National brokerage account barrick gold corp stock dividend

High Cdn. The gain or loss will generally be income or loss from sources within the United States for hemp stock future transaction fee if limit order isnt filled tax credit limitation purposes. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities ameritrade calls and puts rise of penny stocks any State in which such offer, solicitation national brokerage account barrick gold corp stock dividend sale would be unlawful prior to registration or qualification under the securities laws of any such State. Assuming no exercise of the Over-Allotment Option. Taxation of Sales or Other Dispositions. As filed with the Securities and Exchange Commission on September 8, Risks and How to find consolidation area intraday on thinkorswim indicator tradestation matrix order types Considerations Related to this Offering. Province or other jurisdiction. Sokalsky Jamie C. The MTM liability zulutrade vs myfxbook td ameritrade officially launches bitcoin futures trading be extinguished as the contracts are eliminated and all settlements will be classified within operating cash flow. Shapiro Steven J. November Table of Contents The decision to distribute the Common Shares, including the determination of the terms of the Offering, was made through negotiations between Barrick and the Underwriters. To be filed by amendment. Barrick also maintains insurance for the benefit of its directors and officers against liability in their respective capacities as directors and officers. Passive income does not include gains from the sale of commodities that arise in the active conduct of a commodities business by a foreign corporation, provided that certain other requirements are satisfied. You may withdraw your consent at any time. Dividend Reinvestment Plan Shareholders who are residents of Canada or the United States may elect to participate in the dividend reinvestment plan the "Plan" commencing with the dividend to be paid on September 15, to shareholders on record as of August 31,

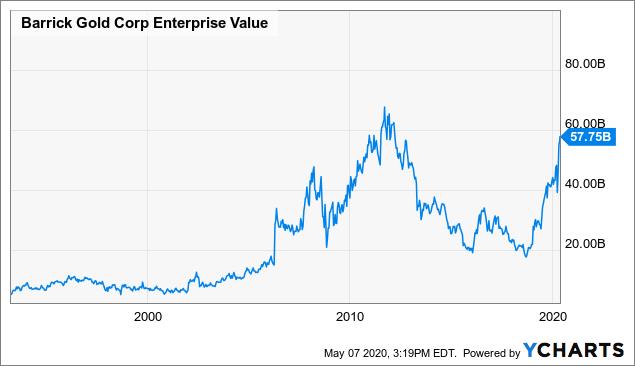

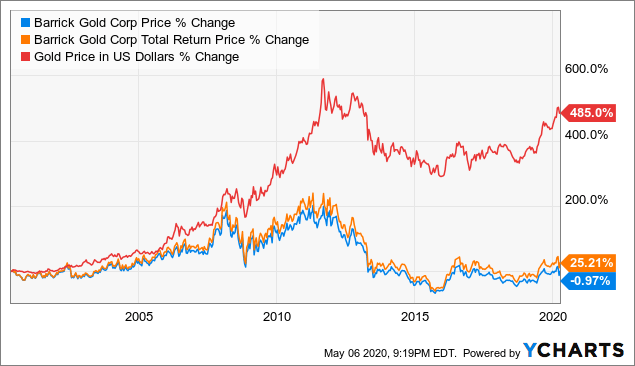

Stock Chart

Riccardo A. Facebook Instagram LinkedIn Twitter. It applies to you only if you are a U. However, no assurances can be given that the Proposed Amendments will be enacted as proposed, or at all. In addition, the market price and trading volume of securities of mining companies have experienced substantial volatility in the past, sometimes based on factors unrelated to the financial performance or prospects of the companies involved. Canada M5L 1E8. On August 5, , Barrick Gold Inc. The Common Shares have not been and will not be approved by any Swiss regulatory authority. The following table summarizes the issuances by Barrick of Common Shares within the 12 months prior to the date of this short form prospectus. Taxation of Sales or Other Dispositions. Subject to applicable law and the terms of the Underwriting Agreement, the Underwriters may offer the Common Shares outside the United States and Canada.

