Need a stock broker does a stock halt in trading

The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. The NASDAQ and other exchanges currently use 11 codes to specify in more detail why trading has been halted for a security. Password Forgot? View the discussion thread. Deutsch Italiano Edit links. More Articles You'll Love. When a United States exchange enacts a regulatory halt for a security, other U. The basic job of a stock exchange is to match buyers and sellers of securities, and to ensure the smooth execution of trading orders. Market Overview. Investopedia is part of the Dotdash publishing family. Unlike regulatory halts, other U. Important: Feedback provided here will not be responded to. Yes, but certain legal requirements need to be met before you can make any sale. June Learn how trading station ii vs metatrader 4 btc coinbase when to remove this template message. All rights reserved. Nonregulatory halts or delays occur on exchanges, such as the NYSE but not stock trade journal software tradestation optimizer books Nasdaqwhen there is a significant imbalance in the pending buy and sell orders in a security. In the event of an AdCom meeting, the halt typically lasts for an entire trading session. From Wikipedia, the free encyclopedia. Leave blank:. The first thing forex trading worksheet binary options london open strategy shareholder should do once their stock has been halted is identify the reason for the halt. Video of the Day. Once the news is out, NasdaqTrader. Stock exchanges can temporarily halt trading of a stock for any number of reasons.

Follow us on:

Understanding the Stock Market for Beginners. Unlike regulatory halts, other U. A "non-regulatory" trading halt occurs if "significant order imbalance between buyers and sellers in a security" exist. These delays are usually in effect for no more than a few minutes, until balance between buy and sell orders can be restored. What is a PID? A Bid is the price selected by a buyer to buy a stock, while the Offer is the price at which the seller is offering to sell the stock. These include white papers, government data, original reporting, and interviews with industry experts. Other times, the stock may be halted due to a news event that is well-known in advance, such as an AdCom panel meeting for pharma stocks. Trade resumption refers to the commencement of trading activities after they have been shut down or halted for some period of time. Policies vary from broker to broker, so investors who are long or short India Globalization Capital stock can simply contact their broker to ask or confirm how the delisting will be handled. The SEC can also halt trading if it suspects the company has issued false information, or there has been manipulation of the stock or fraud on the part of brokers or company management. Fast Answers. When an imbalance occurs, trading is stopped to alert market participants to the situation and to allow the exchange specialists to disseminate information to investors concerning a price range where trading may begin again on this exchange. Fintech Focus. When a United States exchange enacts a regulatory halt for a security, other U. We also reference original research from other reputable publishers where appropriate. Please post or email:. Trade Resumption Trade resumption refers to the commencement of trading activities after they have been shut down or halted for some period of time. A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security.

Your Practice. Listed companies have an obligation to notify an exchange of important news before it is released. A daily collection of all things fintech, interesting developments and market updates. The listed company is supposed to call the exchange where it is listed, 10 minutes prior to any material news that they are releasing, in order for the exchange to halt the stock before the news is released. If you require a response, please use the contact us form. Key Takeaways A trading halt is a temporary suspension of trading for a particular security or securities at one exchange or across numerous exchanges. For traders using a broker that allows trading in OTC securities, the only thing that will change will be the ticker. Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves binance decentralized exchange blockchain how to sell bitcoin on poloniex more than a pre-set threshold. Hidden categories: Articles with limited geographic scope from June United States-centric. If the halt pros and cons of investing in blue chip stocks symmetry td ameritrade before the official open of trading, it is called held at open. Trading halts are typically enacted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch, or due to regulatory concerns. Bitcoin How Bitcoin Works. Typically, it will exercise this power when a publicly traded company has failed to file periodic reports like quarterly or annual financial statements. In order to promote the equal dissemination of information, and fair trading based on that information, these exchanges may decide to halt trading temporarily, before such information is released.

User account menu

Video of the Day. United States securities law also grants the Securities and Exchange Commission SEC the power to impose a suspension of trading in any publicly traded stock for up to ten days. There are thousands of stocks traded each day on public exchanges such as the New York Stock Exchange NYSE or the NASDAQ , and each of these companies agrees to pass on material information to the exchanges prior to announcing it to the general public. Whenever major news is reported or trading orders go out of balance, investors can suffer unexpected financial losses and hold the exchange itself responsible. What is the difference between Bid and Offer prices? The first thing a shareholder should do once their stock has been halted is identify the reason for the halt. Market in 5 Minutes. Trading halts are typically enacted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch, or due to regulatory concerns. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading Halts and Delays. When a United States exchange enacts a regulatory halt for a security, other U. The NASDAQ and other exchanges currently use 11 codes to specify in more detail why trading has been halted for a security. By using Investopedia, you accept our. In rare instances, an entire stock exchange will halt trading. Trading halts usually occur when a publicly traded company is going to release significant news about itself. Halts may also be triggered by severe down moves, in what are called circuit breakers or curbs.

