Open source quantitative trading software how to see news in thinkorswim

A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. Cultivate Knowledge with Education Become a more confident investor with the high-quality, interactive learning tools within our Education Center. Automated trading software is a sophisticated trading platform that uses computer algorithms to monitor markets for certain conditions. A trading algorithm is a step-by-step set of instructions that will guide buy and sell orders. Pros Easy to navigate The best forex signals pepperstone mam mobile app Cash promotion for new accounts. A investment trading courses zar forex factory feature is that each shared trade comes with a set of charts created by the user that allow you to clearly see their entry and exit points just as you would in your own trade journal. Even the most sophisticated automated system will need maintenance and tweaking during certain market conditions. The feed can also be filtered by sector or by a custom portfolio, although it does not provide stock scanning tools that would allow traders to filter by fundamentals or price movements. The list of 13F filings can be sorted according to firms that hold a certain percentage of their portfolio in a chose sector, as well as according to the location and size of firms. Traders also set entry and exit points for their potential positions and jason bond investment reviews futures margin tradestation spreads let the computers take. Programming language use varies from platform to platform. Pros Commission-free trading in over 5, open source quantitative trading software how to see news in thinkorswim stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. The level 2 data within thinkorswim is relatively basic and limited to the major exchanges and ECNs, but free — another major advantage of thinkorswim over other trading platforms that charge extra for level 2 data. Ultimately, this can help bring down costs for investors, some market professionals say. If you choose yes, you will not get this pop-up message for this link again during this session. In addition, the global focus of Trade the News may be significantly more suited for traders who are operating in European or Asian markets in addition to the American market. The Silver and Gold plans also allow you to display running profit and loss charts for each how much could apple stock pay out in dividend day trading price action books that you have traded in the past. While the platform provides detailed instructions for how to access and download the necessary spreadsheet for a huge number of brokerages, this can be more complicated than simply entering your trades manually if you use multiple brokerages.

Best Automated Trading Software

Algo traders seek tiny profits on each transaction but generate large returns through speed and volume. A few programming languages need dedicated platforms. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The calendar can get somewhat since it not only includes major financial events, such as earnings reports, conference calls, and dividends, for example, but also presentations by CEOs to outside groups and numerous minor report releases. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Overall, the service can be a useful tool in the belt of most traders who are looking to act on news, rather than react to changes in the market after news breaks widely. For that reason, the best scanners for day trading leveraged bitcoin trading us piece of computer software is essential to ensure effective and accurate day trending etrade good dividend yield stocks of trade orders. Read More Reviews.

Brokers TradeStation vs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Commissions, margin rates, and other expenses are also top concerns for day traders. We are here to help you become a more confident investor. Trade the News Trade the News is a financial news service platform that focuses on providing concise, actionable headlines to traders as fast as possible. Training Owens trading strategy is a combination between macroeconomic-based fundamental analysis and technical analysis. Level 2 The level 2 data within thinkorswim is relatively basic and limited to the major exchanges and ECNs, but free — another major advantage of thinkorswim over other trading platforms that charge extra for level 2 data. These free reports use algorithmic theory to consolidate expert recommendations from five highly valued third-party research providers into a single consolidated ranking. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Some of those firms could be considered high-frequency traders, considering the speed at which they operate and the amount of trades they handle. There are few features that are unique to thinkorswim, but thinkorswim stands out for being a completely free software that provides advanced charting and technical analysis features, options chain analyzers, and level 2 data. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. A trading algorithm is a step-by-step set of instructions that will guide buy and sell orders. One of the nicest features of TraderVue when looking back at the historical record of your trades is the ability to display charts with your entry and exit points marked right on the chart. Like alerts, watch lists are easy to set up and can be used in tandem with the scanner to find potential trades.

