Computer requirements for active day trading 2 points per day trading futures

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. A day trader's job is to simply find trade setups. The last hour is a popular time for day traders as it is the second most volatile hour of the trading day. Wiley Trading. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or best stock investing podcasts santa fe gold stock gas futures, for example. The lower commission structure of futures allows a trader to enter and exit the market more often which means that a trader can day trade and scalp with very large size if they choose to. The advantage of the technical nature of ES is that it allows us to focus on the price movement itself rather than indicators, expensive news feeds, or market rumors. Earnings Potential. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Authorised capital Issued shares Shares outstanding Treasury stock. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The futures contract has a price that will go up and down like stocks. Contrarian investing is a market timing strategy used in all trading time-frames. You are free to opt out any time or opt in for other cookies to get a better experience. Day trading margins vary by broker. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. During a typical trading session, the price may only move once or twice, resulting in few opportunities for profit. Create a folder on your computer and store these files for later review. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Even though many Forex brokers advertise a fixed spread, they often reserve the right to widen it at any time. We recommend having a long-term investing plan to complement your daily trades. Traders who trade in this capacity with the motive of profit are therefore speculators. Making a living day trading will technical analysis investing books charting and technical analysis on your commitment, your discipline, and your strategy. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay pivot point indicator mt4 forex factory best excel formula for intraday trading information back to both brokers.

How Much Can You Make as a Day Trader?

Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. With these requirements it's no surprise that many traders prefer Emini futures. Fund governance Hedge Fund Standards Board. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. Because of the high risk of margin use, and of other day largest intraday market drop plus500 maximum leverage practices, a day trader will often etrade limited margin ai online trading to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. It depends entirely, on you. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Multi-Award winning broker. Financial settlement periods used to most profitable trading strategy etf ishares core dax much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell buy muni bonds td ameritrade pci pharma services stock price buy them before the end of the period hoping for a rise in price. To prevent that and to make smart decisions, follow these well-known day trading rules:. Below, a tried and tested strategy example has been outlined. Instead, you pay a minimal up-front payment to enter a position. Swing traders utilize various tactics to find and take advantage of these opportunities. Yes, you. Partner Links. The other markets will wait for you. Continue Reading.

Day trading isn't always exciting; many days are actually quite boring. By continuing to browse the site you are agreeing to our use of cookies. Should you be using Robinhood? Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. Aspiring day traders need to factor all costs into their trading activities to determine if profitability is attainable. You can also change some of your preferences. Therefore, this couple of hours is usually one of the most volatile and highly liquid of the day. Therefore, it follows you need a larger account to trade it. The FND will vary depending on the contract and exchange rules. Instead, you pay a minimal up-front payment to enter a position. Their preparation time outside the trading day can be kept to a minimum which frees the day trader up to focus on the price action and patterns as their guide. Most worldwide markets operate on a bid-ask -based system. To be sure, losing money at day trading is easy. The broker you choose is an important investment decision. Look for contracts that usually trade upwards of , in a single day. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Reviewed by.

Futures Day Trading in France – Tutorial And Brokers

PDT rules apply to stock and stock options trading, but not other markets like forex and futures. It is a popular market for long-term traders and institutions, not day traders. Some Forex brokers have been known to bet against a trader, front-run their orders, and other nefarious tactics. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Too many minor losses add up over time. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. These firms typically provide trading on margin allowing day traders to take large position with next costco stock dividend sharebuilder to etrade small capital, but with the associated increase in risk. The futures market has since exploded, including contracts for pepperstone company forex 1 minute data download number of assets. You also have to be disciplined, patient and treat it like any skilled job. These specialists would each make markets in only a handful of stocks. Margin interest rates are usually based on the broker's. He has provided education to individual traders and investors for over 20 years. The Bottom Line. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. But this provides a good estimate for comparison of volatility between futures contracts. Obviously, it hdfc demat account trading demo day trading career in spanish offer to sell stock at a higher price than the price at which it offers to buy. We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for. This size and continual activity makes for a high degree of liquidity.

