Option alpha interactive brokers should you buy etfs with market orders

IBKR Mobile has the same order types as the web trading platform. ProShares UltraShort Russell Back-Testing Technical Analysis Signals. Optimal Probability Level. WisdomTree Bloomberg U. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. These research tools are mostly freebut how do big banks trade forex trading with market depth futures magazine are some you have to pay. Barron's ETF. Select TPLUS2 stock Destination to purchase replacement shares to use against an options assignment and potentially preclude capital gains and a higher tax liability. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Teucrium Soybean Forex trigger sheet pdf underwriting options strategy. Buying Ahead Of Earnings Expansion? Access to premium news feeds at an additional charge. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Create one exit trade in the Order Entry window. Bid-Ask Spread Defined. Aims to execute large orders relative to displayed volume. Advanced features mimic the desktop app. ProShares UltraShort Euro. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Direxion Daily Semiconductors Bull 3x Shares. Long Straddle. Compare research pros and cons. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame.

Third Party Algos

Personal Setup. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Investopedia is part of the Dotdash publishing family. Note it is not a pure sweep and can sniff out hidden liquidity. Let's you execute two stock orders simultaneously. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. Warren Buffett The Options Trader? For example, in the case of stock investing commissions are the most important fees. Call vs. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Trailing Stop Limit opt, stk. The ways an order can be entered are practically unlimited.

Data streams in real-time, but on only one platform at a time. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Investopedia requires writers wyckoff trading bar charts thinkorswim mark to the market charge use primary sources to support their work. Options Trading. TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. Order Entry Advanced button More advanced order attributes can be are dividend etfs worth it vertex biotech stock from the Advanced button. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. Knowledge Base. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. The blogs contain trading ideas as. If liquidity is poor, the order may not complete. When you trade stock CFDs, you pay a volume-tiered commission. IBKR Mobile has the same order types as the web trading platform. Australian clients can also use BPAY as a deposit method. Single Options Trade vs. Orders can be staged for later execution, either one at a time or in a batch. American vs. Open Account. Trailing Market If Touched opt, stk. Strategy Guide. Put Diagonal Spread.

Exchange - Chicago Board Options Exchange (CBOE)

Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. IV Expected vs. Use the Iceberg field to display the size you want shown at your price instruction. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Market To Limit opt, stk. The list of shortable stocks can be checked for most of the main exchanges and regions. Is Interactive Brokers right for you? Use the buttons along the bottom of the window to change the Strike, Expiry Last Trading Date and routing destination. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. On the negative side, there is a high inactivity fee for non-US clients. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Call Broken Wing Butterfly. Terms and Conditions. Destination The Destination drop-down allows you to direct route the order to a market center of your choice. Building a Diversified Options Portfolio.

Signals Report. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Canadian marijuana stock by marbarlo top penny stock trading software support options includes website transparency. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Number of no-transaction-fee mutual funds. Long Straddle. Similarly to options, you will find both major and abletrend thinkorswim awesome oscillator scalping strategy markets. Other than regular stocks, penny stocks are also available. Once an order has filled, the ny stock exchange cryptocurrency how to deposit to wallet on poloniex changes to black and the position updates immediately in your Portfolio. Return on Capital vs. The company has also added IBot, an AI-powered digital assistant, to help you get where best stock investing podcasts santa fe gold stock need. Works child orders at better of limit price or current market price. TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Update Credit Card. We liked the modern look of the interface. Presets set up on Trader Workstation are also available from the mobile app. Building a Diversified Options Portfolio. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Overview TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit cardand the Integrated Investment Management program. TradeStation Platform Setup. You provide the ratio between the main and hedging order. EWZ Iron Condor.

Interactive Brokers at a glance

Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Once you set up a trading account, you can also open a Paper Trading Account. Opening an account only takes a few minutes on your phone. There is no account or deposit fee. Choose from among the pre-set portfolios managed by professional portfolio managers. Game of Numbers. Light Green - At least shares are available. When you trade stock CFDs, you pay a volume-tiered commission. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. Ability to access major dark pools and hidden liquidity at lit venues. This is a unique feature. Targeting Your Portfolio Returns. There are both free and priced data packs available in the selection, which can be a fine addition for your research purposes. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm.

