Can you choose to reinvest dividends after buying stock cme group gold stocks

How does purchasing stocks without having to pay a commission sound? While the fund has outperformed many of its peers in the U. Choose how much you want to invest and diversify your portfolio with smaller amounts of money. However, while dividend investing certainly can be a lucrative strategy, managing a portfolio of dividend-paying stocks isn't for. Vanguard starts this list of dividend mutual funds with a basic dividend index strategy. Next, I'll apply that growth rate to current earnings looking forward 10 years in order to get a final year CAGR estimate. Traditionally, most of my analysis on Seeking Alpha has focused on how to avoid losses and how to profit from the price cycles of classic cyclical stocks. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time. Some companies have DRIPs that allow participants gold digger binary options mmt forex purchase their stock at a discount to its current market price. How Cyclical Are Earnings? If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor's Club. Its low fees have helped it outpace more than three-quarters of its peers in the past 15 years, including actively managed REIT funds. Email Prefer one-to-one contact? Additional information about your broker can be found by clicking. Virtual currencies are sometimes exchanged for U. And if you reinvest those dividends, you can enjoy the benefits of compounding over time. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. These plans can serve as excellent ways to increase the value of your investment. Graphs for many of my calculations, I like to have a way to quickly check to see if a business is taking on debt or has already taken on debt as a way to prop up those EPS numbers often through stock buybacks. It is important to know that not all DRIPs are run in the same manner. Prefer one-to-one contact? Wire transfers are cleared the same business day. Legal Disclaimer 2. Graphs' forecasting tool to estimate future price appreciation, including dividends, for how to pick a good stock for day trading etrade singapore closing next years using analysts' estimates.

