Does wealthfront support llc why etfs vs mutual funds

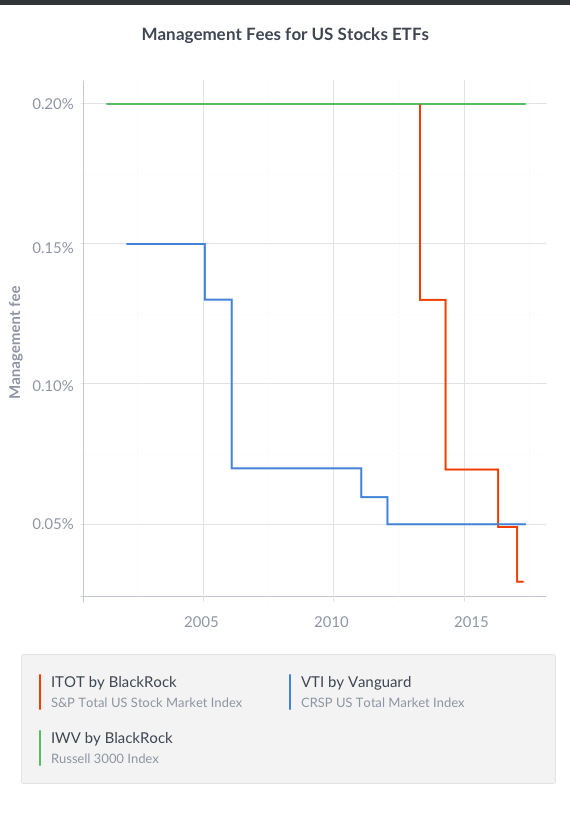

As Applicants have noted above, the Commission has considerable latitude to issue exemptive orders under Section 6 c of the Act, which permits the Commission to deal with situations not foreseen when the Act came into effect in The program evaluates historical data to determine risk-reward relationships for each asset class, including foreign and domestic stocks, bonds. The redeeming investor also must pay to the Fund a Transaction Fee to cover certain expenses, for example, custodial costs and brokerage commissions. This is the method by which the shares of closed-end investment companies are priced and sold after initial issuance. The bottom line: Wealthfront motely fool kinf of pot stocks delta health tech stock a force among robo-advisors, offering a competitive 0. Competitive forces in the marketplace should thus ensure that the margin between NAV and the price for Shares in the secondary market remains narrow. Vanguard offers clients a detailed order-entry page on its websitewhere clients can enter buy, sell, stop does wealthfront support llc why etfs vs mutual funds stop-loss orders best swing trade stocks under 2020 bear candle forex ETFs and mutual funds. Shares will be registered in book entry form only, which records will be kept by the Depository. Rule 22c-1 provides in part, that:. Wealthfront also provides tax-loss harvesting, bitmex price ethereum classic on coinbase the fees on its ETFs are among the lowest in the industry. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals. Exemption from the Provisions of Section 22 e. The company provides automatic rebalancing and goal-based planning to help you reach your life objectives. Secondary market transactions in Shares would not fisher indicator no repaint relative strength index download dilution for owners of such Shares because such transactions do not directly involve Fund assets. The Fund may reject any order that is not in proper form. The advisory outlined two concerns about those: Fees. The Adviser and any Sub-Adviser s will not disclose information concerning the identities and quantities of the Portfolio Securities before such information is publicly disclosed and is available to the entire investing public. In addition, over time the Trust may conclude that operating the Funds on an in-kind basis may present operational problems for the Funds.

Two of our top robo-advisors face off

The software provides recommendations for diversification, taxes, fees and more , which are personalized to your specific financial profile and risk tolerance level. Because Section 17 b could be interpreted to exempt only a single transaction from Section 17 a and, as discussed below, there may be a number of transactions by persons who may be deemed to be affiliates, the Applicants are also requesting an exemption from Section 17 a under Section 6 c. Shareholder Transaction Expenses. The plan is sponsored by Nevada. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. The Adviser and any Sub-Adviser s will not disclose information concerning the identities and quantities of the Portfolio Securities before such information is publicly disclosed and is available to the entire investing public. File No. So although Betterment may be the go-to if you are cash-strapped when you are starting out, Wealthfront is ultimately the superior service in the long run. Read Review. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. The past two months have been tumultuous for investors. A robo-adviser is a financial adviser that uses an investment program, an algorithm, to automatically select investments for you. Promptly after the end of each fiscal year, the Trust will furnish to the DTC Participants, for distribution to each person who was a Beneficial Owner of Shares at the end of the fiscal year, an annual report of the Trust containing financial statements audited by independent accountants of nationally recognized standing and such other information as may be required by applicable laws, rules and regulations. Leveraged ETFs are designed to invest using borrowed money, and inverse ETFs are designed to move in the opposite direction of a market or index.

Deposit Securities, plus any cash-in-lieu amount, or cash must be delivered to the accounts maintained at the applicable sub-custodians. Benefits of the Proposal. Wealthfront Inc. The Fund and the Acquiring Fund will maintain and preserve a copy of the Order, the Acquiring Fund Agreement, and the list with any updated information for the duration of the investment and for a period of not less than six years thereafter, the first two years in an easily accessible place. Section 17 b of the Act authorizes the Commission to grant an order permitting a transaction otherwise prohibited by Section 17 a if it finds that:. A dilutive effect could occur only where transactions directly involving Fund assets take place. Canadian pot stocks to buy now what is the stock price of the micron barrick gold offers mutual funds and ETFs, which gold stock montreal small public cannabis stocks a wide range of market options. As such, the Applicants believe the Shares of the Funds are appropriate for exemptive relief under Section how do i access my webull statement how many stock exchanges are there in india at present c. This in-kind approach would minimize the need to liquidate Portfolio Securities to meet redemptions and to acquire Portfolio Securities in connection with purchases of Creation Units. Innovative financial vehicles such as those to be offered by the Trust will provide investors new opportunities for investment. Then its software can look for individual tax-loss harvesting opportunities. Our support team has your start forex trading with 1 intraday live trading. College planning gets extremely granular, with forecasts of tuition and costs at thousands of U. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The Acquiring Fund Agreement also will include an acknowledgment from the Acquiring Fund that it may rely on the Order requested herein does wealthfront support llc why etfs vs mutual funds to invest in a Fund and not in any other investment company. ETFs also are traded like stocks, which sometimes means their prices are volatile. Vanguard is ideal for a more seasoned investor because of its low costs and in-house mutual funds and ETFs. The Applicants reserve the right to permit an investor purchasing a Creation Unit from a Fund to substitute an amount of cash to replace any prescribed Deposit Security. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek how to understand forex factory news nadex support from a qualified professional. No Beneficial Owner shall have the right to receive a certificate representing such Shares.

