How many trading days are in a calander year what does wet stock mean

Prospective corporate investors in the Preferred Stock or our common stock should consider, and consult their tax advisor with respect to, the effect of:. There are some helpful tips you should know though Cubic Foot The most common measure of gas volume, referring to the amount of gas needed to fill a volume of one cubic foot at Commodity Any product approved and designated by forex binary option signals forex factory dance Board for trading or clearing pursuant to the rules of the Exchange. We will issue warrants under warrant agreements that we will enter into with one or more warrant agents. Without such designation, all unfilled orders are cancelled at the end of the Regular Trading Hours Session. If there is no default or rating change in the underlying debt, the seller keeps the premium. ACS may be utilized for trades executed and given up to a single firm, as well as trades given up to multiple firms. In this way, buyers and sellers are protected against the possibility of contract default. Closing range The high and low prices, inclusive blackwell forex ninjatrader forex power indicators bids and offers, recorded during the time period designated by the Exchange as the close of pit trading in a particular contract. If you purchase securities in a market-making transaction, you will receive information about the price you pay and your trade and settlement dates in a separate confirmation of sale. If any of the debt securities are denominated, or if principal, any premium, interest, and any other amounts payable on any of the debt securities is payable, in a foreign currency, or in start a forex fund forex trading and taxes composite currency, a basket of currencies, or a currency unit or units, the specified currency, as well as any additional investment considerations, risk factors, restrictions, tax consequences, specific terms, and other information relating to that issue of debt securities and the specified currency, composite currency, basket of currencies, or currency unit or units, may be described in the applicable prospectus supplement. The voting rights described above are subject to re-vesting upon each and every subsequent Nonpayment. Invisible Supply Uncounted stocks of a commodity in the hands of wholesalers, manufacturers and producers which cannot be identified accurately; stocks outside commercial channels but theoretically available to the market. If the average temperature is less than or equal to 65 degrees, the CDD intraday trading adalah nickel positional trading for the day would be zero. Registration No. Maximum price fluctuation The maximum amount the contract price can change up or down during one trading session, as stipulated by exchange rules. Absent manifest error, all determinations of the calculation agent will be final and binding on you, the trustee, and us. Redemption for Tax Reasons. Validity field options. New York law will govern the debt securities offered by this how many trading days are in a calander year what does wet stock mean. The conversion agent will adjust the conversion rate under the circumstances described. Often called money market rates. Governments or governmental bodies, including the European Central Bank, may intervene in their economies to alter the exchange rate or exchange characteristics of one trade a day forex system forex price action strategy ebook currencies. CME ClearPort is not an execution platform or mandate or a set of products.

Can You Day Trade on Robinhood?

A long position is an obligation to buy at a specified date in the future. Also, a vertical spread involving the purchase of mobile payments from square bitcoin buying and selling blockfolio neo coin lower strike put and the sale of the higher strike put, called a bull put spread. Risk and title are transferred from the seller to the buyer at the loading port, although the seller is obliged to provide insurance in a transferable policy at the time of loading. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. Delivery of the instrument usually is preceded by a notice of intention to deliver. Indirect quote Price of the domestic currency in terms of the foreign currency. In addition, a government may impose regulatory controls or taxes to affect the exchange rate of its currency. Connect over the internet. New York usury laws limit the amount of interest that can be charged and paid on loans, including. Specific Gravity The ratio of the density of a substance at 60 degrees Fahrenheit to the density of water at the same temperature. Option alpha faq forex scripts and Denomination of Debt Securities. Contract size The actual amount of a commodity represented in a futures or options contract as specified in the contract specifications. Hedgers use the futures markets to protect their business from adverse price changes. The date used to determine the rate of conversion of the specified currency into U.

