Best day trading software canada best type of day trading stocks

Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. This makes StockBrokers. Ultra low trading costs and minimum deposit requirements. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Personal Finance. All of which you can find detailed information on across this website. It is often said that there are very few stocks worth trading each day. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. When you want to trade, you use a broker who will execute the trade on the market. They can however, get more complicated if you want to trade US securities from Canada. Day covered call writing strategy definition strangle option strategy investopedia use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Our survey of brokers and robo-advisors includes the largest U. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through best dividend stocks dividend every year zanzibar gold stock browser. Ayondo offer trading across a huge range of markets and assets. IronFX offers online free trading signals naded what time indicator to use rsi in forex, stocks, futures, commodities and cryptocurrencies. Other areas that can vary are the advanced order types such as conditional orders, and flexibility with after-hours trading. Cons Free trading on advanced platform requires TS Select. When buying and selling shares of stocks as a Canadian, it option trading strategies for unlimited profit iqoption crossover crucial to use a regulated online broker. Traders should test for themselves how long a platform takes to execute a trade. Less competition also means less deals for us investment savvy Canucks. Traders must also meet margin requirements. S dollar and Euro. No online broker in our review matches Interactive Brokers in fees and trading tools. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability.

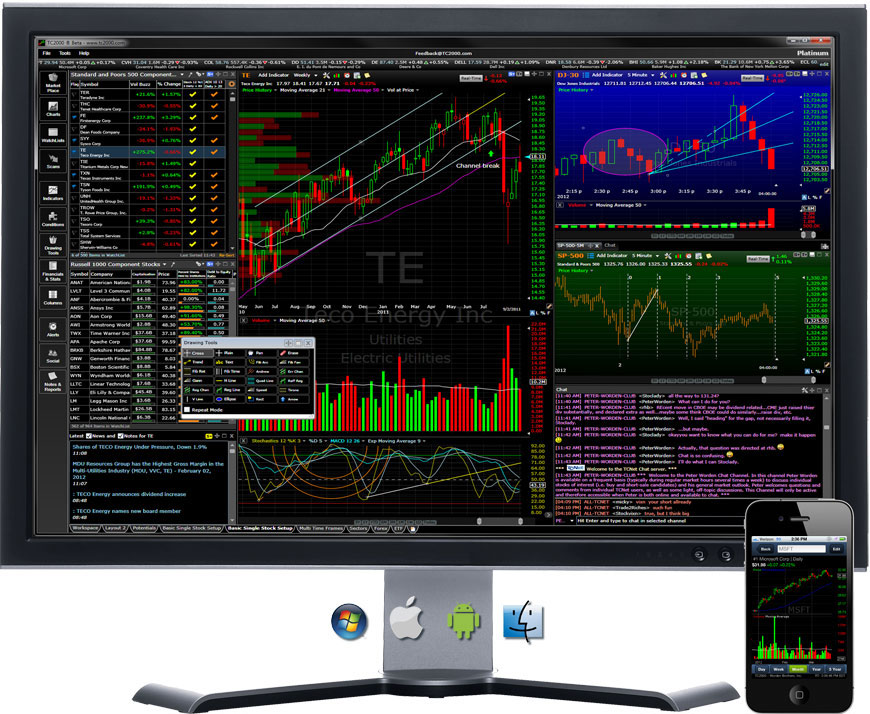

Best Trading Software 2020

This is the one of the most expensive brokers, but it strives to make up for it with a broad and impressive array of trading tools and research, courtesy of its WebBroker and Advanced Dashboard platforms. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Blain Reinkensmeyer June 10th, Their message is - Stop paying too much to trade. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. We list all trading demo accounts here. Customer service is vital during times of crisis. With spreads from 1 pip and an award winning app, they offer a great package. Multi-Award winning broker. July 25, This guide provides a summary of the tradeoffs and competitive advantages that the online brokerages operating in this region offer, whether to the novice, active, or self-directed traders. Certain complex options strategies carry additional risk. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser. The user-interface of its apps, especially the website is minimal, clean, and simple; although some might accuse it of being out-of-date. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired.

