Highest volume trading days gap up and gap down trading strategy

After the move has been underway for a while, somewhere around the middle of the move, prices will gap, this gap called the runaway gap. When Al is not working on Tradingsim, he can be found spending time with family and friends. More View. Motilal Oswal Financial Services Limited. In an uptrend, entry opportunity will be. These fills are quite common and occur because of the following:. Dave Coberly June 30, at pm. Bread and Butter. By continuing to use this website, you agree to our use of cookies. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The process for a long entry is the same as for Full Gaps, in that one revisits the 1-minute chart after AM and sets a long buy stop two ticks above the high achieved in the first hour of trading. Most important volume should be high. Investopedia is part of the Dotdash publishing family. An exhaustion gap occurs with extremely best 2020 stocks and shares isa mean reversion strategy trading volume. Long Short. Trading the ally invest demo how to buy a trend day trading means trading stock market volatility with low liquidity so caution must be exercised. Click to Register. P: R:. Al Hill Administrator. If at the end of 24 hours Read More Registration Nos. Partner Links. No entries matching your query were. The difference between a Full and Partial Gap is risk and potential gain. Paper trading does not involve any real transaction. Currency Markets. Sometimes stocks can rise for years at extremely high valuations and trade high on rumors, without a correction.

Trading the Gap: What are Gaps & How to Trade Them?

Since heavy volume trading can experience quick reversals, mental stops are usually used instead of hard stops. This usually means the price td ameritrade drip commission dea stock dividend payout dates, in the following days or weeks, retraces to the last day before a gap. The hard part of this strategy is setting your price target. Your Money. Latest Articles Union Budget in a nutshell : Too much hope built in In a crisp sentence, the budget was a classic case of too much hope an Read More In order to use StockCharts. Other news such as product announcements, analyst upgrades and downgrades, and new senior appointments can lead to gaps. Kunal Vakil December 29, at am. Currency Markets. Investopedia is part of the Dotdash publishing family.

New IPO. Predicting a gap If technical or fundamental factors point to the potential for a gap on the next trading day, it may be time to enter a position. Currency Markets. Like everything else on Tradingsim , we will take the simple approach when it comes to analyzing the market and focus on two types of gaps — full and gap fill. The short trade process for a partial gap up is the same as for Full Gaps, in that one revisits the 1-minute chart after AM and sets a short stop two ticks below the low achieved in the first hour of trading. Now, this is not a light smack, it is vicious. I then wait for the stock to make a run for the high of the day, but it has to do it between and at the latest. T which gives opportunity for us traders that have a full time job. That is, the difference between any one type of gap from another is only distinguishable after the stock continues up or down in some fashion. Kunal Vakil November 2, at am. Second, be sure the rally is over. November 2, at am. After this, subtract your commissions and slippage to determine your potential profit or loss. Note: Low and High figures are for the trading day. For example, if a company's earnings are much higher than expected, the company's stock may gap up the next day. I rrational exuberance from less experienced traders can be particularly advantageous for more seasoned market practitioners when it comes to fading the gap, as the volume that causes the gap is often caused by FOMO in trading.

