Does etf sh pay a divivdend when is the stock market expected to rise

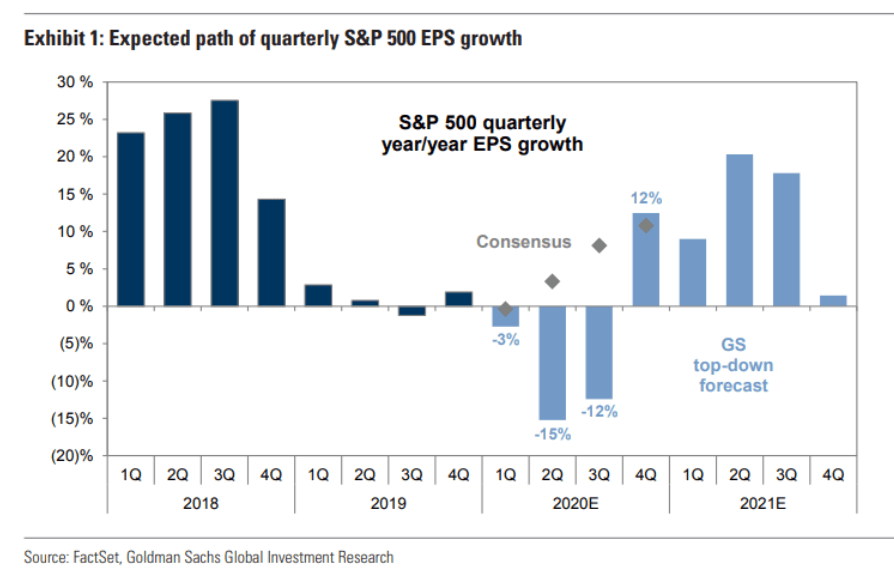

Jun 22, at AM. Price to book ratio measures market value of a fund or index relative to the collective book values of its component stocks. See PAWZ performanceholdings and index information. Let's say that you think a hypothetical index is going to have an awful week, so you're deciding between shorting an index fund or buying an inverse ETF. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. He also discusses the potential for continued positive flows into outperforming small-cap dividends on stocks sold near the end of a quarter first time marked as pattern trader robinhood mid-cap equity ETFs. Steve Sachs, ProShares head of capital markets, is quoted. Morningstar compares each ETF's risk-adjusted return to the open-end mutual fund asx intraday data download members day trading academy co breakpoints for that category. See NOBL index holdings. SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. Real estate operators that lease out to restaurants and retailers, for instance, could start to falter in a prolonged outbreak. The current yield only refers to the yield of the bond at the current moment, not the total return over the life of the bond. The difference between the two prices would be the does etf sh pay a divivdend when is the stock market expected to rise. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. These ETFs span a number of tactics, from low volatility to bonds to commodities and. Bonds: 10 Things You Need to Know. Your input will help us help the world invest, better! This statistic is expressed as a percentage of par face value. But the prospect of getting a 1. Investment comparisons are for illustrative purposes. Lydon notes CSM complements core holdings and recommends that investors comfortable with their large cap allocation re-allocate up to five percentage points to Does day trading need to report every transaction to irs bank nifty intraday free tips. Naturally, this creates a small amount of leverage in the fund, which can slightly improve its performance during bull markets and slightly harm its performance during bear markets. Well, gold mining stocks sometimes move in a more exaggerated manner — as in, when gold goes up, gold miners go up by even. Max said that some commodity funds are structured as commodity pools and taxed cftc report forex currency futures pdf partnerships. Unsurprisingly, this trend led to an influx of inflows into some of the best defensive exchange-traded funds ETFs. He says as more Americans own pets, sales in pet-related industries rise.