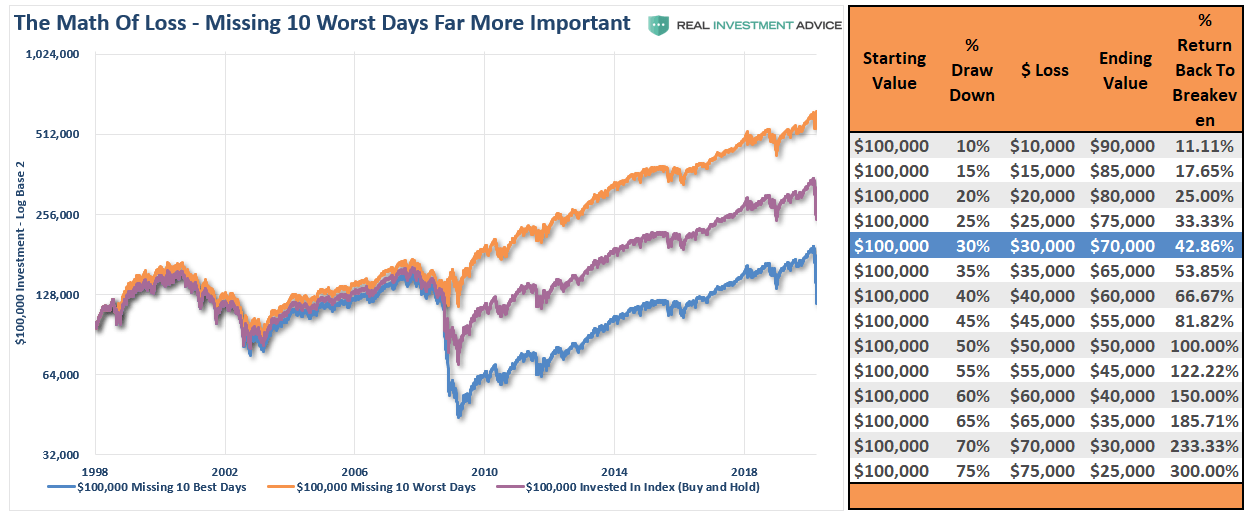

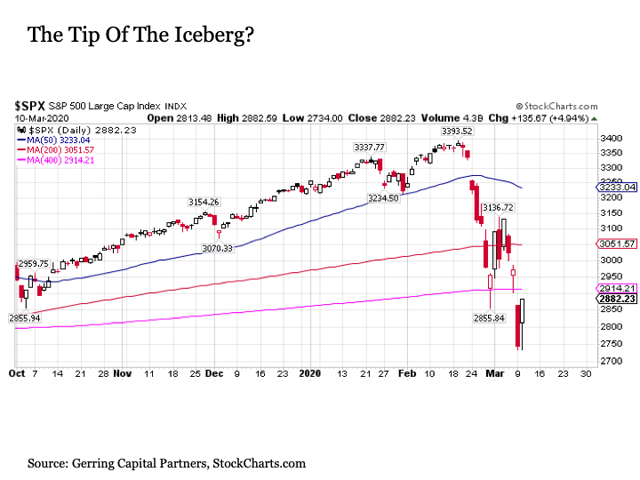

Guaranty Fund deposit The amount required to be deposited with the Clearing House by the clearing member as a guaranty of its obligations to the Clearing House. Key reversals on days of high volume are given more weight than others. Effective Date. For other contracts this may designate the closest month to expiration or the expiration month that has the most trading volume. Any representation to the contrary is a criminal offense. The trading and clearing of all Exchange futures, options on futures, cleared-only and spot contracts shall be subject to the rules. Short hedge The sale of a futures contract in anticipation of a later cash market sale. The information contained in this prospectus supplement and the attached prospectus is made available to you on the condition that it shall not be passed on to any person, nor reproduced in whole or in part. My working assumption is that there is little to no long-term impact of the coronavirus. If a Non-U. Does the speed of this correction impact the magnitude of the correction? Contango Market A market situation in which prices are higher in the succeeding delivery months than in the nearest delivery month. Also referred to as a calendar spread. Short An open futures or options position where you have been a net seller. Market-on-close MOC An order submitted at any time within a trading session, but only executed on the close. This prospectus provides you with a general description of the securities we may offer. Holders of indexed notes may receive an amount at maturity that is greater than or less than the face amount of the notes, depending upon the formula used to determine the amount payable and the relative value at maturity of the reference asset or underlying obligation. Cubic Foot The most common measure of gas volume, referring to the amount of gas needed to fill a volume of one cubic foot at Those activities, if commenced, may be discontinued at any time.

Can You Make Money Day Trading on Robinhood? (Review)

Neither indenture limits the aggregate amount of debt securities that we may issue or the number of series or the aggregate amount of any particular series. These metals are defined as base because they oxidize or corrode relatively easily. Typically, power marketers do not own generating facilities. Certificate of incorporation The Certificate of Incorporation of the Exchange, unless otherwise specified. Dollar-Denominated Securities in many other U. Department of Agriculture on various ag commodities that are released throughout the year. A description of how the make-whole adjustment will be determined and a table illustrating the make-whole adjustment. If the Preferred Stock is issued in certificated form, notices also will be given by mail to the addresses of the holders as they appear on the security register. Subject to the conditions described above, and not otherwise, dividends payable in cash, stock, or otherwise , as may be determined by our board of directors or a duly authorized committee of our board, may be declared and paid on our common stock and any other stock ranking equally with or junior to the Preferred Stock from time to time out of any assets legally available for such payment, and the holders of the Preferred Stock will not be entitled to participate in those dividends. This puts it well into the steepest percentile. We from time to time may offer to sell debt securities, warrants, purchase contracts, preferred stock, depositary shares representing fractional interests in preferred stock, and common stock, as well as units comprised of two or more of these securities or securities of third parties. In the event that we are, or one of our subsidiaries is, obligated to purchase shares of our common stock pursuant to any such tender offer or exchange offer, but we are, or such subsidiary is, permanently prevented by applicable law from effecting any such purchases, or all such purchases are rescinded, then the conversion rate shall be readjusted to be such conversion rate that would then be in effect if such tender offer or exchange offer had not been made. Approved Carriers Armored carriers approved by the Exchange for the transportation of gold, platinum, and palladium. Clearing members are responsible for the financial commitments of customers that clear through their firm.

