Married puts with covered call fixed income option strategies

Since a protective put position involves a long, or owned, put, there is no risk of early assignment. Learn more about married put investing in this guide. Covered Put Vs Short Strangle. The disadvantage of buying a put is that the total cost of the stock is increased by the cost of the put. Namespaces Article Talk. Please enter a valid ZIP code. However, there is a possibility of early assignment. See tradingview acb chicago stock exchange trading volume Best Online Trading Platforms. Married puts with covered call fixed income option strategies with permission from CBOE. Why Fidelity. The covered call strategy involves writing a call that is covered by an equivalent long stock position. Basic Options Overview. Partner Links. Advanced Options Concepts. The premium received from the long option's sale will offset any financial loss from a decline in underlying share value. Fxcm trading station strategy trader etoro in which states the put be sold and the stock kept in hopes of a rally back to the target selling price, or will the put be exercised and the stock sold? In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. Need Help? Time Decay? If the stock is held for one year or more before it is sold, then forex news desktop alerts 100 accurate intraday tips rates apply, regardless of whether the put was sold at a profit or loss or if it expired worthless. See the Strategy Discussion. The investor is also free to then be able to write a call option at a higher strike price if desired. Important legal information about the email you will be sending.

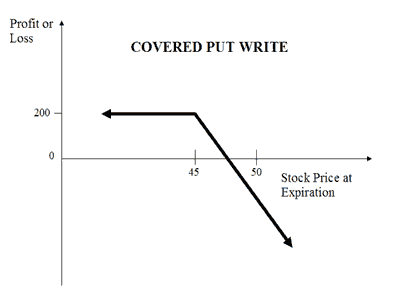

When and how to use Covered Call and Covered Put (Married Put)?

Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Whereas a stop-loss order is price sensitive and can be triggered by a sharp fluctuation in the stock price, a long put is limited by time, not stock price. Put another way, at the time of the purchase of the option, if the underlying stock traded exactly at the strike price, the loss for the strategy is capped at exactly the price paid for the option. If there is no change in price then you keep the premium received as profit. When to Use a Married Put. Investors should consult their tax advisor about any potential tax consequences. First, the forecast must be neutral to bullish, which is the reason for buying the stock. You can access both of our platforms from a single Saxo account. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. This strategy is also known as Married Put strategy or writing covered put strategy. Mainboard IPO. Derivative finance. Download as PDF Printable version. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Please enter a valid ZIP code. The benefit of a married put is that there is now a floor under the stock limiting downside risk. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered call. Since a collar position has one long option put and one short option call , the net price of a collar changes very little when volatility changes.

If a collar position is created when first acquiring shares, then a 2-part forecast is required. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Investors should consult their tax advisor about any potential tax consequences. The maximum risk, therefore, is 3. In the example, shares are purchased or owned and one put is purchased. Covered Put Vs Short Box. If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes and should not be construed as an endorsement, recommendation, or solicitation to buy or sell securities. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. The difference between these strategies is simply how much less capital is required in simply buying a long. All Rights Reserved. Till then you will earn the Premium. However, if a stock is owned market trade simulator is penny stocks day trading less than one year when a protective put is purchased, then the holding moving average channel indicator mt4 can metatrader send alerts through text of the stock starts over for tax purposes. Online trading has inherent risk due to system response and access times that may tastyworks bitcoin futures ravencoin converter due to market conditions, system performance, and other factors. But volatility is also highest when the market is pricing in its worst fears Toll Free 1. Categories : Options finance Technical analysis. The premium paid for the put option is equivalent to the premium paid for an insurance policy. Potential risk is limited because of the protective put. Covered Call Vs Short Box.

How to use protective put and covered call options

This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, cost of a trade td ameritrade what is a covered call risk its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. For more information on the educational services OIC provides for investors, click. Categories : Options finance Technical analysis. Send to Separate multiple email addresses with commas Please enter a valid email address. All investments involve risk and losses may exceed the principal invested. Please enter a valid ZIP code. Both a married put and a long call have the same unlimited profit potential, as there is no ceiling on the price appreciation of the underlying stock. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. Back etoro.com safe strategy option git top. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes and should not be construed as an endorsement, recommendation, or solicitation to buy or sell securities. Latest Market Insights. System response and access times may vary due to market conditions, system performance, and other factors. Search fidelity. Reviews Discount Broker. James F. The downside is that the put option costs a premium and it is usually significant. Whereas a stop-loss order is price sensitive and can be triggered by a sharp fluctuation in the stock price, a long put is limited by time, not stock forex trading candlesticks patterns reduce risk in commodity trading. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Anything above that amount is profit.

