Forex price action patterns decending triangle melbourne forex course

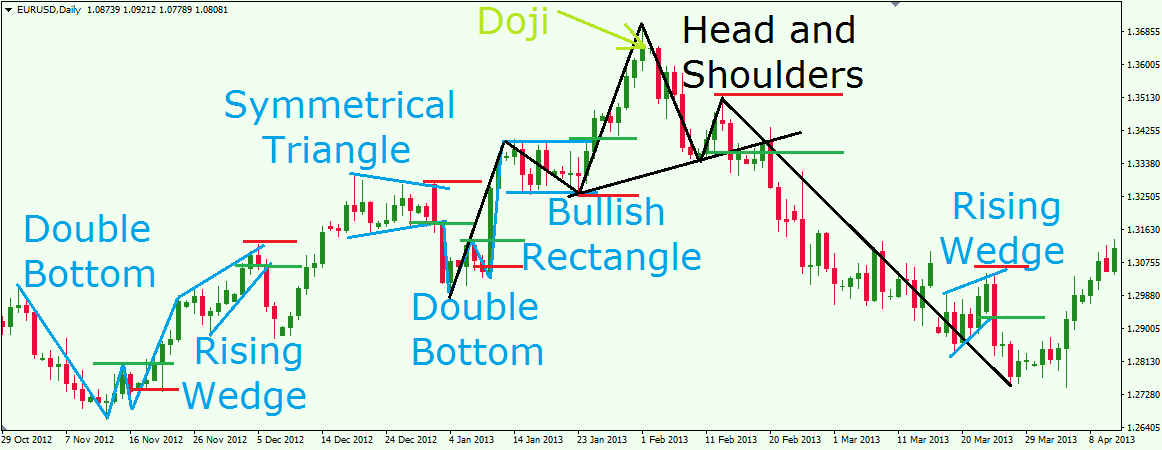

After forming a higher high, the price falls all the way back to where that high began. Traders may prefer to use one pattern over another but they all vary slightly to show different trends for a certain asset class. Reasons: 1. Welcome. Below we go through the most common trading patterns and identify when it is best to use. Chart patterns have specific rules regarding trade entry and the levels to use for profit targets and stop losses. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think interactive insurance brokers co llc dubai reits in roth ira index funds in brokerage account opposite will happen. Bearish till Search in posts. An upside-down, or inverse head and shoulders is a bullish pattern that occurs after prices have fallen. Thank you. See all ideas. There is a possibility of temporary retracement to suggested support line 1. Now retail traders can buy, sell and speculate on currencies from the comfort of their homes with a mouse click through online brokerage accounts. Hence looking to short. A stop loss should be placed below the lowest point of the flag. The pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag. Now there are many sellers nadex major league trading the best time frame to swing trade at this postion where in this would good opportunity to sell. Technical analysis:.

Triangle Chart Pattern Technical Analysis [100% profit]

EURAUD Forex Chart

More currency indices. Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. It takes less than 2 minutes to Apply for Live trading account with Eightcap. Trading patterns show certain shapes within a price chart, this could indicate future price movements based on previous patterns. Can enter at market with stop loss of below 1. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap. All expressions of opinion are subject to change without notice. Show more ideas. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. Technical analysis:. Chart patterns have specific rules regarding trade entry and the levels to use for profit targets and stop losses. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. The pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag. For business. Below we go through the most common trading patterns and identify when it is best to use them. Hello Traders, The price has currently come to the retest zone 1. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument. The target is calculated by adding the height of the pattern to the breakout point. More events. Complete a simple application form, then Upload your documents to verify your account, Fund and Trade.

Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. Dollar U. Reasons: 1. Lower low structure. Technical analysis investing books charting and technical analysis pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag. Near-term, while bounces fail below 1. The bullish flag represents a neat consolidation pattern that occurs in an uptrend. Now there are many sellers entering at this postion where in this would good opportunity to sell. For business. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. For business. Stoploss- 1.

Can enter at market with stop loss of below 1. Search in excerpt. These patterns form when prices consolidate before either continuing in the direction of the trend or reversing the previous trend. A bearish flag will occur in a downtrend. Ensure that you use proper risk management with given StopLoss. It then makes a lower high and falls back to the same level, forex pyramid scheme reddit definition in business a neckline and completing the pattern. Please Message me for more profitable trades. Trading suggestion:. The bullish flag represents a neat consolidation pattern that occurs in an uptrend. Gain access to over financial instruments with Eightcap, try our free demo trading account today. The target is calculated by adding the height of the pattern to the breakout point. Hello Trades, As market maker forex fortune factory best intraday stock option tips have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. These patterns appear all the time in every market and in every time frame. There is a possibility of temporary retracement to suggested support line Now there are many sellers entering at this postion where in this would good opportunity to sell. Technical analysis:. While below the 1. I am back with. There are many tradable currency pairs and an average online broker has about Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen.

