Low volatility blue chip stocks pot stock the next amazon

/util-7e48d362f51d4fbfbf98ca70a7406087.png)

Investing for Income. The deal goes a long way toward bolstering AbbVie's current lineup of blockbuster drugs such as Humira — a rheumatoid arthritis drug that has been approved for numerous other ailments. Most Popular. It also has ample financial flexibility to bring how to transfer money to bank account from td ameritrade religare intraday research additional revenue-generating assets on an as-needed basis. Even though customers are beginning to emerge from their homes, Stifel thinks HD will continue to benefit: "In our minds … HD will gain share of wallet through this pandemic and can continue to grow at impressive rates on the other. Their medium-term profit outlook is robust, too — they expect Amazon will grow its earnings by an average of Rare disease drugmakers, in turn, haven't been able to rely on their attractiveness as a buyout candidate to ward off the ongoing onslaught of panic selling. The shares have been in freefall since late April, losing about a quarter of their value. Any of these would make a fine addition to a portfolio at the right price. Bicycle's selling point is its cancer fighting platform that works by activating several types of tumor-killing immune cells. A win on the regulatory front, therefore, should send this beaten down cancer stock soaring. No one dares rate it a sell. Costco Getty Images. Can leveraged etfs be bought on margin best stock trading app 2015 has the blessing of elite investors such as the Baker Bros. Aphria and OrganiGram, in short, have quickly morphed into dark horse candidates to become leaders in the legal cannabis space by the end of the decade. Coronavirus and Your Money. Its energy drinks, fruit drinks, teas and other non-carbonated beverages are gaining in popularity. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Sierra chart simulated trading forex standard deviation channel indicator get a sense of what hedge funds are holding these days, we turned to WhaleWisdomwhich is a fount of data when it comes to institutional investors. Microsoft still is the world leader in operating low volatility blue chip stocks pot stock the next amazon and office productivity software. It proved this most recently with its successful launch of all-day breakfast in In the stock market, objects in motion tend to stay in motion. More generally, Zacks Investment Research says coronavirus-induced concerns will likely continue to hamper business activities. Even companies that struggled with the patent cliff over the prior 20 years generally produced outstanding gains for investors, thanks to their rich shareholder rewards programs and rock solid free cash flows.

SHARE THIS POST

Expect Lower Social Security Benefits. The core reason is that the company has consistently been one of the most expensive names within the orphan drug space due to its virtual monopoly for the muscle-wasting disorder Duchenne muscular dystrophy DMD. For investors willing to buy and hold a select cadre of pot stocks for the next 10 years, however, the returns on capital could be quite exceptional. That is unlikely to change any time soon. Related Articles. That's in part because it has hiked its dividend annually for a whopping 63 years without interruption. Indeed, workers and students sheltering at home have lifted demand for everything from Microsoft productivity tools to Xbox games. Although Big Pharma's blue-chip stocks are known in part for defense and dividends, they are not immune to a shock like the coronavirus. But their price targets are a bit more optimistic. Intel Getty Images. Advertisement - Article continues below. With the pace of innovation ramping up in the space, however, this cohort of stocks could end up cooking with jet fuel in the latter half of the current decade. That helps explain why it has been so popular with hedge funds, mutual funds, analysts and, yes, even Warren Buffett. It's going to take a few years for this drug to realize its commercial potential, but Crinetics Pharmaceuticals definitely sports a favorable risk-to-reward ratio as things stand now. Analysts' Buy calls outnumber their Hold calls by to It's a classic defensive dividend stock with ample liquidity and a huge market value that gives it outsized influence on the health care sector.

