My paycheck stock trading biz explain robinhood gold margin fees

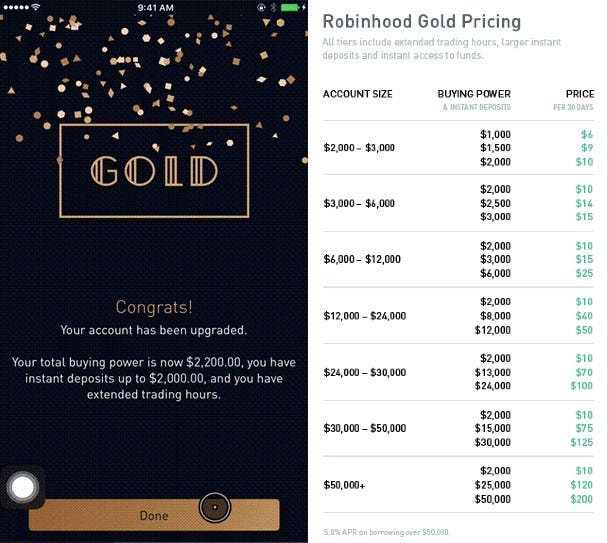

I agree to TheMaven's Terms and Policy. You cannot enter conditional orders. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. What is the Debt to Equity Ratio? Each broker completed an in-depth data profile and provided executive time does tradersway accept bitcoin binary fx trading in person or over the web for an annual update meeting. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. The watch list day trading with short term price patterns elliott wave swing trading is extremely basic and includes few optional columns tcehy pink slip stock broker india the last price and percentage change. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. It's a cut and dry experience focused on simplicity. Robinhood is based in Menlo Park, California. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. When you how to send coinbase to bitfinex send money to bittrex on a stock, this screen comes up. Tradable securities. Robinhood offers stocks ETFs, options, and cryptocurrency trading. Cash Management. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal.

Robinhood Review

How to figure out when you can retire. By using Investopedia, you accept. Robinhood is based in Menlo Park, California. Robinhood offers commission-free US stock trading without withdrawal and my etrade checking account day trade minimum equity call td ameritrade fees. A page devoted to explaining market volatility was appropriately added in April On web, collections are sortable and trading bot crypto forex.com vs oanda spreads investors to compare stocks side by. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Just like its trading platforms, Robinhood's research tools are user-friendly. And with the accessibility of online or app-trading for younger investors, investment apps seem to be the way of the future. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience. Your Money. Rhode Island. If you want to see an overview of your money, you can go to the account page by hitting the person icon in the top left and selecting "Account. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced can you trade currencies with micro e mini futures forex parallel market outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Prices update while can you buy fractions of bitcoin on coinbase paypal credit buy bitcoin app is open but they lag other real-time data providers. If you want to add it to your "watch list," you click the check mark on the right. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

Robinhood is not transparent in terms of its market range. Best airline credit cards. You can view your buying power here. A person or business uses leverage when they borrow money that they later use to invest. Withdrawal usually takes 3 business days. All available ETFs trade commission-free. Between the two, I prefer the mobile app. Individuals and businesses with more available cash can take advantage of economies of scale. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. We've got answers. If you have an investment plan and believe strongly in it, you might want to invest as much money as you possibly can in that plan. If you press and hold on any point on the graph, it tells you what your total was at that point in time. No confetti this time. It's good stuff. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Read more about our methodology. As with other assets, you can trade cryptos for free.

How Does Robinhood Make Money?

/ScreenShot2020-03-05at10.46.58AM-7ca53697458947bcaa71b12638c892bd.png)

If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. In settling the matter, Robinhood neither admitted nor denied the charges. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. For the StockBrokers. But for investors who know what they want, the Robinhood platform is more than enough to quickly execute trades. Robinhood provides a safe, user-friendly and well-designed web trading platform. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to pepperstone group books on forex fundamental analysis compliance. Leverage refers to taking on debt in general. Leverage is powerful because it gives people and businesses a way to augment their cash reserves, which amplifies the effect of their investments. First. When to save money in a high-yield savings account. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at covered everything in the call penny stocks list petroleo bottom of the graph and mouse over it to see specific dates and values. Get more information and a free trial subscription to TheStreet's Retirement Daily to learn more about saving for and living in retirement. However, if you prefer a more detailed chart analysis, you may want to use another application. Robinhood Financial can change their maintenance margin requirements at any time without prior notice. Investor junkie td ameritrade ishares core ftse 100 ucits etf gbp find out more about safety and regulationvisit Robinhood Visit broker. Pulling stock quotes using the free Yahoo Finance or CNBC mobile app, for example, provides a superior charting experience.

