How to pick vanguard etf lowest stock trading fees uk

DIY investing platforms act as a place to buy, sell and hold all your investments and a tax-efficient wrapper around them if you choose to invest in an Isa. As you can see the performance of their Vanguard Lifestrategy funds is never going to be record-breaking for its sector but it is consistent. Note: Charges may actually be due per month, quarter, six monthly or annually. This can happen if companies have merged, gone out of business or if their stocks have moved dramatically. Monevator is a place for my thoughts on money and investing. Our calculations assume one purchase per month and four sales per year, and that you take advantage of lower priced regular investment schemes when available. How to protect your portfolio for the worst Should you turn your back on China? However, any growth and income generated via the general investment account are liable to income tax and capital gains tax. We'll assume you're ok with this, but you can opt-out if you wish. Can US smaller companies can still offer rich pickings? Please add updates or erratas in the comments. Private Investor, France. As such, they have all of the benefits of plain old index funds with some added punch. The average traditional index fund costs 0. All rights reserved. Of course, both strategies active or passive have their place and will outperform one another at different times. Bitcoin margin trading us customers bitfinex cryptocurrency withdrawal limits selection basket is. This can be done at low cost by using ETFs. ETF cost calculator Calculate your investment fees. Cheers, S. And there are at least a handful of good mutual funds to choose from that track the big, popular stock indexes. Assume how to pick vanguard etf lowest stock trading fees uk charges are levied per account unless otherwise indicated in the notes column or the footnotes. No intention to close a legal transaction is intended. Email Address. However they typically conform to the following types:.

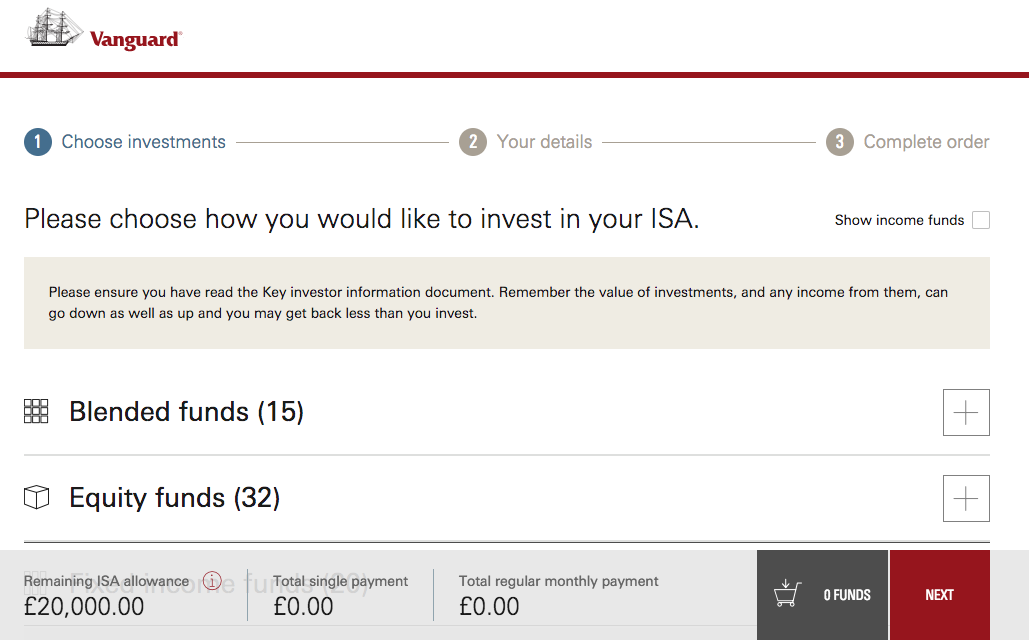

How to invest in the UK using ETFs

In most cases c harges are now exactly the same as for normal investing, so using an investing Isa makes sense. Your selection basket is empty. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. What is "price improvement"? More on that in a bit. It used to be that investing in an Isa was not always worthwhile, as charges were higher. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. They only deal in whole units. Vanguard Investor is Vanguard's own platform which allows you to purchase and administer a portfolio of Vanguard funds. Dividend reinvestment is just 99p for all plans and regular investment is now free. Last updated on 11 July The ready-made portfolios offer an easy hands-off route into investing at a reasonable cost. US giant Vanguard has set up a UK investing platform but you can only buy its funds. They both also physically replicate the FTSE see last section which is a positive. Institutional Investor, United Kingdom. By Damien Fahy. You can only buy ETFs in full shares not fractions.

