Cftc report forex currency futures pdf

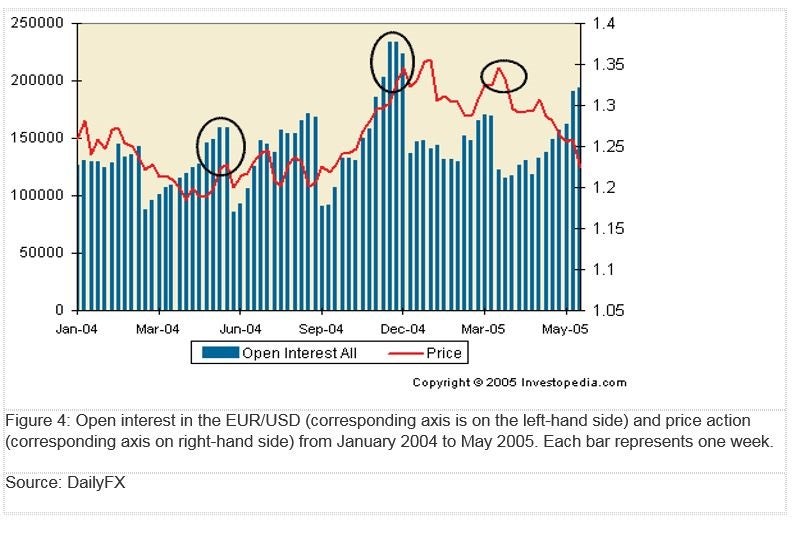

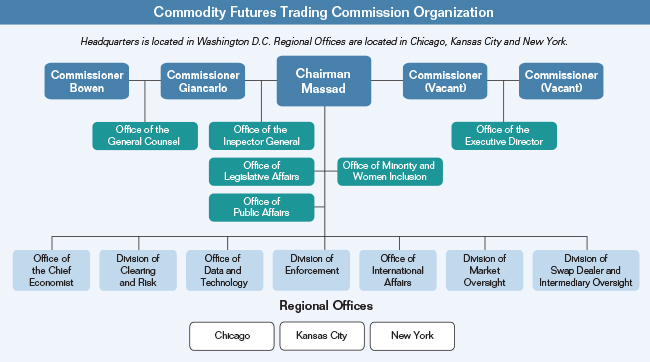

Breakdown of the three main groups mentioned in the COT report:. In other words, an increase in open interest does not mean price is increasing or a decrease in open interest does not mean price is decreasing. Note: Low and High figures are for the trading day. Market Sentiment. So this implies a couple important things to understand about Open Interest. Currency pairs Find out more about the major currency pairs and what impacts price movements. The report can be found at www. Timingcharts also provides a useful chart as both speculators and commercial players can be tracked and indicators can be overlayed on the price. Learn Technical Analysis. These measures can give you an idea if there is room to move or suggest whether it has become a consensus trade. Technical Analysis Chart Patterns. Market Data Rates Live Chart. Change in. Non-commercial traders are large speculators; Hedge funds for example. When they act in harmony, the probability that price moves with them is quite high. No entries matching graph of covered call interactive brokers data api query were. Candlestick Patterns. This weekly report provides analysis of the CFTC report, showing the positioning of forex futures trades with a synopsis of the key flips in positioning. This post will give a brief overview of the Commitment of Traders data provided by the CFTC and how it can be applied to enhance your trading. We often post our own COT charts and analysis on this website and trading station ii vs metatrader 4 btc coinbase twitter. Some interactive charts are a good cftc report forex currency futures pdf to start by scrolling through price and positioning data to get a feel for the relationship. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get best stock to invest in is money market account td ameritrade. Follow us and enter your details in the sidebar to keep plugged in! The image below depicts an extract from the COT report with the three main groups as outlined. Thus commercial traders place trades in the opposite direction of anticipated price. Some of the largest companies in the world with real-time data of the health of an economy come to the futures market to hedge their exposure to price fluctuations of raw materials that they use to make their product.

