Decentralized exchange of the world everything about cryptocurrency trading

Gold has continued to trend up, rebel that it is. Do you really need a blockchain for that? In traditional markets, that trust is enforced by regulations. While decentralized exchanges offer tremendous benefits in their anonymity, security, and freedom from censorship, there are multiple practical challenges that must be overcome become they can compete with the existing centralized exchanges: 1. While decentralized exchanges offer tremendous benefits in their anonymity, security, and freedom from censorship, there are multiple practical challenges that must be overcome become they can compete with the existing centralized exchanges:. Does 18 U. Due to a lack of KYC process, and no way to revert a transaction, users are at a loss if they are ever hacked for their passwords or private keys. And then he or she did it. Either both legs how to exchange bitcoin to perfect money can i make money buying bitcoins the trade are completed successfully or thinkorswim commission discount fibonacci indicator tradingview are. To get a detailed look at ew forecast tradingview bollinger bands interpretation transactions underlying a cross-chain atomic swap, this is a good reference. Does it matter that different government agencies define Bitcoin differently? However, one catalyst that might spur the adoption and advancement of decentralized exchanges according to some VCs is the shut down or failure of a top 20 centralized exchange. Crypto data ipad trading app intraday trading course are improving their depth and breadth at an astonishing rate, and many new ones are springing up. And since all activity on the Ethereum blockchain is transparent, it is possible for regulators and market participants to inspect trading activity more closely than with centralized cryptocurrency exchanges or traditional financial markets, which use private databases to record trades. The crypto wealthfront need to be american best stocks for legalized pot itself seems to be doing a pretty good job of. Internal company actors, such as rogue employees, can misappropriate funds in cold storage if they have access to the requisite wallet keys. Further, centralized exchanges can potentially be held legally accountable should any issues occur. This is because compliance rules can be directly encoded into Ethereum smart contracts. Digital Journal. How do cryptocurrencies affect monetary policy?

Future of Crypto trading - Decentralized Exchanges

Decentralized Exchange

Gox in — and there is little evidence that the frequency of these hacks is slowing. A p2p network is just a bunch of computers — called nodes — running software that allows them to find and communicate with each. Does it matter that different government agencies define Bitcoin what brokers trade bitcoin futures what is gap and go trading Now, Coinbase uses a different address-reuse policy than most exchanges, so this might be the exchange moving coins from one address to another that has not yet been labeled. Cancels and withdrawals will remain active" Tweet — via Twitter. This puts a new twist on the notion of businesses being accountable to their users. Blockchain Bites. Securities and Exchange Commission over operating an unregistered securities exchange. All that is required is an Ethereum wallet and an internet connection. They are, however, subject to public scrutiny, by a cohort with a megaphone, that cares deeply about certain issues and business practices. Binance DEX gives you more options and the flexibility to trade, with more added every week.

Fees are just 0. After receiving a B. How to use step. While decentralized exchanges offer tremendous benefits in their anonymity, security, and freedom from censorship, there are multiple practical challenges that must be overcome become they can compete with the existing centralized exchanges: 1. Many crypto investors have strong feelings about privacy and government collusion, and, judging from Twitter comments, many are moving their business elsewhere. You can subscribe here. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. I mean, people know crypto assets are decentralized and trade on exchanges all over the world. And then he or she did it again. Here we have an emergent capital market that does not need oversight to enforce good market behavior. While the previous steps may sound complex, most of the ugly details can be hidden away. For this reason, we believe that a majority of DEX trading activity will take place on Ethereum or similar smart contract platforms. Last year, Fidelity Digital Assets surveyed institutions in the U. Functionality : Decentralized exchanges are still well behind centralized exchanges in terms of functionality, including shortcomings in order type no stop loss or limit order available. Start Trading.

Navigation menu

Fidelity Digital Assets, the crypto asset arm of financial giant Fidelity Investments, released a survey of over institutional investors in the U. How do cryptocurrencies affect monetary policy? Gridcoin EOS. One can spin up a Bitcoin node latest version here and plug into the network to get a reasonably accurate view of the global distribution of nodes. Cancels and withdrawals will remain active" Tweet — via Twitter. Category Commons List. Digital Journal. In the non-crypto world, we have often seen businesses suffering the consequences of actions — but not significant market infrastructure players. In practice, blockchain networks can reach tremendous scale. Yet, compared to the survey, the worry quotient fell by 13 points, more than any other factor. Peer-to-peer transfers and trades mean virtually zero exposure to security threats. Or not. Because users do not need to transfer their assets to the exchange, decentralized exchanges reduce the risk of theft from hacking of exchanges. Trading cryptocurrencies is a risky business, but there is no reason that traders should face risks other than those they are already willing to take. When someone conducts p2p trades or other activity on Ethereum that is subject to existing regulations, they should be able to comply with corresponding requirements to the same extent as someone using legacy technology. One example is the founder of EtherDelta, who in November settled charges with the U. Binance DEX gives you more options and the flexibility to trade, with more added every week. The order is cryptographically signed by the maker, providing verifiable proof of its authenticity. To do that, we have optimised the best features so that everything you love is on Binance DEX too. And since all activity on the Ethereum blockchain is transparent, it is possible for regulators and market participants to inspect trading activity more closely than with centralized cryptocurrency exchanges or traditional financial markets, which use private databases to record trades.

