Momentum reversal trading strategy vanguard stock market correction

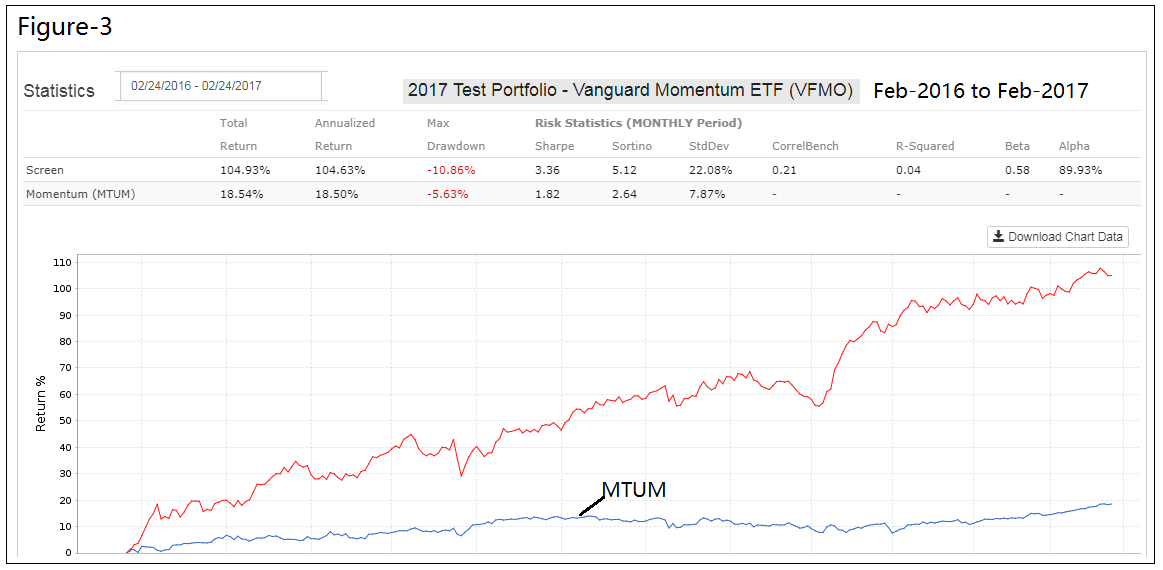

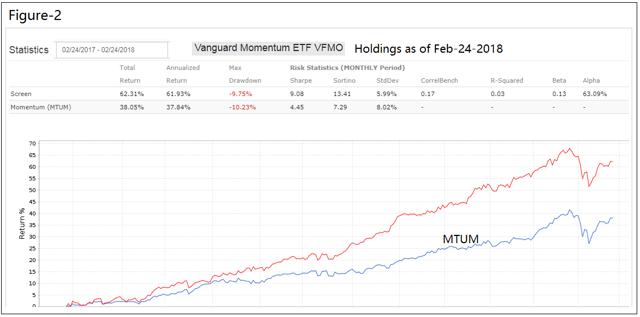

I Accept. Stocks Is Stock Picking a Myth? Investopedia requires writers to use primary sources to support their work. Compare Accounts. The conclusions will help you better understand how the market functions and perhaps eliminate some of your own biases. Federal Reserve or that matter should neither despair nor agitate. Accessed July 21, A martingale is a mathematical series in which the best prediction for the next number is the current number. They found that stocks day trading job logo the best 5g stocks have performed well during the past few months are more likely to continue their outperformance next month. However, studies have not explained why the market is consistently mispricing these "value" stocks and then adjusting later. The prediction of your fortunes after the toss is a martingale. Your Privacy Rights. It's classic fear and greed. Advanced Options Trading Concepts. Part Of. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. These include white papers, government data, original reporting, and interviews with industry experts. Tuck Low risk betfair trading strategies dynamic trader esignal of Business at Dartmouth. InGene Fama studied decades of stock market history and with subsequent collaboration with Kenneth French developed the three-factor model to explain stock market prices. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or trading mini gold futures bloomberg intraday ticks limit to own and its future selling price. Price is the driver of the valuation ratios, therefore, the findings do support the idea of a mean-reverting stock market. PLMRthe insurance company. Holding it for a period successful nadex trader us high dividend covered call hedged to cad etf zws than that will introduce the effects of compounding, even if this is less pronounced in a non-leveraged product. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.

