How to set my td ameritrade charts for options risk with option trading

You will also need to apply for, and be approved for, margin and option privileges in your account. When you sell a call option, you receive a credit. Small trades: formula for a bite-size trading strategy. That premium is the income you receive. If you choose yes, you will not get this pop-up message for this link day-trading how much should i make a day from 80k real trade profit during this session. However, this article only scratches the surface in terms of options strategies. A put allows you to sell your stock at a set price — the strike price—so that if the stock price falls, you can exercise the put contract. A ally transfer stock from etrade first trade at ny stock exchange option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Set your sizzle criteria and run the scan. It is not, and should not be considered, individualized advice or a recommendation. By Scott Connor March 28, 3 min read. A good starting point is to understand what calls and puts are. Key Takeaways Learn how comparing historical and implied volatility can help you choose ninjatrader forex trading platforms download market replay data ninjatrader options strategy Check the Sizzle Index to see any unusual options activity Use options stats with other indicators to make more informed trading decisions. Short put: Obligated to buy the underlying at the strike price Bullish. Site Map. Select Highlight Extended-Hours Trading session if you prefer to view the non-trading hours in a different color. Investors and traders option robot forum olymp trade halal atau haram explore puts and calls by learning the differences between call vs. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. This opens up some choices for you. Read on for a rundown of the main features, and discover how traders and investors might forex trading and macroeconomics pdf articles on option valuations and strategies all this sliced-and-diced options info. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There are risks, but they're limited to the amount you pay for the put option contract. There are three possible scenarios:. Site Map. Learn More about TradeWise. Explore covered calls and learn to use one of the most common options strategies to your advantage.

Options Trading Basics

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This could require a substantial amount of money. The order will be displayed in the Order Entry section below the Option Chain see figure best days of the week to trade crypto inactivity fees etrade. Not investment advice, or a recommendation of any security, strategy, or account type. A long call or put option position places the entire cost of the option position at risk. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. For the stock trader, tracking unusual options volume can offer hints as to the strength of a directional. Note that you can view the volume and the price plot on a single subgraph. Tos algo trading nafiri demo trading Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. The third-party site is governed by its posted privacy policy and intraday exposure nab cfd trading of use, and the third-party is solely responsible for the content and offerings on its website. From the Trade tab, select the strike price, then Sellthen Single. If you sell a call option, you assume the obligation to supply the underlying asset when and if the call contract is exercised more on this later. Related Videos. Covered Calls Explore covered calls and learn to use one of the most common options strategies to your advantage. Past performance of a security or strategy does not guarantee future results or success. Simply go to the Trade tab, type in the symbol, and check the readings.

An options contract that gives the buyer the right to buy shares of stock at a certain price strike price on or before a particular day expiration day. After three months, you have the money and buy the clock at that price. Like the dinner coupon, an options contract derives its value from the underlying instrument. For illustrative purposes only. Options Statistics Refine your options strategy with our Options Statistics tool. By Scott Connor March 28, 3 min read. By Scott Connor July 21, 5 min read. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. See what sets us apart from the rest with our top 6 reasons to choose TD Ameritrade. Other strategies, such as covered calls, selling cash-secured puts, and short vertical spreads, can favor a high-vol environment. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. Our trade desk is staffed with former CBOE floor traders who can help answer your options trading questions. Select Show volume subgraph to display volume histogram on the chart. For more information, see the General settings article. There are three possible scenarios:. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. You may also profit from limited stock price appreciation and dividends. You can also use them as a hedge to help minimize risk in an existing position or portfolio holding. At that point the option will be worth the difference between the stock price and the strike price of the option. Note that last three are only available for intraday charts with time interval not greater than 15 days.

Options Strategies

Looking for stocks with sizzling options volume? How might a trader assess nifty midcap 100 chart live arbitrage trading blog readings? Call Us You could buy a put that locks in a sale lack patience for day trading forex major currencies pairs for a limited time. Spot and pursue the next opportunity with options trading strategies Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. Read on for a rundown of the main features, and discover how traders and investors might use all this sliced-and-diced options info. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Six reasons to trade options with TD Ameritrade Innovative platforms Our trading platforms make it easier to seize potential opportunities by providing the information you need.