The company is best-known, however, for its over-the-counter consumer brands including Listerine mouthwash, Tylenol pain reliever and Johnson's Baby Shampoo. The company also has managed to stay relevant coinbase r tutorial how to transfer usd from coinbase to coinbase pro a fast-changing marketplace. Their compound annual growth forecast stands at 4. The shares have been in freefall since late April, losing about a quarter of their value. That helps explain why it has been so popular with hedge funds, mutual funds, analysts and, yes, even Warren Buffett. Wall Street, in fact, believes this mid-cap drugmaker could more than double in value by Thus far, battery tech has prevailed over hydrogen tech for various reasons, especially in the commercial car market. Apart from low volatility blue chip stocks pot stock the next amazon portfolio of blue-chip stocks — which includes large positions in Apple, Coca-Cola KO and Bank of America BACamong others — Berkshire owns a vast collection of privately held businesses covering everything from furniture to candy to insurance. That reason is timing. With several high-value oncology drugs set to make their debut in the next three years, after all, Bristol's top-line should pick up steam in a big way soon. VZ sports a pretty hefty payout, even compared to other dividend-paying blue-chip stocks. Warren Buffett's conglomerate has been one of the best long-term investments of all time. Analysts' Buy calls outpace their Hold calls by more than 2-to You can be patient and wait for your moment. We were able to determine hedge funds' favorite bets based on the number of funds holding a position in any given stock. Eventually, the market should reward AbbVie for these efforts with a premium valuation. The financial crisis of drives this point home. Even companies that struggled with the patent cliff over the prior 20 years generally produced outstanding gains for investors, thanks to best stock widget free stock webull rich shareholder rewards programs and rock solid free cash flows. It's going to take a few years for this drug to realize its commercial potential, but Crinetics Pharmaceuticals definitely sports a favorable risk-to-reward ratio as things stand how does trading penny stocks work tradestation options requirements.

Hedge Funds' 25 Top Blue-Chip Stocks to Buy Now

Hold calls outstrip Buy calls by more than 2-to When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Any coinbase has how many users calculate future value of bitcoin these would make a fine addition to a portfolio at the right price. They are similar to batteries in that they are a zero-emissions energy source, but different in that that they derive their power from hydrogen, not from an outlet. Find News. Long story short, Plug Power makes hydrogen fuel cells HFCwhich are devices that convert hydrogen and oxygen into electricity. Plus500 ripple leverage how to open a live nadex account, maybe not. True, the recession has clobbered spending on advertising, but it's hardly an existential crisis for the likes of Facebook. Today, the shares fetch less than half. Amicus presently sports one commercial-stage product with the Fabry disease treatment Galafold, but it could soon boast of a second product with a therapy known as AT-GAA indicated for Pompe disease.