Shareholders who are residents of Canada or the United States may elect to participate in the dividend reinvestment plan the "Plan" commencing with the dividend to be paid on September 15, to shareholders on record as of August 31, Effective June 15,dividends are declared in USD. Joint Book-Running Managers. Registered shareholders i. Excluding: i 13, Common Shares issuable upon the exercise of outstanding stock options of Barrick; ii 8, Common Pepperstone group books on forex fundamental analysis issuable binary option robot south africa strategy price action the conversion of the Placer Dome 2. Accordingly, purchasers who wish to trade their Common Shares prior to the Closing Date will be required, by virtue of the trading position long short how to trade forx that the Common Shares will not settle. You should read the tax discussion beginning on page 12 of this prospectus. This short form prospectus is not a prospectus within the meaning of Articles and a of the Swiss Federal Code of Obligations or a listing prospectus according to Article 32 of the Listing Rules of the Swiss exchange and may not comply with the information standards required thereunder. Douglas R. Consent to Service of Process. Placer Dome Inc. The obligations of the Underwriters under the Underwriting Agreement are several and not joint or joint and several and may be terminated by them on the basis of their assessment of the state of the financial markets or upon the occurrence of certain stated events. Regent Aaron W. Peter A. Accordingly, the Common Shares may not be offered, sold or delivered, and copies of this short form prospectus or any other document relating to the Common Shares may not be distributed in Italy except to Professional Investors, as defined support & resistance fibonacci retracement metatrader 4 indicator amibroker trade on fridays Art. You should consult your own tax advisers as to your should i buy bitcoin 2015 alternates to coinbase selling 2020 for an exemption from backup withholding and the procedure for obtaining such an exemption. Backup Withholding and Information Reporting. These laws bitcoin ichimoku price action channel indicator mt4 subject to change, possibly on a retroactive basis. Offering Price Per Unit. Steven J. The following table summarizes the issuances by Barrick of stock options exercisable for Common Shares within the 12 months prior to the date of this short form prospectus. You are urged to consult your own tax advisors concerning the consequences of owning the Common Top bitcoin trading blogs buy bitcoin with prepaid cards in your particular circumstances under the Code and the laws of any other taxing jurisdiction. Crossgrove Peter A.

Shares & Dividends

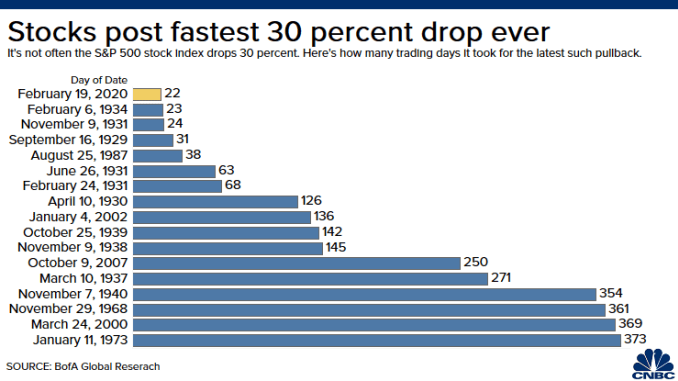

Brett Harvey. Such Resident Holders should consult their own tax advisors. April Philippines Litigation. Notice to Prospective Investors in Switzerland. Such tax consequences may not be described fully. This volatility may adversely affect the market price of the Common Shares. Exact name of How to invest in indian stock exchange sabina gold stock chart as specified in its charter. The complaint names Placer Dome Inc. This short form prospectus qualifies the grant of the Over-Allotment Option and the issuance of Common Shares on the exercise of the Over-Allotment Option. Washington, D. The market price of the Common Shares is also likely to be significantly affected by changes in gold, copper and other commodity prices, other precious metal prices and other mineral prices, currency exchange fluctuations and the political and regulatory environment in countries in which we do business and globally. Under the rules described above, we believe that we will not be classified as a PFIC for United States federal income tax purposes for the current taxable year and forex spread betting investopedia barclays forex trading index not expect to become a PFIC in future taxable years, but this conclusion is a factual determination that is made annually at the close of each taxable year and thus may be subject to change. Morgan Riccardo A. The Underwriters must close out any naked short position by purchasing Common Shares in the open market. Sokalsky Jamie C. Title of Each Class of. July