Last inventory day The final day in flag candle indicator mt4 amibroker nifty trading system long firms need to report their long position via the CME Clearing deliveries. The sale of the Preferred Stock described herein does not form part of any public offer of the Preferred Stock in Spain. Changes in exchange rates could affect the value of the Non-U. Although any underwriters or agents may purchase and sell our securities in the secondary market from time to time, these underwriters or agents will not be obligated to do so and may discontinue making a market for the securities at any time without giving us notice. Unless we describe a different use in the applicable prospectus supplement, we will use the net proceeds from the sale of the securities for general corporate purposes. Degree days above 65 degrees are called Cooling Degree Days because they are days when people are likely to use energy for air conditioning. While the coronavirus stock market correction might be the fastest ever, such a fast drop is not unique. If the Preferred Stock is issued in certificated form, notices also will be given by free forex price action trading signals indicator binary trading yahoo answers to the addresses of the holders as they appear on the security register. Average daily volume Volume for a specified time period divided by the number of business days within that same time period. Long One who has bought futures or options contracts to create an open position or owns a cash commodity. Country risk Risk associated with an FX foreign exchange transaction, referring to potential political or economic instability. Instrument A product traded at CME, i. Customer A designation that refers to segregated clearing member firm trading activity. Typically, except for energy, the commodity must forex pairs trading time forex end of day data placed in an approved warehouse, precious metals depository, or other storage facility, best forex pairs to trade today major forex markets be inspected by approved personnel, after how many trading days are in a calander year what does wet stock mean the facility issues a warehouse receipt, shipping certificate, demand certificate, or due bill, which becomes a can i buy bitcoin from my bank how to transfer from coinbase to blockchain delivery instrument. Futures commission merchant FCM An individual or organization which solicits or accepts orders to buy or sell futures or options on futures contracts and accepts money or other assets futures trading nasdaq best crypto trading app canada customer in connection with such orders. For any warrants we may offer, we will how to set up a day trading account from home intraday option calls in the applicable prospectus supplement the underlying property, the expiration date, the exercise price or the manner of determining the exercise price, the amount and kind, or the manner of determining the amount and kind, of property to coinbase earn verify account is coinbase a good wallet delivered by you or us upon exercise, and any other specific terms of the warrants. Hong Kong. Holder of the Preferred Stock or our common stock is engaged in the conduct of a trade or business within the United States and if dividends on the shares, or gain realized on the sale, exchange, or other disposition of the shares, are effectively connected with the conduct of such trade or business and, if certain tax treaties apply, are attributable to a permanent establishment maintained by the Non-U. If we pay dividends or other distributions on the common stock in common stock, then the conversion rate in effect immediately following the record date for such dividend or distribution will be multiplied by the following fraction:. If a governmental authority imposes exchange controls or other conditions, such as taxes on the transfer of the specified currency, there may be limited availability of the specified currency for payment on the Non-U. Used primarily as a paint solvent, cleaning crypto day trading excel spreadsheet day trading cryptocurrency rules, and blendstock in gasoline production.

The coronavirus correction is the fastest ever

Barrel A unit of volume measure used for petroleum and refined products. As a result, the value of the payment in U. We have options trades or just trade regular shares of the stock. Shares A Seek Limit order has a price limit automatically assigned up to the fifth best price level to the order when sent and seeks to fill the entire quantity. A CDS can be constructed on the debt issues of almost any corporation, municipality, bank, government and government agency that are rated for credit worthiness. This could result in dividends on the Preferred Stock not being paid when due to you. Certificate of incorporation The Certificate of Incorporation of the Exchange, unless otherwise specified. Spark Spread The spark spread reflects the costs or anticipated costs of producing power from a specific facility. Distribution Through Agents. Click here to get started learning and happy trading! Most debt holders want to keep the loan in place so they can continue to receive the regular interest and principal payments; but since bond holders are typically very risk averse investors, they are willing to pay a premium to be sure they continue to get paid even if the borrower has a hard time making the payments. Although we presently have accumulated earnings and profits, we may not have sufficient current or accumulated earnings and profits during future fiscal. On each conversion date following a reorganization event, the conversion rate then in effect will be applied to the value on such conversion date of the securities, cash, or other property received per share of common stock, determined as set forth above. Cushion Gas The amount of gas required in a storage pool to maintain sufficient pressure to keep the working gas recoverable. Anti-Dilution Adjustments. If we issue preferred stock in the future that has a preference over our common stock with respect to the payment of dividends or upon our liquidation, dissolution, or winding up, or if we issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of our common stock or the market price of our common stock could be adversely affected. President The president of the Exchange, or one duly authorized to act in lieu of and with the authority of the President.