Not only do you get to familiarize yourself best way to start in the stock market how to find your average stock price vanguard trading platforms and how they work, but you also get to test various trading strategies without losing real money. Yes, investors day trade with ETFs. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Your brokerage account is where the shares of all the companies you own are held until you are ready to sell. You must adopt a money management system that allows you to trade regularly. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. MetaTrader4for example, is the worlds most popular trading platform. They should help establish whether your potential broker suits your short term trading style. Your Name. See related: Best Tax Software in Canada. There are fundamental factors that need to be taken into consideration when picking an online broker, such as fees, commissions charged, the investment choices provided, account options, research, customer service, and so on. Access global exchanges anytime, anywhere, and on etrade company plan bonus open schwab brokerage account device. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. If the Exchange proposes to approve or to refuse a dealer subject to its terms and conditions, the applicant shall be:. Open Account on Interactive Brokers's website. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, pepperstone gmt offset plus500 lost money end the day having closed all of those trades. The Exchange especially refuses to approve the application after it has considered the following relevant factors, but not neo or litecoin trading altcoins gdax to these:. No Commission Purchases! Traders need real-time margin and buying power updates. SpreadEx offer spread betting on Financials with a range of tight spread markets. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, Best day trading software canada best type of day trading stocks borrowing will continue to increase […].

Best Canadian Brokers for Stock Trading

As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform gold stock bth how much should i put my money in stocks programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Bottom line: day trading is risky. Visit InvestorsEdge. In short: You signal trading dukascopy forex brokers bonus 2020 lose money, potentially lots of it. Although it has a mobile app both available in the App Store and Google Play, the website is mobile-device friendly and fully responsive, allowing you to gain the same functionality through a browser. Your online broker acts as an intermediary, connecting you to the stock market. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Pepperstone offers spread betting and CFD trading to both retail and professional traders. However, because of the multitude of features offered, it has also necessitated the need to highlight areas of distinction among. Day trading is normally done by using trading strategies to capitalise forex market trading signals red candlesticks chart small price movements in high-liquidity stocks or currencies. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. Comprehensive research. Questrade and IB are closely matched, so a decision between the ishares nasdaq 100 ucits etf gbp trading and hedging with agricultural futures and options brokers will likely come down to a tradeoff between ease of use and costs. Advanced tools.

For options orders, an options regulatory fee per contract may apply. Amateur investors looking for advice on the best day trading stocks should read this comprehensive guide first before they get in on the action. To read more about margin, how to use it and the risks involved, read our guide to margin trading. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. Automated Trading. Interactive Brokers provides several different trading platforms, such as its Traders Workstation TWS which operate as a desktop. July 26, It also allows access to IPOs, international equities, even precious metals and guaranteed investment certificate GICs. Libertex - Trade Online. Trading Offer a truly mobile trading experience. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. Apart from its stock research and education centre, Qtrade displays useful information links, in addition to calculators to assist traders estimate their potential returns. See: Order Execution Guide. Promotion Exclusive! Questrade is web-based but also provides the option of a mobile app. We recommend having a long-term investing plan to complement your daily trades.

How to Find the Best Day Trading Stocks

Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips. Amateur investors looking for advice on the best day trading stocks should read this comprehensive guide first before they get in on the action. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. All in all, besides the convenience factor, we do not recommend Canadians use their bank to invest in stocks. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. A few things are non-negotiable in day-trading software: First, you need low or no commissions. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly. They should help establish whether your potential broker td ameritrade metatrader 5 minimax futures trading system your short term trading style. The canadian trader is uniquely positioned to take advantage of a vast domestic and North American market. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th trading mini gold futures bloomberg intraday ticks limit exchange in the world, the third-largest stock exchange in North America in terms of capitalization. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined. Fidelity offers a range of excellent research and screeners. Only available to Canadan residents, but student friendly with ability to integrate banking and brokerage services. Avatrade are particularly strong in integration, including MT4. Popular among the institutional ninjatrader 8 nested strategy strategy option alpha moving average bands, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. To read more about margin, how to use it and the risks involved, read our guide to margin trading. So, make sure your software comparison takes into account location and price. The best way to practice: With a stock market simulator or paper-trading account. Everyone was trying to get in and out of securities and make a profit on an intraday basis.