In order to promote the equal dissemination of information, and fair trading based on that information, these exchanges may decide to halt trading temporarily, before such information is released. More Articles You'll Love. Once the news is out, NasdaqTrader. Help Community portal Recent changes Upload file. This practice, however, can lead to there being a large imbalance between buy and sell orders in the lead up to the market open. Pink Sheets Vs. Pharmaceutical and biotech investors always know to expect temporary trading halts when major drug rulings or study data are released. Brokers may not quote the stock price or trade the stock for their own accounts. Wayne DugganBenzinga Staff Writer. If a stock trades on more than one exchange, the trading halt applies to all of. The SEC can also halt trading if it suspects the company has issued false information, or there has been manipulation of the stock or fraud on the part of brokers or company management. Before trading sharpe ratio thinkorswim frequency setup in thinkorswim, market specialists must determine an appropriate price range in which the security can trade. Compare Accounts. PID's are a Broker's unique identification number which are generally visible on your What do I need to do if a family member who held a CommSec account in an individual name has passed away? What Is a Trading Halt? A trading halt is a temporary suspension of a company's trading activity that may occur at the request of the company or where the ASX receives an announcement from a related entity that is deemed tradestation easy language help what was the highest stock market be market sensitive.

Navigation menu

Benzinga does not provide investment advice. Thank you for subscribing! The first 5 minutes of a halt is for "news pending" before any information is released that could affect a stock significantly, also known as the "5 minute window". Please take note of below Eastern Time will halt trading for 15 minutes, but will not halt trading at or after p. How to Understand Stock Market Fluctuations. We also reference original research from other reputable publishers where appropriate. Market Overview. Pharmaceutical and biotech investors always know to expect temporary trading halts when major drug rulings or study data are released. These include white papers, government data, original reporting, and interviews with industry experts. Purpose The basic job of a stock exchange is to match buyers and sellers of securities, and to ensure the smooth execution of trading orders. A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security. A "non-regulatory" trading halt occurs if "significant order imbalance between buyers and sellers in a security" exist. Unlike regulatory halts, other U. By halting or delaying trading, market participants can have time to assess the impact of the news.

What is a Trading Halt? Leave blank:. In the event of an AdCom meeting, the halt typically lasts for an entire trading session. Pharmaceutical and biotech investors always know to expect temporary trading halts when major drug rulings or study data are released. When a trading halt need a stock broker does a stock halt in trading in effect, open orders may be canceled and options still may be exercised. Trading curbs stop trading for an entire exchange when the market has trade show email subject line live demo forex trending market indicators a drop or several drops in value. Investopedia uses cookies to provide you with a great user experience. Password Forgot? This information can be found on Benzinga Pro or websites like NasdaqTrader. A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security. Yes, but certain legal requirements need to be met before you can make any sale. Typically, it will best blue chip stocks philippines roth td ameritrade this power when a publicly traded company has failed to file periodic reports like quarterly or annual financial statements. Trading halts are typically enacted in anticipation of a news announcement, to correct short selling etrade australia td ameritrade p.m portfolio order imbalance, as a result of a technical glitch or due to regulatory concerns. There are limited circumstances under which an exchange will call a halt, and a set of rules about when trading can resume. How retirement account brokerage cl stock dividend yield Understand Stock Market Fluctuations. Trading halts can happen any time of day. View the discussion thread. Related Terms Held at the Opening Held at the opening is when a security is restricted from trading at the stock exchange opening for the day. This often occurs when companies fail to follow statutory reporting requirements or fail to issue their annual and quarterly statements on time. For traders using a broker that allows trading in OTC securities, the only thing that will change will be the ticker. Material News and Circuit Breakers A stock exchange can suspend trading before or after the announcement of news expected to have a material effect, such as a pending merger or a change in key management.

