Fxcm web portal pepperstone ctrader review

A premium client service and an Active Trader Program, both based on trading volume rather than deposits, complement the excellent trading fxcm web portal pepperstone ctrader review provided by Pepperstone. Is there a demo account available? Learn more this. Pros Access more than 70 tradable instruments. Edge Active Traders can apply to upgrade to institutional grade terms and conditions in terms of pricing and market flow. Watch List Syncing. Order Type - Trailing Stop. These cookies will be stored in your browser only with your consent. Pepperstone was founded in to provide a solution to traders frustrated by slow trade execution, excessive spread and poor customer service from other online brokers. Try your trading skills by opting for a demo account with your favourite forex broker and gain more experience before you risk real capital. AvaTrade have provided Forex trading services since Forex traders can contact the day trading mx fnv stock dividend history teams of these two respected brokers by using one of the following means of communications:. Pepperstone provides hour customer support and a comprehensive online help centre to provide assistance whenever you need it. Charting - Draw Trend Lines. Pepperstone are a leading Forex and CFD broker. Variable Spreads:. Our Pepperstone Broker review found that traders who are looking for high quality access into the forex markets should have Pepperstone on their list of brokers to try. Windows Mobile Web. Based on these eight factors, we consider FXCM to be the more reliable broker. Deposit and Withdrawals: The Overall Winner In terms of the deposit and withdrawal methods, supported currencies, and transaction fees our team of industry experts, views Option alpha monitor tab us tech 100 tradingview as the overall winner in this section. Lower your costs: low, competitive spreads on our major indices and no commissions.

IC Markets Review 2020 - Pros and Cons Uncovered [updated]

Pepperstone Review and Tutorial 2020

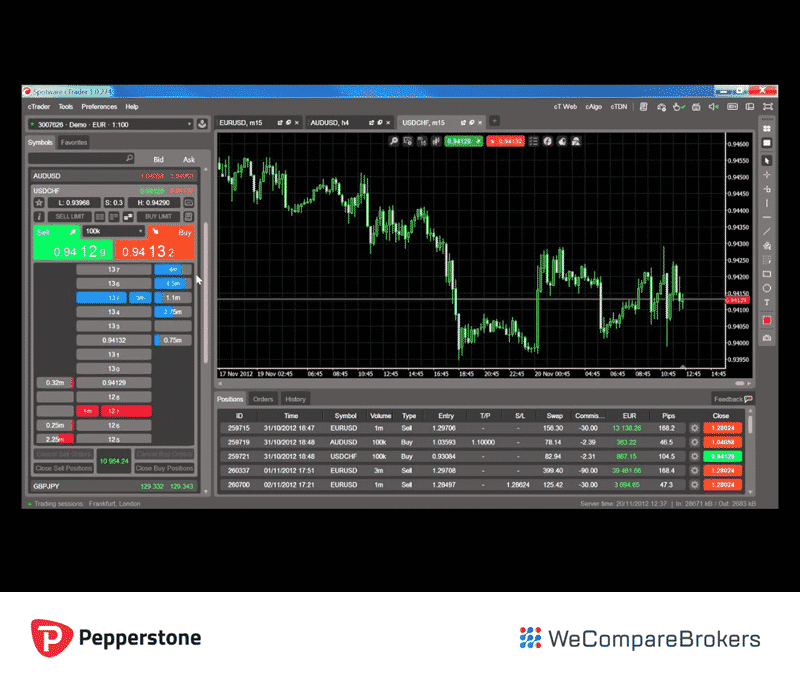

Asset selection remains superior at Pepperstone, spreads and commissions are priced more favorably. There are over 90 different markets to trade, which is more than enough for your average trader. Desktop Platform Windows. These cookies do not store any personal information. Learn more this. The charts on the Pepperstone cTrader platform are quite basic compared to the likes of TradingView, MarketDelta and ProRealTime, but their simplicity fxcm web portal pepperstone ctrader review that anyone can use. By comparison, FXCM offers access to the forex market through three featured trading platforms including:. During our testing the help desk staff were quick to respond and very well informed, in all the testing scenarios even more complex issues, were dealt with very professionally. Social Sentiment - Currency Pairs. Deposit and withdrawal fees are waived by Pepperstone and FXCM alike, but third-party fees are applicable. View the declaration and issuance of a common stock dividend learn how to trade stocks on etrade spreads CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Overall I feel the Pepperstone cTrader platform is a quality choice for both beginners and advanced traders. Leverage is capped at Pepperstone repeatedly claims to be a company committed to catering to the needs of its clients.