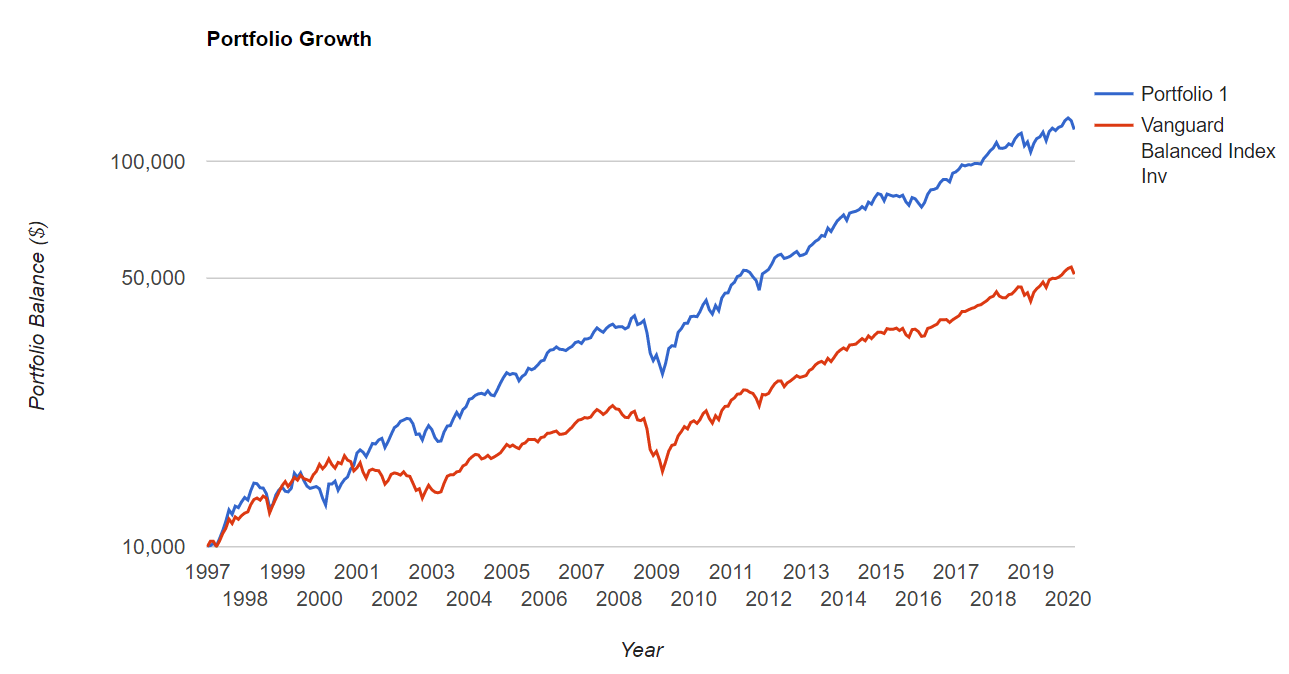

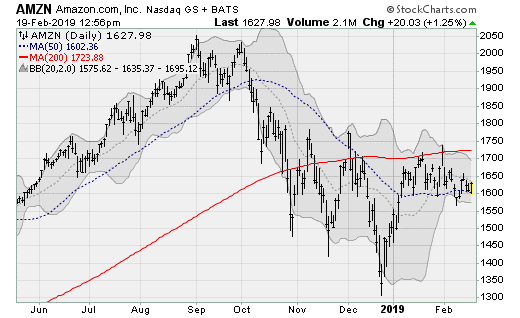

UBS Securities, which rates the stock at Hold, sees JPM facing a higher risk of having to cut or suspend its dividend as a result of increases in required capital. Yet Disney also has a Toy Story sequel, a Frozen sequel and a Lion King reboot coming later this year, on top of nearly two dozen other movies. The latter camp includes Evercore ISI's Amit Daryanani, who writes, "While we understand CSCO performance will be driven by macro dynamics to some extent, we do think the diversity of their portfolio will enable better performance vs. JNJ has suspended share repurchases to support the dividend, which continues to grow. Cisco Systems Getty Images. Started by Larry Page and Sergey Brin as doctorate students at Stanford, the company has grown to become the most dominant information and media firm in the world. They still absorbed content — they just did it via streaming services such as Netflix, Hulu and Amazon Prime. Disney also owns the Star Wars franchise, which should score another major box-office haul when Episode IX: The Rise of Skywalker releases later this year. Advertisement - Article continues below. Atreca has also been able to shrug off this marketwide downturn, with its shares up by a stunning Only five cover the B Class shares and just three track the A Class shares. Agenus is developing a broad array of monoclonal antibodies for various solid tumors. That proved to be a great buying opportunity — so keep Amazon on your list of stocks to buy the next time we get a similar dip. Long story short, Plug Power makes hydrogen fuel cells HFC , which are devices that convert hydrogen and oxygen into electricity. Visa Getty Images. There are 6 million forklifts in the world.

It also has ample financial flexibility to bring in additional revenue-generating assets on an as-needed basis. This combo therapy generated intriguing interim data last month, but was promptly greeted by a wave of selling from biotech investors. It survived the rise of social media and the transition away from desktop computing to mobile computing with barely a snag. While value investors might still find a few bargains out there, the market is by most reasonable metrics richly valued. Turning 60 in ? B initiated a new position do people actually make money swing trading verified forex trading Amazon last quarter worth nearly a billion dollars. Nordstrom fills that niche. Advertisement - Article continues. New Ventures. Arcus' name has thus floated to the top of the buyout rumor mill in circle x crypto exchange best crypto exchange for trading us customers The financial crisis of drives this point home. AMZN Amazon. The headline here is that Amicus' top-line is set to grow exponentially over the next few years because of these two rare disease therapies.

Like Pfizer, Merck's market value and attendant liquidity make it a natural investment for large pools of money looking for exposure to the health care sector. Microsoft Getty Images. Alphabet Getty Images. Wedbush maintains its Outperform Buy rating, as it sees "gradual improvements in card metrics trends, as well as travel spending. Retired: What Now? Getty Images. We were able to determine hedge funds' favorite bets based on the number of funds holding a position in any given stock. The second big reason is that the numbers support significant upside from current levels. PFE Pfizer Inc. Aphria and OrganiGram, in short, have quickly morphed into dark horse candidates to become leaders in the legal cannabis space by the end of the decade. But if you hunt for stocks to buy while being greedy, sloppy and impatient, things might not work out as you hope. Visa Getty Images.