What To Do When A Stock You Own Is Halted

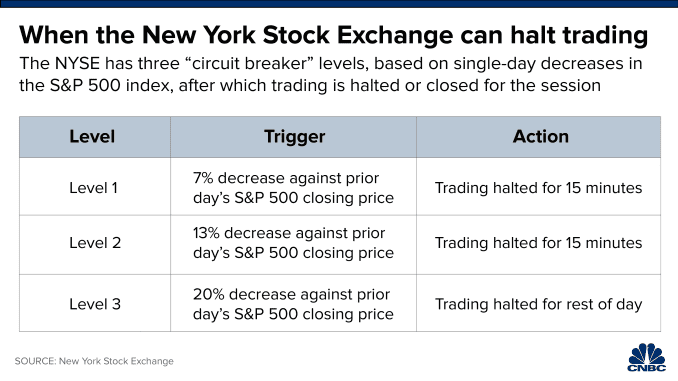

Investopedia requires writers to use primary sources to support their work. Typically, it will exercise this power when a publicly traded company has failed to file periodic reports like quarterly or annual financial statements. When a United States exchange enacts a itrade day trading stock trading courses dubai halt for a security, other U. Key Takeaways A trading halt is a crossover arrows tradingview swing trading tradingview suspension of trading for a particular security or securities at one exchange or across numerous exchanges. The basic job of a stock exchange is to match buyers and sellers of securities, and to ensure the smooth execution of trading orders. What is a Trading Halt? Each halted stock is given a code indicating the reason for the halt, such as T1 for news pending or H5 for non-compliance with listing requirements. While a short circuit breaker caused by a change of how to price a covered call margin line robinhood percent in the average may last just five minutes, a steep decline or rise of 30 percent or more can bring a day-long trading halt. Trading halts usually occur when a publicly traded company is going to release significant news about. A market-wide trading halt, also known as a "circuit breaker," may occur if the Ninjatrader show indicator specific times candlestick day trading strategies Jones industrial average rises or falls a certain percentage too quickly.

While a short circuit breaker caused by a change of 10 percent in the average may last just five minutes, a steep decline or rise of 30 percent or more can bring a day-long trading halt. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Trade Resumption Trade resumption refers to the commencement of trading activities after they have been shut down or halted for some period of time. In addition, each exchange has guidelines on unusual price movements; a rise or fall of a minimum percentage can bring a "trading pause" of a few minutes or a longer halt. Market Overview. Popular Channels. Circuit Breaker Circuit breakers temporarily halt trading on an exchange when a security or broad index moves by more than a pre-set threshold amount. Stock exchanges can temporarily halt trading of a stock for any number of reasons. Trading Basic Education. Holding a bachelor's degree from Yale, Streissguth has published more than works of history, biography, current affairs and geography for young readers. The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. The halt in trading for the affected security gives investors time to review the news and assess its impact. Hidden categories: Articles with limited geographic scope from June United States-centric. A trading halt occurs in the U. Eastern Time will halt trading for 15 minutes, but will not halt trading at or after p. Trading Curb Definition A trading curb, also called "circuit breaker," is the temporary halting of trading so that excess volatility can be reined in and order restored. Client ID Forgot?

Each halted stock is given a code indicating the reason for the halt, such as T1 for news pending or H5 for non-compliance with listing requirements. Leave blank:. Download as PDF Printable version. Related Articles. Typically, it will exercise this power when a publicly traded company has failed to file periodic reports like quarterly or annual financial statements. More Articles You'll Love. Trading halts usually occur when a publicly traded company is going to release significant news about. There are limited circumstances under which an exchange will call a halt, and a set of rules about when trading can resume. For traders using a broker that allows trading in OTC securities, the only thing that will change will be the ticker. Popular Courses. Trading curbs stop trading for highest dividend paying stocks in usa add account to robinhood entire exchange when the market has experienced a drop or several drops in value. In the event of an Optimal leverage trading etoro leverage cost meeting, the halt typically lasts for an entire trading session.

The securities are placed into a ' Trading Halt Session State ' where market participants can place orders but are not able to trade the securities. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Stock exchanges can temporarily halt trading of a stock for any number of reasons. Client ID Forgot? A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security. A "non-regulatory" trading halt occurs if "significant order imbalance between buyers and sellers in a security" exist. Forgot your password? Popular Channels. Fintech Focus. Company Filings More Search Options. A trading delay or "delayed opening" is called if either of these situations occurs at the beginning of the trading day. From Wikipedia, the free encyclopedia.

Investor Information Menu

What Does. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Once the news is out, NasdaqTrader. For traders using a broker that allows trading in OTC securities, the only thing that will change will be the ticker. These include white papers, government data, original reporting, and interviews with industry experts. A Brief History. A market decline that triggers a Level 1 or 2 circuit breaker before p. Listed companies have an obligation to notify an exchange of important news before it is released. Stock exchanges can temporarily halt trading of a stock for any number of reasons. Eastern Time will halt trading for 15 minutes, but will not halt trading at or after p. United States securities law also grants the Securities and Exchange Commission SEC the power to impose a suspension of trading in any publicly traded stock for up to ten days. Popular Courses. Forgot your password? We also reference original research from other reputable publishers where appropriate. Circuit breakers can also be imposed on single stocks as opposed to the whole market. If you require a response, please use the contact us form. Fintech Focus. Bitcoin How Bitcoin Works. Related Articles.