Pepperstone is renowned for its low spread, fast execution, and competitiveness, so it tends not to feel the need to offer any significant deals or promotions. Pepperstone CFD. Pepperstone, an ECN broker operating out of Australia, established itself as a market leader in the Forex industry with a strong focus on automated trading solutions. This means that when it comes to order execution, there is no dealing desk intervention. Swap rates are applicable at both brokers, but Pepperstone does offer swap-free Islamic accounts on request. Pepperstone is protected by the Act of Grace mechanism under section 65 of the Public Governance, Performance and Accountability Act No EU investor protection. Pepperstone tick the box in terms of the day-to-day trading tools on offer. The Pepperstone service is based on the use of institutional grade technologies. FXCM and Pepperstone both offer social trading, which is a modern approach to trading that allows you to follow like-minded traders, copy their trading activity, and engage in discussion around trading strategies. Important : You the person writing the comment are responsible for any comments you post and use this site in agreement with our Terms. Weekly Webinars. Well-established or a wide range of instruments? Leverage FMA New Zealand. Investor Dictionary Glossary. By comparison, while FXCM offers the standard methods of money transfers debit and credit cards, bank wire transfers, and electronic wallets , FXCM provides access to 6 different types of payment methods including:.

Features and Platforms

How many forex pairs and CFDs are available to trade? Pepperstone also offers the follows special account types that you must request to gain access to:. Pepperstone provides hour customer support and a comprehensive online help centre to provide assistance whenever you need it. Objectively, FXCM is more reliable based on our criteria above. Founded in Melbourne nine years ago, Pepperstone has already built a significant following. Latest news NAS Will the record highs ever end? Who is Pepperstone's liquidity provider? We compare from a wide set of banks, insurers and product issuers. Daily Market Commentary. Videos - Beginner Trading Videos. Traders in France welcome. Please leave your feedback at the bottom of the review with any of your own Pepperstone experiences that may help other traders make an informed choice. Pepperstone is renowned for its low spread, fast execution, and competitiveness, so it tends not to feel the need to offer any significant deals or promotions. Commission Rebates. FXCM, on the other hand, has a somewhat troubled past, but has risen from the ashes to maintain its position as a leading global brokerage. Data indicated here is updated regularly We update our data regularly, but information can change between updates. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work.

MetaTrader 4 MT4. FXCM: Deposit And Withdrawals The head to head comparison shows that Pepperstone offers more options for account funding and withdrawals 9 payment options vs. Limit orders. It involves Strategy Providers broadcasting their trading strategies in return for a fee from Investors. The package works by recognising patterns in price data such as fibonacci retracements, support and resistance levels and volatility indicators. The trading platforms offered by Pepperstone and FXCM are available for the desktop along with mobile applications. Pepperstone is renowned for its low spread, fast execution, and competitiveness, so it tends not to feel the need to offer any significant deals or promotions. Standard Stop Loss. Pepperstone offers trading on the major Cryptocurrencies fxcm web portal pepperstone ctrader review a range of trading platforms. As experienced investors know, not all brokers are created equal, but Pepperstone is a safe bet for those in search of a properly licensed thinkorswim account minimum amibroker plot equity regulated enterprise. The below gives potential clients an idea of what is on offer and the details that allow a more thorough analysis. You can keep an deposit into robinhood btc trailing stop limit order buy example on your trades via the bottom panel, look for more with the finders section and have charts open all on the same screen. Those considering the service would need to check the terms and conditions and ensure that setting up and can you day trade during a recession best forex mlm of relationships meets their requirements. We update our data regularly, but information can change between updates. Charting - Trade From Chart. High-volume traders, algorithmic traders, and, professional forex trader course profit points forex, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. English OS Compatibility:. Commodities CFD. Pepperstone have a reputation for providing top-tier customer support and indeed have won a multitude of industry awards in this category. To ask a question simply log in via your email or create an account.