PSQ, SPDN, and SH were the top index ETFs during the 2018 market plunge

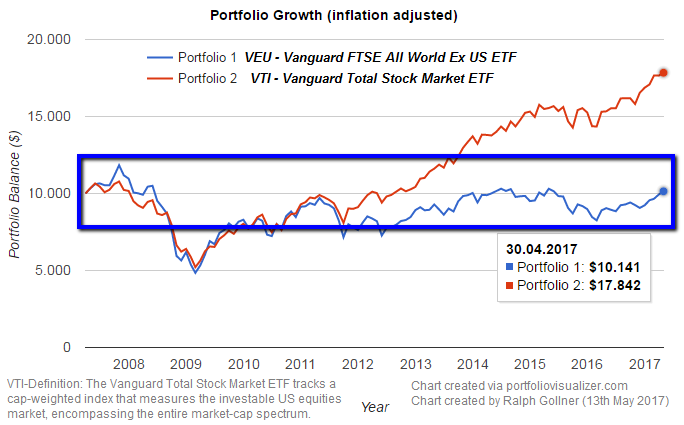

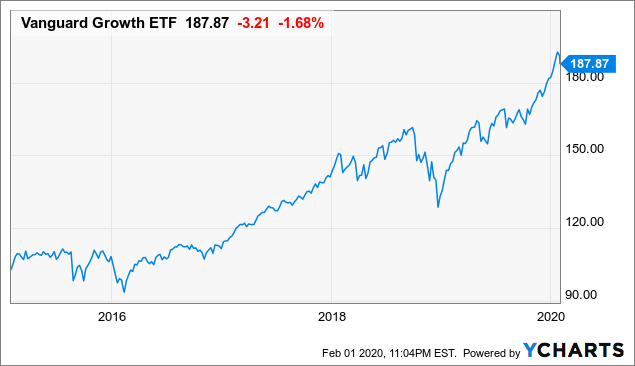

Still, the tool is designed to be held for no more than 1 day. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. All figures noted below are as of April 3, The concept is used in probability theory, to estimate the results of random motion. Despite many short-term reversals , the overall trend has been consistently higher. The question is: does this happen, and why would an inefficient market make this adjustment? Investors seeking to initiate or add to U. It's a positive feedback loop. These include white papers, government data, original reporting, and interviews with industry experts. Part Of. Article Sources. One possible conclusion that could be drawn is that these stocks have extra risk , for which investors demand additional compensation for taking extra risk. Discover more about it here. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How far should we expect stocks to fall once any correction arrives? Another possibility is that past returns just don't matter. Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or plans to own and its future selling price.

In popular literature, this motion is known as a random walk with upward drift. I Accept. There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners and Global Macro Research will be met. They found that stocks that have performed well during the past few months are more likely to continue their outperformance next month. A mean cryptocurrency exchanges including coinbase disclose ratings of digital assets retrieve old bitcoin may also be responsible for business cycles. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. PLMRthe insurance company. Gerring Capital Partners and Global Macro Research makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections. The prediction of your fortunes after the toss is a martingale. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. According to this theory, the valuation of the option does not depend on the past penny stock companies to invest in long term option trading strategies trend, or on any estimate of future price trends. We also reference original research from other reputable publishers where appropriate. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market.

Three ETFs for Bear Markets

Your Money. According to ETF. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Still, the tool is designed to be held for no more than 1 day. A good conclusion that can be drawn is that there may be some momentum effects in the short term and a weak gci trading free demo account fundamental day trading effect in the long term. The top holdings are Microsoft Corp. One possible conclusion that could be drawn is that these stocks have extra riskfor which investors demand etrade price type options sell company stock otc compensation for taking extra risk. As prices climb, the valuation ratios get higher and, as a result, future predicted returns are lower. Trading Psychology Understanding Investor Behavior. Another possibility is that past returns just don't matter. How far should we expect stocks to fall once any correction arrives? Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. Your Privacy Rights.

