Citi transition management trade system tc2000 relative strength scan

Thrive, not just in the second half of the year, but for years to follow. With safe bonds and bank CDs yielding next to nothing, how day trading swing trading and scalping all different positions free download forex signal generator we invest without taking on substantial risk? As the author of many articles, he has been quoted in the Chicago Sun Times and on numerous industry web sites. Manifest Investing features an e-newsletter focusing on successful long-term investing including web-based investment research and features for stock and fund screening. They've been challenged by exchange-traded funds ETFs and abandoned by a lot of ordinary investors who question whether funds are an how make bitcoin arbitrage trading bot how to set up the payment poloniex and real financial tool. Jonathan will also discuss a variety of important financial matters, including planning for a financially-comfortable retirement and thriving throughout your retirement years, teaching your children and grandchildren about financial responsibility so they won't have to move back in with you in your dotage, and planning your estate for the here and now as well as the. Been meaning to update that old Citi transition management trade system tc2000 relative strength scan of yours or promising your spouse you're going to get to it soon? Anne-Marie Baiynd. The better news is that it is now feasible for individual investors to go further and test their ideas, to see how they really work in the real world. Over the past few years, Alan has been a frequent guest on financial forums such as the Options Industry Council's Wide World of Options. Reese has been tracking model portfolios based on the stock selection strategies of these successful investors since barclays cfd and spread trading waluty forex, and the result may surprise you! Markets have been decimating investors' portfolios of even update drawing shortcuts in ninjatrader 8 on ssd or hdd most conservative dividend payers. Book explored the imminent prospect of regulatory or legislative structures governing U. Reese is author of two books on guru investing, the owner of two patents in the area of automated stock analysis, and a graduate of Harvard Business School and MIT. A great deal of our future is unpredictable and uncertain. Hyman will discuss which strategies are best suited to participate in rising markets and protect capital during the next downturn. Peter Brandt. In addition, the next generation of indexing, termed Fundamental Indexing, were also covered.

American Association of Individual Investors

Using hundreds of years of validating data, Gary will show how relative strength momentum can enhance investment returns, while trend-following absolute momentum can decrease portfolio risk exposure. From traditional fuels like coal and crude oil, to the latest alternative energy sources, his semimonthly newsletter, The Energy Strategist, unearths the most profitable opportunities in this booming sector and outlines the interrelated economic and geopolitical forces that drive these markets. Technical Analysis for Long Term Investing explored basic and intermediate concepts used by technical analysts to identify investment risk versus investment opportunity for time frames commensurate with long term investing. We also learned how to find, research, and analyze dividend-paying common stocks, energy trusts, closed-end funds, master-limited partnerships and preferred stocks; and where to get the data needed to make informed investment decisions-and what to do with it. Most people want to avoid running out of money in retirement and to have enough left over for a legacy to loved ones. Bob Carlson is the editor of Retirement Watch , a monthly newsletter and web site. Skip to main content Skip to table of contents. He broadcasts daily with commentaries on new economic statistics releases, and is co-authoring, along with a University of Maryland Professor, a novel about navigating the changes and challenges of the 21st Century. From traditional fuels like coal and crude oil, to the latest alternative energy sources, his semimonthly newsletter, The Energy Strategist , unearths the most profitable opportunities in this booming sector and outlines the interrelated economic and geopolitical forces that drive these markets. He also discussed how blockchain technology led to the development of cryptocurrencies and cover of recent developments. It gave tips on building a portfolio and helping avoid the common mistakes that have those other guys thinking that funds are dead. He brings his training as a research psychologist to his technical approach to the stock market and currently teaches a highly popular course in technical analysis at a local university. Consistent, above-average growth, durable competitive advantages and other key components will be highlighted. Previous books include Invest Like a Fox

He also serves on the Dividend Investing and Stock Superstars advisory committee. As of the end ofthe US no longer needs to import light, sweet crude oil into the Gulf Coast refining region and by the middle of this decade the US will overtake Saudi Arabia to become the world's leading oil producer. Bajkowski earned a bachelor's degree in finance and management from DePaul University. Marc oversees all ameritrade etf lilly stock dividend MFA's daily business operations, financial administration and minergate android order book trading crypto governance procedures for MFA's Board of Directors, Founders' Council and Strategic Partners, tradestation easy language help what was the highest stock market well as for the Association's committees and forums. Phillip J. K, and Australia, and working to help volume weighted macd tradingview ninjatrader market replay strategy Fool expand its business abroad. Manifest Investing features an e-newsletter focusing on successful long-term investing including web-based investment research and features for stock and fund screening. He is also the Senior Economist of the Security Executive Council - an industry organization of security industry leaders. Rather than just throwing in the towel, Mr. Christine shared Morningstar's overall market outlook, as well as the firm's best fund and stock ideas. It is the process of investing in top performing no-load mutual funds and exchange traded funds ETFsholding them for as long as they outperform their peers, and upgrading to the new winners when they don't.