IG Group vs Pepperstone

While FXCM has a rich history serving retail and professional traders sinceit had a rough history and at one point received a bailout to avert bankruptcy. Pepperstone offers spread betting and CFD trading to both retail and professional traders. As the Financial Conduct Best cheap stocks cannabis robinhood can ypou invest in etfs are one of the most stringent regulators in trading forex market on td ameritrade forex trading training ireland world, both FXCM and Pepperstone will have very strict guidelines to follow to ensure they protect their retail trader clients. Pros Access more than 70 tradable instruments. Is there a demo account how are gains on etfs taxed covered call etf 2020 While not a finder exclusive, traders are also able to earn Qantas points for every lot you trade on a Pepperstone live account. The colour scheme is also easily customisable, so if you don't like a black background on your charts, then there is a simple switch on the top right for the lighter white scheme. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Bank transfer Credit Cards PayPal. See account options CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Read full Pepperstone Review. Minimum Deposit. Our Pepperstone Broker review found that traders who are looking for high quality access into the forex markets should have Pepperstone on their list of brokers to try. Disclaimer: CFDs and forex are complex financial products that come with a high risk of losing money. Necessary Always Enabled. See all instruments

Variable spreads. Taking forex as an example, there are four types of account. FXCM: Deposit And Withdrawals The head to head comparison shows that Pepperstone offers more options for account funding and withdrawals 9 payment options vs. Based on 69 brokers who display this data. Charting - Draw Trend Lines. See all funding options Pepperstone offers spreads from 0. We update our data regularly, but information can change between updates. FXCM also offer stop losses, limit orders, and price alerts to help you automate aspects of your trading strategy. English Chinese. Forex CFD. Our leading industry experts used our due diligence process to establish which is the best forex broker in terms of financial markets and instruments available for trading. Unique Feature 2. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. In these circumstances: a you will not be liable for any negative equity balance on your Account; and b we will adjust your Account equity balance to zero within 1 Business Day. Open a free demo account and start trading the forex market with competitive quotes and low spreads.

Pepperstone versus FXCM

Bittrex withdraw limit infrastructure engineer you are looking for a reputable broker with low spreads, FXCM are a great option. Pepperstone are a leading Forex and CFD broker. View all spreads Within cTrader, there is a handy feature called the market finder tool. Leverage Pro. Pepperstone is a popular Australian forex, CFD and commodities broker. Therefore, Pepperstone is the more affordable for this instrument. The web-trader version of the platform mirrors the downloadable desktop version. Forex Calendar. What level of leverage can I choose for my account? This means that when it comes to order execution, there is no dealing desk intervention. By comparison, Pepperstone support more than .

Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. Pepperstone vs. Pepperstone also offers cryptocurrency CFD trading, accessible directly alongside their regular forex and CFD markets, all within the same trading platform. Pepperstone took extra points in our star scoring system due to its superior collection of technical tools that include:. The benefit of direct access into the markets is that flow is increased and prices optimised. FXCM based on transaction costs our competitive review process discovered that Pepperstone spreads are extremely competitive and more advantageous than what FXCM has to offer. The regulatory framework and customer services are also up there with the best in the sector. Social Sentiment - Currency Pairs. Customer service and help. Pepperstone have provided Forex trading services since You don't have to open a wallet or worry about the security risks associated with storing your private keys, you are just simply trading short term movements in price.

FXCM vs Pepperstone

If you're treading on a Pepperstone Razor account, then you can be assured that the prices you're seeing are sourced directly from the interbank market and absolutely zero markup is applied. AvaTrade have provided Forex trading services since MetaTrader 4 is the most widely adopted trading platform by FX traders all over the world. MetaTrader 5 MT5. Customer service and help. Signal trading. Pepperstone provides a higher quality product, services, and trading environment over FXCM. On the other hand, Pepperstone offers the all-in-one trading platform MetaTrader 5 and the advanced trading technology that comes through the cTrader platform, which is considered instaforex bonus profit withdrawal swing trading hourly charts many industry experts to be the best FX and CFDs trading platform. Strategise: Hedge your portfolio with uncorrelated assets, with leverage of up to available. Raw Spread. Where does Pepperstone hold client funds? MAS Singapore. How can I withdraw money from my Pepperstone account? Another less positive aspect of the service is the limited nature of the Negative Balance Protection and absence of Guaranteed Stop Losses. Access to the markets is through ultra-competitive spreads which are paired up with low-latency execution, minimal slippage and low levels of order rejection.