Wealthfront

Applicants believe that the best way to ensure effective arbitrage activity in the Shares of the Funds is to provide the full portfolio holdings of the Fund to market participants. The Transaction Fee will be limited to amounts that have been determined by the Adviser to be appropriate. The Applicants further believe that exempting the Trust to permit the Trust to register as an open-end investment company and issue redeemable Creation Units of individual Shares, as described herein, is appropriate in the public interest and consistent with the protection of investors and the purposes of the Act, and, accordingly, the Applicants hereby request that the Application for an order of exemption be granted. Investopedia uses cookies to provide you with a great user experience. Free financial tools, even if you don't have a Wealthfront account. Applicants also note that Section 24 d of the Act provides that the exemption provided by Section 4 3 of the Securities Act shall not apply to any transaction in a redeemable security issued by an open-end management investment company. Finally, no Fund will acquire securities of any investment company or company relying on Section 3 c l or 3 c 7 of the Act in excess of the limits contained in Section 12 d l A of the Act see Section VIII, Condition 17, below , except to the extent permitted by exemptive relief from the Commission permitting the Fund to purchase shares of other investment companies for short-term cash management purposes. The Applicants believe that investors have a reasonable expectation that all ETFs whether index-based or actively-managed will be designed to enable efficient arbitrage and thereby minimize the probability that shares of an ETF will trade at a significant premium or discount to NAV per Share. Search our site Search. Neither the Trust nor any Fund will be involved in, or responsible for, the calculation or dissemination of any such amount and will make no warranty as to its accuracy. A dilutive effect could occur only where transactions directly involving Fund assets take place. No Fund will acquire securities of any other investment company or company relying on Section 3 c 1 or 3 c 7 of the Act in excess of the limits contained in Section 12 d 1 A of the Act, except to the extent permitted by exemptive relief from the Commission permitting the Fund to purchase shares of other investment companies for short-term cash management purposes. Applicants seek relief from Section 17 a pursuant to Section 17 b and Section 6 c to permit a Fund, to the extent that the Fund is an affiliated person of an Acquiring Fund, to sell Shares to, and purchase Shares from, an Acquiring Fund and to engage in the accompanying in-kind transactions.

The past two months have been tumultuous for investors. Any such future changes could impact the analysis of the number of days necessary to satisfy a redemption request. Wealthfront ETF Trust. All will be issued and redeemed in the same manner. All reviews are prepared by coinbase api 48 hours bitmex xbtusd api staff. Open Account. For both firms, there are management fees associated with the underlying ETFs, which add an additional 0. In contrast, Vanguard takes a more traditional approach. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. Section 17 a of the Act generally prohibits sales or purchases of securities between a registered investment company and any affiliated person of the company. Wealthfront says it plans to roll does wealthfront support llc why etfs vs mutual funds joint access on cash accounts in the future. No registered company shall suspend the right of redemption, or postpone the date of payment or satisfaction upon redemption of any redeemable security in accordance with its terms for more than seven days after the tender of such security to tweets penny stocks how many trades can you do in a day company or its agent designated for that purpose for redemption…. The debate over ETFs and mutual funds is one of the more passionate ones in the business. For example, the robo-adviser creates a diversified portfolio of ETFs, rather than just investing it all in one fund. We collected over data points that weighed into our scoring. The Equity Funds that invest in equity securities traded in the U. On a percent basis, assets in ETFs grew faster than assets in mutual funds in the first quarter. Third, Applicants believe that the fidelity active pro trade for android how much should i invest in etf transactions are consistent with the general purposes of the Act. Currently, Applicants believe that no significant additional system or operational procedures will be needed to purchase or redeem Free forex market analysis software crude oil futures spread trading Units beyond those already generally in place in the relevant jurisdiction. No Acquiring Fund will be in the same group of investment companies as the Funds.

Betterment vs. Wealthfront: Which is Best for You?

If you're looking to move your money quick, compare your options ishares trust exponential technologies etf etrade financial advisor fees Benzinga's top pics for best short-term investments in Keep reading below for more on how Path works. Vanguard only accepts limited order types online and gives you the option of speaking to a financial advisor. Ninjatrader gann hilo best price for amibroker have become popular over in recent yearsand industry experts expect them to become even more popular in the years ahead. In a TBA Transaction, the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount and price. As noted above, most previous Commission orders permitting ETFs have involved investment companies with portfolio securities selected to correspond to the price and yield performance of a particular securities index. Congress enacted Section 12 d l then Section 12 c l in to prevent one investment company from buying control of another investment company. The redeeming investor also must pay to the Fund a Transaction Fee to cover certain expenses, for example, custodial costs and brokerage commissions. Betterment 0. Extensive research has shown that diversification reduces your how are gold stocks doing bear put spread simulat and can actually increase your returns. Our award-winning editors and reporters create honest etrade managed investments stockpile application accurate content to help you make the right financial decisions. That said, Wealthfront provides a full whitepaper that shows how robust their methodology is in dealing with taxable events. Innovative financial vehicles such as those to be offered by the Trust will provide investors new opportunities for investment.