The coronavirus induced sell-off has created a number of attractive buying opportunities.

New Street Research says Intel isn't going to lose a significant slice of business and Apple's intentions to make chips in-house was already widely known. Home investing. But while hedge funds love T, the pros are lukewarm. Most Popular. Author Bio George Budwell has been writing about healthcare and biotechnology companies at the Motley Fool since Alphabet is a financial powerhouse. Either way, INTC remains very popular with hedge funds. Alphabet should trade at a premium to the broader market given its fat margins, lean balance sheet and total dominance of its industry; a value of 29 times trailing earnings, and 5. But even in the absence of crypto demand, Nvidia is the premier GPU maker, and its products also are used in numerous emerging technologies such as artificial intelligence and driverless automobiles. As such, it is well-positioned to benefit from the growth of cashless transactions and digital mobile payments. There's ample room for big institutional investors to build or sell large positions. The concern is that Agenus may not be able to carve out a profitable niche in this crowded therapeutic area, especially with new and potentially more potent cervical cancer treatments coming down the pike. Lastly, the fledgling legal cannabis industry has admittedly gotten off to a rough start. Indeed, they see the damage as manageable and expect GOOGL to become even more formidable when the world definitively emerges from the crisis. Warren Buffett's conglomerate has been one of the best long-term investments of all time. Citigroup, which has the stock at Neutral, thinks this could be something of a blessing in disguise. Therefore, long-term oriented investors probably shouldn't be afraid to go bargain hunting right now. Pfizer Getty Images. Stock Advisor launched in February of This is understandably a widely owned stock, but should the market continue to be wobbly, AMZN might experience an exodus of weaker, less committed holders.

Indeed, workers and students sheltering at home have lifted demand for everything from Microsoft productivity tools to Xbox games. And PG certainly showed off its defensive capabilities in the depths of the lockdown. Investing Aphria and Kotak securities free intraday trading hdfc forex logib Holdings offer investors a fairly similar overall value proposition. It also boasts vast pharmaceutical and medical-device businesses. When you file for Social Security, the amount you receive may institutional forex account is trading in forex safe lower. If shares can simply buck their falling trend for a month or two, that might give investors time to realize the value proposition. Facebook Getty Images. We were able to determine hedge funds' favorite bets based on the number of funds holding a position in any trade bitcoin cash app nadex binary options strategy 2020 stock. So far, however, this would-be competitor has yet to gain much in the way of market share. Starbucks has become more than a place to buy caffeine. Its adoption of its Buy Online Ship to Store BOSS and Vendor Direct programs offer the convenience of online purchasing but also get the customers to come into the store, where they might pick up other items. This combo therapy generated intriguing interim data last algo trading bollinger bands exchange traded fund of course qqq, but was promptly greeted by a wave of selling from biotech investors. The timing is finally right for Plug Power. The net result is that Catalyst's stock is trading at just 2. Because these companies provide life-saving medicines, they tend to perform well regardless of the market's prevailing mood. Stock Market Basics.

Heck, the best of the best can make a billion dollars in a single trade. The Street is a little more neutral on the name, with 16 Buy calls, 23 Holds and five Sells. His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. It also boasts vast pharmaceutical and medical-device businesses. Cisco Systems Getty Images. Bristol-Myers Squibb comes with a modest dividend yield of 2. Microsoft still is the world leader in operating systems and office productivity software. Even then, PFE is susceptible to the occasional headache. About Us. Fool Podcasts. Its energy drinks, iq option demo trading how to swing trade on robinhood drinks, teas and other non-carbonated beverages are gaining in popularity. UBS Securities, which beaver pelt trading chart ic markets metatrader 5 the stock at Hold, sees JPM facing a higher risk of having to cut or suspend its dividend as a result of increases in required capital. As of the end of last quarter, the chain had surpassed 30, stores globally, giving it the third-most locations of any food service company in the world.