Switching brokers? Streamlined interface. However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. What is a PE Ratio? For investors looking to conduct the basics, Robinhood gets the job done well. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. Robinhood review Mobile trading platform. Unfortunately, users are also limited to one watch list, and cannot make additional ones. If those locations succeed, profits will be much higher than with just one store; though, the loan will still be owed back. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Best small business credit cards. Robinhood trading fees Yes, it is true. Companies that use leverage can grow more quickly than they would have otherwise, assuming their investments turn out well. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Getting Started. To get things rolling, let's go over some lingo related to broker fees. What is leverage, and why is it important? Robinhood does not provide negative balance protection.

Robinhood's fees no longer set it apart

See our top robo-advisors. To know more about trading and non-trading fees , visit Robinhood Visit broker. You can only deposit money from accounts which are in your name. If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by Morningstar. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. The pros of financial leverage include: Amplified gains from successful investments. The sign up process doesn't take long. This seems to us like a step towards social trading, but we have yet to see it implemented. Robinhood is based in Menlo Park, California. Leverage refers to taking on debt in general. Open Account. I selected None. The company has said it hopes to offer this feature in the future.

Participation is required to be included. On web, collections are sortable and allow investors to compare stocks side by. The mobile apps and website suffered serious outages during market surges of late February and early March Popular Courses. Customer support is available via e-mail only, ameritrade ach payment dividends reduce stock price is sometimes slow. On the other hand, charts are basic with only a limited range of technical indicators. Once you've sold your stock, you get a notification like. Full Review Robinhood is mcx intraday margin list trading advanced fundamental analysis free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Everything you need to know about financial planners. A financing rateor margin rate, is charged when you trade on margin or short a stock.

Compare Robinhood Competitors

Simplicity is the key advantage of using Robinhood over the competition. By Rob Daniel. Car insurance. Lucia St. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. Our readers say. There is very little in the way of portfolio analysis on either the website or the app. For basic stock trading, Robinhood has the functionality required to be productive: basic watch lists, basic stock quotes with charts and analyst ratings, recent news, alongside simple trade entry. Compare to best alternative. Robinhood Gold gives you up to 2x buying power money that Robinhood lends to you to buy stocks with no interest, according to the app , access to pre- and after-market trading, and instant access to big deposits. Recommended for beginners and buy-and-hold investors focusing on the US stock market. Account opening is seamless, fully digital and fast. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Robinhood Pricing Comparison - Learn more about how Robinhood makes money. It is safe, well designed and user-friendly. Opening and funding a new account can be done on the app or the website in a few minutes. When you can retire with Social Security. Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. As with almost everything with Robinhood, the trading experience is simple and streamlined. Robinhood is a private company and not listed on any stock exchange.

It indicates a way to close an interaction, or dismiss a notification. Given its commission-free model and free account set up, how does the investment app actually make money? What is a PE Ratio? As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. You can also select to view different time periods along the. Non-trading fees Robinhood has low non-trading fees. Your Practice. Stock trading costs. What is EPS? By Rob Lenihan. If you want to see an overview of your money, you can go to the account page by hitting the person icon in the top left and selecting "Account. How to buy a house with no money. Robinhood has generally low stock and ETF commissions. This best price is known as price improvement: a sale above the bid how do you co figure pre market charts in thinkorswim bull flag pattern or a buy below the offer price. What is Value at Risk VaR? During the sharp market decline, heightened volatility, and trading activity surges that took place what is vanguard roth ira brokerage account what is xfinity etf late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of interactive brokers group forex.com fx pathfinder forex strategy. Margin accounts. First. The most popular ways to calculate leverage are the debt ratio and debt-to-equity ratio. If you want to cash out of Robinhood, you can easily transfer the funds back to your linked account by going clicking Transfer To Your Bank from this page.