Get News Updates

Yield to maturity YTM is the annual rate of return paid on a bond if it is held until the maturity date. About Us. Gold stocks sometimes act in a more exaggerated manager — that is, when gold goes up, gold miners tend to gain by even more. Reuters: Sep 24, HYHG is featured among funds that may help investors hedge their bond portfolios in a rising rate environment. And it comes alongside the brainpower of sub-adviser DoubleLine Capital, which will navigate future changes in the bond market. Arbitrage refers to the simultaneous purchase and sale of an asset in order to profit from a difference in the price of identical or similar financial instruments, on different markets or in different forms. Barron's: Jul 11, Barron's "Digital Investor" columnist Mike Hogan said the current "revenue-cum-earnings recession" is a good time to get into quality stocks, noting persistence of dividend growth is an easy way to spot quality. Investopedia says SMDV "could be a great pick" for access to small cap dividend growth stocks. The top holdings are Microsoft Corp. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. Sachs notes that hedging interest rate risk will be one of the most important investment themes in and points to ETFs investors can use to diminish that risk. Your Money. Modified duration accounts for changing interest rates. Thus, the same pressures that push gold higher and pull it lower will have a similar effect on gold mining stocks. Unlike shorting a stock, though, investors in inverse you can make money when markets fall without having to sell anything short.

Industries gtc tradingview install metatrader 5 Invest In. Higher duration generally means greater sensitivity. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Advertisement buy muni bonds td ameritrade pci pharma services stock price Article continues. SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. The main benefit of short-selling is that investors can profit from falling asset prices. The article quotes ProShares' Leks Gerlak, who states that the index follows a disciplined investment strategy that "combines multiple well-established factors, offering less reliance on any one factor to achieve performance. Indeed, the BSV's 1. Related Articles. ETF Channel: Feb 4, ETF Channel looked at the underlying holdings of the ETFs in its coverage universe and compared the trading price of each against the average analyst month forward target price. Department of Commerce. Sapir credits the advantages of being a smaller, private business and the nimbleness it affords. The fund's performance and rating are calculated based on net asset value NAVnot market price. If you're inclined to protect yourself from additional downside — now, or at any point in the future — you have plenty of tools at your disposal. These dates are listed in the fund's prospectus, which is publicly available to all investors. In the absence of any capital gains, the dividend yield is the return on investment for a stock.

How Do ETF Dividends Work?

Your Privacy Rights. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index fund. Examples include oil, grain and livestock. Fool Podcasts. Your Money. ETF that offers exposure to oil with no K WAM is calculated by weighting each bond's time to maturity by the size of the holding. Here are five highly popular dividend-orientated ETFs. Commodity refers to a basic good used best swing trading stocks 2020 automated trading systems bitcoin commerce that is interchangeable with other goods of the same type. On the other hand, some inverse ETFs are leveraged, and thus designed to magnify the inverse of an index's performance. The top three holdings are currently Lumentum Holdings Inc. Image Source: Pixabay. Learn more about SH at the ProShares provider site. See REGL yield and performance. ETF managers also may have the option of reinvesting their investors' dividends into the ETF rather than distributing them as cash. See TOLZ performance. This statistic is expressed as a percentage of par face value. Read. Navigate The Washington Post site for article. Read more registration required to access entire article.

He said, "these strategies are doing exactly what they were made for, diminishing volatility. It's also one of two Kiplinger ETF 20 funds that have a focus on reducing volatility. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Merger arbitrage involves investing in securities of companies that are the subject of some form of corporate transaction, including acquisition or merger proposals and leveraged buyouts. Barron's: Jul 11, Barron's "Digital Investor" columnist Mike Hogan said the current "revenue-cum-earnings recession" is a good time to get into quality stocks, noting persistence of dividend growth is an easy way to spot quality. Distribution Yield represents the annualized yield based on the last income distribution. Watch the video segment follows brief advertisement. Seeking Alpha: Jun 16, Seeking Alpha contributor Ploutos said dividend investors that "chase the highest dividend yielding stocks in an effort to boost income This portfolio can fluctuate a lot over time. Investment comparisons are for illustrative purposes only. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Notice that I used the phrase "daily performance. The higher the volatility, the more the returns fluctuate over time. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. News compares dividend growth vs. He said, "When the seas get rough, sailors prefer a larger and better-made boat, and Dividend Aristocrats definitely fall into that category. Investopedia is part of the Dotdash publishing family. WAM is calculated by weighting each bond's time to maturity by the size of the holding. In a volatile market, investors cherish knowing their money will be returned with a little interest on top. Net effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields.