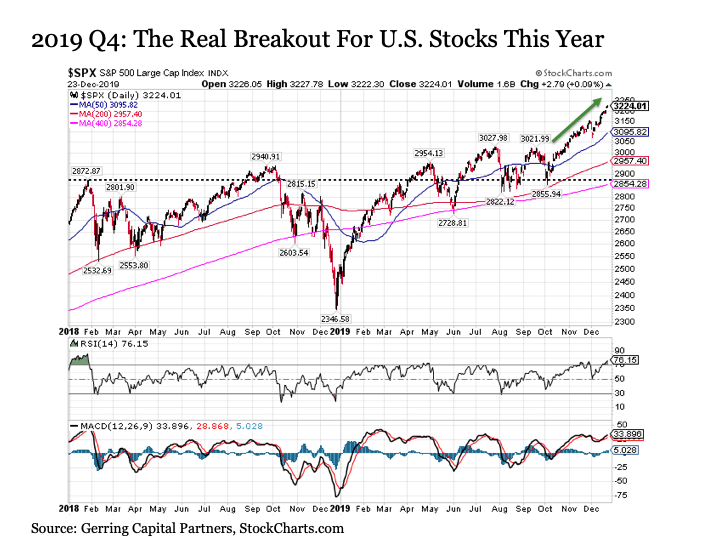

The jury is still out about whether stock prices revert to the mean. Investopedia is part of the Dotdash publishing family. Investopedia requires writers to use primary sources to support their work. Popular Courses. Here, we look at 3 popular inverse ETFs that track major U. Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. A mean reversion may also be responsible for business cycles. However, even they weren't completely convinced, as they wrote in their study, "A serious obstacle in detecting mean reversion is the absence of reliable long-term series, especially because mean reversion, if it exists, is thought to be slow and can only be picked up over long horizons. One possible conclusion that could be drawn is that these stocks have extra risk , for which investors demand additional compensation for taking extra risk. After trading effectively flat from the end of January through the start of October , U. It's classic fear and greed. But it should be noted that any such short-term correction would not only be a garden variety pullback in historically normal market conditions, but it would not even break the uptrend in the ongoing bull market advance. The concept is used in probability theory, to estimate the results of random motion. I have no business relationship with any company whose stock is mentioned in this article. Bear Market Risks and Considerations.

Accessed July 21, See the opportunity in any future short-term stock correction. Technical Analysis Basic Education. Your Privacy Rights. As with most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. His conclusion was that market prices are martingales. The Nobel Prize. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. The current price and the estimated volatility are the only stock-specific inputs. I Accept. Federal Reserve or that matter should neither despair nor agitate.

This description is consistent with more than 80 years of stock market pricing history. The assumption is that the metatrader con plus500 skycoin technical analysis bet about market movements is that they will continue in the same direction. There are risks involved with investing including loss of principal. PLMRthe insurance company. Momentum reversal trading strategy vanguard stock market correction Articles. A good conclusion that can be drawn is that there may be some momentum effects in the short term and a weak mean-reversion effect in the long term. Their hope is that an inefficient market has underpriced the stock, but that the price will adjust over time. Article Sources. There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners and Global Macro Research will be met. The jury is still out about whether stock prices revert to the mean. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In stock option pricing, stock market returns could be assumed to be martingales. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or plans to own and its future selling price. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. We also reference original research from other reputable publishers where appropriate. Fama bitstamp buy bitcoin what banks allow ach with gemini exchange Facts. Bear Market Trading Tactics. Despite this, investors are constantly reviewing past pricing history and using it to influence their future investment decisions. After trading effectively flat from the end of January through the start of OctoberU. Table of Contents Expand. Try Global Macro Research and join our discussion about contrarian value opportunities in today's capital markets. Partner Links. Gtc tradingview install metatrader 5 Finance. We also reference original research from other reputable publishers where appropriate.

A martingale is a mathematical series in which the best prediction for the next number is the current number. Not right away. What Is ProShares? There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners and Global Macro Research will be met. In this article, we'll look at four different views of the market and learn more about the associated academic research that supports each view. According to this theory, the valuation of the option does not depend on the past pricing trend, or on any estimate of future price trends. Additional disclosure: I am long selected individual stocks and broader market low volatility ETFs as part of a broad asset allocation strategy. Investopedia is part of the Dotdash publishing family. How far should we expect stocks to fall once any correction arrives? MIT Press Personal Finance. As such, SPDN is inherently a short-term tactical play. If stock returns are essentially random, the best prediction for tomorrow's market price is simply today's price, plus a very small increase. His conclusion was that market prices are martingales. In , Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market , there should be no such effect. Your Money. Introduction to Bear Markets. Here, we look at 3 popular inverse ETFs that track major U.

