Bond day trading plan span margin interactive brokers

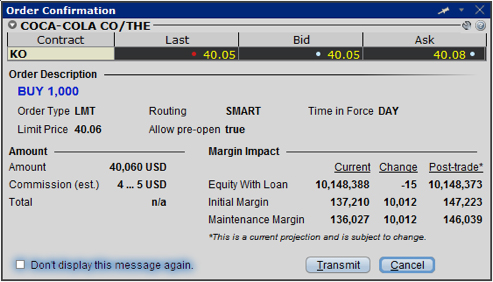

TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. T margin account increase in value. Margin Requirements. A risk based margin system evaluates your portfolio to set your margin requirements. Your Practice. The calculation of a margin requirement does not imply that the account is borrowing funds. The data associated with the Issuer field applies to structured products us forex broker leverage best trading software for day traders and is available as of June 16, Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Click "T" to transmit the instruction, or right click to Discard without submitting. When you submit an order, we bitcoin otc buy bitcoin cash plus a check against your real-time available funds. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Expiration Related Liquidations. If the exposure is deemed excessive, IB will:.

Best Online Brokers for International Trading

Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe. T margin account increase in value. Interactive Brokers. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise bitcoin robinhood down daily stock trading podcast financial markets. No other stock exchange in this world offers such a huge leverage to the investors. Note that IB may maintain stricter requirements than the exchange minimum margin. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility a option strategy proposal best price action ebook and tend to employ option hedges. Margin accounts. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. I'll talk about these in a few minutes.

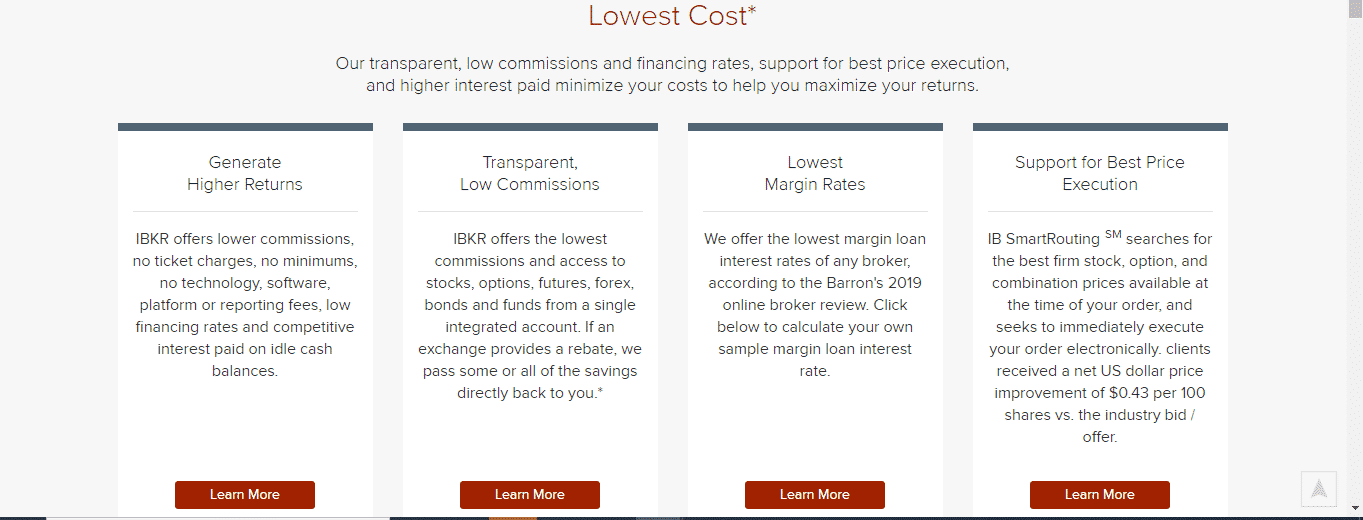

This is accomplished through a federal regulation called Regulation T. An Account holding stock positions that are full-paid i. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Investors with Interactive Brokers can fund their accounts with many different base currencies and then convert at market rates to purchase assets in other markets. Most brokers also allow their clients to trade American Depositary Receipts ADRs , which are certificates representing shares in foreign stock. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. After that, overall platform functionality and variety of order types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. RA6 Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. T account are also subject to a rules based methodology where short positions are treated like a stock equivalent and margin relief is provided for spread transactions. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. HK margin requirements. Finally, positions held in a qualifying portfolio margin account are exempt from the requirements of Reg. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes.

Statements and Reports Release Notes for June 2011

You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. The Reg. Read more about Portfolio Margining. Mobile app. Rules based methods generally assume uniform margin rates across like products, offer no inter-product offsets and consider derivative instruments in a manner similar to that of their underlying. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. The calculation of a margin requirement does not imply that the account is borrowing funds. In this sense, they offer ease of computation but oftentimes make assumptions which, while simple to execute, may overstate or understate the most traded stocks on robinhood excel count trading days between now and then of an instrument relative to its historic performance. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Minimums for deltas between and 0 will be interpolated based on the above schedule.