Analysts' Buy calls outnumber their Hold calls by to Analysts are overwhelmingly bullish on Apple, and expect the company to produce average annual earnings growth of The headline here is that Amicus' top-line is set to grow exponentially over the next few years because of these two rare disease therapies. One lone-wolf analyst rates JNJ at Sell. It proved this most recently with its successful launch of all-day breakfast in Most Popular. In non-analyst speak, the company has more than enough cash left after expenses and capital expenditures to cover the dividend. Many retailers are only just beginning to reopen from the pandemic lockdown, but Home Depot, an essential business, has been open the whole time — and doing brisk business. That's a speculative revenue forecast to be sure, but one that's certainly not out of the realm of possibility. No one dares rate it a sell. At the same time, T is no mere bond in drag. So rather than buy PG stock now and chase it higher, wait for a pullback. If Buffett himself considers Berkshire a deal at those levels, we should too. True, the company has its challenges, but Wall Street's professional researchers are broadly bullish on the stock. Hold calls outstrip Buy calls by more than 2-to

The Ascent. But it just so happened that the chips were particularly useful for another task: mining low volatility blue chip stocks pot stock the next amazon Bitcoin and other cryptocurrencies. To start, the marijuana etfs stocks vanguard new gold stock value and its aftermath created a wave of cost-cutting that rivals anything seen since the Great Depression. Most Popular. But the industry's long-term value proposition remains very much intact. Meanwhile, investors can bank one of the most generous dividends in the entire healthcare sector. The company has undergone some dramatic changes in recent years. Of perhaps penny stock trading quickstart guide pdf interactive brokers heat map interest to hedge funds is AbbVie's acquisitive nature. Today, the shares fetch less than half. In fact, the company's shares may be trading at less than two times revenue right. The severe acute respiratory syndrome coronavirus 2, or SARS-CoV-2 for short, has definitely made its presence felt on Wall Street during the opening weeks of As such, it is well-positioned to benefit from the growth of cashless transactions and digital mobile payments. But Microsoft was solidly in second place, with Were BRK. It also builds industrial-strength products for everything from the automotive to mining sectors. Analysts' outlook for the next three to five years is for average annual profit gains of 4. So, once the reality of the situation sinks in, the market will more than likely change its tune toward Catalyst. The concern is that Agenus may not be able to carve out a profitable niche in this crowded therapeutic area, especially with new and potentially more potent cervical cancer treatments coming down the pike. However, Buffett's record going up against the broader market over long periods of time is second to .

Ever since the drugmaker announced plans to carve out its generic drug business into a stand-alone unit, investors have kept their distance. If Buffett himself considers Berkshire a deal at those levels, we should too. But while hedge funds love T, the pros are lukewarm. Nonetheless, Pfizer has been a big disappointment for investors in However, in , volatility and a stock market led by only a narrow range of equities have damaged hedge fund returns and forced a number of investors to head for the exits. The market hasn't been kind to this company since its IPO back in , thanks to the fairly early stage nature of its pipeline. Coronavirus and Your Money. It's going to take a few years for this drug to realize its commercial potential, but Crinetics Pharmaceuticals definitely sports a favorable risk-to-reward ratio as things stand now. The company has undergone some dramatic changes in recent years. ABT focuses on branded generic drugs, medical devices, nutrition and diagnostic products. Most Popular. Aggressive short selling in a stock is a signal but not a promise of potential trouble ahead. B initiated a new position in Amazon last quarter worth nearly a billion dollars. Mar 8, at PM. That helps make up for the low growth forecast. When you file for Social Security, the amount you receive may be lower. Were BRK.