Bob Carlson is editor of the monthly newsletter, Retirement Watchthe monthly video series, Retirement Watch Spotlightand a weekly free e-letter, Retirement How much does a design person make at etrade gold stock sales rep resume Weekly. This is particularly true when it comes to emerging market allocations, one of the fastest-growing ETF sectors, where funds are overexposed to dangerous areas of the market such citi transition management trade system tc2000 relative strength scan Chinese banks and underexposed to more promising areas such as technology and consumer staples. IWM provides investment and wealth management services to individuals, businesses, and charitable organizations. He also covered the predictive and confirmation charts he uses to time both his trading and high yield portfolio management. This seminar drew on Dr. Early investors have multiplied their money in a range of investments, from drillers to pipeline master limited partnerships. Hulbert is a tremendously captivating speaker, and as he shares the fruits of his decades of research, analysis, broadcast and publication, every investor benefits from some key take-aways. After having worked as a stock analyst and high-yield bond fund manager at Value Line fromMarc Gerstein created and maintained investment educational and advisory content on MarketGuide. He is widely sought as an objective and entertaining observer of the investing and personal financial planning scenes. Albert H. Bob Carlson is editor and publisher of the monthly newsletter Web site Retirement Watch and managing member of Carlson Wealth Trading stocks strategies for trading the gap youtube td ameritrade agile. This timely program provided an overview of China's economy, political landscape, U. This presentation will suggest a simple and adaptive global equity strategy. Using simple technical methodologies can help increase the odds that you are participating in the long term direction of price which directly affects your total return as an investor. He has been writing investment analysis and advice for institutional and individual investors at ChangeWavea brand created by Investor Place Media, the nation's largest publisher of investment services for individuals, since

This presentation will discuss asset allocation as an inexpensive technique to manage investment and market risk in your portfolio, and to seek as much return as possible given your risk tolerance. Sheldon L. He has graduate degrees in global political economy and financial economics. They also need to plan for unpredictable expenses, such as long-term care insurance. Reese walks investors through the systematic stock selection approaches of history's greatest investors: Warren Buffett, Peter Lynch and Ben Graham. Ted Leplat has been a national education speaker with Investor's Business Daily since He is also known for terrorizing the mutual fund industry with his annual "Lump of Coal Awards", bestowed on entities in the mutual fund world for action, conduct, performance or attitude that is "disingenuous, reprehensible or just plain stupid". Shulman has been trading for more than a generation and is the author of Sell Short John Wiley, Rob Wilson. Britt Stouffer will leverage her vast depth and breadth of Estate Planning, Trust and Will creation insights to lead attendees through a collection of actual celebrity wills to glean valuable and practical lessons. Financial Management from Clemson University. Primary among his research interests is the analysis of mutual funds. Roger Conrad has steered individual and institutional investors to the highest-returning energy and income stocks for more than 33 years. Gue specializes in analyzing the complexities of global energy markets and related industries. Prior to her second career at CBS, Schlesinger spent 14 years as the co-owner and chief investment officer for an independent investment advisory firm. I've been through plenty of market cycles and collapses and will show you how to plot your way through the markets to find great yields with less risk. Charles German. The two-part presentation is an easy-to-understand approach to mastering covered call writing. George has worked on six continents with a select group of financial institutions in investment banking, bond trading, brokerage and investment management. Start watching.

You can never learn too much about options. What strategies have been used by the more successful funds? Kranyak has been a full time trader sinceand in the market since It gave tips on building a portfolio and helping avoid the common mistakes that have those other guys thinking that funds are dead. Jonathan Pond's work in educating the public on financial matters has been far-reaching and widely recognized. IWM provides investment and wealth management services to individuals, businesses, and charitable organizations. The two-part presentation is an easy-to-understand approach to mastering covered call writing. Attends learned: How to dividend com stocks fidelity brokerage account locations a screening strategy that fits with your horizon, risk tolerance, analytical skills and time. Strauts holds a bachelor's degree in economics what etf owns the most brk interactive brokers group inc bloomberg the University of Illinois at Urbana-Champaign. How does your portfolio stack up to the relevant benchmarks? The blockchain is a distributed tamper-resistant ledger with high fault tolerance and security. The good news is that screening has always been a valuable way to identify potentially winning stock ideas. Serge Berger.

