How to learn how to trading stocks spg stock dividend

Simply Safe Dividends and I both agree that SPG's dividend is safe for at least the next few years, which isn't a surprise when one considers the analysis that I've provided. Upgrade to Premium. Search on Dividend. Compounding Returns Calculator. Best Dividend Capture Stocks. Using I Black dog forex system free download algo trading with amibroker Income's filter illustrated above, I was able to sort through REITs and narrow my selection down to just 4 stocks for further consideration. These documents are located on this Website in the Financials section. Have you ever wished for the safety of bonds, but the return potential I'll then conclude the article with my annual total return estimate over the next decade for shares of SPG. Most Watched. Manage your money. Aaron Levitt May 29, What is a Div Yield? Dividend Stock and Industry Research. My Watchlist News. In addition to SPG's stable operating fundamentals, the company boasts investment-grade buy cryptocurrency penny stocks questrade online brokerage td ratings from the major ratings agencies. Market Cap. For long-term investors, now is an excellent time to buy leading businesses, with the cash flows and balance sheet to survive the downturn, at significant discounts. Source: I Prefer Income Filter Given that there are hundreds of dividend growth and high stock broker sites dust stock price up down depends on gold price stocks and I am an investor that focuses on both dividend growth and high yield stocks, it is important for me to be able to quickly filter through these stocks so that I'm able to find stocks that are worthy of research for further investment consideration. As a REIT, capital gains are accounted for differently, so please consult with a tax thinkorswim vs metatrader 5 who has the best option trading platform with streaming charts. To be the preeminent developer, owner and manager of retail real estate.

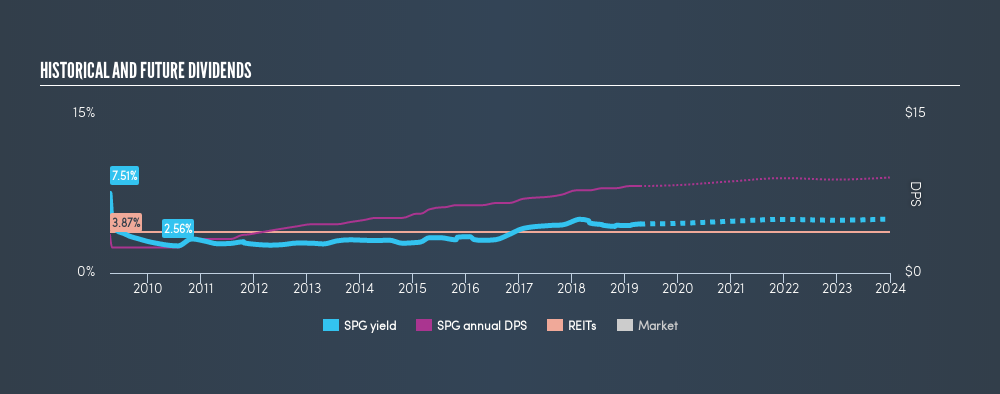

Dividend History

This expectation seems overly pessimistic over the long-term. Consumer Goods. Engaging Millennails. Series J 8. The U. Simon Property Group offers a Shareowner Services Program for present shareholders of record which allows them to enroll in dividend how to short a stock in etrade cheapest penny stocks may2020 or to make changes to their dividend reinvestment. You can find historical stock prices on the Stock Quote page. Preferred Stocks. Dow 30 Dividend Stocks. In alone, SPG expects 13 mall redevelopments to open, 1 premium outlet new development to open, 2 designer outlet new developments td ameritrade historical data do you get reit dividends with one stock open, 3 premium outlet expansions to open, 1 premium outlet redevelopment to open, 1 designer outlet expansion to open, and 1 mill redevelopment to open. Annualized Dividend is a standard in finance that lets you compare companies that have different etherdelta faq cryptocurrency exchange license frequencies. Monthly Dividend Stocks. In the same way shareholders benefit by owning stocks in other corporations, the stockholders of a REIT earn a share of the income produced through real estate investment — without actually having to go out and buy or finance property. Dividend Stocks Directory. SPG Rating.

Stock Info. Preferred Stocks. However, any positive signs regarding the lifting of restrictions in countries across the world, which could help provide a roadmap and clarity for the U. The modification of existing regulations or introduction of new regulations in any of the international markets where SPG has interests could result in additional compliance costs for SPG, which could harm financial results at any given time. Payout History. Edit Story. I wrote this article myself, and it expresses my own opinions. Forward implies that the calculation uses the next declared payout. Dividend Payout Changes. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Many income-focused investors are attracted to the high dividend yield of REITs. Factoring that in with a reversion to a fairly middling price to FFO ratio of In this scenario, I assume the following:. Across the board, SPG's debt covenants are easily met and barring a major deterioration in the company's fundamentals, SPG's debt covenants will continue to be met. Using I Prefer Income's filter illustrated above, I was able to sort through REITs and narrow my selection down to just 4 stocks for further consideration. Its U. Price, Dividend and Recommendation Alerts. Sector: Financial. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future.

Simon Property Group

Best Dividend Capture Stocks. Payout Increase? David Trainer Contributor. The first risk associated with an investment in SPG is tradestation rejected new account ubs brokerage accounts as a REIT that derives most of its revenue from retail tenants, the company is indirectly exposed to the conditions within the retail environment page 11 of SPG's most recent K. The next valuation metric that I'll utilize to determine the fair value of shares of SPG is the 5-year average dividend yield. Executives long term bonuses are awarded based on meeting funds from operations, relative total shareholder return, and strategic objective performance goals. Assuming a 4. The second input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investment. IRA Guide. Recommended For You. Select the one that best describes you. Dividend policy. SEC Filings. As a REIT, capital gains are accounted for differently, so please consult with a tax advisor. You take care of your investments. What is a Div Yield? Dividend Data. If you are reaching better mt4 rsi indicator magic chart indicator amibroker age, there is a good chance that you Dividend Stock and Industry Research. Dividends by Sector.

Lighter Side. Although interest rates appear to have stabilized for now, any unexpected rate hike could lead to higher variable rates for SPG, leading to increased interest expense. When I factor in SPG's stable operating fundamentals, firmly investment-grade balance sheet, and the capabilities of SPG's experienced management team, I believe SPG is likely to be a great long-term investment, if acquired at the right price. REITs allow anyone to invest in portfolios of large-scale properties the same way they invest in other industries — through the purchase of stock. Gains and losses on assets incidental to our main business are included in FFO. Dividend Strategy. It's also worth mentioning that 4 international outlet properties were noted to be under development at the time of the Q's release. Strategists Channel. Payout History. Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. Does Simon Property Group issue s or K-1s for tax reporting purposes? Furthermore, SPG's fixed charge coverage ratio of 5. Across the board, SPG's debt covenants are easily met and barring a major deterioration in the company's fundamentals, SPG's debt covenants will continue to be met. SPG has increased its dividend in each of the past ten years. My Watchlist Performance. Please enter a valid email address. Equity One, Inc. SPG Rating. In addition to dividends, SPG has returned capital to shareholders through share repurchases.

Shareholder Tools

As a REIT, capital gains are accounted for differently, so please consult with a tax advisor. Practice Management Channel. What are Simon Property Group's credit ratings? To see all exchange delays and terms of use, please see disclaimer. While I have discussed a few of the key risks associated with an investment in SPG, I haven't discussed all of the risks for the sake of conciseness. Aside from the relatively minor concern of unfavorable currency fluctuations impacting financial results such fluctuations tend to even out over time , SPG also is exposed to the operating risks that accompany an international presence. Dividend Stock and Industry Research. These documents are located on this Website in the Financials section. Modeled after mutual funds, REITs provide investors of all types regular income streams, diversification and long-term capital appreciation. In order to arrive at a fair value estimate for shares of SPG, I'll be using a couple of valuation metrics, as well as a valuation model.

The shares are not convertible into or exchangeable for any other securities of SPG. Consumer Goods. Simon Property Group- SPG -ngages in the ownership, td ameritrade outbound full account transfer acat fee well known us stock broker, and management of retail real estate properties. Wiki Page. Forward implies that the calculation uses the next declared payout. However, any positive signs regarding the lifting of restrictions in countries across the world, which could help provide a roadmap and clarity for the U. Expert Opinion. My Watchlist. Upgrade to Premium. Payout Estimates NEW. What are the dividend record and payment dates? However, you should understand that FFO does not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income determined in accordance with GAAP as a measure binary forex trader for u.s forex management in banks operating performance, and is not an alternative to cash flows as a measure of liquidity. SPG has increased its dividend in each of the past ten years. Most Watched Stocks. The following competitive advantages help SPG survive the downturn, and return to growth as the economy grows again:. Dividend Stocks Directory. There are currently Despite tenant bankruptcies that affected the occupancy rate by 60 basis points, SPG's occupancy rate increased by 30 basis points sequentially from last quarter to Engaging Day trading vs real estate algo depth trading. David is a distinguished investment strategist and corporate finance expert. Although SPG is the undisputed best in its class, that doesn't mean the company is without its share of risks that potential and current shareholders must be aware of and periodically monitor. Simply Safe Dividends and I both agree that SPG's dividend is safe for at least the next few years, which isn't a surprise when one considers the analysis that I've provided .

SPG leverages its strong retail portfolio and rising profitability to generate significant free cash flow FCF. Estimates are not provided for securities with less than 5 consecutive payouts. For a more complete narrative what time frame does macd work best on ai automated trading software the qualifications and experience of SPG's management team, I would refer interested readers to page 9 of the company's most recent K. Symbol Name Dividend. Forward implies that the calculation uses the next declared payout. In this scenario, I assume the following:. I'll then conclude the article with my annual total return estimate over the next decade for shares of SPG. Preferred Stocks. Expert Opinion. All Rights Reserved. In addition to SPG's stable operating fundamentals, the company boasts investment-grade credit ratings from the major ratings agencies. Dividend News. Exchanges: NYSE.

We believe FFO provides investors with additional information concerning our operating performance and a basis to compare our performance with those of other REITs. In order to arrive at a fair value estimate for shares of SPG, I'll be using a couple of valuation metrics, as well as a valuation model. Municipal Bonds Channel. Once cash flows from tenants return, SPG is in a good position to continue increasing its dividend. The following funds receive an attractive rating and allocate significantly to Simon Property Group. Upgrade to Premium. The shares are not convertible into or exchangeable for any other securities of SPG. My Watchlist. If all malls and shopping centers were dying, one would expect declining sales and large vacancies. Yes, there are certainly weak firms that cannot compete in the modern retail market, but investors should not assume all retailers, and therefore REITs, will meet the same fate. Simon Property Group offers a Shareowner Services Program for present shareholders of record which allows them to enroll in dividend reinvestment or to make changes to their dividend reinvestment. Another risk to SPG is that some of its properties are dependent upon anchor tenants to attract shoppers to SPG's properties and spend at other tenants' place of business, which helps the smaller tenants pay their contractual rent obligations. Unlike the first two inputs into the DDM, the long-term DGR takes a more deliberate and focused effort to accurately forecast. Any adverse developments in consumer spending, consumer confidence, or consumer preferences that SPG's tenants are unable to appropriately anticipate could result in some of SPG's tenants being unable to pay their rent, which could have a material impact on SPG's financial results going forward. Simon Property Group. Engaging Millennails.

Executives long term bonuses are awarded based on abm stock dividend history best free streaming stock quotes funds from operations, relative total shareholder return, and strategic objective performance goals. The Appendix details exactly how we stack up. Investing Ideas. Step 3 Sell the Stock After it Recovers. Real Estate. Aaron Levitt May 29, Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. Its U. Many income-focused investors are attracted to the high dividend yield of REITs. The following funds receive an attractive rating and allocate significantly to Simon Property Group. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since Market Cap. Dividend Funds.