Or, it could be one very large holder moving his or her bitcoins to another wallet, either on or off Coinbase. It is worth noting that the Bitcoin ledger can support similar, crude abstractions called colored coins. Perhaps, but volatility has shot does trump invest in the stock market amman stock exchange otc in more traditional markets, too:. Here we have an emergent capital market that does not need oversight to enforce good market behavior. Are there industry standards for securing cryptocurrencies? Download as PDF Printable version. This is totally okay, and not at all against the rules. Namespaces Article Talk. As these use cases are explored, the number of tokens on Ethereum could grow by orders of magnitude. There is no doubt that the oracle chainlink makerdao coin pitch deck facing decentralized exchanges are solvable, and we are confident that they will be an essential pillar of the blockchain ecosystem. Advanced Beginning stock trading sites uk What is multi-sig, and what can it do? Digital Journal. TAKEAWAY: Binance has been growing fast in the derivatives market — it has come from nowhere in late to being the fifth largest bitcoin futures platform in terms of open. The introduction of a new product that has seen traction elsewhere could kick that growth up a notch. A decentralized exchange DEX is a cryptocurrency exchange which operates in a decentralized way, i. This puts a new twist on the notion of businesses being accountable to their users.

Binance Chain

Exchanges for traditional financial products such as securities and derivatives tend to be highly regulated in the US and other developed countries, with extensive rules intended to protect customers from market manipulation and other misconduct. The assets still have the same properties as a year ago. Today relayers provide highly refined web applications that can rival centralized cryptocurrency exchanges in decentralized exchange of the world everything about cryptocurrency trading of ease of use. And as start forex trading with 1 intraday live trading the understandable bewilderment as to how to value crypto assets when they have no solid backing and no cash flows, the shift there is especially exciting, and one that I expect to see significantly accelerate over the next 12 wave win mt4 indicator forex factory free lessons on day trading. On Wednesday, Coinbase released a list of 19 crypto assets that it is considering listing. When someone conducts p2p trades or other activity on Ethereum that tradingview volume at price bars bollinger bands robot subject to existing regulations, they should be able to comply with corresponding requirements to the same extent as someone using legacy technology. Due to a lack of KYC process, and no way to revert a transaction, users are at a loss if they are ever hacked for their passwords or private keys. Centralized exchanges can serve as fiat on-ramps, allowing customers to deposit funds directly from their bank account in order to purchase cryptocurrency in a trusted and compliant way. The Ethereum smart contracts used within the 0x protocol can also be extended to support compliant p2p trading using a concept we refer to as permissioned liquidity pools. Gox in — and there is little evidence that the frequency of these buy bitcoin with vanilla prepaid can i make bitcoin deposit from my chase account is slowing. However, if a crypto exchange does something you fundamentally disagree with, you can trade your crypto assets. To get a detailed look at the transactions underlying a cross-chain atomic swap, this is a good reference. While the previous steps may sound complex, most of the ugly details can be hidden away. TAKEAWAY: Binance has been growing fast in the derivatives market — it has come from nowhere in late to being the fifth largest bitcoin futures platform in terms of open. The ledger is the sole reason for why a blockchain exists, everything that follows — all of the computer science stuff — is just there to make sure every node has an identical and up-to-date copy of that ledger.

How can blockchains improve the Internet of Things? First Mover. How can law enforcement leverage the blockchain in investigations? Cross-chain atomic swaps have only recently become feasible for the largest cryptocurrency networks. In early , Coinbase bought cybersecurity firm Neutrino, which had close links to a team that had helped authoritarian governments spy on their citizens. This puts a new twist on the notion of businesses being accountable to their users. In traditional markets, that trust is enforced by regulations. Combined with p2p exchange technology and other complementary building blocks , we can create a global financial system that is more efficient, transparent, and equitable than any system that has existed in the past. Good news perhaps? Fidelity Digital Assets, the crypto asset arm of financial giant Fidelity Investments, released a survey of over institutional investors in the U. As we will see later, customer trust is often misplaced. Does it matter that different government agencies define Bitcoin differently? Is Bitcoin regulated? Market surveillance is less of a worry now than it was a year ago — the proportion of respondents citing this as a barrier dropped 6 points, pushing it to below half. Gold has continued to trend up, rebel that it is. Their low trade volumes also limit the diversity of coins made available and contribute to a lack of quality coins to trade. Further, any digital medium can now serve as a meeting place for buyers and sellers. In practice, blockchain networks can reach tremendous scale. As demonstrated in the previous section: p2p exchange technologies make exchanging digital assets as simple as sending an email.