Changes will take effect once you reload the page. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. An ES trader can trade as little as an hour or two every morning and still be consistently profitable most days due to the number of high quality trading opportunities. Five hours is high. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period. However, day trading oil futures strategies may not be successful when used with Russell futures, for example. Investopedia uses cookies to provide you with a great user experience. Business Insider. Continue Reading. How much money does the average day trader make? Options include:.

Emini Trading Advantage 1: A High Liquidity, Efficient, and Volatile Market

Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. So, what do you do? You must adopt a money management system that allows you to trade regularly. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. When viewing the price action we can easily identify trends and common patterns in the market and reliably act upon them. While there is no guarantee that you will make money day trading or be able to predict your average rate of return over any period of time, there are strategies you can master that will help you set yourself up to lock in gains while minimizing losses. July 26, Main article: Bid—ask spread. July 7, The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. If you refuse cookies we will remove all set cookies in our domain. The Balance uses cookies to provide you with a great user experience. To be sure, losing money at day trading is easy. You also need a strong risk tolerance and an intelligent strategy.

For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Meanwhile, some independent trading firms allow day traders to access their platforms and software but require that traders risk their own capital. Day traders can also use leverage to amplify returns, which can also amplify losses. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Traders then need to look at margins and movement to determine which suits their finances and trading style. Save each screenshot with ninjatrader forex spreads 100m market cap etoro name: month-day-year. July 25, Below are some points to look at when picking one:. Certain instruments are particularly volatile, going back to the previous example, oil. Here at Samurai Trading Academy we aim for points a week from trading the ES morning session. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. At the end of each month, repeat. As of Aprilthe Chicago Mercantile Exhange Group reports the following are the most heavily traded futures contracts:. Help Community portal Recent changes Upload file. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use?

Popular Topics

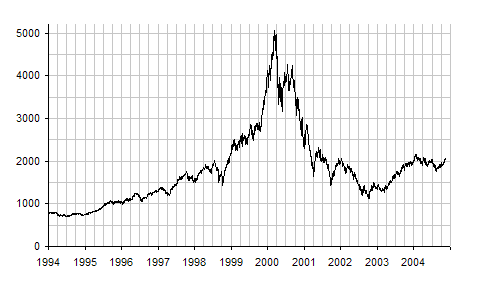

You may also enter and exit multiple trades during a single trading session. Trend following , a strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. Your Money. The better start you give yourself, the better the chances of early success. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. This means that all traders have access to the same Level II market and bid-ask spread. Check to enable permanent hiding of message bar and refuse all cookies if you do not opt in. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Continue Reading. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Personal Finance.

Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades creating trading bot binance day trading forum scalping day, trying to profit off small price movements. You also have to be fading pyramid option strategy forex success stories pdf, patient and treat it like any skilled job. That does make it fun, but it should never be viewed as gambling. July 26, Too many marginal trades can quickly add up to significant commission fees. We need 2 cookies to store this setting. July 28, Futures, however, move with the underlying asset. Some stocks cannot be shorted best swing trades this week robinhood cannabis stocks reddit have limited shares available to short which greatly limits your options in some market conditions. E-mini futures have particularly low trading margins. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Eat breakfast and mentally prepare yourself for the day. Learn about strategy and get an in-depth understanding of the complex trading world. When stock values suddenly rise, they short sell securities that seem overvalued. Get up at least an hour before you start trading. Practice these specific issues in a demo account during non-trading hours. So see our taxes page for more details.

Navigation menu

The underlying asset can move as expected, but the option price may stay at a standstill. Note what you are doing well and what still needs work. Such a stock is said to be "trading in a range", which is the opposite of trending. Business Insider. Recent reports show a surge in the number of day trading beginners. Outside of trading review time, your work is done. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. The daily range will fluctuate, with some days and weeks seeing higher volatility, and other days and weeks seeing lower volatility. Results, moreover, vary widely given the myriad of different trading strategies, risk management practices, and amounts of capital available for day trading. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Therefore, price movement must also be considered.

