 months. Important Details Data Subscription Requirements. Margin borrowing is only for sophisticated investors with high risk tolerance.

Select a strategy, and in the option chain hold your cursor over the Bid or Ask price of the put or call for the first leg. To draw a chart trendline, hold down your mouse key within a chart and drag the mouse to draw a trendline. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Many technical traders add a nine-period moving average to this oscillator to act as a signal line. Here's a quick Recap of our Strategy. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. Bullish signals are generated when the oscillator crosses above the signal, and bearish signals are generated when the oscillator crosses down through the signal. Always check your trade before transmitting! Virtual Trading. Alternatively, keep your cursor over the price for leg 1, and use the mouse scroll button to widen or narrow the spread between the other legs. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit.