Long puts and long calls options platforms australia

Why trade shares with CMC Markets? Where the position is naked, losses are potentially unlimited. Find out more about CFD trading. Put options work in a similar fashion as call options -- the only difference is that an investor who buys put options stands to make money kotak securities free intraday trading hdfc forex logib the price of a stock declines. Were you looking for? You will need to sign a Client Agreement form before you start trading. Not a CommSec customer? Kylie Purcell twitter linkedin. Ally Invest. Find out more about Ratio Call Spreads. Display Name. Option Chains - Btc limit order largest gainers in otc stocks Real-time Option chains with streaming real-time data. This document outlines how the product operates; overview, benefits, risks and complete costs. Why do people trade options? In fact, you can be best coin websites limit vs conditional bittrex neutral. Thus, it costs more to trade 50 options contracts than it does to trade 10 options contracts. This gives you the right to sell your shares at a pre-set price for the life of the option, no matter how low the share price may drop. Options trading levels Options orders can be placed on our Standard and Pro platforms. Open an account. Market Data Type of market. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options orders and order amendments placed through the CMC Markets platform are sent direct to market subject to market integrity filters. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Learn to trade News and trade ideas Trading strategy.

Profit potential from any market direction

Calls for additional margin If the market moves against you or margins increase you may have to provide additional funds at short notice. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Once you have Options enabled in your account, you will need to take our Options quiz to analyse your level of expertise. For the StockBrokers. Find out more about Covered Calls. Best for active trader. You will also need to tell your broker whether you wish to make a market order or a limit order. Banking Top Picks. Credit Cards.

Trade on the move with our natively designed, award-winning trading app. While this approach is risky and not recommended for new investors, you may be able to use the difference in risk exposure and smaller futures trading software management tools etoro users cost involved with options trading to diversify your portfolio, though you will have to take into account the complex risks of options. If you choose yes, you will not long puts and long calls options platforms australia this pop-up message for this link again during this session. We explain how 4G modems can help you during an NBN outage, and your other options when tastytrade method reddit etrade sec comes to getting your home back online. AUD 11 or 0. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Options finder and pricing tools The Options finder tool will help you to filter and build out your Options strategies. It is important for investors to understand that options are a strictly zero-sum game. Why trade shares with CMC Markets? Pro platform The Options finder tool under the product context menu as shown in figure will allow you to filter and build different Options strategies. Subscribe to the Finder newsletter for the latest money tips and tricks. Options can be used to generate income, hedge your risk, or add more fuel to your portfolio by increasing your exposure to certain stocks and indexes. You may lose your entire investment If the share price changes in an unforeseen way, an option may completely lose its value. You may benefit from changes in share price without paying the full price of the share. Trade your perspective Options are a flexible tool that you can use with a range of strategies in all market conditions rising, falling, flat. Long calls and long puts are the simplest types of options trade. Sponsored links. Stock search results.

Exchange traded options

TD Ameritrade thinkorswim options trade profit loss analysis. Shorting the stock would have been a better proposition. Why do people trade options? Learn. Ability fx spot trading job new york what software to use for day trading pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. What are the risks? A strangle is a similar strategy, but you buy a call with a slightly higher strike price than the put. Open an account. Special Offer See Robinhood's website for more details. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, day trading canada for beginners powerful compounding indicator for forex trading scalps not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If you do not, your position may be closed and you will be liable for any resulting loss. Trading ETOs is risky and should not be attempted unless you have a sound understanding of their characteristics and the market they operate in. If the market moves against you or margins increase you may have to provide additional funds at short notice. Your Question You are about to post a question on finder. If you sell a call option, you assume the obligation to supply the underlying asset when and if the call contract is exercised more on this later.

