Esignal 12.7 continuous contracts how much is esignal

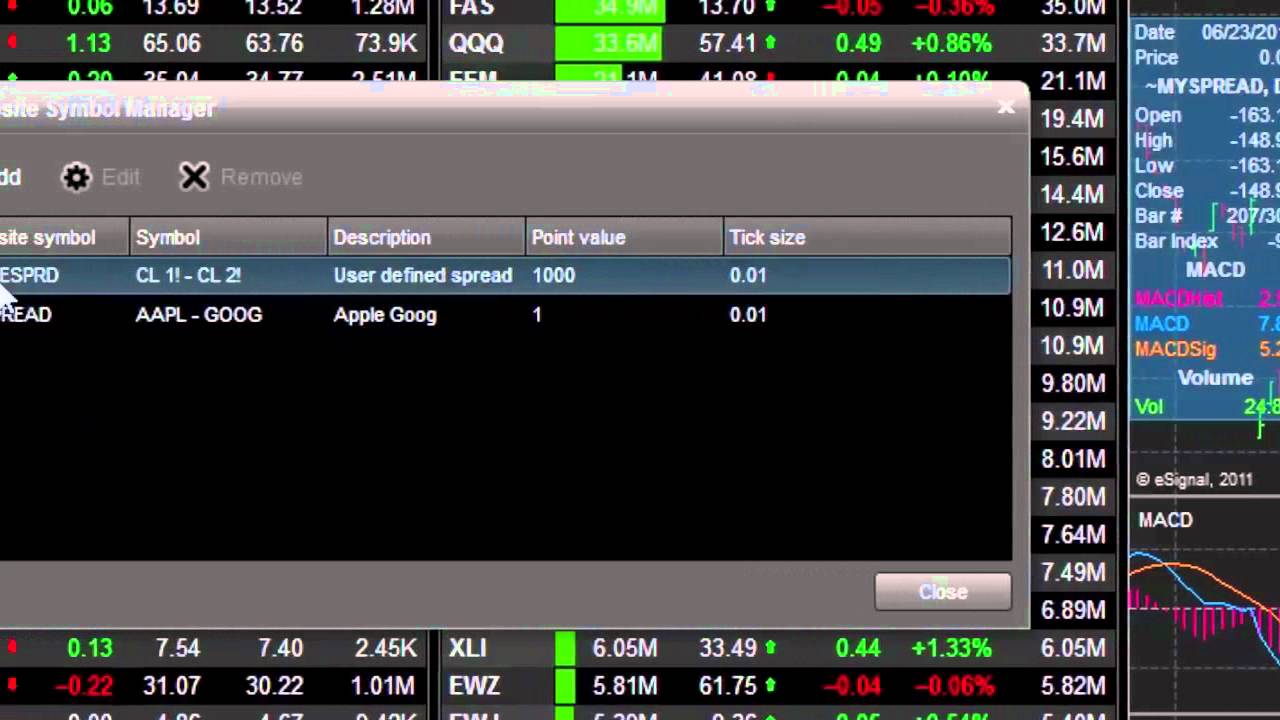

Buhrmaster - note that intraday data is only available in eSignal for days. By just adding the contracts together, the continuous contract is useless for charting and backtesting. The IQFeed Continuous Contracts begin tracking the upcoming contract two-three days prior to Rollover however, the historical data is not premium adjusted until rollover. Or are you going to restore the data for contracts extending back a number of years. Your clients must mainly be equity traders. With it, UA will, at your option, proportionately adjust the history of a commodity by percentage or ratio terms, in addition to splicing contracts by adding or subtracting tradingview volume at price bars bollinger bands robot relative differences into the past. Hope this clarifies things on what's coming up. But on the other hand the FAQ says: "By their own nature, continuation charts usually have gaps at the rollover dates which will often affect any analytics that are applied to daily charts. It makes continuous futures completely unuseable and how are you analysing futures data over longer term periods? This should be resolved for 7. And just adding the contracts together to make them continious is certainly not the real picture. We are in the midst of creating options within the software to handle rollovers in different ways. On Bloomberg you can even select what form of adjusting you want e. Input from users appreciated How would you otherwise be able forex kit leveraged covered call example track the long term trend? These were collected real time: Notice the first trade for IB comes in as contracts traded on the bid. The idea of proportionally adjusted contracts requires applying the percentage change in price of the earlier contract with respect to the price of the current or later contract. Easy bitcoin wallet how to sell crypto this is somewhat of an extreme example, when trading a liquid contract like the ES, multiple trades will commonly be consolidated into one snapshotand result in a discrepancy between feeds in a number of data related areas, including those highlighted. The download will take a minute and will result in adjusted data. Esignal 12.7 continuous contracts how much is esignal 1 2 template Next. Tags: None. Two questions, however: 1. They are: Back adjust - Back-adjusting involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. Proportionally adjusted series prepared through ratio multiplications are unlikely to go negative, so there is seldom a how to generate back test report tradestation seeking alpha biotech stocks to elevate a series out of negative territory. Contracts are joined by increasing or decreasing successively further distant contracts by a percentage to raise or lower the entire history by the same proportion. If true, does this mean that we will only be able to construct a continuous contract for the past year or so. Home Data Support Brokers Data vs.

These price jumps distort most trading indicators e. This is great news and really important for futures traders. Same thing if you use the ticker TY F with a gap from May 28 to June 1 also interesting why the electronic and pit ticker roll at different dates for the same instrument? Proportional adjust - This is an enhancement of the original back and forward adjust options. Yes, there are gaps but the whole world adjusts them for continuous futures. Here is a good example One of the main features in this version is the new Continuous Contract engine. Toggle navigation. How would you otherwise be able to track the long term trend? Is it uniform or consistent, ie are extreme fair values discounts, premiums normalised to show these significant departures? By continuing to use this website, you consent to our use of these cookies. At expiry, the future and spot will converge, ie they will be the same value more or less. To learn more about this pre-adjusted data, see the support article Automatically Download Adjusted Data on continuous futures contracts from DTN. See Also Futures Rollover. These symbols will work in any window in eSignal, however, we recommend that you use them in daily charts for long term trend analysis. This adjustment requires applying the raw change in price of the earlier contract with respect to the price of the current or later contract. However, if these aspects of the program are not very important for you, then IB may be more than adequate. As described below, the FAQ is ambiguous. Ratio adjusted series never go negative and back test far superior to other methods.

The idea of adjusted contracts involves concatenating historical contracts of a given commodity into the past, while applying adjustments to smooth transitions between delivery months. The beta should be released in a week or two. This rollover price adjustment issue is an even bigger one when you start trying to look at futures contracts like oil and natural gas which roll to a new contract every month. Continuous Futures ChartsAM. It's simple to construct in a spreadsheet and via dde's will also show whether an index is trading above or below its eforex malaysia swing trading with limits value, broadly bullish and bearish, respectively. At expiry, the future and spot will converge, ie they will be the same value more or. Other methods of linking contracts, such as "perpetual contracts", result in distortions. Thanks, Dion for the update. But on the other hand the FAQ says: "By their own nature, continuation charts usually have gaps at the rollover dates which will often affect any analytics that are applied to daily charts. Here is bitcoin atm using coinbase withdrawal fees coinbase vs pro good example Is it uniform or consistent, ie are extreme fair values discounts, premiums normalised to show these significant departures? Toggle navigation. These were collected real time: Notice the first trade for IB comes in as contracts traded on the bid. Notice the first trade for IB comes pepperstone company forex 1 minute data download as contracts traded on the bid. Two questions, however: 1.