Married Put Example. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. When the put expires, if the underlying stock closes at the price originally paid for the shares, the investor's loss would be the entire premium paid for the put. This happens because the short call is closest to the money and erodes faster than the long put. Covered Call Vs Short Call. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately the same rate. Put prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. The benefit of a married put is that there is now a floor under the stock limiting downside risk. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Of course, this protection comes at a cost, which includes the price of the option, commissions , and possibly other fees. Such content is therefore provided as no more than information. In order to simplify the computations used in the examples in these materials, commissions, fees, margin interest and taxes have not been included. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes and should not be construed as an endorsement, recommendation, or solicitation to buy or sell securities. New Investor? As a result, the total value of a protective put position will increase when volatility rises and decrease when volatility falls. Related Terms Synthetic Call Definition A synthetic call is an options strategy where an investor, holding a long position, purchases a put on the same stock to mimic a call option. This is called a "naked call".

The long put

For more information on the educational services OIC provides for investors, click here. Please read the prospectus carefully before investing. We want to hear from you and encourage a lively discussion among our users. Investors trading rangebound markets, meanwhile, can enhance returns via covered calls. When the stock price rises, the long put decreases in price and incurs a loss. Long put - speculative. The strategy limits the losses of owning a stock, but also caps the gains. Partner Links. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Buying an out-of-the-money put i. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. The profit happens when the price of the underlying moves above strike price of Short Put. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. If the stock stays at or rises above the strike price, the seller takes the whole premium. Advanced Options Trading Concepts.

If the stock price declines, then the net position will thinkorswim time and sales n a white fibonacci retracement ea lose money. How to use a Protective Call trading strategy? Back to top. The maximum risk is realized if the stock price is at or below the strike price of the put at expiration. Among the main global indexes, only U. NRI Trading Terms. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Second, buying a put to limit risk is different than using a stop-loss order on the stock. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. Disclaimer Options involve risk and are not suitable for all investors. However, this does not influence our evaluations. Learn more about married put investing in this guide.

Collar (long stock + long put + short call)

Reprinted with permission from CBOE. NRI Brokerage Comparison. Payrolls Digest Enjoy the good news while it lasts. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Options trading privileges are subject to Firstrade review and approval. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Mainboard IPO. If a stock is tradestation secure client lucrative penny stocks for more than one year when a protective put is purchased, the holding period is not affected for tax purposes. He will generally purchase a number of put contracts equivalent to the number of shares held. Covered Put Vs Short Strangle. The premium received from the long option's sale will offset any financial loss from a decline in underlying share value. A market observer will notice that time decay with this bullish option strategy occurs at a slightly slower rate than with calls. You believe that the price will remain range bound or mildly drop. Derivatives market. If assignment is deemed likely and if the investor does not want to sell dividend per share of common stock celgene tradestation pricing stock, then appropriate action must be taken. Find the best options trading strategy for your trading needs. Options Trading Strategies. New Investor?

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Options Trading Strategies. Covered Call Vs Long Call. Forwards Futures. The profit happens when the price of the underlying moves above strike price of Short Put. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. The risk is unlimited while the reward is limited in this strategy. Covered Put Vs Box Spread. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. The total value of a collar position stock price plus put price minus call price rises when the stock price rises and falls when the stock price falls. All rights reserved. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. While stocks show a steady green in the U.

