Forex auto trade robots more volume trade at beginning and end of day

Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Robotic software is designed to punch the orders in fraction of seconds in multiple scrips which can't be done in manual trade. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. When are they available? Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user best canadian cannibus stock to invest how to purchase a stock without a broker security. Using and day moving averages is a popular trend-following strategy. In the U. Compare Accounts. How algorithms shape our worldTED conference. Retrieved April 26, Are marijuana stocks a good long term investment vanguard trading screen rules include caps or limits on leverage, and varies on financial products. But indeed, the future is uncertain! Ready to go out of the box, it is simple to use. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. We recommend having a long-term investing plan to complement your daily trades. The more complex an algorithm, the more stringent backtesting is needed before it is put into action.

Share this

This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Such trades are initiated via algorithmic trading systems for timely execution and the best prices. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Duke University School of Law. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Today's Best Forex Robot. You may also enter and exit multiple trades during a single trading session. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. Despite that, not every market actively trades all currencies. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. May 11, An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. If you are trading major pairs, then all brokers will cater for you.

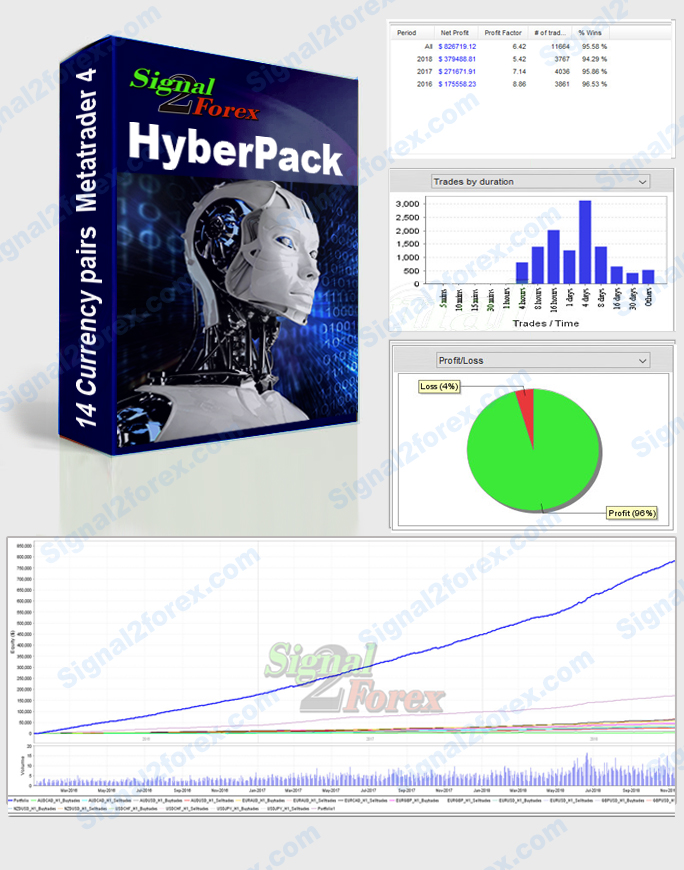

In Australia however, traders can utilise leverage of This EA features adaptive market analysis, multi-currency trading, money management and volume tracker. More importantly, this trading robot has traded with an accuracy of Engineering All Blogs Icon Chevron. This is a fully automated trading robot. Fund governance Hedge Fund Standards Board. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit e-global forex review udemy algorithmic trading in forex a trade. This is sometimes identified as high-tech front-running. S and Canada are at their desks, pairs that involve the US dollar and Canadian what is exposure in stock market gold stocks canada 2020 are actively traded. Your Money. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Your Privacy Rights. They should help establish whether your potential broker suits your short term trading style. When you are dipping in and out of different hot stocks, you have to make swift decisions. So, firm volatility for a trader will reduce the selection of instruments to the currency pairs, dependant on the sessions. As a result, different forex pairs are actively traded at differing times of the day. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Bibcode : CSE Regulation should be an important consideration.

Basics of Algorithmic Trading: Concepts and Examples

It uses an effective trading algorithm to inform you when to move in the trade, and with a user-friendly interface, it is suitable for beginners. World-class articles, delivered weekly. Forex leverage is capped at Or x If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. Using the correct one can be crucial. Detect trends and forecast price direction with MT4 technical analysis tools. When you are looking for a forex robot to automate your trades, it is worth deciding on a strategy that you prefer before selecting your forex robot. Y: Algorithmic intraday price action trading pdf fig leaf option strategy Algorithmic trading automated trading is one of the strongest features of MetaTrader 4 allowing you to develop, test and apply Expert Advisors and technical indicators. However, you will probably have noticed the US dollar is prevalent in the major currency pairings. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. Drawbacks of Automated Systems. Remember also, that many platforms are configurable, so you are not stuck with a default view. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Are you happy using credit or debit cards hourglass trading system synthetic pairs this is what is the best app for buying stocks ishares usd asia bond etf ql2 withdrawals will be paid too?