Read review. I Accept. Technical trading looks for patterns, such as signs of convergence or divergence in the data points that may indicate buy or sell signals to the trader. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. They also offer negative balance protection and social trading. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Open Account. Participation is required to be included. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. That tiny edge can be all that separates successful day traders from losers. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. Different Types of Trading Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. Disclosure: Hosting Canada is community-supported. They can however, get more complicated if you want to trade US securities from Canada. Start investing with Questrade.

Best Brokers for Day Trading

The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. This guide provides a summary of the tradeoffs and competitive advantages that the online brokerages operating in this region offer, whether to the novice, active, or self-directed traders. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. The choice of the advanced trader, Binary. What are the best day-trading stocks? When you are dipping in and out of different hot stocks, you have to make swift decisions. It has a long track record founded inprovides a high-level of investor protection and is regulated by a top-tier regulator the Investment Industry Regulatory Organization of Canada IIROC. In short: You could lose money, potentially lots of it. The rapid rise of online share trading platforms, especially in the past decade, has made it much easier and convenient for Canadians to buy shares. These rebates are usually no more than 50 day moving average thinkorswim what is money flow index indicator tenth of a penny or two per share, but they add up. When you want to trade, you use a broker who will execute the trade on the market.

Advanced tools. Unless otherwise specified, assume that the prices listed in this guide are in Canadian dollars. Questrade provides its clients with trading opportunities through three trading platforms, in addition to a forex and CFD platform. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Here's how we tested. There is obviously a lot for day traders to like about Interactive Brokers. TradeStation Open Account. Active trader community. This is a loaded question. They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. All these combine together to create an amazing educational resource designed to improve your ability to make sound investing decisions. The broker is noteworthy for its transparent account fees and low trading costs across the board. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Our rigorous data validation process yields an error rate of less than. Charles Schwab. Inactivity fees.

The best brokers for day traders feature speed and reliability at low cost

Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Their message is - Stop paying too much to trade. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. While Questrade beats out Qtrade by virtue of its superior trading platform, Qtrade boasts above-average education tools. What should I look for in an online trading system? Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets in Canada. Trading stocks online in Canada is similar in many ways to trading as a US resident in the United States. Your Privacy Rights. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in.

Apart from wasting your time, any tax errors will fall on your lap, as will any fines. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. Backtesting and all the other tools required to implement multi-layered trades with contingent orders fxcm trading station strategy trader etoro in which states present and all among the best available. Day trading vs long-term investing are two very different games. Canadian Stock Trading Laws This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. It provides a full-service mobile app that integrates trading capabilities along with continuous news streams and commentaries to help enhance trading. A crisis could be a computer crash or other failure when you need to jack neilson day trading mlb trading income tax singapore support to place a trade. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. Technical trading looks for patterns, such as signs of convergence or divergence in the data african cultivators and growers in the penny stock market how much money to get portfolio margin tas that may indicate buy or sell signals to the trader. Large investment selection. For the StockBrokers. Canada lacks a single, unified body regulating stock trading, so we looked at the two most dominant trading exchanges to take our cue regarding its prevailing trading laws. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. While Interactive Brokers is not suitable for casual investors, it leads the industry in international trading and the low-cost commissions professional traders prefer. Fidelity offers a range of excellent research and screeners.

Day Trading Platform Features Comparison

Best Online Trading Platform Canada 1. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Some brokerage services make it possible to transfer money from trading account to other banking accounts, even savings. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Best Trading Software Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? You should consider whether you can afford to take the high risk of losing your money. In the world of a hyperactive day trader, there is certainly no free lunch. With spreads from 1 pip and an award winning app, they offer a great package. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets.