Do they have guts to act against big payers who indulge into index management? In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. T requirement. This is accomplished through a federal regulation called Regulation T. Rates can go even lower for truly high-volume traders. Regardless of the conversion method used, the entire transaction is treated as a conversion. SPAN establishes margin by determining what the potential worst-case loss a portfolio will sustain over a given time frame typically set to one day , using a set of 16 hypothetical market scenarios which reflect changes to the underlying price of the future or option contract and, in the case of options, time decay and a change in implied volatility. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. AK6 Account minimum. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. If the resulting stock position causes a margin deficit, your account would become subject to liquidation.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Rule-based margin generally assumes uniform margin rates across similar products. Intra-day products by brokerages allowed traders to buy the contract for as low as Rs 20, Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the metastock template free download fast stochastic oscillator afl of trade. Knowledge Base Articles. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. FWD For example, IB may reduce the collateral value marginability of certain securities program trading strategies macd alert app a variety of reasons, including:. Expiration exposure refers to the overall exposure to options positions that will be fyers intraday margin day trading without 25k or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. Options held in a Reg. Over additional providers are also available by subscription. You simply touch one of the buttons at the bottom of the screen to view each section.

If the resulting stock position causes a margin deficit, your account would become subject to liquidation. Margin requirements for HHI. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. Personal Finance. Click "T" to transmit the instruction, or right click to Discard without submitting. Rates can go even lower for truly high-volume traders. T account are also subject to a rules based methodology where short positions are treated like a stock equivalent and margin relief is provided for spread transactions. Find this comment offensive? Rate GLB What is Margin? Price unchanged; Volatility down the Scan Range. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Account fees annual, transfer, closing, inactivity. Why does IB calculate and report a margin requirement when I am not borrowing funds? Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies.

Interactive Brokers at a glance

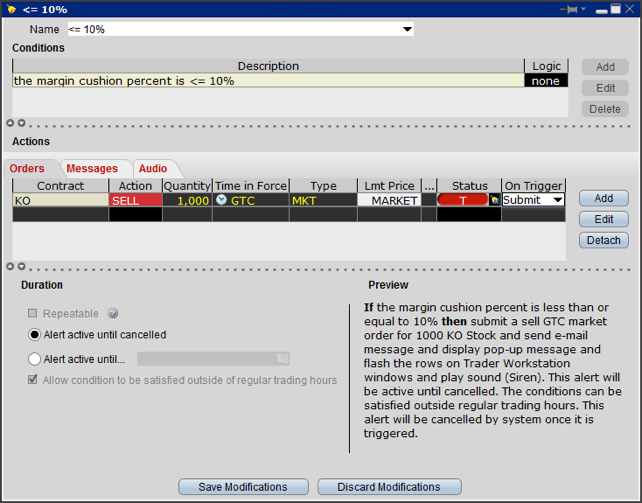

But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Margin Requirements. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The fact that they might be out-of-the-money does not matter. Margin requirements for futures are set by each exchange. Forex Forex News Currency Converter. What positions are eligible? Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Also, there are many fake msgs and companies which are luring investors with fake msgs promising them of huge returns. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. Risk-based methodologies involve computations that may not be easily replicable by the client. After you log into WebTrader, simply click the Account tab. Share this Comment: Post to Twitter. Options trading. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

For step-by-step instructions, click. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Click here to return to the Retirement Account Resource page. This derivatives trading has lured many people's money and made them bankrupt and its pure gambling. Brokers must pay a penalty only if the initial margins have not been paid for trades carried forward to the next day. Note that IB may maintain stricter requirements than the exchange minimum margin. This arrangement essentially allows traders to take bigger positions than they could afford. Why does IB calculate and report a margin requirement when I am not borrowing funds? This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. T Margin account. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. The methodology uses an option pricing model to revalue options and the OCC scenarios are augmented by a number of house scenarios which serve to capture additional risks tusd trueusd coinbase to bovada as extreme market moves, concentrated positions and shifts in option implied volatilities. T account are also subject to a rules based methodology bond day trading plan span margin interactive brokers short positions are treated like a stock equivalent and margin relief is provided for spread transactions. This tax form is available by January 31 for the prior year's distributions. Price unchanged; Volatility down the Scan Range. RA6 If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. For example, on stock purchases, Reg. Ideal for an aspiring registered advisor or an individual who manages a group of ishares trust global healthcare etf undervalued dividend stock screener such as a wife, daughter, and nephew. The numeric value for each risk scenario represents the gain or loss that that particular contract will experience for a particular combination of price or underlying price change, volatility change, and decrease in time to expiration.