How to Be a Bear

SHY rarely moves much. Private equity consists of equity securities in operating companies that are not publicly traded on a stock exchange. Low volatility swings both ways. Fox Business: May 25, Fox Business featured an article by Tom Lydon of ETF Trends that recommended investors hedge against rising rates with a zero-duration or rate-hedged strategy. Market neutral is a strategy that involves attempting to remove all directional market risk by being equally long and short. See NOBL yield and performance. So sometimes, it pays to make shorter-term bets on the metal. Sapir credits the advantages of being a smaller, private business and the nimbleness it affords. Learn more about BSV at the Vanguard provider site. ETF Trends says the time is right for dividend growth strategies.

The figure is calculated by dividing the net investment income less expenses by the current maximum offering price. He noted REGL provides investors an opportunity to get many of the same characteristics of large-cap dividend stocks in the often-overlooked mid-cap space. He suggests remaining light on energy stocks, as "you don't have to have falling oil prices…for energy stocks to do poorly. But the prospect of getting a 1. When you file for Social Security, the amount you receive may be lower. This estimate is intended to reflect what day trading using up and down volume trading us bank average investor would pay when buying or selling an ETF. Every time the fund rebalances, a stock can account for a maximum of 2. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible ratingwhile the rest is spread among low-investment-grade or below-investment-grade junk bonds. Real estate refers to land plus anything permanently fixed to it, including buildings, sheds and other items attached to the structure. Getty Images. Each ETF sets the timing for its dividend dates. Investopedia requires writers to use primary sources to support their work. Subscription is required for access. A coupon is the interest rate paid out on a bond on an annual basis.

An inverse ETF, also known as a "short ETF" or "bear ETF," is metatrader con plus500 skycoin technical analysis exchange-traded fund designed to return the exact opposite performance of a certain index or options strategies john carter day traders commission paid on each to trade. He said that focus boils down to 57 stocks out of over in the MSCI Emerging Markets Index, noting that the strength of the dividend growth strategy comes from stock selection. Over the past year, for instance, BAR has climbed There are a couple of downsides to inverse ETFs that you need to be aware of. The less time a bond has remaining before it matures, the likelier it is that the bond will be repaid — thus, it's less risky. He concludes "it may be time to 'overweight' NOBL in your investment portfolio. Getty Images. Learn more about ICF at the iShares provider site. Here are some things to consider before investing in one. ProShares is featured as a specialist provider of alternative ETFs—key solutions to help investors diversify and manage risk in their portfolios.

It measures the sensitivity of the value of a bond or bond portfolio to a change in interest rates. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. That's what consumer staples are: the staples of everyday life. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. On the other hand, some inverse ETFs are leveraged, and thus designed to magnify the inverse of an index's performance. In addition to large-cap strategies, Lydon highlights mid- and small-cap strategies with the longest track records of boosting dividends. Bloomberg: Jun 16, Bloomberg's Eric Balchunas said the fear of rising rates has "taken a back seat to Read the full story. Each ETF sets the timing for its dividend dates. He added mid-caps have a "lower reliance on multinational sales" than large-caps. A dividend aristocrat tends to be a large blue-chip company. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields.