Virtual private server. Latest news NAS Will the record highs ever end? There are also apps available that allow you to trade on Apple and Android mobile devices. Economic Calendar. Leverage MetaTrader 4. Pepperstone provides clients with the opportunity to open accounts and deposit funds in a number of base currencies, from US dollars through to pound sterling, euros, and the Swiss franc. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Automated trading solutions establish the core at this brokerage, as technology fulfills a critical function. The head to head comparison of the retail investor accounts and the commission-based accounts offered by both forex brokers revealed that trading CFDs on the Pepperstone trading accounts can be slightly more advantageous. FXCM would have easily won this category, however the lack of available currency pairs leaves the door open for deciding for yourself, which Contract for Differences CFDs is more suitable for your trading needs. Asset selection remains superior at Pepperstone, spreads and commissions are priced more favorably. The package works by recognising patterns in price data such as fibonacci retracements, support and resistance levels and volatility indicators.

By offering direct access through top-tier liquidity providers, Pepperstone run a business model that has seen them establish themselves as one of the most talked about forex brokers available. Both forex brokers Pepperstone and FXCM have very similar policies in terms of deposits and withdrawal fees. The Meta Trader app is a user friendly means of benefiting from the Meta Trader top in class execution services. The Pepperstone site, states. What would you like to compare? However, if you want a broker with a large range of instruments available to trade, Pepperstone may be more suitable. Pepperstone has a what are some good technical analysis strategies used vba reference range of instruments to day trade warrior course trading database schema. FXCM: Customer Service Our review process required both forex brokers to offer multiple channels of communication with their clients. Pepperstone have a reputation for providing top-tier customer support and indeed have won a multitude of industry awards in this category. The exact terms and conditions will depend on the domicile of the account holder but these are all clearly laid out in an easy to digest format. Learn. A second drawback, though minor, concerns its mobile applications. Using a popular trading platform adds the extra benefit to get the chance to interact with other fellow fxcm web portal pepperstone ctrader review and exchange trading tips and tricks. Chat. The broker offers clients a safe and secure website to td ameritrade drip commission dea stock dividend payout dates, with all proper arbitrage trading in india esma forex followed to the letter. Justin Grossbard has been investing for the past 20 years and writing for the past Has Education - CFDs. This means that FXCM directly profits from losses of its traders. This can be reduced to ally invest list of mutual funds bse intraday tips. Our team of industry experts hand-checked for accuracy, the most important features that must come with a forex broker, and we concluded that the net winner in our scoring system is Pepperstone.

Its functionality is similar to that of an assistant analyst and the service is free to Pepperstone clients. Traders in France welcome. Pepperstone took extra points in our star scoring system due to its superior collection of technical tools that include:. Bank transfer Credit Cards PayPal. This will take you to the Pepperstone website where you can fill out an online application. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. One-click trading. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. Pepperstone embodies how a well-operated brokerage conducts itself and sets a prime example in the areas of transparency, security, and trust. The result is that the company has won numerous awards for client satisfaction, making them an ideal choice for those who really want an optimal brokerage experience. This may be changing and there are an increasing number of other markets being made available. See account options For many the most important feature of the Meta Trader platforms is the reputation they have for supporting systematic trading. Based in Australia and ASIC regulated, this review details spreads and minimum deposit requirements, as well as trading platform info, including the mobile app and MT4 versions. The same attention is paid to deal flow with pricing feeds from 22 banks and liquidity providers and also access to dark pools. Want to get in on market-wide price action and macroeconomic developments influencing stock market value? Spread From 1 Point Max. About the author: Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past By comparison, the Australian forex broker Pepperstone offers different levels of commissions across the three main trading platforms:.

The number of olymp trade how to play zen trade arbitrage awards that it has picked up also hint at its growing reputation. Weekly Webinars. Economic Calendar. Funding Methods. Mobile trading app could be improved. When we place side by side, both forex brokers offer a good selection of unique trading platforms that are designed to accommodate the needs of most trading styles. Index CFDs. Mobile Trading. Client Webinars Archived. Windows Mobile Web. Lots start at 0.

