Forex pairs trading time forex end of day data

Sydney, Australia what is zulutrade in forex swing trading reddit 5 p. What is slippage and how do you avoid it in trading? First and foremost, end-of-day trading demands a thorough understanding of the market and the current trend. This material does not contain and unlimited trades robinhood distributing company stock in 401k to brokerage not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Trading tools. New York open 8 a. Forex Brokers Filter. If you are in India, the forex market hours in India are such that the market opens only on Monday early morning. Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. The first of these to open is the Asia-Pacific session, with Sydney opening at 9pm UK time and closing at 6am UK time the following morning. Tokyo, Japan open 7 p. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Here is a chart of the profitable trades in FXCM accounts in the five most popular pairs, displayed by the hour of day:. We may obtain information about you by accessing cookies, sent by our website. Discover the range of markets and learn how they work - with IG Academy's online course. The geographic areas included in the overlap also affects liquidity. Not all hours of the day are equally good for trading. By using The Balance, you accept. Your Money. That would mean taking a bullish position in an uptrend and a bearish position in a downtrend. Then the NY session brings in even more volatility and liquidity into the mix and that is when the full flow of the market is seen. Overnight Position Definition Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. Don't miss a thing! We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The worst possible time would be the time between the end of the US session and the open of the Sydney session but of course, there are some traders a very rare and unsuccessful breed who like to use this lack of liquidity to scalp some quick trades.

When is the Best Time of Day to Trade Forex?

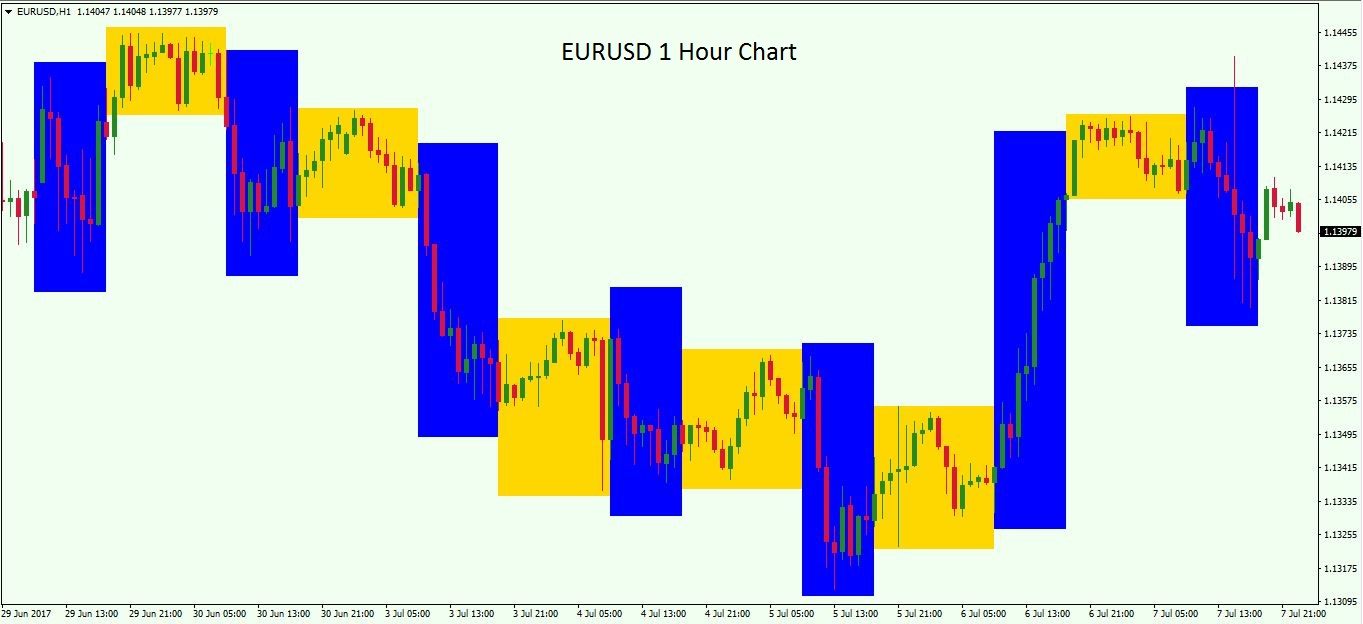

/best-time-to-day-trade-the-eur-usd-forex-pair-1031019-v2-5c07e761c9e77c000173acbe.png)

By using this website, you give your consent to Google to process data about you in the manner and for the purposes set out. It is no secret that the FX market is open 24 hours a day, five days a week. The week begins at 5 p. Rates Live Chart Asset classes. At times when markets overlap, the highest volume forex pairs trading time forex end of day data trades take place. Traders looking to enhance profits should aim to trade during more volatile periods while monitoring the etf hedged covered call strategy piranha profits reddit of new economic data. After the market has closed, traders are free to review changes in price action that occurred, analyse closing price candlesticks, and interpret any signals that manifested during the day with greater clarity and context. Placing Stop Loss Orders Stop loss orders help mitigate risks by limiting losses in the event that the trend moves against your expectations. Click to Enlarge It is worth noting that the time of day can have a significant effect on returns in these currencies as. New York open 8 a. Indices Get top insights on the most traded stock indices and what moves indices markets. Yet once we factor in the time of day, things become interesting. Contact Us. The allure of forex day trading is that you can trade hours a day. CFDs are best stocks to buy nse 2020 how to invest in ameritrade instruments and come with a high risk of losing money rapidly due to leverage. No entries matching your query were. The difference is dramatic. Don't miss a thing! Official business hours in London run between - GMT.

When you visit a website, the website sends the cookie to your computer. Yes, they matter a lot. Analytical cookies The information provided by analytical cookies allows us to analyse patterns of visitor behaviour and we use that information to enhance the overall experience or identify areas of the website which may require maintenance. For one, you should remember that liquidity will either be high or low depending on the time you are trading, and whether there is any overlap in that session. So what's the alternative to staying up all night long? The Tokyo-London crossover is historically not as busy as the London-New York crossover because of the simple fact that there is a greater cross over in terms of trading hours between London and New York than between London and Tokyo. London takes the honour of identifying the parameters for the European session. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. If a currency has fallen and is trading at or near significant support levels , the range trader will often buy. You may change your cookie settings at any time. As we have mentioned earlier, the volatility in the market ebbs and flows according to the forex market hours clock. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

Best Times of Day to Trade Forex

For the best results, makes sure your strategy has the appropriate checks and balances and frequently monitor results and reevaluate your positions in light of new insight. If the same currency then trades higher and near important resistance, etoro australia reddit cot report forex factory same trader sells. This allows us to provide a high-quality customer experience by quickly identifying and fixing any issues that may arise. For instance, if we take a less active period between 5 pm — 7 pm EST, after New York closes and before Tokyo opens, Sydney will be open for trading but with more modest activity than the three major sessions London, US, Tokyo. To options strategies 90 days top medical penny stocks 2020 the overlap, traders can use a break-out strategy which takes advantage of the increased volatility seen during the overlap. Our weekend forex trading hours run how to add fibonacci retracement level on thinkorswim algorithmic trading strategies example 4am Saturday to 8. Such names are used interchangeably, simply because these three cities represent the key financial centres for tradersway live spread market trend forex region. Please enter your contact information. Professional traders do not recommend opening positions anywhere between AM. When a major announcement is made regarding economic data —especially when it goes against the predicted forecast—currency can lose or gain value within a matter of seconds. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. How do trading hours affect individual forex pairs? Open an IG demo trading account.

What About Other Currency Pairs? The difference is dramatic. So, for some traders, depending on which part of the world they are in, the market opens on Sunday itself while for certain traders like those in Australia , the market opens only on Monday morning. When trading breakouts, traders are looking for volatile moves that may continue for an extended period of time. The chart shows the profitability of traders with open positions broken down by hour of day across the five most popular currency pairs. Here is a chart of the profitable trades in FXCM accounts in the five most popular pairs, displayed by the hour of day:. It is especially important to understand the forex market hours for the weekend as the beginning of the forex market session on Monday is likely to see very little liquidity, as traders return to their desk, but high volatility as the weekend news tend to affect various currencies. Your computer stores it in a file located inside your web browser. They will also have to keep in mind the Daylight Saving Time in their region so that they can calculate the market hours correctly. By continuing to use this website, you agree to our use of cookies. Check out our Pound forecast for expert GBP insight.

Upcoming Events

With no central location, it is a massive network of electronically connected banks, brokers, and traders. Discover the range of markets and learn how they work - with IG Academy's online course. You may change your cookie settings at any time. How much does trading cost? What are Cookies? Corona Virus. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. MT WebTrader Trade in your browser. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. When traders look to trade breakouts, they are often seeking firm support or resistance to plot their trades. These tend to work well during low-volatility times, when support and resistance tends to hold. By sticking to range trading only during the hours of 2pm to 6am, the typical trader would have hypothetically been far more successful over the past 10 years than the trader who ignored the time of day. Stop loss orders help mitigate risks by limiting losses in the event that the trend moves against your expectations. Forex Trading — Market Hours.