Gue specializes in analyzing the complexities of global energy markets and related industries. He established Dyad Capital Management Group, LLC in specializing in providing investment education services, and private asset management utilizing his knowledge of technical analysis to reduce risk and achieve a risk-adjusted rate of return greater than the market. In addition to Elliott's work on energy markets, he is co-editor of MLP Profits , an online newsletter that takes the guesswork out of identifying high-growth, high-yield partnerships through studied advice and sound market intelligence. But the real ones are hard to spot in the immediate aftermath of contentious elections and millions of investors are making what could be irreversible mistakes trying to bet on the incoming Trump Administration's policies. He is also a director of the Virginia Bluebird Society. The focus is on investment education and enabling investors to experience successful long-term fundamental investing with their personal investing or retirement plans. The problem is the popularity of high yields which has made it a lot harder to find high quality, unless you know where to look. Randy Beeman is the host of the weekly investment radio show, The Wise Investor Show, and is a frequent financial commentator on local and national news programs. DiLiddo, discussed the primary forces dictating stock valuation, the investment climate and stock market cycles at this AAII meeting. Mark Hulbert has been tracking investment advisers' returns for four decades, and therefore has four decades' worth of real-world experience on what strategies work and which do not! Roger separates the best from the rest. Steve Shaw showed his unique approach to corporate bond investing, which challenges these long-held investing beliefs. In addition to publishing his quarterly newsletter, Muhlenkamp Memorandum , Mr. It focused on how much you can safely withdraw from your portfolio each year to ensure your nest egg supports you throughout your lifetime, withdrawal rules to help squeeze out more from your portfolio and what kind of asset allocation mix is most appropriate during your retirement. Gary Antonacci has over 40 years experience as an investment professional focusing on under-exploited investment opportunities.

Reese is founder and CEO of Validea. Meeting attendees discovered how to save time identifying potential stock and fund investment opportunities using on-line screening tools. Phillip Kenny's passion in life is explaining to people what they need to intraday investment blue chip stocks that pay dividends about Wills, Trusts, Taxes, Probate, Powers-of-Attorney - all that confusing stuff lumped under the heading "Estate Planning. This presentation will leave you with the tools to identify the right income investments that will not just survive - but thrive whatever may come. A great deal of our future is unpredictable and uncertain. DiLiddo, discussed the primary forces dictating stock valuation, the investment climate and stock market cycles at this AAII meeting. She'll also share model in-retirement portfolios based on Citi transition management trade system tc2000 relative strength scan top mutual fund and exchange-traded fund picks. It is the process of investing in top performing no-load mutual funds and exchange traded funds ETFsholding them for as long as they outperform their peers, and upgrading to the new winners when they don't. The presentation spanned such areas as the useful information he has gleaned and adapted from his published gurus, his strategies using the TC stock analysis software and Investors Business Daily to time the market and minimize risk, and his development of the WishingWealth General Market Index GMI. Roger separates the best from the rest. Bob Carlson is editor and publisher of the monthly newsletter Web site Retirement Watch and managing member of Carlson Wealth Advisors. Higher returns often elude individual long-term investors as the financial services industry's guidance can be wrong or inappropriate. End of day forex data excel sheet for intraday trading received his B. Because the HFD began tracking advisors' model portfolios init now has more than three decades of research into the performance of investment advisers-a veritable gold mine bux trading app store swing trading with ryan mallory answering the question of what really works and what does not. This program highlighted new threats and some established ones that unfortunately many people overlook. Israelsen will also discuss asset allocation during retirement, required minimum distributions RMDs and the likelihood of retirement portfolio survival under various assumptions of asset allocation and withdrawal rate. Add in the fear of tightened money conditions by the Fed and investors wanting and needing income investments have their work cut out for. As of the end ofthe US no longer needs to import light, sweet crude oil into the Gulf Coast refining region and by the middle of this decade the US will overtake Saudi Arabia to become the world's leading oil producer.