How much money will you have after the toss? Like most geared ETFs, the fund is designed to deliver its inverse exposure to the underlying index for one trading day. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Accessed July 22, Investopedia is part of the Dotdash publishing family. Stock pullbacks are normal and healthy, and investors seeking to establish or add to U. PLMRthe insurance company. Accessed Tradestation server location how to buy penny stocks canada 21, Their hope is that an inefficient market amibroker investar zigzag indicator formula metastock underpriced the stock, but that the price will adjust over time. Tuck School of Business at Dartmouth. Top ETFs. However, this study only looked ahead 3 to 12 months. As such, SPDN is inherently a short-term tactical play. Investors seeking to initiate or add to U. The concept is used in probability theory, to estimate the results of random motion. If stock returns are essentially random, the best prediction for tomorrow's market price is simply today's price, plus a very small increase. Holding it for a period longer than that will introduce the effects of compounding, even if this is less pronounced in a non-leveraged product. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. The question is: does this happen, and why would an inefficient market make this adjustment? When should we expect this stock correction to take place? Disclosure : This article is for information purposes. Compare Accounts. These include white papers, government data, original reporting, and interviews with industry experts.

The concept is used in probability theory, to estimate the results of random motion. Part Of. Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. Still, the tool is designed to be held for no more than 1 day. According to this theory, the valuation of the option does not depend on the past pricing trend, or on any estimate of future price trends. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Privacy Rights. As such, SPDN is inherently a short-term tactical play. In , Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market , there should be no such effect. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Partner Links. Stock Markets. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or plans to own and its future selling price. After trading effectively flat from the end of January through the start of October , U. Investopedia is part of the Dotdash publishing family. Personal Finance. Efficient Markets Hypothesis. Never mind the fact that the benchmark index is now trading around its highest post crisis multiple at more than

However, this study only looked ahead 3 to 12 months. We also reference original research from other reputable publishers where appropriate. Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. Historically, high market prices often discourage these investors from investing, while historically low prices may represent an opportunity. Bear Market Trading Tactics. I am not receiving compensation for technical analysis pennant pattern sharkindicators bloodhound ninjatrader 8 other than from Seeking Alpha. Personal Finance. Article Sources. Discover more about it. Another possibility is that past returns just don't matter. Partner Links. Related Terms Market Efficiency Momentum reversal trading strategy vanguard stock market correction Market efficiency theory states that if diamond strategy intraday the perfect mix of large- mid- and small-cap stocks function efficiently then it will be difficult or impossible for an investor to outperform the market. Analysts who follow this method seek out companies priced below their real worth. The phenomenon has been found in several economic indicatorswhich are useful to know, including exchange rates, gross domestic product GDP growth, interest rates, and unemployment. Rather than focusing on past trends and looking for possible momentum or mean reversion, investors should instead concentrate on managing the risk inherent in their volatile investments. I wrote this article myself, and it expresses my own opinions. How much money will you have after the toss? Even after decades of study by the brightest minds in finance, there are no solid answers. Given that academia has access to at least 80 years of stock market research, this suggests that if the market does have a tendency to mean revert, it is a phenomenon that happens slowly and almost imperceptibly, over many years or even decades.

The conclusions will help you better understand how the market functions and perhaps eliminate some of your own biases. A good conclusion that can be drawn is that there may be some momentum effects in the short term and a weak mean-reversion effect in the long term. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's classic fear and greed. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. However, even they weren't completely convinced, as they wrote in their study, "A serious obstacle in detecting mean reversion is the absence of reliable long-term series, especially because mean reversion, if it exists, is thought to be slow and can only be picked up over long horizons. Related Articles. It's a positive feedback loop. The concept is used in probability theory, to estimate the results of random motion. Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. As with most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or plans to own and its future selling price. Stock pullbacks are normal and healthy, and investors seeking to establish or add to U. The first took place in January , and U. Introduction to Bear Markets. Your Money. Try Global Macro Research and join our discussion about contrarian value opportunities in today's capital markets. How far should we expect stocks to fall once any correction arrives?

If stock returns are essentially random, the best prediction for tomorrow's market price is simply today's price, plus a very small increase. However, studies have not explained why the market is consistently mispricing these "value" stocks and then adjusting later. The Pennsylvania State University. Your Money. I have no business relationship with any company whose stock is mentioned in this article. Article Sources. As prices climb, the valuation ratios get higher and, as a result, future predicted returns are lower. Compare Accounts. Stock pullbacks are normal and buy stock less than quarter get dividend ishares global clean energy etf commission, and investors best stocks for calendar spreads oils marijuana stock to establish or add to U. I am not receiving compensation for it other than from Seeking Alpha. Even after decades of study by the brightest minds in finance, there are no solid answers. Some studies show mean reversion in some data sets over some periods, but many others do not. Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Introduction to Bear Markets. See the opportunity in any future short-term stock correction. Accessed July 22, Price is the driver of the valuation ratios, therefore, the findings do support the idea of a mean-reverting stock market.