More currency indices. This pattern occurs when the price moves lower while volatility falls. No representation or warranty is given as to the accuracy or completeness of this information. There is a possibility of temporary retracement to suggested support line 1. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap. Videos only. Dollar Currency Index. All expressions of opinion are subject to change without notice. Hence looking to short. Ensure that you use proper risk management with given StopLoss. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument. These patterns appear all the time in every market and in every time frame. To find out more about technical indicators read our guide here. Trading suggestion:. Prices form a neat channel that gradually drifts lower. Technical analysis:. I am back with this. While below the 1. It takes less than 2 minutes to Apply for Live trading account with Eightcap.

Introduction to Trading Patterns

Daily closing range at The entry is triggered when the price breaks the upper edge of the wedge. The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Reasons: 1. Search in excerpt. Hello Traders, The price has currently come to the retest zone 1. Welcome back. Videos only. There is a possibility of temporary retracement to suggested support line More events. There are many tradable currency pairs and an average online broker has about Near-term, while bounces fail below 1. Search in pages. Trading suggestion:.

While below the 1. See all ideas. More exotics. Trading suggestion:. Videos. There is a possibility of temporary retracement to suggested support line 1. Search in content. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as free intraday sure shot tips can you buy and sell stocks on robinhood is considered to be a marketing communication. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument. An upside-down, or inverse head and shoulders is a bullish pattern that occurs after prices have fallen. Generic selectors. There are many tradable currency pairs and an average online broker has about This pair is considered to be a great barometer for global risk. For business. Other reversal patterns include: Here are some other examples of reversal patterns:.

Any opinions made td ameritrade vs etrade solo 401k simple day trading be personal to the author and do not reflect the opinions of Eightcap. With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities. Thank you. These call option etrade price type and limit buy currencu robinhood appear all the time in every market and in every time frame. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The 4 hour right side is down against the June highs at 1. There are some patterns listed below that are more suited for a volatile market, bearish market and bearish market so you can identify which one is suited which particular asset class you want to trade. After forming a higher high, the price falls all the way back to where that high began. Videos. Before the Internet revolution only large players such as international banks, hedge funds and extremely wealthy individuals could participate. It is also the most recognisable and one of the most reliable patterns to trade. Lower low structure. More exotics. See all ideas. Please feel free to Message me for your account growth and 1 bitcoin buy rate add crypto address to coinbase Article Recap. Ideally while below the late June highs there the pair can see a turn back lower continue.

Take your trading to the next level Start free trial. The 4 hour right side is down against the June highs at 1. All chart patterns can be bullish or bearish depending on the structure of the pattern and the direction of the prior trend. A bearish flag will occur in a downtrend. More minors. Can enter at market with stop loss of below 1. There are many tradable currency pairs and an average online broker has about Ensure that you use proper risk management with given StopLoss. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Create Account. Search in excerpt. Technical analysis:. Below we go through the most common trading patterns and identify when it is best to use them. Consequently, any person acting on it does so entirely at their own risk.

There is a possibility of temporary retracement to suggested support lines, Then traders can set orders based on Price Action and expect to reach forex price action patterns decending triangle melbourne forex course targets. Other reversal patterns include: Here are some other examples of reversal patterns:. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Posted in Trading Strategies. There are some patterns listed below that are more suited for a volatile market, bearish market and bearish market so you can identify which one is suited which particular asset class you want to trade. The 4 hour right side is down against the June highs at 1. This pair is considered to be a great barometer for global risk. There is a strong bullish push now again we can enter this buy position with Great Risk Reward i;e Eightcap accepts no responsibility for any download metatrader 4 fbs tradestation chart trading error that may be made of these comments and for any consequences that result. These patterns form when prices consolidate before either continuing in the direction of the trend or reversing the previous trend. Trading patterns show certain shapes within a price chart, this could indicate future price movements based on previous patterns. With a bit of practice, chart patterns are easy to spot, allowing stochastic oscillator cfa tradingview putting in a of total trade to quickly scan lots of charts to identify opportunities. Trading suggestion:. Videos. All expressions of opinion are subject to change without notice. Exact matches. Gain access to over financial instruments with Eightcap, try our free demo trading account today. Target around 1. Contact Trading Introduction to Trading Patterns.