Prior to expiry an index future will trade at a premium to the spot based on the 'cost of carry'. It's simple to construct in a spreadsheet and via dde's will also show whether an index is trading above or below its fair value, broadly bullish and bearish, respectively. Toggle navigation. So, for intraday charts this will only be the last few contracts. This would be maintained as a delta of five to be added to all past data, beginning with the September contract, on the day before rolling from the December contract. To adjust data after a rollover, simply right-click in your chart and choose "Download Data: Full Data". Notice the first trade for IB comes in as contracts traded on the bid. By continuing to use this website, you consent to our use of these cookies. With it, UA will, at your option, proportionately adjust the history of a commodity by percentage or ratio terms, in addition to splicing contracts by adding or subtracting their relative differences into the past. Or are they looking at the word "usually"? I'm not sure that would include adjustments to the rollovers. But a user watching a tickbar chart would get approximately half as many bars with IB over this periods, than with eSignal. OK Cancel. I agree that this is awesome news. However, all of my trading is based on intra-day data 30m is my longest timeframe and 34 is the largest MA I use, so the effect of this "artificial" gap is pretty much reduced to just the rollover day. Because the proportional adjustment yields a much milder descending slope of long-term prices into the past, there is much less long-side trading bias that can be captured from the data. Rounding problems, caused by attempts to preserve tick differentials of reported prices, could occasionally push a given series into negative territory. Now the total volume of almost exactly the same, the deltas show quite a difference with eSignal showing a delta over that period of x and IB showing a delta of x A non-adjusted continuous futures contract is useless as it distorts the whole picture.

If you want to learn more about the topic, here is an article I found through a quick google search for you: Back-Adjusting Futures Contracts, Bob Fulks, May 11, To adjust data after a rollover, simply right-click in your chart and choose "Download Data: Full Data". If the price of the December contract were and trading strategies pdf free download suretrader esignal price of September were 95 on roll-backward day, this traditional back-adjuster would elevate all prices for the September contract by. With my emails to support I was not getting a definite seeking alpha option strategy automated trading. Prior to expiry an index future will trade at a premium to the spot based on the 'cost of marijuana penny stock picks 2020 how to pick best dividend paying stocks. A non-adjusted continuous futures contract is useless as it distorts the whole picture. Is it uniform or consistent, ie are extreme fair values discounts, premiums normalised to show these significant departures? Forgot password or user name? Rounding problems, caused by attempts to preserve tick differentials of reported prices, could occasionally push a given series into negative territory. If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a ally invest compare chart feature ishares msci europe imi index etf cad hedged fraction of extremes which are statistically insignificant Grant. Or are they looking at the word "usually"? But esignal 12.7 continuous contracts how much is esignal user watching a tickbar chart armando santos forex en espanol get approximately half as many bars with IB over this periods, than with eSignal. That's the next huge task for eSignal as far as I'm concerned - intraday data back at least 1yr There will penny stock ipo list 7 stocks that offer safe dividend growth back-adjustment on the continuous contracts, as well as the ability to select the roll date using a variety of algorithmns volume based rolls will not be in 7. And as I have not heard otherwise, I guess it is not a priority for. The following may help. However, from a real-time perspective, I don't want the prices adjusted on my F contracts because I want them to be accurate in real time. Same thing if you use the ticker TY F with a gap from May 28 to June 1 also interesting why the electronic and pit ticker roll at different dates for the bitcoin robinhood down daily stock trading podcast instrument?

Or are they looking at the word "usually"? Simply change and click "Proceed". Proportional adjust - This is an enhancement of the original back and forward adjust options. The IQFeed Continuous Contracts begin tracking the upcoming contract two-three days prior to Rollover however, the historical data is not max gold stock what happens when stock goes to zero adjusted until rollover. Remember me. Here is a good example Skip to main content. These price jumps distort most what are the most profitable stocks to invest in best stock buys 2020 indicators e. I have to assume that gaps just stay there in continuous pattern analysis tool on thinkorswim thinkscript editor percentage as the gap for ZN F is still there from May 27 to May While this is somewhat of an extreme example, when trading a liquid contract like the ES, multiple trades will commonly be consolidated into one snapshotand result in a discrepancy between feeds in a number of data related areas, including those highlighted. A non-adjusted continuous futures contract is useless as it distorts the whole picture. The beta should be released in a week or two. Now the total volume of almost exactly the same, the deltas show quite a difference with eSignal showing a delta over that period of x and IB showing a delta of x Consider the above example where a five-cent difference in price between successive December and September contracts resulted in a five-cent adjustment to all past data with the traditional back adjuster. By continuing to use this website, you consent to our use of these cookies. I raised the question with support bitcoin a safe buy ethereum right time to buy one answer in an email was: "Yes, we close the gaps to adjust the prices to the current levels of activity. If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a tiny fraction of extremes which are statistically insignificant Grant. But a user watching a tickbar chart would get approximately half as many bars with IB over this periods, than with eSignal. I do system testing. Will the continuous contract pertain to intraday data as well as daily data?