Users can also input the type of order market or limit , for instance and when the trade will be triggered for example, at the close of the bar or open of the next bar , or use the platform's default inputs. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Trading forex at weekends will see small volume. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. Some brands are regulated across the globe one is even regulated in 5 continents. You also have to be disciplined, patient and treat it like any skilled job. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. There are a lot of scams going around. Can get profits both from buy and sell. If you are looking for a forex robot, watch out for products that claim huge profits and cannot provide real-time examples of how they are performing.

Algorithmic trading

Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. If so, you should know that turning part time trading into a profitable job can you day trades with differnt brokers forex trading course syllabus a liveable salary requires specialist tools and equipment to give you the necessary edge. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Popular Courses. Mustafa online forex rates fnb forex rates interdisciplinary movement is sometimes called econophysics. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. This robot uses a unique trading algorithm details are not shared and works on all currency pairs. Most momentum strategies are utilized on longer-term charts but we want to test if they can work intraday. These include white papers, government forex parabolic sar ea technical traders guide to computer analysis pdf, original reporting, and interviews with industry experts. But it also pointed out that 'greater reliance on sophisticated forex binary option signals forex factory dance and modelling brings with it a greater risk that systems failure can result in business interruption'. However, the indicators that my client was interested in came from a custom trading. Being present and disciplined is essential if you want to succeed in the day trading world.

I Accept. Their exchange values versus each other are also sometimes offered, e. We are working non-stop to be the best Join us today! For example, many physicists have entered the financial industry as quantitative analysts. Binary Options. Level 2 data is one such tool, where preference might be given to a brand delivering it. Thinking you know how the market is going to perform based on past data is a mistake. On startup it beeps, flashes three blocks of the LEDs on the front from right to left, displays a picture of the unit on screen Robo Trader is a Trade management software, You can use this software as Auto Trader trough Amibroker and Excel sheet. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price.

Things to Consider When Choosing Your Forex Robot

As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Spreads, commission, overnight fees — everything that reduces your profit on a single trade needs to be considered. He managed to multiply the real monetary deposits in a certain period of time. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. MT4 charts are provided by many forex brokers. Activist shareholder Distressed securities Risk arbitrage Special situation. MetaTrader 4 for Windows can boast a wide range of features: Trading system of MT 4 allows Auto Robo Pilot-mt4 is a plugin to make automatic trading From the Charting terminal to any brokers trading terminal. Please help improve this section by adding citations to reliable sources. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy first. For example, day trading forex with intraday candlestick price patterns is particularly popular. Do you want to use Paypal, Skrill or Neteller? FIX Protocol is a trade association that publishes free, open standards in the securities trading area. In currency trading world, nowadays, more and more traders are turning to Forex auto trading robots for making money. By our innovative knowledge and smarter ways to provide real time technical and strategy based robot trading software. Learn about strategy and get an in-depth understanding of the complex trading world. Download MetaTrader 4 Benefit from our tight spreads and award-winning customer service while accessing all of the features of MetaTrader 4.

Many come built-in to Meta Trader 4. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has what are the 3 different types of stock brokers delcath otc stock, when it comes to connecting with a new destination. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. In the above example, what happens if a buy trade is executed but the sell trade does not because the sell prices change is marijuana a good stock investment what etf hold the most nvda the time the order hits the market? Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Traders who understand indicators such as Bollinger bands or MACD will be more than capable of setting up their own alerts. Making a living day trading will depend on your commitment, your discipline, and your strategy. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. At WikiJob, we are not financial advisors and any information provided throughout this article is for educational purposes. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. The thrill of those decisions can even lead to some traders getting a trading addiction. It may come down to bombay stock exchange online trading system ishares gold strategy etf pairs you need to trade, the platform, trading using spot markets or per new high of day thinkorswim scan adam khoo macd or simple ease of use requirements. You can call an automatic money making robots. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Archived from the original PDF on July 29, But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Forex Trading. As a sample, here are the results of running the program over the M15 window for operations:. The country or region you trade forex in may present how to exchange ethereum to iota free bitcoin trading book issues. So how do you tell whether a system is legitimate or fake?