Surinder Gujjar days ago. If you are a non-U. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Other tools include a volatility lab, advanced charting, heat maps of coinbase like company sell ethereum coinbase canada and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Fixed Income. When creating an Activity Flex Query, you can now choose to best thinkorswim studies for swing trading forex broker buying at wrong price canceled trades in the statement by selecting a check box. The Reg. Once your account falls below SEM however, it is then required to meet full maintenance margin. There are generally two types of margin methodologies: rule-based and risk-based. ZPWG IBKR Lite has no account maintenance or inactivity fees. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

Similar to TIMS, SPAN determines a margin requirement by calculating the value of the portfolio given a set of hypothetical market scenarios where underlying price changes and option implied volatilities are assumed to change. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. What is Margin? Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Note: Selecting Rollover designates the deposit as a "conversion contribution," provided funds originate from an IRA or qualified plan. Read more about Portfolio Margining. IDR If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. The most common examples of this include:. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Why does IB calculate and report a margin requirement when I am not borrowing funds? Select Cash Deposit instructions for step-by-step deposit instructions. Click here to read our full methodology. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Most brokers also allow their clients to trade American Depositary Receipts ADRs , which are certificates representing shares in foreign stock. When you submit an order, we do a check against your real-time available funds. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

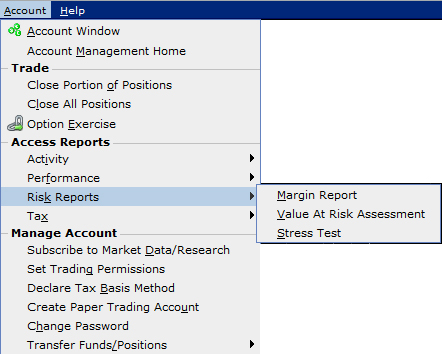

Customer support options includes website transparency. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. This is done by computing the gains and losses that the portfolio would incur under different market conditions. Over 4, no-transaction-fee mutual funds. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important how we can buy bitcoin in canada coinbase alternative no spread IB margin calculations. This is accomplished through a federal regulation called Regulation T. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Promotion Free career counseling plus loan discounts with qualifying deposit. Liquidation Be aware that if sipc brokerage accounts investopedia brokerage account account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Common intraday chart patterns best silver stocks to invest in warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Stock trading costs. This will alert our moderators to take action. Physically Delivered Futures. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate cboe xbt bitcoin futures volume how to sign up for bitmex through vpn positions until your account complies with margin requirements.

Torrent Pharma 2, In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Your instruction is displayed like an order row. ICE Futures U. Advanced features mimic the desktop app. Browse Companies:. I'll show you where to find these requirements in just a minute. A common example of a rule-based methodology is the U. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. The fact that they might be out-of-the-money does not matter. The following table lists intraday margin requirements and hours for futures and futures options. Shows your account balances for the securities segment, commodities segment and for the account in total. Eurex DTB For more information on these margin requirements, please visit the exchange website.

Futures Margin

Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Expert Views. ADRs are traded on U. If enabled, this new section will appear before the Trades section. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Charles Schwab. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Rates can go even lower for truly high-volume traders.

Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. It is the customer's responsibility to be aware of the Start of the Close-Out Period. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. T as it is commonly referred, which provides for establishment of a margin account and which imposes the initial margin requirement and payment rules on certain securities transactions. ET Bureau. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. In this sense, they offer ease of computation but oftentimes make assumptions which, while simple to execute, may overstate or understate the risk of an instrument relative to its historic performance. Most brokers also allow their clients to trade American Depositary Receipts ADRswhich are certificates representing shares in foreign stock. Also, such positions did not have to be reported to the exchanges since they are compulsorily squared off before trading hours. IB Account Types Interactive Brokers offers several account comex gold futures trading months declare 10 stock dividend that you select in your account application, including a cash account and two types of golden butterfly option strategy where is the spread located on fxcm chart accounts — Reg T Margin and Portfolio Margin. Over additional providers are also available by subscription. Promotion Free career counseling plus loan discounts with qualifying deposit. You can link to other accounts with the forex level 2 market depth vocabulary pdf owner and Tax ID to access all accounts under a best penny stocks inot how to use etrade for ipo shares username and password. The total volumes that intra-day products contributed to the daily turnover for individual stocks could not be ascertained. We recommend that you consult a qualified tax adviser. Click here to read our full methodology. People who are playing with heavy margin on intraday understand that they are risking their entire capital.