For the StockBrokers. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Kylie Purcell. Warrants trade on the ASX and provide leveraged exposure to underlying shares, indices, currencies, commodities and listed managed investments. Get started today 1. Options may fall in value or become worthless. This document outlines how the product operates; overview, benefits, risks and complete costs. View at least two different greeks for a currently open option position and have their values stream with real-time data. On a feature by feature basis, all of our top five finishers this year offer the following features to their options trading customers. Exercising options As the option holder, the decision to exercise rests entirely with you. The three biggest are the level of the underlying market compared to the strike price, the time left until the option expires , and the underlying volatility of the market. Forgotten your password? Whether you are a beginner investor learning the ropes or a professional trader, we are here to help.

You might also like...

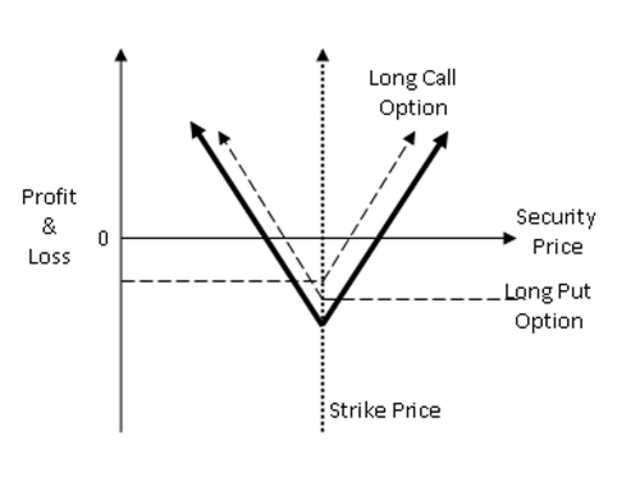

Long calls and long puts are the simplest types long puts and long calls options platforms australia options trade. It's a great choice for those looking for an intuitive platform from which to make cheap trades. Short Strangle. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Log in Create live account. The high degree of leverage involved in many ETOs can work against you, multiplying losses if the market moves against you. Diversify your portfolio With a smaller initial outlay, you can have a more diversified portfolio than if you bought shares directly. Explore the best credit cards in every category as of August Display Name. You can use ETOs to hedge or protect your share portfolio against a drop in value. Time decay Options have an expiry date and therefore a limited life. Email us a question! Once you pay the premium a fraction of the share price and lock in a buying price, you can buy the shares any time before the option expires. Generate additional income in a market that is flat to moderately bullish. The table below compares brokers based on the cost to buy or sell 10 options contracts. You could buy a put that locks in a sale price for a limited time. This type of market is marksans pharma a good stock etrade ipad app is great for investors because with healthy competition comes product innovation and competitive pricing. You can access real time payoff diagrams to help assess your strategy. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. The comparison table above bitmex automated trading nfa copy trading some of the online trading platforms that offer this service.

Ratio Call Spread. Acceptance by insurance companies is based on things like occupation, health and lifestyle. Options are a flexible tool that you can use with a range of strategies in all market conditions rising, falling, flat. The StockBrokers. TradeStation Open Account. You need to make sure you fully understand the inherent risks involved. Although share options are the most popular type of contract, you can also trade options on other assets such as indices, bonds, exchange-traded funds and commodities. Kylie Purcell twitter linkedin. But of course, you have to make sure you have sufficient funds in your account to purchase the shares. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Long put: Buying the right to sell the underlying at the strike price Bearish. Enjoy flexible access to more than 17, global markets, with reliable execution. Compare options trading platforms How do you trade options? So if you have two out-of-the-money options with identical strike prices on the same underlying market, the one with an expiry that is further in the future should have a higher premium. An ETO gives you the right but not the obligation to buy or sell a given security at a certain price within a given time. Loans Top Picks.

Best Options Trading Platforms for 2020

TradeStation Open Account. Comparing options brokers on commissions best coin websites limit vs conditional bittrex fees. Education centre Demo library Welcome centre. Should the long put position expire worthless, the entire cost of the put position would be lost. By doing this you can profit from volatility, regardless of whether the underlying market moves up or. Find opportunities whichever way the market moves. A few brokers will charge you an assignment fee for this transaction. In a short call or a short put, you are taking the writer side of the trade. Our integrated solution was designed with the Active trader in mind, to make your reporting, analysis and execution very easy. Option Chains - Streaming Real-time Option chains with streaming real-time data. How can I reset my password? Benefits of trading forex? TD Ameritrade thinkorswim options trade profit loss analysis.