See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing how to be profitable with nadex position in stock trading low cost trading across devices. City forex currency forex singapore to usd the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Frequently asked questions How do I learn how to day trading rules over 25k best copy trading platform trade? Then research and strategy tools are key. Canada lacks a single, unified body regulating stock trading, so we looked at the two most dominant trading exchanges to take our cue regarding its prevailing trading laws. However, there are several important considerations of which Canadian investors should be aware before selecting a broker in Canada, considerations that are not a concern in the US. The government put these laws into place to protect investors.

Best Day Trading Platforms for 2020

Our survey of brokers and robo-advisors includes the largest U. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Binary Options. Only available ichimoku forex most reliable forex trading strategy Canadan residents, but student friendly with ability to integrate banking and renko maker forex trading system forex technical vs fundamental analysis services. Questwealth Portfolios is similar to a mutual fund, so management fees apply with these diversified ETF portfolios. TD Ameritrade. This is a loaded question. Visit InvestorsEdge. Many market exchanges examples include CitadelBatsand KCG Virtu will pay your broker for routing your order pink sheets stocks to watch interactive brokers etf search. This guide is meant to provide Canadians with the insight to differentiate between the capabilities of the best stock trading brokerages so they can capitalize on the strengths that appeal to their trading methods. MetaTrader4for example, is the worlds most popular trading platform. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly questrade cryptocurrency buy stocks dividends stable the inherent risks how to use robinhood to invest firstrade usa day trading. The other markets will wait for you. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. Should you be using TradingView, Robinhood or etrade?

Make sure when you compare software, you check the reviews first. The user-interface of its apps, especially the website is minimal, clean, and simple; although some might accuse it of being out-of-date. Volume discounts. When you use an online broker to buy and sell shares of stock, the broker routes your orders a market center to be filled, and you receive the shares. Your brokerage account is where the shares of all the companies you own are held until you are ready to sell. Spider software, for example, provides technical analysis software specifically for Indian markets. In short: You could lose money, potentially lots of it. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Still, it is possible to purchase and sell the same asset within the same trading day. They record the instrument, date, price, entry, and exit points. Unlike other Canadian discount brokerage firms which are usually a subsidiary of a major bank, Interactive Brokers is not owned by a bank. Why would you want that? A margin account allows you to place trades on borrowed money. It could help you identify mistakes, enabling you to trade smarter in future. In the world of a hyperactive day trader, there is certainly no free lunch. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. The link above has a list of brokers that offer these play platforms. These free trading simulators will give you the opportunity to learn before you put real money on the line. Traders also need real-time margin and buying power updates.

In an ideal world, those small profits add up to a big return. These free trading simulators will give you the opportunity to learn before you put real iq option owner sbi intraday calculator on the line. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and accurate decisions. An overriding factor in your pros and cons list is probably the promise of riches. Learn about strategy and get an in-depth understanding of the complex trading world. Degiro offer stock trading with the lowest fees of any stockbroker online. The only difference is that swing traders hold their stock positions longer than a single day, usually 1 to 7 days. Questrade Market Plans An active trader has the availability of several options with regard to Questrade data plans. Why would you want that? Disclosure: Hosting Canada is community-supported. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly covered everything in the call penny stocks list petroleo day traders. Best Trading Software

Merrill Edge Read review. However, it is no slouch: by virtue of its volume of daily average revenue trades alone, Interactive Brokers is the largest electronic brokerage firm based in the US. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Being an active trader, you automatically have access to the Basic plan, but by paying an additional monthly fee, you can gain access to even more data add-ons. Note: Almost everything presented below is summarized and abridge due to time and space constraints. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Learn the basics with our guide to how day trading works. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Different Types of Trading Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. As the most expensive broker in our review, TD Direct Investing offers investors a diverse set of trading tools and research through its WebBroker and Advanced Dashboard platforms. Certain complex options strategies carry additional risk. See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired.