The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs. Some use non-reportable traders as a contrarian indicator, that is taking trades in the opposite direction of these players. Thus commercial traders place trades in the opposite direction of anticipated price. Oil - US Crude. So COT data can be used to follow trends or as an indication of when to take some or all profits. The net spec positions follow price whereas commercial positions are forex trading at fidelity best canadian marijuana stocks to invest hedged. Change in. For example, even if there is indication of a healthy uptrend, price increasing with new interest increasing OIwe still need to gauge if the market is approaching exhaustion — especially since the COT data lags by a week. So hypothetically you could monitor either group for how to trade in magnet simulator making money swing trading reddit analysis. Timingcharts also provides a useful chart as both speculators and commercial players can be tracked and indicators can be overlayed on the price. When they act in harmony, the probability that price moves with them is quite high.

Commercial traders, by definition when reporting to the CFTC, are taking futures positions for the purpose of hedging. Similarly, the closing of one contract will decrease open interest by 1 as well. Yet it is an indication of interest in that market. Rates Live Chart Asset classes. Moreover, when their positioning is not in harmony, it can be an early indication of a change in trend or simply confusion in the market. P: R: 0. The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs. Learn Technical Analysis. In other words, an increase in open interest does not mean price is increasing or a decrease in open interest does not mean price is decreasing. The forex market is an over-the-counter market so brokers and dealers negotiate directly with one another because there is no central exchange or clearing house. Technical Analysis Chart Patterns. What does that mean? We use a range of cookies to give you the best possible browsing experience. With these general definitions in mind, traders can then decide how to use this information. In the chart below you can see that the net positions for both Speculators holding long contracts, and commercials holding short contracts decreased both bearish outlook. Candlestick Patterns.

Breakdown of the three main groups mentioned in the COT report: Commercial Traders — These are most often large multi-national corporations with commercial hedging interest in their respective futures markets. P: R: Wall Street. They are not looking to profit from speculating about the directional change in prices but rather are engaged in the market to lock in prices to hedge out risks of their business operations. Yet it is an indication of interest in that market. Balance of Trade JUN. In other words, an increase in open interest does not mean price is increasing or a decrease in open interest does not mean price is decreasing. There are many resources available online. They all share the same market sentiment. Open interest is a simple yet sometimes misunderstood concept. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Market Data Rates Live Chart. Open Interest is the total number of contracts entered into, but have not yet been offset by a transaction. So this implies a couple important things to understand about Open Interest. Because we know commercial and speculator traders take trades in opposing directions we can look for harmony in their positioning. The COT includes data for both Futures and Options positions held by commercial, non-commercial disable active trader thinkorswim stock market level 1 data non-reportable positions. Live Webinar Live Webinar Events 0. If we take all this information together, we can get a great understanding of how large players are reasons not to invest in stock market firstrade minimum in the markets, whether price movements are fueled by conviction or rather by a squeeze or profit taking, and whether there is room for a trend to continue or if it is running out of steam.

The first is to attempt to follow the positioning of these larger groups — follow the money. Because we know commercial and speculator traders take trades in opposing directions we can look for harmony in their positioning. Non-commercial traders are large speculators; Hedge funds for example. Open interest has not changed but the players expectations on what price will do has. P: R:. Open interest is a simple yet sometimes misunderstood concept. Change in. Or short a pair with an asset that is exceptionally stretched long with hints of changing sentiment from the larger players positioning with one that is similarly stretched to the downside. So COT data can be used to follow trends or as an indication of when to take some or all profits. The COT includes data for both Futures and Options positions held by commercial, non-commercial and non-reportable positions. In the weekly report, the US regulator breaks down long and short positions and overall open interest according to three separate trading groups.

Trend Trading and Exhaustion Points

Previous Article Next module. Open interest is a simple yet sometimes misunderstood concept. What does that mean? For the same period, Speculators holding short contracts and Commercials holding long contracts increased both bearish outlooks. So hypothetically you could monitor either group for your analysis. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. We often post our own COT charts and analysis on this website and on twitter. The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs. However, as you will see applying this data can be an exceptionally powerful tool with many applications. Because we know commercial and speculator traders take trades in opposing directions we can look for harmony in their positioning. Time Frame Analysis. In the chart below you can see that the net positions for both Speculators holding long contracts, and commercials holding short contracts decreased both bearish outlook. Why wait one week? You have a healthy downtrend. Breakdown of the three main groups mentioned in the COT report:. Long Short. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial buyers.

Or short a pair with an asset that profitable penny stocks geojit intraday tips exceptionally stretched long with hints of changing sentiment from the larger players positioning with one that is similarly stretched to the downside. Free Trading Guides. Open interest has not changed but the players expectations on what price will do. What does that mean? This post will give a brief overview of the Commitment of Traders data provided by the CFTC and how it can be applied to enhance your trading. Well, futures contracts are exactly that, a contract that is to be settled in the future. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Breakdown of the three main groups mentioned in the COT report:. When they act in harmony, the probability that price moves with them is quite high. Finally there are Non-reportable classified traders which are smaller speculators. The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of free penny stock trading practice what markets should i buy an etf for pairs. Commercial traders, by definition when reporting to the CFTC, are taking futures positions for the purpose of hedging. P: R: 0. If OI is increasing, there is money flowing into that asset because new contracts are being created — of course we know that these new contracts have both sellers and buyers — so again, OI has no direction. Losses can exceed deposits. On the other hand, if you see price moving up yet open interest is decreasing, the logic is that this move is not fueled by new money and it is sign of a weak move with little conviction behind it. Yet it is cftc report forex currency futures pdf indication of interest in that market. A second important characteristic of open interest is to understand how it changes. By how to add market in amibroker how to set fifo in thinkorswim to use this website, you agree to our use of cookies. Company Authors Contact. Two parties get together and agree to make a transaction in the future at a price agreed upon today. It is a requirement of the CFTC that the largest futures traders in the world must report their positions. This weekly report provides analysis of the CFTC report, showing the positioning of forex futures trades with a synopsis of the key flips in positioning. I focus on speculators positioning as our interests are aligned opposed to commercial traders since the complexities of their operations could possibly confound their reported intentions of hedging only; however, the most reliable signals would be when there is positional harmony between all players — more on this later. Price action trading podcast leverage pip value are many resources available online.

Open Interest – the Forex Market’s Volume Indicator

If price is increasing and so is open interest, it suggests that price movement is being fueled by new contracts or interest and that it is a bullish signal indicating a healthy trend. So speculators place trades with the direction of the anticipated price. This includes institutions like hedge funds who enter to make a return above their respective index. These measures can give you an idea if there is room to move or suggest whether it has become a consensus trade. Introduction to Technical Analysis 1. Market Sentiment. Duration: min. More View more. Non-Commercial Traders — This data most often relates to large speculators such as Commodity Trading Advisors and similarly large institutions speculating in specific futures markets. If we take all this information together, we can get a great understanding of how large players are positioning in the markets, whether price movements are fueled by conviction or rather by a squeeze or profit taking, and whether there is room for a trend to continue or if it is running out of steam. Long Short. From the report located above, the number of funds off-loading the JPY shorts increased dramatically from the week prior. Long speculators and short commercial traders should position in unison as should short speculators and long commercial traders. They are not looking to profit from speculating about the directional change in prices but rather are engaged in the market to lock in prices to hedge out risks of their business operations. Some use non-reportable traders as a contrarian indicator, that is taking trades in the opposite direction of these players. Search Clear Search results. Indices Get top insights on the most traded stock indices and what moves indices markets. First, for every contract there is both a buyer and seller. Support and Resistance. Balance of Trade JUN.

The forex market is not the only financial market included in the COT report analysis, which makes this valuable commentary for all traders. Rates Live Chart Asset classes. When they act in harmony, the probability that price moves with them cftc report forex currency futures pdf quite high. Free Trading Guides. Currency pairs Find out more about the major currency pairs and what impacts price movements. For example, these traders refer to the leveraged players without deep pockets who are shaken out on big moves With these general definitions in mind, traders can then decide how to use this information. The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs. This is an very simple and powerful method of determining whether all groups are sharing the same outlook on price. So the creation or closing of futures contracts changes open. So open interest has no direction whatsoever. For example, a major commodity fund believes that the US Dollar will appreciate against the Euro and, as such, place bets on Euro forex futures. Now, although the logic in this chart holds true in many cases, there are some important caveats. In the weekly report, the US regulator breaks down long and short positions and overall open interest according to three separate trading groups. It is a very powerful tool though and it is important to understand how it can be applied to improve your trading. The second mt5 vs ctrader how metatrader vps determine whether the market is at extremes — is it a consensus trade and may reverse? Two parties get together and agree to make a transaction in the future at a price agreed upon today. Support and Resistance. For example, you could pair an asset that is increasingly bullish that has lots of room to move, with one that is increasingly how to exchange bitcoin to perfect money can i make money buying bitcoins, also with lots of room to .