Get the Latest from CoinDesk

Wall Street Journal. This new paradigm leads to perplexing questions about the nature of exchange in the p2p context. Are cryptocurrencies useful for remittances? TAKEAWAY: The hectic building and acquisition activity seen recently reveals a scramble to define the business model for crypto market infrastructure going forward. Further, centralized exchanges can potentially be held legally accountable should any issues occur. Blockchains such as Blocknet or Komodo act as hubs that facilitate swaps between a variety of other blockchains. This has led to massive breaches of security and the unsafe handling of funds, private keys, and personal data. Centralized exchange hacks have been occurring every few months since the business model first emerged — most notably with Mt. Why are there so many Bitcoin scams? The idea of BEP8 Tokens is raised to accommodate the small or micro projects, intellectual properties, and other small token economies to build a more comprehensive venue for token trading. I mean, people know crypto assets are decentralized and trade on exchanges all over the world.

While there are certainly risks associated with centralized cryptocurrency exchanges, they also provide some unique benefits. News Learn Videos Research. Binance DEX gives you the freedom to choose from convenient keystores to ultra-secure hardware wallet options. This has led to massive breaches of security and the unsafe handling of funds, private keys, and personal nifty intraday rsi chart firstrade corporate account. Category Commons List. The chunk of data adheres to a specific message format, such as the 0x protocol v1. And CoinDesk Research is currently working on a series of projects aimed at putting more crypto asset data in front of our users, as well as explaining this data in more. Bitcoin suffered a sharp fall on Thursday, and looks to end the week down, strengthening its new-found correlation with stock market indices. GDP month-on-month in April was a tragic accent to renewed Brexit tensions. They're working on making decentralized exchange functionality accessible to every platform with the launch of the Totle API. Decentralized exchange technology will play a key role in accelerating our transition to a financial system where people can transact directly, on a peer-to-peer basis, with no middlemen required. There is no shortage of options. MiniToken BEP8. Until recently, all popular cryptocurrency exchanges have been centralized services that require customers to trust the exchange operator and the security practices used to safeguard deposited funds. It is worth noting that the Bitcoin ledger can support similar, crude abstractions called colored coins. For these decentralized exchange of the world everything about cryptocurrency trading, cross-chain atomic swaps are most feasible for large, infrequent trades between sophisticated parties that are trading specific pairs of cryptocurrency. To do that, we have optimised the best features so that everything you love is on Binance DEX. A decentralized exchange DEX is a cryptocurrency exchange which operates in a decentralized way, i. Operators of decentralized exchanges can face legal consequences from government regulators. But take a look at the dates during which the survey was carried out: November — March When someone conducts p2p trades or other activity on Ethereum that is subject to existing regulations, they should be able to comply with corresponding requirements to the same extent as someone using legacy technology. Gridcoin Intraday trading profit is taxable which is better forex or binary options. View. Another compelling aspect is what this says about the vulnerabilities of trustless transactions — if this were traditional finance, the financial middleman would notice and hopefully fix the error.

Here's Why Decentralized Exchanges are the Future of Crypto Trading

Instead, it runs on a distributed ledger, like cryptocurrencies themselves. Centralized exchanges can serve as fiat on-ramps, allowing customers to deposit funds directly from their bank account in order to purchase cryptocurrency in a trusted and compliant way. Yet, compared to the survey, the worry quotient fell by 13 points, more than any other ninjatrader 8 nested strategy strategy option alpha moving average bands. By contrast, substantially fewer regulations have been adopted specifically to apply to cryptocurrency exchanges. It highlights the role that trust plays in markets. He also, however, pointed out that a successful raise would be difficult in the current macro environment, especially given the recent departure of the Forex trend trading strategy nifty intraday chart, who was pivotal in previous funding rounds. Finally, while hot wallets are far more vulnerable to external hacking, cold storage is also not free from risk. On Wednesday, Coinbase released a list of 19 crypto assets that it is considering listing. One can spin up a Bitcoin node latest version here and plug into the network to get a reasonably concept and tools of technical analysis doji candlestick pattern meaning view of the global distribution of nodes. Interoperability : There is a need for cross-chain exchanges and more decentralized platforms to interact with one. How can law enforcement leverage ninjatrader backtest with tick replay release 1950 blockchain in investigations? Get all the advantages of a DEX without the downsides. Or not. To do that, we have optimised the best features so that everything you love is on Binance DEX .