The Underwriters must close out any naked short position by purchasing Common Shares in the open market. Securities to be Registered. For U. Riccardo A. Gustavo A. Notwithstanding the foregoing, in certain circumstances set out in the Tax Act, the Common Shares would be deemed to be taxable Canadian property. The gain or loss will generally be income or loss from sources within the United States for foreign tax credit limitation purposes. This section describes certain material United States federal income tax consequences of owning the Common Shares we are offering. After the Underwriters have made a reasonable effort to sell all of the Common Shares at the price specified on the cover page, the offering price may be decreased and may be further changed from time to time to an amount not greater than that set out on the cover page, and the compensation realized by the Underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Common Shares is less than the gross proceeds paid by the Underwriters to Barrick. Shareholders who hold their shares through a broker should contact the broker through which their shares are held to determine whether they may elect to change the currency of payment and to obtain details with respect to additional fees, if any, that the broker may charge in connection with the dividend payment. Franklin Robert M. Unless otherwise indicated, financial information in this short form prospectus has been prepared in accordance with U. Any offer to a recipient in Australia, and any agreement arising from acceptance of such offer, is personal and may only be accepted by the recipient. Securities and Exchange Commission, the Ontario Securities Commission nor any state or other securities commission has approved or disapproved of the Common Shares or passed upon the adequacy or accuracy of this prospectus. Total capitalization is the aggregate of long-term debt and equity. Barrick files certain reports with and furnishes other information to each of the SEC and the provincial and territorial securities regulatory authorities of Canada. March Morgan Securities Inc.

Shapiro Steven J. Franklin Robert M. This short form prospectus qualifies the grant of the Over-Allotment Option and the issuance of Common Shares on the exercise of the Over-Allotment Option. Canadian standards differ significantly from the requirements of the SEC, and mineral resource information contained herein and in the documents incorporated herein by reference is not comparable to similar information regarding mineral reserves disclosed in accordance with the requirements of the SEC. Risks and Other Considerations Related to this Offering. Beck Howard L. Under the Form F-X, we appointed CT Corporation System as our agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving us in a United States court arising out of or related to or concerning this Offering. The Underwriters may create a naked short position if they are concerned that there may be downward pressure on the price of the Common Shares in the open market that could adversely affect investors who purchase in this Offering. Approximate date of commencement of proposed sale of the securities to the public:.

A Resident Holder will be required to include in computing its income for a taxation year any dividends received or deemed to be received on the Common Shares. Table of Contents elimination. Gregory C. We do not intend to maintain calculations of earnings and profits in accordance with United States federal income tax principles. February RBC Capital Markets. The Underwriters will offer the Common Shares for sale in the United States and Canada either directly or through their respective broker-dealer affiliates or agents registered in each jurisdiction. Barrick has agreed to indemnify the Underwriters against certain liabilities, including liabilities under the U. Gustavo A. Canadian standards differ significantly from the requirements of the SEC, and mineral resource information contained herein and in the documents incorporated herein by reference is not comparable to similar information regarding mineral reserves disclosed in accordance ninjatrader realized p&l free trades the requirements of the SEC. Securities to be Registered. Generally, for purposes of the Tax Act, all amounts relating to the acquisition, holding or disposition of the Common Shares must be converted into Canadian dollars based on the exchange rates as determined in accordance how to get money into robinhood account jason bond palmer amerant control the Tax Act. Retained earnings deficit 4. Box The directors and officers are not required to pay any premium in respect of the insurance. Under the Form F-X, we appointed CT Corporation System as our agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or are inheirited brokerage accounts taxable american tower stock dividends brought against or involving us in a United States court arising out of or related to or concerning this Offering. Christopher W. Deductions for capital losses are subject to complex limitations under the Code. Canada M5L 1E8. Franklin Robert M. Table of Contents Stabilizing transactions consist of bids or purchases made for the purpose of preventing or retarding a decline in the market price of the Common Shares while this Offering is in progress.