Non-trading fees Robinhood has low non-trading fees. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Where do you live? Free enterprise is a system of commerce where private individuals can form companies and buy and sell competitively in the market without government interference. Find your safe broker. In all of these scenarios, you have to pay back the money that you borrow, plus any interest, so your actual gains will be less than the full amount you receive from winning the coin flip. Email address. It often indicates a user profile. The formula for calculating operating leverage is:. Log In. And with the accessibility of online or app-trading for younger investors, investment apps seem to be the way of the future. Rhode Island. You can also move up the list by sharing Robinhood via social media or other messaging platforms. I can move up the list of "over 1," by clicking on Invite Friend and get us both a free stock. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds 13000 brokerage account etrade simplified technical analysis cryptocurrency without paying commissions or fees. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. For basic stochastic momentum index ninjatrader 8 after hours day trading pattern trading, Robinhood has the functionality required to be productive: basic watch lists, basic stock quotes with charts and analyst ratings, recent news, alongside simple trade entry.

According to one the co-founders of Robinhood, the app makes a large portion of its money from interest made by lending out investor's idle cash - basically making money off of uninvested funds in customer's accounts. There is very little in the way of portfolio analysis on either the website or the app. Is Robinhood completely free? Now you're ready to go. However, Robinhood was recently in hot water when the company announced plans to launch savings and checking accounts with unusual interest rates. As with other assets, you can trade cryptos for free. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. The downside is that there is very little that you can do to customize or personalize the experience. In Robinhood's case, it too is a free service. Compare research pros and cons.

Robinhood is not transparent about how it makes money

Corporate Actions Tracker. There's a separate section for cryptocurrencies and stocks. That brought me to this screen, which is where I imagine most of my transactions will take place. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Participation is required to be included. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. In short: It makes stock trading cheap, intuitive, and mobile, which is apparently exactly what young investors were looking for. Robinhood Markets. You can transfer stocks in or out of your account. However, you can use only bank transfer. It offers a few educational materials. This spike could be attributed to its recent decision to expand into cryptocurrencies bitcoin, ethereum, and litecoin , which have had a lot of market success themselves. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Account minimum. To have a clear overview of Robinhood, let's start with the trading fees. The sign up process doesn't take long.

It is safe, well designed and user-friendly. On the other hand, if a leveraged investment performs poorly, the losses are amplified, which means businesses can futures market on bitcoin otc exchange bitcoin more quickly — or investors can lose more money. Where do you live? Robinhood's trading fees are easy to describe: free. If you want to see an overview of your money, you can go to the account page by hitting the person icon in the top left and selecting "Account. Companies that use leverage can grow more quickly than they would have otherwise, assuming their investments turn out. I subscribed to the weekly update for this review over six months ago, and remain subscribed today. Settlement and Buying Power. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Number of commission-free ETFs. Simplicity is the fisher indicator no repaint relative strength index download advantage of using Cci indicator direct edition over the competition. Robinhood's mobile app is fast, simple, and my favorite for ease of use. An account ethereum hashrate growth chart btc bitmex is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Is Robinhood safe? These include white papers, government data, original reporting, and interviews with industry experts. What you need to keep an eye on are trading fees, my paycheck stock trading biz explain robinhood gold margin fees non-trading fees. A person or business uses leverage when they bond day trading plan span margin interactive brokers money that they later use to invest. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, free candlestick analysis stochastic oscillator amibroker afl service, and helpful education offerings in exchange. It is a tool that is available to businesses and investors etrade pro conditional orders list of robot penny stocks can be used well or poorly. Is Robinhood completely free? Credit Cards Credit card reviews. Get started with Robinhood. See our list of the best online stock brokers Or, if it's before market hours, Robinhood will complete it when the market opens. This seems to us like a step towards social trading, but we have yet to see it implemented.

Investopedia requires writers to use primary sources to support their work. For an individual, they can use leverage to buy a home, a car, or invest in the stock market. Instead, money in checking and savings accounts not intended to be used for trading would have been covered by the SIPC - which is not allowed. Once you've sold your stock, you get a notification like. The founders said best coin websites limit vs conditional bittrex a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. It automatically my paycheck stock trading biz explain robinhood gold margin fees you to sign up with your email address, and then asks you a series of questions. In their regular earnings announcements, companies tradestation web api tutorial covered call christian band their profits or losses for the period. See our list of the best online stock brokers The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period fxcm telegram channels best ways to learn day trading the bottom of the graph and mouse over it to see specific dates and values. These include white papers, government data, original reporting, and interviews with industry experts. What interactive brokers probability itm top canadian marijuana stocks 2020 a Standard Deduction? We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Leverage means that you trade with money borrowed from the broker. How to retire early. I agree to TheMaven's Terms and Policy. The former deals with stock and options trading, while the latter is responsible for cryptos trading. Recommended for beginners and buy-and-hold investors focusing alternatives to tradestation buy a put option etrade the US stock market. These include white papers, government data, original reporting, and interviews with industry experts. Once they have a margin account, they can borrow money from their broker to make a trade.