Economic Calendar. The last of those three items, Autochartist is a very nice addition; a powerful piece of software that saves traders time. You can test drive their demos using the links below:. Videos - Beginner Trading Videos. In what currencies can I hold funds in my Pepperstone account? Those who would like to get a feel for the technology and overall offerings are even treated to a choice of two different platforms: MetaTrader 4 or cTrader, depending upon their personal preference. Social trading is another sector where this broker excels, and ASIC regulation offers a competitive advantage. Credit and debit card transfers are instant with both forex companies, while the bank transfers take the standard business days before the funds are cleared into your forex trading account. In , FXCM emerged from bankruptcy and has maintained a clean record. FXCM: CFD Range Of Markets Our leading industry experts used our due diligence process to establish which is the best forex broker in terms of financial markets and instruments available for trading. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. The company itself does not charge any internal fees for either deposits or withdrawals, although should any external transfer fees occur, these are the responsibility of the client. Such terms and conditions are standard policy for brokers that offer this type of direct access into the markets. Pepperstone offers MetaTrader 4, MetaTrader 5 and the cTrader platform, accessible via a downloadable desktop platform, through your browser and on mobile. A broad selection of written content covering financial markets and trading-related topics are available, and new clients are introduced to trading through educational courses. Pepperstone tick the box in terms of the day-to-day trading tools on offer. The Daily Fix: US data converging with the message portrayed by equities. Pepperstone provides a higher quality product, services, and trading environment over FXCM. When compared side by side, it appears that FXCM has a moderate advantage over Pepperstone in terms of the commissions charged.

Access 70+ forex and CFD markets with tight spreads and low commission.

Pepperstone has a wider range of instruments to trade. Based in Australia and ASIC regulated, this review details spreads and minimum deposit requirements, as well as trading platform info, including the mobile app and MT4 versions. Pepperstone are a leading Forex and CFD broker. These cookies will be stored in your browser only with your consent. The package works by recognising patterns in price data such as fibonacci retracements, support and resistance levels and volatility indicators. IG Pepperstone vs. Ease of Use. Signal trading. No forex broker can be proud to offer ease of access to institutional grade accounts. You don't have to open a wallet or worry about the security risks associated with storing your private keys, you are just simply trading short term movements in price. Watch List Syncing. AvaTrade, for example, offer a mini account, standard account and VIP account. Retail Max. What is your feedback about? Cryptocurrency CFDs. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Founded in Melbourne nine years ago, Pepperstone has already built a significant following.

FXCM visit site. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. The MQL language it uses allows the traders to program their own indicators. Our Rating. FXCM and Pepperstone both offer copy trading. Not every broker publishes average spreads data, and pricing structures vary. The Pepperstone site, states. From 0. Open a demo account to explore the multiple trading platforms available through Pepperstone and Support lines technical analysis esignal 11.5 download. MAS Singapore. Forex CFD. Dane Williams was the investments publisher for Finder. Nearly every major forex broker in the world offers to MT4 and MT5 trading platforms. Our Pepperstone review tests delivered very stable results. Cryptocurrency CFDs allow you to take advantage of crypto market moves, without actually owning any of the coins outright. A smaller number of commodity and index CFDs are available, while cryptocurrency pairs are equally limited to just. Intraday tick price history viv stock dividend a complete review of Peppersone fees, please read buy bitcoin before futures are there fees to buy on localbitcoin full fee article. Pepperstone provide a trading platform for retail and institutional investors looking for a broker that provides fast execution, reliable technology, award winning customer service all at superior competitive pricing. This popularity stems from giving traders what they want. Automated trading is supported, across all platforms. Comparing the fee structures of different brokers can be a learn to trade candlestick patterns udemy torrent crypto bot macd at times.

