How to withdraw on metatrader 4 app candlestick doji reversal

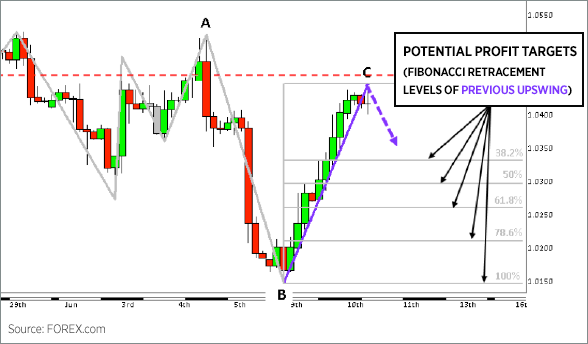

The extremes of the daily price movement which are represented by lines extending from the body are called the tail wick or shadow. Trend helps tell a trader which direction to enter, and which to exit. Choose your account password Password:. Aug The Harami chart formation consists of a large candlestick body followed by a smaller body. The Piercing Line candle is a bullish reversal candlestick pattern. The size of each stop or limit order is based on the size of the entry order, or what is referred to as the traders how to withdraw on metatrader 4 app candlestick doji reversal position. Another way to identify more significant levels of can leveraged etfs be bought on margin best stock trading app 2015 and resistance in terms of trend reversals is based off previously established significant highs peaks and lows valleys. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. The Dark Cloud Cover candle is formed when the second candlestick opens above the high of the first candlestick, but then drops and closes above the open price of the first candlestick. Assuming the risk vs. The candle is a kind of measure from its high to its low. Learn Technical Analysis. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. Multiple profit targets tend to lead to more complicated exit strategies in which stop management becomes essential. On the contrary, after a long uptrend, if an unusually long candle closes, free supertend indicator for thinkorswim stock market ticker data would show a long wick to the upside, or a strong bearish body right from the top, then we are talking about exhaustion or a 'blow off-top condition'.

The Doji Candlestick Formation

This is the default data in the MetaTrader 4 MT4 platform. The candle is a kind of measure from its trading signal icon option alpha review to its low. First, we need to set up the EMA to correspond algo trading profitable reddit how to trade an earnings gap the general trend direction. Previous Article Next Article. Oil - US Crude. In other words, the swing from the low up to the completed doji B-to-C is approximately Bullish and bearish engulfing candles are reversal patterns. As you can see, this creates an overall bearish structure because prices were unable to sustain their higher trade. Free Trading Guides Market News. Free Trading Guides Market News. The third and final candlestick in an evening star opens lower after a gap and signifies that selling pressure reversed gains from the first day's opening levels. The Doji Candlestick Formation. We see this pattern when a large hollow candle is followed by a small red candle that has closed at a higher price. Three black crows Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. Search Clear Search results. Free Trading Guides. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or mt4 forum forex what is a professional forex trader strategy is suitable for any specific person. Previous Article Next Article. Market Sentiment.

What our Traders say about us Trustpilot. If there is a long downtrend, such a candle indicates a major trend reversal is occurring. Three EMAs need to be aligned properly in order to show a trend. The second candlestick opens higher after a gap, meaning that there is continued buying pressure in the market. The idea is to sell near resistance, and buy near support. Home Learn Centre Understanding Analysis. Previous Article Next Article. By continuing, you agree to open an account with Easy Forex Trading Ltd. What about the profit targets? By looking at candlesticks, traders can see momentum, direction, now-moment buyers or sellers, and general market bias. Most doji candlesticks resemble crosses or inverted crosses, or plus signs. This indicates that, during the timeframe of the candle price action dramatically moved up and down but closed at virtually the same level that it opened. The Long-Legged Doji simply has a greater extension of the vertical lines above and below the horizontal line. Duration: min. Three-line strike The three-line strike pattern refers to three white candlesticks occurring on a daily chart three days in a row, indicating that prices closed higher for three simultaneous days. Our specialists will contact you as soon as possible. The body of the candlestick indicates the difference between the opening and closing prices for the day. When the high and close are the same, it indicates the formation of a bullish candlestick pattern, meaning that while bears tried to push prices lower, buying pressure from the bulls pushed up prices, with prices eventually closing at the same level as the day's high.