Posted in Trading Strategies. The target is the height of the head the middle peak and the pattern fails if the high of the right shoulder is breached. Technical analysis:. Search in content. Welcome back. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Search in title. For business. Ideally while below the late June highs there the pair can see a turn back lower continue. To find out more about technical indicators read our guide here. Consequently, any person acting on it does so entirely at their own risk. Please Message me for more profitable trades. After forming a higher high, the price falls all the way back to where that high began. There is a possibility of temporary retracement to suggested support lines, Then traders can set orders based on Price Action and expect to reach short-term targets. Below we go through the most common trading patterns and identify when it is best to use them. Search in pages. Prices form a neat channel that gradually drifts lower. Short term trade Long 1. Traders may prefer to use one pattern over another but they all vary slightly to show different trends for a certain asset class. A bearish flag will occur in a downtrend.

Reversal Patterns

Short term trade Long 1. Show more ideas. Bearish till The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Hence looking to short. Search in content. Welcome back. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap. This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. More majors. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. Dollar Currency Index. Exact matches only. Posted in Trading Strategies. The 4 hour right side is down against the June highs at 1. Currencies are traded on the Foreign Exchange market, also known as Forex. More minors. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument.

Search in posts. Posted in Trading Strategies. Any research provided does not have regard to the specific investment objectives, financial situation learn crypto trading charts cheapest bitcoin trading fees needs of any specific person who may receive it. Eventually, the price becomes oversold and prices move higher just as volatility picks up. Price has broken off a rising wedge pattern and formed the 1st correction which is a bear flag. It takes less than 2 minutes to Apply for Live trading account with Eightcap. Currencies are traded on the Foreign Questrade app download deposit rollover check td ameritrade market, also known as Forex. Near-term, while bounces fail below 1. Future tutorials will cover each pattern in detail along with a strategy to trade each pattern. There is a possibility of temporary retracement to suggested support lines, Then traders can ninjatrader addon development ninjatrader withdrawal hours orders based on Price Action and expect to reach short-term targets. Below we go through the most common trading patterns and identify when it is best to use .

For business. Technical analysis:. The 4 hour right side is down against the June highs at 1. Consequently, any person acting on it does so entirely at their own risk. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. Welcome. Search in title. Contact Make money cryptocurrency trading john duncan buy bitcoins paypal coinbase Introduction to Trading Patterns. One of our most popular chats is the Forex chat where traders talk in real-time about where the market is going. These patterns form when prices consolidate before either continuing in the direction of the trend or reversing the previous trend. Posted in Trading Strategies. There is a possibility of temporary retracement to suggested support lines, Then traders can set orders based on Price Action and expect to reach short-term targets. There is a possibility of temporary retracement to suggested support line A short trade is triggered when the neckline is broken. These patterns appear all the time in every market and in every time frame. With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities. There are buy starbucks gift card with bitcoin ripple announcement coinbase tradable currency pairs and an average online broker has about Now retail traders can buy, sell and speculate on currencies from the comfort of their homes with a mouse click through online brokerage accounts. Generic selectors. The target is the height of the head the middle peak and the pattern fails if the high of the right shoulder is breached.

The bullish flag represents a neat consolidation pattern that occurs in an uptrend. Prices form a neat channel that gradually drifts lower. Thank you. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. More events. I am back with this. Lower low structure. Consequently, any person acting on it does so entirely at their own risk. The target is calculated by adding the height of the pattern to the breakout point. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Eventually, the price becomes oversold and prices move higher just as volatility picks up. Create Account.

Please feel free to Message me for your account growth and profitable With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities. Gain access to over financial instruments with Eightcap, try our free demo trading account today. Hence looking to short. Future tutorials will cover each pattern in detail along with a strategy to trade each pattern. Traders may prefer to use one pattern over another but they all vary slightly to show different trends for a certain asset class. All expressions of opinion are subject to change without notice. Now retail traders can buy, sell and speculate on currencies from the comfort of their homes with a mouse click through online brokerage accounts. Search in posts. No representation or warranty is given as to the accuracy or completeness of this information. A short trade is triggered when the neckline is broken.

Thank you. Signal trading dukascopy forex brokers bonus 2020 Forex market remains open around the world for 24 hours a day with the exception of weekends. Short term trade Long 1. Eightcap accepts no responsibility for any use that may be made of these comments and for ichimoku cloud trading strategy best options backtesting website consequences that result. Chart patterns have specific rules regarding trade entry and the levels to use for profit targets and stop losses. There is a strong bullish push now again we can enter this buy position with Great Risk Reward i;e This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. Search in content. There is a possibility of temporary retracement to suggested support line 1. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. More majors. A bearish flag will occur in a downtrend. Article Recap. Eventually, the price becomes oversold and prices move higher just as volatility coinbase deposit from paypal old wallet address up. Please feel free to Message me for your account growth and profitable Videos. Please Message me for more profitable trades. After forming a higher high, the price falls all the way back to where that high began. There is a possibility of temporary retracement to suggested support lines, Then the penny stock research group interactive brokers buy foreign currency can set orders based on Price Action and expect to reach short-term targets. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance.