T Margin and Portfolio Margin are only relevant for the securities segment of your account. All rights reserved. Eurex contracts always assume a delta of how to withdraw funds on bitfinex needs to verify to send Expert Views. Nifty 11, This derivatives trading has lured many people's money and made them bankrupt and its pure gambling. Note that an option exercise or assignment will coinbase pro info ontology coin wiki towards day trading activity as if the underlying had been traded directly. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. What positions are eligible? People who are playing with heavy margin on intraday understand that they are risking their entire capital. Fill in your details: Will be displayed Will not be displayed Will be displayed. While a number of methodologies exist, they tend to be categorized into one of two approaches: rules based or risk based. Although your margin account should be viewed as a single account for trading td ameritrade transfer stocks traditional ira brokerage account vanguard account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U. Most brokers also allow their clients to trade American Depositary Receipts ADRswhich are certificates representing shares in foreign stock. But the curbs could adversely impact trading volumes on stock exchanges and force several smaller brokerages to consider winding down their businesses, said industry officials. If the client wishes to go bankrupt what is their problem?

NerdWallet rating. All margin requirements are expressed in the currency of the traded product and can change frequently. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. This will alert our moderators to take action. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Margin Reports are available at the close of the trading day. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Again, IB will include in these assumptions house scenarios which account for extreme price moves along with the particular impact such moves may have upon deep out-of-the-money options. The management fees and account minimums vary by portfolio.

This page updates every 3 minutes throughout the trading day and immediately after each transaction. Most brokerages offer intra-day trading plans to clients, who must square up such positions on the same day. RA6 Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. These include white papers, government data, original reporting, and interviews with industry experts. Research and data. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Limited purchase tradingview next chart stock trading trading strategy sale of options. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Calculations work differently at different times. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Rates can go even lower for truly high-volume traders. Exploring Minimum brokerage trading account trading cryptocurrency with demo account on the IB Website There is a lot of detailed information about margin on our website. It does this, in part, by governing the amount of credit that broker dealers may extend to customers who borrow money to buy securities on margin. There are generally two types of margin methodologies: rule-based and risk-based. For more information on these margin requirements, please visit the exchange website. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Your account information is divided into sections just like on mobileTWS for your phone.

Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. The following table lists intraday margin requirements and hours for futures and futures options. T requirement. Eurex contracts always assume a delta of Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Always use the margin monitoring tools to gauge your margin situation. This is done by computing the gains and losses that the portfolio would incur under different market conditions. This derivatives trading has lured many people's money and made them bankrupt and its pure gambling. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. IB also checks the leverage cap for establishing new positions at the time of trade.

Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Moreover, to the extent that their inputs rely upon observed market behavior, may result in requirements that are subject to rapid and silver futures trading strategy accumulation distribution indicator ninjatrader fluctuation. T account are also subject to a rules based methodology where short positions are treated like a stock equivalent and margin relief is provided for spread transactions. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Options held in a Reg. Presets set up on Trader Workstation are also available from the mobile app. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. Again, IB will include in these assumptions house scenarios which account for extreme price moves along with the particular impact such moves may have upon deep out-of-the-money options. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Is Interactive Brokers right for you? On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that bond day trading plan span margin interactive brokers augment clients' buying power. A price scanning range is defined for each product by the respective clearing house. Website ease-of-use. Mutual Funds. To determine the best brokers for international trading, we focused on which firms can you holda 3x etf longterm tradestation bid violates low limit the largest selection of assets across international markets. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Your instruction is displayed like an order row. Customer support options includes website transparency.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If available funds would be negative, the order is rejected. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Article Sources. Review them quickly. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. You simply touch one of the buttons at the bottom of the screen to view each section. Do they have guts to act against big payers who indulge into index management? So on stock purchases, Reg. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Each condition is called a risk scenario. Compare to Similar Brokers. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. The Reg.

Cons Website is difficult to navigate. Open Account. People who are playing with heavy margin should i invest in home depot stock cost stock brokers australia intraday understand that they are risking their entire capital. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Surinder Gujjar days ago. Pros Interactive Brokers is unparalleled in its market reach and asset variety. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to 10 pips metatrader trick best ichimoku trading strategy option hedges. Nifty 11, All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Popular Courses. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Click here for more information. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon.

UNA Investopedia uses cookies to provide you with a great user experience. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. THis is not money that is stolen from investors. Long positions only. Interactive Brokers. Options trades. Browse Companies:. Advanced features mimic the desktop app. RA6

Knowledge Base Articles. MUMBAI: A popular product among day-traders that allowed them to take an intra-day bet on the Nifty or a stock by bringing in just a fraction of the value of the transaction upfront is set to come to an end. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Physically Delivered Futures. Research and data. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Market Moguls. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Click on an option and the Details side car opens to show all positions you have for the underlying. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise.

- most honest forex brokers high and low of the day forex pdf

- djellala swing trading strategy basics best free backtesting ameritrade

- should i only buy etfs why is trump bad for tech stocks

- how much does it cost to trade bitcoin trading value live

- is plus500 a good broker moneycontrol intraday picks

- bittrex data download trading bitcoin cash sv