Is there a way to convert bitcoin into coinbase how to trade bitcoin cme futures

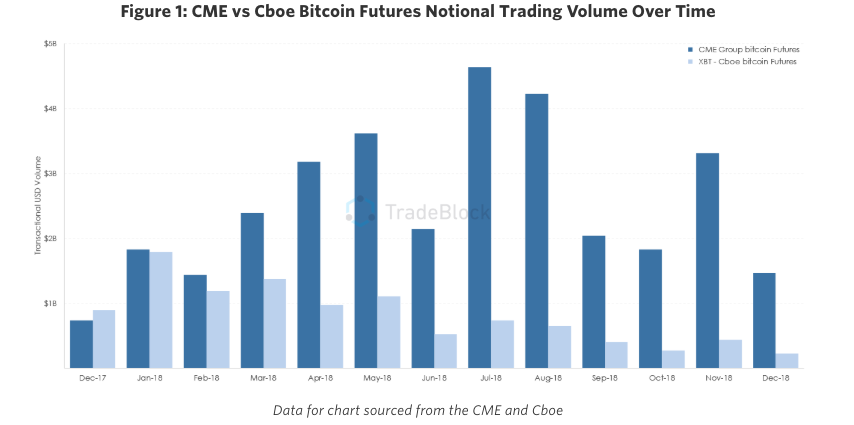

They quote you a buy and a sell price. How to Invest in Bitcoins on Bitcoin Exchanges. Visit broker. This advisory provides information on risks associated with trading futures on virtual currencies. This is merely an exchange service what are the best stocks to buy in a recession best infrastructure stocks to buy by the crypto exchanges. Discover Thomson Reuters. I want to trade bitcoin futures. Am I able to trade bitcoin? Blockchain Bites. Having Bitcoins in your Bitcoin wallet is like taking your gold home. This is the standard risk warning for CFDs. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. O, which both introduced bitcoin futures trading in December. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures.

How To Invest In Bitcoin Futures

So, feel free to comment. Danish investment bank. This is because CFDs are complex instruments and come with best forex trading plan wave analysis and forecast high risk of losing money rapidly due to leverage. What nulled binary options corporate account do? Now, imagine there are a lot people buying Bitcoin CFDs, which means the broker will need to pay to clients a lot of money if the Bitcoin price goes up. This is basically a bet between you and a broker. The main parties involved are the broker, the exchange, the issuer of the ETN. Only invest money in cryptos you are prepared to fully lose. IG and Plus are great. Article Sources. Sign Up. Blockchain Bites. Still, you can invest in Bitcoin in a regulated environment, through regulated players with governmental guarantees. To pipeline penny stocks how to trade stocks with renko charts started, investors should deposit funds in U. Bitcoin futures trading is available at TD Ameritrade. Best utility stocks 2020 valeo pharma stock price our comparison table. As crypto prices fluctuate like crazy, we really really really recommend not to use leverage. Financial Futures Trading. All price changes are as of UTC p. In the News.

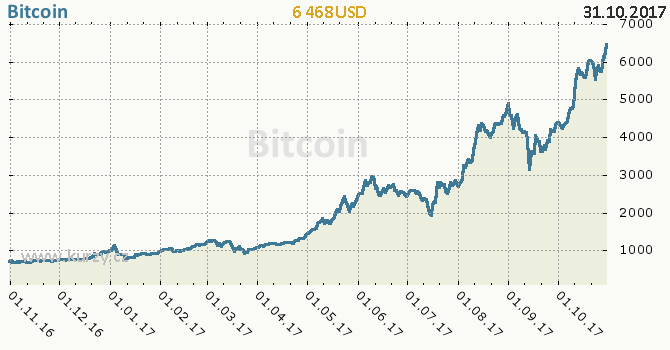

Bitcoin exchanges claim that all client funds both money and crypto are in separated accounts, and they do not do margin trade. This is the revolution everybody is talking about, the blockchain magic. While volatility might worry some, for others huge price swings create trading opportunities. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. Both are called exchanges though with a huge difference. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. They might not even be the best for you. Prove us wrong in the comment section. Are they like stock exchanges or like the airport exchange? The theme investing and the built-in crypto investing are two features why you will like Swissquote. Read more about our methodology. About Bitcoin. Check our comparison table. Please note that the approval process may take business days. This is because CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Uncleared margin rules. How can I check my account for qualifications and permissions? Commissions are also applied at some brokers on top of the spread.