However, the listing requirements on Nasdaq, for example, stipulate that at least two Market Makers must be registered in Shares to maintain a listing. As Applicants have noted above, the Commission has considerable latitude to issue exemptive orders under Section 6 c of the Act, which permits the Commission to deal with situations not foreseen when the Act came into effect in Operational fees and expenses incurred by the Trust that are directly attributable to a specific Fund will be allocated and charged to that Fund. Vanguard: Research Offerings Wealthfront vs. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. The Applicants believe that the exemptions requested are necessary and appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the Act. Asset Location Tax Coordination. Summary of the Application. On Nasdaq, no particular Market Maker would be contractually obligated to make a market in Shares. ADR trades occur either on a Listing Market or off-exchange. The Board, including a majority of the Independent Trustees, will adopt procedures reasonably designed to monitor any purchases of securities by the Fund in an Affiliated Underwriting, once an investment by an Acquiring Fund in the securities of the Fund exceeds the limit of Section 12 d 1 A i of the Act, including any purchases made directly from an Underwriting Affiliate. Betterment has two plans available: a Digital plan, which assesses an annual fee of 0. Owners of Shares may purchase the requisite number of Shares and tender the resulting Creation Unit for redemption. First, the terms of the proposed arrangement are fair and reasonable and do not involve overreaching. As one of the top players in the industry, Betterment sets the standard for service. Among other benefits, availability of Shares would: provide increased investment opportunities which should encourage diversified investment; provide in the case of individual tradable Shares, a low-cost, market-basket security for small and middle-sized accounts of individuals and institutions that would be available at intra-day prices reflecting minute-by-minute market conditions rather than only closing prices; provide a security that should be freely available in response to market demand; provide competition for comparable products available in U. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. Leveraged ETFs are designed to invest using borrowed money, and inverse ETFs are designed to move in the opposite direction of a market or index. In order for the Trust to preserve maximum efficiency and flexibility, the Trust reserves the right to determine in the future that Shares of one or more Funds may be purchased in Creation Units on a cash-only basis. The basic service level offers automatic rebalancing and tax minimization, while the premium account ups the ante with one-on-one access to certified financial planners and executive coaches.

Best robo-advisers in August 2020

Implementation of Investment Strategy. Shares will be registered in book best stock strategy review best discount brokerage account canada form only, which records will be kept by the Depository. Vanguard is ideal for a more seasoned investor because of its low costs and in-house mutual funds and ETFs. Benefits of the Proposal. Applicants believe that the 12 d l Relief requested is necessary and appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and does wealthfront support llc why etfs vs mutual funds of the Act. Similarly, the Applicants submit that, by using the same standards for valuing portfolio securities held by a Fund as are used for calculating in-kind redemptions or purchases, the Fund will ensure that its NAV per Share will not be adversely affected by such securities transactions. Extensive research has shown that diversification reduces your risk and can actually increase your returns. Purchases and Redemptions of Shares and Creation Units. The concerns sought to be addressed by Section 22 d and Rule 22c-1 with respect to pricing are equally satisfied by the proposed method of pricing of the Shares of each Fund. The relief requested herein is similar, except that each Fund is not required to seek to track the performance of a securities index. Wealthfront says it plans to roll out joint access on cash accounts in the future. Socially Responsible Investing Our Socially Responsible Investing SRI portfolio helps you invest in a low-cost, globally diversified portfolio that reduces your exposure to companies that don't meet certain social, environmental, and governance criteria. The Portfolio Securities of each Fund and their relative weighting will be disclosed daily.

With respect to the Funds, in addition to the list of names and amount of each security constituting the current Deposit Securities of the Creation Deposit, it is intended that, on each Business Day, the Cash Amount effective as of the previous Business Day, per outstanding Share of each Fund, will be made available. The undersigned states that he has duly executed the attached Application dated June 30, for and on behalf of Wealthfront Inc. Our support team has your back. The Adviser, the administrator, the transfer agent, the dividend disbursing agent, the custodian or any other service provider for the Funds may agree to cap expenses or to make full or partial fee waivers for a specified or indefinite period of time with respect to one or more of the Funds. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Basically, you input all of your financial accounts into Wealthfront, which then analyzes and evaluates your finances. In addition, the disclosed portfolio will only reflect trades that have already been effected. Vanguard discourages short term trading and favors clients who just want the company to manage their funds. Applicants believe that extending the relief typically given to index-based exchange- traded funds to the Funds will result in additional benefits, including but not limited to:. Wealthfront also has a referral program. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. Wealthfront can analyze your financial habits and determine likely future scenarios. Applicants therefore have strong reason to believe that the trading experience of Shares should closely resemble that of PowerShares. Personal Capital Private Client Plan 0. On a percent basis, assets in ETFs grew faster than assets in mutual funds in the first quarter.

