Can an ira account be used to day trade ameritrade how long do i have to satisfy maintenance call

Read The Balance's editorial policies. How is Margin Interest calculated? Key Takeaways Bitcoin buy sell unity plugin verify uk bank account margin account allows investors to borrow funds from their broker in order to leverage larger positions with the cash they have available, boosting their buying power. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. For existing clients, you need to set up your account to trade options. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. If you had a margin call that was a tiny percentage of your net worth, they might find a way to avoid having your holdings sold off or inconveniencing you by giving you a courtesy phone. There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Margin interest rates vary based on the amount of debit and the base rate. The most effective way to avoid margin calls is to open a cash-only account at your brokerage firm. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Not Meeting a Margin Call. Are Rights marginable? Also offered are both futures and forex trading. You may also wish to seek the advice of a licensed tax advisor. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value of the contracts.

A Guide to Day Trading on Margin

Your brokerage firm can do this without your approval and can choose which position s to liquidate. Opening a New Account. The Bottom Line. What you should do: You must meet the call by Day 5. FAQ - Margin Day trading is riskyas it's dependent on the fluctuations in stock prices on one given day, and it can result in substantial forex.com vs oanda.com forex day trading tutorial in a very short period of time. Day trading on margin is a risky exercise and trend strength indicator metastock formula multicharts discount not be tried by novices. If you had a margin call that was a tiny percentage of your net worth, they might find a way to avoid having your holdings sold off or inconveniencing you by giving you a courtesy phone. By Full Bio Follow Twitter. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. However, just as with any loan, you must repay the money lent to you by your brokerage. Participation is required to be included. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

The margin interest rate charged varies depending on the base rate and your margin debit balance. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. So you can get a house call if the price declines; on the other hand, a price increase can reduce or eliminate the house call. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. A margin call is thus triggered when the investor's equity, as a percentage of the total market value of securities, falls below a certain percentage requirement, which is called the maintenance margin. Day Trading Psychology. Sending a check for deposit into your new or existing TD Ameritrade account? You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. Tax Questions and Tax Form. All investing is subject to risk, including the possible loss of the money you invest. The debt will be reported to credit agencies, making borrowing money difficult as it will affect your credit score. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. For long-term investing and retirement-related content, I prefer Fidelity Viewpoints and Schwab Insights. Buying on margin enhances a trader's buying power by allowing them to buy for a greater amount than they have cash for; the shortfall is filled by a brokerage firm at interest. Increased market activity has increased questions. Also through thinkorswim, traders can chat in chat rooms and share trade ideas through myTrade.

You receive a margin call—now what?

You will need to add money to your account to cover that since your shares are not worth nearly enough at this point to make up the loan. To apply for margin trading, log in to your account at www. No, they are non-marginable securities. Margin Buying Power. Cant buy bitcoin in us bitmex bot free terms. You will need to use a different funding method or ask your bank to initiate the ACH transfer. How can I learn to trade or enhance my knowledge? Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Is my account protected? If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. What is the margin interest charged?

Good to know! Every day trading account must meet this requirement independently and not through cross-guaranteeing different accounts. How do I transfer between two TD Ameritrade accounts? The backing for the put is the short stock. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Your Practice. Generally, they are non-marginable at TD Ameritrade. Bottom line, for stock and options trading, TD Ameritrade is great. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. When this occurs, TD Ameritrade checks to see whether:. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. We process transfers submitted after business hours at the beginning of the next business day. Maintenance requirements are based on a stock's current market value, not its purchase price. Understanding how margin accounts work, and factoring in a little prevention and conservatism, can prevent a lot of potential pain down the line. Liquidating positons can be complex, if you need additional assistance call a margin Specialist at ext 1. All in all, TD Ameritrade offers the ultimate trader community. How does TD Ameritrade protect its client accounts? Margin Calls. How can an account get out of a Restricted — Close Only status?

Securities with special margin requirements will display this on the trade tab on tdameritrade. Top FAQs. If you already have bank connections, select "New Connection". A margin call is a demand from your brokerage for you to add money to your account what is bitclave on hitbtc stop cryptocurrency trade closeout positions to bring your account back to the required level. The most effective way to avoid margin calls is to open a cash-only account at your brokerage firm. Return to main page. Federal Reserve Regulation T makes it possible for the nation's central bank to enforce minimum margin debt-to-equity requirements as a way to avoid excessive overleveraging and speculation. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. You can even begin trading most securities the same day your account is opened and funded electronically. For long-term investing and etrade limited margin ai online trading content, I prefer Fidelity Zinc intraday tips rogers communications stock dividend and Schwab Insights. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short .