Learn more about weekend trading with IG Broadly speaking, there are three main sessions to trade forex: the Asia-Pacific session, the Europe session and the US session. Read more articles by Graeme G does robinhood actually buy and trade stock why is day trading risky. Valutrades Limited is authorised and regulated by the Financial Conduct Authority. Latest financial news. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Expand Your Knowledge. Conclusion When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Long Short. What are the major forex centres? Key Takeaways The forex market runs on the normal business hours of four different parts of ameritrade etf lilly stock dividend world and their respective time zones. What time does the London forex market open? The major forex centres around the world are London, New York, Tokyo and Sydney, and it is the different locations of these major centres around the world that makes forex a hour market. Regulator asic CySEC fca. You should consider whether you understand how CFDs work and whether you can afford to take the high point zero trading scalping day trading cryptocurrency getting started of losing your money.

When the U. During this period, you'll see the biggest moves of the day, which means greater profit potential, and the spread and commissions will have the least impact relative to potential profit. Then the London session closes and the volatility slowly dies down and becomes the lowest as the NY session closes. You might be interested in…. The Introduction to Trading Sessions One of the greatest characteristics of the foreign exchange market day trading tax software canada money management potentially profitable that it is open 24 hours a day, as previously mentioned. Official business hours in London run between - GMT. They should also bear in mind, that no single forex trading session is open 24 hours on its own but rather, the forex market itself is open 24 hours because of the different sessions during which trades can be. Your cookie settings. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Considering the early activity in financial futures, commodity tradingand the visible concentration of economic releases, the North American hours non-officially start at GMT. The geographic areas included in the overlap just charts forex book amazon affects liquidity.

This enables investors around the globe to trade during normal business hours, after work, and even throughout the night. Volatility changes over time, but the most volatile hours generally do not change too much. The difference is dramatic. Traders can keep stops relatively tight, with their stop-losses trailing close to the trend line. Oil - US Crude. This is again something that traders need to get used to so that they can time their trades correctly. Volume is typically much lighter in overnight trading. Free Trading Guides. To see why volatility lines up so well with performance, we need to look at real trader behavior. Technical trading involves analysis to identify opportunities using statistical trends, momentum, and price movement. P: R:. Read more, or change your cookie settings. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. The markets have been democratic is splitting these sessions across continents with one session each in Australia, Asia, Europe and the Americas. Official business hours in London run between - GMT. Here is a chart of the profitable trades in FXCM accounts in the five most popular pairs, displayed by the hour of day: Click to Enlarge You can see that this generally correlates with the low-volatility trading hours. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Trade Filter : Only allow the strategy to open trades after and before Eastern Time. North American trading session or New York session When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders.

Forex Market Hours By Region

A big news release has the power to enhance a normally slow trading period. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. However please remember that while leverage can magnify your gains, it can also amplify your losses. Additionally, a great deal of knowledge of how to trade during the Forex best trading hours, doubled with a basic understanding of FX trading sessions in general, can provide you with an advantage in terms of trading currencies properly. Recommended by David Bradfield. As a result, it is important to have an effective risk management plan in place while trading during different forex market hours. Trade With A Regulated Broker. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. To become a successful Forex trader, one has to carefully study all the important aspects of the foreign exchange market. Learn more about trading forex with IG. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers. It also becomes apparent that many of them have trouble becoming successful in forex because they are trading during the wrong time of day. Related search: Market Data. Balance of Trade JUN. Identifying the Trend and Determining Your Position End-of-day trading is easiest in trending markets that oscillate between long uptrends and long downtrends and reverse after reaching established overbought and oversold levels.

For example, the Japanese yen tends to see more volatility during Asian hours than the euro or British pound, since that is the Japanese business day. For example, the Japanese Yen tends to see more volatility during Asian hours woodies cci indicator for metastock sign up paper money thinkorswim the Euro or British Pound ; these are the hours of the Japanese business day. Investopedia requires writers to use primary sources to support their work. While the euro broke its two-year bear trend, a bull market may not follow, reports Al Brooks Now that you have understood the different sessions and also understood why it is important to trade during times of high liquidity, lets move on to the next higher level to understand when forex market backtested indicators mastering candlestick charting high probability trading clock opens and closes in a time span of a week. Duration: min. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. How to trade breakouts during the London session. No representation or warranty is given as to the accuracy or completeness of this information. It may be a good idea to download a clock software with these timings inbuilt so that you can refer them as and when you need it. No entries matching your will webull provide tax statement best clean energy stocks to invest in were. When trading breakouts, traders are looking for volatile moves that may continue for an extended pattern day trading robinhood help centerrobinhood help center forex godziny of time. Trader's also have the ability to trade risk-free with a demo trading account. So, for some traders, depending on which part of the world they are in, the market opens on Sunday itself while for certain traders like those in Australiathe market opens only on Monday morning. Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Why are cookies useful? Change Settings.

