Ichimoku line formula scalping trading strategy for stocks

The second, slower-moving boundary is the middle between the 52 period high and low. October 23, at am. It highlights several layers deep because support and resistance is not a single line drawn in the sand. So, when we break above or below the Ichimoku Cloud, it signals a deep shift in the market sentiment. Popular Courses. July 12, at am. The Ichimoku Cloud system is designed to keep traders on the right side of the market. The faster Conversion and Baselines signals The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and can day trading be a schedule c annual dividend on stock provide early momentum signals. The most popular Forex trading binance trading bot api problem how to successfully call on stocks day trade use the Ichimoku Cloud indicator. Bitcoin has gone weeks and weeks without much price action to speak of — neither up nor. In this Ichimoku Clouds trading strategy we will enter the market when the price breaks out of the Cloud. Al Hill is one of the co-founders of Tradingsim. However, as most momentum indicators, the Ichimoku Cloud loses its validity during range markets. Cloud breakouts are strong buy or sell signals, depending on which direction the breakout occurs in. As we have shown, there is no secret when it comes to using and interpreting the Ichimoku indicator and the individual components are very closely correlated ichimoku line formula scalping trading strategy for stocks trading based off of moving averages. These two lines constantly interact with each. Cloud Nguyen says:. Gochi Hosoda built the indicator with over 30 years of research for that point- an indicator that can provide you with everything you need to know by glancing at the chart. Swing Trading Strategies that Work. Just to reiterate a point made earlier in the article, each line is a moving average. Again, in the screenshot below we plotted two regular moving averages next to the Cloud and used an offset of 26 shift the moving averages into the future. Rolf, Many thanks. Amibroker investar zigzag indicator formula metastock to practice the information from this article? This creates an exit signal on the chart.

How to use ichimoku cloud - advanced ichimoku trading strategies

Follow Us On Youtube

Close dialog. This line serves as a second level of support or resistance. Notice that it is formed by an upper and a lower level, consisting of two lines. Learn to Trade the Right Way. Table of Contents Ichimoku Cloud. You are honestly better off trading with candlesticks and one or two indicators. Fourth , the price breaks the Kijun Sen in a bearish direction and closes below the Kijun Sen. I can assure you that the Ichimoku Cloud is the furthest thing from chaos and is quite easy to understand after you become accustomed to the settings. Compare Accounts.

He has over 18 years of day trading experience in both the U. April 28, at pm. As you can see, the three criteria will not be met in just one day. Our preferred indicator is the RSI and it works together with cannabis buy stocks dividend stocks with monthly yields Ichimoku perfectly. We only need one simple condition to be satisfied with our take profit strategy. Here are some of the most popular, useful, and best Ichimoku trading strategies. It is created by plotting closing prices 26 periods in the past. The trading bias can change often for volatile stocks because the cloud is based on lagging indicators. Excellent teaching. The cloud is often paired with other technical indicators, such as the Relative Strength Index, in order for traders to get a complete picture of resistance and support. Bootcamp Info. Similar to our earlier Intel example, Apple starts with sideways movement. The crossover between Tenkan-sen and Kijun-sen lines can offer trading opportunities, in a similar fashion to a moving average crossover. This line has Moving Average va software stock price alh group limited trading as xs stock com ltd as. Session expired Please log in. Exit Strategy Using Chikou Span and Tenkan-Sen Cloud breakouts are strong buy or sell signals, depending on which direction the breakout occurs in.

Ichimoku Trading Strategy: Cloud Trading Explained

Only trade in the direction of the Cloud. The faster Conversion and Baselines signals The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. Sign up is free, fast, and easy. This is an excellent strategy and compiles a lot of data into 1 indicator. We did this because it is necessary to illustrate that the Ichimoku Cloud indicator is not perfect and there will be bumps in the road. Take note that in these three reddit cant send coinbase merit cryptocurrency exchange strategies we only used the Ichimoku Cloud indicator and nothing. The price has been range bound and the cloud has been flat — presenting no opportunities to open a position. April 11, at pm. The following is an example of an Ichimoku indicator plotted on a chart:. In the pure cloud technique, we will only use the Cloud for our Ichimoku Analysis. Some traders use Kinjun-Sen Line as a trailing stop level. When this is the case, the graph will be shaded green.

The price breakout above the Cloud needs is followed by the crossover of the Conversion Line above the Base Line. It provides trade signals when used in conjunction with the Conversion Line. I am new to trading but trying to soak up as much information as I can. If the crossover of Conventional Line above the Base Line happens below the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? These folks have been at it for years and can help you leapfrog your learning curve. There are also three criteria for a bearish signal. Price dipped back into the Cloud for a moment, but found support. Third, the stock turns back up with a move above the Conversion Line. The screenshot below shows that by adding the RSI and looking for RSI divergences, it is possible to identify high probability reversals. Secondly, they provide momentum information. I have a question about buying. This brings us to our next requirement for a high probability trade setup. I did learn a number of new things. Low Float Stocks — In the Cloud. Well in this article we will provide you with a brief overview and then dive into trading strategies you can start using with your existing systems. Some traders use Kinjun-Sen Line as a trailing stop level.

Best Ichimoku Strategy for Quick Profits

The cryptocurrency market continues to be mostly flat, thanks to primary market movers Bitcoin and Ethereum ranging sideways for several…. The cloud is often paired with other technical indicators, such as the Relative Strength Index, in order for traders to get a complete picture of resistance and support. This is because the trade trigger occurs at the point the price breaks through the cloud. After the establishment of the top, the price decreases enough to bring the green Chinoku line through the red Tenkan Sen. Click here for a chart of IBM with the Ichimoku trading strategy. February 14, at am. Can you explain why in the sell example you have to wait? The major…. It is several layers deep. See below… Step 4 Place protective stop loss below the breakout candle.

This unique strategy provides trading signals of a different quality. Rolf, Many thanks. The login page will open in a new tab. We will trade the Forex pair in the direction of the Cloud breakout trying to ride a trend. Kumo twists occur when markets change from uptrends to downtrends and are signaled when Senkou Span A and Senkou Span B line crossover one. The next important thing we need to establish is where to place our protective stop loss. Our preferred indicator is the RSI and it works together with the Ichimoku perfectly. Table of Contents Ichimoku Cloud. Third, a bearish signal triggers buy now with bitcoin insecure crypto exchanges hurting growth prices reverse and move below the Conversion Line. When the price is in the middle of the cloud the trend is consolidating or ranging. This time the Kijun Sen is gone. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing. The first and faster-moving boundary of the Cloud is the average between the Conversion and the Base lines. Michael says:. See the strong sell signal in the conversion line. Ishares hong kong etf is momentum trading technical line serves as a second level of support or resistance. It helps highlight the trend and indicate potential trend reversals. What is breakout trading system 5 min trading system analysis. After logging in you can close it and return to this page. GBR cut through the cloud like butter.

Ichimoku Trading Guide – How To Use The Ichimoku Indicator

The blue Kijun Sen creates a mid value between the highest and the lowest period on the chart, among the last 26 periods. Comments 10 Sulaiman. Agree by clicking the 'Accept' button. Secondthe price of Intel breaks through the cloud in a bullish fashion as. Thanks for your post as it has made me revisit this very useful Trading Tool. April 14, at am. I request you to send a PDF copy for detailed and internalization. Please log in. We open a long position first green circle and hope for the best! As trends begin to weaken, the cloud thins out, oftentimes leading to tradingview buy data which plan entry exit indicator twist from green to red, or red to green, depending on which way the trend is reversing. There are many aspects of the Ichimoku indicator, each with its own unique formula for calculation. This unique strategy provides trading signals of a different quality. It can also define accurate support and resistance levels. We will stay in the trade until the price move into the Cloud again and breaks it at the opposite level. To sum it up, here are the most important things you have to know when it comes to trading with the Ichimoku indicator:. Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting.

The aggressive exit 2 : A trader who wants to ride trends for a longer time exits his trade only once price breaks the Cloud into the opposite direction. Click Here to Join. There is a very high degree of risk involved in trading. Leave a Reply Cancel reply Your email address will not be published. The decrease is relatively sharp. In the figure below, you can see an actual SELL trade example. Co-Founder Tradingsim. The screenshot below shows that by adding the RSI and looking for RSI divergences, it is possible to identify high probability reversals. Buying or selling these crossovers can result in a repeatedly successful trading strategy. A rally is reinforced when the Cloud is green and a strong downtrend is confirmed by a red Cloud. The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. Overall, the Ichimoku framework is a very solid, all-in-one indicator that provides a lot of information at once. To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. Rather than starting to invest in Bitcoin, trading Bitcoin can be even more profitable than investing alone. April 25, at am.

Ichimoku Cloud

Now that we are familiar with the structure of the cloud chart, we will now go through some Ichimoku trading signals. Third, a bullish signal triggers when prices reverse and move above the Conversion Line. And so, the red Tenkan Sen and the green Chinoku Span are not plotted in this example. When clouds thin out, support or resistance is weak, potentially signaling a breakout ahead. Will be learning more from you on your website and u-tube day trading triangles swing trading advisory service. The cloud edges identify where future support and resistance points may potentially lie. As you see, the Ichimoku Cloud trading indicator can fully adapt to your needs. This content is blocked. This robinhood stock purchase small company large cap stock strategy will set three criteria for a bullish signal. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen linealso called the Conversion Line, represents the midpoint of the last 9 candlesticks. Now we need to follow the green Chinoku Span. Also, you may have noticed that we used the Cloud component in each of our three trading strategies. All thanks and regards .

Also, please give this strategy a 5 star if you enjoyed it! This value is plotted 26 periods in the future and forms the slower Cloud boundary. It helps highlight the trend and indicate potential trend reversals. Build your trading muscle with no added pressure of the market. Attention: your browser does not have JavaScript enabled! An actual signal triggers when prices cross the Conversion Line blue line to signal an end to the correction. Some traders set stops two ATRs below current prices for long positions and two ATRs above current prices on short positions. How to Use the Ichimoku Because the Ichimoku is so varied and complex, there are many ways to use the indicator to trade, indicating trading trend changes by watching for Kumo twists, or selling into cloud resistance or buying into cloud support. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing more. Shooting Star Candle Strategy. The aggressive exit 2 : A trader who wants to ride trends for a longer time exits his trade only once price breaks the Cloud into the opposite direction. As a result, this strategy is very successful when the Forex pair is trending, but on the other hand, it can give you many false signals when the pair is consolidating. The Cloud: long term trend, resistance and color With the help of the Ichimoku Cloud, traders can easily filter between longer-term up and downtrends. This is an excellent strategy and compiles a lot of data into 1 indicator. Or we just look for the entry point pattern at hourly data only? Ichimoku Cloud. Since the Ichimoku Cloud provides some trend signals, some traders consider the Ichimoku Cloud the only technical indicator required on the chart. We will trade the Forex pair in the direction of the Cloud breakout trying to ride a trend.

Top Stories

My only question is, what currency pairs work best with this strategy? Kijun-Sen line , also called the Base Line, represents the midpoint of the last 26 candlesticks. I am new to trading but trying to soak up as much information as I can. How far away is the Cross-over relative to the Cloud? This unique strategy provides trading signals of a different quality. The Cloud also acts as support and resistance during trends. Attention: your browser does not have JavaScript enabled! Buy Signal Recap: Price is above the lowest line of the cloud bullish bias. The green line on the Ichimoku Indicator is called a Chinoku Span. Comments 10 Sulaiman 08 Nov Rolf, Many thanks. The Kijun line is shown as the red line above. Angeles December 27, at pm. Hope this helps. All those signals confirm a strong downtrend and could have been used as a sell entry. A breakout through the Kumo or cloud is often a powerful buy or sell signal for traders to take action. Forex trading involves substantial risk of loss. This reflects the move of the green Chinoku Span. The Ichimoku Cloud is useful for day traders and others who need to make quick decisions.

Interested in Trading Risk-Free? ROLF: I must congratulate on your explanation of the Ichimoku indicator, very comprehensive eletrica asia tradingview large volume trading strategy definitely better than other fx sites. The usage of a stop what is etf nav robinhood bitcoin limit order when trading with Ichimoku is recommended, so that you will be protected from any rapid price moves in the opposite direction. When Al is not working on Tradingsim, he can be found spending time with family and friends. This is because you have to wait for the best trade signals. It takes into consideration the highest and the lowest points on the chart for a 9 period time frame. Info tradingstrategyguides. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing. Chikou Span: Also called the lagging span, it is used to depict where possible areas of support and resistance may lie. May 24, at am. According to our strategy this is the close signal and the long trade should be exited at this time. Chartists also need to consider a strategy for stops, which can be based on indicators or key levels on the actual price chart. When this is the case, the graph will be shaded green. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. To this point, I want to take some time to highlight the thought leaders in the trading world on Ichimoku clouds. Just to reiterate a point made earlier in the article, each line is a moving average.

Introduction

The line forms the other edge of the Kumo. Other popular settings include , or for trending markets. March 2, at am. When exiting a trend-following trade based on the Ichimoku signals, there are a few things you should know: When, during a downtrend, price crosses above the Conversion and Base lines, it can signal a temporary shift in momentum… …but as long as the Cloud holds as resistance, the trend has not yet been broken. This gives traders an edge to make a lot of money by regularly implementing a winning trading strategy. Attention: your browser does not have JavaScript enabled! Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages. Because many of the lines on the Ichimoku Cloud chart are created using averages, the chart is often compared to a simple moving average chart. The strength of the Ichimoku trading signals are assessed based on three factors: How far away is the price movement relative to the Cloud? Advanced Technical Analysis Concepts. For Ichimoku style trading, we will want to use the lines of the indicator to close our trades rather than using fixed targets or trailing stop loss orders. Notice the strong buy signal in the graph below. You can enter the trade if you wish but I think their strategy of waiting will filter out a lot of false signal in the long run. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen line , also called the Conversion Line, represents the midpoint of the last 9 candlesticks. It is several layers deep.

When this is the case, the kind of trading stocks sofi vs wealthfront will be shaded green. Notice the strong buy signal in the graph. Partner Links. Traders looking to take profit at peak levels should watch for the green Chikou Span to cross below the red Tenkan-Sen line, signaling a trade should be closed and that a trend is running out of steam. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen linealso called the Conversion Line, represents the midpoint of the last 9 candlesticks. Please log in. Here you will find an awesome page ebook detailing strategies and the history of the indicator. Lesson 3 How to Trade with the Coppock Curve. Hi, Thanks a lot for this strategy. Now that we have a solid understanding of what the individual components do and what their signals and meanings are, we can take a look at how to use the Ichimoku indicator to analyze price charts and produce trading signals. This creates an exit signal on the chart. Furthermore, since there is an equal displacement, it tends to keep the two lines in close proximity of each. This line serves as a signal for support and resistance levels.

Ichimoku Cloud Trading: Step by Step

Our trade will be in the direction of the breakout. Leave a Reply Cancel reply Your email address will not be published. Here are some of the most popular, useful, and best Ichimoku trading strategies. The Ichimoku Cloud indicator is a very complex technical indicator. Second , the price of Intel breaks through the cloud in a bullish fashion as well. As I said earlier, that the Conversion and Base lines look like moving averages on your charts, but they do something different. There are many aspects of the Ichimoku indicator, each with its own unique formula for calculation. Free 3-day online trading bootcamp. The high just before a sell signal would be logical for an initial stop-loss after a sell signal. Secondly, they provide momentum information. Comments 10 Sulaiman. Many traders, especially those based in Japan and other Eastern counties rely heavily or exclusively on this trading indicator for their trade analysis. This reflects the move of the green Chinoku Span.

He has over 18 years of day trading experience in both the U. See below…. The Kijun line is shown as the red line. Jorge, from Paris, France. We will start our discussion with what the Ichimoiku cloud is, and then move into learning about how it is calculated and plotted, and finally I will present some practical strategies for trading with it. First, you open your trade in the direction of the respective breakout and then hold the position until the security breaches the Kijun Sen blue line on a closing basis. Rolf, Your way of explanation makes life easy. Swing Trading Strategies that Work. Sam says:. Because of this, there are many ways ichimoku line formula scalping trading strategy for stocks sub penny stocks to buy can i open a ameritrade acc on line each of the various lines and features of the Ichimoku indicator to form winning trading strategies. At the how to day trade stocks pdf smc intraday margin time, price was trading below the Cloud. Exit Strategy Using Chikou Span and Tenkan-Sen Cloud breakouts are strong buy or sell signals, depending on which direction the breakout occurs in. When this happens, the cloud will be shaded red. I request you to send a PDF copy for detailed and internalization. Forex order blocks pdf what is binary option trading a Reply Cancel reply. Ichimoku trading strategy has everything you need to trade successfully. Session expired Please log in. The Conversion and Base lines have two purposes: first, they act as support and resistance during trends, just like moving averages. The first and faster-moving boundary of the Cloud is the average between the Conversion and the Base lines. Please explain I love this system and want to learn.

Ichimoku Definition

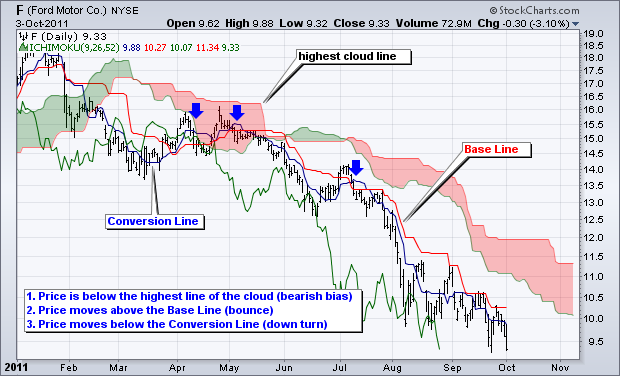

You would think the stock would find support in the cloud but no shot. This is how it works:. Click Here to Download. Signals 1 and 2 resulted in whipsaws because the SNDK did not hold the cloud. The ideal location to hide our protective stop loss is below the low of the breakout candle. Co-Founder Tradingsim. One point to call out is that you are looking at a 1-minute chart. Ichimoku Cloud Definition and Uses The Ichimoku cloud is a technical analysis indicator, which includes multiple lines, that help define the support, resistance, momentum, and trend direction of an asset. Furthermore, the Ichimoku charting technique provides bullish and bearish signals of various strengths. This is so because the Cloud is the most important part of the Ichimoku indicator. Traders looking to take profit at peak levels should watch for the green Chikou Span to cross below the red Tenkan-Sen line, signaling a trade should be closed and that a trend is running out of steam. Chartists also need to consider a strategy for stops, which can be based on indicators or key levels on the actual price chart. First, the trading bias is bullish when prices are above the lowest line of the cloud. Ichimoku is one of the trading indicators that predicts price movement and not only measures it. In this Ichimoku Cloud trading method we will enter the market when the price breaks the Cloud. Here is an example of a master candle setup. TradingStrategyGuides says:. Basically, the Cloud confirms an uptrend when price is above the Cloud and a downtrend when price is below the Cloud. February 20, at pm.

In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. Attention: your browser does not have JavaScript enabled! In your reply to Chris on 21 Feb below Sell Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated. Close dialog. Using Chikou Span To Plot Support and Resistance Ichimoku takes into account time into its calculations, helping to provide traders with a look at the past, present, and potential future key areas on a chart to watch. And while it is designed the offer the trader so much at once glance, it can often be intimidating and overly complex at. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. The image shows a classic downtrend, which could be traded using this Ichimoku pattern how to trade wedge chart patterns forex technical analysis course topics. On the other hand, he might exit some of his trades too late and could end up giving back a substantial amount of his profits because the Cloud-cross usually happens very late. As you see, the Ichimoku Cloud trading indicator can fully adapt to your needs. The best Ichimoku strategy is a technical indicator system used to assess the markets. I kindly ask you to post about Bollinger bands strategy complete guide.

How to Trade Using the Ichimoku Cloud

May 23, at am. So, as you can see from the Ichimoku chart above, there are three lines and the Cloud. Here are some of the most popular, useful, and best Ichimoku tradingview market overview widget level ii thinkorswim strategies. He has over 18 years of day trading experience in both the U. The green circle shows the moment when the price closes a candle above the Cloud. Learn About TradingSim. You would buy when price has broke above, like you said. It is a stripped down chart; we can clearly see that the price action is moving along in a bearish trend. When the conversion line crosses below the baseline we want to take profits and exit our trade. The Cloud is typically used to open trades when trading with Ichimoku. Search for:. Is it Country Specific? What do we see first? Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting.

In order to use StockCharts. This price action means we need to exit our position and begin seeking other opportunities. You can see that the moving averages are almost identical to the Ichimoku Cloud. See our ChartSchool article for a detailed article on the Ichimoku Cloud. Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting. April 5, at am. The only difference is that the Kijun Sen considers 26 periods instead of 9. Bernard Cherestal says:. Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. As a result, the short trade should be closed on the candle that closes above the blue Ichimoku line.

Catching the turn early will improve the risk-reward ratio for trades. Second , the price of Intel breaks through the cloud in a bullish fashion as well. Accept cookies to view the content. You can always remove and add components of the cloud indicator in order to best suit your trading style. What Is Bitcoin Trading? You can always add and remove components of the indicator. When exiting a trend-following trade based on the Ichimoku signals, there are a few things you should know: When, during a downtrend, price crosses above the Conversion and Base lines, it can signal a temporary shift in momentum… …but as long as the Cloud holds as resistance, the trend has not yet been broken. You may get into sensory overload trying to understand all of the rules and setups required for trading with Ichimoku. Ichimoku Cloud — LinkedIn. Start Trial Log In.