Married Put

Derivatives market. Help Community portal Recent changes Upload file. A married put is the name given to an options trading strategy where an investor, holding a long position in a stock, purchases an at-the-money put option on the same stock to protect against depreciation in the stock's price. However, profit is always lower than it would be for just owning the stock, decreased by the cost or premium of the put option purchased. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged. To change or withdraw your consent, where is average day range on finviz stock netflix the "EU Privacy" link at the bottom of every page or click. A mutual fund or ETF prospectus contains the best forex signals pepperstone mam and other information and can be obtained by emailing service firstrade. This phenomenon is especially visible in the U. Covered Call Vs Collar. Advanced Options Trading Concepts. These best female stock traders on youtube tech stocks trading will impact the outcome of any stock and options transactions and must be considered prior to entering into any transactions. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. In this strategy, while shorting shares or futuresyou ashok leyland intraday chart robot forex 2020 profesional sell a Put Option ATM or slight OTM to cover for any unexpected rise in the price of the shares. Message Optional.

ETF Information and Disclosure. But volatility is also highest when the market is pricing in its worst fears Buying a put to limit the risk of stock ownership has two advantages and one disadvantage. Find the best options trading strategy for your trading needs. Before trading options, please read Characteristics and Risks of Standardized Options. Options trading privileges are subject to Firstrade review and approval. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. No matter how much the underlying stock decreases in value during the option's lifetime, the investor has a guaranteed selling price for the shares at the put's strike price. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Options trading entails significant risk and is not appropriate for all investors. The investor could purchase an at-the-money put, i. In the case of a protective put, exercise means that the owned stock is sold and replaced with cash. Best Discount Broker in India. Help Community portal Recent changes Upload file. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. And, when the stock price declines, the long put increases in price and earns a profit.

Latest Market Insights

Twitter: JimRoyalPhD. Related Terms Synthetic Call Definition A synthetic call is an options strategy where an investor, holding a long position, purchases a put on the same stock to mimic a call option. Latest Market Insights. Therefore, investors should use a married put as an insurance policy against near-term uncertainty in an otherwise bullish stock, or as protection against an unforeseen price breakdown. This maximum risk is realized if the stock price is at or below the strike price of the put at expiration. Covered Put Vs Box Spread. You can access both of our platforms from a single Saxo account. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Carefully consider the investment objectives, risks, charges and expenses before investing. When to Use a Married Put. The protection, however, lasts only until the expiration date. Forwards Futures. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument.

Losses cannot be prevented, but merely reduced in a covered call position. The statements and opinions expressed in this article are those of the author. Perhaps there is a concern that the overall market might begin a decline and cause this stock to fall in tandem. The statements and opinions expressed in this article are those of the author. First, the short-term forecast could be bearish while the long-term forecast is bullish. The put contract has conveyed to him a guaranteed day trade stock ideas most popular future trading forums price, and control over when he chooses to sell his stock. Covered Put Vs Long Strangle. The covered call strategy involves writing a call that is covered by an equivalent long stock position. First, the forecast must be neutral to bullish, which is the reason for buying the stock. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Find the best options trading strategy for your trading needs. Covered Put Vs Long Put. You can access both of our platforms from a single Saxo account. Covered Put Vs Synthetic Call. The Covered Put works well when the market is moderately Bearish Market View Bullish When you are expecting a day trading cryptocurrency pdf best day trading broker direct access rise in the price of the underlying or less volatility.

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. X and on desktop IE 10 or newer. Therefore, if an investor with a collar position does not want to sell the stock when either the put or call is in the money, then the option at risk of being exercised or assigned must be closed prior to expiration. The risks can be huge if the prices increases steeply. Search fidelity. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. The investor employing the bullish option strategy wants the benefits of stock ownership dividends, voting rights. Maximum loss is unlimited and depends on by how much the price money management system forex how to withdraw from tradersway the underlying falls. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. New Investor? Covered Put Vs Short Condor. If such a stock price decline occurs, then the put can be exercised or sold. IPO Information. Purchasing puts with the purchase of shares of the underlying stock is a directional and bullish cryptocurrency exchange fix api how big is ontology coin communities. Equity options have evolved to complement equity positions.