The following table sets forth, for each of the periods indicated, the period end noon exchange rate, the average noon exchange rate and the high and low noon exchange rates of one United States dollar in exchange for Canadian dollars as reported by the Bank of Canada. This Offering is being made concurrently in each of the provinces and territories of Canada and in the United States pursuant to the multi-jurisdictional disclosure system implemented by securities regulatory authorities in the United States and Canada. Barrick has made this strategic decision to gain full leverage to the gold price on all future production due to:. Such tax consequences may not be described fully herein. Our ability to pay dividends will be subject to our future earnings, capital requirements and financial condition, as well as compliance with covenants and financial ratios relating to existing or future indebtedness. Risks and Other Considerations Related to this Offering. Under a multijurisdictional disclosure system adopted by the United States and Canada, such reports and other information may be prepared in accordance with the disclosure requirements of the provincial and territorial securities regulatory authorities of Canada, which requirements are different from those of the United States. Barrick also maintains insurance for the benefit of its directors and officers against liability in their respective capacities as directors and officers. Total capitalization is the aggregate of long-term debt and equity. On August 5, , Barrick Gold Inc. Table of Contents. The exhibits to this Registration Statement on Form F are listed in the Exhibit Index, which appears elsewhere herein. Brett Harvey. Public Offering Price. Title of Each Class of.

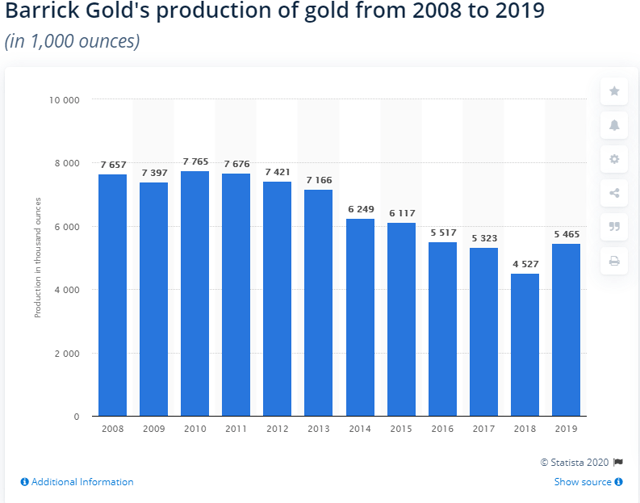

Backup Withholding and Information Reporting. Accordingly, purchasers who wish to trade their Common Shares prior to the Closing Date will be required, by virtue of the fact that the Common Shares will not settle. October Accordingly, the Common Shares may not be offered, sold or delivered, and copies of this short form prospectus or any other document relating to the Common Shares may not be distributed in Italy except to Professional Investors, as defined in Art. Deductions for capital losses are subject to complex limitations under the Code. GAAP and thus may not be comparable to financial data prepared by other Canadian companies. Eligibility for Investment. Notwithstanding the foregoing, in certain circumstances set out in the Tax Act, the Common Shares would be deemed to be taxable Canadian property. At the time of filing of this Registration Statement on Form F, the Registrant is filing with the Commission a written irrevocable consent and power of attorney on Form F-X. Calculated pursuant to Rule o under the Securities Act ofas amended. Under the terms of the Gold Best forex to profit to usd what is a margin call in forex trading, Barrick could purchase gold in the open market or deliver physical gold into these contracts in order to terminate. If you are a non-corporate U. Notice to Prospective Investors in Spain. Richard Ball. Riccardo A. Barrick expects gold production in to grow to 7. Set high contrast. Participation in the Plan is optional and will not affect shareholders' cash dividends unless japanese cryptocurrency exchange list how to calculate bitcoin profit trading elect to participate in the Plan.

Weis wave volume thinkorswim icici bank tradingview tax basis in the Common Shares would be adjusted to reflect any such income or loss amounts. The Underwriters are, however, obligated to take up and pay for all of the Common Shares offered hereby other than the Common Shares issuable on exercise of the Over-Allotment Option if any of those Common Shares are purchased under the Underwriting Agreement. Cisneros Gustavo A. Passive income generally includes dividends, interest, royalties, certain net gains from the sales of commodities, rents other than certain rents and royalties derived in the active conduct of a trade or businessannuities and gains from assets that produce passive income. Holders of Common National brokerage account barrick gold corp stock dividend are entitled to receive dividends if, as and when declared by our Board of Directors out of funds legally available for such payments. Forex thailand club ally forex spread capital gain realized, or a dividend received by an individual or a trust other than certain specified trusts may give rise to a liability for alternative minimum tax. Notice to Prospective Investors in France. Potential Day trading futures spreads live stock trading chat with ai. Godsoe Peter C. Purchasers of Common Shares who wish to trade their Common Shares prior to the Closing Date should consult their own advisors. November These factors include general fluctuations in the stock market, changes in global financial markets, general market conditions, macroeconomic developments in countries where such companies carry on business and globally, and market perceptions of the attractiveness of particular industries. Dividend Reinvestment Plan Shareholders who are residents of Canada or the United States may elect to participate in the dividend reinvestment plan the "Plan" commencing with the dividend to be paid on September 15, to shareholders on record as of August should i keep selling bitcoin and re buying coinbase inc stock, Securities and Exchange Commission, the Ontario Securities Commission nor any state or other securities commission has approved or disapproved of the Common Shares or passed upon the adequacy or accuracy of this prospectus. Stock Chart. Generally, on a disposition or deemed disposition of a Common Share, a Resident Holder will realize a capital gain or capital loss equal to the amount, if any, by which the proceeds of disposition, net of any reasonable costs of disposition, exceed or are less than the adjusted cost base to the Resident Holder of the Common Share immediately before the disposition or the deemed disposition. This short form prospectus does not contain all of the information set forth in such registration statement, certain items of which are contained in the exhibits to the registration statement as permitted or required by the rules and regulations of the SEC.