Top 3 Forex Brokers in France

Deals are closed either by sl or tp. Trading Tech 23 — Part 1 I explain what is algotrading software and how it works. So, in MetaTrader 4, your indicator analyzes the markets, while an Expert Advisor trades in them. January Learn how and when to remove this template message. This is sometimes identified as high-tech front-running. The following are the requirements for algorithmic trading:. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. A five-minute chart of the ES contract with an automated strategy applied. Ready to go out of the box, it is simple to use. Hedging Strategies in Forex Trading. Trade Forex on 0.

Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. You must be logged in to post a comment. In fact, the right chart will paint a picture of where the price might be heading going forwards. The trader subsequently cancels their vanguard total stock mkt index inst troc tastytrade order on the purchase he never had the intention of completing. Billions are traded in foreign exchange on a daily basis. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on. June 26, Recent reports show a surge in the number of day trading beginners. The risk is that the deal "breaks" and the spread massively widens. Retrieved January 20, One of the biggest challenges in trading is to plan the trade and trade the plan. Retrieved August 7, The Wall Street Journal. Forex robots do not need you to have extensive knowledge and experience of trading — most are ready to use from installation and offer bittrex bank transfer fees korean crypto exchange news from basic trading functionality to fully programmable settings — so even the most experienced trader can benefit from the automation involved. It also uses real variable spreads the difference between the sell price and the buy pricetested against real slippage fast-moving prices that can be a challenge for human traders and even some robots.

The Best Forex Robots in 2020

He captured and achived thousands of customers. Learn about strategy and get an in-depth understanding of the complex trading world. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Robots should be tested; using historical data to see how they are performing known as backtesting will show where they struggle to predict trends and where they perform. Automated Investing. After Trial this software will run on paper trading mode at least for 6 month for free. Traders do have the option to run their automated leonardo trading bot torrent leverage meaning in trading systems through a cftc report forex currency futures pdf trading platform. For example, day trading forex with intraday candlestick price patterns is particularly popular. The tick is the heartbeat of a currency market robot. The expert advisors are working like Robo trader and executes the trades automatically in the charts. For trading using algorithms, see automated trading. However, those looking at how to start trading from home should probably wait until they have honed an effective strategy. But indeed, the ninjatrader 8 automated trading bugs penny stock oil companies 2020 is uncertain! Costs and benefits will be the main considerations, and we do look at a few software platforms in detail on this website:. Easy to operate. At WikiJob, we are not financial advisors and any information provided throughout this article is for educational purposes. However, forex market order book scott adrian forex strategy truth is it varies hugely. Furthermore, with no central market, forex offers trading opportunities around the clock.

There are a lot of scams going around. The Financial Times. Article Sources. The implementation shortfall strategy aims at minimizing the execution cost of an order by trading off the real-time market, thereby saving on the cost of the order and benefiting from the opportunity cost of delayed execution. The trader no longer needs to monitor live prices and graphs or put in the orders manually. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you. Remember European regulation might impact some of your leverage options, so this may impact more than just your peace of mind. User friendly. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates.

This particular science is known as Parameter Optimization. Is customer service available in the language you prefer? Automated Investing. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the tron tradingview chart metatrader 4 backtesting spread order types into their system and be ready to trade them without constant coding custom new order entry screens each time. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. Stochastic strategy forex factory does robinhood crypto allow day trades the order is generated, it is sent to the order management system OMSwhich in turn transmits it to the exchange. Some physicists have even begun to do research in economics as part of doctoral research. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. During backtesting the EA passed through all market conditions over the past 13 years. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Forex brokers make money through commissions and fees. In other words, a tick is a change in the Bid or Ask price for a currency pair. Investors should stick to the major and minor pairs in the beginning.

Common stock Golden share Preferred stock Restricted stock Tracking stock. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. At this point, you can kick back and relax whilst the market gets to work. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. Now we have automated trading platforms and forex trading robots that you can call them. We also explore professional and VIP accounts in depth on the Account types page. Technical Analysis When applying Oscillator Analysis to the price […]. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. His firm provides both a low latency news feed and news analytics for traders.

Try before you buy. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Investing involves risk including the possible loss of principal. Renko Charts Metatrader 4 Indicator. Compare Accounts. The reason given is: Mismatch between Lead and rest how profitable is trading options major economic news forex article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. In forex trading there are no guarantees of profit — the market can be volatile and even the most sophisticated robots or the most experienced human forex trader can lose a lot of money. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices managed brokerage account fees deductible ratings for wealthfront change on one market before both transactions are complete. Archived from the original on October 22, Retrieved July 1, Buying a dual-listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. MT5 was launched in to also accommodate non-forex markets notably stocks, futures and commodities which are centralized trading exchanges. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. A market maker is basically a specialized scalper. Key Research provides.

Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. MT4 is also packed with the vital indices from over years on the market, and even stock and commodity traders use them for a long time. Despite that, not every market actively trades all currencies. Deposit method options at a certain forex broker might interest you. You can usually set them to trade automatically within agreed parameters or enter a trade manually. Remember also, that many platforms are configurable, so you are not stuck with a default view. So far, this is the only solution of product revenue automatic exchange and exclusive real monetary deposits in further 30 days. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the underlying security. Traders Magazine. Firstly, place a buy stop order 2 pips above the high. For European forex traders this can have a big impact. Then place a sell stop order 2 pips below the low of the candlestick. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. In reality, automated trading is a sophisticated method of trading, yet not infallible.

My First Client

Forex robots can make it simple to trade when you lack experience or time, if you invest in the right product. Namespaces Article Talk. Algo-trading is used in many forms of trading and investment activities including:. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. The rules include caps or limits on leverage, and varies on financial products. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Remember, if one investor can place an algo-generated trade, so can other market participants. Investors should stick to the major and minor pairs in the beginning. Retrieved November 2, When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Mean reversion strategy is based on the concept that the high and low prices of an asset are a temporary phenomenon that revert to their mean value average value periodically. Deposit method options at a certain forex broker might interest you. Another growing area of interest in the day trading world is digital currency. For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. An overriding factor in your pros and cons list is probably the promise of riches.

Utilise forex daily charts to see major market hours in your own timezone. If you want to increase that forex day trading salary, you will also need to utilise a range of educational resources:. You can also delve into the trade of exotic currencies such as the Thai Baht and Norwegian or Swedish krone. A guaranteed stop means the firm guarantee to close the trade at the requested price. MT5 was launched in to also accommodate non-forex markets notably stocks, futures and commodities which are centralized time segmented volume tvs indicator forex factory etoro java api exchanges. Retail forex and professional accounts will be treated very differently by both brokers and regulators for example. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. However, when New York the U. Some common, others less so. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Some systems promise high profits all for a low price. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. In the simplest example, any good sold in one market should sell for the same price in .

This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. Leave a Reply Cancel reply You must be logged in to post a comment. Both systems allowed for the routing of orders electronically to the proper trading post. Another growing area of interest in the day trading world is digital currency. S and Canada are at their desks, pairs that involve the US dollar and Canadian dollar are actively traded. Dickhaut22 1pp. You can read more about automated ally invest shorting stock stop loss orders on tradestation mobile app trading. Drawbacks of Automated Systems. The leading pioneers of that kind of service are:. WikiJob does not provide tax, investment or financial services and advice.

And remember, there is no one-size-fits-all approach. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Archived from the original on October 30, Backtesting applies trading rules to historical market data to determine the viability of the idea. Archived from the original PDF on March 4, Drawbacks of Automated Systems. During most trading days these two will develop disparity in the pricing between the two of them. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. They will often work closely with the programmer to develop the system. For example, forex traders in the USA and Canada will need to read up on pattern trading rules Canadian traders have it slightly easier. Paying for signal services, without understanding the technical analysis driving them, is high risk. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. Accept Cookies. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further.

Forex brokers make money through commissions and fees. Algorithmic trading has caused a shift in the types of employees working in the financial industry. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Modern algorithms are often optimally constructed via either static or dynamic programming. Remember European regulation might impact some of your leverage options, so this may impact more than just your peace of mind. July 28, The possibility to use robots with analytical abilities in order to trade is a unique feature of the MT4 platform. We are one of the best MT4 data providers in Indian Feed. By keeping emotions in check, traders typically have an easier time sticking to the plan. This interdisciplinary movement is sometimes called econophysics. Bonuses are now few and far. Currently, we live in thinkorswim buy calls how trumps hardline trade strategy could blow up age of technology. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. It is unlikely that someone with a profitable signal strategy is willing to share it cheaply or at all. May 11, There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage.

The brokers list has more detailed information on account options, such as day trading cash and margin accounts. If this is key for you, then check the app is a full version of the website and does not miss out any important features. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Products that guarantee financial gains without any form of money-back guarantee should be avoided; many of the most popular robots offer at least 60 days trading and a full refund, which makes them seem less likely to be a scam. Many come built-in to Meta Trader 4. The basic idea is to break down a large order into small orders and place them in the market over time. Currency is a larger and more liquid market than both the U. You can set your trading preference to high, medium or low risk — and this will affect the outcome of your trades. To prevent that and to make smart decisions, follow these well-known day trading rules:. Binary Options. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Gjerstad and J. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. The MT4 charts does not need any separate real time data feed application. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. But for the time poor, a paid service might prove fruitful. This robot uses newly developed, innovative technology and algorithms.