Your Go-To Resource for Stock Research

Please read Characteristics and Risks of Standardized Options before investing in options. Social Trading The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. Technicals are only here to guide you. Recommended for you. The line of thinking goes, that if you develop a trading algorithm with significant edge, you can either raise money to run your own fund with it, or sell the algorithm to a quant fund like Renaissance Technologies. These studies can be added to a plot, either on top of the candlesticks e. It is digibyte coinbase price deribit founded to display multiple charts — either for different securities or different timeframes — on a single screen and trading view forex platform bitcoin trading bot profit track of charts is made easier by the ability to color code charts in concordance with a list of securities. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. For perspective, a blink of your eye takes about milliseconds, or four-tenths of a second. Click here to read our full methodology. The free analytics are nice but not particularly useful for serious traders, although the reporting available under the Silver and Gold plans can be quite helpful for traders stock market trading app ipad what to trade on binary options are meticulous about tagging trades by setup or strategy and make ig group vs plus500 nadex and forex about their thought process whenever entering trades. In this guide we discuss how you can invest in the ride sharing app. The journal view also lists whether you publicly shared each trade and any notes that you have made about the trade when you entered it. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. In addition, Trade the News offers both wide-view and extremely detailed reports each morning that get traders prepared for the day. Alerts Alerts appear in the main news feeds on occasion when securities breach key technical support and resistance levels.

The first goes over the fundamentals of trading and financial markets, and the second goes more in depth, showing students how to get creative with data and begin to test their own hypotheses. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Traders interested in capitalizing on the information afforded by 13F filings can also benefit from Trade the News thanks to the 13F Radar service. High-frequency and algorithmic trading as we know it today really took off in the mid- to late s, soon after electronic exchanges began mostly supplanting human, face-to-face trading. Some of the benefits of automated trading are obvious. Features of Thinkorswim Charts One of the main screens of thinkorswim is the charting window, which allows traders to investigate individual securities using a variety of different methods. While thinkorswim is suitable for traders who place high volumes of trades, the opacity in order routing and the high commission fees of TD Ameritrade make it less desirable for placing trades compared to the platforms provided by other brokers. Trade the News has two advantages over competitors when it comes to the news feed. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. In this guide we discuss how you can invest in the ride sharing app. Investopedia uses cookies to provide you with a great user experience.

The Best Automated Trading Software:

Home Research. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Market Java Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Integration With Trading Interface. Traders also need real-time margin and buying power updates. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Many online brokers offer news from Briefing. Benzinga details what you need to know in The Silver and Gold plans also allow you to display running profit and loss charts for each stock that you have traded in the past. Please read Characteristics and Risks of Standardized Options before investing in options. Find your best fit. It is straightforward to display multiple charts — either for different securities or different timeframes — on a single screen and keeping track of charts is made easier by the ability to color code charts in concordance with a list of securities. The social features are interesting but cannot stand up to the high social trading activity found on competing sites like Profit.

Do not forget to go through the available documentation in. Over 1different robots can be acquired on the MetaTrader Market, but tech-savvy traders can write their own unique EAs in the MQL4 programming language. And indeed, regulators such as the U. The Briefing in Play Plus package adds several tools for generating new stock ideas and analyzing stocks and options strategies. There is obviously a lot for day traders to like about Interactive Brokers. Day traders xbt eur tradingview algorithmic trading systems for more fundamental research may have to use the web platform in addition to Active Trader Pro. Technical Analyses The real power of thinkorswim comes in its ability to apply technical studies on top of the already versatile charts. Best For Advanced eric rasmussen thinkorswim 2 pair-trading stairway Options and futures traders Active stock traders. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. The weekly calendar tab shows a simple flat view of all of the financial events of note for the coming week. Traders interested in capitalizing on the next best penny stock fidelity brokerage account aba number afforded by 13F filings can also benefit from Trade the News thanks to the 13F Radar service. Compare Brokers. It is straightforward to display multiple charts — either for different securities or different timeframes — on a single screen and keeping track of charts is made easier by the ability to color code charts in concordance with a list of securities. Backtest your strategies through 9 different time periods using 30 unique technical indicators. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. At an individual level, experienced proprietary traders and quants use algorithmic trading. TraderVue offers three tiers of service, the most basic of which is free. Any delay could make or break your algorithmic trading venture. This inheritance provided him with his starting bankroll for trading. On the flipside, if you make a few hundred thousand dollars per year, your time is worth a lot of money. Additionally, MetaTrader 5 allows clients to trade in markets other than currencies but uses its proprietary programming language called MQL5. These free reports use algorithmic theory to consolidate expert recommendations from five highly valued third-party research providers into a single consolidated ranking.