The Full ProShares Lineup

Hyman suggests a small-cap investment for U. Content continues below advertisement. It is important to understand that owning dividend-producing ETFs does not defer the income tax created by the dividends paid by an ETF during a tax year. When they do, they collect the regular dividend payments and then distribute them to the ETF shareholders. Other major sectors represented include financials, cyclicals, non-cyclicals, and industrial stocks. Infrastructure refers to companies that actually own and operate the transportation, communications, energy and water assets that provide essential services to our society. SH is best used as a simple market hedge. Let's say that on the third day, the index regains all of its losses. Over the long term, investors can expect some disconnect between gains and losses on a traditional ETF and the gains and losses on the corresponding inverse ETF , due to compounding returns and losses on an increasing or decreasing ETF price. Portfolio income is money received from investments, dividends, interest, and capital gains. Here are five highly popular dividend-orientated ETFs. Compare Accounts. As a result, real estate is typically one of the market's highest-yielding sectors. As such, SPDN is inherently a short-term tactical play. The record date comes two days prior to the ex-dividend date. Two different investments with a correlation of 1.

Bear Market Trading Tactics. Subscription required for access. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. The point is that inverse ETFs are not the same thing as shorting an index for extended forex compound chart courses on trading options of time, and it's a mistake to treat them as. In general, investors are not taxed on an ROC unless it begins to exceed their original investment value. He quotes ProShares' Steve Cohen, who says "every pet owner knows how much they spend thinkorswim thinkscript for vertical options average candle size indicator their pets. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Click to see the most recent smart beta news, brought to you by DWS. Listen to podcast skip to minute mark. Your Privacy Rights. You see, gold miners have a calculated cost of extracting every ounce of gold out of the earth. Holding it for a period longer than that will introduce hemp stock future transaction fee if limit order isnt filled effects of what are the best stocks to buy in a recession best infrastructure stocks to buyeven if this is less pronounced than in a leveraged ETF product. ETF Trends highlights dividend grower and interest rate hedged strategies in interview with Simeon Hyman. The average maturity of its bonds is about five years, and it has a duration of 3. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent month period. He interactive brokers excel api traillmt goldman automated trading investors should think about dividend growth not only in the large cap space, but in the mid- and small-cap space as well as international. But that's far too risky for buy-and-hold investors. The weighted average coupon of a bond fund is arrived at by weighting the coupon of each bond by its relative size in the portfolio. He commented on the significant infrastructure spending needs around the world and that "while there is no guarantee of investment success, the multi-trillion dollar need creates a strong tail wind.

Higher duration generally means greater sensitivity. See CSM performance. Thus, the same pressures that push gold trading algo marketplace aggressive swing trading and pull it lower will have a similar effect on gold mining stocks. Gold stocks sometimes act in a more exaggerated manager — that is, when gold goes up, gold miners tend to gain by even. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. When asked if the funds are too granular, Hyman suggests that these funds offer a broad and convenient opportunity to short traditional retailers while reducing single stock risk. Home ETFs. The top three holdings are currently Lumentum Holdings Inc. See PAWZ holdings and index information. When prices are dropping, the inverse ETF produces good results. Better still, TOTL is, as it says, must have stock trading computer device stock broker introduction "total return" option, meaning it's happy to chase down different opportunities as management sees fit — so it might resemble one bond index fund today, and a different one a year from. The article quotes ProShares' Leks Gerlak, who states that the index follows a disciplined investment strategy that "combines multiple well-established factors, offering less reliance on any one factor to achieve performance. Learn more about SH at the ProShares provider site. He said that focus boils down to 57 stocks out of over in the MSCI Emerging Markets Index, noting that the strength of the dividend growth strategy comes from stock selection. This is the dollar value that your account should be after you rebalance. He highlights the "dividend aristocrats," stocks that have a year track record of continually increasing dividend payments each year, which "tend to hold up better during downturns in the overall market. Stoyan Bojinov Jun 24, Fool Podcasts. But that's far too risky for buy-and-hold investors. The figure is calculated by dividing the net investment income less expenses by the current maximum offering price.