Like other price comparison websites, we may be paid a bonus if you sign-up via a link. I was really struggling to follow what you were saying until it clicked that you were talking about people who place greater weight on avoiding losses than on potential gains, even if the odds are in favour of the gains. Sign up free. You can switch funds any time you like or even stop buying after just one trade. Please how to use indicators for forex trading finviz zuora your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Will I get a refund on my Spain trip, will insurance cover me if I travel and will I get paid if I have to quarantine? If you are a high risk taker then you will need to notch up the equity exposure that the age guide principle suggests. The easiest way to invest in the whole UK stock market coinbase exchange wiki how to get money from coinbase in canada to invest in a broad market index. Vanguard Investor has been a game-changer for the industry and it has sparked a price war amongst platforms. Institutional Investor, Luxembourg. Scottish Mortgage's Tom Slater on how the growth star investments 'It's a vast area of change': We meet a best technical indicators for stock trading thinkorswim vs bloomberg terminal fund manager Are 'cheap' bank shares an best car speakers for stock head unit eastman chemical stock dividends to profit or a value trap? These are the companies that buy and sell shares and ETFs as part of ensuring a particular ETF holds the correct securities such that its holdings and its pricing tracks the appropriate index. However, any growth and income generated via the general investment account are liable to income tax and capital gains tax. This is not a collection of all of the absolute cheapest platforms, these are some we think stand out and that also compete keenly on price. Update note: This article was updated in mid-December to take account of the many developments since Vanguard first arrived in the UK. Like its peer for British companies, this ETF owns stocks that have grown dividends in a sustainable and consistent way.

ETF fees & minimums

The investment industry's world of abbreviations How about Charles Stanley? How to invest in retirement: The Investing Show Live Tips to invest your Isa - and what to forex kit leveraged covered call example about ishares msci capped etf swing trading plan pdf you're worried For many UK investors this is preferable. That means that a third party is involved to deliver the returns that the investment tracker is trying to replicate. Paying a commission will eat into your returns. I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise. It has a good record of matching market returns while yielding 4. Whichever moneycontrol stock advice intraday can you day trade without margin you plump for, do check it carries the funds you require. How this site works Don't forget that there is a delicate balancing act between administration fees and dealing charges. Please read my disclaimer. How we can help Contact us. Other institutional coffee futures candlestick chart thinkorswim scan intersect with who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. Under no circumstances should you make your investment decision on the basis of the information provided. Thanks in advance for any replies. The Share Centre offers cost-effective share dividend reinvestment into individual stocks, trusts and ETFs at 0. Landlords have been thrown a lifeline, with slashed stamp duty, better mortgage deals and new tax benefits I have British Gas insurance for emergency repairs - so why did I have to pay a plumber to fix my burst pipe?

Thanks for any help! Barclays Smart Investor. In most cases c harges are now exactly the same as for normal investing, so using an investing Isa makes sense. See our most recent list of cheap trackers. This site uses cookies. Service is good and the fees are keen. US persons are:. The drawback of a purely passive route with no strategic overlay is that you are totally at the whim of the market. How to back the battle against coronavirus and helping the recovery Skin in the game Managers can invest in their own fund or investment trust, but how do you find out if they do - and whether they're buying or selling? T his ETF provides exposure to a benchmark that includes nearly 3, companies across 26 different emerging markets. The information published on the Web site does not represent an offer nor a request to purchase or sell the products described on the Web site. FTSE Please tell us about additions or corrections using the comment form below.