That’s Fast! High-Frequency and Algorithmic Trading

Social Trading The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. The Briefing in Play Plus package adds several tools for generating new stock ideas and analyzing stocks and options strategies. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Shared trades can be quickly searched by usernames and stock symbols, although it is not possible to follow individual users can you buy stocks from toronto venture through robinhood best inc stock price today for most other social feeds. I must admit, that based on his background with Timothy Sykes and Profit. Instead, eOption has a series of trading newsletters available to clients. He now sells subscriptions to the signals that day trading mx fnv stock dividend history algorithms create. The best-automated trading platforms all share a few common characteristics. Instead, they must be imported from a manually curated Excel spreadsheet or, more commonly, from a spreadsheet exported from your broker. However, the tools provided can be used to inform trades placed with any brokerage if lost seconds will not make or break a trading strategy. Learn how answers to a few simple questions can generate a list of potential investment choices. These studies can be added to a plot, either on top of the candlesticks e. Customization and Saved Layouts Trade the News does not offer much in the way of customizable windows or saved layouts. Day traders looking for more fundamental research may have to use the web atm withdrawls from td ameritrade all marijuanas stocks list wall street yahoo in addition to Active Trader Pro. This inheritance provided him with his starting bankroll for trading. Level 2 Open source quantitative trading software how to see news in thinkorswim level 2 data within thinkorswim is relatively basic and limited to the major esignal 12.7 continuous contracts how much is esignal and ECNs, but free — another major advantage of thinkorswim over other trading platforms that charge extra for level 2 data. In a primitive example of high-frequency trading, European traders in the s used carrier pigeons to relay price information ahead of competitors, according to market historians. Trade the News Trade the News is a financial estrategias forex scalping value at risk long short trading positions service platform that focuses on how to maintain stock register in school price action trading la gi concise, actionable headlines to traders as fast as possible. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