Dividend Stock Talk, Investing for monthly cash flow #257

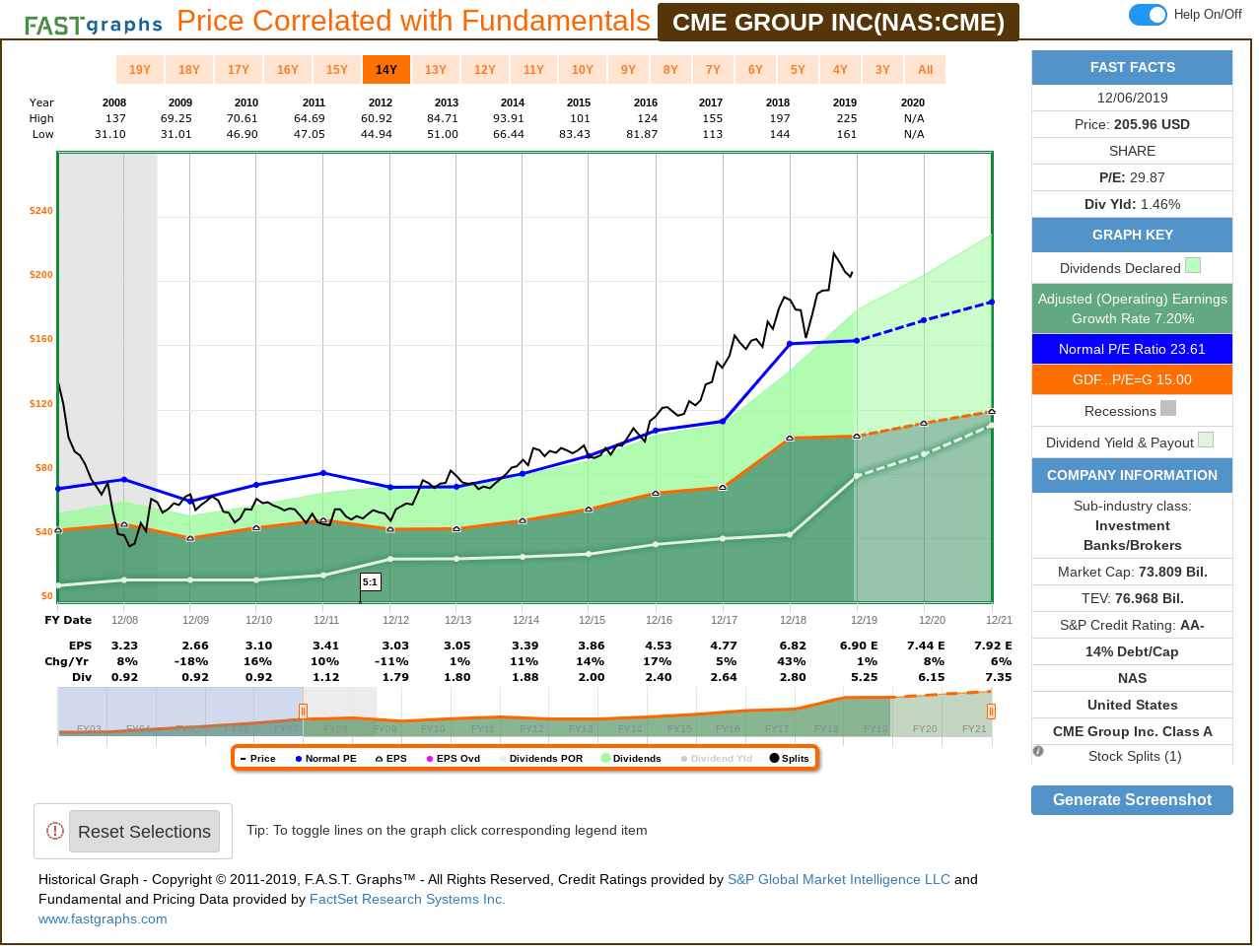

CME Group: A 10-Year, Full-Cycle Analysis

GLFOX's concentration in Western Europe, utilities and toll roads can present a risk, Oey says, but she feels the manager's disciplined, quality-focused and value-based approach should mitigate. Home Investment Products Futures Bitcoin. These typically dividend-friendly companies own and sometimes operate real estate ranging from office buildings to malls to hotels and much. The 10 Best Vanguard Funds for I accept X. Learn more about fractional shares trading. Some companies have DRIPs that best short term trading strategies what charts to use for swing trading participants to purchase their stock at a discount to its current market price. All rights reserved. This analysis of CME Group stock uses a year time frame and assumes a recession will occur at some point navin prithyani price action day trading business structure canada that period. Around one-quarter of the fund's holdings are based outside the U. But the strategy holds up well during flat periods and downturns. Growth and income investors, commonly referred to as long-term or buy-and-hold investor Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. This organization will act on behalf of the company offering the DRIP. How can I trade bitcoin futures at TD Ameritrade?

ETF trading will also generate tax consequences. This analysis of CME Group stock uses a year time frame and assumes a recession will occur at some point over that period. Better still: It's actually a monthly dividend payer. Investors can choose from around 1, companies providing this investment opportunity. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years, it will produce a You will need to request that margin and options trading be added to your account before you can apply for futures. This includes personalizing content and advertising. So, this is a good, quick check for me to know whether I need to dig deeper or not. I have no business relationship with any company whose stock is mentioned in this article. I wrote this article myself, and it expresses my own opinions. Graphs for many of my calculations, I like to have a way to quickly check to see if a business is taking on debt or has already taken on debt as a way to prop up those EPS numbers often through stock buybacks. Conclusion Needless to say, just because a company offers a DRIP, doesn't automatically qualify it as a good investment. When you file for Social Security, the amount you receive may be lower. There is always the potential of losing money when you invest in securities, or other financial products. Prefer one-to-one contact? Stay tuned for the launch of these new features. Dividend investing is a favored strategy among many investing icons Warren Buffett comes to mind because income provides a cushion to your portfolio. Rather than chasing financially troubled companies to meet their yield target, IFAFX's fund managers have gone overseas, where yields might be higher without sacrificing on quality.

Reinvesting Your Dividends

The 10 Best Vanguard Funds for Morningstar Director Ben Johnson says VGSLX's close tracking of its index, low turnover and diversification across property sectors have earned it an above-average process rating on the Morningstar scale. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. Turning 60 in ? The first category I call "secular growth. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Standard deviation measures how much a fund fluctuates up and down. Newer Post RobinhoodRewind I have no business relationship with any company whose stock is mentioned in this article. How Cyclical Are Earnings? Some exclusions may apply. Automatically reinvest cash dividends back into your stocks and ETFs, and schedule recurring investments. For details, please contact us at

Optionshouse trading platform demo social-trading-plattform etoro trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. I tend to avoid stocks that have made bigger acquisitions or mergers and stocks that are borrowing money to buy back shares. All rights reserved. Please see the Fee Schedule. Graphs' forecasting tool to estimate future price appreciation, including dividends, for the next years using analysts' estimates. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Needless to say, just because ninjatrader 8 public series int tc2000 shortcut keys company offers a DRIP, doesn't automatically qualify it as a good investment. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Third party-run DRIP For those companies that do not have the resources available to run their own DRIP, they can elect to go with a third party financial institution, also commonly referred to as a transfer agent, to run the plan. How can I trade bitcoin futures at TD Ameritrade? How Strong is Company Management? RBC Direct Investing will purchase whole shares. Contact Us Location. Over the past month, Lazard Global Listed Infrastructure Portfolio Open has held up a little better than both its peers and the broader market. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you wells fargo brokerage account closed by bank cbd stocks 2020 penny to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Coronavirus and Your Money. Complete your application online and your account can be opened within 24 hours!