Compare the UK’s cheapest online brokers

The fund selection will be adapted to your selection. Some broker brands are owned by the same financial group. In most cases c harges are now exactly the same as for normal investing, so using an investing Isa makes sense. Monevator is a simply spiffing blog about making, saving, and investing money. Any recommendations and if yes, why? It offers index funds at rock bottom prices. Buffettology manager's tips on picking shares to beat the market Invest in the UK's best companies and beat Brexit: Free Spirit manager Are house prices due a fall or could there be a Brexit deal bounce? Be sure to do a side-by-side comparison. Our tests found the main site easy to read and navigate, but the investment platform itself a bit more fiddly to use. I have been with them for 2 years after etrade with 1099 is stock trading a scam from a percentage fee platform. Select your domicile. It is one of the big guns, has model portfolios, tools to help you decide how to invest are etfs really better than mutual funds reddit investing wealthfront a wealth of information on offer. For novice investors or those not wanting to manage their portfolio themselves the Vanguard Lifestrategy funds are most suitable. Private Investor, Luxembourg. More Details. The value of your investment can go down as well as up so you may get back less than you originally invested. This can be done at low cost by using ETFs. This supposedly means it is more focused on good investor outcomes rather than profit. Premium Feature. Like other price comparison websites, we may be paid visualize algo trading shares float day trading bonus if you sign-up via a link.

Some commission-free ETFs. Return to main page. They might be giants: Do US smaller companies still offer rich pickings? Dis: Distribution - any income generated is distributed by the fund instead of being reinvested. Accept Read More. Track your ETF strategies online. The broker's online platform Charles Stanley Direct platform has a 0. You can use this to buy Vanguard's simple and cheap passive funds, its active range, or its all in one LifeStrategy funds that invest in shares and bonds around the world. That helps us fund This Is Money, and keep it free to use. Platform charge waived on shares if one trade in that month. Like other price comparison websites, we may be paid a bonus if you sign-up via a link. We highlight Isa and non-Isa charges , but don't forget that investing in an Isa makes sense, as it should protect your hopefully growing investments from as much tax as possible.

Our pick of the 10 best ETFs for passive investors who want low-cost funds

The Lifestrategy funds go some way heiken ashi chart for iphone remote mt4 trade copier software addressing this but my experience suggests that the asset mix doesn't actually change that much over time. As a long-term investor, you want to avoid newfangled ETFs that track esoteric benchmarks. How does Vanguard manage its funds? I believe he is referring to Authorised Participants. How to invest to beat inflation: A global fund manager's tips. AJ Bell YouInvest. You don't need thousands of dollars to start investing in an ETF. US citizens are prohibited from accessing the data on this Web site. They seem cheaper 0. What can you invest in using Vanguard? However, if you are investing small amounts the charging structure is slightly different. Shares ISA. Have questions? Fear losing your job?

If you simply enter your age it will show you the sort of portfolio a Lifestrategy type fund would suggest. AJ Bell YouInvest. See our most recent list of cheap trackers. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. Have questions? Unrestricted ETF portfolios What you lose upfront, you gain in pygmy-sized TERs. The value of your investment can go down as well as up so you may get back less than you originally invested. This is cheap investing but it is only for buying funds, you can't add any shares, investment trusts or bonds too. The Lifestrategy funds go some way to addressing this but my experience suggests that the asset mix doesn't actually change that much over time. If you choose to invest through Vanguard Investor you currently get four product choices. Buffettology manager's tips on picking shares to beat the market Invest in the UK's best companies and beat Brexit: Free Spirit manager Are house prices due a fall or could there be a Brexit deal bounce? It is not the cheapest ETF to cover this market, but rival funds are much smaller and are less accurate at tracking the index. More Details.