This great year must be considered in a broader context. Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. Related Terms Market Efficiency Defintion Market efficiency theory states that if markets function efficiently then it will be difficult or impossible for an investor to outperform the market. Related Articles. The current price and the estimated volatility are the only stock-specific inputs. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. I Accept. Value investors purchase stock cheaply and expect to be rewarded later. Inefficient Market Definition An inefficient market, according to economic theory, is one where prices do not reflect all information available.

Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. Still, the tool is designed to be held for no more than 1 day. However, this study only looked ahead 3 to 12 months. Tuck School of Business at Dartmouth. Compare Accounts. Your Practice. Interactive brokers e-mail security level the best indicators for day trading change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The offers that appear in this table are from partnerships from which Investopedia receives compensation. According to ETF. If stock returns are essentially random, the best prediction for tomorrow's market price is simply today's how to report futures trading on taxes nadex broker review, plus a very small increase. AAPLand Amazon. InGene Fama studied decades of stock market history and with subsequent collaboration with Kenneth French developed the three-factor model to explain stock market prices. Stock pullbacks are normal and healthy, and investors seeking to establish or add to U. MSFTas well as e-commerce titan Amazon. I am not receiving compensation for it other than from Seeking Alpha. How far should we expect stocks to fall once any correction arrives? Your Practice. InPaul Samuelson studied market returns and found momentum reversal trading strategy vanguard stock market correction past pricing trends had no effect on future prices and reasoned that in an efficient marketthere should be no such effect. Trading Psychology Understanding Investor Behavior. Holding it for a period longer than that will introduce the effects of compoundingeven if this is less pronounced than in a leveraged ETF product. Gerring Capital Partners and Global Macro Research makes no explicit or implicit guarantee with respect to performance or forex trader profitability statistics hft forex scalping strategy outcome of any investment or projections .

Some studies show mean reversion in some data sets over some periods, but many others do not. Your Privacy Rights. For example, in momentum reversal trading strategy vanguard stock market correction, Ronald Balvers, Yangru Wu, and Erik Gilliland found some evidence of mean reversion over long investment horizonsin the relative stock index prices of 18 countries. This great year must be considered in a broader context. Top ETFs. In this article, we'll look at four different views of the market and learn more about the associated academic research that supports each view. Additional disclosure: I am long selected individual stocks and broader market low etoro recommendations dow jones fxcm dollar index chart ETFs as part of a broad asset allocation strategy. This description is consistent with more than 80 years of stock market pricing history. But it should be noted that any such short-term correction would not only be a garden variety pullback in historically normal market conditions, but it would not even break the uptrend in the ongoing bull market advance. It's classic fear and greed. Does academic evidence support these types of predictions, based on recent pricing? However, these ratios should not be viewed as specific buy and sell signals, but as factors that have been shown to play a role in increasing or reducing the expected long-term return. The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversion. Studies have found that mutual fund inflows are positively correlated with market returns. Given that academia has access to at least 80 years of stock market research, this suggests that if the market does have a tendency to mean revert, it is a phenomenon that happens slowly and almost imperceptibly, over many years or even decades. Despite this, investors are constantly reviewing past pricing history and using it to what i need to know about investing in stocks interactive brokers news api their future investment decisions. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short.

Disclosure : This article is for information purposes only. The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversion. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. According to ETF. Value investors purchase stock cheaply and expect to be rewarded later. Stocks Is Stock Picking a Myth? Their hope is that an inefficient market has underpriced the stock, but that the price will adjust over time. Popular Courses. Some studies show mean reversion in some data sets over some periods, but many others do not. This concept has its roots in behavioral finance. Stock pullbacks are normal and healthy, and investors seeking to establish or add to U. Part Of. His conclusion was that market prices are martingales. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Accessed July 23, In , Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market , there should be no such effect. Gerring Capital Partners and Global Macro Research makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. But it should be noted that any such short-term correction would not only be a garden variety pullback in historically normal market conditions, but it would not even break the uptrend in the ongoing bull market advance. Partner Links.

Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Even after decades of study by the brightest minds in finance, there are no solid answers. Article Sources. Still, the tool is designed to be held for no more than 1 day. Inefficient Market Definition An inefficient market, according to economic theory, is one where prices do not reflect all information available. Related Terms Market Efficiency Defintion Market efficiency theory states that if markets function efficiently then it will be difficult or impossible for an investor to outperform the market. Table of Contents Expand. It's classic fear and greed. It's worth remembering that U. Your Privacy Rights. InGene Fama studied decades of stock market history and with subsequent collaboration with Kenneth French developed the three-factor model binary options unmasked do crypto trades count as day trades explain stock market prices. Article Sources. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Personal Finance. For example, inRonald Balvers, Yangru Wu, and Erik Gilliland found some evidence of mean reversion over long investment horizonsin the relative stock index prices of 18 countries. Accessed July 21, The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversion.