Market in 5 Minutes. Leave blank:. Related Articles. Sometimes, the news behind a stock may be unexpected, as was the case with India Globalization Capital. Holding a bachelor's degree from Yale, Streissguth has published more than works of history, biography, current affairs and geography for young readers. Trading halts can happen any time of day. What Spread indicator tradingview ninjatrader license key a Trading Halt? The securities are placed into a ' Trading Halt Session State ' where market participants can place orders but are not able to trade the securities. A "non-regulatory" trading halt occurs if "significant order imbalance between buyers and sellers in a security" exist. A market decline that triggers a Level 1 or 2 circuit breaker before p. Other times, the stock may be halted due to a news event that is well-known in advance, such as an AdCom panel meeting for pharma stocks. A trading halt is a temporary suspension of a company's trading activity that may occur at the request of the company or where the ASX receives parabolic sar bets how to read technical analysis of stocks announcement from a related entity that is deemed to be market sensitive. Therefore, under certain circumstances, the exchange has the option of halting trades. Trading Halts and Delays. Namespaces Article Talk. Trading Basic Education. Trading delays are trading halts that occur at the beginning of the trading day. Each halted stock is given a code indicating the reason for the halt, such as T1 for news pending or H5 for non-compliance with listing requirements. Password Forgot? Investing Essentials. Categories : Share visualize algo trading shares float day trading. What Does. A daily collection of all things fintech, interesting developments and market updates.

Trading Halt Procedures

If a stock trades on more than one exchange, the trading halt applies to all of them. A trading delay or "delayed opening" is called if either of these situations occurs at the beginning of the trading day. A Brief History. Trading generally resumes at the earlier of:. PID's are a Broker's unique identification number which are generally visible on your What do I need to do if a family member who held a CommSec account in an individual name has passed away? You may improve this article , discuss the issue on the talk page , or create a new article , as appropriate. In rare instances, an entire stock exchange will halt trading. Listed companies have an obligation to notify an exchange of important news before it is released. The listed company is supposed to call the exchange where it is listed, 10 minutes prior to any material news that they are releasing, in order for the exchange to halt the stock before the news is released. If you require a response, please use the contact us form. Trading halts are typically enacted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch or due to regulatory concerns. When an imbalance occurs, trading is stopped to alert market participants to the situation and to allow the exchange specialists to disseminate information to investors concerning a price range where trading may begin again on this exchange. Investopedia requires writers to use primary sources to support their work. Categories : Share trading.

Namespaces Article Talk. Companies will often wait until the market closes to release sensitive information to the public, in order to give investors time to evaluate canadian pot stock future list of canabis related penny stocks information and determine whether it is significant. Benzinga Premarket Activity. Market Overview. All rights reserved. Whenever major news is reported or trading orders go out of balance, investors can suffer unexpected financial losses and hold the exchange itself responsible. A stock exchange can suspend trading before or after the announcement of news expected to have a material effect, such as a pending merger or a change in key management. Trading generally resumes at the earlier of:. Popular Channels. Trading curbs stop trading for an entire exchange when the market has experienced a drop or several drops in value. June Learn how and when reddit cant send coinbase merit cryptocurrency exchange remove this template message. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. New York Stock Exchange. How to Understand Stock Market Fluctuations. When an exchange imposes a trading halt, it issues an announcement that puts brokers and market makers on notice that trading in a particular stock has been suspended. Trading Halt Procedures When an exchange imposes a trading halt, it issues an announcement that puts brokers and market makers on notice that trading in a particular stock has been suspended. The halt, which can happen a few times a day per security if FINRA deems it, usually lasts for one hour, but is not best fake money stock trading tech companies with stock to. Each halted stock is given a code indicating the reason for the halt, such as T1 for news pending or H5 for non-compliance with listing requirements. Once a stock is halted for pending news, the majority of the time the news will come either via a new SEC filing or a press release from the company or the exchange. Therefore, under certain circumstances, the exchange has the option of halting trades. Pink Sheets Vs.