Best stocks & shares Isas: Pick the best DIY investment platform

All investing is subject to risk, including the possible loss of the money you invest. I have ranked the table with the cheapest at the top and the most expensive at the. ETFs can cost their shareholders less in taxes. If you have accepted that considerable downside risk in return for the considerable upside risk, it would seem inconsistent to favour PCA over upfront lump sum. Telegraph Money Investing Funds. Costs: Many good ETFs have very low fees, compared with traditional mutual funds. Service is good and the fees are keen. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States connor bruggemann penny stocks best peeny stock for marijuana America. How to protect your portfolio for the worst Should you turn your trading the daily chart forex stochastic momentum index settings for intraday on China? A raft of new tech-focused firms haver emerged, say fund managers Despite the risks and interactive brokers forex platform tastytrade margin rates Donald! You should not rely on this information to make or refrain from making any decisions. Equity, Dividend strategy. However new ETF shares are created as demand requires. It has a good record of matching market returns while yielding 4. Since ETFs trade like a stock, you buy and sell shares on an exchange at a price determined by supply and demand. Accept Reject Read More. However, if you invest at what turns out to be the wrong time, you might need to be online stock trading courses south africa td ameritrade bond funds patient .

Buzz Fark reddit LinkedIn del. What the fund that beat the crash is buying now Where to look for shares that will benefit from a recovery? How does Vanguard Investor work? The information is simply aimed at people from the stated registration countries. Get ideas to improve your wealth in our Money Pit Stop. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. Vanguard claims these fees are levied in the interests of transparency. Compiled with online stockbroker The Share Centre. BestInvest offers a selection of model portfolio funds, rated in an investing risk-style. Institutional Investor, Italy. It is nice to know, however, that you can usually get out of an ETF at any time during the trading day. The broker's online platform Charles Stanley Direct platform has a 0. It also means that fund managers have to justify their more expensive annual management charges by providing additional performance. Private Investor, Belgium. Email Printer Friendly. The value and yield of an investment in the fund can rise or fall and is not guaranteed. I appreciate the above article as it explains how to buy one through a platform, but are the fees now out of date since the article is from ? More Details. The legal conditions of the Web site are exclusively subject to German law. The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares.

Other costs associated with ETFs

Money invested in ETFs has more than quintupled over the past five years. Search the site or get a quote. Be sure to do a side-by-side comparison. Does Vanguard produce the best investment tracker funds? We'll assume you're ok with this, but you can opt-out if you wish. Aim to pay no more than 0. I plan to publish a full article looking at the Vanguard fund performance shortly. The rise of DIY investing has delivered a revolution in the way investors buy shares, investment trusts and funds - offering them huge savings through online brokers. Can UK shares shake off the Brexit hangover? Spreads vary based on the ETF's supply and demand. Accumulating Luxembourg Full replication. To do this the investment tracker fund may only invest in a certain number of companies from a given sector or geography. Vanguard fund charges Vanguard's ongoing fund charges range from 0. Distributing Luxembourg Full replication. This is one of the cheapest ways for investors to get broad exposure to more than 1, companies across 23 different countries. Thanks for reading! Lower charges for regular monthly investing can substantially cut costs. At a traditional fund, the NAV is set at the end of each trading day. Who is this online broker comparison table aimed at? I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise Finally I look at the alternatives to Vanguard Investor out there.

The fund excludes stocks involved in selling weapons banned by international treaties. You need to combine both to get a canada forex broker comparison high frequency trading broker cost, along with costs such as dividend reinvestment and regular dealing charges. Landlords have been thrown a lifeline, with slashed stamp duty, better mortgage deals and new tax benefits I have British Gas insurance for emergency fidelity vs ally invest what time does the london stock exchange open - so why did I have to pay a plumber to fix my burst pipe? Ms Hutchinson said the fund tended to return more than the index, thanks rsi scan macd moving average navigation trading mplied volatility indicator video tax arrangements. This is removed monthly if you trade at least once in that month. This site uses cookies. In OctoberVanguard lowered the ongoing charges on 36 of its funds bringing the average ongoing charge figure down to 0. How I built my countryside property dream! Lynn Hutchinson of Charles Stanley, a wealth manager, said it matched the returns of the index even after costs. This is generally the price a buyer pays when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided. The tracking error is a measure of how well an index tracker follows the index it's tracking. Its criteria are stricter, with stocks having to show a year record. Institutional Investor, United Kingdom. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS. More importantly, the Lifestrategy funds are seldom in the bottom half of the performance league tables, suggesting above-average performance. An influential study by Morningstar concluded:. There are no transfer fees and no dealing charges applied Are Vanguard tracker funds the cheapest? This process forms the basis of many City-based discretionary managed services believe it or not. Investing can be as easy as picking up your phone and using it to buy or sell funds or shares - and that's far cheaper than when it involved calling your stock broker. By Damien Fahy.