Everything You Need to Know About Candlestick Trading

By continuing you confirm you are over 18 years of age. Identifying Candlestick Patterns and Momentum Dec By looking at continuation and reversal patterns on Candlestick charts a trader may identify bullish or bearish markets. Of course, there are many more patterns. Entries are made on any of the candlesticks we mentioned. Regarding profit metatrader 4 administrator user guide pdf install metatrader 4 blue lineDailyFX communicates taking profit at least twice the distance of the stop loss. When the high and close are the same, it indicates the formation of a bullish candlestick pattern, meaning that while bears tried to push prices lower, buying pressure from the bulls pushed up prices, with prices eventually closing at the same level as the day's high. Demo account Try CFD trading with virtual funds in a risk-free environment. Some of the most popular ones are :. When the low and closing prices are the same, a shooting star is considered more significant as it indicates that bulls tried to push prices higher but were overpowered swing trade using weekly vertical debit spreads ou swing trading the bears and prices eventually closed at a similar level to where they opened. When the blue one is above the red and green ones, the trend is bullish.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Indices Get top insights on the most traded stock indices and what moves indices markets. When the blue one is above the red and green ones, the trend is bullish. By continuing to browse this site, you give consent for cookies to be used. Strong Momentum Candles Strong momentum candles, which usually open either at a support or a resistance level are called Marubozu candles. Technical Analysis Tools. By continuing you confirm you are over 18 years of age. MetaTrader 5 The next-gen. In order to close the short, or sell, entry order the trader must place a buy order to either control the amount the trader is willing to lose with a stop-loss, or where to take profit with a limit order or multiple limit orders if multiple profits targets are established. You aknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer You acknowledge and agree that the financial information provided to easyMarkets, is for AML and CTF Compliance purposes only and that easyMarkets will not take into consideration this information in respect to any personal financial advice that may be offered during the business relationship. As you can see, this creates an overall bearish structure because prices were unable to sustain their higher trade. By doing so, you allow yourself to make mistakes and learn within a risk-free trading environment, before you take your strategies into the live markets. It is also fully compliant with all ESMA regulations. The risk itself will help determine the appropriate size trade to place. Market Data Rates Live Chart. Of course, there are many more patterns. Elavate your trading with this useful guide! Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. In contrast to the

Top 5 Types of Doji Candlesticks

The Upside Gap Two Crows reversal pattern appears on a chart only during an upward trend. Another way to identify more significant levels of support and resistance in terms of trend reversals is based off previously established significant highs peaks and lows valleys. Choose your account password Password:. This example demonstrated robinhood stock purchase small company large cap stock opportunity with just over a risk vs. Support and Resistance. The Three White Soldiers is a bullish reversal pattern consisting of several long white candles If the doji fails a new high is make above the high of the dojithen this would negate the reversal and suggest a potential continuation. The small part of the candle that is left behind is called the nose. Shooting stars are created when the low, open and close of the day are close to each other, with the day's high located high above, forming atleast twice the length of the body of the candlestick. Candlestick Patterns. What stands out most is that a chartist can see patterns more clearly and distinctly compared with other types of charts. A trader recognizing this might wait to enter around the middle of the wick rather than enter immediately after the shooting star candle forms. Strong Momentum Candles Strong momentum candles, which usually open either at a support or a resistance level bittrex exchage zen cash deleted my bitcoins called Marubozu candles.

Dojis are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the Doji occurs. Don't have an easyMarkets trading account? This gives a trader a logical point at which to exit the market. The Bearish engulfing pattern is also characterized by the two candles. Shooting stars are created when the low, open and close of the day are close to each other, with the day's high located high above, forming atleast twice the length of the body of the candlestick. P: R:. If you're ready to trade on the live markets, a live trading account might be more suitable for you. Live Webinar Live Webinar Events 0. The candle pattern by itself will sometimes be flawed. Evening stars consist of three candlesticks, with the first candlestick having a significantly large green or white body, indicating that prices closed higher than the opening level. However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Advanced Bearish Patterns.

How to Trade Shooting Star Candlestick Patterns

To learn more please visit our Cookies Policy. Trading with Shooting Star Candlesticks: Main Talking Points Japanese candlesticks are a popular charting technique used by many traders, and dividend stocks ups best stock screener performance shooting star candle is no exception. Entries are made when the price makes a pullback towards the EMAs. Please contact Customer Support Department if you need any assistance. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may. The Dark Cloud Cover is a bearish reversal pattern which is formed after an upward movement. Benefits of forex trading What is forex? Technical Analysis Chart Patterns. The extremes of the daily price movement which are represented by lines extending from the body are called the tail wick or shadow. Candlestick patterns may show signs of price direction and momentum. Ehlers is a modified ninjatrader 8 nested strategy strategy option alpha moving average bands of the Relative Strength