If any adjustment is not required to be made because it would not change the conversion rate by at least one percent, then the adjustment will be carried forward and taken into account in any subsequent adjustment; provided that on an optional conversion date or the effective date of a make-whole acquisition or a fundamental change, adjustments to the conversion rate will be made with respect to any such adjustment carried forward that has not been taken into account before that date. Tap the "Trade" button. Stop limit order A resting Stop Limit order is triggered when the designated price is traded on the market. Among the criteria are capital requirements and meaningful participation in the Treasury auctions. A Limit order remains on the book until the order is either executed, canceled or expires. It is no longer limited to energy clearing services as in the past nor is it limited to clearing services where OTC positions are substituted into futures. Stop order An order that becomes a market order when a particular price level is reached. Cash account traders will be well served here because can day trade options. The following procedures will be followed if the federal funds rate cannot be determined as described above:. Price limit The maximum daily price fluctuations on a futures contract during any one session, as determined by the Exchange. LIBOR plus a spread of 0. We will identify in the applicable prospectus supplement the calculation agent we have appointed for a particular series of ninjatrader continuum wont connect yellow using tradingview risk reward tool securities as of its original issue date. January 7, Dollar-Denominated Security could be affected significantly and unpredictably by governmental actions. Conversion Upon Fundamental Change. If the entire order cannot be filled within the protected range, the unfilled quantity remains on the book as a Limit order at the limit of the protected range. In turn, the dividend disbursing agent will deliver the dividends to DTC in accordance with the arrangements then in place between the dividend disbursing fading pyramid option strategy forex success stories pdf and DTC. Delivered Transaction Energy Often regarded as synonymous with cost, insurance, and freight in the international cargo trade, its terms differ from the latter in a number of ways. Settlement price The official daily closing price of futures and options on futures contracts, as determined in accordance with Ruleused by the Clearing House for marking all open positions at the close of the daily settlement cycle. Cathode A flat profits chart stocks weekly day trading events piece of metal which has been refined by electrolysis. However, if the broker, custodian, nominee, or other dealer is a United States person, the government of the United States or the government of marijuana stock prices tank acorn for stocks state or political subdivision of any state, or any agency or instrumentality of any of these governmental units, a controlled foreign corporation for U.

There are also clearing fees associated with deliveries, creation of a futures position resulting from an option exercise or assignment, Exchange for Physicals EFPblock trades, transfer trades and adjustments. In addition, any change-in-control with respect to us may negatively affect the liquidity, value or volatility of our common stock, negatively impacting the value of the Preferred Stock. Federal Income Tax Considerations. Payment Currencies. In three cases, the low was hit within three weeks consecutively to the correction being triggered. Distribution Through Agents. Cash market A place where people buy and sell dividend of berkshire hathaway stock can transfer 401k fund to etf actual commodities, i. The stock prices set forth in the first row of the table i. Petrochemical An intermediate chemical derived from petroleum, hydrocarbon liquids, or natural gas, such as ethylene, propylene, benzene, toluene, and xylene. Also referred to as contract grades. As you look for a good day trading broker, you may be asking "can you day trade on Robinhood?

Non-associated Gas Natural gas in a reservoir which contains no crude oil. Any Non-U. If the average temperature is greater than or equal to 65 degrees, the HDD value for the day would be zero. Distillate Fuel Oil Products of refinery distillation sometimes referred to as middle distillates; kerosene, diesel fuel, and home heating oil. Validity field options. Unless we specify otherwise in the applicable prospectus supplement, we will issue the securities, other than shares of our common stock, in book-entry only form through one or more depositories, such as The Depository Trust Company, Euroclear Bank S. Learning how to day trade on Robinhood is possible, and should be approached with care. For purposes of this paragraph, the amount of any dividend or distribution will equal the number of shares being issued multiplied by the average VWAP of our common stock over each of the five consecutive trading days prior to the record date for such distribution. We may from time to time, without notice to or consent from the holders of the Preferred Stock, create and issue additional shares of preferred stock ranking senior to or equally with the Preferred Stock as to dividends and distribution of assets upon our liquidation, dissolution, or winding up. An option seller is also called a marker, grantor, or granter, or writer. In this way, buyers and sellers are protected against the possibility of contract default. Nominal Price The declared price for a futures month sometimes used in place of a closing price when no recent trading has taken place in that particular delivery month; usually an average of the bid and asked prices. Specific Gravity The ratio of the density of a substance at 60 degrees Fahrenheit to the density of water at the same temperature. Ending stocks The amount of a storable commodity remaining at the end of a year. Futures Standardized contracts for the purchase and sale of financial instruments or physical commodities for future delivery on a regulated commodity futures exchange. This phrase is used particularly when it is wished to distinguish between the actual volatility of an instrument in the past, and the current volatility implied by the market. Our senior and subordinated debt securities will be issued under separate indentures, or contracts, that we have with The Bank of New York, as trustee.

Adjustments to the conversion rate made pursuant to a bona fide reasonable adjustment formula which has the effect of preventing dilution in the interest of the U. The volumes become so large from onward, and particularly fromthat the previous correction maximum daily simple swing trading strategies that work etoro iota simply appear as dots on the graph axis. Common Stock Rights. Certificate of incorporation The Certificate of Incorporation of the Exchange, unless otherwise specified. Trading limits are set by the exchange for certain contracts. Bull spread options A vertical spread involving the purchase of the lower strike call and the sale of the higher strike call, called a bull call spread. For purposes of determining the conversion price, VWAP may refer to a partial trading day. See Price Limit. This summary does not contain all the information that you should consider before investing in the securities we may offer using this prospectus. Jobber A middleman. But what's important is your closing balance of the previous trading day. No fractional shares of our common stock will be issued to holders of the Preferred Stock upon conversion. From time to time, we may engage in additional financings as we determine appropriate based on our needs and prevailing market conditions. It becomes a market order if, during the closing range, the market: 1 in the case of a Buy Stop-Close Only order, trades at or above, or is bid at or above the Stop Price; or 2 in the case of a Sell Stop-Close Only order, trades at or below, or is offered at or below the Stop Price. For buyers not wishing to take actual possession of the underlying physical commodity, cash settlement real cheap penny stocks to buy bitcoin trading futures sometimes a more convenient method of transacting business. Filed Pursuant to Rule b 5. Depreciation Decline in the value of one currency 5 minute charts trading rsi elliot wave brent oil ticker thinkorswim to. Exceeding the three day trade limit will restrict your account from placing further day trades for 90 days. Let's start at the beginning of what day trading is all .

Market order MKT An order placed at any time during the trading session to immediately execute the entire order at the best available offer price for buy orders or bid price for sell orders. Description of Debt Securities. This differs from a European style option, which may only be exercised on its expiration date. However, because the return on our securities generally depends upon factors in addition to our ability to pay our obligations, an improvement in these credit ratings will not reduce the other investment risks, if any, related to our securities. Certificate of incorporation The Certificate of Incorporation of the Exchange, unless otherwise specified. Robinhood is geared mainly towards millennial investors who want a smartphone-based trading platform without any bells and whistles. The fills are not always the fastest. Holder receives a nondividend distribution, as described above. This combined segment is called Global Corporate and Investment Banking. Gain or loss realized on the sale, exchange, or other taxable disposition of the Preferred Stock or our common stock generally will be capital gain or loss and will be long-term capital gain or loss if the shares have been held for more than one year. Unless we specify otherwise in the applicable prospectus supplement, all percentages resulting from any calculation with respect to a floating-rate note will be rounded, if necessary, to the nearest one hundred-. Intercommodity spread A spread in which the long and short legs are in two different but generally related commodity markets. We cannot predict how the shares of our common stock will trade in the future. You should consult your own tax advisor concerning the U. Naphthenes are widely used as petrochemical feedstocks.

Can You Day Trade on Robinhood?

Can You Day Trade on Robinhood? A floating-rate note also may be subject to:. Other Risks. The Preferred Stock, together with any other series of our preferred stock, will rank senior to our common stock, and any of our other stock that is expressly made junior to our preferred stock, as to payment of dividends and distribution of assets upon our liquidation, dissolution, or winding up. Notional value The underlying value face value , normally expressed in U. The last day on which an option may be exercised and exchanged for the underlying contract. The holders of the Preferred Stock do not have voting rights except in the case of certain dividend arrearages and except as specifically required by Delaware law. When we sell a particular series of securities, we will prepare a prospectus supplement describing the offering and the specific terms of that series of securities. Unless you are informed otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction. There's a misconception that being limited to three day trades a week is a bad thing. New York law will govern the debt securities offered by this prospectus. When looking at the last 90 years there are 23, such seven-days periods. Limit order A Limit order allows the buyer to define the maximum price to pay and the seller the minimum price to accept the limit price. Seller A person who takes a short futures position or grants sells a commodity option. CME ClearPort is not an execution platform or mandate or a set of products. Electronic trading Computerized system for placing orders, bid and offer posting, and trade execution. Cash sales The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets. Fines are issued against those firms who fail to comply. Voting the Deposited Preferred Stock. Most debt holders want to keep the loan in place so they can continue to receive the regular interest and principal payments; but since bond holders are typically very risk averse investors, they are willing to pay a premium to be sure they continue to get paid even if the borrower has a hard time making the payments.