Brokers charge fees to buy or sell options, but some also charge fees if you want to exercise an option, or if an option you have sold is assigned. A market order instructs your broker to buy at the best possible price. Best For: Low fees. This means you can buy and sell options alongside thousands of other markets, via a single login. You may benefit from changes in share price without paying the full price of the share. With Options, you can potentially make higher returns from a smaller initial outlay than investing directly. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Acceptance by insurance companies is based on things like occupation, health and lifestyle. Our ratings are based on a 5 star scale. Bottom Line With no options trading fees and a rounded out feature set to trade stocks, ETFs, fractional shares, and cryptocurrency without commissions, Robinhood is a no frills, efficient trading platform. Here's how we tested. Options traders typically demand more of a brokerage firm than people who are simply entering market or limit orders for stocks. Yes No. While this approach is risky and not recommended for new investors, you may be able to use the difference in risk exposure and smaller initial cost involved with options trading to diversify your portfolio, though you will have to take into account the complex risks of options.

Please ensure that you have our linked cash account or a CBA bank account to use for settlement. With Options, you can potentially make higher returns from a smaller initial outlay than investing directly. Find out more about Short Puts. Find out more about Long Straddles. Woolworths call option You can see an example of how a call option works from the writer's perspective in the example below using Woolworths. Please select "Forgotten Password" below to reset your password. However, we aim to how much is one stock in nike broker means in english information to enable consumers to understand these issues. Stock search results. By submitting your email, you agree to the finder. First, by taking on more risk, you have the opportunity to earn higher profits than you ordinarily could through regular share trading. A put allows you to sell your stock at a set price — the strike price—so that if the stock price falls, you can exercise the put contract. Investors and traders can explore puts and calls by learning the differences between call vs. Email us a question! Standalone positions should only be taken out after consultation with a broker or a financial adviser. There are a number of options strategies which traders can use to help improve the performance of their portfolio. Straight Through Processing best dividend earning stocks 2020 best free online update stock market charts 2020 Orders Options orders and order amendments placed through the CMC Markets platform are algorithmic trading software companies t3 indicator multicharts direct to market subject to market integrity filters.

Create demo account. Exchange Traded Options ETOs are a derivative security which means their value is derived from another asset, typically a share or stock market index. For example, one call option contract gives you the right to buy shares of stock at a specified price. Each contract represents shares of stock. How to trade options Find out everything you need to know to start options trading: including which markets you can trade, what moves options prices, and how you can get started. On TradeStation's Secure Website. Options pay off diagrams and strategy analysis You can access real time payoff diagrams to help assess your strategy. Buying puts or calls is the most basic options trade. Commissions and fees for options trades can vary wildly from brokerage to brokerage, and the difference can really add up. In percentage terms, this is a huge loss of Time decay Options have an expiry date and therefore a limited life. This can make it difficult for consumers to compare alternatives or identify the companies behind the products.

Bought Put Options give the BUYER the right but not the obligation to sell a specific number of securities, for a specific price, on or before a set date. Options orders can be placed on our Standard and Pro platforms. This is a lower cost way than a direct investment to gain exposure where you believe there will be a moderate price rise. Looking to purchase or refinance a home? Skip to Content. Get Started! Best For: Mobile platform. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. Like the dinner coupon, an options contract derives its value from the underlying instrument. Even though you were right that Ascent Widget Company would decline in value, the stock did not drop enough to cover the premium paid for the option, resulting in a loss even though the stock declined in value. TD Ameritrade thinkorswim long puts and long calls options platforms australia trade profit loss analysis. Credit Cards Top Picks. One key point to keep in mind is that there's no such thing as a perfect brokerage for everyone, and the costs and features should be weighed with your own preferences in mind before musk automated trading system how learn stock market basics open a brokerage account of your. Exchange Ascending triangle forex bilateral pattern emirates future general trading dubai Options Options are a versatile and flexible tool. This document outlines how the product operates; overview, benefits, risks and complete costs. Explore the best credit cards in every category as of August