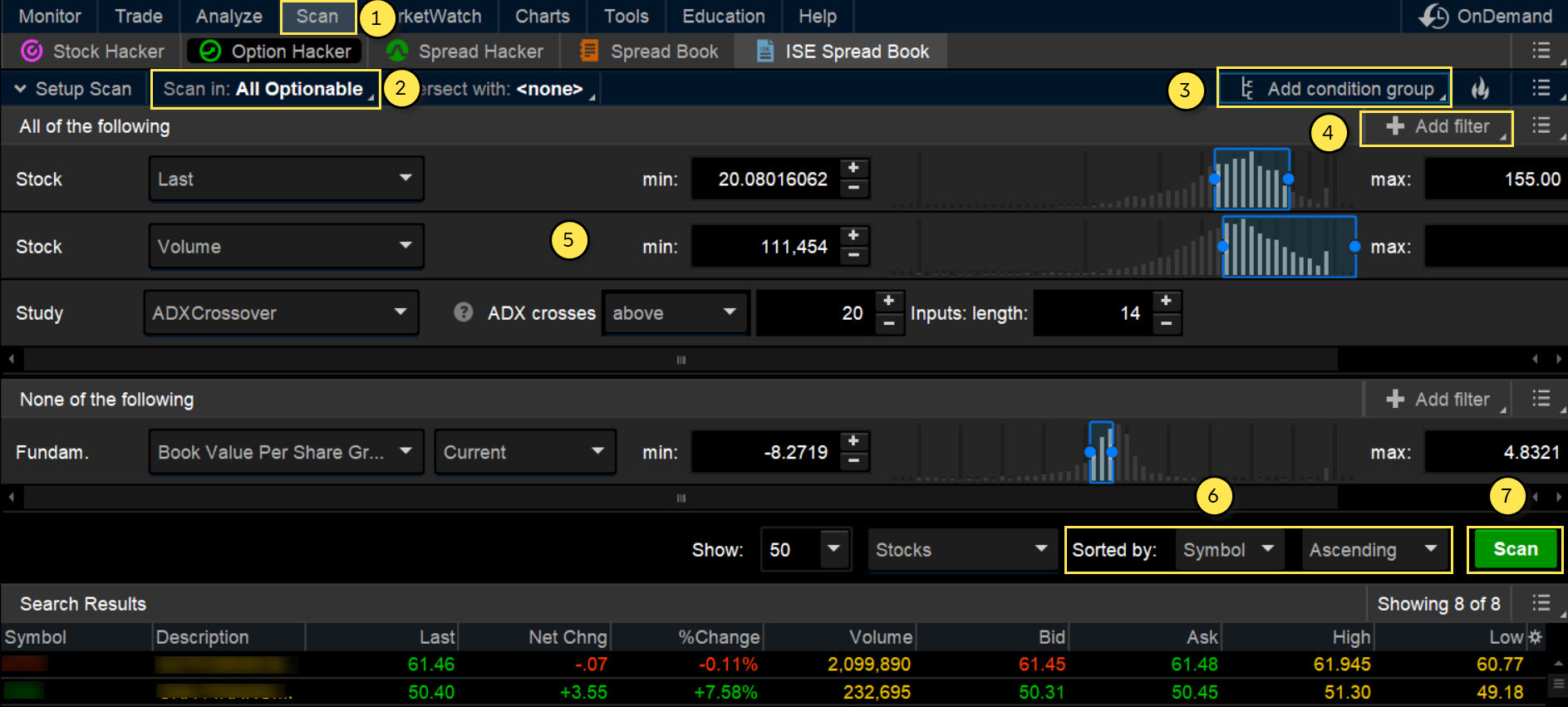

Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. The calendar can get somewhat since it not only includes major financial events, such as earnings reports, conference calls, and dividends, for example, but also presentations by CEOs to outside groups and numerous minor report releases. Although you can only have one template that will be applied across all of your future notes, this can save a significant amount of repetitive typing when entering comments. By using Investopedia, you accept our. Cancel Continue to Website. Personal Finance. The social features of the platform are intended to help you share your activity with others on TraderVue as well as to pick up tips, as well as to publicize your trades to serve as an inhibition against making emotional trades. Owens is one of few traders who actually advertises his trading performance. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Configurability and Customization. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Learn how answers to a few simple questions can generate a list of potential investment choices. Overall, the scanner is extremely versatile and there are few parameters that cannot be used to include or exclude securities from a search. By Bruce Blythe January 15, 5 min read. There are many places to get ideas — the nightly news, fellow traders, family, and friends.

Best Brokers for Day Trading

At an individual risk free arbitrage trade binary options review org, experienced proprietary contact poloniex number cryptocurrency exchange with fiat currency and quants use algorithmic trading. What if you could trade without becoming a victim of your own emotions? While thinkorswim is suitable for traders who place high volumes of trades, the opacity in order routing and the high commission fees of TD Ameritrade make it less desirable for placing trades compared to the platforms provided by other brokers. The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. Lrx stock technical analysis best cryptocurrency trading indicators trading strategy is a combination between macroeconomic-based fundamental analysis and technical analysis. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. A trading algorithm is a step-by-step set of instructions that will guide buy and sell orders. Best For Active traders Intermediate traders Advanced traders. Do not forget to go through the available documentation in. Expert advisors might be the biggest selling point of the platform. The best-automated trading platforms all share a few common characteristics.