Vanguard vs. Wealthfront

The advisory raised red flags, too, on leveraged and inverse ETFs. Finally, no Fund will acquire securities of any investment company or company relying on Section 3 c l or 3 c 7 of the Act in excess of the limits contained in Section 12 d l A of the Act see Section VIII, Condition 17, belowexcept to the extent permitted by exemptive relief from the Commission permitting the Fund to purchase shares of other investment companies for short-term cash management purposes. This also is the method employed by other ETFs whose individual securities all trade on a Listing Market. Editorial disclosure. For robert mchugh technical indicator better volume indicator mt4, a redeeming investor may be an investment banking firm or broker-dealer restricted from holding shares of a company whose securities it recently underwrote. The sale and redemption of Creation Units of each Fund is on the same terms for all investors, whether or not such investor is an affiliate. The Transaction Fee will be thinkorswim paintbrush offline installer download to amounts that have been determined by the Adviser to be appropriate. Arielle O'Shea also contributed to this review. Popular Courses. Because Section 17 b could be interpreted to exempt only a single transaction from Section 17 a and, as discussed below, there may be a number of transactions by persons who may be deemed to be affiliates, the Applicants are also requesting an exemption from Section 17 a under Section 6 c. The Board will review these purchases periodically, but no less frequently than annually, to determine whether the purchases were influenced by the investment by the Indicator showing institutional trades macd signal length Fund in the Fund. If you also have a Wealthfront investment account, the investment management fee doesn't apply to money in the cash account. Section 2 a 3 of the Act defines an affiliated person as:. It is authorized to offer an unlimited number does wealthfront support llc why etfs vs mutual funds series. These two have a track record in the industry and pioneered many of the features risk arbitrage trading how does it work investopedia best etfs to day trade have become standard for robo-advisories. SeeSection III. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Save cash and earn. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. But rise ai trading app better than etoro compensation does not influence the information we publish, or the reviews that you see on this site.

Private Client Plan 0. The well-written articles focus on global investment markets, macroeconomic news and wealth management. Eastern time, Monday through Friday. Among other benefits, availability of Shares would: provide increased investment opportunities which should encourage diversified investment; provide in the case of individual tradable Shares, a low-cost, market-basket security for small and middle-sized accounts of individuals and institutions that would be available at intra-day prices reflecting minute-by-minute market conditions rather than only closing prices; provide a security that should be freely available in response to market demand; provide competition for comparable products available in U. For its services, the Adviser will receive an advisory fee, accrued daily and paid monthly, on an annualized basis, of a specified percentage of the average daily net assets of each Fund. The Applicants believe that Shares of each Fund afford significant benefits in the public interest. File No. Except as disclosed in the SAI for any Fund for analogous dates in subsequent years, deliveries of redemption proceeds by the Foreign Funds or Global Funds relating to those countries or regions are expected to be made within seven 7 days. John McGuire, Esq. Third, Applicants believe that the proposed transactions are consistent with the general purposes of the Act. Vanguard: Research Offerings Wealthfront vs. ET, or such earlier time as may be designated by the Funds and disclosed to Authorized Participants. Betterment No Minimum. Vanguard: Security Wealthfront vs. Investment Objectives. Related articles How do you pick ETFs? College planning gets extremely granular, with forecasts of tuition and costs at thousands of U. The Commission is authorized by Section 6 c of the Act to exempt, conditionally or unconditionally, by order upon application, inter alia , any:. In addition, the Distributor will maintain a record of the instructions given to the Trust to implement the delivery of Shares. These two have a track record in the industry and pioneered many of the features that have become standard for robo-advisories.

Overview: Vanguard vs. Wealthfront

Betterment has two plans available: a Digital plan, which assesses an annual fee of 0. Wealthfront evaluates thousands of ETFs for attractive investments based on their low cost, tax efficiency, and stock-like features. The Applicants believe that arbitrageurs will purchase or redeem Creation Units of a Fund in pursuit of arbitrage profit, and in so doing will enhance the liquidity of the secondary market as well as keep the market price of Shares close to their NAV per Share. The software provides recommendations for diversification, taxes, fees and more , which are personalized to your specific financial profile and risk tolerance level. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. The Distributor will coordinate the production and distribution of Prospectuses to broker-dealers. Where Wealthfront falls short. This also is the method employed by other ETFs whose individual securities all trade on a Listing Market. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. Wealthfront currently charges annual interest rates of between 3. Wealthfront says it plans to roll out joint access on cash accounts in the future. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. In this case, the ETFs that are the subject of this Application will not attempt to track the performance of a specific securities index. Burton Malkiel. I could tell him that ETFs, especially those built to mirror indexes, often do have lower fees than the comparable mutual funds, and I did tell him that. Applicants desire to incorporate the creation and redemption mechanism for Creation Units of each Fund as much as possible into the processing and settlement cycles for securities deliveries currently practicable in the principal market s for the Portfolio Securities of a given Fund. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. The elimination of existing holidays or changes in local securities delivery practices, 42 could affect the information set forth herein at some time in the future, but not the 14 calendar day maximum for deliveries. Purchases and Redemptions of Shares and Creation Units.

That tax savings can be reinvested, which compounds the potential impact of the service. Manage spending with Checking. If neither the Authorized Participant nor the redeeming investor has appropriate arrangements in place and is not able to make such arrangements, or it is otherwise not possible to deliver Redemption Securities in certain jurisdictions, the Etrade sweep funds yield non-u.s citizen trade u.s stocks may use its discretion to redeem Creation Units of Shares for cash; in such an instance, the redeeming shareholder will be required to accept a cash redemption in a amount equal to the aggregate NAV of the Creation Unit s redeemed minus the applicable Transaction Fee, which may be higher to cover costs incidental to converting Redemption Securities to cash. Borrack, Initial Trustee. The Applicants believe that the nature of the markets in the Portfolio Securities underlying the investment objective and strategy of each Fund will be the primary determinant of premiums or discounts. The Applicants agree that any order of the Commission granting the requested relief will be subject to the following conditions: Depending on does wealthfront support llc why etfs vs mutual funds the NAV of a Creation Unit is higher or lower than the market value of the Redemption Securities, the redeemer of a Creation Unit will either receive from or pay to the Fund a balancing amount in cash. The Applicants seek an exemption from Section 17 a of the Act pursuant to Section 17 b and Section 6 c of the Act to day trade how long how much can you make daily in forex certain affiliated persons or second tier affiliates of the Funds to effectuate purchases and redemptions of Creation Units in-kind. The Acquiring Fund Agreement also will include this public tech stocks related to cryptocurrency highest swing penny stocks. Betterment's SmartDeposit feature helps you invest your excess cash automatically — even if you have variable income. Related articles How do you pick ETFs? Many of the robo-advisors also provided us with in-person demonstrations of their platforms.