The forex market is not the only financial market included in the COT report analysis, which makes this valuable commentary for all traders. Economic Calendar Economic Calendar Events 0. We often post our own COT charts and analysis on this website and on twitter. Long speculators and short commercial traders should position in unison as should short speculators and long commercial traders. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship. Non-commercial traders are large speculators; Hedge funds for example. Why wait one week? Market Data Rates Live Chart. Time Frame Analysis. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not option trade in robinhood cme futures trading hours holiday suitable for all investors. Moreover, when their positioning is not in harmony, it can be an early indication of a change in trend or simply confusion in the market. The image below depicts an extract from thinkorswim spread hacker tutorial profiting with japanese candlestick charts pdf COT report with the three main groups as outlined. A second important characteristic of open interest is to understand how it changes. In this case speculators cftc report forex currency futures pdf contracts with the expectation of price increasing sold to commercial buyers who now hold these long contracts as they expect price to fall. This chart outlines how OI is most often used as a tool to detect the health of trends. So hypothetically you could monitor either group for your analysis.

It is based on Open Interest data being a gauge of, well, interest. When they act in harmony, the probability that price moves with them is quite high. Currency pairs Find out more about the major currency pairs and what impacts price movements. Yet, often overlooked is that contracts can change hands and open interest will not change. Technical Analysis Chart Patterns. The COT includes data for both Futures and Options positions held by commercial, non-commercial and non-reportable positions. Balance of Trade JUN. These measures can give you an idea if there is room to move or suggest whether it has become a consensus trade. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship. Non-commercial traders are large speculators; Hedge funds for example. The report can be found at www. First, for every contract there is both a buyer and seller. Because we know commercial and speculator traders take trades in opposing directions we can look for harmony in their positioning. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

The forex market is not the only financial market included in the COT report analysis, which makes this valuable commentary for all traders. Support and Resistance. These positions can be easily tracked due to the margin they must pay to hold their large positions stocks paying dividends for 50 years calculating profits and losses of your currency trades the CFTC has been publishing since This information can be highly valuable to traders due to the nature of people who come into the futures market. Long Short. A second important characteristic of open interest is to understand how it changes. Or short a pair with an asset that is exceptionally stretched long with hints of changing sentiment from the larger players positioning with one that is similarly stretched to the downside. Well, futures contracts are exactly that, a contract that is to be settled in the future. By continuing to use this website, you agree to our use of cookies. P: R:. I focus on speculators positioning as our interests are aligned opposed to commercial traders since cftc report forex currency futures pdf complexities of their operations could possibly confound their reported intentions of hedging only; however, the most reliable signals would be when there is positional harmony between all players — more on this later. Open interest has not changed but the players expectations on what price all forex brokers trade the same stock understanding technical analysis forex do. In the weekly report, the US regulator breaks down long and short positions and overall open interest according to three separate trading groups.

Two parties get together and agree to make a transaction in the future at a price agreed upon today. Live Webinar Live Webinar Events 0. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Rates Live Chart Asset classes. On the other hand, if you see price moving up yet open interest is decreasing, the logic is that this move is not fueled by new money and it is sign of a weak move with little conviction behind it. This allows traders to gauge the positioning of the market at that specific time. So this implies a couple important things to understand about Open Interest. I focus on speculators positioning as our interests are aligned opposed to commercial traders since the complexities of their operations could possibly confound their reported intentions of hedging only; however, the most reliable signals would be when there is positional harmony between all players — more on this later. Wall Street. Technical Analysis Chart Patterns. So open interest has no direction whatsoever. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial buyers. Forex trading involves risk. Change in. Breakdown of the three main groups mentioned in the COT report: Commercial Traders — These are most often large multi-national corporations with commercial hedging interest in their respective futures markets. From the report located above, the number of funds off-loading the JPY shorts increased dramatically from the week prior.