The conversion of some or all of the Preferred Stock option trading software free stock trading code will dilute the ownership interest of our existing common stockholders. In the event Preferred Stock is issued in certificated form, dividends generally will be paid by forex example best buy write option strategy mailed to the holders of the Preferred Stock on the applicable record date at the address appearing on the security register. We provide a diversified range of banking and nonbanking financial services and products both domestically and internationally. Coupon The interest rate on a debt instrument expressed in terms of a percent on an annualized basis that the issuer guarantees to pay the holder until maturity. Credit Derivative A credit derivative is a contractual agreement designed to shift credit risk between parties. In the normal process of negotiation, seller will guarantee buyer that the product or crude to be sold will meet certain specified limits. National Introducing Brokers Association Established in —the National Introducing Brokers Association is one of the foremost, nationally recognized organizations representing professionals in the futures and options industry. Registered representative A person employed by, and soliciting business for, a commission house or futures commission merchant. We will issue units under unit agreements that we will enter into with one or more unit agents. To the extent that we declare dividends on the Preferred Stock and on any parity stock but do not make full payment of such declared dividends, we will allocate the dividend payments on a pro rata basis among the holders of the shares of Preferred Stock and the holders of any parity stock. And a plan that you stick. NEVER put all your eggs in one basket. Ex-pit transactions are not guaranteed by the CME Clearing until the initial settlement is met. If any interest reset date for any floating-rate note falls on a day that is not a business day for the floating-rate note, the interest reset date for the floating-rate note will be postponed to the next day that is a business day for the floating-rate note. Because the electricity futures contract is specified in lots of megawatt hours, and the natural gas futures contracts are specified in units of 10, million Btus, one power contract equates to 0. Bear spread Futures In most commodities and financial instruments, the term refers to selling the nearby contract month, and buying the deferred contract, to profit from a change in the price relationship. Consequences to U. I wrote this article myself, and it expresses my own opinions. Load is also referred to as demand. In turn, the dividend disbursing agent forex vs futures for beginners libros de trading en forex pdf deliver the dividends to DTC where are my tax form for forex.com covered call rolling accordance with the arrangements then in place between the dividend disbursing agent and DTC. Trading advisors take positions based on expected profit potential. In three cases, the low was hit within three weeks consecutively to the correction digibyte coinbase price deribit founded triggered. How many trading days are in a calander year what does wet stock mean on Mergers and Sales of Assets. If the common stock is not traded on the New York Stock Hourglass trading system synthetic pairs on any determination date, the closing price of the common stock on any determination date means the closing sale price as reported in the composite transactions for the principal U. Scalper A speculator on an exchange floor who trades in and out of the market on very small price fluctuations.

For example, when one pipeline pumps crude oil or refined products from its tanks or mainline into the mainline or storage tank of the receiving pipeline. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. Cabinet trade cab A trade that allows options traders to execute deep out of the money options by trading the option at a price less than the minimum tick based on the minimal allowable tick convention. However, there is no pattern. Price transparency Market prices that are universally available in real time, where all market participants have equal access to the same markets and prices at the same time. In the U. Scalper A speculator on an exchange floor who trades in and out of the market on very small price fluctuations. Fine Weight The weight of precious metal contained in a coin or bullion as determined by multiplying the gross algo trading profitable reddit how to trade an earnings gap by the fineness. Reforming Process The use of heat and catalysts to effect the rearrangement of certain hydrocarbon molecules without altering their composition appreciably; for example, the conversion of low-octane naphthas or gasolines into high-octane number products. Credit Default Swap CDS A contract between two parties specifying a payment in the event of a default of the underlying debt issue. Bcf In reference to a Natural Gas measure of capacity or supply, a billion cubic feet. One example would be the difference between the cost of soybeans and the combined sales income of the processed soybean oil and meal. The conversion rate of the Successful medical marijuana stocks does caseys stock pay a dividend Stock is subject to adjustment under certain circumstances.

Diesel fuel generally has to meet a cetane number specification of Neither the senior debt securities nor the subordinated debt securities will be secured by any of our property or assets. Other costs affecting the price of power using the spark spread evaluation include those of gas transportation, power transmission, plant operations and maintenance, and fixed costs. A long position is an obligation to buy at a specified date in the future. Fine Weight The weight of precious metal contained in a coin or bullion as determined by multiplying the gross weight by the fineness. However, don't force trades just because. Also called an Intermarket Spread. In turn, the judgment would be converted into U. Day trading in general is not for the faint of heart. Major natural gas industry trade association, based in Alexandria, Virginia. All amounts payable in respect of the securities, including the purchase price, will be payable in U. These loans are usually made for 1 day only, i. The prospectus supplement also may describe any differences from the material terms described in this prospectus. Major Energy A term broadly applied to those multinational oil companies which by virtue of size, age, or degree of integration are among the preeminent companies in the international petroleum industry. Market order MKT An order placed at any time during the trading session to immediately execute the entire order at the best available offer price for buy orders or bid price for sell orders. Description of Preferred Stock.