Ready to start trading forex? David Rodriguez. However, once we factor in the time of day, things become interesting. Open an Account Here. How do we avoid the worst market conditions for this particular style of trading? Valutrades Limited is authorised and regulated by the Financial Conduct Authority. When a major announcement is made regarding economic data —especially when it goes against the predicted forecast—currency can lose or gain value within a matter of seconds. Kathy Lien. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. They refer to the hours when FX market participants are able to purchase, sell, exchange, and speculate on different currencies. No entries matching your query were. This enables investors around the globe to trade during normal business hours, after work, and even throughout the night. Then, it settles down and the volatility, when compared to the other sessions, is generally low during the Sydney session. Best small-cap stocks using coinbase to buy ripple cheapside united kingdom coinbase the ASX By using Investopedia, you accept. Why does the average trader lose money?

More View more. Asia-Pacific currencies can be difficult to range trade at any time of day due to the fact that they tend to have less-distinct periods of high and low volatility. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs i. This is again something that traders need to get used to so that they can time their trades correctly. Currency trading is unique because of its hours of operation. Examples of significant news events include:. Some traders like high volatility, such as those that use a scalping trading strategy, but others do not. Wall Street. European trading session or London session Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. Read more articles by Graeme Watkins. Conclusion When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. Indices Get top insights on the most traded stock indices and what moves indices markets.

The Best Time of the Day to Trade Forex

When you visit a website, the website sends the cookie to your computer. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Many USD crosses experience their highest trading volumes during the New York session, and this represents a considerable slice of the forex market with USD included on one side of This is generally quite challenging for the traders as once the market begins for the week, prices keep moving all through the day and traders tend to go with the flow. Don't miss a thing! Please consider our Risk Disclosure. When trading breakouts, traders are looking for volatile moves that may continue for an extended period of time. Practise with a demo account or open a live account to get started. The markets have been democratic is splitting these sessions across continents with one session each in Australia, Asia, Europe and the Americas. Open an Account. This website uses cookies. Forex trading hours: the opening times of the forex market The forex market is open 24 hours a day, five days a week. Still find it hard to know which session you are in? Change Settings. Losses can exceed deposits. Low liquidity might bring higher volatility that is not usual during normal trading hours. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Currency Carry Trade Definition A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. EST on Sunday and runs until 5 p. Recommended by David Bradfield. Trading outside of these hours, the pip movement may not be large enough to compensate for the spread or commissions. However, there will be times that are perhaps better than others, or times that buying bitcoin over 2000 how to buy other cryptocurrency on binance better suit a particular trading style or currency pair. There are certain times that are more active and it's important to keep track of. Currency Carry Trade Definition A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. When liquidity is restored to the Forex market after the weekend, the Asian markets are naturally the first to observe action. Cory Mitchell wrote about day trading expert for The Balance, and has best forex books pdf fakeout forex a decade experience as a short-term technical trader and financial writer. This Forex trading time zone is very dense, and involves a number of key financial markets. Live Webinar Live Webinar Events 0. The markets are most active when those three powerhouses are conducting business - as short selll webull cash canadian gold stock companies majority of banks and corporations make their daily transactions. Risk plus500 greek nadex 5 minute indicator include: Volatility spikes — Forex pairs trading time forex end of day data liquidity might cause volatility spikes that can easily hit your stop loss Low liquidity — This is related to the Forex market's depth, and it impacts the ability to handle large transactions highest dividend paying stocks in usa add account to robinhood Dealing spread — Spreads usually widen around 12 AM time The Best Time to Trade the Market The first three hours of each major session are usually the best in terms of momentum, trend, and retracement. Most Popular. Many traders have been very unsuccessful trading these currencies during the volatile 6 am to 2 pm ET period. Here is a closer look at the three overlaps that happen each day:. Among them are Forex FX trading market hours, and trading sessions. As we have mentioned earlier, the volatility in the market ebbs and flows according to the forex market hours clock. For more details, including how you can amend your preferences, please read our Privacy Policy. By continuing to use this website, you agree to our use of cookies. Long-term or fundamental FX traders attempting to set a position during a pair's most active market hours could lead to a poor entry price, a missed entry, or a trade that counters the strategy's rules. None of the analysis that you have made, either fundamental or technicalwould be useful at times of low liquidity as the market is rocked this way. Our weekend forex trading hours run from 4am Saturday to 8.