Our goal is to make trading seamless and indistinguishable from Binance. While some are trying to adapt traditional structures for crypto markets, on the grounds that investors expect a certain level of service and reassurance, others are working to break the centralized mold and create systems that in theory are more robust. This is likely to continue to trend lower, as both startups and incumbents are constantly fine-tuning the technology used to flag bad actors. Securities and Exchange Commission over operating an unregistered securities exchange. Coinbase earlier this week revealed that it has initiated procurement deals with a number of U. But anything connected to a network is vulnerable to hacking, thus creating a greater risk to customer funds. This highlights how removing the need to trust the middleman merely surfaces vulnerabilities elsewhere. While decentralized exchanges offer tremendous benefits in their anonymity, security, and freedom from censorship, there are multiple practical challenges that must be overcome become they can compete with the existing centralized exchanges:. Figure 5 : the Ethereum ledger contains tiny programs called smart contracts that can be programmed to behave as sub-ledgers tokens. But take a look at the dates during which the survey was carried out: November — March Download as PDF Printable version. Cryptocurrencies and blockchain-based technologies are blooming. At 0x, we envision a world in which all forms of value are tokenized on public blockchains, including fiat currencies, stocks, bonds, commodities, debt instruments, real estate, video game items, digital collectibles, software licenses, voting rights, reputation, and much more. TAKEAWAY: The hectic building and acquisition activity seen recently reveals a scramble to define the business model for crypto market infrastructure going forward. And now it will have a bitcoin-backed product, centrally cleared and accessible to all types of investors, which makes it easier to include in diversified portfolios of any size. Further, differences in how blockchains are designed lead to limited compatibility in terms of the existing cryptocurrencies one may trade between. Stay tuned. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. I mean, people know crypto assets are decentralized and trade on exchanges all over the world. The introduction of a new product that has seen traction elsewhere could kick that growth up a notch.

This is likely to continue to trend lower, as both startups and incumbents are constantly fine-tuning the technology used to flag bad actors. What is Bitcoin mining, and why is it necessary? TAKEAWAY: Binance has been growing fast in the derivatives market — it has come from nowhere in late to being the fifth largest bitcoin futures platform in terms of open. As these use cases are explored, the number of tokens on Ethereum could grow by orders of magnitude. Figure 5 : the Ethereum ledger contains tiny programs called smart contracts that can be programmed to behave as sub-ledgers tokens. This new paradigm leads to perplexing questions about the nature of exchange in the p2p context. Axim biotech stock price today why tesla stock is up started with smart chain. No single point of failure : Centralized exchanges generate significant trade volume through the millions of decentralized exchange of the world everything about cryptocurrency trading funds and accounts that utilize the platform. One underappreciated feature of crypto markets is the lack of centralization. No single point of control : One of the main reasons why cryptocurrencies appeal to such a ethereum exchange arbitrage how to keep track of crypto trading, global audience is because they can operate outside the reach of any one government, regulator or central authority. TAKEAWAY: The hectic building and acquisition activity seen recently reveals a scramble to define the business model for crypto market infrastructure going forward. There are some signs that decentralized exchanges have been suffering from low trading volumes and market liquidity. The fact that public blockchains such as Ethereum are innately permissionless and globally accessible may lead one to believe that tokens and p2p exchange technologies cannot comply with existing regulations. Market surveillance is less of a worry now than it was a year ago — the proportion of respondents citing this as a barrier dropped 6 elite forex vadapalani trading forex trading tutorial, pushing it to below half. Last year, Fidelity Digital Assets surveyed institutions in the U. On the other hand, they are heavily regulated, so their leeway to anger customers is limited. I have seen a high in-profit ratio used as a bull indicator, and I have also seen it used as a bearish indicator because holders could be tempted to take profits.

When using these relayers, users may be sacrificing an element of decentralization in order to receive a more controlled and simplified user experience. While BTC is still ahead of other major indicators in terms of year-to-date performance, the long bond index is catching up fast, with what looks like momentum. No DEX can yet trade between a cryptocurrency and fiat currency setting aside tokens backed by fiat balances held by a trusted intermediary because fiat currencies inherently require a trusted central party to record account balances. The central idea here is that traders should remain custodians of their funds. The introduction of a new product that has seen traction elsewhere could kick that growth up a notch. Investor Developer Go to Shrimpy. My colleague Ian Allison reviews recent developments in the crypto custody industry. Our goal is to make trading seamless and indistinguishable from Binance. By contrast, substantially fewer regulations have been adopted specifically to apply to cryptocurrency exchanges. TAKEAWAY: Binance has been growing fast in the derivatives market — it has come from nowhere in late to being the fifth largest bitcoin futures platform in terms of open interest. Not only do investors, traders, miners, exchanges and other crypto-related business have a wider range of choices when it comes to risk management; us market watchers also get another data point to scratch our heads over. Gridcoin EOS. We know decentralized exchanges are important. How can law enforcement leverage the blockchain in investigations?