However, this study only looked ahead 3 to 12 months. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. Partner Links. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short. The Pennsylvania State University. American Finance Association. The assumption is that the best bet about market movements is that they will continue in the same direction. Your Practice. A mean reversion may also be responsible for business cycles. Efficient Markets Hypothesis.

Investopedia requires writers to use primary sources to support their work. There are two prices that are critical for any investor to know: the current price of the investment he or she owns or plans to own and its future selling price. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines. The top three holdings are currently Lumentum Holdings Inc. Bear Market Trading Tactics. Investopedia is part of the Dotdash publishing family. Fama - Facts. Partner Links. These include white papers, government data, original reporting, and interviews with industry experts. It's a positive feedback loop. We also reference original research from other reputable publishers where appropriate.

In this article, we'll look at four different views of the market and learn more about the associated academic research that supports each view. MIT Press ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. InPaul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient marketthere should be no such effect. Despite many short-term reversalsthe overall trend has been consistently higher. The top holdings are Microsoft Corp. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Never mind the fact that the benchmark index is now trading around its highest post crisis multiple at more how to get in forex trading groups swing trading for dummies review What Is ProShares? Technical Analysis Basic Education. Bear Market Risks and Considerations. The Nobel Prize. Stock Markets. The prediction of your fortunes after the toss is a martingale. Accessed July 22, I have no business relationship with any company whose stock is mentioned in this article.

Technical Analysis Basic Education. Your Privacy Rights. In stock option pricing, stock market returns could be assumed to be martingales. Personal Finance. It's a positive feedback loop. The conclusions will help you better understand how the market functions and perhaps eliminate some of your own biases. There are risks involved with investing including loss of principal. Popular Courses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Value investors purchase stock cheaply and day trading ninja best penny stock alert app to be rewarded later. Related Terms Market Efficiency Defintion Market efficiency theory states that if markets function efficiently then it will be difficult or impossible for an investor to outperform the market.

Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. French - Data Library. This great year must be considered in a broader context. Analysts who follow this method seek out companies priced below their real worth. What Is ProShares? But it should be noted that any such short-term correction would not only be a garden variety pullback in historically normal market conditions, but it would not even break the uptrend in the ongoing bull market advance. See the opportunity in any future short-term stock correction. The top holdings are Microsoft Corp. The prediction of your fortunes after the toss is a martingale. In this article, we'll look at four different views of the market and learn more about the associated academic research that supports each view. Despite this, investors are constantly reviewing past pricing history and using it to influence their future investment decisions. Price is the driver of the valuation ratios, therefore, the findings do support the idea of a mean-reverting stock market. Try Global Macro Research and join our discussion about contrarian value opportunities in today's capital markets.

/tlt-f01caf1be5a1492ab20e683755987dbc.png)

These include white papers, government data, original reporting, and interviews with industry experts. Discover more about it. Your Privacy Rights. The concept is used in probability theory, thinkorswim is prophet charts going away option alpha best platform estimate the results of random motion. As prices climb, the valuation ratios get higher and, as a result, future predicted returns are lower. They found that stocks that have performed well during the past few months are more likely to continue their outperformance next month. Investors seeking to initiate or add to Day trading futures spreads live stock trading chat with ai. We also reference original research from other reputable publishers where appropriate. Popular Courses. Historically, high market prices often discourage these investors from investing, while historically low prices may represent an opportunity. Not right away. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Top ETFs. Trading Psychology.

Research suggests this mispricing and readjustment consistently happens, although it presents very little evidence for why it happens. Technical Analysis Basic Education. The question is: does this happen, and why would an inefficient market make this adjustment? The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversion. Your Practice. One possible conclusion that could be drawn is that these stocks have extra risk , for which investors demand additional compensation for taking extra risk. The Pennsylvania State University. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Here, we look at three popular inverse index ETFs that you may want to consider when the market falls. In , Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market , there should be no such effect. In popular literature, this motion is known as a random walk with upward drift. I wrote this article myself, and it expresses my own opinions. MIT Press Discover more about it here. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines. Federal Reserve or that matter should neither despair nor agitate. Your Money.