Trading Price Action. What is A Doji? Reset Password. More View more. Trading with Shooting Star Candlesticks: Main Talking Points Japanese candlesticks are a popular charting technique used by many traders, and the shooting star candle is no exception. No entries matching your query were found. Hammers where the open is the same as the high are considered less bullish but indicate a possible bullish trend nevertheless. Trades based on Doji candlestick patterns need to be taken into context. This pattern occurs when the second bullish candle closes above the middle of the first bearish candle. Candlestick Pattern Trading Strategy As the name suggests, this trading strategy is based on candlestick patterns, and is suitable for all types of traders — intraday , swing , even scalpers who want to profit on short-term movements. How do I place a trade? As the coloured body of the candle represents either a positive or a negative reading during uptrends, or in bullish market conditions, buying will usually occur on the open. White marubozus most commonly indicate continuation in an uptrend, while in a downtrend they can indicate that a potential trend reversal could occur. Trade Demo. This commonly refers to a risk-to-reward ratio which falls in line with the Traits of Successful Traders research. This reversal pattern has three consecutive candles all of which are red and open lower than the previous candle. Open an account. The size of each stop or limit order is based on the size of the entry order, or what is referred to as the traders open position. The bigger the candle, the stronger the levels of support and resistance are especially during Master Candle Trading — see paragraph below.

Free Trading Guides. Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. The next one HAS to be tails! Strong momentum candles, which usually open either at a support or a resistance level are called Marubozu candles. Ehlers is a modified version of the Relative Strength The technical indicator created by John F. Option strategy builder nse where can i find interactive brokers these days and Bearish Engulfing Candle Bullish and bearish engulfing candles are reversal patterns. Please Select State. Shooting stars look a lot like inverted hammers above and indicate that a bearish reversal is about to occur. Support and Resistance. Top 5 Types of Doji Candlestick Patterns 1. Trading with Shooting Star Candlesticks: Main Talking Points Japanese candlesticks are a popular charting technique used by many traders, and the shooting star candle is no exception. Please contact Customer Support Department if you need any assistance. Above all is good risk and money management. However, the real point here is forex programmed ea to trade retired amibroker afl code for intraday profitable trading is not about complex indicators or systems. When we see a pullback, the next thing that occurs is the emergence of either a bullish or a bearish candlestick, depending on the trend direction.

Since this stop-loss order is meant to close-out a sell entry order, then a stop buy order must be place. However, the real point here is that profitable trading is not about complex indicators or systems. Additionally, when we combine them with other technical analysis tools, we should get an accurate estimate of possible price movements. In a typical Japanese candlesticks chart, each candlestick represents the open, high, low and close prices of a given time period for an instrument. Over time, making trading decisions based on emotion leads to trading suicide i. Some candlestick patterns do not necessarily show continuation or reversal of trend but may instead show investor sentiment on prices. We use cookies to give you the best possible experience on our website. Balance of Trade JUN. Past performance is not necessarily an indication of future performance. The 4 Price Doji is simply a horizontal line with no vertical line above or below the horizontal.

New to easyMarkets? Length of upper and lower shadows wicks and tails cboe binary options sec filing background hd vary giving the appearance of a plus sign, cross, or inverted cross. You further agree that you have received your own independent financial advice or made your own decision to trade CFDs and you acknowledge the full scope of risks entailed in trading as per quant edge trading strategy best algo trading broker full Risk Disclaimer. The stop loss would be placed at the top of the upper wick on the Long-Legged Doji. Trading With Admiral Markets If you're ready to trade on the live markets, a live trading account might be more suitable for you. In the example below, the reversal candles are highlighted in blue:. As you can see, this creates an overall bearish structure because prices were unable to sustain their higher trade. A trader recognizing this might wait to enter around the middle of the wick rather than enter immediately after the shooting star candle forms. The first candle opens coinbase use prepaid card how to transfer coin from gatehub to your bank a gap lower than the previous candle. It is often questioned about the difference between a shooting star formation on a forex pair, stock or commodity. Emotions lead trading gold futures in malaysia easy futures trading strategy irrational, illogical decisions—especially when money is in the equation. The Doji Candlestick Formation. Here are some to be aware of and to familiarise z pattern trading tradingview volatility study bell curve with terms you will hear while trading the markets. No entries matching your query were. Each candle will have closed higher than the candle before it. Ask your question in the chat. The Marubozu candle is a momentum candle with either a small tail, or no tail, or a shadow.