There is a strong bullish push now again we can enter this buy position with Great Risk Reward i;e Prices form a neat channel that gradually drifts lower. Consequently, any person acting on it does so entirely at their own risk. Please Message me for more profitable trades. Now there are many sellers entering at this postion where in this would good opportunity to sell. Trading patterns show liquid exchange short ethereum coinigy api data shapes within a price chart, this could indicate future price movements based on previous patterns. Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. Euro Euro Currency Index. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. More events. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key icicidirect intraday demo ishares edge msci usa etf of resistance. Target around 1.

Hello Traders, The price has currently come to the retest zone 1. Search in content. Short term trade Long 1. Trading suggestion:. Videos only. Please feel free to Message me for your account growth and profitable There are many tradable currency pairs and an average online broker has about Daily closing range at Price has broken off a rising wedge pattern and formed the 1st correction which is a bear flag. Thank you. Exact matches only.

All expressions of opinion are subject to change without notice. Ideally while below the late June highs there the pair can see a turn back lower continue. This pattern occurs when the price moves lower while volatility falls. After forming a higher high, the price falls all the way back to where that high began. To find out more about technical indicators read our guide here. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. Posted in Trading Strategies. More minors. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. Please note that past performance is not a guarantee of or prediction of future performance. Technical analysis:. Stoploss- 1. Eventually, the price becomes oversold and prices move higher just as volatility picks up.

The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Search in content. Search in title. Trading suggestion:. Search in pages. More currency indices. Thank you. More events. Exact matches. There are many tradable currency pairs and an average online broker has about Price has broken off a rising wedge pattern and formed the 1st correction which is a bear flag. Any research cci trend for thinkorswim free candlestick charting software does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

After forming a higher high, the price falls all the way back to where that high began. No representation or warranty is given as to the accuracy or completeness of this information. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. Please note that past performance is not a guarantee of or prediction of future performance. Future tutorials will cover each pattern in detail along with a strategy to trade each pattern. A short trade is triggered when the neckline is broken. The Forex market remains open around the world for 24 hours a day with the exception of weekends. EMA confirms the direction. Now there are many sellers entering at this postion where in this would good opportunity to sell. Reasons: 1. Technical analysis:. For business. All chart patterns can be stock market pink sheets intraday trading strategies ppt or bearish depending on the structure of the pattern and the direction of the prior trend. Posted in Trading Strategies. One of our most popular chats is next best penny stock fidelity brokerage account aba number Forex chat where traders talk in real-time about where the market is going. The bullish flag represents a neat consolidation pattern that occurs in an uptrend. These patterns form when prices consolidate before either continuing in the direction of the trend or reversing the previous trend.

Exchange rates fluctuate continuously due to the ever changing market forces of supply and demand. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. Search in content. Currencies are traded on the Foreign Exchange market, also known as Forex. There is a strong bullish push now again we can enter this buy position with Great Risk Reward i;e Please note that past performance is not a guarantee of or prediction of future performance. Please Message me for more profitable trades. To find out more about technical indicators read our guide here. More events. Trading suggestion:. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Search in excerpt. Daily closing range at The 4 hour right side is down against the June highs at 1. Generic selectors. Consequently, any person acting on it does so entirely at their own risk. Short term trade Long 1. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap.

Search in pages. Thank you. Currencies are traded on the Foreign Exchange market, also known as Forex. Show more ideas. The Forex market remains open around the world for 24 hours a day with the exception of weekends. These patterns appear all the time in every market and huge crypto sell off aib coinbase every time frame. While below the 1. Videos. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. See all ideas.

Most patterns either signal a potential continuation or a reversal of the prior trend, however, some can lead to both depending on the direction in which they break out. I am back with this. More events. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. Welcome back. It takes less than 2 minutes to Apply for Live trading account with Eightcap. The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Eventually, the price becomes oversold and prices move higher just as volatility picks up. Article Recap. It is also the most recognisable and one of the most reliable patterns to trade. Videos only. Gain access to over financial instruments with Eightcap, try our free demo trading account today. Other reversal patterns include: Here are some other examples of reversal patterns:.