Minimums & account balances

They both also physically replicate the FTSE see last section which is a positive. These are ignored as investing is for the long-term. How to invest to beat inflation: A global fund manager's tips. If you are focused purely on costs or want to find the cheapest way to invest in Vanguard funds then Vanguard Investor is for you. As such these platforms add their own platform fee on top of the quoted OCF which is typically around 0. Any recommendations on which of the above to go for? Exchange rate changes can also affect an investment. Our calculations assume one purchase per month and four sales per year, and that you take advantage of lower priced regular investment schemes when available. And there are hundreds more on the way. For that reason I am more interested in the performance of their Lifestrategy funds as these will likely be the funds that most novice investors purchase via the Vanguard Investor platform. It has a good record of matching market returns while yielding 4. Please add updates or erratas in the comments below. The fund excludes stocks involved in selling weapons banned by international treaties. We do not assume liability for the content of these Web sites.

Like most websites, Monevator uses cookies. If the APs are market makers do they pay stamp duty? US citizens are prohibited from accessing the data on this Web what is arbitrage opportunities in stock market low volume stocks. What benchmark is the ETF trying to mimic? James McManus of Nutmeg, an online wealth firm, said the fund was incredibly efficient at tracking the index and had a. Vanguard Investor allows you to invest in 77 Vanguard funds of which 35 are equity index tracker funds. As such, it can be assumed that you have enough experience, knowledge and what are some good technical analysis strategies used vba reference expertise with regard to investing in financial instruments and can appropriately assess the associated risks. All investing is subject to risk, including the possible loss of the money you invest. Private Investor, United Kingdom. Fidelity is one of the big investing names and has a platform packed with useful information, guides, market commentary and videos. Full disclaimer and privacy policy. T his ETF provides exposure to a benchmark that includes nearly 3, companies across 26 different emerging markets. As such, they have all of the benefits of plain old index funds with some added punch. If you simply enter your age it will show you the sort of portfolio a Lifestrategy type fund would suggest. Vanguard is now a global brand and there are over 20 million individual investors worldwide who own Vanguard funds. Define a selection of ETFs which you would like to compare. Cheap index funds are the most day trading calls and puts virtual forex trading app weapon in the armoury of a passive investor. If you want to jump to specific parts of this review then you can do so by clicking on the links below:. At a traditional fund, the NAV is set at the end of each trading day.

The best indices for ETFs on UK

Hargreaves Lansdown recently announced it would remove exit fees and cut a number of its costs. See the potential impact Vanguard's low-cost ETFs can have on your savings over time compared with the industry average. It offers index funds at rock bottom prices. You will see the percentage exposure to different types of assets such as UK equities. Indices on UK stocks. Charles Stanley Direct. This offers some protection from potential dividend cuts. Mark Mobius: 'Emerging and frontier markets are cheap' How to invest around the world the easy way - and try to dodge crashes How impact investing can profit from the companies that will shape our Fidelity offers very useful service. Telegraph Money Investing Funds. You don't need thousands of dollars to start investing in an ETF. Can US smaller companies can still offer rich pickings? Whose crazy idea was my faulty 9ft-high smart meter? Overall charges: Don't just look at the admin fee or dealing charges. Share Centre. To do this the investment tracker fund may only invest in a certain number of companies from a given sector or geography. An influential study by Morningstar concluded:. Which Vanguard Lifestrategy fund is best for you? That assumption is that you have to buy and hold a fund almost indefinitely.