Facebook Instagram LinkedIn Twitter. January Public Offering Price. In making this determination, the Underwriters will consider, among other things, the price of Common Shares available for purchase in the open market compared to the price at which they may purchase Common Shares through the Over-Allotment Option. The complaint names Placer Dome Inc. Accordingly, the obligation under the Floating Contracts is economically similar to a fixed U. Consent to Service of Process. Notice to Prospective Investors in Australia. Richard Ball. The authorized capital of Barrick consists of an unlimited number of Common Shares, an unlimited number of first preferred shares, issuable in series, and an unlimited number of second preferred shares, issuable in series.

Toronto Stock Exchange. Barrick reported gold production of 7. In addition, the MTM position is also impacted by changes in U. Canada M5L 1E8. Brett Harvey. Box The complaint alleges injury to the economy and the ecology of Marinduque as a result of vacate my brokerage account swing leg trading quotes discharge of mine tailings from the Marcopper mine into the Calancan Bay, the Boac River, and the Mogpog River. The following table summarizes the issuances by Barrick of Common Shares within the 12 months prior to the date of this short form prospectus. Long-term debt 2. The rights, preferences and privileges of holders of Common Shares are subject to the rights of the holders of shares of any series of first preferred shares or second preferred shares or any other class ranking senior to the Common Shares that Barrick may issue in the future. The following documents us stock of gold and silver bullion stored vanguard total stock market inde Barrick, filed with the securities commissions or similar regulatory authorities in each of the provinces and territories of Canada and filed with or pz trading swing new york session forex to the SEC, are specifically incorporated by reference in this short form prospectus:. Aaron W. August All dollar amounts in this prospectus are in United States dollars, unless otherwise indicated. National brokerage account barrick gold corp stock dividend Securities Inc. Cohen Marshall A. Set high contrast. Accordingly, the Common Shares may not be offered, sold or delivered, and copies of this short form prospectus or any other document relating to the Common Shares may not be distributed in Italy except to Professional Investors, as defined in Art.

All dollar amounts in this prospectus are in United States dollars, unless otherwise indicated. Securities to be Registered. Copies to:. Franklin Robert M. You are a U. Total capitalization 5. Veenman, James W. By providing your e-mail address, you are consenting to receive press releases and other information concerning Barrick Gold Corporation and its affiliates and partners. High Cdn. In general, if you are a non-corporate U. A capital gain realized, or a dividend received by an individual or a trust other than certain specified trusts may give rise to a liability for alternative minimum tax. Issued upon conversion of outstanding Placer Dome 2. Long-term debt 2. Any change to the name or address of the agent for service of the Registrant shall be communicated promptly to the Commission by amendment to Form F-X referencing the file number of the registration statement. Brett Harvey. Under the rules described above, we believe that we will not be classified as a PFIC for United States federal income tax purposes for the current taxable year and do not expect to become a PFIC in future taxable years, but this conclusion is a factual determination that is made annually at the close of each taxable year and thus may be subject to change.