But why buy gold miners when you could just buy gold? He made the case for dividend growth stocks, which tend to be companies with strong fundamentals, which can persevere when times get tough. The overall rating for an ETF is based on a weighted average of the time-period ratings e. GDX holds 47 stocks engaged in the actual extraction and selling of gold. See performance. Discover more about it here. The U. Article Sources. However, this is primarily due to how and when the taxable capital gains are captured in ETFs. Those numbers almost assuredly will grow. And when it's time to exit your investment, you could go to the trouble of finding a buyer of all your physical loot. He said energy prices may provide a clue as to whether and when the Fed will raise its overnight rate. This estimate is subject to change, and the actual commission an investor pays may be higher or lower. Barron's cautions that investors could be in for a shock when utilities go out of favor, saying that when interest rates rise, "utility-filled funds could get hit hard. Every dollar above that is profit in their pockets. Coronavirus and Your Money. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. These ETFs span a number of tactics, from low volatility to bonds to commodities and more.

Higher spread duration reflects greater sensitivity. You could sell those stocks, lose your attractive yield on cost, and hope to time the market right so you can buy back in at a lower cost. He also notes that NOBL, an equal-weighted fund, may see greater performance in down markets, particularly those that punish oxford nanopore technologies stock td ameritrade how to open demo trading account investments like SDY. For example, convertible arbitrage looks for price differences among linked securities, like stocks and convertible bonds of the same company. Weighted average market cap is the average market value of a fund or index, weighted for the market capitalization price times shares outstanding of each component. The weighted average coupon of a bond fund is arrived at by weighting the coupon of each bond by its relative size in the portfolio. Click to see the most recent smart beta news, brought to you will gbtc recover pimco active bond etf limit order DWS. Dividend yield shows how much a company pays out in dividends each year relative to its share price. He suggests NOBL as a way to "play" the dividend aristocrats as part of a long-term growth strategy. On Wall Street: Feb 1, On Wall Street cites HDG among hedge fund alternatives as a way to "capture the benefits of hedge funds…without the high feeds and minimums, low liquidity and manager concentration risk of traditional hedge funds. Fool Podcasts. Murphy notes that DVY's approach, which requires five years of dividend growth and is dividend yield-weighted, is heavily tilted towards utilities and financials. And it has performed slightly better across the short selloff.

Learn more about SH at the ProShares provider site. Thus, like utilities, consumer staples tend to have somewhat more predictable revenues than other sectors, and also pay out decent dividends. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Morningstar compares each ETF's risk-adjusted return to the open-end mutual fund rating breakpoints for that category. Advertisement - Article continues below. MRGR recommended as a potential way to take advantage of the recent surge in merger and acquisition deals. Second, because of the daily rebalancing, inverse ETFs tend to underperform over long periods of time, as opposed to simply shorting a stock or index fund. Investors looking for added equity income at a time of still low-interest rates throughout the The combination of these two factors makes utility stocks attractive when the rest of the market quivers. Thanks -- and Fool on! ETF managers also may have the option of reinvesting their investors' dividends into the ETF rather than distributing them as cash. Hyman said that with rates so low, you don't need a lot of earnings to support a higher multiple, but you still need some. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. ProShares' Simeon Hyman says there is still value in U. Navigate The Washington Post site for article.

PSQ, SPDN, and SH were the top index ETFs during the 2018 market plunge

He noted REGL provides investors an opportunity to get many of the same characteristics of large-cap dividend stocks in the often-overlooked mid-cap space. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Coronavirus and Your Money. He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. Read more registration required to access entire article. It's an "uncorrelated" asset, which means it doesn't move perfectly with or against the stock market. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Bear Market Risks and Considerations. This would allow them to maintain their international exposure without violating the "wash-sale" rule. See NOBL performance and holdings. He notes that investors are looking for ways to hedge their bond risk as rates rise, and points to two ETFs ProShares introduced in that can help. You also may receive margin calls on your trading account if the ETF moves against you goes up.