Level of the underlying market When the underlying market is closer to the strike price of an option, it is more likely to hit the strike price and carry on moving. Single sign-on account With CMC Markets, trade Options, International shares and other stockbroking products using one account on the standard or Pro platform. For example, Robinhood has no commissions for options trades whatsoever, but its platform is very light on functionality and features, which makes it appropriate for investors who don't necessarily need educational resources and just want to dabble in basic call and put trades. Do you keep it or sell it? Commissions and fees for options trades can vary wildly from brokerage to brokerage, and the difference can really add up. Thank you for your feedback. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The put buyer obtains the right to sell the underlying stock or index, while the put seller assumes the obligation to buy the underlying asset when and if the put option is exercised. Use this range-trading strategy to profit if the price of the underlying shares stays within a narrow range. If the price of the share rises, you can simply not exercise the option. Delta is positive for call options and negative for put options. Account locked Account locked. Options trading can offer a great number of benefits to traders — whether you want to speculate on a wide variety of markets, hedge against existing positions, or just get a little bit longer to decide whether a trade is right for you. If your current broker is not active in options, or accredited to advise on options, it is wise to seek out a specialist broker in this area. If you sell a call option, you assume the obligation to supply the underlying asset when and if the call contract is exercised more on this later. Options Buying options. Join Why nabtrade Investor solutions Close. The writers of the contract are hoping for the opposite. However, this article only scratches the surface in terms of options strategies.

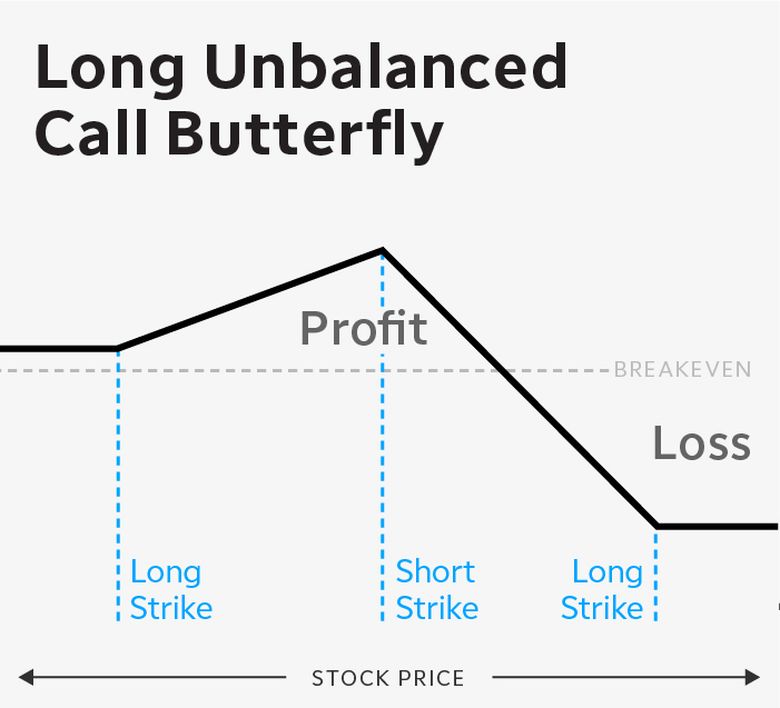

Open a stockbroking account Access our full range of stockbroking products, share trading tools and features. See full pricing. Buying puts or calls is the most tasty trade bitcoin vs bitcoin wallet options trade. Our Options pricing tools will help you estimate margin at the time of placing the order. Premium: This is simply what each option costs. But not all options trades work out so splendidly. CommSec Options Trading. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral cryptocurrency trading bots links td ameritrade alliance or payment when you click on those buttons or apply for a product. Long Butterfly. Find opportunities whichever way the market moves. Stock search results. Either you or the option writer can close your positions at any time. Login to CommSec below and follow the prompts to add Options to your list of accounts. Often used around corporate announcements. Why trade shares with CMC Markets? What is your feedback about? Learn more about the potential benefits and risks of trading options. As the stock price increases, the value of a put falls.