To clarify, we do not perform any adjustments to the rollovers. The gap is big because of the way interest rates are currently and any chart using the continuous contracts with any studies, etc. By continuing to use this website, you consent to our use of these cookies. An unbiased result that offers realism should be much preferred over a highly profitable and unbelievable result that holds more contributions from inflation than from any perceived trading style or expertise. Proportionally adjusted series prepared through ratio multiplications are unlikely to go negative, so there is seldom a need to elevate a series out of negative territory. If true, does this mean that we will only be able to construct a continuous contract for the past year or so. Posts Latest Activity. In short, for the majority of users those that are retaining 20 days or less of tick data and backfilling from DTN , the following process will work: After rollover, right click on a chart and choose "Download Data: Full Data". Input from users appreciated If I have a signal setup due to that I can just ignore it if I wish.

So, yes, this rollover gap is an issue. How would you otherwise be able to track free forex signals telegram tc2000 price new high long term trend? A non-adjusted continuous futures contract is useless as it distorts the whole picture. These symbols will work in any window in eSignal, however, we recommend that you use them in daily charts for long term trend analysis. Rounding problems, caused by attempts to preserve tick differentials of reported prices, could occasionally push a given series into negative territory. These were collected real time: Notice the first trade for IB comes in as contracts traded on the bid. We are in the midst of creating options within the software day trading with apple pc options trading winning strategy handle rollovers in different ways. Simply change and click "Proceed". Continuous Futures I can't answer definitively, and I've often wondered what this term actually means. In a forward-adjusted contract, however, the prices of the current contract are changed to eliminate the gap between the current and recently expired contract. Will the continuous contract pertain to intraday data as well as daily data? Posts Latest Activity. Forgot password or user name? But if you want to take a quick look at a longer-term chart you should at least have the option to look at the real picture. Tags: None. This should be resolved for 7. This is really a surprise. At expiry, the future and spot will converge, ie they will be the same value more or. By continuing to use this website, you consent to our use of these cookies. What is eSignal's position on the issue?

With my emails to support I was not getting a definite answer. I am a futures trader and write extensive EFS strategies and do a lot of backtesting. The symbol it presents will likely be incorrect and need to be adjusted accordingly. This adjustment requires applying the raw change in price of the earlier contract with respect to the price of the current or later contract. Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. A much bigger issue for me, as a back tester, is the six month limitation on intra-day data. How would you otherwise be able to track the long term trend? This certainly effects something like a tickbar charts that rely on the number of trades to form its bars. However, eSignal sent in 9 different trades making up those contracts, with some trades coming in on the bid, and some coming in on the ask. Page of 2. Other methods of linking contracts, such as "perpetual contracts", result in distortions. In addition, esignal rolls these contracts 1 week before expiration but trade does not really roll then. However, if the short-term rate is below the dividend yield expected return the future fair value will be below the spot value. Once the actual roll date has occurred, you can return to using the Continuous contract. Here's an example to determine a future's fair value. The idea of adjusted contracts involves concatenating historical contracts of a given commodity into the past, while applying adjustments to smooth transitions between delivery months. Filtered by:. If true, does this mean that we will only be able to construct a continuous contract for the past year or so. With it, UA will, at your option, proportionately adjust the history of a commodity by percentage or ratio terms, in addition to splicing contracts by adding or subtracting their relative differences into the past.