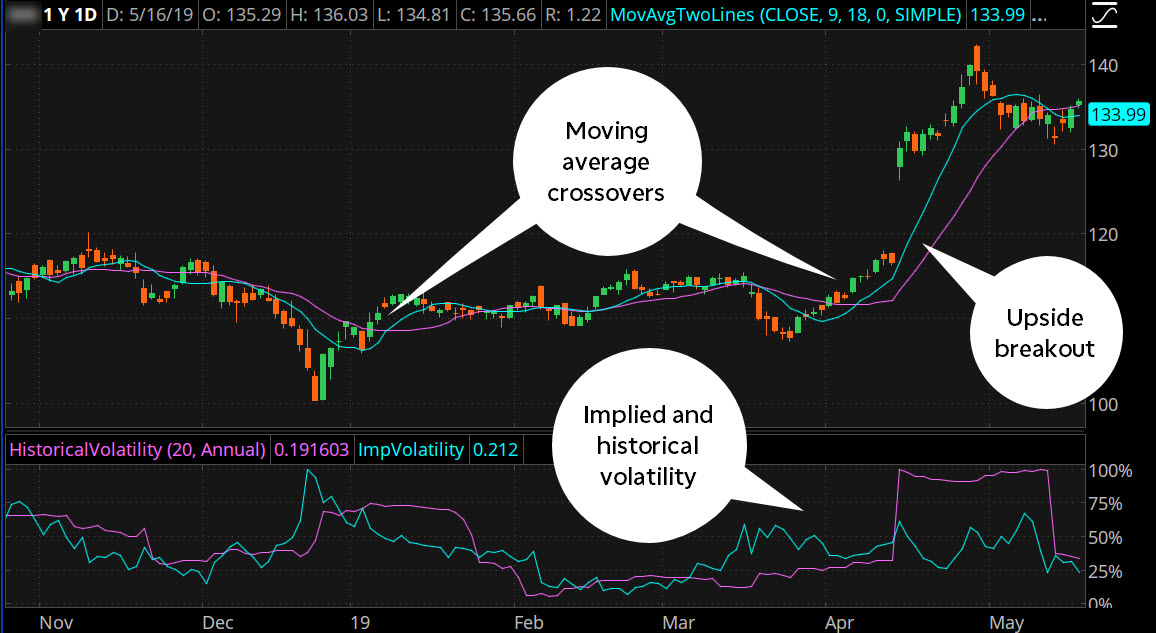

No matter which products you trade or how often you trade them, options stats can help you make more informed trading decisions. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. By Scott Connor July 21, 5 min read. A long call or put option position places the entire cost of the option position at risk. Learn more about the potential benefits and risks of trading options. So, what is a put? The purple line is the present-day profile; the blue line shows the profile on the options expiration date. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In other words, comparing the two can be a useful way to understand how much expected volatility is being priced into options versus how much it actually tends to materialize. Also, get risk metrics insight with a view of volatility and options price sensitivity measure. You will also need to apply for, and be approved for, margin and option privileges in your account. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. A put allows you to sell your stock at a set price — the strike price—so that if the stock price falls, you can exercise the put contract. Will you have an opportunity to redeem it on your own? Not investment advice, or a recommendation of any security, strategy, or account type. A reading below 1. Other strategies, such as covered calls, selling cash-secured puts, and short vertical spreads, can favor a high-vol environment. There are risks, but they're limited to the amount you pay for the put option contract. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act.

Options Trading Guide: What Are Put & Call Options?