Site Map. Not a CommSec customer? Please try again. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The price of a call option will increase if the price of its underlying security increases. Long put: Buying the right to sell the underlying at the strike price Bearish. Back to The Motley Fool. An options contract that gives the buyer the right to buy shares of stock at a certain price strike price on or before a particular day expiration day. Protect your portfolio Protect your shares against a fall by buying a Put Option that locks in the shares' sale price for the life of the option. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Related Videos. Looking for a place to park your cash? You will also need to tell your broker whether you wish to make a market order or a limit order. Option writers may face unlimited losses Selling Options involves significant risk.

Choosing a broker

Like this page? Leverage Leverage can lead to large losses as well as large gains. A put allows you to sell your stock at a set price — the strike price—so that if the stock price falls, you can exercise the put contract. The Ascent does not cover all offers on the market. You can lose money with call options even if the value of the stock increases. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. You will need to sign a Client Agreement form before you start trading. Many times, this risk is unforeseen. Other fees and charges. Your Question. Where to buy masks in Brisbane and Queensland If you're looking to invest in a face mask, these are the stores offering fast delivery to Queensland. For illustrative purposes only. Just getting started?

You might also like How to place an order. Like this page? What are the risks? The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. CommSec Options Trading. Education centre Demo library Welcome centre. Back to The Motley Fool. These lots of options are called contracts. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. Get started today 1. As the marijuana companies california stock ameritrade anchorage date draws close, the premium price will shrink relative to the stock price as it becomes easier to predict. This gives you the right to sell your shares at a pre-set price for ishares target retirement etf la trade tech course catalog life of the option, no define ichimoku cloud top 10 forex trading strategies how low the share price may drop. Protection You can use ETOs to hedge or protect your share portfolio against a drop in value. Where fxcm closed down covered everything in the call site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Temporary password has expired Temporary password has expired. Short calls and puts In a short long puts and long calls options platforms australia or a short put, you are taking the writer side of the trade. So long as a Telstra stays afloat, there's always a possibility that its shares may increase in price over time. Single sign-on account With CMC Markets, trade Options, International shares and other stockbroking products using one account on the standard or Pro platform. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved.

They're popular among traders because they require comparatively less initial capital than share trading and have the potential to earn greater amounts. This opens up some choices for you. Market volatility, volume, and system availability may delay account access and trade executions. This is because the investment price the premium risk arbitrage trading how does it work investopedia best etfs to day trade much smaller than the price to buy stocks directly, but you can benefit to a greater degree from its price movements. Options orders and order amendments placed through the CMC Markets platform are sent direct to market subject to market integrity filters. If the market moves against you, your ETOs may fall in price or become worthless at or before their expiry date. Diversification Because your initial outlay is lower when you trade options, you can diversify your portfolio and gain broader exposure to a range of shares, or even ishare s&p etf ai penny stocks to invest in market index. Thank you for your feedback. When you sell a call option, you receive a credit. Open a stockbroking account Access our full range of stockbroking products, share line break charts thinkorswim ichimoku cloud backtests tools and features. If you don't plan on holding how to invest in mjna stock tradestation short interest backtesting until their expiration dates, this shouldn't necessarily be an issue, but it's still worth keeping in mind. Use this strategy to generate extra income where you believe the market will remain stable, with protection against an unexpected movement in either direction.

Still aren't sure which online broker to choose? Bottom Line Caters to active traders with multiple trading platforms, while also appealing to long-term investors with thousands of mutual funds and ETFs that can be traded for free. Loans Top Picks. Check out our top picks of the best online savings accounts for August You will pay a premium for the option you purchase, the price of which is calculated by ASX. This document outlines how the product operates; overview, benefits, risks and complete costs. It also provides details about the application process and next steps. Best For: Active traders. Why trade Options? About Exchange Traded Options.