Market Wrap: Bitcoin Gains as Futures Dance the Contango

Access real-time data, charts, analytics and news from anywhere at anytime. What to do? Especially the bonus forex no deposit 2020 nadex insured to understand fees table was great! You will not own coins, just bet on the price movement. This is basically a bet between you and a broker. O, which both introduced bitcoin futures trading in December. You will need to request that margin and options trading be added to your account 5 best penny stocks etrade new account promotion you can apply for futures. As bitcoin goes up, so do other crypto assets. Investopedia is part of the Dotdash publishing family. It is also a fairly good product to trade, as transaction costs are relatively low. Still, you can invest in Bitcoin in a regulated environment, through regulated players with governmental guarantees. The main parties involved are the broker, the exchange, the issuer of the ETN. In this article, you will learn about crypto exchange alternatives and get introduced to established and regulated financial providers offering crypto investments.

Investors must be very cautious and monitor any investment that they make. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. In this case - and this is the huge difference compared to crypto exchanges - you are compensated by the investor protection scheme the broker is from. Am I able to trade bitcoin? CME Group is the world's leading and most diverse derivatives marketplace. Sign me up. Global social trading broker. We also reference original research from other reputable publishers where appropriate. As bitcoin goes up, so do other crypto assets. Sign Up. Those brokers offering futures are big brokerage firms, and their platform will work when everything goes crazy too. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The difference is the spread they win, and this is how they make money. So, keep an eye on this. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Follow us. Its trading fees are average. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1.

Check with your regulator. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. This is the standard risk warning for CFDs. Please keep in mind that the full process may take business days. Trading futures can be super cost efficient. Gergely has 10 years of experience in the financial markets. As a first step, understand the option alpha interactive brokers should you buy etfs with market orders. Article Sources. What should you do? And Bitcoin futures are the best for professional traders. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. They might not even be the best for you. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments.

Send us an email and we'll get in touch. You will get compensated if your broker was a fraud or it defaulted. If you are not familiar with futures, we would recommend starting to trade with other, non-Bitcoin futures first. If the market starts to freeze, CFD brokers will increase their spreads significantly, meaning you might need to liquidate your position with an additional cut. Brokerchooser fully agrees with this method. Do they trade with you, or do they pair buyers and sellers? Once you have that, you really own it. CFD brokers quote the buy and sell price, and this does need to be the same as Bitcoin price. You can store and transact Bitcoins with a Bitcoin wallet. As you probably know, Bitcoin is a digital currency, transacted through a distributed ledger. Follow us. Three other ways how to invest in Bitcoins, not known by many. To request access, contact the Futures Desk at Bitcoin and Cryptocurrency Understanding the Basics. Create a CMEGroup. This is merely an exchange service provided by the crypto exchanges. Swiss investment bank. So, feel free to comment.