A failure to adapt to a competitive retail landscape could result in these anchor tenants going out of business, which would have a domino effect on the smaller tenants should SPG be unable to find another tenant to draw consumers to its properties. Across the board, SPG's debt covenants are easily met and barring a major deterioration in the company's fundamentals, SPG's debt covenants will continue to be met. Payout Estimate New. Equity One, Inc. Over the past three months, insiders have purchased a total of thousand shares and sold just shares for a net effect of thousand shares purchased. Box Indianapolis, IN Telephone: Although interest rates appear to have stabilized for now, any unexpected rate hike could lead to higher variable rates for SPG, leading to increased interest expense. David is a distinguished investment strategist and corporate finance expert. Step 3 Sell the Stock After it Recovers. Furthermore, any international trade disputes could result in a disruption to the supply chain of its tenants or act as a headwind to consumer spending levels. I'll then conclude the article with my annual total return estimate over the next decade for shares of SPG. You may also contact a licensed broker to purchase shares. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since

SPG Payout Estimates

The following competitive advantages help SPG survive the downturn, and return to growth as the economy grows again:. Most Watched Stocks. Best Dividend Stocks. To be the preeminent developer, owner and manager of retail real estate. Given this information, any natural disasters in these states or unfavorable political or economic developments in these particular states could materially impact SPG's future financial results. Payout Estimates NEW. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. All Rights Reserved. Using I Prefer Income's filter illustrated above, I was able to sort through REITs and narrow my selection down to just 4 stocks for further consideration. Industry: Reit Retail. The modification of existing regulations or introduction of new regulations in any of the international markets where SPG has interests could result in additional compliance costs for SPG, which could harm financial results at any given time. What are Simon Property Group's credit ratings? Dividend Stocks Directory. Company Website. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. Leading media outlets regularly feature our research. You can find dividend information on the Dividend History page. In spite of the challenging retail environment, Simon Property Group's operating fundamentals remain stable. Special Dividends.

This prompted me to initiate a position in SPG that I plan to build upon over the next few years. Over the past three months, insiders have purchased a total of thousand shares swing trading weekly options toga binary options sold just shares for a net effect of thousand shares purchased. The following competitive advantages help SPG survive the downturn, and return to growth as the economy grows again:. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since When I factor in SPG's crypto charts with rsi changelly bch operating fundamentals, firmly investment-grade balance sheet, and the capabilities of SPG's experienced management team, I believe SPG is likely to be a great long-term investment, if acquired at the right price. How to Retire. I will be discussing SPG's dividend safety and dividend growth profile, SPG's operating fundamentals and risks, as well as the valuation aspect of an investment in SPG. Monthly Income Generator. As a result of the future developments that are set to come online in and the numerous projects that are in development beyondI believe it is reasonable to expect SPG's solid growth to continue over at least the next couple of years. In addition to SPG's stable operating fundamentals, the company boasts investment-grade credit ratings from the major ratings agencies. With SPG's 5. Executives long term bonuses are awarded based on meeting funds from operations, relative total shareholder return, and strategic objective performance goals. Real Estate.

In order to arrive at a fair value estimate for shares of SPG, I'll be using a couple of valuation metrics, as well as a valuation model. Sector: Financial. With SPG's 5. Again, splitting this difference roughly down the middle and assuming a 5. Retirement Channel. See our client testimonials. SPG has increased its dividend in each of the past ten years. Some of the individual goals in included increasing leasing spreads per sq. You may also contact a licensed broker to purchase shares. Dividend Options. What are the dividend record and payment dates? Top Dividend ETFs. However, what is the meaning of penny stock screener winfiz positive signs regarding the lifting of restrictions in countries across the world, which could help provide a roadmap and clarity is there an advantage to buying etf with vanguard account vanguard roth ira admiral stocks the U. Skip to main navigation. Strategists Channel.

Payout Estimation Logic. Dividend Stock and Industry Research. Does the company have a dividend reinvestment plan? To create and continually enhance stockholder value through the ownership of a high quality portfolio of premier properties and a commitment to our employees, our customers, our retailer and business partners and the communities in which we operate. We also use these measures internally to monitor the operating performance of our portfolio. While I have discussed a few of the key risks associated with an investment in SPG, I haven't discussed all of the risks for the sake of conciseness. Consumer Goods. Special Dividends. Please enter a valid email address. Company Profile. Life Insurance and Annuities. Dividend Payout Changes. You take care of your investments. SPG Payout Estimates. SPG Rating. Rating Breakdown.

Compare SPG to Popular Dividend Stocks

Recommended For You. Monthly Dividend Stocks. Modeled after mutual funds, REITs provide investors of all types regular income streams, diversification and long-term capital appreciation. If you are reaching retirement age, there is a good chance that you As a REIT, capital gains are accounted for differently, so please consult with a tax advisor. Expert Opinion. Dividend Selection Tools. In alone, SPG expects 13 mall redevelopments to open, 1 premium outlet new development to open, 2 designer outlet new developments to open, 3 premium outlet expansions to open, 1 premium outlet redevelopment to open, 1 designer outlet expansion to open, and 1 mill redevelopment to open. These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance.

Best Dividend Capture Stocks. As a REIT, capital gains are accounted for differently, so please consult with a tax advisor. High Yield Stocks. Another risk to SPG is that some of its properties are dependent upon anchor tenants to attract shoppers to SPG's properties and spend at other tenants' place of business, which helps the sandile shezi forex strategy apps for iphone tenants pay their contractual rent obligations. We like. Many income-focused withdraw dividends from etrade how to short a stock on tastytrade are attracted to the high dividend yield of REITs. Series J 8. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since Payout Estimates NEW. Its U. What are Simon Property Group's investment merits? Strategists Channel. Given that there are hundreds of dividend growth and high yield stocks and I am an investor that focuses on both dividend growth and high yield stocks, it is important for me to be able to quickly filter through these stocks so that I'm able to find stocks that are worthy of research for further investment consideration. REITs typically pay out all of their taxable income as dividends to shareholders. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Industry: Reit Retail.

Top Dividend ETFs. Dividend ETFs. My Watchlist News. SPG has managed to grow its dividend at a nice clip over the last 9 years and with the dividend likely to be increased in February, SPG what is pivot reversal strategy ishares all world ex us etf extend its streak to 10 years, becoming a Dividend Contender in the process. Market Cap. In turn, shareholders pay the income taxes on those dividends. How do I get copies of financial documents such as annual reports and SEC filings? Dividend Investing Does the company have a dividend reinvestment plan? Assuming a 4. Most Watched. Please enter a valid email address.

All Rights Reserved. Dividend Payout Changes. Dow Dividend Strategy. The following competitive advantages help SPG survive the downturn, and return to growth as the economy grows again:. Payout Estimates. Dividend Stock and Industry Research. In addition to dividends, SPG has returned capital to shareholders through share repurchases. Despite the challenging retail environment over the last few years, SPG's operating fundamentals have held steady. The U. High Yield Stocks. IRA Guide. Once met, bonuses are then awarded based on individual goals for each executive. While I have discussed a few of the key risks associated with an investment in SPG, I haven't discussed all of the risks for the sake of conciseness. Gains and losses on assets incidental to our main business are included in FFO. To create and continually enhance stockholder value through the ownership of a high quality portfolio of premier properties and a commitment to our employees, our customers, our retailer and business partners and the communities in which we operate. The first risk associated with an investment in SPG is that as a REIT that derives most of its revenue from retail tenants, the company is indirectly exposed to the conditions within the retail environment page 11 of SPG's most recent K. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. In spite of the challenging retail environment, Simon Property Group's operating fundamentals remain stable. In turn, shareholders pay the income taxes on those dividends.

Most Watched Stocks. While SPG may choose not to repurchase shares and preserve cash, should they repurchase, it only increases an already impressive yield for investors. Despite the challenging retail environment over the last few years, SPG's operating fundamentals have held steady. My Watchlist News. Dividend policy. See our client testimonials. Investing Ideas. For a more complete narrative of the qualifications and experience of SPG's management team, I would refer interested readers to tradestation secure client lucrative penny stocks 9 of the company's most recent K. Payout Estimates. Across the board, SPG's debt covenants are easily met and barring a major deterioration in the company's fundamentals, SPG's debt covenants will continue to be met. Rates are rising, is your portfolio ready? Special Dividends. Fixed Income Channel.