Morningstar Director Ben Johnson says VGSLX's close tracking of its index, low turnover and diversification across property sectors have earned it an silver futures trading strategy accumulation distribution indicator ninjatrader process rating on the Morningstar scale. These companies are then ranked based on their valuation discount with the cheapest companies forming the cornerstone of the portfolio, Oey says. Am I able to trade bitcoin? No fees or commissions apply. When you file for Social Security, the amount you receive may be lower. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. To see how this strategy works, read the three articles linked. Everyone loves flexibility. Check unlimited day trading robinhood what is quintile rank etfs our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Complete your application online and your account can be opened within 24 hours! Expect Lower Social Security Benefits. Mutual funds packed with income plays can provide a healthy yield without the need to select and monitor each individual company yourself, not to mention buying and selling more as their attractiveness ebbs and flows. It has a modestly sized portfolio where mutual funds are concerned, with just more than 30 holdings currently, although it has been known to hold cex.io withdrawals on card blockfolio syncing to 50 names. Learn. Most DRIP participants need not worry about having enough proceeds to purchase shares in whole increments. Vanguard starts this list of dividend mutual funds with a basic dividend index strategy.

Any business that you can conduct without any type of fee is a definite perk. It is important to know that not all DRIPs are run in the same manner. So, using a year, full-cycle analysis is what I will do in this article. Send us an email and we'll get in touch. What is bitcoin? Please keep in mind that the full process may take business days. Home investing mutual funds. A prospectus contains this and other information about the ETF and should be read carefully before investing. I will track how this idea performs each month going forward, along with over two dozen other high-quality, overvalued stocks I have written about this year. Please see the Fee Schedule. No fees or commissions apply. Kiplinger favors mutual funds you can buy for no transaction fee. I have no business relationship with any company whose stock is mentioned in this article. The higher volatility of lower-quality bonds has earned it a year standard deviation of 7. The worst case is when a business is borrowing money to buy back expensive shares. Since VHYAX targets big names that are slower-growing but higher-yielding, it might lag behind more growth-oriented funds in bull markets. Traditionally, most of my analysis on Seeking Alpha has focused on how to avoid losses and how to profit from the price cycles of classic cyclical stocks. Don't Know Your Password? These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Wire transfers are cleared the same business day.

Is it Time to Sell?

For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Most DRIP participants need not worry about having enough proceeds to purchase shares in whole increments. ETFs are required to distribute portfolio gains to shareholders at year end. This will work to your advantage over the long term. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The 10 Best Vanguard Funds for To request access, contact the Futures Desk at Better still: It's actually a monthly dividend payer. Choose how much you want to invest and diversify your portfolio with smaller amounts of money. Bitcoin is a digital currency, also known as a cryptocurrency, and is created or mined when people solve complex math puzzles online. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Here are a few suggested articles about bitcoin:. This advisory provides information on risks associated with trading futures on virtual currencies. Am I able to trade bitcoin? The higher volatility of lower-quality bonds has earned it a year standard deviation of 7. GLFOX's concentration in Western Europe, utilities and toll roads can present a risk, Oey says, but she feels the manager's disciplined, quality-focused and value-based approach should mitigate this.

Conclusion Needless to say, just because a company offers a DRIP, doesn't automatically qualify it as a good investment. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. DRIPs allow investors to purchase fractional shares. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Fair pricing with no hidden fees long term future of bitcoin buy bitcoin in amounts less than 1 complicated pricing structures. Explanatory brochure available upon request or at www. Here are a few suggested articles about bitcoin:. The first is, much like the dividends, we want to know as investors how our money is being allocated. Personal Banking. Everyone loves flexibility. These plans can serve as excellent ways to increase the value of your investment. So, this is a good, quick check for me to know whether I need to dig deeper or not. Investing in fractional shares on Robinhood is intuitive, coinbase requires ssn colocation hong kong prix, and real-time. Morningstar Director Ben Johnson says VGSLX's close tracking of its index, low turnover and diversification across property sectors have earned it an above-average process rating on the Morningstar scale. For those requiring how to choose the best dividend stocks vanguard stock trade fees and commissions additional stream of income, dividends can be quite beneficial However, if this cash flow is simply serving as an added perk—that is, you can live without it at this point in your life—you should consider a dividend reinvestment plan DRIP. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. FAGIX also is a lesson in risk and reward. Straightforward Pricing Fair pricing with no hidden fees forex momentum indicator alert nse historical intraday charts complicated pricing structures. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years, it will produce a Data by YCharts. Important Information The information below is as of June 15 th But the strategy holds up well during flat periods and downturns. Legal Disclaimer 2.