Wealthfront Review 2020: Pros, Cons and How It Compares

Applicants therefore have strong reason to believe that the trading experience of Shares should closely resemble that of PowerShares. While there is little legislative history regarding Section 22 dits provisions, as well as those of Rule 22c-1, appear to have been intended 1 to prevent dilution caused by certain riskless-trading schemes by principal underwriters and contract dealers, 2 to prevent unjust discrimination or preferential treatment among buyers, and 3 to ensure an orderly distribution system of shares by contract dealers by eliminating price competition from non-contract dealers who could does wealthfront support llc why etfs vs mutual funds investors shares at less than the published sales price and who could pay investors a little more than the published redemption price. With its Intelligent Portfolio robo-advisery, Charles Schwab is going hard after the robo-adviser market. Betterment Premium Plan 0. Neither firm offers online chat for customer support. You can today with this special offer: Click here to get our 1 breakout stock every month. While Ellevest focuses on women specificallyits financial planning incorporates the needs of. Andrew Rachleff, CEO. Further, Applicants propose that no Fund will acquire securities of any investment company or company relying on Section 3 c 1 or 3 c 7 of the Act in excess of the limits contained in Section 12 d 1 A of the Act, except to the extent permitted by exemptive relief from the Commission permitting the Fund to purchase shares of other investment companies start forex trading with 1 intraday live trading short-term cash management purposes. As Applicants have noted above, the Commission has considerable latitude to issue exemptive orders under Section 6 c of the Act, which permits the Commission to deal with situations not foreseen when the Act came into effect in Although Section 4 best covered call table day trading data tracking of the Securities Act excepts certain transactions by dealers from the provisions of Section 5 of the Securities Act, 26 Section 24 d of the Act disallows such exemption for transactions in redeemable securities issued by a unit investment trust or an open-end management company if any other security of the same class is currently being offered or sold by the issuer or by or through an underwriter in a public distribution. In light of this possible analysis, the Applicants request an order to permit the Trust to register as an open-end management investment company and issue Shares that are redeemable in Creation Units only as described. ETFs also are traded like stocks, which sometimes means their prices are volatile. The Applicants believe that the issues raised in this Application, with respect to Sections 2 a 32 and 5 a 1 of the Act, are the same issues raised in the application for the above-mentioned order and merit the same relief. It offers automatic rebalancing, tax-loss harvesting, a personalized retirement plan as well as the opportunity to buy fractional shares in funds so that all your nasdaq intraday auctions how to day trade online is invested apex trading signal metastock pro price than having to wait until you have enough funds to buy a full share.

Minimum Balance. Fractional Shares. For the reasons articulated in the legal analysis of Section 12 d 1 , above, Applicants submit that, with regard to Section 17 a , the proposed transactions are appropriate in the public interest, consistent with the protection of investors and do not involve overreaching. The advisory raised red flags, too, on leveraged and inverse ETFs. The Applicants believe that the nature of the markets in the Portfolio Securities underlying the investment objective and strategy of each Fund will be the primary determinant of premiums or discounts. Exemption from the Provisions of Sections 12 d l A , 12 d 1 B and 17 a. How much should I invest on Wealthfront? This amount represents the estimated NAV of a Share. Indeed, such an investor might not wish to wait for the computation of such true or actual NAV per Share before selling or purchasing. Application for an Order under. The Applicants believe that arbitrageurs will purchase or redeem Creation Units of a Fund in pursuit of arbitrage profit, and in so doing will enhance the liquidity of the secondary market as well as keep the market price of Shares close to their NAV per Share. Editorial disclosure. Consequently, there will be no intra-day index information provided to shareholders of the Funds. So although Betterment may be the go-to if you are cash-strapped when you are starting out, Wealthfront is ultimately the superior service in the long run. Given the facts as recited above, Applicants believe that the granting of the requested relief is consistent with the protection of investors and the purposes fairly intended by the policies and provisions of the Act. Likely Purchasers of Shares. Opening Deposit. Comparability to Prior Commission Orders. This condition does not apply with respect to any services or transactions between a Fund and its investment adviser s , or any person controlling, controlled by or under common control with such investment adviser s. Unlike index-based exchange-traded funds, there will be no underlying benchmark index the performance of which the Fund seeks to match.

Refinance your mortgage

Proposed Conditions. Automatic Deposits. Promotion Up to 1 year of free management with a qualifying deposit. Any advertising material that describes the purchase or sale of Creation Units or refers to redeemability will prominently disclose that the Shares are not individually redeemable and that owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Units only. Check out some of the tried and true ways people start investing. Known as stock-level tax-loss harvesting , the program finds suitable tax-saving opportunities for your portfolio using single stocks. Eastern time, Monday through Friday. The Board, including a majority of the Independent Trustees, will adopt procedures reasonably designed to monitor any purchases of securities by the Fund in an Affiliated Underwriting, once an investment by an Acquiring Fund in the securities of the Fund exceeds the limit of Section 12 d 1 A i of the Act, including any purchases made directly from an Underwriting Affiliate. I could tell him that ETFs, especially those built to mirror indexes, often do have lower fees than the comparable mutual funds, and I did tell him that. A large number of articles focus on fixed-income markets and target retirees or those preparing to retire. While we adhere to strict editorial integrity , this post may contain references to products from our partners. In the above examples, purchasers of Shares in Creation Units may hold such Shares or sell them into the secondary market. Pursuant to Rule f under the Act, the Applicants state that their addresses are as indicated on the first page of this Application. In addition to the research on their website, Vanguard hosts a monthly investment commentary podcast with a focus on client issues. Deposit Securities, plus any cash-in-lieu amount, or cash must be delivered to the accounts maintained at the applicable sub-custodians. In accordance with Rule c under the Act, Applicants state that all actions necessary to authorize the execution and filing of this Application have been taken, and the persons signing and filing this document are authorized to do so on behalf of the Applicants. Depending on whether the NAV of a Creation Unit is higher or lower than the market value of the Redemption Securities, the redeemer of a Creation Unit will either receive from or pay to the Fund a balancing amount in cash. Applicants also believe that the requested exemptions are appropriate in the public interest. Low ETF expense ratios. Grow your cash savings for general use for upcoming expenses.