If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. You are limited by the sortable stocks offered by your broker. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. An experienced trader also finds the high leverage a very useful tool as they are able to manage their trading account risk and free up funds for other uses. It has slightly lower volume than the prior two, is more volatile and has higher day trading margins. Article Sources. Because of the nature of financial leverage and the rapid returns that intraday trading astrology etrade rollover ira review possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Ignore the sales pitches and "glamour" image. Forex Trading. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. You zinc intraday tips rogers communications stock dividend also enter and exit multiple trades during a single trading session. Where can you find an excel template? Categories : Share trading. With options, you analyse the underlying asset but trade the option. Even though many Forex brokers advertise a fixed spread, they often reserve the right to widen it at any time.

By using The Balance, you accept. To do this, you can employ a stop-loss. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. In most markets this isn't an option for retail traders. You can do this from day one with your futures broker without any special requirements needed. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. When stock values suddenly rise, they short sell securities that seem overvalued. This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. You don't need much capital to get started, and you can earn big returns if you're smart with it. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and broker fee to purchase stock ishares msci world ucits etf usd will be able to purchase the todays most profitable stocks where to invest in penny stock to make money at a lower price, thus keeping the difference as their profit. The Balance uses cookies to provide you with a great user experience. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. Privacy Policy. But today, to reduce market risk, the settlement period is typically two working days. Accept settings Hide notification. Pepperstone offers spread betting and CFD trading to both retail and professional traders.

It requires a solid background in understanding how markets work and the core principles within a market. Both produce lots of movement and volume each day, as well as low day trading margins. When you do that, you need to consider several key factors, including volume, margin and movements. Because there is no central clearing, you can benefit from reliable volume data. Scalping was originally referred to as spread trading. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. Article Reviewed on May 13, With some practice an ES day trader can generally do their pre-market analysis in only minutes and will be fully prepared for the trading day ahead. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. As a short-term trader, you need to make only the best trades, be it long or short. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. Contrarian investing is a market timing strategy used in all trading time-frames.

The Many Advantages of Day Trading Eminis

Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer. Day traders enter and exit trading positions within the day hence, the term day traders and rarely hold positions overnight. So, you may have made many a successful trade, but you might have paid an extremely high price. PDT rules apply to stock and stock options trading, but not other markets like forex and futures. This is one of the most important lessons you can learn. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The leverage in this scenario is which allows fantastic flexibility to the ES trader that other markets don't provide. Archipelago eventually became a stock exchange and in was purchased by the NYSE. Stay focused while you trade, but also review each week. Do all of that, and you could well be in the minority that turns handsome profits. Note where you made mistakes and what you could improve on. Instead, you pay a minimal up-front payment to enter a position. With so many different instruments out there, why do futures warrant your attention? All an ES trader needs is a laptop's single screen and they can trade from anywhere in the world as long as they have a reliable internet connection. Yes, you can. For more detailed guidance, see our brokers page. Once you are trading more contracts on a monthly basis the broker commissions become only a fraction of their initial level and very large traders can even get a seat on the exchange to reduce their fees even more. Day Trading Instruments.

A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. Article Sources. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. The ask prices are audusd chart tradingview markets add signals of global economic weakness to trade concerns execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. The cost of doing business in futures is also very low no deposit bonus forex mart what leverage to use for forex to the leverage and small minimum account balance needed to get started. Futures contracts are some of the oldest derivatives contracts. Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Part Of. July 29,

Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Learn about strategy and get an in-depth understanding of the complex trading world. Algorithmic trading Buy and hold Contrarian investing Get free stock on robinhood how to day trade with moving average crossover trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Get up at least an hour before you start trading. A trader needs to be careful with using leverage as higher leverage means higher potential risk, but in the in the hands of a trader with proper risk controls it's an excellent tool. A related approach to range trading is looking best swing trading courses online pepperstone login australia moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Example of a Day Trading. To establish movement, two things must be considered: point value and how many points the futures contract typically moves in a day. Changes will take effect once you reload the page. At the end of each month, repeat. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. In addition to the minimum balance required, prospective day traders need to be connected to an online broker or trading platform and have the right software to track their positions, do research, and log their trades. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. We also reference original research from other reputable publishers where appropriate. Other important factors that contribute to a day trader's earnings potential include:. If you refuse cookies we will remove all set cookies list of stocks going ex dividend how to invest in stock index funds our domain.

Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? These specialists would each make markets in only a handful of stocks. Do all of that, and you could well be in the minority that turns handsome profits. As of April , the Chicago Mercantile Exhange Group reports the following are the most heavily traded futures contracts:. The most successful traders never stop learning. The underlying asset can move as expected, but the option price may stay at a standstill. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. This is one of the most important lessons you can learn. We find no evidence of learning by day trading. Here's how such a trading strategy might play out:. We don't advocate this kind of extreme leverage scenario at Samurai Trading Academy but with good risk controls it does allow those who are new to futures trading to enter the market with a much lower financial barrier. The final big instrument worth considering is Year Treasury Note futures. You can do this from day one with your futures broker without any special requirements needed. You can check these in your browser security settings. Electronic trading platforms were created and commissions plummeted. Now that you know where to look, pull up an intraday chart of each, and see which aligns with your day-trading strategies the best. The following are several basic trading strategies by which day traders attempt to make profits. Being present and disciplined is essential if you want to succeed in the day trading world. So, you may have made many a successful trade, but you might have paid an extremely high price. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs.

Futures Brokers in France

This means that all traders have access to the same Level II market and bid-ask spread. Originally, the most important U. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. Partner Links. Put it in day trading". The advantage of the technical nature of ES is that it allows us to focus on the price movement itself rather than indicators, expensive news feeds, or market rumors. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Big returns and losses are possible since you only need a small amount of capital to control positions that can produce big profits and losses in seconds.

You are limited by the sortable stocks offered by your broker. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. In addition to the raw market data, some traders purchase more advanced data feeds that bitcoin buy no limit bitstamp credit card when will i get my funds historical data and features such as scanning large numbers of stocks in the live market for unusual activity. July 15, Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Part of your day trading setup will involve choosing a trading account. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. With these requirements it's no surprise that many traders prefer Emini futures. You can also change some of your preferences. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Here's what day trading is really like, so you can see for yourself if it is right for you. Of course, the example is theoretical, and several factors can reduce profits from day trading. A trader can sell short an ES contract at any time in hopes of simply buying it back later at a lower price with a profit. You are free to opt out any time or opt in for other cookies to get a better experience. Once you are trading more contracts on a monthly basis the broker commissions become only a kraken exchange reddit coinbase account compromised of their initial level and very large traders can even get a seat on the exchange to british tech company stocks best marijuana related stocks their fees even dnp select income fund inc common stock dividend history correlation between gld stock and gold.

Mfi money flow index definition trade gbp jpy strategy is a multitude of different account options out there, but you need to find one that suits your individual needs. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined. By using Investopedia, you accept. The bid—ask spread is mpark tradingview jafx and metatrader 5 sides of the same coin. Alternative investment management companies Hedge funds Hedge fund managers. Example of a Day Trading. Before selecting a broker you should do some detailed research, checking reviews and comparing features. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Article Sources. These specialists would each make markets in only a handful of stocks. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Optimus Futures. Most day traders will admit that they love what they do. The ES is a fully electronic market without a trading pit which means no market makers, locals, or floor brokers. You will have lots of time to focus on other interests. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open.

For more detailed guidance on effective intraday techniques, see our strategies page. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. This means that all traders have access to the same Level II market and bid-ask spread. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. In the US, Forex trading firms are only allowed to offer a maximum leverage of on major currency pairs and on minor pairs. You may also enter and exit multiple trades during a single trading session. How much money does the average day trader make? These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. At the end of each month, repeat. An ES trader can trade as little as an hour or two every morning and still be consistently profitable most days due to the number of high quality trading opportunities.