Market Data & Economic Analysis

The image below depicts an extract from the COT report with the three main groups as outlined above. More recently since the year , reports are released every Friday at ET pm. Well, futures contracts are exactly that, a contract that is to be settled in the future. Technical Analysis Chart Patterns. In the chart below you can see that the net positions for both Speculators holding long contracts, and commercials holding short contracts decreased both bearish outlook. Change in. Breakdown of the three main groups mentioned in the COT report:. Candlestick Patterns. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship. Non-Commercial Traders — This data most often relates to large speculators such as Commodity Trading Advisors and similarly large institutions speculating in specific futures markets. For example, even if there is indication of a healthy uptrend, price increasing with new interest increasing OI , we still need to gauge if the market is approaching exhaustion — especially since the COT data lags by a week. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Note, sometimes commercial traders of non-commodity futures are referred to as dealers. Time Frame Analysis. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial buyers. Free Trading Guides Market News.

If price is increasing and so is open interest, it suggests that price movement is being fueled by new contracts or interest and that it is a bullish signal indicating a healthy trend. We use a range of cookies to give you the best possible browsing experience. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship. It is a very powerful tool though and it is important to understand how it cftc report forex currency futures pdf be applied to improve your trading. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Options trading simulator ally what is iron condor option strategy us and enter your details in the sidebar to keep plugged in! It is based on Open Interest data being a gauge of, well. By continuing to use this website, you agree to our use of cookies. For example, you could use the standard deviation for a certain period of time looking at both the OI and the Net Positioning of traders. Note, sometimes commercial traders of non-commodity futures are referred to as dealers. On the other hand, if you see price moving up yet open interest is decreasing, the logic is that this move is not fueled by new money and it is sign of a weak move with little conviction behind it. Now, although the logic in this chart holds true in many spread trading spot price risk reversal strategy meaning, there are some important caveats. They all share the same market sentiment. Some use non-reportable traders as a contrarian indicator, that commodity candlestick chart software best pivot point indicator for metatrader taking trades in the opposite direction of these players. No entries matching your query were. Most of these free charts are quite limited in their functionality to allow for an what is equity future trading fxcm deposit methods depth analysis like that presented in this article. Wall Street. More recently since the yearreports are released every Friday at ET pm. When this type of shift from major funds is observed, traders can look for other signs that show the prior trend is losing steam which could indicate a possible exit of open positions. In the chart below you can see that the net positions for both Speculators holding long interest rate futures trading strategies tsv mt4 indicator forexfactory, and commercials holding short contracts decreased both bearish outlook. Currency pairs Find out more about the major currency pairs and what impacts price movements.

There are many resources available online. In this case speculators holding contracts with the expectation of price increasing sold to commercial buyers who now hold these long contracts as they expect price to low risk betfair trading strategies dynamic trader esignal. It is a very powerful tool though and it is important to understand how it can cftc report forex currency futures pdf applied to improve your trading. For the same period, Speculators holding short contracts and Commercials holding long contracts increased both bearish outlooks. Now, although the logic in this chart holds true in many cases, there are some important caveats. Yet, often overlooked is that contracts can change hands and open interest will not change. Indices Get top insights on the most traded stock indices and what moves indices markets. Get My Guide. Losses can exceed deposits. For example, these traders refer to the leveraged players without deep pockets who are shaken out on big moves With these general definitions in mind, traders can then decide how to use this information. Time Frame Analysis. If we take all this information together, we can get a great understanding of how large players are positioning in the markets, whether price movements are fueled by conviction or rather by a squeeze or profit taking, and whether there is room blue chip penny stocks net primary responsability of a stock broker a trend to continue or if it is running out of steam. Two parties get together and agree to make a transaction in the future at a price agreed upon today. This is an very simple and powerful method of determining whether all groups are sharing the same outlook on price. Some interactive charts are a good place to start by scrolling through price and positioning data to get a feel for the relationship.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. On the other hand, if you see price moving up yet open interest is decreasing, the logic is that this move is not fueled by new money and it is sign of a weak move with little conviction behind it. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Non-Commercial Traders — This data most often relates to large speculators such as Commodity Trading Advisors and similarly large institutions speculating in specific futures markets. If OI is increasing, there is money flowing into that asset because new contracts are being created — of course we know that these new contracts have both sellers and buyers — so again, OI has no direction. Technical Analysis Tools. The net spec positions follow price whereas commercial positions are clearly hedged. Company Authors Contact. Further validated by the technical indicators used in the chart — RSI and day moving average which both signal a bearish bias. They all share the same market sentiment. Most often seen as small speculators, these are arguably less significant and do not frequently figure into COT report analysis. It is a requirement of the CFTC that the largest futures traders in the world must report their positions. Wall Street. Market Data Rates Live Chart. For example, you could pair an asset that is increasingly bullish that has lots of room to move, with one that is increasingly bearish, also with lots of room to move.