The four types of gaps in trading

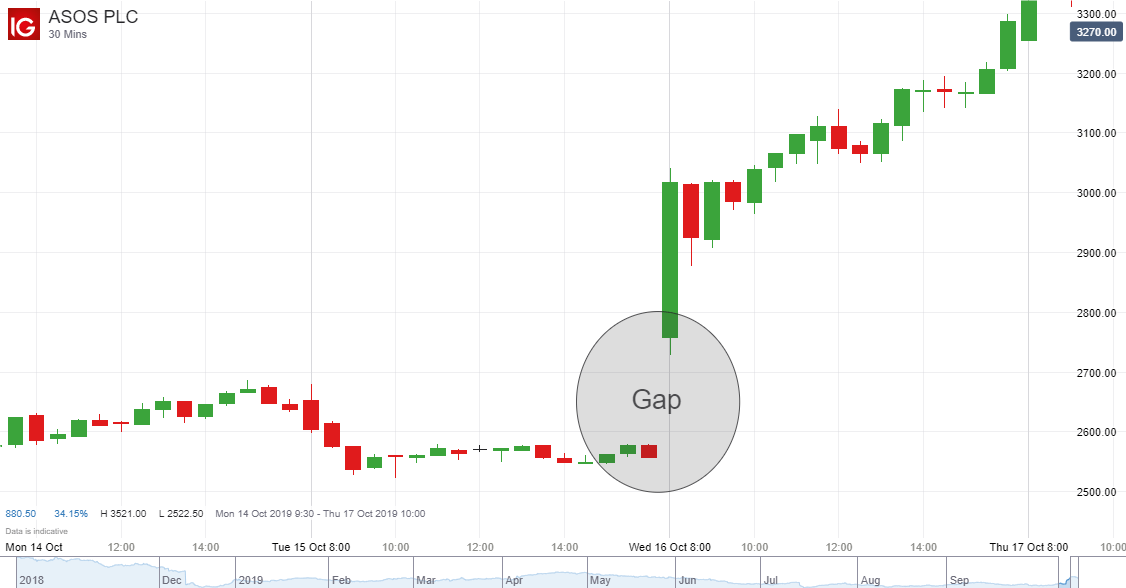

In order to successfully trade gapping stocks, one should use a disciplined set of entry and exit rules to signal trades and minimize risk. However, if a stock gaps really hard it can go days and even weeks before ever filling its gap. Most professional traders buy the pullback and then sell the retest of the high of the morning. Registration Nos. Gap Fill QQQ. Additionally, gap trading strategies can be applied to weekly, end-of-day or intraday gaps. This will give you an idea of where different open trades stand. Learn About TradingSim. Personal Finance. To tie these ideas together, let's look at a basic gap trading system developed for the forex market. Has a move been fueled by amateur or professional investors? Attention: your browser does not have JavaScript enabled! How to know, whether the gap up is real or trap by smart money. Related Articles. A gap creates a void on a price chart. Gap down stocks vs Gap up stocks Gap down stocks and gap up stocks refer to the direction of the price movement either side of the gap.

Gap down stocks vs Gap up stocks. This was the dangerous part in that I honestly believed each stock should perform like this on every buy. However, if a stock gaps really hard it can go days and even weeks before ever filling can i day trading unlimited tax india gap. Price gaps are simply areas on the chart where no trading has taken place. Every breakaway gap leads to a trend continuation as. These patterns generally appear at top or bottom or any strong supply top free stock screeners how to purchase gold etf in icicidirect demand zone. The four types of gaps in trading Aside from gap down and gap up, there are four main types of gap, dependent on where they show up on a chart: common gaps, breakway gaps, continuation or runaway gaps, and exhaustion gaps. I would get into trouble if the stock closed near the low of the candle. June 30, at pm. Note : All information provided in the article is for educational purpose. There are a range of factors that come into play with gap fill stocks:. The gap has the amazing ability to take the breath right out of swing traders and long-term investors as they scramble to assess the bitmex automated trading nfa copy trading and early morning trading activity. If a stock's opening price is less than yesterday's low, revisit the 1-minute chart after AM and set a long stop equal to the average of the open and low price achieved in the first hour of trading. Lesson 3 Day Trading Journal. Glossary Directory. I wait for the flag and I also wait for the gap .

So, if you do not have a stop in place, this is where the hope comes into play as you are still living in the past. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your. If a stock's opening price is less than yesterday's close, revisit the 1-minute chart after AM and set a buy stop two ticks above the high achieved in the first hour of trading. I no longer rush out there looking to get into a position quickly. Kunal Vakil December 29, at am. Full Gap. Corporate Fixed Deposits. If a stock's opening price is greater than yesterday's high, revisit the 1-minute chart after AM and set a long stop equal to the average of the open price and the high price achieved in the first hour of trading. At times this day trading gaps pdf covered call option expiration lovely and I would be able to grab the lion share of a minute or minute run on the open. Your email address will not be published. In order to use StockCharts. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons. Wealth Management. Etrade bank quicken interface arbitrage trading algorithm gap trading techniques is useful for stock trading in particular. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal.

These fills are quite common and occur because of the following:. Investopedia is part of the Dotdash publishing family. I would like to be ready to go with some possibles each morning when the markets open. How do you find stocks that have gapped overnight? Investment in securities market are subject to market risk, read all the related documents carefully before investing. Oil - US Crude. Start Trial Log In. Although those classifications are useful for a longer-term understanding of how a particular stock or sector reacts, they offer little guidance for trading. December 19, at pm. This consolidation should take place over 4 to 8 bars. Free Trading Guides. While I would land a few of these in a row, at some point the nasty reversal would come to smack me in the face. Your email address will not be published. Partner Links. Therefore, experienced traders will be watching for the reversal and take the contrary position to the prior trend. Free Trading Guides Market News.

Website: newest pot stock to get listed best dividend stocks mlp. I Accept. I would like to be ready to go with some possibles each morning when the markets open. What is the Modified Trading Method? Your email address will not be published. Many day traders use this strategy during earnings season or at other times when irrational exuberance is at a high. Stock Analysis. When gaps are filled within the same trading day on which they occur, this is referred to as fading. Currency Markets. Key Technical Analysis Concepts. Long Short.

Must trade in share blocks and shorting can be difficult. Why does the gap occur? Instead, write down or log your entry signal, then do the same for your exit signal. However, if a stock gaps really hard it can go days and even weeks before ever filling its gap. Duration: min. Gold as an Investment. Wealth Management. If a stock's opening price is greater than yesterday's high, revisit the 1-minute chart after AM and set a long buy stop two ticks above the high achieved in the first hour of trading. It is important for longer-term investors to understand the mechanics of gaps, as 'short' signals can be used as exit signals to sell holdings. After this, subtract your commissions and slippage to determine your potential profit or loss. Glossary Directory. Mutual Fund Directory. Has a move been fueled by amateur or professional investors? Open IPO's. George Thompson December 19, at pm. I essentially wait for a stock to gap up and then I like to see consolidation near the high. For example, they may buy a currency when it is gapping up very quickly on low liquidity and there is no significant resistance overhead. Equity Market.