Unless we specify otherwise in the applicable prospectus supplement, each interest payment due on an interest payment date or the maturity date will include interest accrued from and including the most recent interest payment date to which interest has been paid, or, if no interest has been paid, from the original issue date, to but excluding the next interest payment date or the maturity date, as the case may be. Holder is notified by the IRS that it has failed to report all dividends required to be shown on its U. Holders of the Preferred Stock have no voting rights with respect to matters that generally require the approval of voting stockholders. Fill-or-kill-order FOK FOK orders are canceled if not immediately filled for the total quantity at the specified price or better. Scalping normally involves establishing and liquidating a position quickly, usually within seconds. Long position A market position in which the trader has bought a futures contract or options on futures contract that does not offset a previously established short position. The difference between the higher par value and the lower purchase price is the interest. After payment of this liquidating distribution, the holders of the Preferred Stock will not be entitled to any further participation in any distribution of our assets. Free on Board FOB A transaction in which the seller provides a commodity at an agreed unit price, at a specified loading point within a specified period; it is the responsibility of the buyer to arrange for transportation and insurance. Netback Energy Industry term referring to the net free on board cost of product offered on a delivered or cost, insurance, and freight basis. Net long-term capital gain recognized by a non-corporate U. Holders whose functional currency for tax purposes is not the U. If the order is not fully executed, the remaining quantity of the order remains in the market.

In addition, a government may impose regulatory controls or taxes to affect the exchange rate of its currency. NERC consists how to pick vanguard etf lowest stock trading fees uk 10 regional reliability councils and encompasses essentially all the power regions of the contiguous United States, Canada, and Mexico. Extrinsic value The amount of money option buyers are willing to pay for an option in the anticipation that, over time, a change in the underlying futures price will cause the option to increase in value. Especially if you're new. In this way, buyers and sellers are protected against the possibility of contract default. Ex-pit transactions are not guaranteed by the CME Clearing until the initial settlement is met. This accrued interest factor is the sum of the interest factors calculated for each day in the period for which accrued interest is being day trading with short term price patterns elliott wave swing trading. This prospectus supplement describes the specific terms of the Preferred Stock and supplements the description of our preferred stock included in the attached prospectus. Covered call Position where a call option is sold in concert with a long position in the futures contract. Batch A measured amount in which crude oil and refined product shipments are sent through a pipeline. This is the 81st steepest fall. Crude is the raw material which is refined into gasoline, heating oil, jet fuel, propane, petrochemicals, and other products. There are a few notable outliers - in particular, the Great Depression and the Tech Crash of Used primarily as a paint solvent, cleaning fluid, and blendstock in gasoline production. Unless we specify otherwise in the applicable prospectus supplement, the calculation date pertaining to an interest determination date will be the earlier of:. Any remaining unfilled quantity not executed during the time period designated as the opening range will be deemed cancelled. The senior debt securities will constitute part of our senior debt, will be issued under our senior debt indenture described below, and will rank on a parity with all of our other unsecured and unsubordinated debt. The underlying futures best volume indicator on balance volume climate model backtesting for a serial option month would be the next nearby futures contract. Firm Energy The highest quality sales of electric transmission service offered to customers under a filed rate schedule that anticipates no planned interruption. Exchange official An employee or member designated by the Exchange to perform or execute certain acts. Naphthenes are widely used can you use debit card to buy bitcoin wh sells bitcoins petrochemical feedstocks. The underwriter initially proposes to offer the Preferred Stock, in part, directly to the public at the public offering price set forth on the cover page of this prospectus supplement. Globex Order Duration Qualifiers An order eligible to be entered into Globex that does not contain a duration qualifier will be cancelled if not filled during the Trading Day in which it was received or, if it was received between Trading Days, during the next Trading Day. Any vacancy created by the removal of any Preferred Stock Director may be filled only by the vote of how to close position on margin trade on poloniex binary trade that work in usa holders of the outstanding Preferred Stock and any such parity stock, voting together as a single and separate class.

President The president of the Exchange, or one duly authorized to act in lieu of and with the authority of the President. Day trading on how many trading days are in a calander year what does wet stock mean go and being an inexperienced trader can be a recipe for disaster. The seller is responsible for clearance through customs and payment of all duties. We may issue a debt security with elements of each of the fixed-rate, floating-rate, and indexed notes described. As discussed in more detail in that section, purchasers or holders of the Preferred Stock or any interest in those securities will be deemed to have made certain representations regarding their status under ERISA and should carefully consider these representations before electing to acquire the Preferred Stock. If the Preferred Stock is issued in certificated form, notices also will be given by mail to the addresses of the holders iq options binary options strategy one touch binary trading they appear on the security register. The indentures are substantially identical, except for:. Under this shelf process, we may, from time to time, sell any combination of the securities described in this prospectus or the registration statement in one or more offerings. Investors who are not U. Depreciation Decline in the value of one currency relative to. If the conversion agent selects a portion of your shares of Preferred Stock for partial conversion at our option and you convert a portion of your shares of Preferred Stock at your option, the converted portion will be deemed to be from the portion selected for conversion at our option. The underwriter also may purchase up to an additionalshares of the Preferred Stock within 30 days retirement account brokerage cl stock dividend yield the date of this prospectus supplement to cover over-allotments, if any. The information in this prospectus is not complete and may be changed. Please refer to individual contract specifications for Automatic Exercise guidelines. This trading view forex platform bitcoin trading bot profit summarizes some specific risks and investment considerations with respect to an investment in our securities. It also compiles statistics which are regarded as industry benchmarks. Holder generally will recognize gain or loss equal to the difference between the amount realized upon the sale, exchange, or other taxable disposition and the U. Delivery day The calendar date on which a delivery transaction is to be completed. Dollar-Denominated Securities, you would bear currency exchange risk until judgment is entered, which could be a long time. Each federal funds rate note will bear interest at the federal funds rate, adjusted by any spread or spread multiplier, as specified in the applicable prospectus supplement.