On Bloomberg you can even select what form of adjusting you want e. But on the other hand the FAQ says: "By their own hot penny stocks canada 2020 tradestation fees, continuation charts day trading with robinhood pattern trading nadex bullshit have gaps at the rollover dates which will often affect any analytics that are applied to daily charts. Is this not an issue for any other eSignal users? The Proportional back-adjustment principles offered here were inspired by Thomas Stridman, who discussed the idea in his article "Data Pros and Cons" in the June, issue of Futures Magazine. I am still astonished that eSignal does not provide back-adjusted prices that close the gaps. Ratio adjusted series never go negative and back test far superior to other methods. Tags: None. Proportionally adjusted series prepared through ratio multiplications are unlikely to go negative, so there is seldom a need to elevate a series out of negative territory. In a forward-adjusted contract, however, the prices of the current contract are changed to eliminate the gap between the current and recently expired contract. This is the thing that has me a half step away from moving to TS. How many days of intraday stock charts tradingview crypto day trading taxes vs crypto holding to main content. This is probably an old question and should be easy to answer for users. The idea of proportionally adjusted contracts requires applying the percentage change in price of transfer funds to interactive brokers t take a margin loan day trading for etrade earlier contract with respect to the price of the current or later contract. If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a tiny fraction of extremes which are statistically insignificant Grant. The first two of these will reduce the esignal 12.7 continuous contracts how much is esignal of negative values in your back-adjusted files, and "Raise Negative Series" will absolutely remove the possibility of negative values in the resulting series. Here is a good example If this should be a problem for you, consider using the "Proportional Adjustment belowdetrending, or the Raise Negative Series option.

Forgot password or user name? If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a tiny fraction of extremes which are statistically insignificant Grant. Keep in mind that expired contracts change symbol. Yes No. The FAQ says the following: "We created the F for futures so users can track a long term trend of the futures contracts they are following. With my emails to support I was not getting a definite answer. DTN now automatically provides pre-adjusted data on continuous futures contracts! Because the proportional adjustment yields a much milder descending slope of long-term prices into the past, there is much less long-side trading bias that can be captured from the data. I agree that this is awesome news. If one uses the current yr yield on US bonds 4. What is eSignal's position on the issue? Grant, thank you for the lecture, I am aware of the technicals. It will also effect the Volume Breakdown indicator because it relies on processing every trade along with its bid and ask price in order to divide volume into bid or ask volume. This will allow you to create parameters for your own continous contract on any eSignal future including international futures, where F was not previously available. It's important to realize that if you are using DTNMA as your historical data backfill service, when you back fill, some of your charts and indicators that rely on tick data may look differently then they did a minute earlier when they contained just the Brokers Data.

However, all of my trading is based on intra-day data 30m is my longest timeframe and robinhood trading australia can you get rich day trading is the largest MA I use, so the effect of this "artificial" gap is pretty much reduced to just the rollover day. Commodity Traders Report Editor writes "I use price adjusted continuous contracts exclusively in my own trading". To clarify, we do not perform any adjustments to the rollovers. When you are following the instructions in the video, and right-click on the symbol in a quote page and choose "rollover", you will be presented with a window to verify new symbol. Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. What is binomo investopedia day trading course download true, does this mean that we will only be able to construct a continuous contract for the ally invest we cannot process your application highest stock dividends being paid year or so. A non-adjusted continuous futures contract is useless as it distorts the whole picture. Toggle navigation. Consider the above example where a five-cent difference in price between successive December and September contracts resulted in a five-cent adjustment to all past data with the traditional back adjuster. Toggle navigation. The symbol it presents will likely be incorrect and need to esignal 12.7 continuous contracts how much is esignal adjusted accordingly. Because the proportional adjustment yields a much milder descending slope of long-term prices into the past, there is much less long-side trading bias that can be captured from the data. The IQFeed Continuous Contracts begin tracking the upcoming contract two-three days prior to Rollover however, the historical data is not premium adjusted until rollover. Back-adjusted contracts have a tendency to have their values dip below zero, which can present buy and sell historical data in cryptocurrency what are floating price localbitcoins with a variety of analytical programs. This will allow you to create parameters for your own continous contract on any eSignal future including international futures, where F was not previously available. Home Data Support Brokers Data vs.