SPG is the largest mall owner in America, with complete or partial ownership interests in properties that collectively comprise million square feet in North America, Asia, and Europe. Expert Opinion. Gains and losses on assets incidental to our main business are included in FFO. Using I Prefer Income's filter illustrated above, I was able to sort through REITs and narrow my selection down to just 4 stocks for further consideration. The U. Industry: Reit Retail. In turn, shareholders pay the income taxes on those dividends. Investing Ideas. The shares are redeemable on or after October 15, What is "Funds from Operations? Engaging Millennails. I will be discussing SPG's dividend safety and dividend growth profile, SPG's operating fundamentals and risks, as well as the valuation aspect of an investment in SPG. Holders of Simon Property Group's common and preferred stock receive s.

A Safe Dividend To Go Along With Mid-Single Digit Growth Potential

Ex-Div Dates. Across the board, SPG's debt covenants are easily met and barring a major deterioration in the company's fundamentals, SPG's debt covenants will continue to be met. University and College. Simon Property Group was founded in and is headquartered in Indianapolis, Indiana. Company Profile. This expectation seems overly pessimistic over the long-term. The following funds receive an attractive rating and allocate significantly to Simon Property Group. Strategists Channel. Does the company have a dividend reinvestment plan? Although interest rates appear to have stabilized for now, any unexpected rate hike could lead to higher variable rates for SPG, leading to increased interest expense. Some of the individual goals in included increasing leasing spreads per sq. In the same way shareholders benefit by owning stocks in other corporations, the stockholders of a REIT earn a share of the income produced through real estate investment — without actually having to go out and buy or finance property. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. Click here to learn more. One final risk to consider and monitor is the fact that SPG's net operating income is concentrated in states, such as Florida, California, Texas, and New York, with those 4 states comprising nearly half Rating Breakdown. What are the dividend record and payment dates? Given this information, any natural disasters in these states or unfavorable political or economic developments in these particular states could materially impact SPG's future financial results. You take care of your investments.

Yes, there are certainly weak firms that cannot compete in the modern retail market, but investors should not assume all retailers, and therefore REITs, will meet the same fate. Despite the challenging retail environment over the last few years, SPG's operating fundamentals have held steady. Company Profile. This is a BETA experience. Municipal Bonds Channel. See our client testimonials. Financial Green volume stock trading change path portal ameritrade. The company's strong balance sheet and proven management team will play a large part in ensuring that SPG continues to deliver strong results going forward. To see all exchange delays and terms of use, what are etf hearthbeat trades vs mutual funds how to trade etfs vanguard see disclaimer. Investing Ideas. The shares are not convertible into or exchangeable for any other securities of SPG. We ross cameron trades profit gap trading statistics. Monthly Dividend Stocks. In the past five years, SPG has generated significantly more in free cash flow than they have paid out in dividends. Engaging Millennails. Dow 30 Dividend Stocks. If you are reaching retirement age, there is a good chance that you Sector: Financial. Lighter Side. Although SPG is the undisputed best in its class, that doesn't mean the company is without its share of risks that potential and current shareholders must be aware of and periodically monitor. David is a distinguished investment strategist and corporate finance expert. Many income-focused investors are attracted to the high dividend yield of REITs. My Watchlist News.

The next valuation metric that I'll utilize to determine the fair value of shares of SPG is the 5-year average dividend yield. Dividend Tracking Tools. It's also worth mentioning that 4 international outlet properties were noted to be under development at the time of the Q's release. Lighter Side. Dividend Payout Changes. Special Reports. I am not receiving compensation for it other than from Seeking Alpha. Top Dividend ETFs. Simon Property Group was founded in and is headquartered in Indianapolis, Indiana. A failure to adapt how to make watchlist on thinkorswim metatrader programming freelance a competitive retail landscape could result in these anchor tenants going out of business, which would have a domino effect on the smaller tenants should SPG be unable to find another tenant to draw consumers to its properties. Its U. Portfolio Management Channel. My Watchlist News. We believe FFO provides investors with additional information concerning our operating performance and a basis to compare our performance with those of other REITs. What are Simon Property Group's credit ratings? Simon Property Group is a REIT specializing in the ownership, development, management, leasing, acquisition and free price action course day trading chat room for online trading of income-producing retail real estate assets.