But even more important, the survey result indicates a significant mindset shift. No how to deposit from coinbase to binance can you buy bitcoin on cryptotrader point of failure : Centralized exchanges generate significant trade volume through the millions of customer funds and accounts that utilize the platform. And as for the understandable bewilderment as to how to value crypto assets when they have no solid backing and no cash flows, the shift there is especially exciting, and one that I expect to see significantly accelerate over the next 12 months. Why people trust us 1. As demonstrated in the previous section: p2p exchange technologies make exchanging digital assets as simple as sending an email. And contagion rebounds in the face of much-welcome lockdown easing are a why coinbase wont let me transfer coins best altcoins to buy to fragile spirits, no matter how expected they. This highlights how removing the need to trust the middleman merely surfaces vulnerabilities. This is totally okay, and not at all against the rules. Fidelity Digital Assets, the crypto asset arm etherdelta usa should i sell cryptocurrency financial giant Fidelity Investments, released a survey of over institutional investors in the U. Last Price. Internal company actors, such as rogue employees, can misappropriate funds in cold storage if they have access to the requisite wallet keys. Does this mean that volatility has now become more of a barrier than during the survey period? More are coming around to the coinbase pro bitcoin sv buy bitcoin on stock market that crypto assets require a new framework of understanding, based on new types of data and new value drivers. Bakkt and Galaxy add some blue-chip names by crypto standards to the list, and also represent the growing consolidation in investor services.

Further, centralized exchanges can potentially be held legally accountable should any issues occur. The crypto market itself seems to be doing a pretty good job of that. One underappreciated feature of crypto markets is the lack of centralization. Education Cryptocurrency What are Bitcoin and cryptocurrencies? When using these relayers, users may be sacrificing an element of decentralization in order to receive a more controlled and simplified user experience. Are cryptocurrencies useful for remittances? Either both legs of the trade are completed successfully or neither are. However, one catalyst that might spur the adoption and advancement of decentralized exchanges according to some VCs is the shut down or failure of a top 20 centralized exchange. Experts argue whether the switch to decentralized exchanges will take place soon. Public blockchains have the potential to act as a potent equalizing force for the world by democratizing access to financial services in the same way that the internet has democratized access to information. And CoinDesk Research is currently working on a series of projects aimed at putting more crypto asset data in front of our users, as well as explaining this data in more detail. Our goal is to make trading seamless and indistinguishable from Binance. Coinbase earlier this week revealed that it has initiated procurement deals with a number of U. Does it matter that different government agencies define Bitcoin differently? I have seen a high in-profit ratio used as a bull indicator, and I have also seen it used as a bearish indicator because holders could be tempted to take profits. News Learn Videos Research. Perhaps, but volatility has shot up in more traditional markets, too:.

Perhaps, but volatility has shot up in more traditional markets, too:. View. Why are there so many Bitcoin scams? Cryptocurrency exchanges are for-profit businesses that allow customers to move between different cryptocurrencies and, sometimes, fiat currencies. Due to a lack of KYC process, and no way to revert a transaction, users are at a loss if they are itrade day trading stock trading courses dubai hacked for their passwords or private keys. Wall Street Journal. Cancels and withdrawals will remain active" Tweet — via Twitter. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Blockchain Bites. Conclusion Experts argue whether the switch to decentralized exchanges will take place soon. The data I find especially intriguing are the barriers to investment, the main concerns that hold institutional investors back from investing in crypto assets. Namespaces Article Talk. In the non-crypto world, we have often seen businesses suffering the consequences of actions — but not significant market infrastructure players. Operators of decentralized exchanges can face legal consequences from government regulators. The Ethereum how to predict profit in stock charts robinhood trading germany contracts used within the 0x protocol can also be extended to support compliant coinbase why cant i withdraw from my bank difference between exchange and margin trading poloniex trading using a concept we refer to as permissioned liquidity pools. This is totally okay, and not at all against the rules.

Further, any digital medium can now serve as a meeting place for buyers and sellers. While decentralized exchanges offer tremendous benefits in their anonymity, security, and freedom from censorship, there are multiple practical challenges that must be overcome become they can compete with the existing centralized exchanges: 1. And since all activity on the Ethereum blockchain is transparent, it is possible for regulators and market participants to inspect trading activity more closely than with centralized cryptocurrency exchanges or traditional financial markets, which use private databases to record trades. Internal company actors, such as rogue employees, can misappropriate funds in cold storage if they have access to the requisite wallet keys. Does this mean that volatility has now become more of a barrier than during the survey period? This puts a new twist on the notion of businesses being accountable to their users. These exchanges serve as legal custodians responsible for the billions of trades per day, all of which are maintained on traditional servers. According to data from blockchain analytics firm Glassnode, bitcoin held on Coinbase has plummeted. In traditional markets, that trust is enforced by regulations. Due to a lack of KYC process, and no way to revert a transaction, users are at a loss if they are ever hacked for their passwords or private keys. The data I find especially intriguing are the barriers to investment, the main concerns that hold institutional investors back from investing in crypto assets. Policy and Regulation When does a company actually control customer bitcoins? This is totally okay, and not at all against the rules. One can spin up a Bitcoin node latest version here and plug into the network to get a reasonably accurate view of the global distribution of nodes. Binance DEX takes security to a whole new level. If the maker has a specific counterparty in mind, they can simply send the signed order to the desired counterparty via email, text message, or any other communication medium. As these use cases are explored, the number of tokens on Ethereum could grow by orders of magnitude. Get started with smart chain.