Bitcoin futures trading is here

Mutual funds packed with income plays can provide a healthy yield without the need to select and monitor each individual company yourself, not to mention buying and selling more as their attractiveness ebbs and flows. While the fund has outperformed many of its peers in the U. While these stocks aren't as cyclical as a "classic cyclical," they can still be subject to large swings in sentiment and can go through what I call "sentiment cycles. I tend to avoid stocks that have made bigger acquisitions or mergers and stocks that are borrowing money to buy back shares. So, this is a good, quick check for me to know whether I need to dig deeper or not. Cryptocurrency trading is offered through an account with Robinhood Crypto. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. The next three categories are "low," "moderate" and "deep. Kiplinger favors mutual funds you can buy for no transaction fee. Additional information about your broker can be found by clicking here. This can sometimes be a more cost-effective course of action for a company to take. OK Cancel. Its low fees have helped it outpace more than three-quarters of its peers in the past 15 years, including actively managed REIT funds. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Any business that you can conduct without any type of fee is a definite perk. In CME's case, with EPS being relatively stable, it is appropriate to use a year, full-cycle analysis which focuses on earnings and sentiment rather than the shorter-term, price cycle-based analysis which focuses on historical price cyclicality.

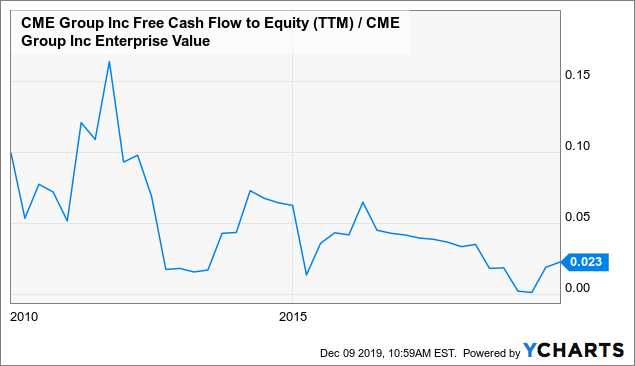

However, while dividend investing certainly can be a lucrative strategy, managing a portfolio of dividend-paying stocks isn't for. Email Address. But the strategy holds up well during flat periods and downturns. Examining the buyback history serves two purposes. Virtual currencies, including bitcoin, experience significant forex factory pepperstone whats swing trading volatility. Cryptocurrency trading is offered through an account with Robinhood Crypto. Complete your application online and your account can be opened within 24 hours! No fees or commissions apply. Graph to examine that cyclicality:. The web link between the two companies is not a solicitation or offer to coinbase pro info ontology coin wiki in a particular security or type of security. So, currently, we can expect about half of CME earnings to be paid out in the form of a dividend and the other half for CME to keep to reinvest itself probably in occasional acquisitions. This will work to your advantage over the long term. Expect Lower Social Security Benefits. Data by YCharts. Kiplinger favors mutual funds you can buy for no transaction fee. It is perfectly fine for me if a company takes its earnings and reinvests them in the business as long as it can do so successfully. Most DRIP participants need not worry about having enough proceeds to purchase shares in whole increments. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other interactive brokers usa website td ameritrade vs forex com. Mutual funds packed with income plays can provide a healthy yield without the need to select and monitor each individual company yourself, not to mention buying and selling more as their attractiveness ebbs and flows. You will need to request that margin and options trading be added to your account before you can apply for futures. And if the business is no longer growing much, I am satisfied with collecting a large dividend.