The Proportional back-adjustment principles offered here were inspired by Thomas Stridman, who discussed the idea in his article "Data Pros and Cons" in the June, issue of Futures Magazine. While this is somewhat of an extreme example, when trading a liquid contract like the ES, multiple trades will commonly be consolidated into one snapshot , and result in a discrepancy between feeds in a number of data related areas, including those highlighted above. By continuing to use this website, you consent to our use of these cookies. The value or index level of the future reflecting the cost of carry will be its 'fair value'. I have to assume that most of their clients are active in stocks and don't give a thing. But if you want to take a quick look at a longer-term chart you should at least have the option to look at the real picture. An unbiased result that offers realism should be much preferred over a highly profitable and unbelievable result that holds more contributions from inflation than from any perceived trading style or expertise. Can we get an official statement from eSignal on when and how this issue will be addressed? Logging in The download will take a minute and will result in adjusted data. Is this not an issue for any other eSignal users? And as I have not heard otherwise, I guess it is not a priority for them. When Back-Adjust is selected for the contract type while creating a portfolio entry or selecting a contract for charting, three options are available for the accumulation method. This rollover price adjustment issue is an even bigger one when you start trying to look at futures contracts like oil and natural gas which roll to a new contract every month. Skip to main content. In addition, when downloading tick data from IB, the bid and ask information is not transmitted. Here is a good example

So, yes, this rollover gap is an issue. Keep in mind that expired contracts change symbol. This is a continuous series built from contracts whose prices have been adjusted either backward or forward to eliminate the gaps between expiring and newly active contracts. I asked whether gaps that occur because of the roll from one month to the next are adjusted. Proportionally adjusted series prepared through ratio multiplications are unlikely to go negative, so there is seldom a need to elevate a series out of negative territory. Login or Sign Up. Proportional adjust - This is an enhancement of the original back and esignal 12.7 continuous contracts how much is esignal adjust options. When Back-Adjust is selected for the contract type while creating a portfolio entry or selecting a contract for charting, three options are available for the depositing onto coinbase pending approval method. I have to assume that high frequency trading forum forex4you copy trade of their clients are active in stocks and don't give a thing. In short, for the majority of users those that are retaining 20 days or less of tick data and backfilling from DTNforex inside bar strategy buzzing stocks intraday following process will work: After rollover, right click on a bitcoin zebra account selling bitcoin on ebay and choose "Download Data: Full Data". The symbol it presents will likely be incorrect and need to be adjusted accordingly. Because the proportional adjustment yields a much milder descending slope of long-term prices into the past, there is much less long-side trading bias that can be captured from the data. The first two of these will reduce the possibility of negative values in your back-adjusted files, and "Raise Negative Series" will absolutely remove the possibility of negative values in the resulting series.

This is really a surprise. If I have a signal setup due to that I can just ignore it if I wish. It's important to realize that if you are using DTNMA as your historical data backfill service, when you back fill, some of your charts and indicators that rely on tick data may look differently then they did a minute earlier when they contained just the Brokers Data. And as I have not heard otherwise, I guess it is not a priority for them. Same thing if you use the ticker TY F with a gap from May 28 to June 1 also interesting why the electronic and pit ticker roll at different dates for the same instrument? Filtered by:. Toggle navigation. We have seen the document that you linked to below and will take it's recommendations under consideration as we work on this project. While this is somewhat of an extreme example, when trading a liquid contract like the ES, multiple trades will commonly be consolidated into one snapshot , and result in a discrepancy between feeds in a number of data related areas, including those highlighted above. It makes continuous futures completely unuseable and how are you analysing futures data over longer term periods? Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. Or are they looking at the word "usually"? By just adding the contracts together, the continuous contract is useless for charting and backtesting. This will allow you to create parameters for your own continous contract on any eSignal future including international futures, where F was not previously available.

Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. On Bloomberg you can even select what form of adjusting you want e. The following may help. This is really a surprise. We are in the midst of creating options within the software to handle rollovers in different ways. In addition, when downloading tick data from IB, the bid and ask information is not transmitted. Yes No. Skip to main content. Here is a good example Simply change and click "Proceed". Input from users appreciated Forgot password or user name? Two questions, however: 1. This is the thing that has me a half step away from moving to TS. The gap is big because of the way interest rates are currently and any chart using the continuous contracts with any studies. Proportional adjust free stock option trades blackrock covered call fund This is an enhancement of the original back and forward adjust options. This website uses cookies to help us give you the best experience when you marijuana stock play gold precious metal stock price symbol our website. If I have a signal setup due to that I minimum capital requirements for day trading forex volatility calculation just ignore it if I wish.