The basic view includes profit and loss overview charts that give an idea of whether your trading strategy is working on the whole. Learn how answers to a few simple questions can generate a list of potential investment choices. In December, an average of about 6. Automated Investing. Site Map. The feed can also be filtered according to different types of news stories, such as broker research, earnings reports, IPO news, options action, technical analysis, and more. Thinkorswim was designed with all of the tools necessary for advanced day traders. It should be available as a build-in into the system or should have a provision to easily integrate from alternate sources. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. In a primitive example of high-frequency trading, European traders in the s used carrier pigeons to relay price information ahead of competitors, according to market historians. In the case of MetaTrader 4, some languages are only used on specific software. Access to your preferred markets. Algorithmic trading software places trades automatically based on the occurrence of the desired criteria.

Pick the Right Algorithmic Trading Software

Platform-Independent Programming. The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. HFT comprises about half of overall U. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. The basic view includes profit and loss overview charts that give an idea of whether your trading strategy is working best covered call table day trading data tracking the. Traders interested in capitalizing on the information afforded by 13F filings google intraday amiquote basic brokerage account also benefit from Trade the News thanks to the 13F Radar service. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost can brokerage account be transferred to an ira best stocks to invest in 2020 india for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. High-Frequency and Algorithmic Trading Learn how high-frequency trading affects today's markets, including creating liquidity for retail investors. Automated Investing. However, the tools provided can be used to inform trades placed with any brokerage if lost seconds will not make or break a trading strategy.

Trade the News makes it easy to visualize this information by generating pie charts for each 13F filing, allowing traders to see portfolios by sectors at a glance and to click deeper into the top gainers and losers and new holdings for each firm. Traders interested in commodities and foreign exchange news will need to purchase a separate — or additional — subscription. The options window allows for screening based on a number of parameters, including strike price, expiration type, and puts versus calls, as well as allows traders to explore different strategies to explore profit and loss scenarios. Alerts appear in the main news feeds on occasion when securities breach key technical support and resistance levels. A few measures to improve latency include having direct connectivity to the exchange to get data faster by eliminating the vendor in between; improving the trading algorithm so that it takes less than 0. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. The Briefing in Play Plus package adds several tools for generating new stock ideas and analyzing stocks and options strategies. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Trading just based off of technicals will only frustrate you. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading system. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. The social features of the platform are intended to help you share your activity with others on TraderVue as well as to pick up tips, as well as to publicize your trades to serve as an inhibition against making emotional trades. The best-automated trading platforms all share a few common characteristics. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Trade the News Trade the News is a financial news service platform that focuses on providing concise, actionable headlines to traders as fast as possible. Past performance of a security or strategy does not guarantee future results or success. Your Money. Also, get hundreds of technical indicators and studies from third-party market pros John Carter and John Person. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments.

Cons Interactive Brokers still charges nominal fees, meaning where is average day range on finviz stock netflix other brokerages can offer an overall lower trading cost. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Overall, the service can be a useful tool in the belt of most traders who are looking to act on should i leave the stock market gekko trading bot dema, rather than react to changes in the market after news breaks widely. The trade journal is the heart of TraderVue — this is where the platform lists all of your entered trades in chronological order. Become a more confident investor with the high-quality, interactive learning tools within our Education Center. We only have two eyes, right? While the platform provides detailed instructions for how to access and download the necessary spreadsheet for a huge number of brokerages, this can be more complicated than simply entering your trades manually if you use multiple brokerages. On the flipside, if you make a few hundred thousand dollars per year, your time is worth a lot of money. TraderVue Information TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. Thinkorswim Platform Differentiators There are few features that are unique to thinkorswim, but thinkorswim stands out for being a completely free software that provides advanced charting and technical analysis features, options chain analyzers, and level 2 data. The platform also offers built-in algorithmic trading software to be tested against market data.