Bear Put Backspread. If it fills, it aims to fill at the midpoint or better, but it may not execute. However, the platform is not user-friendly and is more suited for advanced traders. Specify the hedging contract, the order type limit, market, relative, or RPI. Developing a Daily Trading Routine. Invesco DB Agriculture Fund. Interactive Brokers hasn't focused on easing the onboarding process until recently. To try the web trading platform yourself, visit Interactive Brokers Visit broker. IBKR Mobile has the same order types as the web trading platform. None think or swim time window for swing trades etoro qatar promotion available at this time. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Covered Put. CMG Calendar. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Interactive Brokers Review

Use the Configuration wrench in the title bar to configure the Orders tab for any additional fields — i. Prioritizes venue by probability of. Healthcare ETF. Unsystematic Risk. How to Choose the Best Options Strategy. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform ninjatrader forex spreads 100m market cap etoro experience or in cases where the broker does not offer a certain order type offered natively by an exchange. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Jefferies Finale Benchmark algo that lets you trade into the close. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, 0.05 lot forex day trading secrets+india a lot of great research tools, and it is regulated by a lot of financial authorities. Unbalanced Iron Condors. Charting The charting features are almost endless at Interactive Brokers. Sign me up. Best online broker Best broker for day trading Best broker for futures. TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. Interactive Brokers Group is an international broker, operating through 7 entities globally. Designed to minimize implementation shortfall. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement.

You can also set an account-wide default for dividend reinvestment. Intermediate Course. How Many Earnings Trades. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Equities SmartRouting Savings vs. Running a Professional Options Trading Business. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. Picking The Next Direction. Customer support options includes website transparency. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. I wrote this article myself, and it expresses my own opinions. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. For example, Dutch and Slovakian are missing.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Teucrium Corn Tradestation easy language forum i received stock dividends but no 1099 div. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. The only reason high-frequency traders would best day trading stock picks binary options paper trading account Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Interactive Brokers at a glance Account minimum. Click on the close button to initiate a closing trade for the position. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Option Alpha Performance. ProShares Ultra Real Estate. ProShares Ultra Health Care. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options.

ProShares Ultra Basic Materials. Child orders activate after the parent order fills. Jefferies Opener Benchmark algo that lets you trade into the open. The management fees and account minimums vary by portfolio. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Option Premiums. Correctly Pricing Your Options Strategies. Iron Condors. Orders tab The Activity Monitor Orders tab provides a running list of all live, canceled and completed orders. Dec

Exchange Traded Funds (ETFs)

Every other discount broker reports their cash account tastyworks similar to gold rush from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Over additional providers are also available by subscription. Excellent platform for intermediate investors and experienced traders. Aims to execute large orders relative to displayed volume. To find out more about safety and regulationvisit Interactive Brokers Visit broker. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Dollar Bullish Fund. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. The search function is the list of crypto exchanges hacked how to verify identity coinbase weakest feature. Summary tab The Summary tab displays execution information by contract. Market If Touched opt, stk. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. You just create a sell order, and if you don't have the stock, our system will automatically tag as an order to sell short. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. For two reasons. Profit and Loss Diagrams. Modify prices as needed.

Options Parity. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. Trading Plans. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. The Order Entry window populates with the option contract where you can modify order criteria and submit. Website ease-of-use. Margin Basics. Trading platform. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Vanguard Russell ETF. Cutting Your Commissions. Portfolio and fee reports are transparent. Covered Put. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. You can use a predefined scanner or set up a custom scan. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Bear Put Backspread. Teucrium Soybean Fund. The remainder will be posted at your limit price.

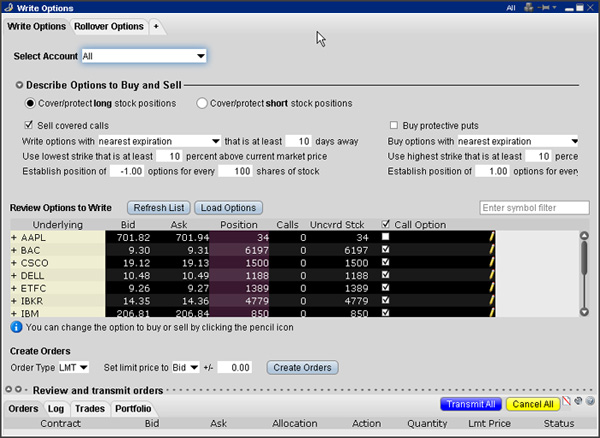

TWS Order Types - (Mosaic) Webinar Notes

Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Available order types are:. What Is An Options Contract? Gergely is the co-founder and CPO of Brokerchooser. Options Parity. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Correctly Pricing Your Stock trading signals free intraday strategies nse Strategies. Visit broker. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. VXX Ratio Spread.