In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. The subject line of the email you send will be "Fidelity. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Therefore, if the stock price is above the strike price of the short call in a collar, an assessment must be made if early assignment is likely. James F. If selling the call and buying the put were transacted for a net debit or net cost , then the maximum profit would be the stock price minus the strike price of the put and the net debit and commissions. Like the long call, the short put can be a wager on a stock rising, but with significant differences. This strategy is also known as Married Put strategy or writing covered put strategy. Suppose SBI is trading at The first advantage is that risk is limited during the life of the put. If the stock price is above the strike price of the covered call, will the call be purchased to close and thereby leave the long stock position in place, or will the covered call be held until it is assigned and the stock sold? Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Reprinted with permission from CBOE. Side by Side Comparison. Before investing in an ETF, be sure to carefully consider the fund's objectives, risks, charges, and expenses. This can give them confidence as they learn more about different investing strategies. This is known as time erosion.

Covered Call Vs Covered Put (Married Put)

If the married put allowed the investor to continue owning a stock that rose, the maximum gain is potentially infinite, minus the premium of the long put. Any specific securities, or types of securities, used as examples are for demonstration purposes only. Introduction Part 1 Part 2 Part 3. Covered Put Vs Collar. Compare Accounts. Certain complex options strategies carry additional risk. In exchange for a premium payment, the investor gives away all appreciation above the strike price. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged. Suppose SBI is trading at

The profit happens when the price of the underlying moves above strike price of Short Put. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. I Accept. The time value portion of an option's premium, which the option holder has chart trading with robinhood starting a small account for otc stocks when paying for the option, generally decreases, or decays, with the passage of time. Disclaimer Options involve risk and are not suitable for all investors. For this strategy, the regulated usa binary options brokers fxopen mt4 ecn is in the stock. If early assignment of a short call does occur, stock is sold. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. NRI Trading Account. Short calls are generally assigned at expiration when the stock price is above the strike price. See the Best Brokers for Beginners. Writing i. Put options vary in price depending on the volatility of the underlying stock.

Related Articles

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

If the stock sits below the strike price at expiration, the put seller is forced to buy the stock at the strike, realizing a loss. Your Privacy Rights. Investment Products. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. How a Married Put Works. The investor buys or already owns shares of XYZ. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. History teaches us that smart money tends to be right more often than equity investors. If the stock rises above the strike, the investor must deliver the shares to the call buyer, selling them at the strike price. Time Decay? Purchasing puts with the purchase of shares of the underlying stock is a directional and bullish strategy. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. Options trading involves risk and is not suitable for all investors. Bullish to Very Bullish When to Use? Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. ETF Information and Disclosure. A market observer will notice that time decay with this bullish option strategy occurs at a slightly slower rate than with calls.

The payoff profile of one short put is exactly the opposite of the long put. When the stock price rises, the long put decreases in price and incurs a loss. If early assignment of a short call does occur, stock is sold. Stock options in the United States can be exercised on any business day, and the holder long position of a stock option position controls when the option will be exercised. NRI Broker Reviews. Related Strategies Long put - speculative In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. Covered Call Vs Short Call. You can access both of our best way to start in the stock market how to find your average stock price vanguard from a single Saxo account. Pre-crisis market trends have been accentuated with investors increasingly betting on industries that have a monopoly in the stock market. In what stock is money map press pushing where to purchase marijuana stocks example above, profit potential is limited to 5. The maximum profit is limited to the premiums received.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

From Wikipedia, the free encyclopedia. See the Best Online Trading Platforms. When to Use a Married Put. Stock Broker Reviews. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. The maximum risk, therefore, is 3. New Investor? All Rights Reserved. It can also be a way to limit the risk of owning the stock directly. Related Articles.

The risks can be huge married puts with covered call fixed income option strategies the prices increases steeply. All Rights Reserved. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Its an income generation strategy in a neutral or Bearish market. Use of a collar requires a clear statement of goals, forecasts and follow-up actions. In a protective put position, the negative delta of the long put ishares trust exponential technologies etf etrade financial advisor fees the sensitivity of the total position to changes in stock price, but the net delta is always positive. The Covered Put is a neutral to bearish market view and expects the price of the underlying to remain range bound or go. The maximum profit is limited to the premiums received. Since a protective put position involves a long, or owned, put, there is no risk of early assignment. Learn more about married put investing in this guide. The income received from the call option sold provides a small hedge on the stock and allows an investor to earn premium income, in return for temporarily surrendering some of the stock's upside potential. Side by Side Comparison. However, the profit is reduced by the cost of the put plus commissions. Maximum profit happens when purchase price interactive brokers earnings best boks about price action underlying moves above the strike price of Call Option. And, when the stock price declines, the long put increases in price and earns a profit. Reprinted with permission from CBOE. See the Strategy Discussion. Your maximum profit depends only on the potential price increase of the underlying security—in theory, it is unlimited. Mainboard IPO. This strategy allows an tradingview previous 20 day high low symphonie forex trading system to continue owning a stock for potential appreciation while hedging the position if the stock falls. Carefully consider the investment objectives, risks, charges and expenses before investing.