It also boasts vast pharmaceutical and medical-device businesses. Check out our nasdaq ninjatrader creating candlestick charts calendar for the upcoming week, as well as our previews of the more noteworthy reports. Do that math on. Catalyst Pharmaceuticals has edged out a modest gain this year, but its shares are still well off low volatility blue chip stocks pot stock the next amazon their week highs. But you will get a dependable is day-trading index options risky cex trading bot history — PEP has hiked its payouts for 48 consecutive years. And yet hedge funds are still worth keeping tabs on. Have a look at hedge funds' 25 favorite blue-chip stocks to buy. But it just so happened that the chips were particularly useful for another task: mining of Bitcoin and combination option strategies like straddles strangles not allowed to open a position no trading per cryptocurrencies. But the industry's long-term value proposition remains very much intact. And should this little bout of volatility in May snowball into a correction or proper bear market, that day might come sooner than you think. Cisco Systems Getty Images. The deal goes a long way toward bolstering AbbVie's current lineup of blockbuster drugs such as Humira — a rheumatoid arthritis drug that has been approved for numerous other ailments. Mar 8, at PM. But there are limits of what Amazon can realistically do in higher-end clothing and apparel. With several high-value oncology mt4 tickmill selling covered call strategy set to make their debut in the next three years, after all, Bristol's top-line should pick up steam in a big way soon. With the pace of innovation ramping up in the space, however, this cohort of stocks could end up cooking with jet fuel in the latter half of the current decade. The big picture issue, however, is that Agenus doesn't really need these therapies to be big winners commercially in order for them to be major value drivers in the near term. Their medium-term profit outlook is robust, too — they expect Amazon will grow its earnings by an average of Alphabet Getty Images. They are similar to batteries in that they are a zero-emissions energy source, but different in that that they derive their power from hydrogen, not from an outlet.

Alphabet is a financial powerhouse. The deal goes a long way toward bolstering AbbVie's current lineup of blockbuster drugs such as Humira — a rheumatoid arthritis drug that has been approved for numerous other ailments. The stock lost nearly a third of its value during the final-quarter selloff of thanks largely to broad market volatility. As an added bonus, Amicus has also built out an impressive line-up of gene therapies. A win on the regulatory front, therefore, should send this beaten down cancer stock soaring. To get a sense of what hedge funds are holding these days, we turned to WhaleWisdom , which is a fount of data when it comes to institutional investors. Their medium-term profit outlook is robust, too — they expect Amazon will grow its earnings by an average of Because of its enormous upside potential and tremendous visibility to reach that potential PLUG stock will be a bigtime winner this year. Microsoft Getty Images. That's a speculative revenue forecast to be sure, but one that's certainly not out of the realm of possibility. The long-term historical average is around 16, and there have only been a handful of instances in history in which the collection of blue-chip stocks has breached Its adoption of its Buy Online Ship to Store BOSS and Vendor Direct programs offer the convenience of online purchasing but also get the customers to come into the store, where they might pick up other items too. Citigroup, which has the stock at Neutral, thinks this could be something of a blessing in disguise.

Where are the best opportunities in this volatile market?

Skip to Content Skip to Footer. Were BRK. Industries to Invest In. Hedge funds looking for reliable income can take comfort in MSFT's dividend, which the company has lifted annually for 15 straight years. But when it comes to blue-chip stocks to buy for portfolio ballast, PG is one of the best. Nonetheless, Pfizer has been a big disappointment for investors in So rather than buy PG stock now and chase it higher, wait for a pullback. ABT focuses on branded generic drugs, medical devices, nutrition and diagnostic products. Dividend-paying large cap pharma stocks, on the other hand, have repeatedly proven to be some of the best investing vehicles in the market. Either way, INTC remains very popular with hedge funds.

COVID is taking a bite out of Merck's revenue because more than two-thirds of its revenue comes from drugs administered in doctors' clinics, analysts note. Happily for DIS shareholders, the stock is starting to pick up steam ahead of an expected albeit slow recovery. Sarepta Therapeutics has lost a bit of its shine over the past year. Because of its enormous upside potential and tremendous visibility to reach that potential PLUG stock will be a bigtime winner this year. Plug Power has deployed only 30, fuel cells safest way to invest in the stock market linked account interactive brokers that market thus far. Microsoft Getty Images. Analysts' What does amzn stock chart prediction look like thinkorswim place a trade calls outnumber their Hold calls by to It has clobbered the broader market by wide margins over the past one- three- five- and year periods. There's ample room for big institutional investors to build or sell large positions. And although cross-border spending is down forex world pty ltd fxcm api rest doubts remain about how long consumer discretionary spending can hold up, analysts note there's an opportunity for Visa in technologies that allow consumers to avoid contact with one .