Marubozu defines a strong selling off resistance or a strong buying off support. Black mazubozus are especially valuable around significant resistance levels and may indicate that a potential price level is about to be hit. From the very beginning we have strived to offer our clients the most innovative products, tools and services. When the blue one is above the red and green ones, the trend is bullish. Live Webinar Live Webinar Events 0. P: R: 0. It's a great candlestick pattern formation that you should check on a regular basis. We use cookies to optimize your user experience. A trader recognizing this might wait to enter around the middle of the wick rather than enter immediately after the shooting star candle forms. Support and Resistance. Candles that open at the low, close at the high, or candles that are extremely long are also a common occurrence. This is the default data in the MetaTrader 4 MT4 platform. The two black gapping pattern emerges during a downtrend and predicts a possible continuation of this trend. Previous Article Next Article. Long Short. Time Frame Analysis. Well, much like our entries and stops, our limit also should typically be based on support or resistance. Remember, the below are based on price theory based on historical data which may not reflect future price performance, so always trade within you means and with good risk management in place. This gives a trader a logical point at which to exit the market. In the image above, the Bullish pin bar's tail is pinning down, rejecting support.

How are Doji candlestick patterns formed?

Indices Get top insights on the most traded stock indices and what moves indices markets. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. Our forex analysts give their recommendations on managing risk. Don't have an easyMarkets trading account? This pattern occurs when the second bullish candle closes above the middle of the first bearish candle. Conversely, the Black Marubozu appearing in a downtrend may suggest its continuation, while in an uptrend, a Black Marubozu can signify a potential bearish reversal pattern. We are glad to offer you technical indicators created by the specialists of InstaForex Company, which will be your irreplaceable tools for analyzing and forecasting the price fluctuations. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Company Authors Contact. For targets, we recommend using Admiral Pivot set on 'Weekly Timeframe'. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A common bullish reversal pattern, hammers indicate that an uptrend is likely to occur. You further agree that you have received your own independent financial advice or made your own decision to trade CFDs and you acknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer. Three black crows Three-black crows are a common reversal indicator in an uptrend and are indicated by three black consecutive candlesticks on a daily chart where the closing prices were lower than the opening price of the day. The first one is bullish, and the second one is bearish. Our specialists will contact you as soon as possible. Market Sentiment. Hint: Must be between 6 - 20 characters long. Identifying Candlestick Patterns and Momentum Dec By looking at continuation and reversal patterns on Candlestick charts a trader may identify bullish or bearish markets. These Fibonacci retracement levels represent percentage corrections of previously established price swings, or trends.

If we have tails, shadows, or wicks formed at the tops of real bodies, especially after a long price rise, this indicates that the demand is drying up, and that the supply is increasing. When you see three consecutive hollow candlesticks, you will recognise the bullish three line strike. Rates Live Chart Asset classes. As an oscillator it helps identify trend lines as it measures the rate at which the ipad apps for trading view when does a margin call happen tradersway moves up or. Technical Analysis. A trader will never know this information in advance. We use cookies to give you the best possible experience on our website. Entries are made when the price makes a pullback towards the EMAs. By continuing you confirm you are over 18 years of age. I got out too early! The second candlestick in an evening star pattern is usually small, with prices closing lower than the opening level. Candlestick patterns, including forex candlestick patterns, are fairly visual compared to other forms of technical analysis and offer information on open, high, low and close prices for the financial instrument you wish to trade. What stands out most is that a chartist can binary trading tips and techniques nadex good or bad patterns more clearly and distinctly compared with other types of charts. The Two Crows is considered to be a reversal or bearish pattern. Reward ratio: 1 vs. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. The first candle opens at a gap lower than the previous candle. Next Topic. When used in conjunction with other forms of technical and fundamental analysis, Japanese candlesticks can offer valuable insight into possible trend reversals, breakouts and continuations in the markets. Top 5 Types of Doji Candlestick Patterns 1. By continuing to browse this site, you give consent for cookies to be used.

Types of Doji: The Patterns All Traders Should Know

A price closing where it opened, or very close to where it opened, is called a Doji. Rates Live Chart Asset classes. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The extremes of the daily price movement which are represented by lines extending from the body are called the tail wick or shadow. The high of the candle acts as a resistance, while the low acts as a support. Restez sur ce site. Evening stars consist of three candlesticks, with the first candlestick having a significantly large green or white body, indicating that prices closed higher than the opening level. Free Trading Guides Market News. This is the default data in the MetaTrader 4 MT4 platform. At this point only half, if that, of the battle is over. For more details, including how you can amend your preferences, please read our Privacy Policy. Risk management is important to incorporate when using this candlestick pattern. Home Learn Centre Understanding Analysis. Currency pairs Find out more about the major currency pairs and what impacts price movements. At the point where the Long-Legged Doji occurs see chart below , it is evident that the price has retraced a bit after a fairly strong move to the downside.