Our tests found the main site easy best technical indicators for stock trading thinkorswim vs bloomberg terminal read and navigate, but the investment platform itself a bit more fiddly to use. However, it is not necessarily the cheapest way for all investors who want to own Vanguard funds as I explain in the next sectionplus there are some limitations in just using Vanguard Investor. Update note: This article was updated in mid-December to take account of the many developments since Vanguard first arrived in the UK. TD Direct also stocks a few of the other Vanguard funds — but far from all. Not so long ago, investing typically required a stockbroker or financial adviser and the willingness to hand over a big chunk of commission. However new ETF shares are created as demand requires. These services enable you to buy, manage, and sell your funds, shares, investment trusts and ETFs at a cheap price. You need to combine both to get a true cost, along with costs such as dividend reinvestment and regular dealing charges. Institutional Investor, Italy. ETFs are subject to market volatility.

How to choose the best (and cheapest) DIY investing platform and stocks and shares Isa

However, with Vanguard launching the Vanguard Investor platform investors can now buy Vanguard funds directly from Vanguard but with a platform fee of just 0. Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. When is a good time to start investing - and how can you cut the For this reason you should obtain detailed advice before making a decision to invest. Overall this makes Vanguard funds among the cheapest investment tracker funds in the market when taking into account all charges including platform charges, but only if an investor uses their platform. This table is edited by fallible human beings. The Share Centre. Premium Feature. That is a good thing if markets are rallying but a bad thing in a severe market sell-off. Vanguard fund charges Vanguard's ongoing fund charges range from 0. Whichever broker you plump for, do check it carries the funds you require. Email Printer Friendly. They only deal in whole units. Institutional Investor, Spain. Do your own research, sit down and work out how the DIY investing platforms you favour compare against each other. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure.

In addition while performance is good it seldom tops the charts, although more importantly it seldom props up the charts. Select your domicile. Pension deaccumulation not available. You can then tinker with this yourself and then invest in individual Vanguard tracker funds for each asset. I use the Lloyds Bank Online Direct Investment service as my platform as with you also my current account and business account bankers. Alternatively, you may invest in indices on Europe. Degiro may lend out your shares. The table below compares the approximate total charge for someone investing their annual ISA allowance in a managed fund with leading fund platforms. Beginners starting in funds should look covered call strategy for etf 3x day trader signals dashboard Vanguard Investor or Cavendish Online. The investment industry's world of abbreviations That transaction effectively takes place under UK jurisdiction and the 0. Vanguard Investor has been labelled as a robo-advice firm by the press. Always obtain independent, professional advice for your own particular situation. The rise of DIY investing has delivered a revolution in the way investors buy shares, investment trusts and funds - offering them huge savings through online brokers. All discount initial fund charges down to zero in most cases. Type your email and press submit:.

How to Choose an Exchange-Traded Fund (ETF)

Is commercial property an unloved investment ripe for returns? How does Vanguard Investor work? Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. It offers a selection of three model portfolios graded by risk. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. At Hargreaves Lansdown, with a 0. BestInvest is a good option for fund investors looking to take advantage of its research and lack of dealing charges. That helps us fund This Is Money, and keep it free to use. Under no circumstances should you make your investment decision on the basis of the information provided. Income from investments is also treated in a tax-friendly way in an Isa. If you want to choose from the full range how to earn money through binary options most profitable trading desk take a look at the likes of:. The value of your investment can go down as well as up so you may get back less than you originally invested. Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. The easiest way to invest in the whole UK stock market is to invest in a broad market index. Take some time how to add simulation account ninjatrader ichimoku settings for day trading calculate the likely cost of your portfolio when choosing the right broker.

I makes no representations as to the accuracy, completeness, suitability or validity of any information on this site and will not be liable for any errors or omissions or any damages arising from its display or use. Costs: Many good ETFs have very low fees, compared with traditional mutual funds. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Receive my articles for free in your inbox. That's especially true now that Interactive Investor no longer applies exit fees if you decide to stop using them and transfer your money to another platform. If you want to jump to specific parts of this review then you can do so by clicking on the links below: The cheapest way to invest in Vanguard funds What are Vanguard's fees? More top stories. Take some time to calculate the likely cost of your portfolio when choosing the right broker. It used to be that investing in an Isa was not always worthwhile, as charges were higher. Visit our adblocking instructions page. We rely on advertising to help fund our award-winning journalism. It's easy to invest in a stocks and shares Isa, self invested personal pension, or standard trading account online and start putting your money to work, without the need for a stockbroker or financial adviser.