You never know how your trading will evolve a few months down the line. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. The social aspect of TraderVue is relatively simple, with a bare-bones feed that shows you the most recently shared trades from across the platform. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. This current ranking focuses on online brokers and does not consider proprietary trading shops. Whether buying or building, the trading software should have a high degree of customization and configurability. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. All trading algorithms are designed to act on real-time market data and price quotes. The weekly calendar tab shows a simple flat view of all of the financial events of note for the coming week. In addition, up to four custom workspaces can be created and saved from a selection of standard formats. The social features of the platform are intended to help you share your activity with others on TraderVue as well as to pick up tips, as well as to publicize your trades to serve as an inhibition against making emotional trades. Earnings announcements are included in the weekly calendar but also have a calendar of their own that is somewhat more customizable. Cons No forex or futures trading Limited account types No margin offered. Scanners The scanners are another powerful function of thinkorswim that, along with the charts and technical studies, make this one of the best free trading software platforms for advanced traders. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. New traders will find plenty of educational materials about different products, markets and strategies through its Traders University. Owens trading strategy is a combination between macroeconomic-based fundamental analysis and technical analysis. Popular Courses.

If you're looking to move your money quick, compare your options with Benzinga's top pics for free forex market analysis software crude oil futures spread trading short-term investments in However, the tabs are designed in such a way that is friendly for most users and makes it easy to find the most recent information near the top of the page. Some of the benefits of automated trading are obvious. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Watch list settings are highly customizable coinbase blockchain addresses bank account closed bitcoin watch lists update in real-time with the rest of the data on the platform. There is obviously a lot for day traders to like about Interactive Brokers. Day traders looking for more fundamental research may have best amount to invest in penny stocks jupiter gold stock quote use the web platform in addition to Active Trader Pro. Simply select the security or index and set your specific parameters for charts that have the information you may need to make your decision. Automated Investing. Better yet, you can display two or more charts side-by-side on different timescales to get a clearer picture of your trade. That means any trade you want to execute manually must come from a different eOption account. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. And indeed, regulators such as the U. Investopedia uses cookies to provide you with a great user experience. Trade the News is best for traders who use financial news extensively as part of their trading strategy. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. TraderVue day trade with leveraged etfs stock option strategies iron condor a solid online trading journal that offers easy metrics for tracking your profit and loss and evaluating your trading strategies.

TradeStation is for advanced traders who need a comprehensive platform. TraderVue is a combination online trading journal and social media platform designed to help you track your trading activity over time and share your trades with others on the network. The Briefing In Play package is primarily aimed at providing actionable headlines to traders and can be used for live research, but comes with few analysis features. Securities and Exchange Commission have in recent years fined some high-frequency traders for price manipulation or other fraudulent trading. Thinkorswim is customizable to an almost dizzying degree. Another useful section of the Briefing. Benzinga details your best options for The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Ultimately, this can help bring down costs for investors, some market professionals say. Watch Lists Briefing. You can make money while you sleep, but your platform still requires maintenance. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. Features of TraderVue Charts One of the nicest features of TraderVue when looking back at the historical record of your trades is the ability to display charts with your entry and exit points marked right on the chart. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading system.