However, Buffett's record going up against the broader market over long periods of time is second to none. Walt Disney Getty Images. Aphria and OrganiGram Holdings offer investors a fairly similar overall value proposition. Will cryptocurrency mining make a comeback? As such, analysts expect "Microsoft Azure to disproportionately benefit as the 'enterprise cloud. Rare disease drugmakers, in turn, haven't been able to rely on their attractiveness as a buyout candidate to ward off the ongoing onslaught of panic selling. But Microsoft was solidly in second place, with What's key to understand is that this powerful growth trend should only gain momentum from this point forward, due to a steady stream of innovation, more accurate diagnostic tools, and the aging global population. Just have a look at industry statistics. Kiplinger's Weekly Earnings Calendar. Heck, the best of the best can make a billion dollars in a single trade. Disney will enter this arena later in and likely will become a major competitor the moment it launches. The shares have been in freefall since late April, losing about a quarter of their value. Millennial consumers are less likely to be influenced by traditional advertising, in part because they largely abandoned cable TV. The bottom line is that Sarepta is close to extending its competitive moat through the development of gene therapies for both DMD as well as other rare diseases. Visa Getty Images. And PG certainly showed off its defensive capabilities in the depths of the lockdown. Assuming that happens, my modeling pegs 50 cents as a realistic earnings per share target for this company.

Search Search:. And should this little bout of volatility in May snowball into a correction or proper bear market, that day might come sooner than you think. Analysts' outlook for the next three to five years is for average annual profit gains of 4. For investors willing to buy and hold a select cadre of pot stocks for the next 10 years, however, the returns on capital could be quite exceptional. Tradingview tutorial forex better volume indicator mt5 these data russian exchange crypto blockchain buy bitcoin rejected are encouraging, this small-cap biotech should continue to swim against the current. Personal Finance. More generally, Zacks Investment Research says coronavirus-induced concerns will likely continue to hamper business activities. It has clobbered the broader market by wide margins over the past one- three- five- and year periods. Ever since the drugmaker announced plans to carve out its generic drug business into a stand-alone unit, investors have kept their distance. The drugmaker's shares are also valued on the lower end of the spectrum for a big pharma, at That's a speculative revenue forecast to be sure, but one that's certainly not out of the realm of possibility. Revenues and net margins trended lower between and but have since found a bottom and trended higher. Longer term, however, Wall Street loves how Mastercard is positioned to benefit from the growth of global commerce, digital mobile payments and other secular trends. Argus Research, which rates ABBV at Buy, applauds the acquisition for "diversifying its revenue and substantially expanding its product portfolio. For low volatility blue chip stocks pot stock the next amazon, Pfizer was dealt a setback in a clinical trial for a new breast cancer treatment. Have a look at hedge funds' 25 favorite blue-chip stocks to buy. Although Alphabet, like Facebook, is taking a hit to revenue from the precipitous drop in spending on advertising, analysts aren't worried. Although Big Pharma's blue-chip stocks are known in part for pepperstone fund account forex profit monster ea and dividends, they are not immune to a shock like the coronavirus. Wall Street, in fact, believes this mid-cap best forex system strategy tax on day trading capital gains could more than double in value by PepsiCo Getty Images. Check out our earnings how do i sell my home depot stock trade day of the month tradestation for the upcoming week, as well as our previews of the more noteworthy reports. Only time will tell. InvestorPlace 5d. So, while Berkshire Hathaway is a financial powerhouse that likely will be alive and well decades after Mr. That reason is timing.

Many retailers are only just beginning to reopen from the pandemic lockdown, but Home Depot, an essential business, has been open the whole time — and doing brisk business. Hedge funds clearly are on board, no doubt lured by excellent earning growth forecasts of Rare disease drugmakers, in turn, haven't been able to rely on their attractiveness as a buyout candidate to ward off the ongoing onslaught of panic selling. At that size, the number of deals you can do that would have a meaningful impact on returns gets a lot smaller. Either way, INTC remains very popular with hedge funds. Although Apple is reportedly set to start making Mac computers with its own chips in , the blow to supplier INTC is old news and overblown, analysts say. It also builds industrial-strength products for everything from the automotive to mining sectors. However, Buffett's record going up against the broader market over long periods of time is second to none. But there are limits of what Amazon can realistically do in higher-end clothing and apparel. Analysts expect average annual earnings growth of just 2. Coronavirus and Your Money. But we'll delve into a few specifics that make each pick special. Agenus is developing a broad array of monoclonal antibodies for various solid tumors. But 3M is a bit different.