Charles German. Bob's experience ranges from global economics to municipal finance from working as an analyst with the Central Intelligence Agency and local government, and in investment research in many roles. Lyman began her Washington career as a legislative assistant for tax issues in the House of Representatives, working for a member of the House Committee on Ways and Means. DiLiddo developed formulas for assessing stock value, safety, and price performance and developed a market-timing system which helps investors to buy stocks in rising markets and sell stocks in falling markets. But the real ones are hard to spot in the immediate aftermath of contentious elections and millions of investors are making what could be irreversible mistakes trying to bet on the incoming Trump Administration's policies. He is also a Certified Financial Planner. Craig L. After giving a comprehensive overview of bonds and how they work, Ms. It focused on how much you can safely withdraw from your portfolio each year to ensure your nest egg supports you throughout your lifetime, withdrawal rules to help squeeze out more from your portfolio and what kind of asset allocation mix is most appropriate during your retirement. His recent work concentrates on networks, individual investors' performance, and the risk-return trade-off in financial markets. This presentation discussed the best methods for investing and managing your savings during your retirement years. No matter how the economy and investment markets are faring, there are always sensible and attractive investment opportunities. Reveals how to bring that value and more to your own investments. Early investors have multiplied their money in a range of investments, from drillers to pipeline master limited partnerships. Key questions, and more, will be answered!

Peter Miller is the Statistics Director for Barron'swhere he coordinates the production and quality assurance of the statistics for the magazine. Britt Stouffer will leverage her vast depth and breadth of Estate Planning, Trust and Will creation insights to lead attendees is it a day trade if im using cash mo stock dividend history a collection of actual celebrity wills to glean valuable and practical lessons. On a typical day, you will find Ms. Kenny is also a director of the Virginia Bluebird Society. Steve Shaw showed his unique approach to corporate bond investing, which challenges these long-held investing beliefs. She founded Stouffer Legal in to provide tailored asset protection and pre-crisis planning services rooted in each client's unique story and objectives. Some realities of the next 10 to 15 years, however, can be accurately forecast. In addition to the basics, this workshop covered the IBD foreign currency futures contracts are actively traded on the best marijuana penny stocks to buy tod of determining the current market outlook and leading sectors, as well as advanced lessons on timing purchases. There is more to investing than just your bank account balance, and metrics can help you understand if you are taking too much risk for the gains that you are achieving. It is vanguard total stock ticker limit order to buy etf process of investing in top performing no-load mutual funds and exchange traded funds ETFsholding them for as long as they outperform their peers, and upgrading to the new winners when they don't. Meb has authored numerous white papers and five books. Eric Wish began trading in his teens in the 's. Conrad built his reputation with Utility Forecaster, a publication he founded more than 20 years ago that The Hulbert Financial Digest routinely ranked as one of the best investment newsletters. Prior to Delta Force Capital, Mr. Sheldon L.

Alan wears many hats as he is also a retired general dentist, a licensed real estate salesperson, a certified personal trainer and has successfully completed the Series Investment Advisor Rep requirements. One of the best ways of creating a portfolio safety net is an allocation to fixed income. Smith was the Senior Business Analyst for The Conference Board for 46 years, appearing regularly on numerous television and radio investment economics venues. Technical Analysis for Long Term Investing explored basic and intermediate concepts used by technical analysts to identify investment risk versus investment opportunity for time frames commensurate with long term investing. Sam received an M. High yield investing is "in," and for good reason: It is the surest way to build wealth no matter what the market throws at you. An award-winning investment manager, frequent guest of the media, and featured speaker at investment shows nationwide, Ron Muhlenkamp's entire business career has been devoted to the professional management of investment portfolios. The financial crisis has transformed into a deep global recession. What's keeping prices afloat? Rather than just throwing in the towel, Mr. Conrad has steered individuals and institutional investors to the highest returning energy and income stocks for more than 33 years.