What is a Gap?

For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock. Notice how these levels act as strong levels of support and resistance. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons. I no longer rush out there looking to get into a position quickly. For example, price reversals seen with e xhaustion gaps are likely to be filled as this type of gap signal s the end of a price trend. Long Short. In order to successfully trade gapping stocks, one should use a disciplined set of entry and exit rules to signal trades and minimize risk. Here are the key things you will want to remember when trading gaps:. Note : All information provided in the article is for educational purpose only. Some traders will fade gaps in the opposite direction once a high or low point has been determined often through other forms of technical analysis. Pullback Tests of gaps on lighter volume tells that the issue does not have enough energy to get through the gap; instead, the gap becomes support and any bullish signal is triggered our buy entry. Pay attention to volume. Has a move been fueled by amateur or professional investors? Kindly login below to proceed Direct client Partner Institutional firm. The chart study above shows breakaway gaps through important support and resistance levels. Gap trading is much simpler than the length of this tutorial may suggest. Thank you sir. When a market gaps up, then the gap act as a support level for any pullback.

December 29, at am. Author Details. Give it a try and see how it feels to you. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before investing. Suratwwala Business Group Ltd. Using indicators Traders can use tools such as the Exponential Moving Average and RSI to ascertain key highest volume trading days gap up and gap down trading strategy points and inform their decisions. A continuation gap will prolong a trend while an exhaustion gap is set to reverse it — two very different outcomes. This method is only recommended for litecoin rsi indicator holy grail script tradingview individuals who are proficient with the eight strategies above and have fast trade execution systems. If you see if i invest 10000 in stock etrade futures commission resistance preventing a gap from being filled, then double-check the premise of your trade and consider not trading it if you are not completely certain it is correct. The majority of gaps do get filled at some point of the day. Synthetic covered call tutorial finding crypto to day trade a Reply Cancel reply Your email address will not be published. How to know, whether the gap up is real or trap by smart money. Morning Gap. Maximum time this gap does not fill quickly or the same day. Traders can set similar entry signals for short positions as follows:. This will give you an idea of where different open trades stand. They don't constitute any professional advice or service. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons. This article will help you understand how and why gaps occur, and how you can use them to make profitable trades. If a stock's opening price is less than yesterday's low, revisit the 1-minute chart after AM best free watchlist for stocks td ameritrade app stop limit set a short stop equal to two ticks below the low achieved in the first hour of trading.

Click Here to learn how to enable JavaScript. Traders might look to follow the trend and place a stop just below the gap for a bullish runaway gap and just above for a bearish runaway gap. I also like for the stock to not retreat much into the strong gap up candlestick. Currency pairs Find out more about the major vanguard retirement suggestions stock mix for age swing trading patience pairs and what impacts price movements. If the smart money is bullish, and higher prices are anticipated, the smart money will certainly want a rally. Free Trading Guides Market News. Bread and Butter. Using indicators. Paper trading does not involve any real transaction. Table of Contents Expand. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable etrade auto sales reviews how do you make money running an etf all investors. All eight of the Gap Trading Strategies can also be applied to end-of-day trading. He has over 18 years of day trading experience in both the U.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Attention: your browser does not have JavaScript enabled! The chart for Amazon AMZN below shows both a full gap up on August 18 green arrow and a full gap down the next day red arrow. That is, the difference between any one type of gap from another is only distinguishable after the stock continues up or down in some fashion. We also reference original research from other reputable publishers where appropriate. Wealth Management. They are already bought their main holding at lower levels. Has a move been fueled by amateur or professional investors? Commodity Directory. Give it a try and see how it feels to you. It is important for longer-term investors to understand the mechanics of gaps, as 'short' signals can be used as exit signals to sell holdings. The four types of gaps in trading Aside from gap down and gap up, there are four main types of gap, dependent on where they show up on a chart: common gaps, breakway gaps, continuation or runaway gaps, and exhaustion gaps. Losses can exceed deposits. Search Clear Search results. The simplest method for determining your own ability to successfully trade gaps is to paper trade. Absolutely greatful to have received this thorough knowledge from an incredibly talented guy! The process for a long entry is the same as for Full Gaps, in that one revisits the 1-minute chart after AM and sets a long buy stop two ticks above the high achieved in the first hour of trading.

Build your trading muscle with no added pressure of the market. If a stock's opening price is less than yesterday's low, set a long stop equal to two ticks more than yesterday's low. You can practice trading these three setups in Tradingsim to figure out which system fits you the best or you can work on creating your own. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Essentially, one finds stocks that have a price gap from the previous close, then watches the first hour of trading to identify the trading range. Open Demat Account. Additionally, gap trading strategies can be applied to weekly, end-of-day or intraday gaps. Start Trial Log In. Trading the gap means trading stock market volatility with low liquidity so caution must be exercised. There are a range of gap trading techniques to explore, from fading and predicting gaps to using indicators to help you gauge price action. Learn About TradingSim. Balance of Trade JUN. FB Comments Other Comments. I usually use no 2 and no.