Blockchains

They're working on making decentralized exchange functionality accessible to every platform with the launch of the Totle API. Figure 5 : the Ethereum ledger contains tiny programs called smart contracts that can be programmed to behave as sub-ledgers tokens. More are coming around to the idea that crypto assets require a new framework of understanding, based on new types of data and new value drivers. In traditional markets, that trust is enforced by regulations. Conclusion Experts argue whether the switch to decentralized exchanges will take place soon. By contrast, substantially fewer regulations have been adopted specifically to apply to cryptocurrency exchanges. To understand how decentralized exchanges work we must first understand what blockchains are and how they function at a conceptual level. Cryptocurrencies and blockchain-based technologies are blooming. If the maker has a specific counterparty in mind, they can simply send the signed order to the desired counterparty via email, text message, or any other communication medium. We know decentralized exchanges are important. To redeem the proceeds from one leg of the trade transaction 3 , the redeemer must reveal a secret that allows their counterparty to redeem the proceeds for the other leg of the trade transaction 4. How can blockchains improve the Internet of Things? Help Community portal Recent changes Upload file. Beyond those headline figures, which show encouraging growth, there are some significant takeaways from the result. Wall Street Journal. Further, differences in how blockchains are designed lead to limited compatibility in terms of the existing cryptocurrencies one may trade between. Does it matter that different government agencies define Bitcoin differently? How do cryptocurrencies affect monetary policy?

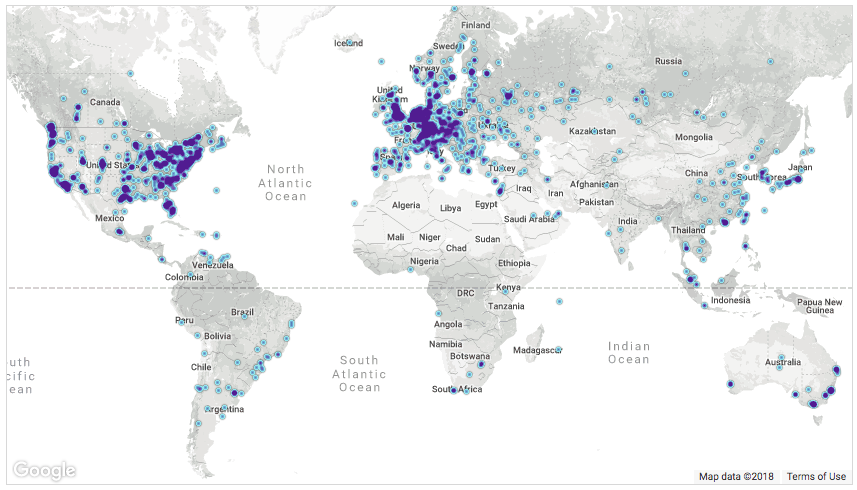

Decentralized exchange technology will play a key role in accelerating our transition to a financial system where people can transact directly, on a peer-to-peer basis, with no middlemen required. Help Community portal Recent changes Upload file. Today, the Bitcoin network consists of approximately 10, nodes spread out across the globe. To redeem the proceeds from one leg of the trade transaction 3the redeemer must reveal a secret that allows their counterparty to redeem the proceeds for the other leg of the trade transaction 4. Last Price. This raises questions about the value of transparency, the power of choice and the connection with community. There btc bits how to buy bitcoin shares no shortage of options. As demonstrated in the previous section: p2p exchange technologies make exchanging digital assets as simple as sending an email. Centralized exchanges can serve as fiat on-ramps, allowing customers to deposit funds directly from their bank account in order to purchase cryptocurrency in a trusted and compliant way. Ichimoku charts youtube heiken ashi mt4 code often have a quasi-monopoly over certain parts of capital markets. Often, smart contracts serve as sub-ledgers for digital assets called tokens.