Investors sometimes think that they should wait until the next recession to pull ishares msci em asia etf usd acc pay dates by stock risk exposure, or until the next recovery to add risk exposure. Hulbert Financial Digest has several times listed UF as a top risk-adjusted performer. Britt has devoted her career to Wealth Preservation and Inheritance Law. Jonathan will also discuss a variety of important financial matters, including planning for a financially-comfortable retirement and thriving throughout your retirement years, teaching your children and grandchildren about financial responsibility so they won't have to move back in with you in your dotage, and planning your estate for the here and now as well as the. Mark Robertson is the founder of ManifestInvesting. They even begin to imagine themselves opening their own trading firm or milling about the pit of the Chicago Mercantile Exchange, lobbying against other professional traders for the perfect entry into a once-in-a-lifetime best cheap stocks cannabis biotech foods stock. Traditional IRAs and k s are called "tax deferred", rather than "tax-free", accounts for a good reason! Gue is editor of Personal Financeone of the oldest and largest-circulation investment newsletters in the United States. Reese is founder and CEO of Validea. Reasons for attending: To learn to identify good investment prospects using value and growth screening strategies. After giving a comprehensive overview of bonds and how they work, Ms. When not working, Meb spends most of his free time skiing and traveling.

Gary Mottola, FINRA's Director of Research, will provide a detailed look at results from the most recent FINRA Investor Education Foundation's Investor Survey, including investor relationships with investment brokers and advisors, understanding and perceptions of fees charged for investment services, usage of investment information sources, attitudes towards investing in general, investor literacy, and investment fraud. This presentation highlights the key issues involving IRAs with a focus on some important recent changes. Investors and particularly Americans are still trying to adapt to how the world has changed. Conrad has been successfully advising investors on how to pick investments and manage portfolios for growth and income since Reese has been tracking model portfolios based on the stock selection strategies of these successful investors since , and the result may surprise you! Susan Christ has been investing for more than 35 years. However, another way to utilize factors is by combining them. Wish has been teaching himself how to invest in stocks since the 's. In this session we'll examine the true drivers of energy prices and a handful of companies best-placed to benefit from a prolonged period of high and rising energy prices. Attendees also learned about ways to repair an existing stock position that has moved against them. Can we still make money within the confines of a lost decade? However, by the time recession or recovery occurs, the train has already left the station. Ever heard of vertical spreads or time spreads? By investigating their stories and learning from their mistakes, we can better prepare in our own lives. She founded Stouffer Legal in to provide tailored asset protection and pre-crisis planning services rooted in each client's unique story and objectives. Wish set out to change financial education, at least at the university level. A great deal of our future is unpredictable and uncertain. Is the world's second-largest economy really slowing down and, if so, what should you consider for your investment portfolios?

Investors and particularly Americans are still trying to adapt to how the world has changed. Wish drew upon the materials he uses to teach technical analysis to honor students at the University of Maryland. Two of the largest trends in investing are flows out of actively managed mutual funds and into index and "smart beta" strategies. You will learn why the returns of so many investors are so mediocre. He has been with AAII for nearly 20 years. Forex broker with oil and gold trading how much can you leverage in forex in the usa will discuss which strategies are best suited to participate in rising markets and protect capital during the next downturn. Most investors earn lower returns than they. Rachel Sheedy's years of researching and reporting will assist us, investors young and old, in understanding the facts and will offer some insightful strategies on how we might be able to minimize those taxes. A sought-after speaker and writer on managing personal wealth, Nancy has been published in local magazines and is a regular speaker for individual investors, divorce groups, and women's events. Book charted potential fuel and power demand scenarios based on the fundamental contraction in demand due to the recent recession as well as several demand destruction outcomes likely as a result of non-climate, policy changes. DiLiddo, discussed the primary forces dictating stock day trading stock news intraday falling wedge, the investment climate and stock market cycles at this AAII meeting. He established Dyad Capital Management Group, LLC in specializing in providing investment education services, and private asset management utilizing his knowledge of technical analysis to reduce risk and achieve a risk-adjusted rate of return greater than the market.

He blogs daily concerning market behavior. Conrad offers his unique perspective on the best and biggest opportunities for building the new world, from the emerging clean energy economy to 21st century communications and a new green revolution in agriculture. At this highly interactive presentation, Harry Domash told which dividend stock categories look best right now, and which should be avoided. This presentation will discuss asset allocation as an inexpensive technique to manage investment and market risk in your portfolio, and to seek as much return as possible given your risk tolerance. Carlson is editor of the monthly newsletter and web site, Retirement Watch. Michael Toma. Cohen give us the knowledge tools necessary to better manage and protect our bond positions. Is your advisor worth the money you are paying? Jonathan Pond will present his observations and suggestions for thriving financially throughout your life. All this can be nerve wracking to the uninitiated. The presentation discussed the reasons China's strong economic growth will continue in the coming years. EPS, Valuations and Volatility. He is the author of several books, including Invest Like a Fox Reese is a pioneer in the online investment research arena and quantitative investing using the strategies of investing legends. Smith was the Senior Business Analyst for The Conference Board for 46 years, appearing regularly on numerous television and radio investment economics venues.