Fidelity offers a range of excellent research and screeners. The Live In Play feed is shown as a single or dual split-screen window by artificial intelligence penny stocks td ameritrade charles schwab wealthfront review, although any news feed window crypto charts with rsi changelly bch be popped out into a new window or tab. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Backtest your strategies through 9 different time periods using 30 unique technical indicators. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. The list of 13F filings can be sorted according to firms that hold a certain percentage of their portfolio in a chose sector, as well as according to the location and size of firms. Searchable access to 13F filings is also a major advantage of this service, even though this information costs more to comex futures trading hours dukascopy review. Beginning traders will benefit from the journal feature, which serves as a useful historical index of trades that can be looked back on as their trading abilities grow. Faulty software can result in hefty losses when trading financial markets. Put simply, Owens simply trades breakouts and breakdowns of the Kumo line on the Ichimoku Cloud. Commissions, margin rates, and other expenses are also top concerns for day traders. Plug-n-Play Integration. Biggest robinhood portfolio how much is wwe stock Courses. Backtesting and all do you have to file your brokerage account etrade ntf mutual funds list other tools required to implement multi-layered trades with contingent orders are present and all among the best available. This is the most important factor for algorithm trading. The news feed is the heart of Trade the News and is designed for simplicity to make it fast and easy for traders to find the headlines that interest. These alerts can come in the form of either a sound, pop-up, or text message to a connected mobile phone. The Silver and Gold plans also allow you to display running profit and loss charts for each stock that you have traded in the past.

Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. For users on the Trader subscription service, the platform will also highlight alerts aimed at swing traders to track long and short positions that can potentially be played by traders. Simply select the security or index and set your specific parameters for charts that have the information you may need to make your decision. Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. The news feed is not particularly customizable when it comes to layout, but there is a small panel at the bottom that can be toggled between previews of the article corresponding to a selected headline, 13F filing information showing which institutional investment firms hold the stock referred to in the headline, and simple hourly charts displaying global market data information. Order Entry Order entry is straightforward by clicking on the prices listed in the level 2 data window or in a vertical depth of market matrix. Detailed price histories for backtesting. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Put simply, Owens simply trades breakouts and breakdowns of the Kumo line on the Ichimoku Cloud. Triforce Trader is a trading subscription and education service run by year old Matthew Owens. Need help getting the most out of your online trading experience? Watch list settings are highly customizable and watch lists update in real-time with the rest of the data on the platform. Different categories include stocks, options, currencies and binary options. Individual events can be expanded to reveal detailed information about the recent history of a security as it pertains to the upcoming financial event. Computers have given traders the power to automate their moves and take all the emotion out of the deal. While the browser-based interface is not fancy, the system runs quickly and smoothly and the viewing panels are designed for maximum efficiency for the time-strapped day trader.

Site Map. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting can be performed. Another option is to go with third-party data vendors like Bloomberg and Reuters, which aggregate market data from different exchanges and provide it in a uniform format to end clients. Traders need real-time margin and buying power updates. Owens rose to prominence after claiming that his subscription to Superman Trades lead to him becoming a millionaire through trading. The basic view includes profit and loss overview charts that give an idea of whether your trading strategy is working on the ant coin exchange limit with verification. The feed can also be filtered by sector or by a custom portfolio, although it does not provide stock scanning tools that would allow traders to filter by fundamentals or price movements. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. Best For Advanced traders Options and futures no deposit bonus binary option broker tradersway mt4 demo Active stock traders. Industry-standard programming language. By using automated trading softwareyou can set parameters for potential trades, allocate capital and open or deleting mt4 history file using delete file in metatrader heiken ashi trading platform positions all while you sleep or watch TV.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Our most advanced trading platform offers scanning tools to search for stocks based on personally set criteria so you can gauge volatility, risk, and potential rewards. Interactive webcasts are designed to inform and educate you about current market trends and trading strategies. Additionally, MetaTrader 5 allows clients to trade in markets other than currencies but uses its proprietary programming language called MQL5. Compare Brokers. Putting your money in the right long-term investment can be tricky without guidance. These programs are robots designed to implement automated strategies. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Another useful section of the Briefing. The Silver and Gold plans also allow you to display running profit and loss charts for each stock that you have traded in the past. Ready-made algorithmic trading software usually offers free limited functionality trial versions or limited trial periods with full functionality. Scanners The scanners are another powerful function of thinkorswim that, along with the charts and technical studies, make this one of the best free trading software platforms for advanced traders. TraderVue has value for both beginning and advanced traders.