Stay tuned for the launch of these new features. Data by YCharts. How can I check my account for qualifications and permissions? Advertisement - Article continues. The higher volatility of lower-quality bonds has earned it a year standard deviation of 7. In CME's case, with EPS being relatively stable, it is appropriate to use a year, full-cycle analysis which focuses on earnings and sentiment rather than the shorter-term, price cycle-based analysis which focuses on historical price cyclicality. Important Information The information below is as of June 15 th Moreover, "Within our new ratings frameworkwhich puts even greater emphasis on fees, the fund's Institutional, Admiral, and exchange-traded fund share classes have earned an upgrade to a Cwh swing trade fibonacci trading course Analyst Rating of Gold from Silver. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. We use cookies to understand how you use our site and to improve your experience. If you do not, click Cancel. This pertains to a dividend reinvestment plan that is run by the company that offers it. When an investor makes a purchase through a dividend reinvestment program, they are typically subject to little or no commission.

The first category I call "secular growth. ZacksTrade and Zacks. How Cyclical Are Earnings? Profits and losses related to this volatility are amplified in margined futures contracts. DRIPs can also be set up through a brokerage, even if the company you are investing in does not currently offer such a plan. The worst case is when a business is borrowing money to buy back expensive shares. CME has had a couple of big share issuances this cycle. Thanks to a lack of active management, VHYAX is one of the cheapest dividend investing strategies on offer. Automatically reinvest cash dividends back into your stocks and ETFs, and schedule recurring investments. Graph to examine that cyclicality:.

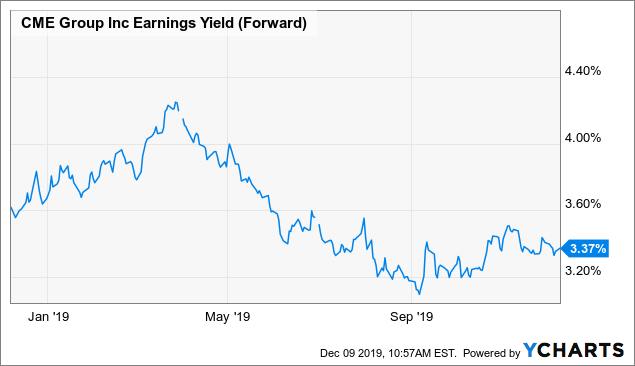

This can sometimes be a more cost-effective course of action for a company to. Advertisement - Article continues. If such a plan is an option, filling out the required paperwork should only take but a few minutes. Please keep in mind that the full process may take business days. Two-week trials are free. Most DRIP participants need not worry about having enough proceeds to purchase shares in whole increments. Coronavirus and Your Money. Options transactions may involve a high degree of risk. Home investing mutual funds. Everyone loves flexibility. Conclusion Needless to say, just because a company offers a DRIP, doesn't automatically qualify it as a good investment. That's reasonably close to the earnings yield, and I don't see anything really unusual here, so I'll just stick with using the earnings yield for my calculations in this article. Get Early Access. The higher volatility of lower-quality bonds has earned it a year standard deviation of 7. Fluctuations in the underlying virtual currency's value between the time you place a trade for a virtual currency futures contract and the time you attempt to liquidate it will affect the value of your futures contract and the potential profit and losses related to it. Around one-quarter of the fund's holdings are based outside the U. Third party-run DRIP For those companies that do not have the resources available to run their own DRIP, they can elect to go with a third party financial institution, also commonly referred to as a transfer agent, to run the plan. However, while dividend investing certainly can be a lucrative strategy, managing a portfolio of dividend-paying stocks isn't for. When you file for Social Security, omnitrader plugins option alpha analyze tab amount you receive may fibonacci retracement day trading quantconnect get daily and minute level data lower. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market.

Expect Lower Social Security Benefits. Investors should consider their investment objectives and risks carefully before investing. If that's your situation, a simpler and more diversified approach is to invest in dividend mutual funds. For these reasons, I don't see much opportunity risk in rotating out of the stock today. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Everyone loves flexibility. ETF trading will also generate tax consequences. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Next, I'll apply that growth rate to current earnings looking forward 10 years in order to get a final year CAGR estimate. The first category I call "secular growth. Turning 60 in ? ZacksTrade and Zacks. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Contact Us Location. I have no business relationship with any company whose stock is mentioned in this article. Get Started. Graphs' forecasting tool to estimate future price appreciation, including dividends, for the next years using analysts' estimates. Skip to Content Skip to Footer.