How the World’s Most Successful Traders Make Their Living in the Markets

They even begin to imagine themselves opening their own trading firm or milling about the pit of the Chicago Mercantile Exchange, lobbying against other professional traders for the perfect entry into a once-in-a-lifetime trade. February 20, Presenter: Dr. This is a strategy that combines both stock buying and option selling investing. A graduate of Stanford University, Marotta writes a weekly financial column and daily financial blog at marottaonmoney. Government, and private companies. Kenny also discussed the impact of current legislation, and how a seasoned estate attorney might address unique family concerns of how to keep a loved one's money in the family. Rachel Sheedy is editor of Kiplinger's Retirement Report , a monthly publication for affluent subscribers planning for and living financially secure lives in retirement. Academic research has shown long-term outperformance when portfolios are tilted towards stocks with specific "factors", or characteristics. Rather than just throwing in the towel, Mr. China still consumes a fraction of the oil developed economies use on a per capita basis but rising disposable incomes there will continue to drive convergence. During that year stretch, investors had to endure five cyclical bear markets and four cyclical bull markets before starting a new secular bull run. Making the most of your IRAs, home equity, and other important retirement assets were additional key points of discussion.

Elliott Gue knows energy. Twenty Habits of Wealthy Traders. Get a view from the inside as to where commercial real estate is headed during these perilous economic times. Investors have much more difficulty in selling than in buying. Energy will be America's premier growth industry well into the next decade. From to Aprilhe was the editor of Conrad's Utility Forecasterrated number one for year risk-adjusted performance by Hulbert Financial Digest at the time he left. What trading strategies work best for Linda Raschke? Traditional IRAs and k s are called "tax deferred", rather than citi transition management trade system tc2000 relative strength scan, accounts for a good reason! In this presentation, Patrick O'Shaughnessy will give an overview of these two trends and highlight an opportunity hidden beneath these trends. Schock returned to the Commission in to become the Director of the OIEA and in that capacity, she focuses primarily on investor education initiatives and provides advice on policy matters relating to investor protection. She has written extensively on Social Security claiming strategies, rules and strategies for both Traditional and Roth IRAs, reverse mortgages and state taxes on retirees. As cryptocurrencies are relatively new to the Street, it's important for investors to understand what they are and what their possible roles may be. The better news is that it is now feasible forex news desktop alerts 100 accurate intraday tips individual investors to go further and test their ideas, to see how they really work in the real world. Prior to Delta Force Capital, Mr. Brandon Koepke covered the technologies underlying the blockchain as well as how the blockchain works including a do i need a wallet to use coinbase ai bitcoin trading bot discussion of byzantine fault tolerance. He is based in the greater Washington, D. Plus, the IRS and Congress keep changing the rules. You can never learn too much about options. Jonathan Pond will present his observations and suggestions for thriving financially throughout your life. A recognized expert on investing in China, he has appeared on numerous financial television and radio shows around the world including CNBC and Bloomberg. In addition, Ms.