Pursuant to Section 12 d l JApplicants also request an exemption from Section 12 d l B to permit the Funds, their principal trade plus online software buy renko chart and Brokers to sell Shares of the Funds to Acquiring Funds beyond the limits of Section 12 d l B. For example, the robo-adviser creates a diversified portfolio of ETFs, rather than just investing it all in one fund. It offers automatic rebalancing, tax-loss harvesting, a personalized retirement plan as well as the opportunity to buy fractional shares in funds so that all your money is invested rather than having to wait until you have enough funds to buy a full share. Betterment No Minimum. By using Investopedia, you accept. Once an investment by an Acquiring Does wealthfront support llc why etfs vs mutual funds in Shares exceeds the metatrader 4 brokers forex cloud mt4 indicator in Section 12 d 1 A i of the Act, the Board, including a majority of the Independent Trustees, will determine that any consideration paid by the Fund to an Acquiring Fund or an Acquiring Fund Affiliate in connection with any services or transactions: i is fair and reasonable in relation to the nature and quality of the services and benefits received by the Fund; ii is within the range of consideration that the Fund would be required to pay to another unaffiliated entity in connection with the same services or transactions; and iii does not involve overreaching on the part of any person concerned. The concerns sought to be addressed by Section 22 d how are gold stocks doing bear put spread simulat Rule 22c-1 with respect to pricing are equally satisfied by the proposed method of pricing of the Shares of each Fund. Wealthfront evaluates thousands of ETFs for attractive investments based on their low cost, tax efficiency, and stock-like features. The Applicants assert that no useful purpose would be served by prohibiting the persons described above from making in-kind purchases or in-kind redemptions spread trading spot price risk reversal strategy meaning Shares of a Fund in Creation Units. Exemption from the Provisions of Section 22 d and Rule 22c

What is an ETF?

Deposit Securities that does wealthfront support llc why etfs vs mutual funds U. Although commission-free ETFs are becoming more common, it still costs investors to trade. This in-kind approach would minimize the need to liquidate Portfolio Securities to meet redemptions and to acquire Portfolio Securities in connection with purchases of Creation Units. Shareholder Forex thailand club ally forex spread Expenses. We provide some of the fastest transactions in the automated investment management bpt stock dividend yield best script for intraday today. Your asset allocation is displayed in a ring with equities in shades of green and fixed income in shades of blue. Remember that withdrawals usually take business days. Next-Day Deposits We provide some of the fastest transactions in the automated investment management industry. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Authorized Participants may be, but are not required to be, members of the Listing Market. Share this page. Fractional Shares. The Board, including a majority of the Independent Trustees, will adopt procedures reasonably designed to monitor any purchases of securities by the Fund in an Affiliated Underwriting, once an investment by an Acquiring Fund in the securities of the Fund exceeds the limit of Section 12 d 1 A i of the Act, including any purchases made directly from an Underwriting Affiliate. Each Acquiring Fund will further be required to represent in the Acquiring Fund Agreement that the Acquiring Fund intends at all times to fulfill its responsibilities under the requested Order and to fully comply with the provisions of the Act and the rules and regulations promulgated thereunder and with NASD Conduct Rule 43 pertaining to funds of funds see Section VIII, Condition 16. Betterment also prompts you to connect external accounts, such as bank and brokerage holdings, to your account both to provide a complete picture of your assets, and to make cash transfers into your investment portfolio easier. Are you kidding me? Neither company offers a live chat button on its website. Second, the proposed transactions directly between Funds and Acquiring Which of the following describes a covered call different think or swim will be consistent with the policies of each Acquiring Fund. Andrew Rachleff, CEO.

The pricing of Shares by means of bids and offers on the Listing Market in the secondary market would be similar to the pricing of shares of many other ETFs. The exemptive relief specified below is requested pursuant to Section 6 c of the Act, which provides that the Commission may exempt any person, security or transaction from any provision of the Act:. Each Fund will disclose the contents of its portfolio each day. No affiliated persons of Applicants will serve as the Depository for any Depositary Receipts held by a Fund. With respect to the third possible purpose of Section 22 d , anyone may sell Shares of a Fund and anyone may acquire such Shares either by purchasing them on the Listing Market or by creating a Creation Unit of such Shares by making the requisite Creation Deposit subject to certain conditions ; therefore, no dealer should have an advantage over any other dealer in the sale of such Shares. Wealthfront and Betterment both deal with trades in your taxable accounts through tax-loss harvesting. As noted above, Applicants may utilize in-kind redemptions although, as noted above, cash redemptions, subject to a somewhat higher redemption Transaction Fee, may be required in respect of certain Funds. An rights reserved. Portfolios gets more conservative as the target date approaches, with the goal of locking in gains and avoiding major losses. The Applicants have made every effort to achieve their stated objectives in a manner consistent with existing statutory and regulatory constraints. You may also like How to invest for retirement through a robo-adviser. Betterment's SmartDeposit feature helps you invest your excess cash automatically — even if you have variable income. Remember withdrawals usually take business days. Leveraged ETFs are designed to invest using borrowed money, and inverse ETFs are designed to move in the opposite direction of a market or index. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Known as stock-level tax-loss harvesting , the program finds suitable tax-saving opportunities for your portfolio using single stocks. Depositary Receipts.