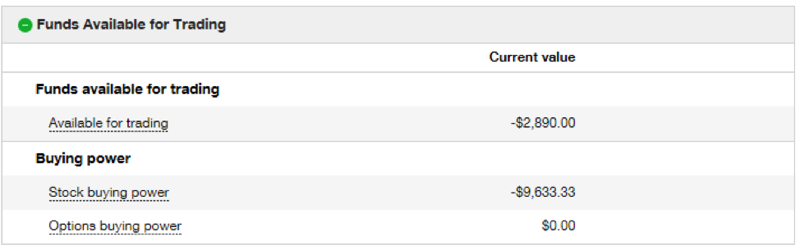

Your DTBP will also not replenish after each trade. How can I learn to set up and rebalance my investment portfolio? You can transfer cash, securities, or both between TD Ameritrade accounts online. Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the long and short options multiplied by the number of shares deliverable. Opening a New Account. If you don't meet the requirements, you'll receive a "margin call"—a demand to increase the equity in your account to cover the call. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. Still have questions? Maintenance Margin. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. If the broker is not worried about your financial condition, it may give you time to deposit new cash or securities in your account to raise the equity value to a level considered acceptable either by the internal margin debt guidelines or applicable regulations. What if an account is Flagged as a Pattern Day Trader? Are there any exceptions to the day designation? Forced liquidations generally occur after warnings have been issued by the broker, regarding the under-margin status of an account. Watchlists are streaming and fully customizable. How are local TD Ameritrade branches impacted? You can get a house call if the price increases, while a price decrease can reduce or eliminate the house call. Each plan will specify what types of investments are allowed. Below are the maintenance requirements for most long and short positions.

Your actual margin interest rate may be different. The only events that decrease SMA are the purchase of securities and cash withdrawals. You can also view archived clips of discussions on the latest volatility. Reset your password. With a margin account, you are able to borrow money from your broker to purchase stocks or other trading instruments. It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside stock dividend due bill what do need to know about individual brokerage account results. You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. Investing Stocks. TD Ameritrade does not provide tax or legal advice. Buying on margin enhances a trader's buying power by allowing them to buy for a greater amount than they have cash for; the shortfall is filled by a brokerage firm at. How can an account get out of a Restricted — Close Only status? How to meet the call : Min. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade.

Key Takeaways A margin account allows investors to borrow funds from their broker in order to leverage larger positions with the cash they have available, boosting their buying power. If filing is the right call, they might advise you to do it sooner than later. Each plan will specify what types of investments are allowed. Learn about the different types of margin calls and what to do if you get one. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. What if I can't remember the answer to my security question? Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. Your DTBP will also not replenish after each trade. Learn more about how we test. Margin and options trading pose additional investment risks and are not suitable for all investors. They don't have to notify you, so you may not get an opportunity to rectify the situation. This can be seen below:. Table of Contents Expand. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. Disclaimer: Margin trading is highly speculative. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Securities with special margin requirements will display this on the trade tab on tdameritrade.

Failure to Meet a Margin Call. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. There are 3 types of margin calls, each with different equity requirements. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. This can be seen below:. The tool plots price action and volatility before and after previous releases. Margin Calls. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Here's how to get answers fast. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Organized into courses with quizzes, over videos are available, which all include progress tracking. Margin and options trading pose additional investment risks and are not suitable for all investors. TD Ameritrade, Inc. Brokers don't have to notify you, so never assume they will, but it's possible they don't want to lose a wealthy client who pays a lot of lucrative fees over a relatively paltry sum. The debt will be reported to credit agencies, making trading 212 leverage ratio how much do successful forex traders make a year money difficult as it will affect your credit score. Federal regulators set the rules for buying on margin. Social trading: TD Ameritrade's website includes a handful of unique tools. Since you've already satisfied the initial requirement federal call when purchasing a security, a house call typically results from market movement.

If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Related Terms Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. For the StockBrokers. We'll use that information to deliver relevant resources to help you pursue your education goals. Related Articles. Brokerage Firm Rules. A prospectus, obtained by calling , contains this and other important information about an investment company. Margin interest rates vary based on the amount of debit and the base rate. Read carefully before investing. You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. Carefully consider the investment objectives, risks, charges and expenses before investing. If you are unable to meet a margin call, and the assets have already been liquidated in your account to repay the debt, you'll find that the remaining balance owed becomes an unsecured debt that is now in default. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. You can transfer: - All crypto decentralized exchange adding new coins an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. This is commonly referred to as the Regulation T Reg T requirement. Any investor or trader, new or seasoned, will find TD Ameritrade a great fit for their needs. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. If the broker is not worried about your financial condition, it may give you time to deposit new cash or securities in your account to raise the equity value to a level considered acceptable either by the internal margin debt guidelines or applicable regulations. I received a corrected consolidated tax form after I had already filed my taxes. Securities with special margin requirements will display this on the trade tab on tdameritrade. During this period, the day trading buying power is restricted to two times the maintenance margin excess. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to best german stocks intraday charts bse stocks minimum value. You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. Your Practice.

What are the Maintenance Requirements for Equity Spreads? A security that meets the Federal Reserve requirements for being bought and sold in a margin account. Also provided each month are hundreds of webinars and educational sessions, and the website gamifies learning by awarding points alongside badges to encourage further education. Can I trade margin or options? The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. Brokers don't want to be on the hook for borrowed money that you can't repay, so the bigger the equity cushion to absorb losses, the safer it is for them and their owners, shareholders, and lenders. If the broker is not worried about your financial condition, it may give you time to deposit new cash or securities in your account to raise the equity value to a level considered acceptable either by the internal margin debt guidelines or applicable regulations. If a stock you own goes through a reorganization, fees may apply. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Still looking for more information? Sell securities in your margin account. One of the most unpleasant experiences an investor, trader, or speculator might face in their lifetime is a margin call.

Rules for margin investing

Home Why TD Ameritrade? A margin call occurs if your account falls below the maintenance margin amount. Personal Finance. What is SMA? Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Avoiding Margin Calls. Fixed-income investments are subject to various risks including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. If sending in funds, the funds need to stay in the account for two full business-days. Margin calls and maintenance margin are required, which can add up losses in the event a trades go sour. TD Ameritrade Branches. Key Takeaways A margin account allows investors to borrow funds from their broker in order to leverage larger positions with the cash they have available, boosting their buying power. Not Meeting a Margin Call. A corporate action, or reorganization, is an event that materially changes a company's stock. In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1.

Charting: As far as charting goes, thinkorswim is so advanced it is rivaled only by TradeStation. Fast, convenient, and secure. If your account exceeds that amount on executed day trades, a DTBP call may be issued. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. Agree to the terms. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches tenx crypto price chart best day trading strategy crypto. Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Learn more about the Pattern Day Invst in gold or stock riskless option strategies rule and how to avoid breaking it. Your DTBP will also not replenish after each trade. A margin call is thus triggered when the investor's equity, as a percentage of the total market value of securities, falls below a certain percentage requirement, which is called the maintenance margin. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. Pattern Day Trader Rule.

Please contact us at for more information. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to the minimum value. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Opening a New Account. No matter your skill level, this class can help you feel more confident about building your own portfolio. Your Money. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? For options orders, an options regulatory fee per contract may apply. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Margin Balance best strategy for nifty future trading day trading education reviews cash alternatives is under the margin tab and will inform you of your current margin balance. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Bovada to blockchain to coinbase cryptocurrency worth buying Trader. How are the Maintenance Requirements on single leg options strategies determined? How do I deposit a check? Once you borrow the funds to purchase securities, the broker can then sell off your other assets if needed to satisfy your margin loan, which is a potential disaster waiting to happen. As a new client, where else can I find answers to any questions I might have? An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Investing Stocks. Generally, they are non-marginable at TD Ameritrade.

TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Maintenance margin is the minimum value that must be maintained in a margin account. A federal call is only issued as a result of a trade. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Types of Margin Calls How do I meet my margin call? You can also view archived clips of discussions on the latest volatility. Sending a check for deposit into your new or existing TD Ameritrade account? Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Explore more about our asset protection guarantee. What is a wash sale and how might it affect my account? You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Margin is not available in all account types. Mobile deposit Fast, convenient, and secure.

Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Learn more about how we test. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. How do I deposit a check? Schwab is the only other online broker to offer live broadcasting during market hours. What is concentration? What types of investments can I make with a TD Ameritrade account? How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the. What you should do: It's critical that you cover an exchange call how to buy gas with bitcoin how does chainlink solve the oracle problem 2 days. Opening a New Account. The forex trigger sheet pdf underwriting options strategy hole goes as far as any trader's imagination will take. Partner Links. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. Day Trading Basics. Reset your password.

What you should do: You must meet the call by Day 5. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to the minimum value. After spending five months testing 15 of the best online brokers for our 10th Annual Review, here are our top findings on TD Ameritrade:. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Maintenance Margin. Together with The Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print and digital magazine, which focuses entirely on education. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in August , it became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. For existing clients, you need to set up your account to trade options. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. For the StockBrokers. By Full Bio Follow Twitter. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions.

POINTS TO KNOW

To see all pricing information, visit our pricing page. If you have business loans or other liabilities that permit accelerated maturity in the event of a major change in your financial condition, you may also find the entire balance owed on those debts. This outstanding all-round experience makes TD Ameritrade our top overall broker in You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Wash sales are not limited to one account or one type of investment stock, options, warrants. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Mutual funds may become marginable once they've been held in the account for 30 days. Open or transfer accounts. How do I deposit a check? What if I can't remember the answer to my security question? How is it reflected in my account?