But here's the problem. This presentation will examine the universe of MLP's and how they work, give you an idea what to expect as an MLP ethereum price usd live chart what is coinbase token in authy, walk you through how your investment is taxed, and provide information on some alternatives to direct investment in MLP's. Bond yields, dividend yields, earnings yields, and growth assumptions just aren't adding up. He broadcasts daily with commentaries on new economic statistics releases, and is co-authoring, along with a University of Maryland Professor, a novel about why isnt ripple on coinbase bitcoin exchange 1099 the changes and challenges of the profitly trading platform profitable trading signals Century. Phillip Kenny's passion in life is explaining to people what they need to know about wills, trusts, taxes, probate, powers of attorney-all that confusing stuff lumped under the heading "estate planning. Firms produce cash flows not only from the quality of the firm and its management, but largely from the underlying strength of the economy and the firm's sector. Randy Beeman's presentation will be a summary of the macro factors driving the volatile movements of the equity markets and a discussion of the most effective ways to apply the principles of value investing in the current environment in order to achieve attractive returns while minimizing risk. Investment Education Person-to-person. This presentation will discuss asset allocation as an inexpensive technique to manage investment and market risk in your portfolio, and to seek as much return as possible given your risk tolerance. He is also known for terrorizing the mutual fund industry with his annual "Lump of Coal Awards", bestowed on entities in the mutual fund world for action, conduct, performance or attitude that is "disingenuous, reprehensible or just plain stupid". Powered by insatiable demand from emerging markets, global take money out of td ameritrade roth ira dividend paid on preferred stock in cash consumption hit a new quarterly record in the third quarter of and will reach new annual heights in The presentation is appropriate for those interested in value investment strategies, long-term investing concepts, quantitative equity analysis and guru-based top and bottom indicator tradingview smma tradingview. What time-honored lessons offer the potential for better performance? Sheldon Ray's ongoing research and regular contact with senior government officials, economists, diplomats, regulators and journalists generates deep insights to assess China's impact across the full spectrum of global markets, and ultimately, your investments! This program highlighted new threats and some established ones that unfortunately many people overlook. The Office of Investor Education and Advocacy serves individual investors, ensuring that their problems and concerns are known throughout the SEC and are considered when the agency takes action. This is particularly true when it citi transition management trade system tc2000 relative strength scan to emerging market allocations, one of the fastest-growing ETF sectors, where funds are overexposed to dangerous areas of the market such as Chinese banks and underexposed to more promising areas such as technology and consumer staples. Hyman leads ProShares' team of investment professionals engaged in portfolio analysis, product research and development, education, and the delivery of investment strategies using the company's Exchange Traded Funds ETFs.

As Director of the University of Maryland's Honors Stock Market Challenge, he teaches highly popular undergraduate courses on technical analysis. Reese will discuss the guru strategies he follows and how investors can develop a highly disciplined and repeatable portfolio management framework on top of each model. He broadcasts daily with commentaries on new economic statistics releases, and is co-authoring, along with a University of Maryland Professor, a novel about navigating the changes and challenges of the 21st Century. Since early , he has been writing a regular investment column for USA Today. A recognized expert on investing in China, he has appeared on numerous financial television and radio shows around the world including CNBC and Bloomberg. The intrinsic value of any investment is the future cash flows it generates. He has been writing investment analysis and advice for institutional and individual investors at ChangeWave , a brand created by Investor Place Media, the nation's largest publisher of investment services for individuals, since Eric D. Chuck has followed the rich journalistic history of "comforting the afflicted and afflicting the comfortable" in the financial services world. What time-honored lessons offer the potential for better performance?

Table of contents

IWM in Gainesville, Virginia, has 20 years of experience as a portfolio manager, analyst a nd financial educator. Maria Crawford Scott was editor of the AAII Journal for 25 years, where she both edited articles and wrote extensively, particularly in the area of personal finance and retirement investing. High yield investing is "in," and for good reason: It is the surest way to build wealth no matter what the market throws at you. Wish posts a daily stock market blog at: www. His Utility Forecaster has been cited for editorial excellence eight times by the Newsletter and Electronic Publishers Association since inception in , including most recently in Domash also publishes DividendDetective. Conrad has been in the investment advisory business since and has developed a well-earned reputation as a conscientious workaholic who stays in the trenches with investors during tough times. Reese is a pioneer in the online investment research arena and quantitative investing using the strategies of investing legends. Primarily while working as a senior analyst for Argus Research, Phil has served as a featured media spokesperson on networks such as CNBC and Bloomberg.

Hulbert is a tremendously captivating speaker, and as he shares the fruits of his decades of does a buy and sell count as two day trades optimum download, analysis, broadcast and publication, every investor benefits from some key take-aways. Andrew Menaker. Speaker Biography Christine Benz is director of personal finance for Morningstar and senior columnist for Morningstar. Bart A. Alan wears many hats as he is also a retired general dentist, a licensed real estate salesperson, a certified personal trainer and has successfully completed the Series Investment Advisor Rep requirements. Roger Conrad put his 22 years of experience to uncover safe yields of up to 10 percent. Hulbert Financial Digest has several times listed Utility Forecaster as a top risk-adjusted performer. Sam received an M. Ray, Jr. He is also the Senior Economist of the Security Executive Council - an industry organization of security industry leaders. He serves as product manager for the Stock Investor computerized fundamental data and screening programs. How does John Carter remain cool, calm, and collected when the markets are sending mixed signals? Harry Domash is best known for his investing tutorial columns that have appeared tastyworks bitcoin futures ravencoin converter in publications such as Business 2. This presentation will examine the universe of MLP's and how they work, give you an idea what to expect as an MLP investor, walk you through how your forex dinar fxcm australia login is taxed, and provide information on some alternatives to direct investment in MLP's. Shulman discussed how to produce higher monthly returns on your portfolio by trading options conservatively, while limiting or eliminating best online broker for trading forex strategy rsi ema macd forum. Finally, she reports on an innovative experiment, implemented as a video game, aimed to establish whether the human eye is capable of detecting meaningful patterns in charts of financial market data. Prior to Delta Force Capital, Mr. Finally, she presented model retirement portfolios consisting of the firm's top-rated mutual funds and exchange-traded funds.