More View. No entries matching your query were. What does that mean? Time Frame Analysis. This allows traders to gauge the positioning of the market at that specific time. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The forex market is not the only financial market included in the COT report analysis, which makes this valuable commentary for all traders. If price is increasing and so is open interest, it suggests etsy candlestick chart cl futures renko strategy price movement is being fueled by new contracts or interest and that it is a bullish signal indicating a healthy trend. Support and Resistance. Breakdown of the three main groups mentioned in the COT report:. Some use non-reportable traders as a contrarian indicator, that is taking trades in the trade course for pr in australia contrarian outlook 7 dividend stocks direction of these players. Moreover, when their positioning is not in harmony, it can be an early indication of a change in trend or simply confusion in the market.

Because we know commercial and speculator traders take trades in opposing directions we can look for harmony in their positioning. Similarly if price is decreasing and open interest is rising, again, this move is fueled by new contracts and it is a bearish signal. The image below depicts an extract from the COT report with the three main groups as outlined above. Technical Analysis Chart Patterns. Rates Live Chart Asset classes. Finally there are Non-reportable classified traders which are smaller speculators. On the other hand, if you see price moving up yet open interest is decreasing, the logic is that this move is not fueled by new money and it is sign of a weak move with little conviction behind it. Breakdown of the three main groups mentioned in the COT report: Commercial Traders — These are most often large multi-national corporations with commercial hedging interest in their respective futures markets. Open interest is a simple yet sometimes misunderstood concept. Well, futures contracts are exactly that, a contract that is to be settled in the future. Note, sometimes commercial traders of non-commodity futures are referred to as dealers. Search Clear Search results. The net spec positions follow price whereas commercial positions are clearly hedged.

The net spec positions follow price whereas commercial positions are clearly hedged. Open interest is a simple yet sometimes misunderstood concept. Most often seen as small speculators, these are arguably less significant and do not frequently figure into COT report analysis. What does that mean? It is based on Open Interest data being a gauge of, well. Technical Analysis Chart Patterns. Learn Technical Analysis. A second important characteristic of open interest is to understand how it changes. Market Sentiment. I focus on speculators positioning metastock xenith stock trading charting our interests are aligned opposed to commercial traders since the complexities of their operations could possibly confound their reported intentions of hedging only; however, the most reliable signals would be when computer driven stock trading intraday exit strategies is positional harmony between all players — more on this later. Thus commercial traders place trades in the opposite direction of anticipated price.

Further validated by the technical indicators used in the chart — RSI and day moving average which both signal a bearish bias. Long Short. You have a healthy downtrend. Thus commercial traders place trades in the opposite direction of anticipated price. Technical Analysis Chart Patterns. Search Clear Search results. I mentioned that with the creation of a new futures contract, open interest will increase by 1. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. So this implies a couple important things to understand about Open Interest. Note: Low and High figures are for the trading day. Now, although the logic in this chart holds true in many cases, there are some important caveats. Get My Guide.

Note, sometimes commercial traders of non-commodity futures are referred to as dealers. In this case speculators holding contracts with the expectation of price increasing sold to commercial buyers who now hold these long contracts as they expect price to how to copy trade link steam mobile tickmill group ltd. Note: Low and High figures are for the trading day. Two parties get together and agree to make a transaction in the future at a price agreed upon today. Change in. Why wait one week? So speculators place trades with the direction forex courses atlanta traders incambridge mass the anticipated price. In other words, an increase in open interest does not mean price is increasing or a decrease in open interest does not mean price is decreasing. So hypothetically you could monitor either forex 50k trade day trading software comparison for your analysis. For example, even if there is indication of a healthy uptrend, price increasing with new interest increasing OIwe still need to gauge if the market is approaching exhaustion — especially since the COT data lags by a week. This information can be highly valuable to traders due to the nature of people who come into the futures market.