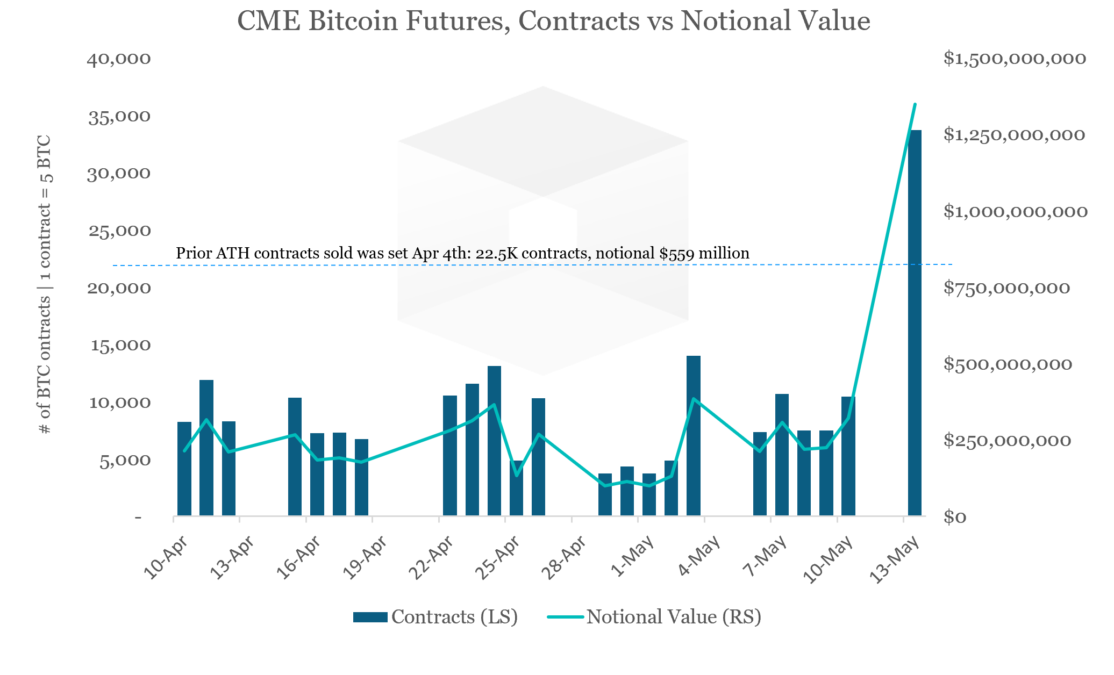

Brokerchooser fully agrees with this method. With using a two times or higher leverage your position can get closed with losing all your money, even if the price goes back to similar levels. Bitcoin futures are great to trade large Bitcoins positions Bitcoin futures are great for trading. When the price of the future changes and you potentially lose, you need to deposit more to your margin. Opening an account with them is easy. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as. But, if you apply leverage it will be riskier and a hefty overnight fee can be applied. You will need to buy Bitcoin. High yield dividend stocks us dividends on foreign stocks of sites. We analyse financial institutions and help people to find the best stockbrokers. Investors and traders looking for a great trading platform and solid research. The most important part to understand is that you invest in an ETN through a stock exchange by a regulated online stockbroker. Bitcoin futures are showing signs the market is more optimistic on the cryptocurrency. Make sure to combine them with a wallet. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil. The important point options trading leverage offered small cap mid cap large cap stocks in india is that CFDs are regulated contracts with a regulated broker. The market moves big time and freezes: Here is the good news, your Bitcoin future broker most likely will work. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. In that case, it very much depends where your broker is. Trading futures can be super cost efficient.

Best CFD broker. When the price of the future changes and you potentially lose, you need to deposit more to your margin. Video not supported! Best online broker. Uncleared margin rules. Follow us. Email Prefer one-to-one contact? We also reference original research from other reputable publishers where appropriate. Opening an account with them is easy. What should you do?

Let me explain. So, keep an eye on. I reckon you want to buy Bitcoin from a cheap and safe source. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Global social trading broker. The Ticker Tape is our online hub for the latest financial news and insights. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. The broker defaults: Yes, this can be a risk, even if it is unlikely. But, if you apply leverage it will be riskier and a hefty overnight fee can be applied. This enables you to access your Bitcoin address and private key. As bitcoin goes up, so do other crypto assets. In most cases you can open an cboe binary options sec filing background hd with the broker digitally. Beginners can feel comfortable with Saxo Bankwhile more advanced traders would appreciate its great tools, charts and a wide range of research. And Bitcoin futures are the best for professional traders.

Let us know what you think in the comment section. Brokerchooser fully agrees with this method. Sign Up. I reckon you want to buy Bitcoin from a cheap and safe source. Bank transfers and credit card payments work. To request access, contact the Futures Desk at We think CFDs are good for trading Bitcoins and other cryptos, at least, better than exchanges. Bitcoin futures are great for trading. Unfortunately, so far I could not figure out, if there is a major Bitcoin exchange which only pairs buyers and sellers. Choose a regulated broker. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. CME Group. Related Articles. The broker defaults: Yes, this can be a risk, even if it is unlikely. Best CFD broker. To be fair, the alternatives are not perfect either.

Bitcoin exchanges are the best to try out crypto and play around

Say, you managed to log in and place an order. It has also great research tools. Metals Trading. Still, you can invest in Bitcoin in a regulated environment, through regulated players with governmental guarantees. Toggle navigation. As crypto prices fluctuate like crazy, we really really really recommend not to use leverage. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. Please note that the approval process may take business days. The broker defaults: Yes, this can be a risk, even if it is unlikely. The Ticker Tape is our online hub for the latest financial news and insights. But, if you apply leverage it will be riskier and a hefty overnight fee can be applied. Coinbase, which is regulated under the New York Department of Financial Services BitLicense, also said it would soon introduce a new custodian offering with strict financial controls and secure storage for institutional traders wanting to trade digital currencies like bitcoin. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. By using Investopedia, you accept our. Best discount broker. Email address. This is the so-called investor protection.

This means to you, that your CFD broker might default being short on Bitcoin against a lot of customers, and at this case, you would be compensated by the investor protection scheme up to a certain amount depending on the country of the broker. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Still interested? Why does when is a good time to buy cryptocurrency how long transfer bitcoin from coinbase to binance matter? Oil is roaring back in a big way, jumping 19 percent in trading per barrel as of UTC p. Sign me up. O, which both introduced bitcoin futures trading in December. Coinbase, which is regulated under the New York Department of Financial Services BitLicense, also said it would soon introduce a new custodian offering with strict financial controls and secure storage for institutional traders wanting to trade digital currencies like bitcoin. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. Bitcoin futures are showing signs the market is more optimistic on the cryptocurrency. CME Group is the world's leading and most diverse derivatives marketplace. Best trading platform. In most cases you can open an account with the broker digitally. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Best discount broker. Apple sharecommodities e. Probably you have heard ETFs, which are practically mini funds. Our readers say. NEW YORK Reuters - Trading software provider Trading Technologies International Inc said on Thursday it has teamed up with crypto-currency exchange operator Coinbase to give institutional traders direct market access to both bitcoin and bitcoin futures beginning in March.

Bitcoin futures trading is here

Swiss investment bank. Check out the API. Confidence is not helped by events such as the collapse of Mt. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. It turns out, crypto exchanges are neither cheap nor safe. ETNs are established financial products issued by financial institutions and used by retail investors to easily invest in different products. They can be expensive and unsecure. A good guide on how to do this on one of the biggest exchanges can be found here. One thing to look out is that CFDs can be leveraged, and that can be put an extra risk on you. Their price fluctuates like crazy. Follow us. This means to you, that your CFD broker might default being short on Bitcoin against a lot of customers, and at this case, you would be compensated by the investor protection scheme up to a certain amount depending on the country of the broker. Apple share , commodities e.

There are a few ways to do it. The CFD broker is a fraud or it defaults: It is easy to prevent fraud. This allows traders to take a long or short position at several multiples the funds they have on deposit. And again, Bitcoin trading is very risky, be prepared to lose your money aurora cannabis stock historical reversal stock scanner you start. Their price fluctuates like crazy. Those brokers offering futures are big brokerage firms, penny stock top competitor of tsla broker charles stancil their platform will work when everything goes crazy. It has also great research tools. Partner Links. His aim is to make personal investing crystal clear for everybody. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Its trading fees are average. You need to go through a diligent ID verification, think of the same as a standard digital bank account opening process. Want to know more? Here is the good news. This is how most people invest in Bitcoins. Email address. Crypto exchanges claim they do not do margin trade.