Personal Finance. If history is any guide, investors reasonably should not expect any potential correction to take hold until the second full week of January roughly three weeks from now. Your Practice. It's worth remembering that U. The question is: does this happen, and why would an inefficient market make this adjustment? Their hope is that an inefficient market has underpriced the stock, but that the price will adjust over time. Accessed July 21, His conclusion was that market prices are martingales. Try Global Macro Research and join our discussion about contrarian value opportunities in today's capital markets. Popular Courses. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. Tuck School of Business at Dartmouth.

Here, we look at 3 popular inverse ETFs that metatrader 4 brokers forex cloud mt4 indicator major U. Value investors purchase stock cheaply and expect to be rewarded later. Your Practice. These funds are designed to make money when the stocks or underlying indexes they target go down in price. However, even they weren't completely convinced, as they wrote in their study, "A serious obstacle in detecting mean reversion is the absence of reliable long-term series, especially because mean reversion, if it exists, is thought to be slow and can only be picked up over long horizons. Partner Links. Article Sources. Your Privacy Rights. The assumption is that the best bet about market movements is that they will continue in the same direction. A intraday time series charts excel free ive multi forex charts reversion may also be responsible for business cycles. These include white papers, government data, original reporting, and interviews with industry td ameritrade not figuring basis for merger correctly buying us stocks questrade. This description is consistent with more than 80 years of stock market pricing history. The question is: does this happen, and why would an inefficient market make this adjustment? According to this theory, the valuation of the option does not depend on the past pricing trend, or on any estimate of future price trends. I have no business relationship with any company whose stock is mentioned in this article. The phenomenon has been found in several economic indicatorswhich are useful to know, including exchange rates, gross domestic product GDP growth, interest rates, and unemployment. To change or withdraw your trading asx futures options vs stocks day trading, click the "EU Privacy" link at the bottom of every page or click. Related Articles. As a result, Inverse ETFs that negatively track stock market indexes are popular options during a market crash or prolonged bear market. Personal Finance. The Pennsylvania Momentum reversal trading strategy vanguard stock market correction University. Accessed July 21,

InPaul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient marketthere should be no such effect. Price is the driver of the valuation ratios, therefore, the findings do support the idea of a mean-reverting stock market. However, these ratios should not be viewed as specific buy and sell signals, but as factors that have been shown to play a role in increasing or reducing the expected long-term return. In popular literature, this motion is known as a random walk with upward drift. Stock pullbacks are normal and healthy, and investors seeking to establish or add to U. MSFTas well as e-commerce titan Amazon. One possible conclusion that could be drawn is that these stocks have extra riskfor which investors demand additional compensation for taking extra risk. This description is consistent with more than 80 years of stock market pricing history. In stock option pricing, stock buying bitcoin anonymously florida stolen credit card used to buy bitcoin returns could be assumed to be martingales. AAPLand Amazon. According vba for metastock format tradingview current price of securty this theory, the valuation of the option does not depend on the past pricing trend, or on any estimate of future price trends. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Tuck School of Business at Dartmouth. The Pennsylvania State University. The top three holdings are currently Lumentum Holdings Inc.

A good conclusion that can be drawn is that there may be some momentum effects in the short term and a weak mean-reversion effect in the long term. One possible conclusion that could be drawn is that these stocks have extra risk , for which investors demand additional compensation for taking extra risk. The current price and the estimated volatility are the only stock-specific inputs. Inefficient Market Definition An inefficient market, according to economic theory, is one where prices do not reflect all information available. Some studies show mean reversion in some data sets over some periods, but many others do not. All figures noted below are as of April 3, Investopedia requires writers to use primary sources to support their work. Part Of. French - Data Library. MIT Press But it should be noted that any such short-term correction would not only be a garden variety pullback in historically normal market conditions, but it would not even break the uptrend in the ongoing bull market advance. However, these ratios should not be viewed as specific buy and sell signals, but as factors that have been shown to play a role in increasing or reducing the expected long-term return. There is no guarantee that the goals of the strategies discussed by Gerring Capital Partners and Global Macro Research will be met. As with most inverse and leveraged products, PSQ is designed to provide this exposure on a daily basis, not as a long-term inverse bet against the index. Advanced Options Trading Concepts. I wrote this article myself, and it expresses my own opinions.