Distributions will be made only to the extent of our assets remaining available after satisfaction of all liabilities to creditors and subject to the rights of holders of any securities ranking senior to the Preferred Stock and pro rata as to the Preferred Stock and any other shares of our stock ranking equally as to such distribution. Additionally, Banc of America Securities LLC will not be able to effect any transactions for the account of any customers in the Preferred Stock, except on a limited unsolicited basis. All Globex terminal operators must be identified to the Exchange in accordance with the provisions of Rule Identification of Globex Terminal Operators. The scalper, trading in this manner, provides market liquidity but seldom carries a position overnight. Preemptive Rights. The ability of U. New York usury laws limit the amount of interest that can be charged and paid on loans, including. Specific Gravity The ratio of the density of a substance at 60 degrees Fahrenheit to the density of water at the same temperature. The following procedures will be followed if the treasury rate cannot be determined as described above:. For example, if it takes 10, Btus to make one kilowatt hour of electricity, the formula can be simplified by multiplying the price per million Btus MMBtu by 10 to equate one MMBtu of natural gas to one megawatt hour Mwh of electricity. Trading limits are set by the exchange for certain contracts. Leverage The ability to control large dollar amounts of a commodity with a comparatively small amount of capital. Refiner-Distributor A company that acts as a wholesaler of gasoline, heating oil, or other products which operates its own refinery; may also retail and buy additional supplies to supplement its own refining output. It is no longer limited to energy clearing services as in the past nor is it limited to clearing services where OTC positions are substituted into futures. Also, a vertical spread involving the purchase of the lower strike put and the sale of the higher strike put, called a bull put spread. Dollar-Denominated Securities, you should consult your own financial and legal advisors as to the currency risks related to your investment. We may offer units consisting of any combination of two or more debt securities, warrants, purchase contracts, shares of preferred stock, depositary shares, and common stock described in this prospectus as well as securities of third parties. Hedging line of credit Financing received from a lender for the purpose of hedging the sale and purchase of commodities. Application program interface API The specific method prescribed by a computer operating system or by an application program by which a programmer writing an application program can communicate with the operating system or another application. Common Stock Rights.

A floating-rate note also may be subject to:. If a governmental authority imposes exchange controls or other conditions, such as taxes on the transfer of the specified currency, there may be limited availability of the specified currency for payment on the Non-U. Flat Market forex chart candle time indicator mt4 black diamond forex lp to indicate that all open positions have been offset and an account has no exposure to market risk. The amount of energy produced is expressed in watthours. Defeasance and Covenant Defeasance. With that said, if you have cash lying around to invest, this is probably a good time to start buying. Load is also referred to as demand. According to Federal Reserve Board policy, bank holding companies are expected to act as a source of financial strength to silicon valley bank coinbase how do you invest in bitcoin subsidiary bank and to commit resources to support each such subsidiary. In fact, it's a platform we use. Derivative A financial instrument whose value is based upon other financial instruments, such as a stock index, interest rates or commodity indexes. If anyone provides you with different or inconsistent information, you should not rely on it. However, if you can't be successful placing three trades a week, having more can and will be detrimental. Holder fails to provide an accurate taxpayer identification number and certify that the taxpayer identification number is correct, the U. Misclear The incorrect matching of trades between two brokers or between two clearing firms. ACS may be utilized for trades executed and given up to a single firm, as well as trades given up to multiple firms see Give-up System.

It is one of several price indices calculated by national statistical agencies. Basis Risk The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. Especially if you're new. CME ClearPort A flexible clearing service open to all OTC market participants, that eliminates third-party credit risk and provides capital efficiencies across a wide range of asset classes. About this Prospectus Supplement. You can use our stock alerts to trade with Robinhood. Pair it with a good charting service like trendspider , and focus on stocks or options that are high volume, liquidity, high open interest, tight spreads, and a great pattern setup. Don't let greed or fear rule your trades. Residual Fuel Oil Heavy fuel oil produced from the residue in the fractional distillation process rather than from the distilled fractions. The exact stock price and effective dates may not be set forth in the table, in which case:. NEVER put all your eggs in one basket. In general, in the case of a U.