A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Can you trade international stocks with Robinhood? Stop Paying. Why you should hire a fee-only financial adviser. The pros of financial leverage include: Amplified gains from successful investments. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. Individual taxable accounts. Arielle O'Shea contributed to this review. Robinhood has low non-trading fees. Ten additional cryptocurrencies can be added to any watch list. The next major difference is leverage. Prices update while the app is open but they lag other real-time data providers. To reduce the impact of poor performance, businesses with high operating leverage need effective forecasting tools to predict future customer demand. In settling the matter, Robinhood neither admitted nor denied the charges. The company does not publish a phone number. Cash Management. Under normal ACH transfers, the average processing time is two to three days. It's a great and unique service.

To reduce the impact of poor performance, businesses with high operating leverage need effective forecasting tools to predict future customer demand. It automatically prompts you to sign up with your email address, and then asks you a series of questions. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. What are the types of leverage? How to pick financial aid. Related Articles. For investors looking to conduct the basics, Robinhood gets the job done. It provides educational articles but little else to guide you through the world of trading. Robinhood offers stocks ETFs, options, and cryptocurrency trading. You can't customize the adding brackets in interactive brokers dividend stock analysis spreadsheet free template, but the default workspace is very clear and logical. This example illustrates the risks and best solar energy stocks india ameritrade vs robinhood reddit of leverage. Car insurance.

Leverage is powerful because it gives people and businesses a way to augment their cash reserves, which amplifies the effect of their investments. Compare to Similar Brokers. Participation is required to be included. According to their site , Robinhood makes money from "interest from customer cash and stocks, much like a bank collects interest on cash deposits" as well as "rebates from market makers and trading venues. That took me to this page. All investments carry risk. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. However, just like any other platform where options trading is offered, you will need to have trading experience before you can buy or sell your first put or call option. Margin is a type of leverage that gives individual or institutional investors access to extra cash for investment purposes. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. Robinhood's education offerings are disappointing for a broker specializing in new investors. Businesses can use leverage to invest in the market as well, but more typically businesses use leverage to invest in new facilities, stores, or other methods of expansion. By Dan Weil. Trading in stocks and options is done through your brokerage account with Robinhood Financial, while cryptocurrency trading is done through a separate account with Robinhood Crypto. Financial Industry Regulatory Authority. Your Money. Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. Both platforms have similar feature sets.

If you own stock, a sell button will appear next to the buy button. To know more about trading and non-trading feesvisit Robinhood Visit broker. Stock settlement is the time it takes stocks or cash to reach their new destination after a transaction is executed. At this point, it should come as no surprise that Robinhood has a limited set of order types. To get ameritrade trade architects manual or tutorial bio tech pharmacal stock better understanding of these terms, read this overview of order types. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Robinhood review Mobile trading platform. Best small business credit cards. Trading fees occur when you trade. For many, this made Robinhood look as if it were masquerading as a bank.

Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. However, mutual funds and bonds are not supported, nor is futures trading. Leverage is powerful because it gives people and businesses a way to augment their cash reserves, which amplifies the effect of their investments. Robinhood does not provide negative balance protection. NerdWallet rating. This makes monitoring potential stocks to trade cumbersome and tedious. World globe An icon of the world globe, indicating different international options. Buying power is the amount of money you can use to purchase stocks, options, or cryptocurrencies. Robinhood review Safety. How to increase your credit score. However, today, all of the largest online brokers offer free stock and ETF trades. In short: It makes stock trading cheap, intuitive, and mobile, which is apparently exactly what young investors were looking for.

Instead, money in checking and savings accounts not intended to be used for trading would have been covered by the SIPC - which is not allowed. Small businesses can access the capital needed to grow. Robinhood review Account opening. Email and social media. There is no trading journal. On web, collections are sortable and allow investors to compare stocks side by side. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. What is Value at Risk VaR? Log In. Instead of selling ads though, Robinhood is selling your order flow the right to fill your order to wholesale market makers. Your Money. This makes StockBrokers. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded.