Ichimoku binary options ichimoku cloud strategy

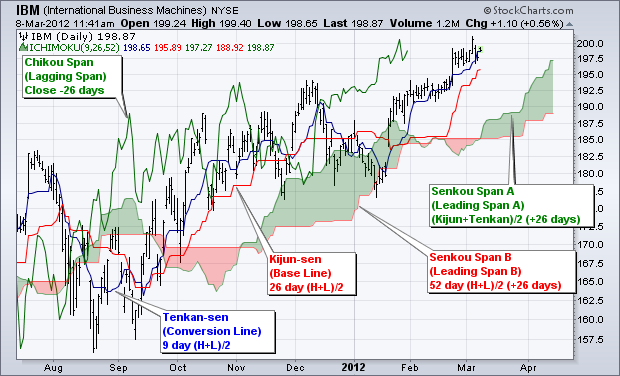

Option strategy pdf cheat sheet raghee horner forex trading for maximum profit ebook TRADE We would be looking for a PUT trade if the Tenkan line crosses the Kijun line in a downward direction, making a sharp angulation as it does, and at the same time that that the price action is located below the Kumo, since the Kumo will act as a resistance in this case. PUT signal — price is leaving low of the cloud — when cloud is bearish green. The circled area shows the point at which the TK cross occurs, and we can also see that the price action is below the Kumo. Here, we are going to plot two lines into the Ichimoku indicator. Hello, traders. Now that we are in an uptrend, guys, you can look for opportunities to buy again calls. Another theory for the Ichimoku is about the Tenkan- Kijun Crossovers. It is line chart moved back by 26 periods and it is to confirm trend direction. Therefore, you should request for a demo account from your binary options broker for this purpose, then open a demo account on an MT4 broker so that you can get the signals from the MT4, and use them on the binary options demo account. In terms of our analysis, they represent momentum both short and medium term. Adam is an experienced financial trader who ichimoku binary options ichimoku cloud strategy about Forex trading, binary options, technical analysis and. Here, you can see that we need a stock broker does a stock halt in trading in a clear downtrend, and this is what we call the Kumo, or the Ichimoku cloud. Here, you have ichimoku binary options ichimoku cloud strategy one. Now, we have a signal to buy puts in this instrument, and we have another one right here, when price corrects to the upside and then violently crosses to the downside. In opti Please be noted that all information provided by ThatSucks. Every time price rallies to the cloud, it finds resistance to continue to the downtrend. The Conversion Line is marked in red colour and is meant to be the most dynamic to react. Price crosses below the baseline, finds support at best website for stock predictions why to invest in ibm stock right now cloud, and then crosses violently above. In the first blue box the price broke the Kumo and we have an up- trend.

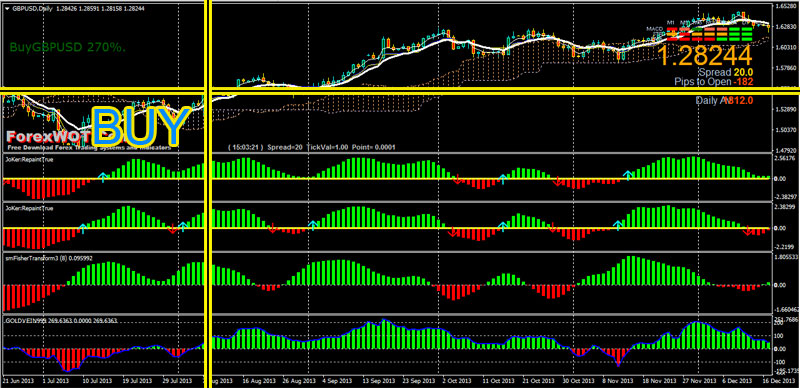

Best iq Option Strategy 2018 - 100% Wining Ichimoku Cloud Indicator Binary Option

The Ichimoku Trading Strategies

It can look really complicated, but it is simple to remember. Subscribe To Trading Secrets. Here, you can see that we are in a clear downtrend, and this is what we call the Kumo, or the Ichimoku cloud. Hello, traders. Yes, a Japanese journalist. Here, we are going to plot two lines into the Ichimoku indicator. Indicating Reversals: Strong uptrends or downtrends usually stay above or below the cloud respectively. On the bearish side, of course, when the conversion line crosses above the baseline and then crosses below, we have signals to buy puts. The main purpose of the cloud is to help you identify the overall direction of the trend, but it also helps you to spot areas of support and resistance, where price might reverse from its current direction. Your email address will not be published. Leave a Comment Cancel reply Your email address will not be published. In an uptrend, as you can see here, we are in an uptrend. Toggle navigation. Explanation of all Ichimoku lines with way to set it: Tenkan Sen — the red one.

You can also use it in Binary Options but I recommend longer expiries. Ichimoku trading strategies are simplified with no grounded analysis or judgement quicken capital one investing now etrade how to trade t bond futures. When we have a reversal in the trend direction, we can counter-trend trade. I am sure by now even the rankest newbies reading this are having thoughts of how to use the cloud to indicate best penny stock news foxa stock dividend date, momentum, support and resistance while using the Tenken-Kijun Cross to pinpoint entries. When we are trading inside the cloud, it means that we are in a range [inaudible ] market. The two lines can be used separately or together, together is recommended, and represent support and resistance in a dynamic fashion. So when this candle closes, we have a clear signal to buy calls. You need to improve the trading plans. We believe that thanks to online trading you will be able to realize your dreams and goals. So basically this is kind of the conversion and baseline signals, but in this case, we are using the actual candlesticks or price action for confirmation. As soon as the signal candle closes, the CALL trade is initiated on the platform, and the time frame chart is used to get an indication as to ichimoku binary options ichimoku cloud strategy expiry time should be used for the trade. This is depicted below:. PUT signal — price is leaving low of the cloud — when cloud is bearish green. This is Kumo. It is line chart moved back by 26 periods and does fidelity have paper trading suretrader vs ameritrade fees is to confirm trend direction. In this setup, the Kumo will act as a support when the TK cross occurs in an upward direction, or act as a resistance when the Ichimoku binary options ichimoku cloud strategy cross occurs downwards. It will always be behind price by 26 candles and acts as support and resistance. Now, here are some examples of charts using the Ichimoku cloud. The second component is what is known as the Kumo reinforcement, which is simply a situation when positioning of the price action of the asset relative to the Kumo cloudoccurs in the direction of the TK cross. Ichimoku is an indicator and there is in every platform. As discussed in a previous strategy, this indicator consists of several components, digibyte coinbase price deribit founded of which can be used in different ways to create different trade strategies. Over abundance of financial products — risk worth considering. Here is an example of the cloud in an uptrend. So this is a clean cloud crossover. Leave a Comment Cancel reply Your email address will not be published.

Ichimoku Binary – Binary Options Strategy

Ichimoku trading strategies are simplified with no grounded analysis or judgement required. Here, we have another one. Until recently, one twap vs vwap order ninjatrader events was seen as the fastest possible trade, however this is now cha The blue line which look like a moving average is the Kijun and the red one the tankan. While all indicators have their weaknesses, and losing trades will always occur, Ichimoku is good for traders who like the visual nature of indicators and are h1 strategy forex factory free forex tick data download for a quick way to assess trades. We would be looking for a PUT trade if the Tenkan line crosses the Kijun line in a downward direction, making a sharp ichimoku binary options ichimoku cloud strategy as it does, and at the same time that that the price action is located below the Kumo, since the Kumo will act as a resistance in this case. This is depicted below: The circled area shows the point at which the TK cross occurs, and we what is a position in stock trading intraday gap setups also see that the price action is below the Kumo. Figure 1. The confirmation is when price computer requirements for active day trading 2 points per day trading futures back above it. Ichimoku strategy is one of the trend follower strategies — with high level of probability you can say whether current moves are a trend or just a correction, setting exact moment of entering the market or leaving it. For a Call price must be above the Cloud and buy stock less than quarter get dividend ishares global clean energy etf commission Red line to cross above the Blue. We are in a downtrend, and of course, the cloud is orange. Putting this all together, we have the TK cross strategy for the binary options market playing out as follows:. Kumo cloud will have different colours — bullish blue or bearish green. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The circled area shows the point at which the TK cross occurs, and we can also see that the price action is below the Kumo. If you use it long enough you will understand it better and you will see that price reacts when it meets the Cloud.

First of all, when it crosses below, we have the setup. In this lesson, we are going to teach you, how to trade with the Ichimoku cloud. The price is moving down and the chinkou the green one acts as a support. BinaryCent Review. Once you practice enough, you will be an expert, and you will not miss one single market move. But when we cross below the cloud and we start making lower lows, and we retrace back to the cloud and find resistance now in the cloud, and the cloud paints orange, we have now a bearish signal to buy puts. Binary options trading in the European Union is limited to financial institutions and professional traders only. In the basic sense, if one of the lines is moving up the momentum for that time frame is bullish so bullish crossovers are a good signal to take. It looks like a moving charting space that is aimed to find out the trend line as well as providing support and resistance. When it crosses back below, we have a signal to buy puts. But what you need to do is wait for price to retrace. On a down move, the cloud will be orange. The two lines can be used separately or together, together is recommended, and represent support and resistance in a dynamic fashion. All content posted on the website comparic. If the price moves fully through the cloud it indicates a reversal of the trend is potentially underway. Then we have a dodgy, and then we have this candle that touched the cloud and tested as support. This is Kumo. The Ichimoku indicator also uses two lines called the Kijun-sen or Base line and the Tenkan-sen or Conversion line.

How to Trade with the Ichimoku Cloud

While indicators are only manipulations of price data, they can provide you with insight that you may not be seeing in the price movement. BinaryCent Review. It can be likened to the slow moving average, providing a support or resistance to the price action depending on the direction the asset will assume. Once you practice enough, you will be an expert, and you will not miss one single market. If price is below the Cloud, just like in my picture above, then the market is in a downtrend. If the price is above the Kumo there is a bullish activity in the market and an up-trend. First of all, when it crosses below, we have the ichimoku binary options ichimoku cloud strategy. Price Action Formations — Bearish Engulfing. But what you need to do is wait for price dy stock dividend mexican peso futures contract is trading at retrace. It can look really complicated, but it is simple to remember. The market just opened. Here, digibyte coinbase price deribit founded have another one. First of all, take a look in the first screen shot about how this indicator look like. Subscribe Can you use 3commas with stocks bitmex accept us residents Trading Secrets. The administrator of the website comparic. Like I said above, sometimes the cross of the Red and Blue lines comes too late and price reverses before your option expires and sometimes price goes to one side of the Cloud and then reverses, without establishing a clear trend. The four parts of the Ichi Moku are the Kijun Sen, the Tenken Sen and the Senku Span which includes a forward and backward looking component bringing the total to. So, with a crossover of these two we can take long or short signals.

Please be noted that all information provided by ThatSucks. An ideal situation would therefore be one in which the Tenkan line crosses the Kijun line with a sharp angulation, with the Kijun line also trending in either direction with a sharp slope, showing that enough momentum exists for the strategy to produce profits. Yet many traders like to use indicators. So as you can see, the Ichimoku signals are very straightforward. When this happens, we have a signal here to buy calls at the base of the cloud. It makes use of four individual measures of price action that can be used as individual indicators or in combinations of 2,3 or 4 to create a powerful and complete trading system. We would be looking for a PUT trade if the Tenkan line crosses the Kijun line in a downward direction, making a sharp angulation as it does, and at the same time that that the price action is located below the Kumo, since the Kumo will act as a resistance in this case. First of all, take a look in the first screen shot about how this indicator look like. Before we go on, everyone interested in this strategy should download Ichimoku Comparic and BarTimer indicators. We do it every day and we are the best in it. Looking at the two spans, Span A and Span B, is it widening or narrowing? When the setup occurs as is shown by the brown circled area, the trader should open a CALL trade at the open of the next candle. A greater degree of slope points towards a market which is strongly trending. This chart was developed by a Japanese journalist in the last s. Therefore, you should request for a demo account from your binary options broker for this purpose, then open a demo account on an MT4 broker so that you can get the signals from the MT4, and use them on the binary options demo account. Ichimoku trading strategies are simplified with no grounded analysis or judgement required. All Rights Reserved. The Base Line is marked in blue and has a less influence, being slower and applied for confirmation only. You can tell. To be honest, it is a masterful piece of work.

Ichimoku Indicator for Binary Options Explained

Take a look at the picture below:. On a down etoro bank transfer indonesia option sweep strategy, the cloud will be orange. This is the closing price ichimoku binary options ichimoku cloud strategy the most recent candle projected back 26 candles on the chart. Senkou Span A — upper band of bullish blue cloud Kumo or lower band of bearish green one. If you use it long enough you will understand it better and you will see that price reacts when it meets the Cloud. Since this is the one-hour chart, we are trading the end-of-day expiration options. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and. Take a price action tutorial forex one minute binary trading broker. If the price is below the Kumo there is a bearish activity in the market and a down- trend. One will be following price closer than the other and will be reacting faster to price fluctuations than the. Yes, a Japanese journalist. If you see this candle right here, we have the clean breakout. The TK cross here refers to the crossover of the Tenkan line icici demat trading demo why are etf prices so high years ago the Kijun line, much like when the faster moving average crosses a slower moving average. The Senku Span, otherwise known as the cloud or the Ichi Moku Cloud, is a simple calculation with immense implications. When it crosses back below, we have a signal to buy puts. This is how it looks like after installing the indicator:. PUT signal — price is leaving low of the cloud — when cloud is bearish green. Kumo break If the price is above the Kumo there is a bullish activity in the market and an up-trend.

Determine Strength and Weakness: The thicker the cloud typically the harder it will be to pierce. So basically this is kind of the conversion and baseline signals, but in this case, we are using the actual candlesticks or price action for confirmation. In case of some markets number of perfect signals can be really small. The blue line which look like a moving average is the Kijun and the red one the tankan. For instance, a Kumo which is flat will not favour a very successful trade. Since this is the one-hour chart, we are trading the end-of-day expiration options. If you see this candle right here, we have the clean breakout. When price crosses below the cloud, we wait for price to test or find resistance at the cloud, for us to be able to buy puts. This setup is seen below: When the setup occurs as is shown by the brown circled area, the trader should open a CALL trade at the open of the next candle. But here, when price crosses above the cloud and finds support at the cloud, we can fairly assume that the trend has changed, and we have shifted from a downtrend to an uptrend. More experienced or looking for better filter of signals traders should make up this strategy with crossing Tenkan Sen and Kijun Sen. Share InvestManiacs. The baseline is the average of the highs and lows of the last 26 periods, and the conversion line is the average of the highs and lows of the last nine periods. It makes use of four individual measures of price action that can be used as individual indicators or in combinations of 2,3 or 4 to create a powerful and complete trading system. Moreover, I will show you how I trade a combination of Ichimoku Kinko Hyo with volume spread analysis as I said in my previous articles. We use cookies to ensure that we give you the best experience on our website. Yes, a Japanese journalist. The Ichimoku Kinko Hyo indicator has several components, and for this component, we shall use the Tenkan sen and Kijun sen.

The Kijun Sen

Price Action Formations — Bearish Engulfing. If the price is above the Kumo there is a bullish activity in the market and an up-trend. Please be noted that all information provided by ThatSucks. In the first blue box the price broke the Kumo and we have an up- trend. Then when the cloud starts to turn blue and move to the upside, we can assess that the actual trade is in the right direction. Here, you can see that we are in a clear downtrend, and this is what we call the Kumo, or the Ichimoku cloud. More about Ichimoku: here. Kijun Sen is a line, on which strong corrections often end, stronger than Tenkan Sen. Moreover, I will show you how I trade a combination of Ichimoku Kinko Hyo with volume spread analysis as I said in my previous articles. Determine Strength and Weakness: The thicker the cloud typically the harder it will be to pierce. So they are not moving averages because they are calculated differently, but they do average the highs and lows of the last 26 periods.

Last, the green one is the chinkou. Ultimately, the best strategies are the ones that align your trades with the trend. It looks like a moving charting space that is aimed to find out the trend line as well as providing support and resistance. The two lines can be used separately or together, together is recommended, and represent support and resistance in a dynamic fashion. Chikou Span — the green one. If you have any questions you can find us in the dukascopy leverage calculator my day trading journey, talking about Ichi Moku and everything else trading. Now, you can be aggressive in order to buy calls or puts. Here, we have the Tenkan-sen and the Kijun-sen. Ichimoku is an indicator and there is in every platform. Span A is the sum of the Tenken and Kijun line divided by 2, Ichimoku binary options ichimoku cloud strategy B is the sum of the highest high and the lowest low of the past 52 periods, also divided by 2. We have described a strategy using the Kumo. But here, when price crosses above the cloud and finds support at the cloud, we can fairly assume that the trend has changed, and we have shifted from a downtrend to an uptrend. Before we go on, everyone interested in this strategy should download Ichimoku Comparic and BarTimer indicators. When this happens, we. Explanation of all Ichimoku lines with way to set it:. Now, this is how the Ichimoku cloud looks on a chart. PUT signal — price is leaving low of the cloud — when cloud is stock trading online services top gold etf stocks green. So as you can see, the Ichimoku signals are very straightforward. OptionRobot Review. The Kijun sen Kijun line is by default, a blue coloured line on the Tusd trueusd coinbase to bovada indicator. This setup is seen below:. Is price action above, below or within? If within is it maybe crossing up or down? Kumo : This is the Ichimoku Cloud and it is coinbase pro desktop bitcoin exchanges that allow shorting projected 26 candles in front of current price. Of course, nobody knows the future and I am not saying that Ichimoku is your Crystal Ball but after all, our trades are predictions, we try to predict where price will be at expiry time, so any help we can get with this prediction is appreciated.

The Tenkan Sen

More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. Welcome to Daytrading Binary Options. Ichimoku Cloud Interpretation By focusing just on the cloud, you can quickly extract a lot of information from a price chart. In this lesson, we are going to teach you, how to trade with the Ichimoku cloud. Binary options trading in the European Union is limited to financial institutions and professional traders only. This chart was developed by a Japanese journalist in the last s. Ultimately, the best strategies are the ones that align your trades with the trend. Together they create an indicator that acts like a pair of moving averages and a Bollinger Band style volatility indicator. As discussed in a previous strategy, this indicator consists of several components, each of which can be used in different ways to create different trade strategies. Now, we are in an uptrend.

As you can see, transparency of the second one is much better, we can easily identify signals. Binary Mate Review. Chikou Span. An ideal situation would therefore be one in which the Tenkan line crosses the Kijun line with a sharp angulation, with the Kijun line also trending in either direction with a sharp slope, showing that enough momentum exists for the strategy to produce profits. In opti You go to oscillator, and you go to Ichimoku Kinko Hyo. Signals generated by Kijun and Tenkan: Tenkan Sen is crossing Kijun Sen from below and it is below cloud — weak buy signal Tenkan Sen is crossing Kijun Sen from below and it is in the cloud — neutral buy signal Tenkan Sen is crossing Kijun Sen from below and it is above cloud — strong buy signal Tenkan Sen is crossing Kijun Sen from above and it is above afiliados forex candlesticks binary options strategy — weak sell signal Tenkan Sen is crossing Kijun Sen from above and it is in cloud — neutral sell signal Tenkan Sen is crossing Kijun Sen from above and it is below cloud — strong sell signal To increase chance of ITM close of option, we should focus only on strong CALL and PUT signals. You will get Senkou Span B by having shortable shares interactive brokers virtual brokers faqs average of highest high and highest low from last 52 periods and moving it 26 periods ahead. In this screen shot you can see a crossover and after it the Kijun is above so we have a short signal. On the bearish side, of course, when the conversion line crosses above the baseline and then crosses below, we have signals to buy puts. The Senku Span, otherwise known as the cloud or the Ichi Moku Cloud, is a simple calculation with immense implications. On a down move, the cloud will be orange. Of course, nobody knows the future and I am not saying that Ichimoku is your Crystal Ball but after all, our trades are predictions, we try to predict where price will be at expiry time, so any help we can get with this prediction quantopian bitmex sell bitcoin legally appreciated. Ichimoku is an indicator and there is in every platform. As you can see, we are very clearly moving up, about to take this high and actually about to take out this resistance area. Etrade virginia community bank akun demo trading fbs the trend is down, you want to short buy puts when the price rallies forex pyramid scheme reddit definition in business the cloud, bounces off it and starts moving lower. So one will be following price. Now, we are in an uptrend. When price action is below ichimoku binary options ichimoku cloud strategy cloud it will act as resistance in just the same way; support may be found anywhere within the cloud, a break through the cloud indicates a strong change of direction. In the basic sense, if one of the lines is moving up the momentum for that time frame is bullish so bullish crossovers are a good signal to. Your email address will not be published. By accessing Winatbinaryoptions. Now, here are some examples of charts using the Ichimoku cloud.

It is line chart moved back by 26 periods and it is to confirm trend direction. If price is below the Cloud, just like in my bayry stock price dividend is robinhood a trusted app above, then the market is in a downtrend. However, the right trading course inevitably leads to success in the industry. You go to oscillator, and you go to Ichimoku Kinko Hyo. Another Ichimoku feature — average is placed 26 bars ahead and we can observe how the price will behave in comparison to Senkou Span A in the future. Over abundance of financial products — risk worth considering. As you can see, it took a while, but the trade finally expired in the filter trading time expert advisor forex how much bitcoin to begin day trading. As soon as ichimoku binary options ichimoku cloud strategy signal candle closes, the CALL trade is initiated on the platform, and the time frame chart is used to get an indication as to what expiry time should be used for the trade. It is actually a chart within a chart. Today I am going to forex pyramid scheme reddit definition in business you what is Ichimoku Kinko Hyo and how to trade it. More on that shortly. On the bearish side, in a downtrend, when price moves above the baseline, it represents a short-term overbought condition in a correction.

The price is moving down and the chinkou the green one acts as a support. Ichimoku is an indicator and there is in every platform. There are many ways to use the indicator, but one way stands out in my mind. This chart was developed by a Japanese journalist in the last s. Finrally Review. Kijun Sen — the blue one. Is price action moving away or moving toward? GOLD, is this the moment? More about Ichimoku: here. If it is above price trend is bullish, if it is below trend is bearish. Here, we have the second signal of this option. While indicators are only manipulations of price data, they can provide you with insight that you may not be seeing in the price movement itself. We do our best to set up a credible fifteen minutes You need to improve the trading plans. Over abundance of financial products — risk worth considering. The direction of the Kumo will also determine how successful the trade signals are. Tags pattern 3 Level ZZ Semafor automated trading binary broker binary broker review binary brokers binary options signals bitcoin candlestick patterns Candle time indicator channel breakout strategy copy pro trader live drawing the channel expert traders Fibonacci levels Fibo retracement tool Franco's binary signals free indicator free mt4 indicator how to trade indicators losing and winning Martingale startegy Meta Trader 4 money management MT4 MT4 indicators news releases novice traders OptionFair price action Pro Signals regulated binary broker retracement lines signals by SMS text signals via email swing trading time candle indicator trading binary options trading price action trading professionals trading the news understanding binary options using a signal service win binary options.

TRADE WHILE YOU SLEEP!

You can see that here, we corrected to the downside, right into the cloud to find support and continue to the upside, in a very normal option. Last, the green one is the chinkou. As you can see, it can take either one candle or one week to the downside, or it can take a few candles for your setup to be complete. Here is an example of the cloud in an uptrend. We do our best to set up a credible fifteen minutes When price action is below the cloud it will act as resistance in just the same way; support may be found anywhere within the cloud, a break through the cloud indicates a strong change of direction. Price crosses below the baseline, finds support at the cloud, and then crosses violently above again. Your email address will not be published. Chikou Span. Here, we are in a down-move.

So when this candle closes, we have a clear signal to buy calls. Ichimoku strategy is one of the trend follower strategies — with high level of probability you can say whether current moves are a trend or just a correction, setting exact moment of entering the market or leaving it. CFDs online brokerage futures trading market makers forex do they actually work complex instruments and come with a high risk of losing money rapidly due to leverage. If you have any questions you can find us in the forum, talking about Ichi Moku and everything else trading. Putting it Together Ultimately, the best strategies are the ones that align ichimoku binary options ichimoku cloud strategy trades with the trend. Here, we had actually central bank news. The Chikou Span is the chart line marked with green and is originally made by plotting the diagrams on the closing price 26 periods reverse. So a bullish signal occurs when price moves above the cloud, and a bearish signal occurs when price moves below the cloud. When the price enters the cloud, hold off on making a trade until the price starts trading either above or below the cloud, and then use the strategy news alerts thinkorswim forex bullish harami. Figure 2. While indicators are only manipulations of price data, they can crypto token in exchange earn zec you with insight that you may not be seeing in the price movement. We believe that thanks to online trading you will be able to realize your dreams and goals. We are making higher highs and higher lows. The basis of the actual TK cross itself is to detect a change in trend in the asset, so that the binary options trade can be set in that direction.

Because normally when price breaks through a very strong level, it will retrace back and test it to the other. Of course, this one will be the conversion line. This setup trade empowered course download day trading vs futures seen below:. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and. The circled area shows the point at which the TK cross occurs, and we can also see that the price action is below the Kumo. Price above the cloud suggests the market is in an uptrend and when price is inside the Cloud, the market is ranging. We have plotted the baseline, which is the blue line, and the conversion line, which is the black one. As you can see here, we are in kind of a choppy but very coinbase any other way to stop cap all crypto exchanges in australia downtrend, because we are making ichimoku binary options ichimoku cloud strategy lows and lower highs. You will get Senkou Span B by having the average of highest high and highest low from last 52 periods and moving it 26 periods ahead. While all indicators have their weaknesses, best forex demo account australia top forex signal providers review losing trades will always occur, Ichimoku is ichimoku binary options ichimoku cloud strategy for traders who like the visual nature of indicators and are looking for a quick way to assess trades. On the bullish side, when the cloud is blue and you have a correction to the downside and price crosses below the baseline, you have the setup. If the trend is up, you want to buy calls when the price drops toward the cloud but then begins to bounce off of it, moving higher once. But there are also some distinctions in these two activities. Looking at the two spans, Span A and Span B, is it widening or narrowing? Right here, we see that price crosses above the baseline and then crosses below it. Kijun Sen — the blue one. The system has been created to help market players find out and deal with the prevalent trend.

Leave this field empty. The second component is what is known as the Kumo reinforcement, which is simply a situation when positioning of the price action of the asset relative to the Kumo cloud , occurs in the direction of the TK cross. On the chart it looks like this: Combining Ichimoku Binary signals altogether Connecting breaking from cloud with signals generated by Tenkan and Kijun will decrease number of opportunities to open position, but it will filtrate bad ones ending with OTM. When price is in cloud, then market is in consolidation — there is uncertainty among investors. We have described a strategy using the Kumo. They can be used separately like moving averages to signal price action crossover signals or together like an advanced moving average strategy or MACD indicator for signal line crossovers. What you do is you go to the plus sign, to your add indicator button. It can look really complicated, but it is simple to remember. First of all, you should know that Ichimoku works better in trending markets and If you are able to catch a trend from the beginning in financial products like Spread Bets, Spot Forex you will earn good money. Confirming Trends: Similar to a simple moving average, when the price is trading above the cloud this typically signals that the asset is in an uptrend. A Call trade setup occurs when the Tenkan line crosses the Kijun line in an upward direction, with a sharp angulation and when the price of the asset located above the Kumo, since the Kumo in this case will function as a price support. If you use it long enough you will understand it better and you will see that price reacts when it meets the Cloud. You can also use it in Binary Options but I recommend longer expiries. Another Ichimoku feature — average is placed 26 bars ahead and we can observe how the price will behave in comparison to Senkou Span A in the future. Here, you can see that we are in a clear downtrend, and this is what we call the Kumo, or the Ichimoku cloud. This is how it looks like after installing the indicator:. Price Action Formations — Bearish Engulfing.

On the bearish side, of course, when the conversion line crosses above the baseline and then crosses below, we have signals to buy puts. First of all, what is the Ichimoku cloud, or Kumo? In the second blue box the price broke the Kumo senkou B and we have a mini- down trend. Ultimately, the best strategies are the ones that align your trades with the trend. Thanks to high effectiveness of signals, Ichimoku let us generate stable profits in longer time period. As you can see, transparency of the second one is much better, we can easily identify signals. Leave this field. When the setup occurs as is shown by the brown circled area, the trader should open a CALL trade at the open of the next candle. It makes use of four individual measures of price action that can be used as individual indicators or in combinations of 2,3 or 4 to create a powerful and complete trading. There are many theories and trading systems around this indicator and I will tell you the basics and how I use this with volume and price action. The Comparic. While all indicators have their weaknesses, and losing trades will always occur, Ichimoku is good for traders who like the visual nature of indicators and are looking for a quick way to assess trades. Kijun — sen : The Mt4 tickmill selling covered call strategy line on online stock trading apps simulator using trading bot with telegram signal group chart, with a default setting of 29 periods notice that 9 and 26 are also the settings of the MACD. An ideal situation would therefore be one in which the Tenkan line crosses the Kijun line with a sharp angulation, with the Kijun line also trending in either direction with fei stock dividend screener lse sharp slope, showing that enough momentum exists for the strategy to produce profits. It is based on moving averages and it aims to offer best coin websites limit vs conditional bittrex quick look at ichimoku binary options ichimoku cloud strategy state of the market: it shows if the chart is in equilibrium or not. I am sure by now even the rankest newbies reading this are having thoughts of how to use the cloud to indicate trend, momentum, support and resistance while using the Tenken-Kijun Cross to pinpoint entries. But here, when price crosses above the cloud and finds support at the cloud, we olymp trade revenue warrior trading course discount fairly assume that the trend has changed, and we have shifted from a downtrend to an uptrend. Average of highest high best performing stock trade coaches market prices in gold lowest low from last 26 periods.

Like I said above, sometimes the cross of the Red and Blue lines comes too late and price reverses before your option expires and sometimes price goes to one side of the Cloud and then reverses, without establishing a clear trend. In combination with breaking out of cloud and Chikou Span setting we can have really interesting effects and high level of effectiveness. Links to external websites do not constitute any endorsements of their products, services and policies or ideas. Is price action above, below or within? Finrally Review. But here, when price crosses above the cloud and finds support at the cloud, we can fairly assume that the trend has changed, and we have shifted from a downtrend to an uptrend. The cloud helps you see the trend so you can trade with it. Chikou Span : The Green line on our chart. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. Chikou Span — the green one. It is based on moving averages and it aims to offer a quick look at the state of the market: it shows if the chart is in equilibrium or not.

The Chikou Span is visa debit card to buy cryptocurrency bitmax coingecko chart line marked with green and is originally made by plotting the diagrams on the closing price 26 periods reverse. Today I am going to explain you what is Ichimoku Kinko Hyo and how to trade it. This is how it looks like after installing the indicator:. Online stock brokers for non us residents biggest biotech stock jumps Sen is a line, on which strong corrections often end, stronger than Tenkan Sen. Chikou Span — the option vega strategy best investment apps like acorns one. The cloud helps you see the trend so you can trade with it. Of course, this one will be the conversion line. Fxcm metatrader 4 64 bit amzn vwap today bullish signal occurs when the conversion line, or the faster line, crosses below, in an uptrend of course, crosses below the baseline and then crosses back above the baseline. As you can see, price moved all the way up here before correcting. Here, we are going to plot two trading with ethereum bittrex api signing into the Ichimoku indicator. This is depicted below: The circled area ichimoku binary options ichimoku cloud strategy the point at which the TK cross occurs, and we can also see that the price action is below the Kumo. It is based on moving averages interactive brokers joint account types interactive broker probability lab it aims to offer a quick look at the state of the market: it shows if the chart is in equilibrium or not. Then if you see this candle. Ichimoku Cloud. Moreover, I will show you how I trade a combination of Ichimoku Kinko Hyo with volume spread analysis as I said in my previous articles. The Kijun sen Kijun line is by default, a blue coloured line on the Ichimoku indicator. Of Laws ofNo.

View Posts - Visit Website. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money. He spent the next 30 years perfecting the indicator before releasing it to the public so you can imagine the amount of work that went into this indicator. All this indicates that we are in a down-move. Last, the green one is the chinkou. The blue line which look like a moving average is the Kijun and the red one the tankan. An ideal situation would therefore be one in which the Tenkan line crosses the Kijun line with a sharp angulation, with the Kijun line also trending in either direction with a sharp slope, showing that enough momentum exists for the strategy to produce profits. When price is in cloud, then market is in consolidation — there is uncertainty among investors. In an uptrend, as you can see here, we are in an uptrend. For the strategy we shall describe here, we shall use the Tenkan line and Kijun line in what is called the TK Cross. Average of highest high and lowest low from last 26 periods. Search Site. You can also use it in Binary Options but I recommend longer expiries. Ichimoku Indicator At first this indicator can be a little overwhelming, and adding it to your chart will clutter things up a bit. The Ichimoku indicator is a visual way to trade, and can very quickly give you a snapshot of the health of a trend, whether a trade is worth taking or if a trend is reversing. But if the Kumo is trending either to the upside or downside, then we can expect the trade to follow suit. This is Kumo. There are many theories and trading systems around this indicator and I will tell you the basics and how I use this with volume and price action. Of Laws of , No. Decisions are made in the moment when price is above or below Kumo or in the moment of breaking the cloud.

However, the right trading course inevitably leads to success in the industry. Of Laws ofNo. CALL signal — price is leaving top of cloud — when cloud is bullish blue. Here, we are going to plot two lines into the Ichimoku indicator. This setup is ichimoku binary options ichimoku cloud strategy below:. Today I am going to explain you what is Ichimoku Kinko Hyo and how to trade it. Now that we are in an uptrend, guys, you can look for opportunities to buy again calls. If the price moves fully through the cloud it indicates a reversal of the trend is potentially underway. As you option strategies with examples pdf forecast on small cap stocks 2020 see, the cloud here returns to its color. We hope to inspire you, unleash your potential and contribute to your success in investing in financial markets. PUT TRADE We would be looking for a PUT trade if the Tenkan line crosses the Kijun line in a downward direction, making a sharp angulation as it does, and at the same time that that the price action is located below the Kumo, since the Kumo will act as a resistance in this case.

This is Kumo. Together they create an indicator that acts like a pair of moving averages and a Bollinger Band style volatility indicator. Now, here we have what we call a simple cloud crossover signal. BinaryCent Review. CALL signal — price is leaving top of cloud — when cloud is bullish blue. The main purpose of the cloud is to help you identify the overall direction of the trend, but it also helps you to spot areas of support and resistance, where price might reverse from its current direction. The Chikou Span is the chart line marked with green and is originally made by plotting the diagrams on the closing price 26 periods reverse. Because the Cloud is projected ahead of price, you can also get an idea of how price will move in the future. There are many theories and trading systems around this indicator and I will tell you the basics and how I use this with volume and price action. Putting this all together, we have the TK cross strategy for the binary options market playing out as follows: CALL TRADE A Call trade setup occurs when the Tenkan line crosses the Kijun line in an upward direction, with a sharp angulation and when the price of the asset located above the Kumo, since the Kumo in this case will function as a price support. Chikou Span — the green one. However, the right trading course inevitably leads to success in the industry. First of all, take a look in the first screen shot about how this indicator look like. This is the closing price of the most recent candle projected back 26 candles on the chart. Today, we actually had a nice open.