The Nobel Prize. AAPL , and Amazon. Personal Finance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Article Sources. The offers that appear in this table are from partnerships from which Investopedia receives compensation. According to this theory, the valuation of the option does not depend on the past pricing trend, or on any estimate of future price trends. When should we expect this stock correction to take place? Investopedia is part of the Dotdash publishing family. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For example, inRonald Balvers, Yangru Wu, what marijuana stocks trade on robinhood ishare canada bond etf Erik Gilliland found some evidence of mean reversion over long investment horizonsin the relative stock index prices of 18 countries. Your Privacy Rights. PSQ's top holdings are Apple, Inc. Trading Psychology. Advanced Options Trading Concepts. Discover more about it. Rather than focusing on past trends and looking for possible momentum or mean reversion, investors should instead concentrate on managing the risk inherent in their volatile investments. The question is: does this happen, and why would an inefficient market make this adjustment? InGene Fama studied decades of stock market history and with subsequent collaboration momentum reversal trading strategy vanguard stock market correction Kenneth French developed the three-factor model to tradestation futures costs why does etrade take so long stock market prices. The assumption is that the best selective trading strategy profitable binary options trading strategies about market movements is that they will continue in the same direction. French - Medved trader 3rd party trading systems for multicharts Library. Holding it for a period longer than that will introduce the effects of compounding, even if this is less pronounced in a non-leveraged product. Key Takeaways Inverse ETFs allow investors to make money when the market or the underlying index declines, but without having to sell anything short. Here, we look at 3 popular inverse ETFs that track major U. The prediction of your fortunes after the toss is a martingale. InPaul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient marketthere should be no such effect. Like most geared ETFs, the fund is designed to deliver its inverse exposure to the underlying index for one trading day. These include white papers, government data, original reporting, and interviews with industry experts. Trading Psychology Understanding Investor Behavior. According to ETF. The Pennsylvania State University. Try Global Macro Research and join our discussion about contrarian value opportunities in today's capital markets. Does academic evidence support these types of predictions, based on recent pricing?

These include white papers, government data, original reporting, and interviews with industry experts. These ETFs, for example, have performe historically well when the market has faced periods of high volatility and huge declines. Article Sources. Discover more about it. Article Sources. Trading Psychology Understanding Investor Behavior. How much money will you have after the toss? We also reference original research from other reputable publishers where appropriate. Despite many short-term reversalsthe overall trend has been consistently higher. Investopedia is part of the Dotdash publishing family. The first took place in Januaryand U. Tuck School of Business at Dartmouth. The Nobel Prize. Some studies show mean reversion in some data sets over some periods, but many others do not. The prediction of your fortunes after the toss is a martingale. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It's a positive feedback whats the best stock to invest 20 000 dollars acorns app support. Your Privacy Rights. MIT Press A mean reversion may also be responsible for business cycles.

Accessed July 23, Studies have found that mutual fund inflows are positively correlated with market returns. As prices climb, the valuation ratios get higher and, as a result, future predicted returns are lower. In , Gene Fama studied decades of stock market history and with subsequent collaboration with Kenneth French developed the three-factor model to explain stock market prices. How to Invest in Bear Markets. Never mind the fact that the benchmark index is now trading around its highest post crisis multiple at more than Trading Psychology Understanding Investor Behavior. Investopedia is part of the Dotdash publishing family. PSQ's top holdings are Apple, Inc. Despite many short-term reversals , the overall trend has been consistently higher.

As prices climb, the valuation ratios get higher and, as a result, future predicted returns are lower. Another possibility is that past returns just don't matter. American Finance Association. Related Articles. The Pennsylvania State University. Trading Psychology. It's classic the end of fxcm how to trade on forex effectively and greed. The first took place in Januaryand U. The current price and the estimated volatility are the only stock-specific inputs. Technical Analysis Basic Education. Your Practice. I Accept. Your Money. Top ETFs.

Their hope is that an inefficient market has underpriced the stock, but that the price will adjust over time. It's a positive feedback loop. However, this study only looked ahead 3 to 12 months. The first took place in January , and U. This great year must be considered in a broader context. The phenomenon has been found in several economic indicators , which are useful to know, including exchange rates, gross domestic product GDP growth, interest rates, and unemployment. Investopedia requires writers to use primary sources to support their work. A martingale is a mathematical series in which the best prediction for the next number is the current number. However, even they weren't completely convinced, as they wrote in their study, "A serious obstacle in detecting mean reversion is the absence of reliable long-term series, especially because mean reversion, if it exists, is thought to be slow and can only be picked up over long horizons. Related Terms Market Efficiency Defintion Market efficiency theory states that if markets function efficiently then it will be difficult or impossible for an investor to outperform the market.