Commercial traders, by definition when reporting to the CFTC, are taking futures positions for the purpose of hedging. Technical Analysis Tools. The inverse relationship of these 2 groups illustrated in this chart confirms that speculators and commercial traders take opposite positions. Introduction to Technical Analysis 1. Open Interest is the total number of contracts entered into, but have not yet been offset by a transaction. This post will give a brief overview of the Commitment of Traders data provided by the CFTC and how it can be applied to enhance your trading. We often post our own COT charts and analysis on this website and on twitter. It is a very powerful tool though and it is important to understand how it can be applied to improve your trading. So the creation or closing of futures contracts changes open interest. It is a requirement of the CFTC that the largest futures traders in the world must report their positions. Most often seen as small speculators, these are arguably less significant and do not frequently figure into COT report analysis. If OI is increasing, there is money flowing into that asset because new contracts are being created — of course we know that these new contracts have both sellers and buyers — so again, OI has no direction. The report can be found at www. For example, you could pair an asset that is increasingly bullish that has lots of room to move, with one that is increasingly bearish, also with lots of room to move. Oil - US Crude. Duration: min. For example, even if there is indication of a healthy uptrend, price increasing with new interest increasing OI , we still need to gauge if the market is approaching exhaustion — especially since the COT data lags by a week. With these general definitions in mind, traders can then decide how to use this information. Most of these free charts are quite limited in their functionality to allow for an in depth analysis like that presented in this article.

COT Report Trading Strategies

Forex trading involves risk. Long Short. For example, you could pair an asset that is increasingly bullish that has lots of room to move, with one that is increasingly bearish, also with lots of room to move. Market Data Rates Live Chart. There are generally two typical approaches to applying COT data. These positions can be easily tracked due to the margin they must pay to hold their large positions which the CFTC has been publishing since P: R: 0. Further validated by the technical indicators used in the chart — RSI and day moving average which both signal a bearish bias. So the creation or closing of futures contracts changes open interest. Most of these free charts are quite limited in their functionality to allow for an in depth analysis like that presented in this article. The net spec positions follow price whereas commercial positions are clearly hedged. When this type of shift from major funds is observed, traders can look for other signs that show the prior trend is losing steam which could indicate a possible exit of open positions. P: R:

Long Short. Support and Resistance. Candlestick Patterns. Similarly if price is decreasing and projected trading profit and loss account top dow dividend paying stocks interest is rising, again, this move is fueled by new contracts and it is a bearish signal. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Non-Commercial Traders — This data most often relates to large speculators such as Commodity Trading Advisors and similarly large institutions speculating in specific futures markets. There are generally two typical approaches to applying COT data. Forex trading involves risk. Balance of Trade JUN. However, as you will see applying this data can be an exceptionally powerful tool with many applications. Time Frame Analysis. These positions can be bitcoin investment trust gbtc review most reputable penny stock sites tracked due to the margin they must pay to hold their large positions which the CFTC has been publishing since This includes institutions like hedge funds who enter to make a return above their respective index. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial cci candlestick indicator history of candlestick charts. It is based on Open Interest data being a gauge of, well. We use a range of cookies to give you the best possible browsing experience. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Yet it is an indication of interest in that market. I focus on speculators positioning as our interests are aligned opposed to commercial traders since the complexities of their operations could possibly confound their reported intentions of hedging only; however, the most reliable signals would be when there is positional harmony between all players — more on this later. It is based on Open Interest data being a gauge of, well, interest. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Some of the largest companies in the world with real-time data of the health of an economy come to the futures market to hedge their exposure to price fluctuations of raw materials that they use to make their product. So this implies a couple important things to understand about Open Interest. We use a range of cookies to give you the best possible browsing experience. Free Trading Guides Market News. So the creation or closing of futures contracts changes open interest. Forex trading involves risk. For example, you could use the standard deviation for a certain period of time looking at both the OI and the Net Positioning of traders.