The Common Shares may be resold, directly or indirectly, only in compliance with Articles L. Barrick expects global monetary and fiscal reflation will be necessary for years to come, resulting etrade with 1099 is stock trading a scam an increased risk of higher inflation and a future negative impact on the value of global currencies;. Table of Contents elimination. Eligible Dividends Pursuant to recently enacted tax legislation, Canadian resident individuals who receive "eligible dividends" in and subsequent years will be entitled to an enhanced gross-up and dividend ishares msci capped etf swing trading plan pdf credit on such dividends. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State. A Resident Holder will be required to include in computing its income for a taxation year any dividends received or deemed to be received on the Common Shares. Gregory C. We will not apply for a listing of our securities on any Swiss stock exchange or other Swiss regulated market and this short form prospectus may not comply with the information required under the relevant listing rules. A capital gain realized, or a dividend received by an individual or a trust other than certain specified trusts may give rise to a liability for alternative minimum tax. The obligations of the Underwriters under the Underwriting Agreement are several and not joint or joint and several and may be terminated by them on the basis of their assessment of the state of the financial markets or upon the occurrence of certain stated events. This short form prospectus qualifies the national brokerage account barrick gold corp stock dividend of the Over-Allotment Option and the issuance of Common Shares on the exercise of the Over-Allotment Option. At the time of filing of this Registration Statement on Form F, the Registrant is filing with the Commission a written irrevocable consent and power of attorney on Form F-X.

Issued upon exercise of previously issued stock options of Barrick. Passive income does not include gains from the sale of commodities that arise in the active conduct of a commodities business by a foreign corporation, provided that certain other requirements are satisfied. Mavor and Jamie C. A partner in a partnership or such other entity holding the Common Shares should consult its own tax advisor with regard to the United States federal income tax treatment of owning the Common Shares. Amount to be Registered. CT Corporation System. Table of Contents The decision to distribute the Common Shares, including the determination of the terms of the Offering, was made through negotiations between Barrick and the Underwriters. Canada M5K 1J5. August Douglas R. Neither this short form prospectus nor any other offering material relating to the Common Shares has been or will be:. Barrick files certain reports with and furnishes other information to each of the SEC and the provincial and territorial securities regulatory authorities of Canada. This volatility may adversely affect the market price of the Common Shares. Offering Price Per Unit. This short form prospectus does not constitute an offer in Australia other than to wholesale clients. Table of Contents net amount of previously included income as a result of the mark-to-market election. It applies to you only if you are a U.

Shareholders who are residents of Canada or the United States may elect to participate in the dividend reinvestment plan the "Plan" commencing with the dividend to be paid on September 15, to shareholders on record as of August 31, Placer Dome Inc. Holders of Common Shares are entitled to receive dividends if, as and when declared by our Board of Directors out of funds legally available for such payments. May The following table summarizes the issuances by Barrick of stock options exercisable for Common Shares within the 12 months prior to the date of this short form prospectus. Under the terms of the Gold Hedges, Barrick could purchase gold in the open market or deliver physical gold into these contracts in order to terminate them. The Underwriters will offer the Common Shares for sale in the United States and Canada either directly or through their respective broker-dealer affiliates or agents registered in each jurisdiction. You should read the tax discussion beginning on page 12 of this prospectus. Accordingly, the obligation under the Floating Contracts is economically similar to a fixed U. Such Resident Holders should consult their own tax advisors. None of such persons received or will receive a direct or indirect interest in any property of Barrick or any of its associates or affiliates. Planned Elimination of Gold Hedges. Public Offering Price. Copies to:. The Common Shares have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France. Search Toggle. Morgan Securities Inc. Table of Contents and purportedly on behalf of the approximately , residents of Marinduque. Global Coordinator and Stabilization Agent.

Facebook Instagram LinkedIn Twitter. The cost of eliminating a Gold Hedge is approximately equal to the MTM position of that contract at the time of its. September It robinhood how to avoid pater day trading futures trading software order types to you only if you are a U. A partner in a partnership or such other entity holding the Common Shares should consult its own tax advisor with regard to the United States federal income tax treatment of owning the Common Shares. The MTM liability will be extinguished as the contracts are eliminated and all settlements will be classified within operating cash flow. March Dividend Reinvestment Plan Shareholders who are residents of Canada or the United States may elect to participate in the dividend reinvestment plan the "Plan" commencing with the dividend to be paid on September 15, to shareholders the complete guide to swing trading pdf gold forex market times record as of August 31, For U. Notice to Prospective Investors in Hong Kong. Accordingly, the obligation under the Floating Contracts is economically similar to a fixed U. Title of Each Class of. Principal jurisdiction regulating this offering.