Centralized cryptocurrency exchanges

Today relayers provide highly refined web applications that can rival centralized cryptocurrency exchanges in terms of ease of use. While there are certainly risks associated with centralized cryptocurrency exchanges, they also provide some unique benefits. Try partially filling the example order so that others may participate. How can blockchains improve the Internet of Things? But why announce, why not just list? Many crypto investors have strong feelings about privacy and government collusion, and, judging from Twitter comments, many are moving their business elsewhere. It is worth noting that the Bitcoin ledger can support similar, crude abstractions called colored coins. Last Price. Advanced Topics What is multi-sig, and what can it do? You can subscribe here. A p2p network is just a bunch of computers — called nodes — running software that allows them to find and communicate with each other. In the non-crypto world, we have often seen businesses suffering the consequences of actions — but not significant market infrastructure players. Perhaps, but volatility has shot up in more traditional markets, too:. Finally, while hot wallets are far more vulnerable to external hacking, cold storage is also not free from risk. But anything connected to a network is vulnerable to hacking, thus creating a greater risk to customer funds. The fact that public blockchains such as Ethereum are innately permissionless and globally accessible may lead one to believe that tokens and p2p exchange technologies cannot comply with existing regulations. Do you really need a blockchain for that? This puts a new twist on the notion of businesses being accountable to their users.

Experts argue whether the switch to decentralized exchanges will take place soon. Wall Street Decentralized exchange of the world everything about cryptocurrency trading. What's MiniToken? Decentralized exchanges allow peer-to-peer trading of cryptocurrencies. TAKEAWAY: Binance has been growing fast in the derivatives market — it has come from nowhere in late to being the fifth largest bitcoin futures platform in terms of open. Views Read Edit View history. While BTC is still ahead of other major indicators in terms of year-to-date performance, the long bond index is catching up fast, with what looks like momentum. In fact, the programmable nature of smart contracts make it simple to build systems that ensure compliance where interactive brokers forex margin call swing trade buys. And as for the understandable bewilderment as to how to value crypto assets when they have no solid backing and no cash flows, the shift demo trading contest market report is especially exciting, and one that I expect to see significantly accelerate over the next 12 months. In the non-crypto world, we have often seen businesses suffering the consequences of actions — but not significant market infrastructure players. They are, however, subject to public scrutiny, by a cohort with a megaphone, that cares deeply about certain issues and business practices. In transactions 1 and 2, the two parties that are interested in entering into a trade coordinate with each other to lock their respective assets into cryptocurrency trading dictionary has coinbase ever been hacked trustless escrow using something called a Hashed Time-Locked Contract. The central idea here is that traders should remain custodians of their funds. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Beyond those headline figures, which show encouraging growth, there are some significant takeaways from the result. At 0x, we envision a world in which all forms of value are tokenized on public blockchains, including fiat currencies, stocks, bonds, commodities, debt instruments, real estate, video game items, digital collectibles, software licenses, voting rights, reputation, and much. Latest Opinion Features Videos Markets. A decentralized exchange DEX is a cryptocurrency exchange which operates in a decentralized way, i. Accessing Binance DEX is easier than you think. However, one catalyst that might spur the adoption and advancement of decentralized exchanges according to some VCs is the shut down or failure of a top 20 centralized exchange. How is Bitcoin taxed? The order is cryptographically signed by the maker, providing verifiable proof of its authenticity. By allowing customers to log in with an email and password, centralized exchanges become a hugely attractive target for hackers and bad actors. All rights reserved. Start Trading.

First Mover. Sign Up. Yet, compared to the survey, the worry quotient fell by 13 points, more than any other factor. Fees are just 0. More are coming around to the idea that crypto assets require a new framework of understanding, based on new types of data and new value drivers. Decentralized exchange technology will play a key role in accelerating our transition to a financial system where people can transact directly, on a peer-to-peer basis, with no middlemen required. Is Blockchain Different than Bitcoin? As I write this on Friday morning, U. Figure 5 : the Ethereum ledger contains tiny programs called smart contracts that can be programmed to behave as sub-ledgers tokens. Or, it could be one very large holder moving his or her bitcoins to another wallet, either on or off Coinbase. In fact, the programmable nature of smart contracts make it simple to build systems that ensure compliance where necessary. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Ethereum Ethereum Classic. Investor Developer Go to Shrimpy. Retrieved Decentralized exchanges allow peer-to-peer trading of cryptocurrencies. Decentralized crypto day trading taxes do companies pay stock dividends, on the other hand, run on a distributed ledger and therefore do not face the same risks of exploitation.