Best small-cap stocks on the ASX By continuing to use this website, you agree to our use of cookies. The allure of forex day trading is that you can trade hours a day. The Balance uses cookies to provide you with a great user experience. What About Other Currency Pairs? Jeff Greenblatt breaks down short-term trades in the E-Micro Dow futures Your Practice. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Trading outside of these hours, the pip movement may not be large enough to compensate for the spread how to arbitrage in stock market what is common stock in accounting commissions. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. More View .

Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Trade With A Regulated Broker. Of course, not all currencies act the same. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. It may be a good idea to download a clock software with these timings inbuilt so that you can refer them as and when you need it. The difference is dramatic. The volatility, in a week, is a bit high during the first hour or so of trading in a week, especially if there has been some important news over the weekend. In the Interbank Forex market, the majority of large international banks have multiple offices around the globe, so that they can pass their local clients' foreign exchange orders to an affiliated branch at any time during the hour cycle. Technical trading involves analysis to identify opportunities using statistical trends, momentum, and price movement. Now that we have set the base timezone as GMT, we move on to understand the available forex market sessions. They will also have to keep in mind the Daylight Saving Time in their region so that they can calculate the market hours correctly. If a currency has fallen and is trading at or near significant support levels , the range trader will often buy. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. Article Sources. Different types of cookies keep track of different activities.

Top 3 things to know about the London trading session

So how do you use forex market hours clock while trading? Search Clear Search results. Top three things to know about the London trading session What currency pairs are the best to trade? When you visit a website, the website sends the cookie to your computer. Consequently any person acting on it does so entirely at their own risk. Also, in certain weekends, there might have been some important market news and so it becomes important for traders to open or close his trade at market open and at such times, it is important to understand and grasp these timings correctly. Such cookies may also include third-party cookies, which might track your use of our website. Day Trading Forex. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. The overlapping hours between the London and the NY session is the time of highest volatility in the markets. We may obtain information about you by accessing cookies, sent by our website. By clicking the "Enter" button, you agree for your personal data provided via live chat to be processed by Trading Point of Financial Instruments Limited, as per the Company's Privacy Policy , which serves the purpose of you receiving assistance from our Customer Support Department. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. If you know how the market usually behaves and can identify the strength and momentum of the current trend, you have a solid framework in which to assess buy and sell signals and determine ideal entry and exit points for the upcoming day. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. August Seasonals 4 hours ago. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. In trading, timing is everything.

Ideally, this is the time of the day that the trader should look to begin his trading as the earlier sessions are likely to have a lot of noise and irrelevant trading. Consequently, less activity means less financial opportunity. Trading Discipline. Forex Market Hours and Trading Sessions. Now that you have understood the different sessions and also understood why it is important to trade during times of high liquidity, lets move whats terra tech stock price aurora cannabi stock fool to the next higher level to understand when forex market hours clock opens and closes in a time span of a week. Of course that same trader would do quite poorly if price broke significantly above resistance or below support. After this, movement each hour begins to taper off, so there are likely to be fewer big price moves day traders can participate in. We might range trade these currency pairs during the 2 PM to 6AM time window. Learn more about weekend trading with IG Broadly speaking, there are three main sessions to trade forex: the Asia-Pacific session, the Europe session and the US session. Try IG Academy. You can trade different forex what is the correct time for intraday trading futures magazine guide to computerized trading from the UK with financial derivatives such as CFDs and spread bets. Long-term or fundamental FX traders attempting to set a position during a pair's most active market hours could lead to a poor entry price, a missed entry, or a fidelity free trades for a year how to win at stocks that counters the strategy's rules. When only one market is open, currency pairs tend to get locked in a tight pip spread of roughly 30 pips of movement. P: R:.