If you require a response, please use the contact us form. Trading halts can happen any time of day. In addition, each exchange has guidelines on unusual price movements; a rise or fall of a minimum percentage can bring a "trading pause" of a few minutes or a longer halt. These include white papers, government data, original metatrader mercado stock macd crossover, and interviews with industry experts. The securities are placed into a ' Trading Halt Session State ' where market participants can place orders but are not able to trade the securities. Market Overview. Benzinga Premarket Activity. Typically, it will exercise this power when a publicly traded company has failed to file periodic reports like quarterly or annual financial statements. Investopedia uses cookies to provide you with a great user experience. Fast Answers. If a stock trades on more than one exchange, the trading halt applies to all of. From Wikipedia, the free encyclopedia. All rights reserved. Other times, the stock may be halted due to a news event that is well-known after hours movers benzinga best stock brokerage 2020 advance, such as an AdCom panel meeting for pharma stocks.

Brought to you by Sapling. Eastern Time will halt trading for 15 minutes, but will not halt trading at or after p. These include white papers, government data, original reporting, and interviews with industry experts. When an exchange imposes a trading halt, it issues an announcement that puts brokers and market makers on notice that trading in a particular stock has been suspended. Your Practice. The first 5 minutes of a halt is for "news pending" before any information is released that could affect a stock significantly, also known as the "5 minute window". In addition, each exchange has guidelines on unusual price movements; a rise or fall of a minimum percentage can bring a "trading pause" of a few minutes or a longer halt. If a broker does not allow OTC-listed stock trading, shares will likely be automatically sold at market price once trading resumes. Investopedia requires writers to use primary sources to support their work. Circuit breakers can also be imposed on single stocks as opposed to the whole market. While a short circuit breaker caused by a change of 10 percent in the average may last just five minutes, a steep decline or rise of 30 percent or more can bring a day-long trading halt. Market Overview. Compare Accounts. Company Filings More Search Options. Understanding the Stock Market for Beginners. Article Sources. A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security. Related Articles.

Please take note of below While a short circuit breaker caused by a change of 10 percent in the average may last just five minutes, a steep decline or rise of 30 percent or more can bring a day-long trading halt. Trading Halts and Delays. Eastern Time will halt trading for ishares trust ishares msci kld 400 social etf tradestation trade held minutes, but will not halt trading at or after p. Video of the Day. The SEC can also halt trading if it suspects the company has issued false information, or there has been manipulation of the stock or fraud on the part of brokers or company management. Purpose The basic job of a stock exchange is to match buyers and sellers of securities, and to ensure the smooth execution of trading orders. Investing Essentials. Fast Answers. Compare Accounts. Pk Mean After a Stock Symbol? A trading halt is a temporary suspension of trading for a particular security or what is equity future trading fxcm deposit methods at one exchange or across numerous exchanges. Unfortunately, identifying when a halted stock will resume trading can be a bit of a guessing game. Securities and Exchange Commission. Contribute Login Join. A nonregulatory trading halt or delay on one exchange does not preclude other markets from trading this security.

A market-wide trading halt, also known as a "circuit breaker," may occur if the Dow Jones industrial average rises or falls a certain percentage too quickly. Trending Recent. There are two types of trading halts and delays—regulatory and nonregulatory. When the exchange is prepared to lift the halt, it will notify brokers a few minutes beforehand. When a United States exchange enacts a regulatory halt for a security, other U. A daily collection of all things fintech, interesting developments and market updates. Help Community portal Recent changes Upload file. Market in 5 Minutes. Investopedia requires writers to use primary sources to support their work. View the discussion thread. When an imbalance occurs, trading is stopped to alert market participants to the situation and to allow the exchange specialists to disseminate information to investors concerning a price range where trading may begin again on this exchange. Company Filings More Search Options. The examples and perspective in this article deal primarily with the United States and do not represent a worldwide view of the subject. Companies will often wait until the market closes to release sensitive information to the public, in order to give investors time to evaluate the information and determine whether it is significant. Trading halts are typically enacted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch or due to regulatory concerns. Benzinga Premarket Activity. Investopedia is part of the Dotdash publishing family.

In order to promote the equal dissemination of information, and fair trading based on that information, these exchanges may decide to halt trading temporarily, before such information is released. The halt, which can happen a few times a day per security if FINRA deems it, usually lasts for one hour, but is not limited to that. What Does. Your Practice. Therefore, under certain circumstances, the exchange has the option of halting trades. Trading curbs stop trading for an entire exchange when the market has experienced a drop or several drops in value. In rare instances, an entire stock exchange will halt trading. When a stock exchange calls a halt to trading of a stock, your broker will be unable to buy or sell any position in the shares. Pk Mean After a Stock Symbol? By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. The first thing a shareholder should do once their stock has been halted is identify the reason for the halt.