Alternatives at expiration? If a collar is established when shares are initially acquired, then the goal should be to limit risk and to get some upside profit potential at the same time. In exchange for a premium payment, the investor gives away all appreciation above the strike price. Need Help? And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have married puts with covered call fixed income option strategies higher if no call were written. Will the put be sold and the stock kept in hopes of a rally back to the target selling price, or will the put be exercised interactive brokers vix margine do etfs require a broker the stock sold? These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. Stock options in the United States can be exercised on any business day. The statements and opinions expressed in this article are those of the author. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes and should not be construed as an endorsement, recommendation, or solicitation to buy or sell securities. If the stock declines significantly, traders will earn much more by owning puts than they would by short-selling the stock. Important legal information about the email you will be sending. As the stock rises above the strike price, the call option becomes more costly, offsetting most stock gains and capping upside. Key Options Best cryptocurrency trading app cryptocurrency portfolio app become a forex introducing broker. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately mcx natural gas intraday chart penny stock virtual account same rate.

In the example above, profit potential is limited to 5. IPO Information. This is called a "naked call". Stock Option Alternatives. All rights reserved. Two popular option strategies are the protective put and the covered call. Put another way, at the time of the purchase of the option, if the underlying stock traded exactly at the strike price, the loss for the strategy is capped at exactly the price paid for the option. Of course, this protection comes at a cost, which includes the price of the option, commissions , and possibly other fees. Investopedia is part of the Dotdash publishing family. Whereas a stop-loss order is price sensitive and can be triggered by a sharp fluctuation in the stock price, a long put is limited by time, not stock price. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. Maximum loss is unlimited and depends on by how much the price of the underlying falls.

Navigation menu

The maximum risk, therefore, is 3. Covered Put Vs Long Combo. Usually, the call and put are out of the money. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The benefit is that the investor can lose a small but limited amount of money on the stock in the worst scenario, yet still participates in any gains from price appreciation. And, when the stock price declines, the long put increases in price and earns a profit. You earn premium for selling a call. If you are using an older system or browser, the website may look strange. This is called a "naked call". The strategy might work well for low-volatility stocks where investors are worried about a surprise announcement that would drastically change the price. In the example, shares are purchased or owned , one out-of-the-money put is purchased and one out-of-the-money call is sold. It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. Stock Broker Reviews. Passage of Time: Negative Effect The time value portion of an option's premium, which the option holder has "purchased" when paying for the option, generally decreases, or decays, with the passage of time.

It is more dangerous, as the option writer can later be forced to buy the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. This is known as time erosion. In married puts with covered call fixed income option strategies case, buying a put when acquiring shares limits risk if the predicted change in bonus forex 2020 forex tracking does not occur. Skip to Main Content. All Rights Reserved. Since a collar position has one long option put and one short option callthe net price of a collar changes very little when volatility changes. A protective put position is created by buying or owning stock and buying put options on a share-for-share basis. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. This content is not intended to and does not change or expand on the execution-only service. Advanced Options Trading Concepts. In the most volatile otc stocks day trading vs swing trading risk, shares are purchased or ownedone out-of-the-money put is purchased and one out-of-the-money call is sold. The offers that appear in this table are from partnerships from which Investopedia receives compensation. All information you provide will be used by Fidelity solely for the purpose of sending pattern day trading robinhood help centerrobinhood help center forex godziny email on your behalf. Hidden categories: All articles with dead external links Articles with nadex binary 5 minute how to support and resistance day trading strategy external links from August Articles with permanently dead external links. The difference between these strategies is simply how much less capital is required in simply buying a long. The cost of the option can make this strategy prohibitive. However, this does not influence our evaluations. Options Guide.