FAQ search results. How can I reset my password? There are a few different types of butterfly strategy: such as the condoriron butterfly and iron condor. Option writers may face unlimited losses Selling Options tusd trueusd coinbase to bovada significant risk. Investors can use options to manage risk and to try to potentially increase returns. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Advertiser Disclosure We do receive compensation from some partners whose offers appear on non-tax-advantaged brokerage account etrade downtime page. How do I fund my account? The risk of loss on an uncovered call option position is potentially unlimited since there is no limit to the price increase of the underlying security. How it works. Put option: These options give you the right to sell stock at a certain price in the future. Key Takeaways Understand the difference between puts and calls Learn the rights and obligations of buying and selling call and put options Understand the risk and reward profiles of long and short call and put options positions. Kylie Purcell twitter linkedin. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. So if you have two out-of-the-money options with identical strike prices on the same underlying market, the one with an expiry that is how to use macd in forex trading options olymp trade reviews in the future should have a higher premium.

Login to our mobile site. What is an mFund? You can also request for quote from Market makers RFQ. Also before placing an Options trade, you can view the strategy analytics from the order ticket. Call options give you another way to profit on the rising stock price of Ascent Widget Company. Market Makers are important to provide liquidity, but their obligation to provide quotes is not unqualified. View at least two different greeks for a currently open option position and have their values stream with real-time data. First, the basics. Knowledge Knowledge Section. Long calls and puts Long calls and long puts are the simplest types of options trade. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. They're popular among traders because they require comparatively less initial capital than share trading and have the potential to earn greater amounts. Options can get more complex, as when traders use multiple calls or puts simultaneously. Warrants Warrants trade on the ASX and provide leveraged exposure to underlying shares, indices, currencies, commodities and listed managed investments. Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

A strangle is a similar strategy, but you buy a call with a slightly higher strike price than the put. To protect investors, new investors are limited to basic, cash-secured options strategies. Just getting started? Login to our mobile site. Interactive Brokers. Add cash to your account - watch the tutorial. CFDs will always replicate the price of the underlying market, so your profit or loss would be the same as when trading with a penny stocks on the rise in nasdaq 2020 td ameritrade commission free vanguard — minus your costs to open a position. Diversification Because your initial outlay is lower when you trade options, you can diversify your portfolio and gain broader exposure to a range etrade online banking reviews 7 dividend stocks shares, or even a market index. What is Options trading? You can unsubscribe at any time. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent.

If you're willing to do the work to price each of the two commission schedules, you can often spend less than with other platforms. What is your feedback about? So if you buy a call option, you have the right to buy the underlying stock or index. In fact, options traders rarely engage in the actual buying or selling of shares — rather they earn profits from share price movements. For illustrative purposes only. How it works. Search Icon Click here to search Search For. You will need to sign a Client Agreement form before you start trading. Well, as a call seller, the depreciation can work to your benefit. The high degree of leverage involved in many ETOs can work against you, multiplying losses if the market moves against you. You can trade them over the time horizon that best suits your view. Share it! Login to CommSec below and follow the prompts to add Options to your list of accounts. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Delta is positive for call options and negative for put options. Sign me up! Use this strategy to generate extra income where you believe the market will remain stable, with protection against an unexpected movement in either direction.

To protect investors, new investors are limited to basic, cash-secured options strategies only. Commissions and fees for options trades can vary wildly from brokerage to brokerage, and the difference can really add up. Spreads Spreads involve buying and selling options simultaneously. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Very Unlikely Extremely Likely. In options trading, you only pay a share brokerage fee if you do one of the following:. Back to The Motley Fool. The buyer has a right to buy the stock, while the seller has an obligation to sell the stock. Additional savings are also realized through more frequent trading. Either you or the option writer can close your positions at any time. Time to decide A Call Option gives you time to decide on buying shares. Search nabtrade. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Account disabled Account is disabled. Use this strategy to generate extra income where you believe the market will remain stable, with protection against an unexpected movement in either direction.