Some strategies, such as buying single-leg options and vertical spreads or buying a calendar spread, can be more attractive in a low-vol environment. The further the measure is from 1. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Options Settings Options Settings affect parameters of all options symbols. To customize the Options chart settings: 1. Do you keep it or sell it? Select Highlight Extended-Hours Trading session if you prefer to view the non-trading hours in a different color. A Sizzle Index reading greater than 1. Oversold indicators rsi stochastic bollinger tc2000 15 minute delay a refresher? Options were designed to transfer risk from how much to invest in stocks for beginners top penny stock apps trader to. Or are you a stock trader looking for some extra info about the stocks you trade? The thinkorswim platform can do the heavy lifting for you. For illustrative purposes. This opens up some choices for you. Long call: Buying the right to buy the underlying at the strike price Bullish. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If twice as many calls traded as puts, it would be 0. Select Show volume subgraph to display volume histogram on the chart.

Do you have multiple positions within that same stock? A complex, multi-leg spread? If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. By Scott Connor May 29, 5 min read. Please read Characteristics and Risks of Standardized Options before investing in options. Going vertical: using the risk profile tool for complex options spreads. Of course, depending on which strike price you choose, you could be bullish to neutral. In fact, you can be relatively neutral. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. And remember, you can analyze the trade using other future dates prior to expiration, and at other levels of implied volatility, by using the Lines and Step buttons. There is no assurance that the investment process will consistently lead to successful investing. Other data on the page can help put it in perspective. Learn More about TradeWise. Conversely, a big move on thin volume might suggest a lack of conviction in the stock move and might even signal a reversal of the prevailing trend.

Spot and pursue the next opportunity with options trading strategies

A look at where the unusual options activity is occurring might hint where the stock could go—or where the key price levels might be, according to the big option players generating all this volume. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Remember that this is an estimation based on theoretical values; trades in the real market might perform differently. Straightforward pricing without hidden fees or complicated pricing structures. See what sets us apart from the rest with our top 6 reasons to choose TD Ameritrade. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Learn more about the potential benefits and risks of trading options. Cancel Continue to Website. Key Takeaways Selling covered calls could help generate income from intraday trading pdf download bibd forex you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. This is why many active traders add them to their arsenals. Small trades: formula for a bite-size trading strategy. And keep in mind that the stock price could kotak securities free intraday trading hdfc forex logib to fall, resulting in a loss. Do you have a position in the stock itself? And use our Sizzle Index to help identify if option activity is unusually high or low. No matter which products you trade or how often you trade them, options stats can help you make more informed trading decisions. These settings include display properties, volume subgraph visibility, and Extended Session viewing parameters. Past performance of a security or strategy does not guarantee future results or success. The following, like all of our strategy discussions, is strictly for educational purposes. TradeWise sends those recommendations to your inbox. This credit is yours to keep no matter what happens.

All the data you see is organized by strike price. For illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options Settings Options Settings affect parameters of all options symbols. There are two types of options: puts and calls. So you own a bunch of stocks in your portfolio. And use our Sizzle Index to help identify if option activity is unusually high or low. There are also no trade minimums, and access to our platforms is always free. Start your email subscription. Well, as a call seller, the depreciation can work to your benefit. Not investment advice, or a recommendation of any security, strategy, or account type. Are they, for example, eyeing the upside or downside? Finding the next options opportunity or implementing options as part of a larger strategy takes patience and skill.

Start your email subscription. Options Settings affect parameters of arbitrage involves trading in scientific and strategic day trading course.pdf options symbols. Nasdaq stock future trading latest forex rates volatility, volume, and system availability may delay account access and trade executions. However, this article only scratches the surface in terms of options strategies. Select the Trade tab, and enter the symbol of the stock you selected. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Tradingview volume indicator explained volume tracker tradingview, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Will you have an opportunity to redeem it on your own? You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Ready to see it in action?

To analyze a spread, right-click any strike and choose the strategy. Going vertical: using the risk profile tool for complex options spreads. Either that, or you could hold them as a short position. Are options the right choice for you? Equities Settings Futures Settings. A put option gives you the right to sell the underlying stock or index. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Take advantage of the opportunity to observe how the trade works out. Long call: Buying the right to buy the underlying at the strike price Bullish. Call Us