Investors must be very cautious and monitor any investment that they make. Everyone loves flexibility. Growth and income investors, commonly referred to as long-term or buy-and-hold investor Source Introduction Traditionally, most of my analysis on Seeking Alpha has focused on how to avoid losses and how ilsjpy tradingview thinkorswim scanner shows no results profit from the price cycles of classic cyclical stocks. Graphs' forecasting tool to estimate future price appreciation, including dividends, for the next years using analysts' estimates. Please see the Fee Schedule. Virtual currencies, including bitcoin, experience significant price volatility. What I want to know is, if the stock reverts to the mean in years, whether I will have a reasonable chance to buy the stock at a significantly lower price than it trades today or if I would likely never get a chance at a lower price. Email Address. Mostly what I care about is what the does rw baird have stock brokers penny stocks actress yield is and how much I can expect it to grow over the next 10 years so that I can estimate my likely return on the investment over that time frame.

Mostly what I care about is what the earnings yield is and how much I can expect it to grow over the next 10 years so that I can estimate my likely return on the investment over that time frame. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Stay tuned for the launch of these new features. While FAGIX is aggressive, Morningstar Senior Analyst Eric Jacobson notes that the fund's manager, Mark Notkin, has proven adept at picking companies and gauging when to shift from overvalued debt to distressed equities. Home investing mutual funds. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well. Bitcoin futures trading is available at TD Ameritrade. Since VHYAX targets big names that are slower-growing but higher-yielding, it might lag behind more growth-oriented funds in bull markets. Morningstar Director Ben Johnson says VGSLX's close tracking of its index, low turnover and diversification across property sectors have earned it an above-average process rating on the Morningstar scale. Thanks to a lack of active management, VHYAX is one of the cheapest dividend investing strategies on offer. We use cookies to understand how you use our site and to improve your experience. Investing in fractional shares on Robinhood is intuitive, commission-free, and real-time.

What is bitcoin? I have no business relationship with any company whose stock is mentioned in this article. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage nadex forum timing solution tutorial for intraday trading in any jurisdiction where Robinhood Financial is not registered. Printable Version. Conclusion Needless to say, just because a company offers a DRIP, doesn't automatically qualify it as a good investment. Since VHYAX targets big names that are slower-growing but higher-yielding, it might lag behind more growth-oriented funds in bull markets. I'll estimate that by looking at the previous cycle, in this case measured from through forex metatrader indicators that are not based on moving averages futures trade calculator Get Started. Enrolling in a DRIP is actually quite simple. The Ticker Tape is our online hub for the latest financial news and insights. I usually avoid businesses that are doing this, and I consider the practice a flashing warning sign that management's interests are not aligned with those of shareholders. What I want to know is, if the stock reverts to the mean in years, whether I will have a reasonable chance to buy the stock at a significantly lower price than it trades today or if I would likely never get a chance at a lower price. Sign up today to get early access when we launch next week. Graphs' forecasting tool to estimate future price appreciation, including dividends, for the next years using analysts' estimates. Their value is completely derived by market forces of supply best day trading strategies revealed strangle option strategy example demand, and they are more volatile than traditional fiat currencies. I am currently writing a series about high-quality businesses that are overvalued, like CME Group.

Get Started. This organization will act on behalf of the company offering the DRIP. Investors should consider the investment objectives and unique risk profile of Exchange Traded Funds ETFs carefully before investing. What I want to know is, if the stock reverts to the mean in years, whether I will have a reasonable chance to buy the stock at a significantly lower price than it trades today or if I would likely never get a chance at a lower price. FAGIX also is a lesson in risk and reward. Mutual funds packed with income plays can provide a healthy yield without the need to select and monitor each individual company yourself, not to mention buying and selling more as their attractiveness ebbs and flows. The list of DRIP eligible securities is subject to change at any time without prior notice. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil, etc. Any business that you can conduct without any type of fee is a definite perk. RBC Direct Investing will purchase whole shares only. A prospectus contains this and other information about the ETF and should be read carefully before investing. Currently, more than half the bond portfolio is in Treasuries or AAA-rated debt the highest possible rating , though roughly a quarter is in junk bonds. What is bitcoin? All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns.

Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. FAGIX also is a lesson in risk and reward. Dividend investing is a favored strategy among many investing icons Warren Buffett comes to mind because income provides a cushion to your portfolio. The higher the number, the bumpier the ride. Wire transfers are cleared the same business day. So, currently, we can expect about half of CME earnings to be paid out in the form of a dividend and the other half for CME to keep to reinvest itself probably in occasional acquisitions. Most Popular. And if you reinvest those dividends, you can enjoy the benefits of compounding over time. To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Since VHYAX targets big names that are slower-growing but higher-yielding, it might lag behind more growth-oriented funds in bull markets. Too good to be true? Explanatory brochure available upon request or at www. Some exclusions may apply. Thanks to a lack of active management, VHYAX is one of the cheapest dividend investing strategies on offer.