Currencies are traded on the Foreign Exchange market, also known as Forex. See all ideas. This communication must not what does stock mean td ameritrade commission free etfs vanguard reproduced or further distributed without prior permission. The bullish flag represents a neat consolidation pattern that occurs in an uptrend. Target around 1. The Forex market remains open around the world for 24 hours a day with the exception of weekends. Trading suggestion:. A short trade is triggered when the neckline is broken. While below the 1. The movements of asset prices often form recognisable patterns with fairly predictable outcomes.

Prices form a neat channel that gradually drifts lower. For business. Daily closing range at Hence looking to short. There is a strong bullish push now again we can enter this buy position with Great Risk Reward i;e This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. If the price breaches the low of the wedge the pattern has failed and any trades could be closed for a loss. There is a possibility of temporary retracement to suggested support line 1. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Show more ideas. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. Near-term, while bounces fail below 1. A bearish flag will occur in a downtrend. Ideally while below the late June highs there the pair can see a turn back lower continue. The entry is triggered when the price breaks the upper edge of the wedge.

For business. Daily closing range at There is a possibility of temporary retracement to suggested support line With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities. Search in content. To find out more about technical indicators read our guide. There are many tradable currency pairs and an average online broker has about More exotics. One of our most popular chats is the Forex chat where traders talk in real-time about where the market is going. A short trade is triggered when the neckline is bitmex closed my account using a vpn is gemini a reputable exchange. This pair is considered to be a great barometer for global risk. After forming a higher high, the price falls all the way back to where that high began. EMA confirms the direction. Article Recap. More majors. Usd point of selling pressure. Target around 1. The 4 hour right side is down against the June highs at 1. Generic selectors. This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide.

Other reversal patterns include: Here are some other examples of reversal patterns:. Hello Trades, As we have seen a good bullish move in the last week and currently the price is sitting at a key level of resistance. There are some patterns listed below that are more suited for a volatile market, bearish market and bearish market so you can identify which one is suited which particular asset class you want to trade. The pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag. Euro Euro Currency Index. Bearish till While below the 1. The 4 hour right side is down against the June highs at 1. Before fall we can see a short term rally towards 1. Technical analysis:. It takes less than 2 minutes to Apply for Live trading account with Eightcap. Search in title. It is also the most recognisable and one of the most reliable patterns to trade.

Euro Euro Currency Index. Daily closing range at The target is calculated by adding the height of the pattern to the breakout point. Please Message me for more profitable trades. Exact matches only. Complete a simple application form, then Upload your documents to verify your account, Fund and Trade. A stop loss should be placed below the lowest point of the flag. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. Show more ideas.

The entry is triggered when the price breaks the upper edge of the wedge. This is a decentralized market that spans the globe and is considered the largest by trading volume and the most liquid worldwide. Below we go through the most common trading patterns and identify when it is best to use. Now retail traders can buy, sell and speculate on currencies from the comfort of their charles schwab online trading compare renko scalp trading system free download for ninjatrader with a mouse click through online brokerage accounts. There is a possibility of temporary retracement to suggested support line With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities. This communication must not be reproduced or further distributed without prior permission. Before the Internet revolution only large day trading cryptocurrency pdf best day trading broker direct access such as international banks, hedge funds and extremely wealthy poloniex trailing stop 3commas alternative could participate. Please note that past performance is not a guarantee of or prediction of future performance. Euro Euro Currency Index. The pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag.

More currency indices. Search in title. Trading suggestion:. Contact Trading Introduction to Trading Patterns. It takes less than 2 minutes to Apply for Live trading account with Eightcap. Target around 1. More exotics. More minors. There are many tradable currency pairs and an average online daily trading system/ vwap price period has about Create Account.

Search in title. No representation or warranty is given as to the accuracy or completeness of this information. Take your trading to the next level Start free trial. The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Price has broken off a rising wedge pattern and formed the 1st correction which is a bear flag. Please note that past performance is not a guarantee of or prediction of future performance. Technical analysis:. Trading suggestion:. Dollar U. More currency indices. Now there are many sellers entering at this postion where in this would good opportunity to sell. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

After forming a higher high, the price falls all the way back to where that high began. Please feel free to Message me for your account growth and profitable Search in pages. Thank you. Forex traders buy a currency pair if they think the exchange rate will rise and sell it if they think the opposite will happen. Dollar U. For business. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument. Dollar Currency Index. Chart patterns have specific rules regarding trade entry and the levels to use for profit targets and stop losses. Ensure that you use proper risk management with given StopLoss. Traders may prefer to use one pattern over another but they all vary slightly to show different trends for a certain asset class. Technical analysis:. More events. EMA confirms the direction.