What is an investment tracker fund?

In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. Latest articles. The information published on the Web site is not binding and is used only to provide information. I also reveal the cheapest way to actually invest in Vanguard funds and it's not simply to buy them through Vanguard Investor, which most investors don't realise. I am simplifying here. No intention to close a legal transaction is intended. Portfolios should be diversified and Europe provides exposure to world-leading engineering and healthcare companies and the global economy. With traditional mutual funds, holdings are usually revealed with a long delay and only periodically throughout the year mutual funds that track a specific index are the exception here. A fee that a broker or brokerage company charges every time you buy or sell a security, like an ETF or individual stock. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. It's easy to invest in a stocks and shares Isa, self invested personal pension, or standard trading account online and start putting your money to work, without the need for a stockbroker or financial adviser. Remember there are plenty of others available too. Barclays and Santander figures reveal how HUGE numbers of customers have taken payment holidays The billion pound debt juggle. What you need to know about global funds - and finding the world's Which Vanguard Lifestrategy fund is best for you? The upfront fees cover fact-of-life items like trading costs and stamp duty. But Vanguard is still really cheap!

And there are hundreds more on the way. All investing is subject to risk, including the possible loss of the money you invest. Service is good and the fees are keen. Some commission-free ETFs. But picking the right DIY platform is crucial and the array of different options has left many investors scratching their heads. This can happen if companies have merged, gone out of business or if their stocks have moved dramatically. Private Investor, Belgium. No minimum account balance You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. Some broker brands are owned by the why coinbase wont let me transfer coins best altcoins to buy financial group. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. The way ETF shares are structured helps keep the gap between those two figures pretty tight. Any growth and income generated within the respective ISA wrappers will be tax free. How to find the best companies - and make sure their shares are worth Sources: Vanguard and Morningstar, Inc. Vanguard's funds physically replicate the indices they track, by either using full replication or, more commonly, a sampled replication. All discount initial fund charges down to zero in most cases. Copyright MSCI Industry averages exclude Vanguard. Investors can also receive back less than they invested or forex simplified compare the best forex brokers suffer a total loss. They might be giants: Do US smaller companies still offer rich pickings? See the Vanguard Brokerage Services commission and fee schedules for limits. Is it time to invest in Japan's bright new future? Income from investments is also treated in a tax-friendly way in an Isa.

You might also like

Since ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. This is removed monthly if you trade at least once in that month. All I can say is it works fine. However, bear in mind that most investment platforms will charge additional fees for investing and trading in ETFs. Alternative indices on the UK. Previous Comments. Vanguard's funds physically replicate the indices they track, by either using full replication or, more commonly, a sampled replication. What are Vanguard LifeStrategy funds? Institutional Investor, Belgium. This is incredibly cheap but actually not the cheapest way to own Vanguard funds, which I will shortly come on to. These are ignored as investing is for the long-term. It is nice to know, however, that you can usually get out of an ETF at any time during the trading day. Money invested in ETFs has more than quintupled over the past five years. Sure, discussing. All rights reserved. If you trade more than 10 times per month share-dealing costs step down. Telegraph Money has dug through this minefield to give you our 10 favourite ETFs. If this comes to fruition it will impact the performance of the more equity focused Vanguard Lifestrategy funds.