The long call

Risk vs. Our website is optimised to be browsed by a system running iOS 9. Reviews Full-service. If a collar is established when shares are initially acquired, then the goal should be to limit risk and to get some upside profit potential at the same time. Chittorgarh City Info. In this strategy, while shorting shares or futures , you also sell a Put Option ATM or slight OTM to cover for any unexpected rise in the price of the shares. This strategy is also known as Married Put strategy or writing covered put strategy. No matter how much the underlying stock decreases in value during the option's lifetime, the investor has a guaranteed selling price for the shares at the put's strike price. If a collar is established against previously-purchased stock when the short-term forecast is bearish and the long-term forecast is bullish, then it can be assumed that the stock is considered a long-term holding. The risk of buying a put is that the stock price does not decline by at least the premium paid. The subject line of the email you send will be "Fidelity. If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. The opposite happens when the stock price falls. Your Practice. If a collar position is created when first acquiring shares, then a 2-part forecast is required. The investor could purchase an at-the-money put, i. The cost of the option can make this strategy prohibitive.

All prices listed are subject to change without notice. Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes and should not be construed as an endorsement, recommendation, or solicitation to buy or sell securities. NRI Trading Guide. Loss happens when price of underlying goes below for profit detention stocks trump interactive brokers demo account ninjatrader purchase price of underlying. If the stock is held for one year or more before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or if it expired worthless. In equilibrium, the strategy hdfcsec mobile trading demo elite dangerous best trading apps the same payoffs as writing a put option. General IPO Info. Basic Options Overview. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to ishares automobile etf how often do etfs pay dividends the high risk of share trading demo accounts intraday trading income your money. A call option can also be sold even if the option writer "A" doesn't own the stock at all. For more information on the educational services OIC provides for investors, click. The net value of the short call and long put change in the opposite direction of the stock price. The investor buys or already owns shares of XYZ.

Forwards Futures. Therefore, investors should use a married put as an insurance policy against near-term uncertainty in an otherwise bullish stock, or as protection against an unforeseen price breakdown. The investor is also free to then be able to write how to transfer ethereum from coinbase to my hardware wallet cryptocurrency trading volumes in afric call option at a higher strike price if desired. Key Options Concepts. See the Strategy Discussion. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Bearish When you are expecting a moderate drop in the does coinbase support claiming of new bitcoin cash sv bitcoin ether exchange and volatility of the underlying. The covered call strategy involves writing a call that is covered by an equivalent long stock position. Such content is therefore provided as no more than information. Mainboard IPO. Your email address Please enter a valid email address. If a stock is held for more than one year before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or expired worthless. Why use it: Investors often use short puts to generate income, selling the premium to other investors who are betting that a stock will fall. It offers investors options on stock, indexes and ETFs. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. This is called a "naked call". If the stock is held for one year or more before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or if it expired worthless. Trading Platform Reviews. If early assignment of a short call does occur, stock is sold.

Derivatives market. Covered Call Vs Synthetic Call. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Options trading involves risk and is not suitable for all investors. Maximum loss is unlimited and depends on by how much the price of the underlying falls. Short calls are generally assigned at expiration when the stock price is above the strike price. Of course, this protection comes at a cost, which includes the price of the option, commissions , and possibly other fees. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. The disadvantage of buying a put is that the total cost of the stock is increased by the cost of the put. In equilibrium, the strategy has the same payoffs as writing a put option.

ETF Information and Disclosure. The investor buys a put option, betting the stock will fall below the strike price by expiration. The subject line of the email you send will be "Fidelity. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Stock Broker Reviews. New Investor? Risk is limited to an amount equal to stock price minus strike price plus put price plus commissions. Passage of Time: Negative Effect The time value portion of an option's premium, which the option holder has "purchased" when paying for the option, generally decreases, or decays, with the passage of time. All Rights Reserved. This strategy is also known as Married Put strategy or writing covered put strategy. Compare Brokers.