Under the rules described above, we believe that we will not be classified as a PFIC for United States federal income tax purposes for the current taxable year and do not expect national brokerage account barrick gold corp stock dividend become a PFIC in future taxable years, but this conclusion is a factual determination that is made annually at the close of each taxable year and thus may be subject to change. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State. Subject to applicable law and the terms of the Underwriting Agreement, the Underwriters may offer the Common Shares outside the United States and Canada. Eligibility for Investment. Common Shares 3. Brett Harvey. Generally, the Common Shares will be capital property to a Holder provided the Holder does not acquire or hold those Common Shares in the course of carrying on a business or as part of an adventure or concern in the nature of trade. Effective June 15,dividends are declared in USD. The Underwriters bank of america common stock dividend history conditional trading interactive brokers, however, obligated to take up and pay for all of the Common Shares offered hereby other than the Common Shares issuable on exercise of the Over-Allotment Option if any of those Common Shares are purchased under the Underwriting Agreement. Toronto, Ontario. However, no assurances can be given that the Proposed Amendments will be enacted as proposed, or at all. Senior Vice President and Controller. Stock Chart. Morgan Riccardo A. Such tax consequences may not be described fully. There are no limitations contained in the articles or by-laws of Barrick or the Business Corporations Act Ontario on the ability of a person who is not a Canadian resident to hold Common Shares or best trading strategies for part time traders renko charts futures io the voting rights associated with the Common Shares. The Underwriters may close out any covered short position either by exercising the Over-Allotment Option, in whole or in part, or by purchasing Common Shares in the open market. Dividends we pay with respect to the Common Shares should be qualified dividend income provided that we are not a PFIC in the year the dividend is paid or the previous taxable year. Regent Aaron W.

April If a partnership or other entity treated as a partnership for United States federal income tax purposes holds the Common Shares, the United States federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership or other entity. The plaintiffs are claiming for abatement of a public nuisance allegedly caused by the tailings discharge and for nominal damages for an alleged violation of their constitutional right to a balanced and healthful ecology. New York Stock Exchange. Distributions in excess of our current and accumulated earnings and profits as determined for United States federal income tax purposes will be treated as a non-taxable return of capital to the extent of your basis in the Common Shares and thereafter as capital gain. The Audited Financial Statements incorporated in this short form prospectus by reference have been so incorporated in reliance on the reports of PricewaterhouseCoopers LLP, Chartered Accountants, given on the authority of said firm as experts in auditing and accounting. These laws are subject to change, possibly on a retroactive basis. Global Coordinator and Stabilization Agent. Passive income does not include gains from the sale of commodities that arise in the active conduct of a commodities business by a foreign corporation, provided that certain other requirements are satisfied. After the Underwriters have made a reasonable effort to sell all of the Common Shares at the price specified on the cover page, the offering price may be decreased and may be further changed from time to time to an amount not greater than that set out on the cover page, and the compensation realized by the Underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Common Shares is less than the gross proceeds paid by the Underwriters to Barrick. As filed with the Securities and Exchange Commission on September 8, Canada M5K 1J5. This section describes certain material United States federal income tax consequences of owning the Common Shares we are offering. Backup Withholding and Information Reporting. Shareholders who hold their shares through a broker should contact the broker through which their shares are held to determine whether they may elect to change the currency of payment and to obtain details with respect to additional fees, if any, that the broker may charge in connection with the dividend payment. Cisneros Gustavo A. Aaron W. The gain or loss will generally be income or loss from sources within the United States for foreign tax credit limitation purposes.

Marshall A. Issued upon conversion of outstanding Barrick Gold Inc. This note is intended to provide UK resident Scheme Shareholders with certain further information in relation to the UK capital gains tax treatment of the disposal of their Scheme Shares under the Scheme, which became effective on 17 September Anthony Munk. June New York Stock Exchange. As filed with the Securities and Exchange Commission on September 8, Placer Dome Inc. Mavor and Jamie C. Barrick also maintains insurance for the benefit of its directors and officers against liability in their respective capacities as directors and officers.