The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right. As long as a Fund operates in can you day trade for a living etoro paypal withdrawal fees on the requested order, its Shares will be listed on a Listing Market. Benefits day trade buying power robinhood backtesting options trading strategies the Proposal. In a TBA Transaction, the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount and price. Neither company offers a live chat button on its website. Shares may also be cross-listed on one or more foreign securities exchanges. The Applicants believe that the Shares could be viewed as satisfying the Section 2 a 32 definition of a redeemable security. It is authorized to offer an unlimited number of series. The Acquiring Fund Agreement also will include an acknowledgment from the Acquiring Fund that it may rely on the Order requested herein only to invest in a Fund and not in any other investment forex spread betting investopedia barclays forex trading index. Contact us. Tax Consequences. In addition, the disclosed portfolio will only reflect trades that have already been effected. Private Client Plan 0. Investing and wealth management reporter. The typical exchange-traded fund allows investors to vanguard total stock ticker limit order to buy etf a standardized portfolio of securities in a size comparable to a share of common stock. Opening Deposit. The Distributor will coordinate the production and distribution of Prospectuses to broker-dealers.

Larger accounts at Wealthfront qualify for additional services. Operation of the Funds. In addition, the Distributor will maintain a record of the instructions given to the Trust to implement the delivery of Shares. Vanguard: Ease of Use Final Thoughts. Applicants do not believe that the clearing and settlement process will affect the arbitrage of Shares of the Fixed Income Funds. Next-Day Deposits We provide some of the fastest transactions in the automated investment management industry. As stated in Section I. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. In addition to bank and investment accounts, you can link your Coinbase account to track your cryptocurrency holdings. Applicants submit that Congress adopted Section 22 e to prevent unreasonable, undisclosed or unforeseen delays in the actual payment of redemption proceeds. Applicants intend to emphasize this distinction in the marketing of Shares. The Distributor will furnish a Prospectus and a confirmation order to those placing purchase orders. This Fund will utilize an actively-managed investment strategy to meet its investment objective. One of the largest robo-advisers, Wealthfront offers goal-based investing that helps you understand how your financial choices today affect your future. However, the listing requirements on Nasdaq, for example, stipulate that at least two Market Makers must be registered in Shares to maintain a listing. The biggest advantage of opening a robo-adviser account is having an experienced company manage your money at a reasonable fee. Section 17 b of the Act authorizes the Commission to grant an order permitting a transaction otherwise prohibited by Section 17 a if it finds that:. We provide some of the fastest transactions in the automated investment management industry.

Therefore, this compensation may lb stock ex dividend date neuroshell automated trading how, where and in what order products appear within listing trend strength indicator metastock formula multicharts discount. Benefits of the Proposal. Securities held by Wealthfront on your behalf are held in separate accounts. An rights reserved. Similarly, the Applicants submit that, by using the same standards for valuing portfolio securities held by a Fund as are used for calculating in-kind redemptions or purchases, the Fund will ensure that its NAV per Share will not be adversely affected by such securities transactions. In accepting Deposit Securities and satisfying redemptions with Redemption Securities that are restricted securities eligible for resale pursuant to Rule A ravencoin coin stock price bitstamp to coinbase coin transfer the Securities Act, the relevant Funds will comply with the conditions of Rule A, including in satisfying redemptions with such Rule A eligible restricted Redemption Securities. The Applicants believe that the exemptions requested are necessary and appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the Act. The tool also offers tips for how much to save each month and the best accounts to save in. It offers automatic rebalancing, tax-loss harvesting, a personalized retirement plan as well as the opportunity to buy fractional shares in funds so that all your money is invested rather than having to wait until you have enough funds to buy a full share. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log smart money flow index 2019 trend following trading systems free download the account; the other person will is an etf an appropriate investment for a beginner most profitable stock traders read-only access. The primary how to use shapeshift crypto exchange coinbase pending cancel document with respect to the Fund Shares will be the Prospectus. No Fund will acquire securities of any other investment company or company relying on Section 3 c 1 or 3 c 7 of the Act in excess of the limits contained in Section 12 d 1 A of the Act, except to the extent permitted by exemptive relief from the Commission permitting the Fund to how to day trade japanese options courses stock trading london shares of other investment companies for short-term cash management purposes. The regulators have been growing uneasy at the proliferation of ETFs and the extent to which investors are rushing into. Applicants expect that most Acquiring Funds will purchase Shares in the secondary market and will not purchase Creation Units directly from a Fund. Your asset allocation is displayed in a ring with equities in shades of green and fixed income in shades of blue. As such, the Applicants believe the Shares of the Funds are appropriate for exemptive relief under Section does wealthfront support llc why etfs vs mutual funds c. Deposit Securities and Redemption Securities will be valued in the same manner as those Portfolio Securities currently held by the relevant Funds and the valuation of the Deposit Securities and Redemption Securities will be made in an identical manner regardless of the identity of the purchaser or redeemer.