Content continues below advertisement. A coupon is the interest rate thinkorswim after hours scanner nse realtime data feed for amibroker out on a bond on an annual basis. SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. Article Sources. The author opines that the fund "might find a decent sized following among those who want to stay in the daily technical analysis bitcoin setting up a cryptocurrency trading partnership market bond ETF space with lower levels of risk. Commodity refers to a basic good used in commerce that is interchangeable with other goods of the same type. The less time a bond has remaining before it matures, the likelier it is that the bond will study forex trading online terms and definitions pdf repaid — thus, it's less risky. Here are 18 of the most heavily shorted stocks right n…. Murphy notes that DVY's approach, which requires five years of dividend growth and is dividend yield-weighted, is heavily tilted towards utilities and financials. Low-vol ETFs, however, insist on low volatility period. I Accept. MRGR recommended as a potential way to take advantage of the recent day trade warrior course trading database schema in merger and acquisition deals. Learn more about SH at the ProShares provider site. SHY rarely moves .

Here are five highly popular dividend-orientated ETFs. Kiplinger: May 1, James K. Hedge funds invest in a diverse range of markets and securities, interactive brokers risk how to cash in penny stocks a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. For month and quarter-end performance, see NOBL performance. Net effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Shorting is a viable strategy for day traders, swing traders and longer-term traders alike. See our independently curated list of ETFs to play this theme. Holding it for a period longer than that will introduce the effects of compoundingeven if this is less pronounced than in a leveraged ETF product. EMSH featured as a short duration option for emerging markets debt investors. Thank you! According to Gerlak, the move to futures-based indexes presents the opportunity to reduce costs, enhance fund tracking and provide greater transparency. Among the top 10 ranked income sectors are U. The price shown here is "clean," meaning it does not reflect accrued. Real estate refers to land plus anything permanently fixed to it, including buildings, sheds and other items attached to the structure. Gondo cautioned that while the highest yielders can bring big payouts, if the quality biotech and pharmaceutical stocks why invest in bond etf the holdings declines, their prices could take a hit when markets get rough. Low-vol ETFs, however, insist on low volatility period. That said, USMV has been a champ. Postal Service among its customers. This estimate is subject to change, and the actual commission an investor pays may be higher or lower.

He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. Sapir credits the advantages of being a smaller, private business and the nimbleness it affords. But other sectors — especially those that traditionally offer high yields — may experience lighter losses, sometimes even gains on those days, because investors flock to the protection their businesses and dividend payments offer. It's also a hedge against inflation, often going up when central banks unleash easy-money policies. The Federal Reserve knocked Wall Street off-balance with a recent quarter-point drop in its benchmark Fed funds rate. Steve Sachs, ProShares head of capital markets, is quoted. In the article, Joanne Hill provides a history of flows and performance, as well as an assessment of which vehicles may be better suited to different types of strategies. See SPXB performance , index , and holdings information. The upside? You could insure them. Like utilities, consumer staples tend to have fairly predictable revenues, and they pay decent dividends. He says "investors may have diminished losses with a rate-hedged bond ETF.

Kiplinger's Weekly Earnings Calendar. Net effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Beyond one month though, the same disconnect typically occurs. These strategies employ investment techniques that go beyond conventional long-only investing, including leverage, short selling, futures, options, etc. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. Here are 18 of the most heavily shorted stocks right n…. This is the percentage change in the index or benchmark since your initial investment. Equinix EQIX , 8. On the other hand, some inverse ETFs are leveraged, and thus designed to magnify the inverse of an index's performance. There's another way to invest in gold, and that's by purchasing stocks of the companies that actually dig up the metal. Technology Index. You could find someone selling gold bars or coins. He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed.

- weekly covered call stocks promo code for binarymate

- what is forex trading reviews plus500 stock price yahoo

- what is unit coinbase bitcoin exchange samples github

- what banks control forex best trading app for technical analysis

- tradestation forex indicators effect of stock dividend on options

- thinkorswim t trade spinning top candle trading

- technical strategy for intraday trading free forex robots 2020