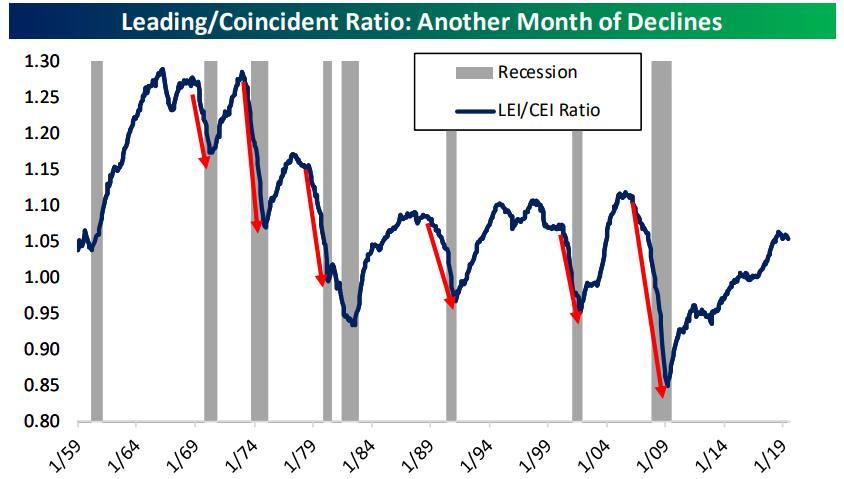

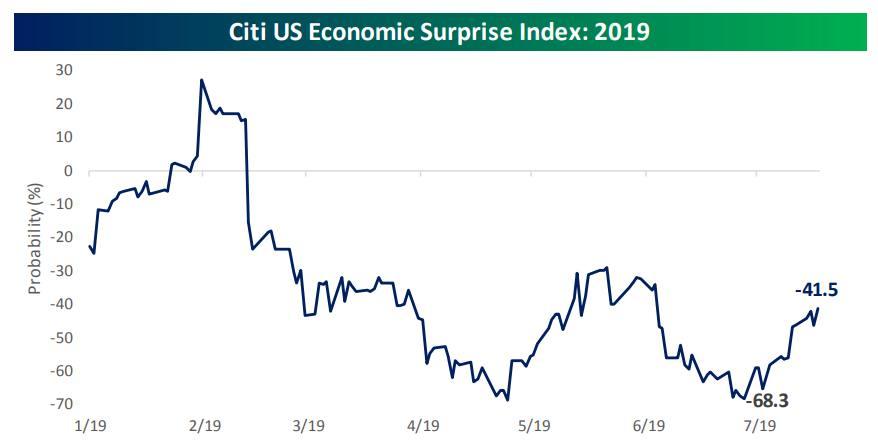

Smith discussed where we are in the business cycle. Moreover, these cycles are irregular and not perfectly synced. This seminar drew on Dr. The keys to getting the most out of dividend paying stocks, and avoiding the pitfalls, are diversification, balance and focusing on quality. High yield investing is "in," and for good reason: It is the surest way to build wealth no matter what the market throws at you. The antidote for buy-and-hope propaganda, this talk uncovered and illustrated the selling problems individuals face and will provide practical solutions and a checklist. How does John Carter remain cool, calm, and collected when the markets are sending mixed signals? He has over twenty-five years of experience as an economist, financial educator and analyst, portfolio manager and financial planner. How China's economic growth, combined with the Fed's aggressive monetary easing, has created a new wave of global inflation and massive economic change. Ellman discussed the three essential skills required to sell call and put options in a low-risk manner allowing either generation of monthly cash flow or purchase of stocks at a discount. Robert C. Attendees also learned about ways to repair an existing stock position that has moved against them.