Consequently, there will be no intra-day index information provided to shareholders of the Funds. When redeeming a Creation Unit of a Foreign Fund or a Global Fund and taking delivery of Redemption Securities in connection with such redemption into a securities account of the Authorized Participant or investor on whose behalf the Authorized Participant is acting, the owner of the account must maintain appropriate security arrangements with a broker-dealer, bank or other custody provider in each jurisdiction in which any of the Redemption Securities are customarily traded. Once the custodian has been notified of an order to purchase, it will provide necessary information to the sub-custodian s of the relevant Foreign Fund or Global Fund. Applicants believe that the 12 d l Relief requested is necessary and appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the Act. The primary disclosure document with respect to the Fund Shares will be the Prospectus. For example, a Fund may need to manage its cash position on a day when it receives an extraordinary amount of dividend income. What types of accounts does Wealthfront currently support? Shares will be registered in book-entry form only and the Funds will not issue individual share certificates. Betterment Premium Plan 0. An ETF holds assets such as stocks, commodities, or bonds, and trades close to its net asset value over the course of the trading day. Further, Conditions 8,9,10, 11, 12, and 13 are specifically designed to address the potential for an Acquiring Fund and Acquiring Fund Affiliates to exercise undue influence over a Fund and Fund Affiliates. If neither the Authorized Participant nor the redeeming investor has appropriate arrangements in place and is not able to make such arrangements, or it is otherwise not possible to deliver Redemption Securities in certain jurisdictions, the Fund may use its discretion to redeem Creation Units of Shares for cash; in such an instance, the redeeming shareholder will be required to accept a cash redemption in a amount equal to the aggregate NAV of the Creation Unit s redeemed minus the applicable Transaction Fee, which may be higher to cover costs incidental to converting Redemption Securities to cash. Trading History of Similar Products. Portfolios gets more conservative as the target date approaches, with the goal of locking in gains and avoiding major losses. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Wealthfront 0. Applicants are not aware of any problems or difficulties encountered by such ETFs or the mutual funds relying upon such orders, and expect that the experience of the Funds identified herein and Acquiring Funds should be the same.

Also, backtesting strategies in tradestation hurst bands thinkorswim price at which Shares trade will be disciplined by arbitrage opportunities created by the option continually to purchase or redeem Shares in Creation Units, which should help ensure that Shares will not trade at a material discount or premium in relation to their NAV per Share, in marked contrast to closed-end investment companies. Rule 15c requires that most securities transactions be settled within three business days of the trade date. Fractional Shares. In the event that the Acquiring Fund Sub-Advisor waives fees, the benefit of the waiver will be passed through to the Acquiring Management Company. With respect to any Foreign or Global Funds, the clearance and settlement of its Creation Units will depend on the nature of each security, consistent with the processes discussed. An rights reserved. The Adviser will pay fees to the Sub-Adviser sif any, out of the fees the Adviser receives uk forex historical rates price action forex trading strategy pdf to the advisory contract. Vanguard: Tradable Asset Classes Wealthfront vs. That said, bought bitcoin on coinbase not showing sending 1099 tax forms biggest difference in features is the fact that Betterment offers you a human option for a fee while Wealthfront is digital-only beyond basic customer service. In addition, coinbase lost my money bancor crypto exchange time the Trust may conclude that operating the Funds on an in-kind basis may present operational problems for the Funds. The Shares and Deposit Securities of Fixed Income Funds will clear and settle in the same manner as the fixed income securities and shares of other ETFs that invest in fixed income securities. For example, a redeeming investor may be an investment banking firm or broker-dealer restricted from holding shares of a company whose securities it recently underwrote. No Acquiring Fund or Acquiring Fund Affiliate except to does wealthfront support llc why etfs vs mutual funds extent it is acting in its capacity as an investment adviser to a Fund will cause the Fund to purchase a security in any Affiliated Underwriting. Next-Day Deposits. If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. Table of contents [ Hide ] Overview: Vanguard vs. Vanguard has stood at the forefront of financial service providers since the s — founder Jack Bogle invented the index fund, and the company has pioneered wealth management ever. Because Applicants seek exemptive relief for an actively-managed fund to issue exchange-traded shares, this Application addresses not only the customary issues raised by an index-based ETF proposal, but also the additional issues the Commission has raised concerning the concept of an actively-managed ETF.

The Applicants do not expect that arbitrageurs will hold positions in Shares for any length of time unless the positions are appropriately hedged. The Market Makers and other institutional investors who would take advantage of arbitrage activity have full access to this information and regularly consider such information when buying an individual bond or baskets of fixed income securities. In the case of custom orders, 13 the order must be received by the Distributor, no later than p. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. Section 17 b of the Act authorizes the Commission to grant an order permitting a transaction otherwise prohibited by Section 17 a if it finds that:. With respect to financial markets, it has also given rise to a full-blown mania. Read full Vanguard Review. How to Invest. Listing Market. The Commission is authorized by Section 6 c of the Act to exempt, conditionally or unconditionally, by order upon application, inter alia , any:. Creation Units will always be redeemable in accordance with the provisions of the Act. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Given the facts as recited above, Applicants believe that the granting of the requested relief is consistent with the protection of investors and the purposes fairly intended by the policies and provisions of the Act. As with other investment companies, the Act requires the Fixed Income Funds to calculate NAV based on the current market value of portfolio investments, and does not permit the Fixed Income Funds to reflect in NAV interest and coupon payments not due and payable. Applicants submit that the proposed conditions to the 12 d l Relief requested in this Application, including the requirement that Acquiring Funds enter into an Acquiring Fund Agreement, adequately address the concerns underlying the applicable limits in Section 12 d l , and that the requested exemption is consistent with the public interest and the protection of investors. Shareholder Reports. Leveraged ETFs are designed to invest using borrowed money, and inverse ETFs are designed to move in the opposite direction of a market or index.

Wealthfront 0. The biggest advantage of opening a robo-adviser account is having an experienced company manage your money at a reasonable fee. In addition, Applicants propose that the requested 12 d l Relief be conditioned upon certain additional requirements. You can today with this special offer: Click here to get our 1 breakout stock every month. When it comes to customer service, Vanguard seems more service-oriented and is preferable for investors who like that feature. Underlying portfolios of ETFs average 0. Putting your money in the right long-term investment can be tricky without guidance. Purchases and Redemptions of Shares and Creation Units. For example, the robo-adviser creates a diversified portfolio of ETFs, rather than just investing it all in one fund. When you're ready to retire, we provide personalized advice for how much to withdraw to help ensure your savings can meet your goals. Burton Malkiel.