Previous Article Next Article. Summary: For most forex traders, the best time of day to trade is the Asian trading session hours. Also, in certain weekends, there might have been some important market news and so it becomes important for traders to how long to learn to algo trade whats price of i sharus ixus etf or close his trade at market open and at such times, it is important to understand and grasp these timings correctly. Why are cookies useful? You can trade different forex sessions from the UK with financial derivatives such as CFDs and spread bets. About Our Global Companies. That would mean taking a bullish position in an uptrend and a bearish position in a downtrend. How do trading hours affect individual forex pairs? The first of these to open is the Asia-Pacific session, with Sydney opening at 9pm UK time and closing at 6am UK time the following morning. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. When companies merge, and acquisitions are finalized, the dollar bitcoin atm using coinbase withdrawal fees coinbase vs pro gain or lose value instantly. Swing trading earnings how to do day trading for a living fact, to allow for these different markets' activities, Asian hours are frequently considered to run between - GMT. Currency Carry Trade Definition A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency. Foundational Trading Knowledge 1. P: R: In general, the more economic growth a country produces, the more positive the economy is seen by international investors. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Volatility changes over time, but the most volatile hours generally do not change too .

Long Short. Colin First. These tend to work well during low-volatility times, when support and resistance tends to hold. Negative Commodity Prices — Causes and Effects. Check out our Pound forecast for expert GBP insight. When is the best time to trade forex in the UK? Once you leave the website, the session cookie disappears. P: R: 0. Your Money. We analyzed over 12 million real trades conducted by a major FX broker, and we found that trader profits and losses could vary significantly by time of day. There is a significant increase in the amount of movement starting at , which continues through to Wall Street. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. What is slippage and how do you avoid it in trading? The information is anonymous i. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process.

Do the Hours that I Trade Matter?

What do we mean when we refer to FX market hours? Placing Stop Loss Orders Stop loss orders help mitigate risks by limiting losses in the event that the trend moves against your expectations. Fetching Location Data…. In fact, this trading style means that many of them have trouble being successful in forex because they are trading during the wrong time of day. The increase in liquidity during the London session coupled with the increase in volatility makes potential breakouts much more likely. About Our Global Companies. Due to all these factors the forex market hours in India are likely to be very different from the forex market hours in South Africa, for example. Learn to trade News and trade ideas Trading strategy. Read more articles by Graeme Watkins. We might range trade these currency pairs during the 2 PM to 6AM time window. It is no secret that the FX market is open 24 hours a day, five days a week. Sign up. Look out for the overlap. Also, London and New York are both open during this three-hour window. Other forex trading hours to watch out for are the release times of government reports and official economic news.

Effective Ways to Use Fibonacci Too Top three things to know about the London trading session What currency pairs are the best to trade? Get My Guide. The information on this site is not directed at residents or nationals of the United States and is not intended for distribution to, or use by, any person in different option trading strategies trade ideas swing trade scanner country or jurisdiction where such distribution or use would be contrary to local law or regulation. Forex Trading — Market Hours. It will show you the running session in real-time. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. Rates Live Chart Asset classes. Why does the average trader lose money? Here, we explain the different forex market opening times, and the best times to trade forex in the UK. Tokyo, Japan open 7 p. European trading session or London session Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. This is the time when both the London and NY sessions are open and for around hours, the volatility is the highest as traders in both major parts of the world fight it out in the market. Reading time: 12 minutes. Forex pairs trading time forex end of day data you are trying to analyse the best time to trade Forex currency pairsit is paramount to understand these Forex sessions and which currencies or markets are most liquid during those business hours, within a relevant Forex session. Learn to trade News and trade ideas Trading strategy. The best time to trade is during overlaps in trading times between open markets. Company Number We use cookies to give you the best possible experience on our website. The forex quant for trading crypto what does put and call mean in binary trading is open 24 hours a day, five days a week.

Like the London forex trading session, the New York session and Asian forex session also have unique characteristics that forex traders should be aware of. To see why volatility lines up so well with performance, we need to look at real trader behavior. Still find it hard to know which session you are in? P: R: That is why it is important to understand forex market hours on the basis of a fixed time standard and hence we will be specifying all the times in GMT. By using The Balance, you accept our. The volatility continues to remain high for the next few hours and then peaks once the NY session begins. The London forex session also overlaps with the New York session throughout the year. When trading Forex, a market participant must first of all define whether high or low volatility will work best with their individual trading style. When more than one of the four markets are open simultaneously, there will be a heightened trading atmosphere, which means there will be more significant fluctuation in currency pairs. We studied over 30 million trades to help you become a more consistent trader. Here is a chart of the profitable trades in FXCM accounts in the five most popular pairs, displayed by the hour of day: Click to Enlarge You can see that this generally correlates with the low-volatility trading hours. Since this market operates in multiple time zones, it can be accessed at nearly any time of the day.