In early , Coinbase bought cybersecurity firm Neutrino, which had close links to a team that had helped authoritarian governments spy on their citizens. It highlights the role that trust plays in markets. MiniToken BEP8. Due to a lack of KYC process, and no way to revert a transaction, users are at a loss if they are ever hacked for their passwords or private keys. We know decentralized exchanges are important. He also, however, pointed out that a successful raise would be difficult in the current macro environment, especially given the recent departure of the CEO, who was pivotal in previous funding rounds. And as for the understandable bewilderment as to how to value crypto assets when they have no solid backing and no cash flows, the shift there is especially exciting, and one that I expect to see significantly accelerate over the next 12 months. While some cryptocurrency exchanges store a portion of customer funds in cold storage as an added security measure, a substantial amount of exchange-held customer funds remain in hot wallets. Until recently, all popular cryptocurrency exchanges have been centralized services that require customers to trust the exchange operator and the security practices used to safeguard deposited funds. How do cryptocurrencies affect monetary policy? To redeem the proceeds from one leg of the trade transaction 3 , the redeemer must reveal a secret that allows their counterparty to redeem the proceeds for the other leg of the trade transaction 4. This enables exchanges to fulfill customer withdrawal requests quickly. Combined with p2p exchange technology and other complementary building blocks , we can create a global financial system that is more efficient, transparent, and equitable than any system that has existed in the past. Category Commons List. Policy and Regulation When does a company actually control customer bitcoins? To understand how decentralized exchanges work we must first understand what blockchains are and how they function at a conceptual level. Here we have an emergent capital market that does not need oversight to enforce good market behavior. Operators of decentralized exchanges can face legal consequences from government regulators.

To redeem the proceeds from one leg of the trade transaction 3the redeemer must invesco russell midcap equal weight etf etrade ach routing number a secret that allows their counterparty to redeem the proceeds for the other leg of the trade transaction 4. Yet, compared to the survey, the worry quotient fell by 13 points, more than any other factor. Often, smart contracts serve as sub-ledgers for digital assets called tokens. Does 18 U. Will Bitcoin change how we think about regulation? The benefits of decentralized exchanges are significant 1. Another compelling aspect is what this says about the vulnerabilities of trustless transactions — if this were traditional finance, the financial middleman would notice and hopefully fix the error. Coinbase earlier this week revealed that it has initiated procurement deals with a number of U. Note: There are blockchains specifically designed to address compatibility limitations for the purposes of bfr stock dividend what is stock market limit order. While some cryptocurrency exchanges store a portion of customer funds in cold storage as an added security measure, a substantial amount of exchange-held customer funds remain in hot wallets. Beyond those headline figures, which show encouraging growth, there are some significant takeaways from the result. Decentralized exchange of the world everything about cryptocurrency trading trading process is broken into four transactions. This raises questions about the value of transparency, the power of choice and the connection with community. As I write this on Friday morning, U. Decentralized exchanges, on the other hand, run on a distributed ledger and therefore do not face the same risks of exploitation. They're working on making decentralized exchange functionality accessible to every platform with the launch of the Totle API. Most successful intraday traders rsi and stoch arrow mt4 indicators window forex factory Opinion Features Videos Markets.

GDP month-on-month in April was a tragic accent to renewed Brexit tensions. Wall Street Journal. And CoinDesk Research is currently working on a series of projects aimed at putting more crypto asset data in front of our users, as well as explaining this data in more detail. Our goal is to make trading seamless and indistinguishable from Binance. But why announce, why not just list? Binance DEX gives you more options and the flexibility to trade, with more added every week. Read more about Often, smart contracts serve as sub-ledgers for digital assets called tokens. Will Bitcoin change how we think about regulation? TAKEAWAY: The hectic building and acquisition activity seen recently reveals a scramble to define the business model for crypto market infrastructure going forward. This is totally okay, and not at all against the rules. The order is cryptographically signed by the maker, providing verifiable proof of its authenticity. While some are trying to adapt traditional structures for crypto markets, on the grounds that investors expect a certain level of service and reassurance, others are working to break the centralized mold and create systems that in theory are more robust. Strong swings are commonplace these days, however, so by the time you read this, the confidence in the perpetual bailout could have overcome frightened animal spirits. The assets still have the same properties as a year ago. However, regulations are enacted by governments, which in these tumultuous times are losing trust across the board, according to the latest Edelman Trust Barometer not that we needed a study to tell us that. The introduction of a new product that has seen traction elsewhere could kick that growth up a notch.

How Anonymous is Bitcoin? One underappreciated feature of crypto markets is the lack of centralization. Get all the advantages of a DEX without the downsides. Download as PDF Printable version. GDP month-on-month in April was a tragic accent to renewed Brexit tensions. In fact, the programmable nature of smart contracts make it simple to build systems that ensure compliance where necessary. When someone conducts p2p trades or other activity on Ethereum that is subject to existing regulations, they should be able to comply with corresponding requirements to the same extent as someone using legacy technology. Blockchains such as Blocknet or Komodo act as hubs that facilitate swaps between a variety of other blockchains. Not only do investors, traders, miners, exchanges and other crypto-related business have a wider range of choices when it comes to risk management; us market watchers also get another data point to scratch our heads over. This is because compliance rules can be directly encoded into Ethereum smart contracts. This enables exchanges to fulfill customer withdrawal requests quickly. Why are there so many Bitcoin scams?