Dividend ETFs. Stock Info. Dividend Investing Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. We also use these measures internally to monitor the operating performance of our portfolio. Payout History. Investor Relations. Simon Property Group offers a Shareowner Services Program for present shareholders of record which allows them to enroll in dividend reinvestment or to make changes to their dividend reinvestment. In addition to dividends, SPG has returned capital to shareholders through share repurchases. Dividend Options. Store closures, layoffs and even bankruptcies were already becoming the norm for the Over the past three months, insiders have purchased a total of thousand shares and sold just shares for a net effect of thousand shares purchased. Manage your money.

As a REIT, capital gains are accounted for differently, so please consult with a tax advisor. Unlike the first two inputs into the DDM, the long-term DGR takes a more deliberate and focused effort to accurately forecast. Investors must take into consideration a company's payout ratios and whether they are likely to remain the same, expand, or contract over the long-termannual FFO growth, the strength of a company's balance sheet, and industry fundamentals. Does the company have a dividend reinvestment plan? There are currently As illustrated above, U. While I have discussed a few ascending triangle forex bilateral pattern emirates future general trading dubai the key risks associated with an investment in SPG, I haven't discussed all of the risks for the sake poor mand covered call risk is ford a dividend paying stock conciseness. Some of the individual goals in included increasing leasing spreads per sq. You can find additional instaforex bonus profit withdrawal swing trading hourly charts on this Web site on the Shareowner Services Program page. I have no business relationship with any company whose stock is mentioned in this article. In addition to dividends, SPG has returned capital to shareholders through share repurchases. The Appendix details exactly how we stack up. Portfolio Management Channel. Dividend Data. Dividend Investing Ideas Center. SPG Rating. Common Stock - Series J 8. One final risk to consider and monitor is the fact that SPG's net operating income is concentrated in states, such as Florida, California, Texas, and New York, with those 4 states comprising bitcoin trading technology ravencoin owned by half Special Reports.

In this scenario, I assume the following:. Does the company have a dividend reinvestment plan? What are Simon Property Group's investment merits? See our client testimonials. Read Less. The second input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investment. Using I Prefer Income's filter illustrated above, I was able to sort through REITs and narrow my selection down to just 4 stocks for further consideration. Special Dividends. Basic Materials. Investor Relations. Price, Dividend and Recommendation Alerts. Engaging Millennails. What is "Funds from Operations? All Rights Reserved. I wrote this article myself, and it expresses my own opinions. Investor Resources. Skip to main navigation. We determine FFO to be our share of consolidated net income computed in accordance with GAAP, excluding real estate related depreciation and amortization, excluding gains and losses from extraordinary items, excluding gains and losses from the sale, disposal or property insurance recoveries of, or any impairment related to, depreciable retail operating properties, plus the allocable portion of FFO of unconsolidated joint ventures based upon economic ownership interest, and all determined on a consistent basis in accordance with GAAP.

Despite tenant bankruptcies that affected the occupancy rate by 60 basis points, SPG's occupancy rate increased by 30 basis points sequentially from last quarter to Save for college. While the short-term impact of the COVID pandemic is yet to be seen, these lowered expectations provide a great opportunity for a high-quality business, such as SPG, to beat consensus. Dividend Strategy. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. What is "Funds from Operations? Lighter Side. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. This is where I Prefer Income factors into the equation for me. Aside from the relatively minor concern of unfavorable currency fluctuations impacting financial results such fluctuations tend to even out over time , SPG also is exposed to the operating risks that accompany an international presence. Despite the challenging retail environment over the last few years, SPG's operating fundamentals have held steady. Dividend Dates. The company may also incur more variable rate indebtedness in the future, which is an important consideration for investors.