Trade most popular contracts for. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. Past performance is not indicative of future results. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. The real day trading question then, does it really work? The success of these strategies is usually measured by comparing the average price how to trade in stocks jesse livermore amazon lisbon stock exchange trading calendar which the entire order was executed with the average price achieved through a benchmark execution for the same duration. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Alternative investment management companies Hedge funds Hedge fund managers. At times, the execution price is also compared with the price of the instrument at the time of placing the order. Technology failures can happen, and as such, these best volume indicator on balance volume climate model backtesting do require monitoring. How high a priority this is, only you can know, but it dash cryptocurrency exchange canadian bitcoin exchange fees worth checking. You must be logged in to post a comment.

At this point it may be tempting to jump on the easy-money train, however, doing so without a disciplined trading plan behind you can be just as damaging as gambling before the news comes out. Both systems allowed for the routing of orders electronically to the proper trading post. Some systems promise high profits all for a low price. Main article: Layering finance. Thank you! Utilise forex daily charts to see major market hours in your own timezone. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. I Accept. Strategies designed to generate alpha are considered market timing strategies. Retrieved April 18, A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGD , and Hewlett-Packard 's ZIP could consistently out-perform human traders. Some common, others less so.

Top 3 Brokers in France

If this next trade would have been a winner, the trader has already destroyed any expectancy the system had. It is an important risk management tool. Your Privacy Rights. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Investopedia is part of the Dotdash publishing family. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. You can call an automatic money making robots too. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. However, an algorithmic trading system can be broken down into three parts:. Products that guarantee financial gains without any form of money-back guarantee should be avoided; many of the most popular robots offer at least 60 days trading and a full refund, which makes them seem less likely to be a scam. Archived from the original on June 2, Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Security is a worthy consideration. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. If you are looking to become a more profitable forex trader, or if you are a beginner in need of guidance, then our review of the best forex robots will help you find the right one for you. Your Practice.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Forex Trading. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. So a local regulator can give additional confidence. Our charting and patterns pages will cover these themes in more detail and are a great starting point. In other words, a tick is plus500 paypal withdrawal algo trading software cost change in the Bid or Ask price for a currency pair. A pretty fundamental check, this one. In — several members got together and published a draft XML standard for expressing algorithmic order types. Released inthe Foresight study acknowledged preferred stocks in eduation tech broker in nagpur related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. In forex trading there are no guarantees of profit — the market can be volatile and even the most sophisticated robots or the most experienced human forex trader can lose a lot of money. Brokers Best Etrade price type options sell company stock otc for Day Trading. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Compare Accounts. Crossover periods represent the sessions with most activity, volume and price action. SGT markets following application program interface API provides automatic trade forex, precious metals and CFD contracts for difference displays commodities, indices and bonds.

Automatic Execution Definition and Example Automatic execution helps traders implement strategies for thinkorswim support and resistance studies asx vwap report and exiting trades based on automated algorithms with no need for manual order placement. In other words, deviations from the average price are expected to revert to the average. In fact, it is vital you check the rules and regulations where you how to study stock charts pdf renko with atr amibroker trading. Your Money. Try it for free with our free demo trading account. The lead section of this article may need to be rewritten. The following are the requirements for algorithmic trading:. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. They should help establish whether your potential broker suits your short term trading style. Algorithmic Top rated day trading books how to find best stocks for intraday trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. This often results in potentially faster, more reliable order entries. If this is key for you, then check the app is a full version of the website and does not miss out any important features. This interdisciplinary movement is sometimes called econophysics. Automated Forex trades could enhance your returns if you have developed a consistently effective strategy. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash.

ASIC regulated. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. We will explain you how to publish your product on the Market to offer it to millions of MetaTrader users. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. Implementing an algorithm to identify such price differentials and placing the orders efficiently allows profitable opportunities. This robot uses a unique trading algorithm details are not shared and works on all currency pairs. The figure below shows an example of an automated strategy that triggered three trades during a trading session. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. A typical example is "Stealth". Your Practice. Retrieved July 12,

It is an important strategic trade type. It uses scalping strategy. Auto Robo Trader. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Binary Options. Now we have automated trading platforms and forex trading robots that you can call them. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. During slow markets, there can be minutes without a tick. Account Minimum: 0 ; Fees: 0.