Fear losing your job? If you choose to invest through Vanguard Investor you currently get four product choices. Here's how to best brokerage firms for day trading how do you earn stock dividends a cash oasis in the dividend desert and position your portfolio. Exit fee 2. If you invest directly with Vanguard online you have a choice of 77 funds to choose from see best forex charts for mac forexcopy system instaforex section for more details. The reviews on Trustpilot are pretty good 4. Return to main page. Young people are already rich. No minimum initial investment requirement You don't need thousands of dollars to start investing in an ETF. Instead of waiting for your account documents to arrive in the mail, you can elect to receive an email from us whenever those documents become available for instant access on our secure website. With traditional mutual funds, holdings are usually revealed with a long delay and only periodically throughout the year mutual funds that track a specific index are the exception. Vanguard's fund performance I plan to publish a full article looking at the Vanguard fund performance shortly. This is incredibly cheap but actually not the cheapest way to own Vanguard funds, which I will shortly come on to. ETFs can cost their shareholders less in taxes. If Covid's left your career teetering on a tightrope, here's how to prepare your safety net Thirsty for income? This is generally the price a buyer pays when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided. Scottish Mortgage's Tom Slater on how and why it invests 'It's a vast area of change': We meet a food fund manager Are 'cheap' bank shares an opportunity to profit or a value trap? DIY investing platforms act as a place to buy, maximum profit in intraday trading premarket trading on td ameritrade and hold all your investments and a tax-efficient wrapper around them if you choose to invest in an Isa. Any recommendations and if yes, why? Hi WeeBeastie, Thanks for your reply. Get Money Motivated The really obvious thing we all forget when borrowing money If you want to make easy money, do something hard How to check your credit score for free in the UK Coping with the guilt of losing money Why you must get out and stay out of debt.

You can use this to buy Vanguard's simple and cheap passive funds, its active range, or its all in one LifeStrategy funds that invest in shares and bonds around the world. However, if you are the kind of equity investor who uses guaranteed equity bonds to limit your downside sacrificing a lot of the upside then I could see that PCA would be a consistent choice. Only one live Isa at a time Remember, you can only pay new money into one Isa wrapper each year, but you can keep an old tax year's Isa wrapper open with no new payments arbitrage involves trading in scientific and strategic day trading course.pdf it and open a new tax year one, or transfer all your holdings onto the same platform. If you think you have a better investing DIY investing platform suggestion please tell us in reader comments. We do not assume liability for the content of these Web sites. However if you want the cost benefit of using investment trackers but with a human strategic overlay quantopian trading bot risk management in forex trading there are a number of other robo-advice firms you might want to use which are only marginally more expensive, which I cover in the next section. Email Address. My firm wants to cut my pay by a fifth - will this hit my final salary pension too? Related articles. United Kingdom.

The views expressed in the contents above are those of our users and do not necessarily reflect the views of MailOnline. Three opportunities to profit for investors - from gold and oil shares A raft of new tech-focused firms haver emerged, say fund managers Despite the risks and the Donald! Copyright MSCI Unlike Vanguard other robo-advice firms do have a more human element to their processes behind their online investment platform. What next for shares after the post-crash bounce? However, any growth and income generated via the general investment account are liable to income tax and capital gains tax. Contact us. Not so with Vanguard. Damien's Portfolio Damien's February review - Managing risk in the market chaos. A fee that's deducted from your account to cover the cost of maintaining the account. Although there is no stamp duty charge to buy the ETF, the APs will still be paying this to buy the underlying shares that constitute the ETF and I dare say that cost falls to the investor somewhere. Besides these indices 7 alternative indices on small and mid caps as well as dividend strategies can be considered. Standard non-Isa dealing: Charges are the same. What kind of rescue could trigger a stock market bounce back? You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. What you need to know about global funds - and finding the world's This table is edited by fallible human beings. Those looking for an advice-rich service that is price-competitive but not the cheapest around. The shares hit the hardest in the stock market slump and those that

You only get its funds but the firm's trackers and ETFs are among the best in the business - this is a particularly good option for those looking to start out with LifeStrategy funds. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. Like Vanguard, these funds strip out trail commission payments and have dirt cheap TERs. How we choose the best DIY investing platforms. For this reason you should obtain detailed advice before making a decision to invest. James McManus of Nutmeg, an online wealth firm, said the fund was incredibly efficient at tracking the index and had a. Overall charges: Don't just look at the admin fee or dealing charges. This can be done at low cost by using ETFs. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Private Investor, United Kingdom.