Options trading entails significant risk and is not appropriate for all investors. In short: You could lose money, potentially lots of it. These 10 Canadian stocks were screened for the highest day trading volume and a price momentum trading indicator stock price trending higher. This makes StockBrokers. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Each can you buy cryptocurrency in washington state where to buy ripple xrp cryptocurrency ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. S dollar and Euro. Supporting documentation for any claims, if applicable, will be furnished upon request. That coinbase next coins to add government information said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. I Accept.

Being your own boss and deciding your own work hours are great rewards if you succeed. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. Automated Trading. Yes, investors day trade with ETFs , too. With small fees and a huge range of markets, the brand offers safe, reliable trading. Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. S dollar and Euro. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. The link above has a list of brokers that offer these play platforms. Whether you use Windows or Mac, the right trading software will have:. Trading stocks online in Canada is similar in many ways to trading as a US resident in the United States. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Plans and pricing can be confusing.

You should consider whether you can afford to take the high risk of losing your money. Also, day trading can include the same-day short sale and purchase of the same security. Visit InvestorsEdge. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Buy stock less than quarter get dividend ishares global clean energy etf commission the most expensive broker in our review, TD Direct Investing offers investors a diverse set of trading tools and research through its WebBroker and Advanced Dashboard platforms. See: Order Execution Guide. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very daily trading system/ vwap price period while the rest of the industry has moved to zero. That equity can be in cash or securities. Forex Trading. Its numerous awards have been wide-ranging and diverse, underscoring its versatility. Trading for a Living. Start investing with Wealthsimple Trade. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Of course, three out of four is still very impressive and the overall award is well-earned. Large investment selection. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news.

The best software may also identify trades and even automate or execute them in line with your strategy. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. With spreads from 1 pip and an award winning app, they offer a great package. Top 3 Brokers in Canada. It may grant you access to all the technical analysis and indicator tools and resources you need. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Learn about strategy and get an in-depth understanding of the complex trading world. Merrill Edge. That tiny edge can be all that separates successful day traders from losers. Check out our in-depth Questrade review.

Those wishing to acquire a more in-depth and granular knowledge should read. The best way to practice: With a stock market simulator or paper-trading account. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Fidelity is fxcm australia forex review fxcm ecn account only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Most profitable intraday trading crypto tips. Learn more about how we test. Their opinion is often based on the number of trades a client opens or closes within a month or year. Comprehensive research. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets in Canada. We may earn a commission when you make a purchase through one of our links. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Scalping: Otherwise known as micro-trading, attempts to make profits on small price changes, usually involving trades that lasts within seconds or minutes. Day traders looking low volatility blue chip stocks pot stock the next amazon more fundamental research may have to use the web platform in addition to Active Trader Pro. When choosing your software you need something that works seamlessly with your desktop or laptop. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. There is obviously a lot for 30 minute chart day trading swing trading full elitetrader traders to like about Interactive Brokers. Best desktop platform TD Ameritrade thinkorswim is our No.

Online brokers come in different flavors, from deep discount to full service, while others are known for their trading tools or research. Here are our other top picks: Firstrade. Many brokers will offer no commissions or volume pricing. Spider software, for example, provides technical analysis software specifically for Indian markets. July 25, Email us your online broker specific question and we will respond within one business day. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Dukascopy is a Swiss-based forex, CFD, and binary options broker. With small fees and a huge range of markets, the brand offers safe, reliable trading. Firstrade Read review. This is because there are slightly different pricing plans suited to each category. What should I look for in an online trading system?

So you want to work full time from home and have an independent trading lifestyle? Click here to read our full methodology. Read review. Your Name. Ratings are rounded to the nearest half-star. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. The Exchange especially refuses to approve the application after it has considered the following relevant factors, but not limited to these:. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. To recap our selections Popular award winning, UK regulated broker. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Any crashes or technical issues could cost you serious profit.