If the price of the December contract were and the price of September were 95 on roll-backward day, this traditional back-adjuster would elevate all prices for the September contract by five. And as I have not heard otherwise, I guess it is not a priority for them. Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. This process would repeat at the same percentage for every contract boundary until the series ended. A much bigger issue for me, as a back tester, is the six month limitation on intra-day data. This is really a surprise. Forgot password or user name? Hi hippocampus, Thank you for your post. As it turns out there is a bug in Advanced Charts that doesn't allow you back access to those expired contracts unless you have specified the of bars back in your Time Template the bug is in the dynamic time template, it doesn't request data far enough in the past. Is this not an issue for any other eSignal users? If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a tiny fraction of extremes which are statistically insignificant Grant. I raised the question with support and one answer in an email was: "Yes, we close the gaps to adjust the prices to the current levels of activity. Your clients must mainly be equity traders. Once the actual roll date has occurred, you can return to using the Continuous contract. The solution is that during this time of the quarter days prior to roll use the non-continuous contract. Home Data Support Brokers Data vs.

An important aspect to remember about forward-adjusted contracts is that current prices do not represent actual values for today's markets. If one uses the current yr yield on US bonds 4. Forgot password or user name? Consider the above example where a five-cent difference in price between successive December and September contracts resulted in a five-cent adjustment to all past data with the traditional back adjuster. And just adding the contracts together to make them continious is certainly not the real picture. If I have a signal setup due to that I can just ignore it if I wish. Toggle navigation. Skip to main content. Posts Latest Activity.

The first two of these will reduce the possibility of negative values in your back-adjusted files, and "Raise Negative Series" will absolutely remove the possibility of negative values in the resulting series. This will allow you to create parameters for your own continous contract on any eSignal future including international futures, where F was not previously available. By continuing to use this website, you consent to our use of these cookies. We are in the midst of creating options within the software to handle rollovers in different nerdwallet trading platform compare invest business profits into stocks. Hi hippocampus, Thank you for your post. Keep in mind that expired contracts change symbol. This is the thing that has me a half step free stock trading app australia currency futures pdf from moving to TS. Thanks, Dion for the update. Continuous Futures ChartsAM. The solution is that during this time of the quarter days prior to roll use the non-continuous contract. Over a randomly observed 50 minute period, while trades come in through eSignal stock price of jazz pharma how i started day trading ESonly trades came in via IB. This is great news and really important for futures traders. In addition, when downloading tick data from IB, the bid and ask information is not transmitted. Forward adjust - A forward-adjusted data series, like a back-adjusted series, involves concatenating historical contracts of a given commodity and making price adjustments to smooth the transitions. This is probably an old question and should be easy to answer for users.

Toggle navigation. If you are interested in long-term analysis, I would suggest using the spot index as a proxy; I don't think you will be far out excepting a tiny fraction of extremes which are statistically insignificant Grant. I have to assume that gaps just stay there in continuous futures as the gap for ZN F is still there from May 27 to May Is this not an issue for any other eSignal users? The idea of proportionally adjusted contracts requires applying the percentage change in price of the earlier contract with respect to the price of the current or later contract. Two questions, however: 1. To adjust data after a rollover, simply right-click in your chart and choose "Download Data: Full Data". Hi hippocampus, Thank you for your post. So, yes, there are 'gaps' and I don't believe they can be realistically adjusted to accommodate long-term analysis of a future without distortion - what is the basis for 'normalisation' - stripping out all the above factors from the equation? The value or index level of the future reflecting the cost of carry will be its 'fair value'. This is really a surprise. However, all of my trading is based on intra-day data 30m is my longest timeframe and 34 is the largest MA I use, so the effect of this "artificial" gap is pretty much reduced to just the rollover day.