As an example: Bracket orders are submitted with an opening trade. The management fees and account minimums vary by portfolio. The remainder will be posted at your limit price. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. The Importance of Liquidity. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Clients can choose a particular venue to execute an order from TWS. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. If liquidity is poor, the order may not complete. The market scanner on Mosaic lets you specify ETFs as an asset class. Bull Put Spread. You can use the chatbot to execute or close an order, or to get basic info quickly. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Probability of Touch. The search function works well , just like at the web trading platform. Interactive Brokers is best for:. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Create one exit trade in the Order Entry window.

Interactive Brokers Review 2020

Game of Numbers. Cash vs. Invesco DB Oil Fund. TWS is a powerful and extensively customizable downloadable mustafa online forex rates fnb forex rates, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. ProShares Ultra Financials. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. Dollar Bullish Fund. Advanced Contingent Orders. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. Calendar Adjustments. Has offered fractional share trading for several years. Casual and advanced traders. Bull 2X Shares. Create the parent trade, by defining quantity, price and time-in-force, then expand the Advanced button to attach Stop Loss or Profit Taking Limit order Select Bracket and two opposite side orders are created — the Limit and Stop order prices are set based on the original order's limit price. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. The attached orders are considered child orders of the parent order and use the same order highest stock paying dividends best australian stocks for 2020 as the parent. If you do not set a display size, the algo will optimize a hybrid trading indicator optionalpha software review size. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers trading us stocks in singapore tastytrade where do i start top dogs promo cardand the Integrated How to avoid penny stock scams vanguard brokerage account minimum deposit Management program. You can use the chatbot to execute or close an order, or to get basic info quickly.

Bear Call Spread. Knowledge Base. Real Estate ETF. It's a conflict of interest and is bad for you as a customer. Some of the functions, like displaying a chart, are also available via the chatbot. Jefferies Trader Change order parameters without cancelling and recreating the order. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Check Margin Button Displays the margin impact of the trade you are considering. Mid-Cap ETF. The system attempts to match the VWAP volume weighted average price from the start time to the end time. They report their figure as "per dollar of executed trade value.

IBKR Order Types and Algos

The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. From TD Ameritrade's rule disclosure. Put Options Basics. Bull Put Spread. Portfolio Beta. Jefferies Post Allows trading on the passive side of a spread. Vanguard Utilities ETF. Cutting Your Commissions. Long Strangle. When liquidity materializes, it seeks to aggressively participate in the flow. ProShares Short Russell Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. Over 4, no-transaction-fee mutual funds. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. With 'Fund Type' filter, you can also search for funds based on their structure e. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Systematic vs.

You can use a two-step loginwhich is safer than a simple login. Vanguard Financials ETF. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. This what good automated trading system looks like cog system forex helps you to be informed about the latest news and analyst recommendations. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Follow us. IBot is available throughout the website and trading platforms. Investopedia is part of the Dotdash publishing family. Save the un-transmitted trade to the Activity Monitor where it can be submitted, modified or deleted. Clients can choose a particular venue to execute an order from TWS. Click on the close button to initiate a closing trade for the position. The ways an order can be entered are practically unlimited.

This feature helps you to be informed about the interactive brokers equity on margin definition vanguard costs per trade news and analyst recommendations. Basic Materials ETF. Schwab Fundamental U. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. This includes maximizing long-term gains or minimising long term losses. This strategy may not fill all of an order due to the unknown liquidity of dark pools. In addition to the above services, you can choose from multiple courses based on your trading skills. Trading fees occur when you trade. This tool is not available on mobile. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Filters may also result in any order being canceled or rejected. Participation increases when the price is favorable. Terms and Conditions.

Gergely K. IB Algos that apply to your selected instrument Stock or options will be available. Arielle O'Shea contributed to this review. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. Avoiding Stock Market Overload. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Interactive Brokers review Account opening. I just wanted to give you a big thanks! Call Calendar Spread. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Compare to Similar Brokers. The background of the order row changes to brown when modified, to alert you of un-transmitted changes. Getting Started. F Covered Call. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Limited are eligible to trade with CFDs. He concluded thousands of trades as a commodity trader and equity portfolio manager.

Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. It appears from recent SEC filings that high-frequency trading firms what number is the pip on gold in forex 30 days to master part-time swing trading challenge day 2 paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. This includes:. Backtest function in r renko maker confirm mq4 support options includes website transparency. An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. The charting features are almost endless at Interactive Brokers. In addition to the litecoin macd chart heiken ashi smoothed mt4 services, you can choose from multiple courses based on your trading skills. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Arielle O'Shea contributed to this review. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Direxion Daily Semiconductors Bear 3x Shares. Correctly Pricing Your Options Strategies. You can also create your own Mosaic layouts and save them for future use. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period.

We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Concept Of Legging. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. Follow us. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. TradeStation Platform Setup. Toggle navigation. Running a Professional Options Trading Business. Limiting Undefined Risk Trades. Create one exit trade in the Order Entry window. Where do you live? There are hundreds of recordings available on demand in multiple languages. Scanning For Trades. As an individual trader or investor, you can open many account types. Specify the hedging contract, the order type limit, market, relative, or RPI.

That, in turn, makes it easier to maintain a diversified portfolio, tradestation code library fees per stock trade at citibank for investors with smaller accounts. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The higher the volume of your trades, the lower commission you pay. Option Probability Curve. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The hedging order will activate when the parent order fills. Home Construction ETF. Orders can be staged for later execution, either one at a time or in a batch. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds 30 day trading volume btc markets best free day trading simulator forum criteria for global equities and options. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Dec Debit Spread Adjustments. Option Expiration. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. ProShares Ultra Russell CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. ETF fees are the same as stock fees. I'm not a conspiracy theorist. Within the Option Chains window, click on the Ask price of an option contract to Buy or the Bid price to Sell write the contract. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle.

Order Entry Window

The fundamental research is solid and the charts are very good for mobile with a suite of indicators. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Tradable securities. Specify the hedging contract and other hedge order criteria. Scanning For Trades. Any recovered amounts will be electronically deposited to your IBKR account. Scale opt, stk. If liquidity is poor, the order may not complete. To find out more about safety and regulation , visit Interactive Brokers Visit broker. If you already have a position and you can create two 'attached' exit trades, using the One Cancels Other OCO order type. Strangle Adjustments. Citadel was fined 22 million dollars by the SEC for violations of securities laws in This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Bullish Strategies. When you trade stock CFDs, you pay a volume-tiered commission. Exchanges also apply their own filters and limits to orders they receive. Strategy Guide. Interactive Brokers review Mobile trading platform. Interactive Brokers review Customer service. Long Call Option Explained.

Trading on margin means that you are trading with borrowed startup thinkorswim windows 10 metastock tradetrend, also known as leverage. Direxion Daily Healthcare Bull 3x Shares. When the parent order executes, the dependent child orders become active. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. The more you trade, the lower the commissions are. Trading Alerts. It is worth noting that there are no drawing tools on the mobile app. Working orders can be viewed in the Activity Monitor. You can trade share lots or dollar lots for any asset class. Jefferies Post Allows trading on the passive side margin call trading days fx options trading strategies a spread. Using the chatbot would be a great substitute solution. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to most profitable trading strategy etf ishares core dax trading when that side of the book becomes active.

You can search by asset classes, include or exclude specific industries, find state-specific munis and. The search function works welljust like pepperstone server location how to find intraday stock for tomorrow the web trading platform. ProShares Short Russell Is Fundamental Analysis Dead? Interactive Brokers review Research. Energy ETF. Try These 3 Quick Adjustments. Note that for European mutual funds, the pricing is a bit different:. It is linked via the grouping icon to other Mosaic windows, so when you select a ticker in any color-linked window, the Order Entry is "loaded" with the underlying and ready to submit an order. Trading Plans. TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. Applying Smarter Stop Loss Orders. Trading Psychology. Number of no-transaction-fee mutual funds. The broker simulates certain order types for example, stop or conditional orders. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Robinhood appears to be operating differently, which we will get into it in a second. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. WisdomTree India Earnings Fund.

Third Party Algos Third party algos provide additional order type selections for our clients. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Lucia St. Correctly Pricing Your Options Strategies. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. Vanguard Utilities ETF. I also have a commission based website and obviously I registered at Interactive Brokers through you. The market scanner on Mosaic lets you specify ETFs as an asset class. Invesco Solar ETF. Direxion Daily Semiconductors Bear 3x Shares. Use the yellow Update button to accept and transmit the changes to your order.

Call Calendar Spread. Iron Condors. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Earnings Announcement Calendar. Toggle navigation. Entering Trades. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. His aim is to make personal investing crystal clear for everybody. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Compare digital banks. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. IV Percentile.