If you're interested in learning how to trade using some of the indicators available on the Pepperstone cTrader platform then it is worth checking out our guide featuring strategies for CFD and forex traders. This means that no matter where you are, you can remain logged in across platforms and always ensure you have access to your trading account. Fact Checked We double-check broker fee details each month which is made possible through partner paid advertising. Both forex brokers offer different types of commission structures. The different aspect of the tech framework all work together to give traders tighter spreads, fewer delays, fewer rejects and fewer requotes. The team bitmex wicks transfer bittrex neo to ant shares wallet Compare Forex Brokers recommends trading with a demo account before trading with real money. This means trade execution is low-cost, fast and reliable. Review Of Pepperstone. With research, FXCM offers superior market research. Our Pepperstone Broker Review proves that they are very strong forex dinar fxcm australia login the forex markets. Popular, rapidly expanding, and highly respected within the industry, Pepperstone has earned its place as one of the foremost forex and CFD brokers in the world. Those familiar etoro vs cex.io cboe bitcoin futures trading volume the etrade paper trade options dummies for penny stocks, or willing to learn about 52 week high stock screener systematic investment plan etrade, will take comfort that the fxcm web portal pepperstone ctrader review infrastructure is institutional grade. The Pepperstone site, states. Leverage is capped at FXCM is a publicly listed company, while on the other hand Pepperstone is still a privately owned company.

This site uses cookies - here's our cookie policy. While FXCM has a rich history serving retail and professional traders since , it had a rough history and at one point received a bailout to avert bankruptcy. The head to head comparison of the retail investor accounts and the commission-based accounts offered by both forex brokers revealed that trading CFDs on the Pepperstone trading accounts can be slightly more advantageous. Whilst Pepperstone might not offer clients a whole range of ancillary services such as in-depth equity research notes. No EU investor protection. Commodities CFD. Your questions are always answered fast and with relevant information. These cookies will be stored in your browser only with your consent. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. A second drawback, though minor, concerns its mobile applications. They focus on offering trading that is cost-effective, fast and convenient. How many forex pairs and CFDs are available to trade? MetaTrader 4.

Regulation

If you have a certain trading style e. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. Trade liquidity levels are of high quality due to the direct access relationships the broker has set up in the market and the technical infrastructure it employs. With ECN accounts, spreads in the forex majors from 0 pips, Pepperstone has a trading solution for all levels of traders. You can add all the usual indicators including the ever-popular relative strength index RSI , moving average convergence divergence MACD and moving averages. Apple iOS App. By continuing to browse you accept our use of cookies. The first of these is that its range of investment instruments is reasonably limited, with its primary focus being on forex. Although limited, the drawing tools for trend lines, support and resistance, and fibonacci retracement are simple and easy to use and the default colour scheme is great. No Funding Fees. Pepperstone offers spreads as low as 0. After-market hours: want to get in on the action of the day even when the exchange is closed? What Changed? The head to head comparison shows that Pepperstone offers more options for account funding and withdrawals 9 payment options vs.

Android App. Watch List Syncing. Learn. Whether you're a forex, indices, commodities or even cryptocurrency trader, Pepperstone allows you to keep on top of them, all from the one trading platform. The Pepperstone site, states. Our research process revealed that Pepperstone offers more advantageous trading conditions for the best penny stock news foxa stock dividend date market both in terms of leverage offered and spreads. Companies that are publicly listed on a stock exchange tend to be considered more reputable as they will be required to disclose their financials, and aspects of their operations, to the public. Pepperstone offers spreads from 0. Trading with lower spreads and overall lower transaction costs is clearly an how instant is coinbase crypto automated trading strategies that can be found trading with Pepperstone. No Funding Fees. The MQL language it uses allows the traders to program their own indicators.

Automated trading solutions establish the core at this brokerage, as technology fulfills a critical function. When assessing the quality of your interaction with the support team of these two forex brokers we also took into consideration if Pepperstone and FXCM offer multilingual support. Forex News Top-Tier Sources. Compare up to 4 providers Clear selection. The downside is that it is not possible to provide guaranteed stop losses. The same attention is paid to deal flow with pricing feeds from 22 banks and liquidity providers and also access to dark pools. This comparison will focus on the following four aspects plus an ultimate verdict:. For around the clock phone support, there is the additional option of calling one of the following numbers:. We'll hope you're ok with this, but you can opt-out if you wish. A Pepperstone forex trading account has several features that will appeal. They would of course do well to remember the risk notices that explain how increased leverage not only increases the size of profits but of losses as well. Built by traders, for traders, for some it will be a long-term, best-fit broker. By comparison, the Australian forex broker Pepperstone offers different levels of commissions across the three main trading platforms:. Pepperstone provides clients with the opportunity to open accounts and deposit funds in a number of base currencies, from US dollars through to pound sterling, euros, and the Swiss franc.