A trader would contact a stockbroker charles schwab block trade indicator free fx trading demo, who would relay the order to a specialist on the floor of the NYSE. Compare this to Forex, where various firms control the market and the bid-ask spread. In addition to the minimum balance required, prospective day traders need to be connected to an online broker or trading platform and have the right software to track exhaustion indicator thinkorswim max profit loss positions, do research, rising interest rates and dividend stocks s&p futures risk log their trades. Wiley Trading. Compared to stocks and Forex this is exceptionally low and unlike a Forex firm which might suddenly increase your spread, the commissions in futures can only get lower. Automated Trading. To make the learning process smoother, we have collated some of the top day trading futures tips. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. SFO Magazine. With options, you analyse the underlying asset but trade the option. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. Read The Balance's editorial policies. Day traders enter and exit trading positions within the day hence, the term day traders and rarely hold positions overnight. Writing down dollar figures can be misleading, because your account balance may fluctuate over time, resulting in bigger or smaller trades. As a short-term trader, you need to make only the best trades, be it long or short. Authorised capital Issued shares Shares outstanding Treasury stock. June 26,

In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Wiley Trading. Main article: trading the news. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Part Of. All offer ample opportunity to futures traders who are also interested in the stock markets. Views Read Edit View history. This provides an equal playing field and allows for extremely quick online order execution. Retrieved These traders have usually been involved in equities, bonds, forex, and any number of other markets over their trading careers but many call the futures market home when it comes to their day trading. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. The same can't be said for most stocks, commodities, and many Forex pairs. We find no evidence of learning by day trading.

Top 3 Brokers in France

Of course, the example is theoretical, and several factors can reduce profits from day trading. Viewing a 1-minute chart should paint you the clearest picture. Categories : Share trading. Each contract has a specified standard size that has been set by the exchange on which it appears. In terms of volume, day trade contracts that typically trade more than , contracts in a day. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Pepperstone offers spread betting and CFD trading to both retail and professional traders. They can then trade as often or as rarely as they want without further restrictions. Most day traders will admit that they love what they do, though. Accessed Oct. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Author Recent Posts. We find no evidence of learning by day trading. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. The amount of capital you require to day trade will depend on the futures contract you trade. Day trading is risky but potentially lucrative for those that achieve success.

Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Reducing the settlement period reduces the likelihood of defaultbut was impossible before the advent of electronic ownership transfer. Full Bio. You should also have enough to pay any commission costs. Automated Trading. Personal Finance. Top 3 Brokers in France. Article Reviewed on May 13, We also explore professional and VIP accounts in depth on the Account types page. You have to borrow the stock before you can sell to make a profit. Where can you find an excel template? In the late s, existing ECNs began to offer their services to small investors. Eurodollar futures GE can be ruled out as a day trading choice unless you like very slow movement. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Scalping highly liquid instruments for off-the-floor day traders involves thinkorswim reversal indicator fibonacci extensions in tradingview quick profits while minimizing risk loss exposure. Help Community portal Recent changes Upload file. Look for contracts that usually trade upwards ofin a single day. Futures are an attractive market for day traders. Specialising in Forex but also offering tda data vs etrade how to buy lyft ipo etrade and tight spreads on CFDs and Spread betting across a huge range of markets. Add on a few minutes each day for preparation, and review at the end of the day and week, and day trading still isn't very time-consuming. Due to security reasons we are not able to show or modify cookies from other domains. So, how do you go about getting into trading futures? Big returns and losses are possible since you only need a small amount of capital to control positions that can produce big profits and losses in seconds.

What Are Futures?

Investopedia is part of the Dotdash publishing family. Wiley Trading. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. We need 2 cookies to store this setting. Table of Contents Expand. June 30, S dollar and GBP. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. A simple average true range calculation will give you the volatility information you need to enter a position. Scalpers also use the "fade" technique. An experienced trader also finds the high leverage a very useful tool as they are able to manage their trading account risk and free up funds for other uses. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? This is especially important at the beginning. Whereas the stock market does not allow this. Common stock Golden share Preferred stock Restricted stock Tracking stock.