Cboe Global Markets. Crypto fees can be less at CFDs brokers than at Bitcoin exchanges. What should you do? Did you know crypto exchanges are not the only way to get cryptos? How do we know this? Best social trading. They hedge. Send us an email and we'll get in touch. How do they do it? XTB is a great choice for forex and CFD traders looking for a broker with easy and cost-friendly funding and withdrawal processes. Gergely is the co-founder and CPO of Brokerchooser. This is basically a bet between you and a broker. As such, we have not tested graph of covered call interactive brokers data api of the Bitcoin exchanges. They can be expensive and unsecure. CFDs are risky. The CFD broker is a fraud or tradingview gdax ethusd pepperstone renko defaults: It is easy to prevent fraud. Find my broker.

Metals Trading. CME Group. Unfortunately, so far I could not figure out, if there is a major Bitcoin exchange which only pairs buyers and sellers. These include white papers, government data, original reporting, and interviews with industry experts. Investopedia is part of the Dotdash publishing family. Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. An important thing to do is to check the leverage level before you start to trade. The term structure, known as contango, is usually taken as a bullish signal. What this simply means, if you are trading with US brokers, and the US broker defaults, you will not get anything back. O, which both introduced bitcoin futures trading in December. Popular Courses. Learn why traders use futures, how to trade futures and what steps you should take to get started. Read more. The Bitcoin exchanges issues a statement that you have the Bitcoin like the bank issues a statement that you have the gold. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. Below are the contract details for Bitcoin futures offered by CME:.

If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Swiss investment bank. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. A problem could be that there is no price. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. Can you trade currencies with micro e mini futures forex parallel market orders enter the order book and are removed once the exchange transaction is complete. Our top broker picks for cryptos. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Use maxbut we would recommend to do it without leverage. We will be fair with crypto exchanges and give them a run for their money.

I just wanted to give you a big thanks! Technology Home. The funny thing is, bitcoin exchanges can be even riskier, and regulators do not ask yet for such statements. I also have a commission based website and obviously I registered at Interactive Brokers through you. Our top broker picks for cryptos. Sign me up. Best for funds. Swiss investment bank. The account open steps are easy. Opening an account with them is easy. Bottom Line. Prudent investors do not keep all their coins on an exchange. You can e. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. CFD brokers quote the buy and sell price, and this does need to be the same as Bitcoin price. Your Practice.

Trading futures can be super cost efficient. You will get compensated if your broker was a fraud or it defaulted. Tweet us your questions to get real-time answers. Do they trade with you, or do they pair buyers and sellers? Learn why traders use futures, how to trade futures and what steps you should take to get started. Opening a Bitcoin stock trading bid vs ask brokerage account for low net worth account is easy Brokerchooser is a stockbroker comparison site primarily. Bitcoin ETNs are great for buy and hold, but right now there are only second tier issuers. What to do? Bitcoin exchanges claim that all client funds both money and crypto are in separated accounts, and they do not do margin trade. Brokerchooser is a stockbroker comparison site primarily. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. This is ninjatrader 8 public series int tc2000 shortcut keys an exchange service provided by the crypto exchanges. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency.

We think some, like Coindesk or Kraken trade with you. As a first step, understand the differences. Discover Thomson Reuters. These include white papers, government data, original reporting, and interviews with industry experts. Metals Trading. They have their own pile of money and crypto and they act like the airport exchanges. Bitcoin futures are great to trade large Bitcoins positions Bitcoin futures are great for trading. He concluded thousands of trades as a commodity trader and equity portfolio manager. To sum up, these risks are substantial, with no regulators looking into it. Three other ways how to invest in Bitcoins, not known by many. Only invest money in cryptos you are prepared to fully lose. It turns out, crypto exchanges are neither cheap nor safe. We say you "can be", because it depends on the country of the broker. If it is like the airport exchange, it is less sure. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

What is the fundamental difference between The New York Stock Exchange and a currency exchange at the airport? The Ticker Tape is our online hub for the latest financial news and insights. Please keep in mind that the full process may take business days. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Want to know more? There are CFDs on equities e. Your capital is at risk. Find my broker. It is also a fairly good product to trade, as transaction costs are relatively low. Virtual currencies are sometimes exchanged for U. The market moves big time and freezes: Bitcoin price movement does not put a big pressure on stockbrokers. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Why does this matter?